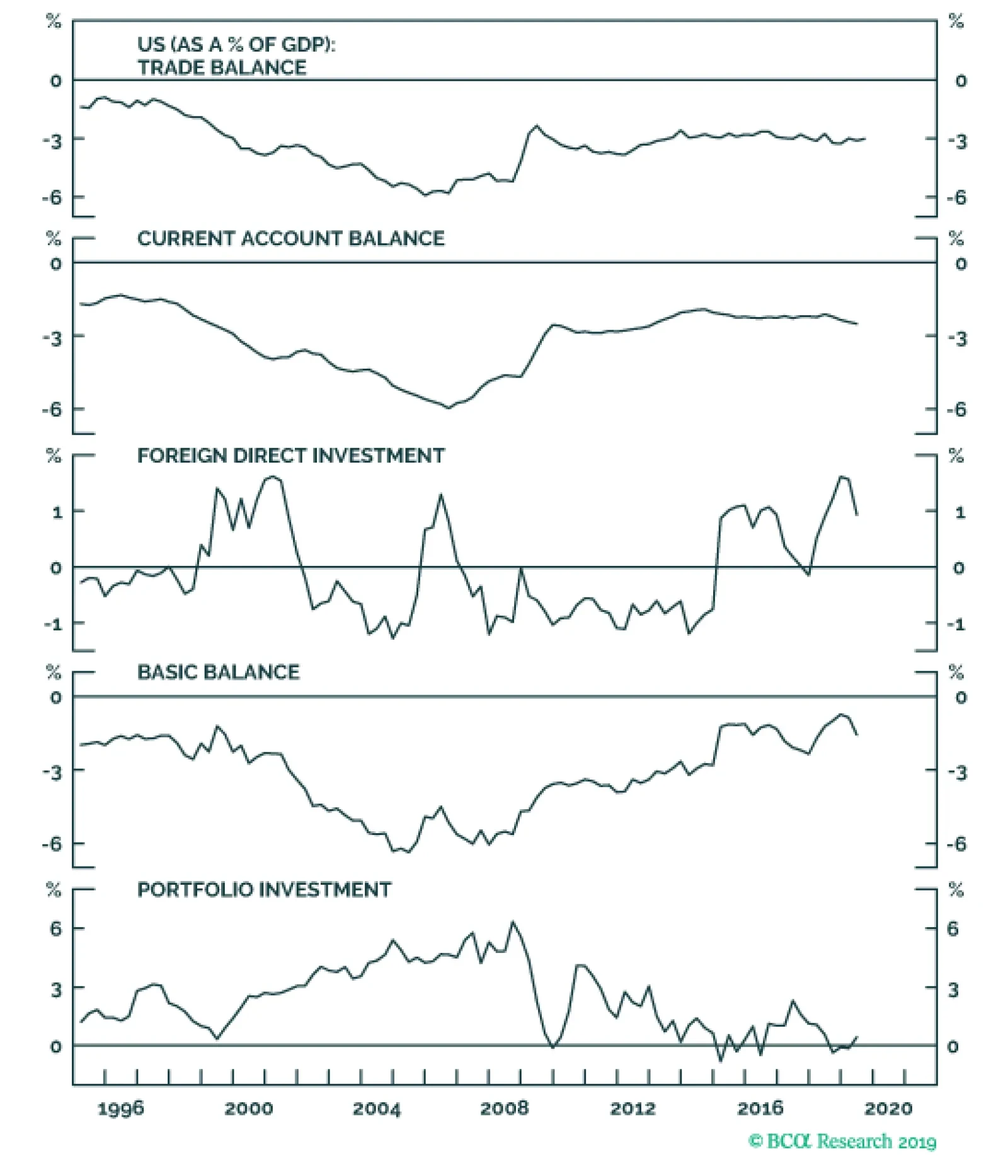

The US trade deficit has been more or less flat around 3% of GDP. The trade deficit mostly comes from manufactured goods. On the positive side, the US has been exporting more petroleum and related products. The current account is…

Highlights Investors should remain overweight global stocks relative to bonds over the next 12 months and begin shifting equity exposure towards non-US markets. Bond yields will rise next year as global growth picks up, while the…

Highlights The US-China trade talks will continue despite Hong Kong. The UK election will not reintroduce no-deal Brexit risk – either in the short run or the long run. European political risk is set to rise from low levels,…

An analysis on Brazil is available below. Feature Chart I-1Poor Performance By EM Stocks, Currencies And Commodities I had the pleasure of meeting again with a long-term BCA client Ms. Mea last week during my trip to Europe…

Highlights Duration: A survey of the five factors that determine the path for Treasury yields suggests that further upside is likely. We see a clear path to 2.5% for long-maturity Treasury yields as recessionary risk moves to the back…

Feature Chart I-1Lebanese Bond Yields Have Surged To Precarious Levels In a May 2018 Special Report, we warned that a devaluation and government default were only a matter of time in Lebanon. The country's sovereign US…

Highlights The slowdown in global industrial activity appears to have bottomed. This, along with an apparent shared desire for a ceasefire in the Sino-US trade war, points toward a measured recovery in manufacturing and global trade,…

Highlights An expansion in the Federal Reserve’s balance sheet will increase dollar liquidity. This should be negative for the greenback, barring a recession over the next six to 12 months. Interest rate differentials have…