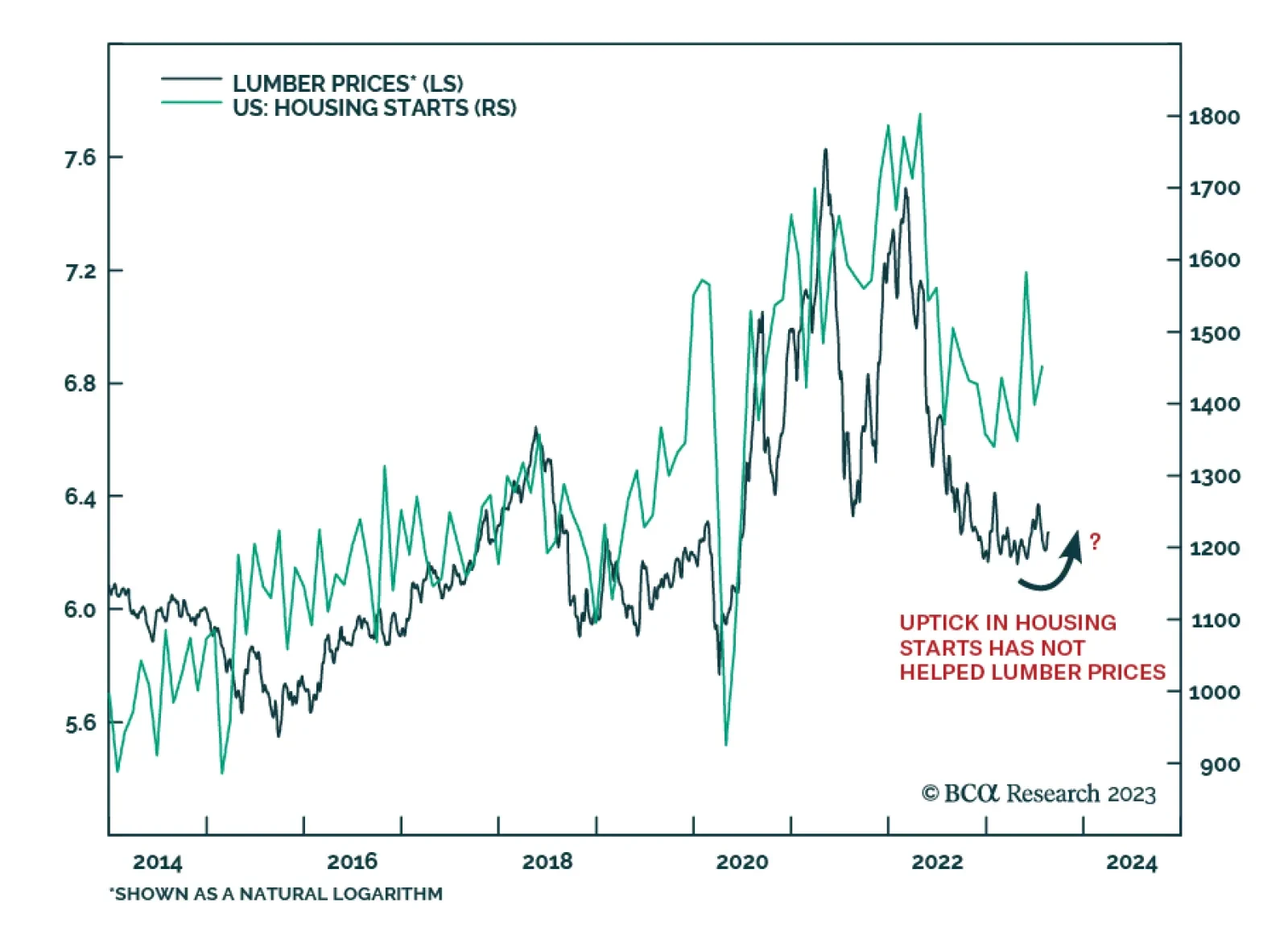

In a June insight, we discussed the possibility of a sustained lumber rally due in part to resilient housing market activity in the US and supply constraints in Canada, a major exporter of lumber. Since then, prices have remained…

Numerous divergences have opened up between global risk assets and global business cycle variables. These gaps are unsustainable, and odds are that the recoupling will occur to the downside with risk assets selling off.

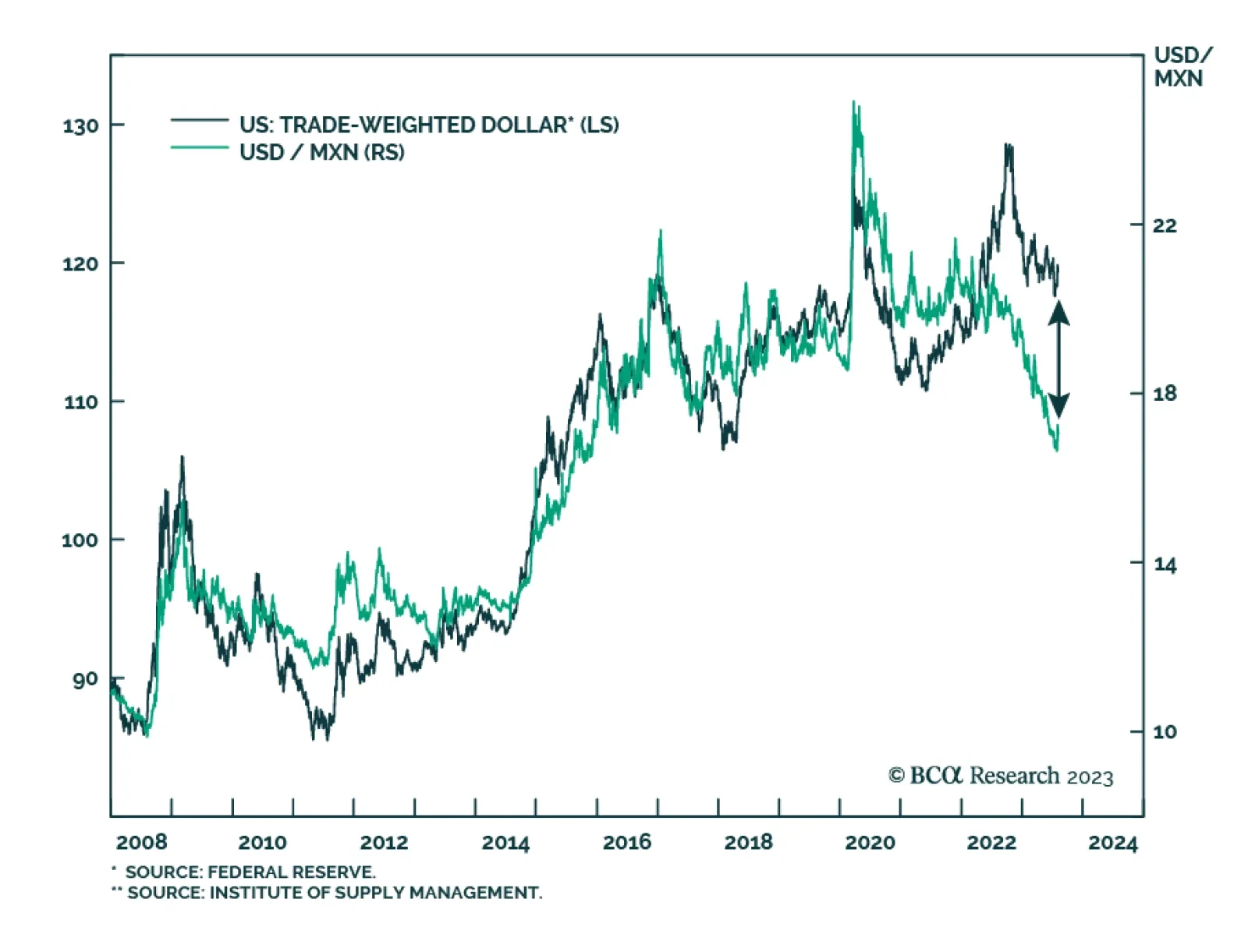

The Mexican peso is the best performing major currency so far this year, gaining 14% vis-à-vis the greenback over this period. Even during the latest bout of dollar strength since mid-July, MXN has weakened by the least…

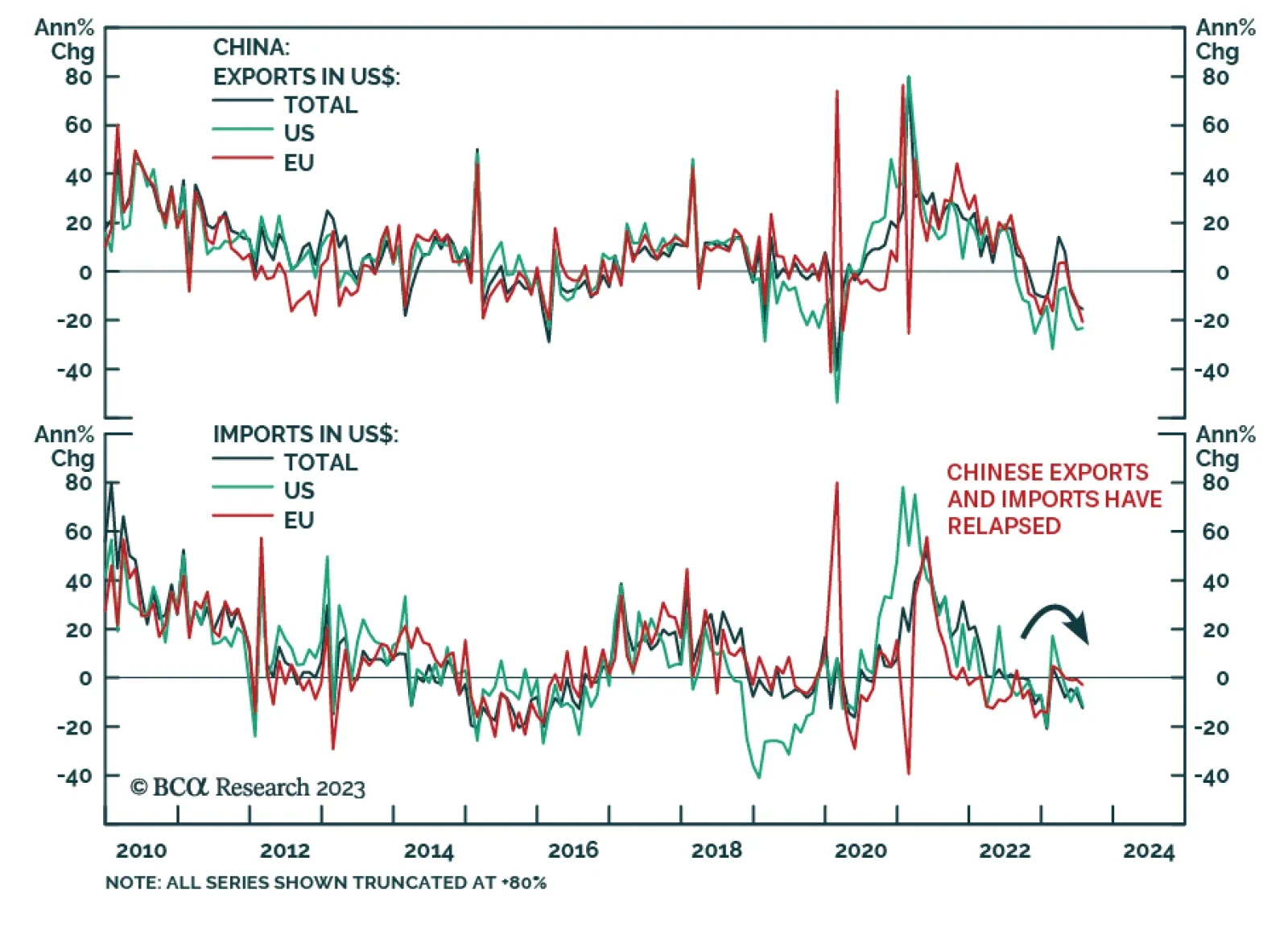

Although the RMB has cheapened, macro conditions are not yet favorable for the Chinese currency. We expect the RMB to decline by at least another 5% in the next six months. A weak currency and subdued economic growth lead us to…

Chinese trade data continued to deliver a pessimistic signal about the global manufacturing cycle. The export contraction deepened to -14.5% y/y in US dollar terms in July – below expectations of a -13.2% y/y decline and…

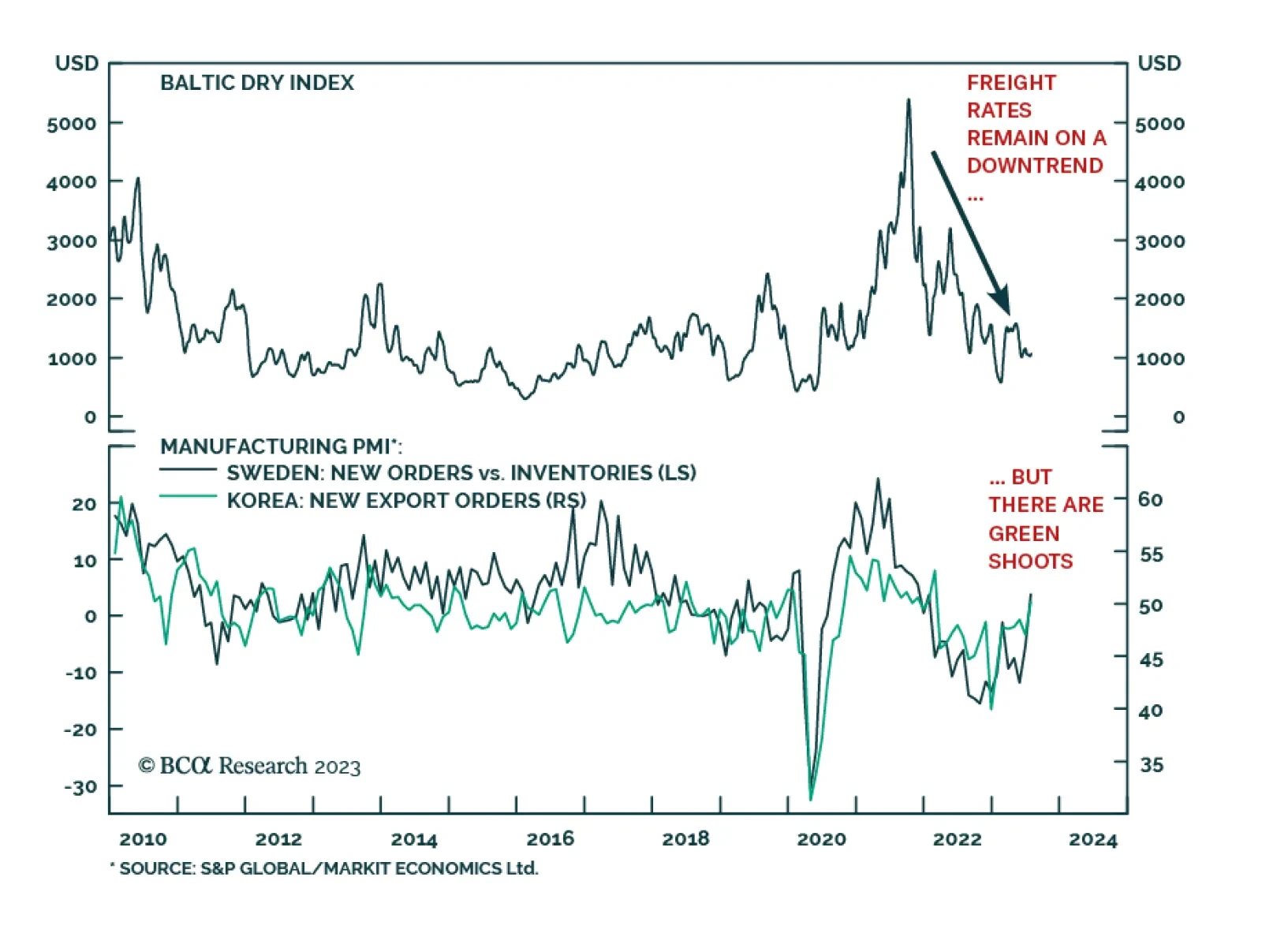

On Friday, shipping giant Maersk delivered a pessimistic outlook for global trade. Although the company raised its 2023 earnings forecast, the upgrade comes on the back of a better-than-anticipated performance in the first half…

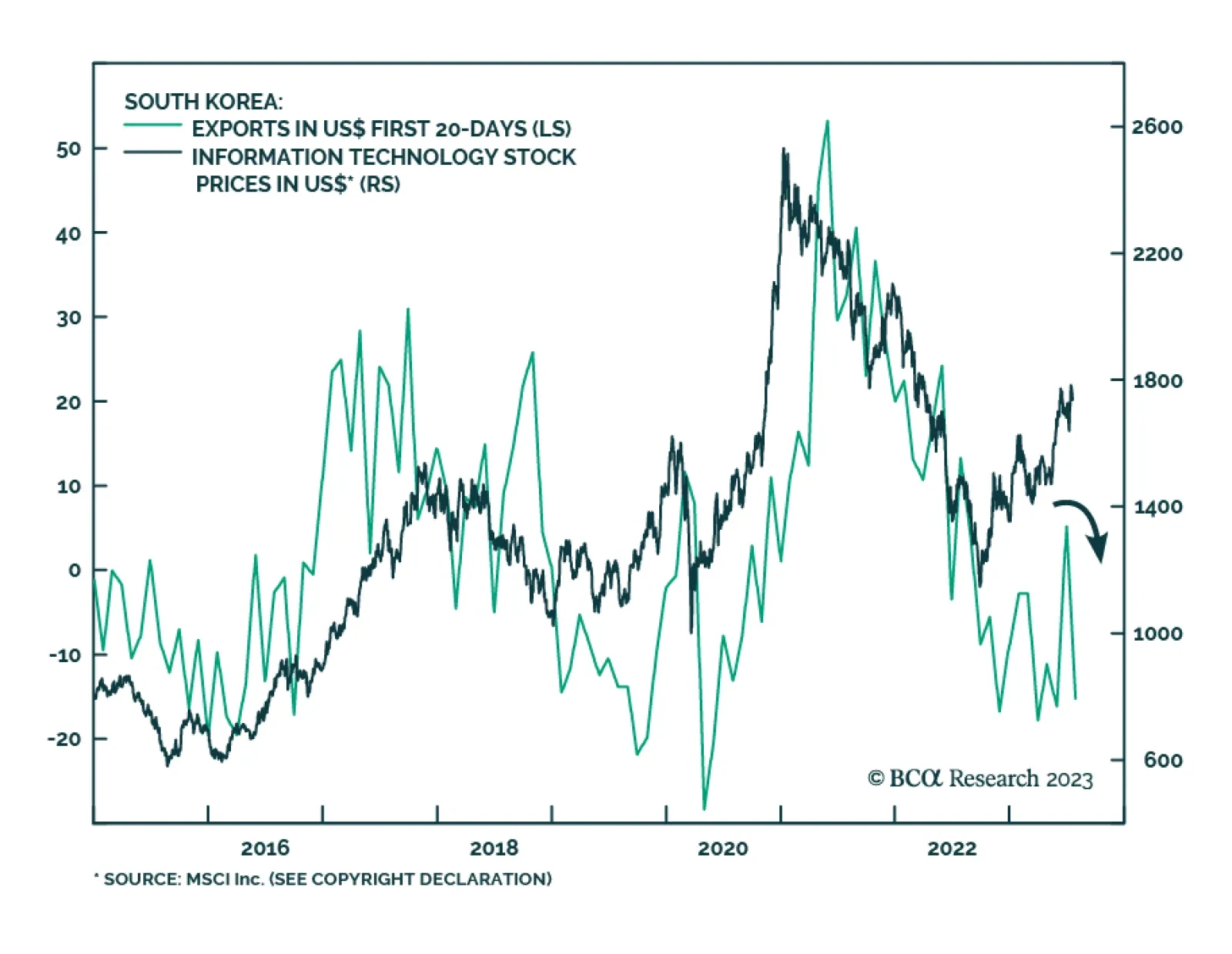

South Korean exports in the first 20 days of July corroborate the signal from Taiwanese export orders that Asian trade conditions remain weak. The former declined by -15.3% y/y, undoing the optimism following a 5.3% y/y increase…

In this report, we dissect which markets have broken out and which ones have not, and reflect what this entails for our global macro view. Also, we analyze how the S&P 500 has been taking its cues from a change in the inflation…