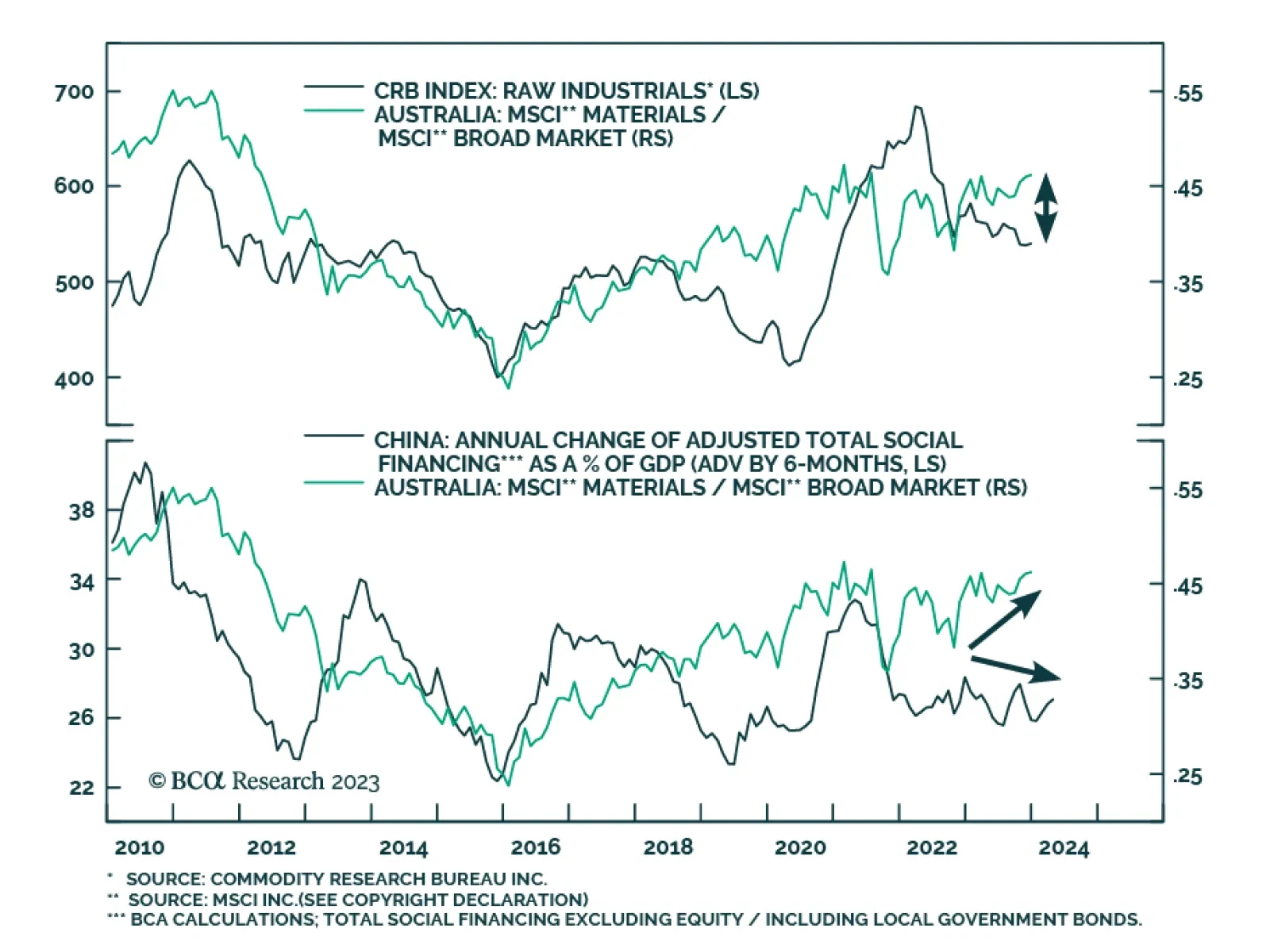

Australian materials stocks have been outperforming the country’s broad index since mid-August, undoing the sector’s relative losses of the prior months, and bringing the year-to-date gain to 7.7% in absolute terms…

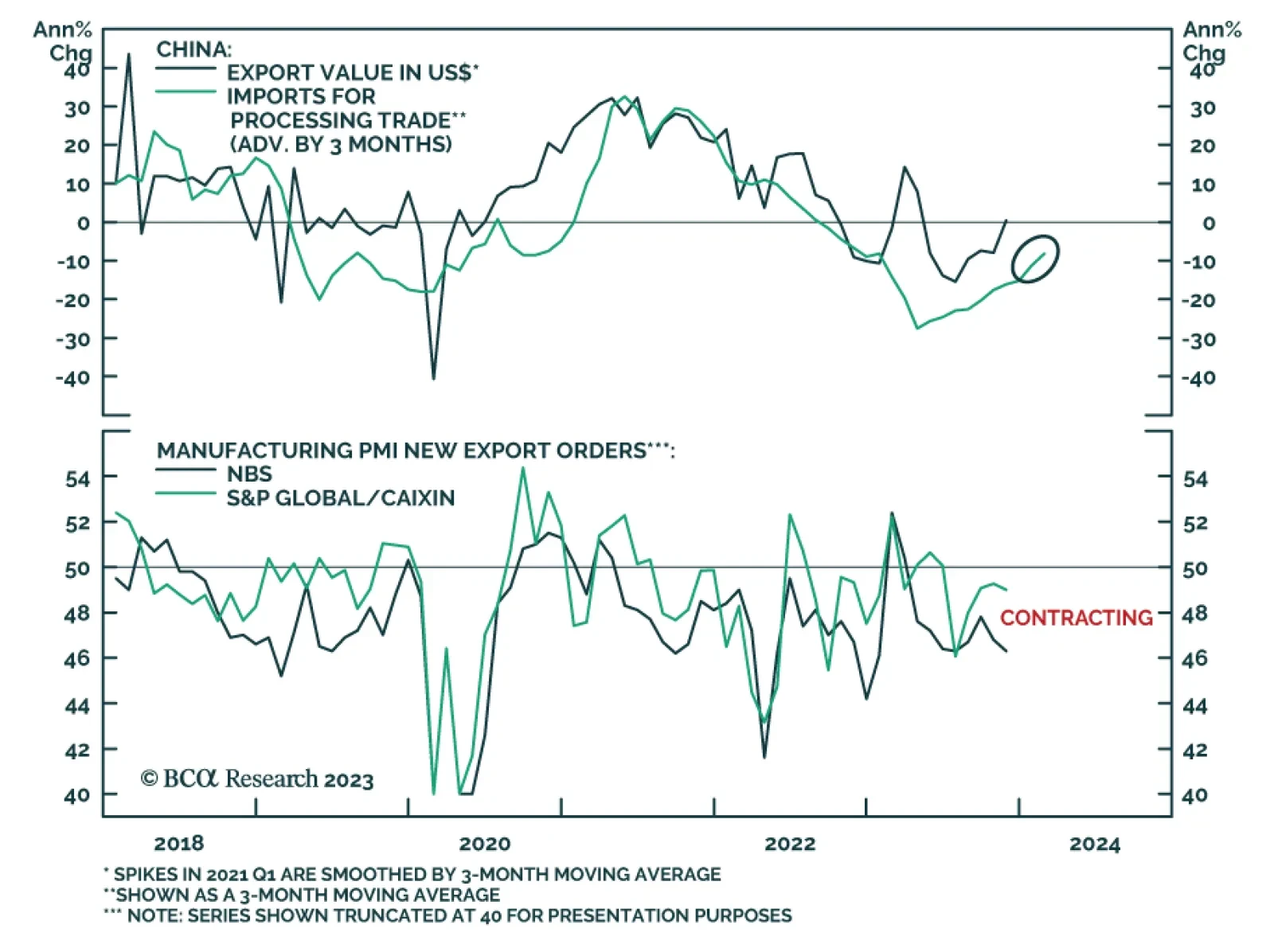

On the surface, Chinese export data delivered a positive surprise on Thursday, painting a favorable picture of the global manufacturing cycle. Exports unexpectedly grew on a year-over-year basis in November for the first time…

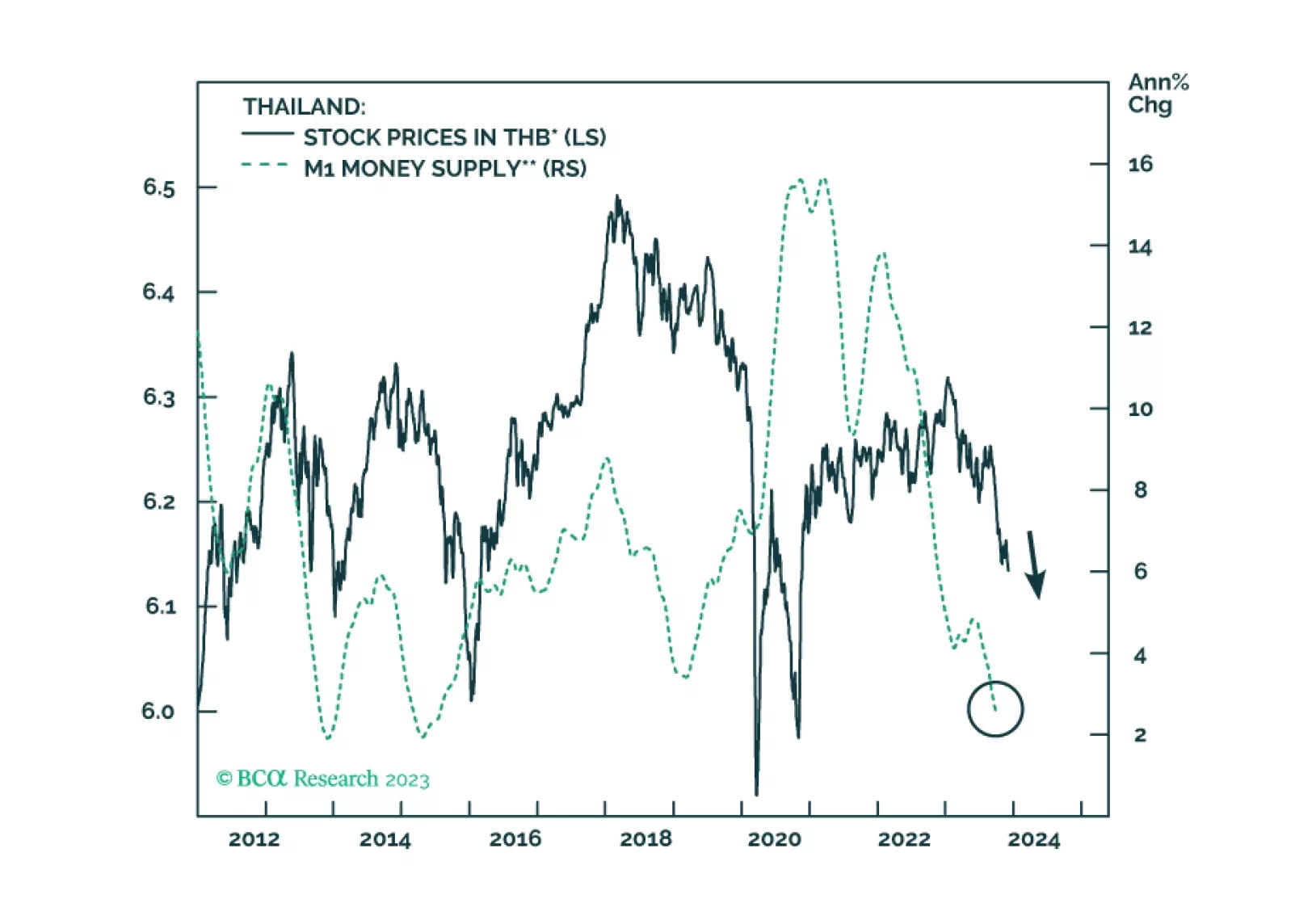

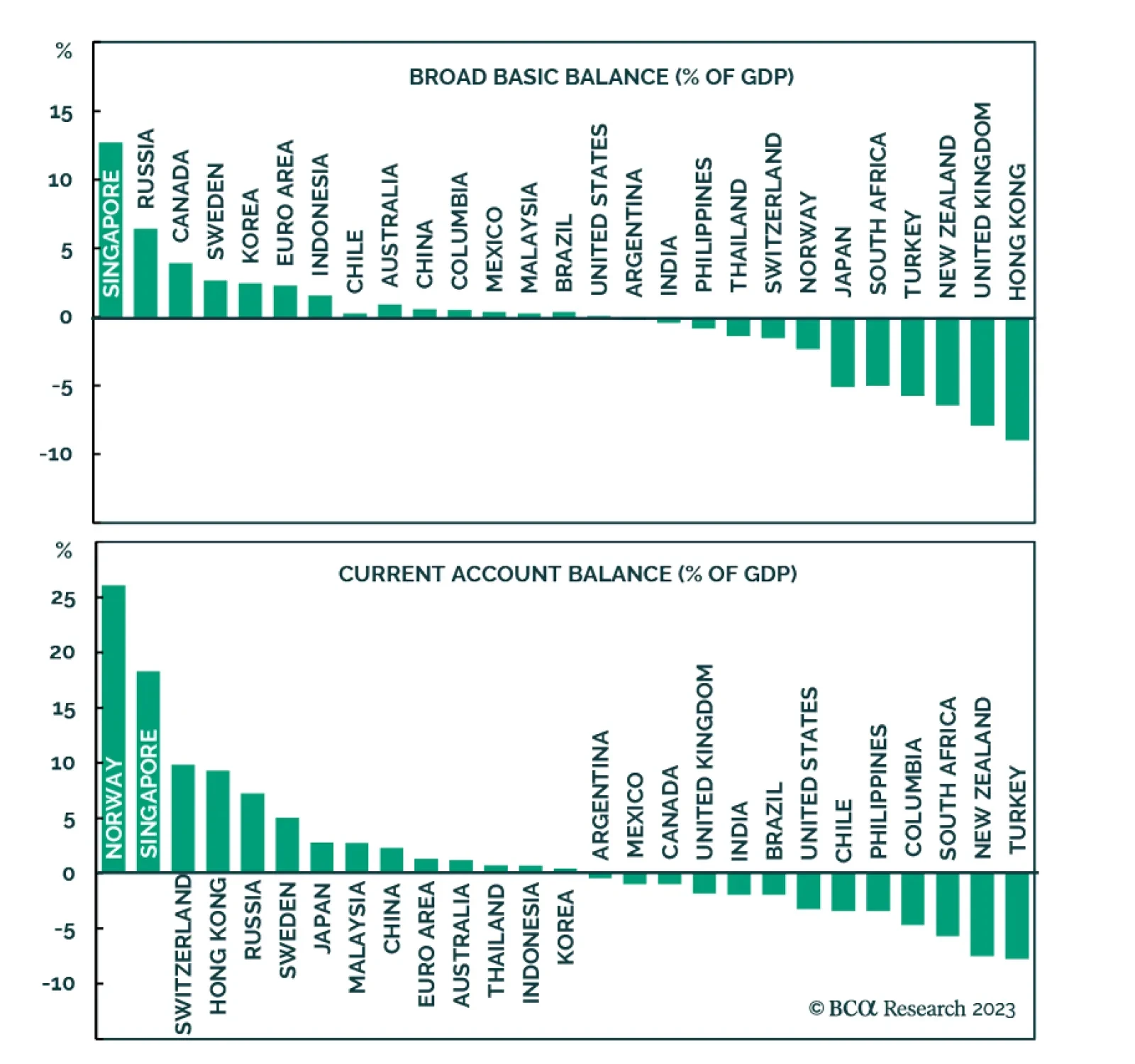

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

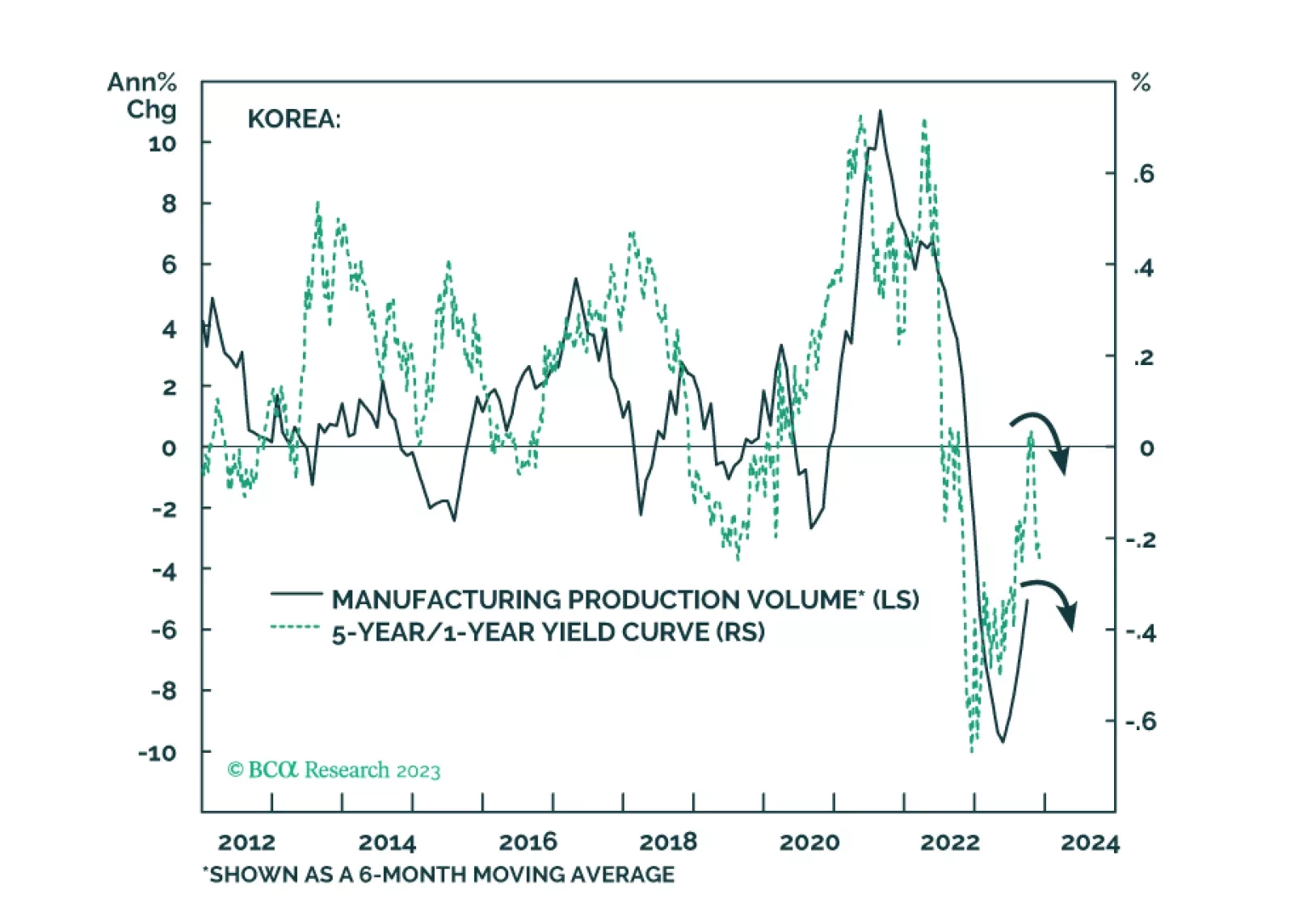

The recent increase in Korean exports will likely prove to be a mid-cycle rebound within a cyclical downtrend. Korea’s households and enterprises are among the most indebted globally, and their debt service ratio is among the highest…

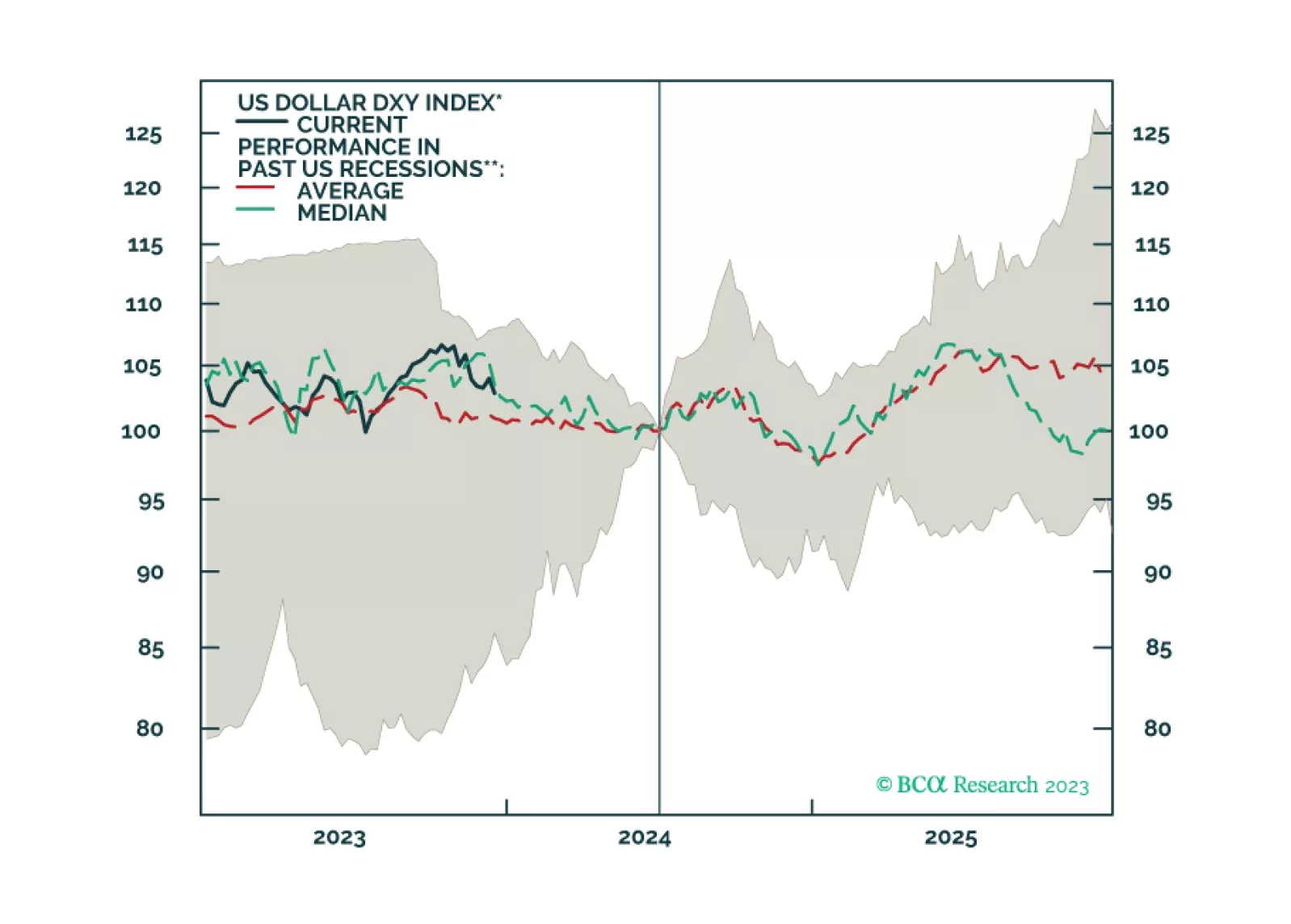

Most developed market central banks have paused hiking interest rates. With interest-rate differentials having been the most important driver of currencies over the last two years or so, the focus might now shift to other factors…

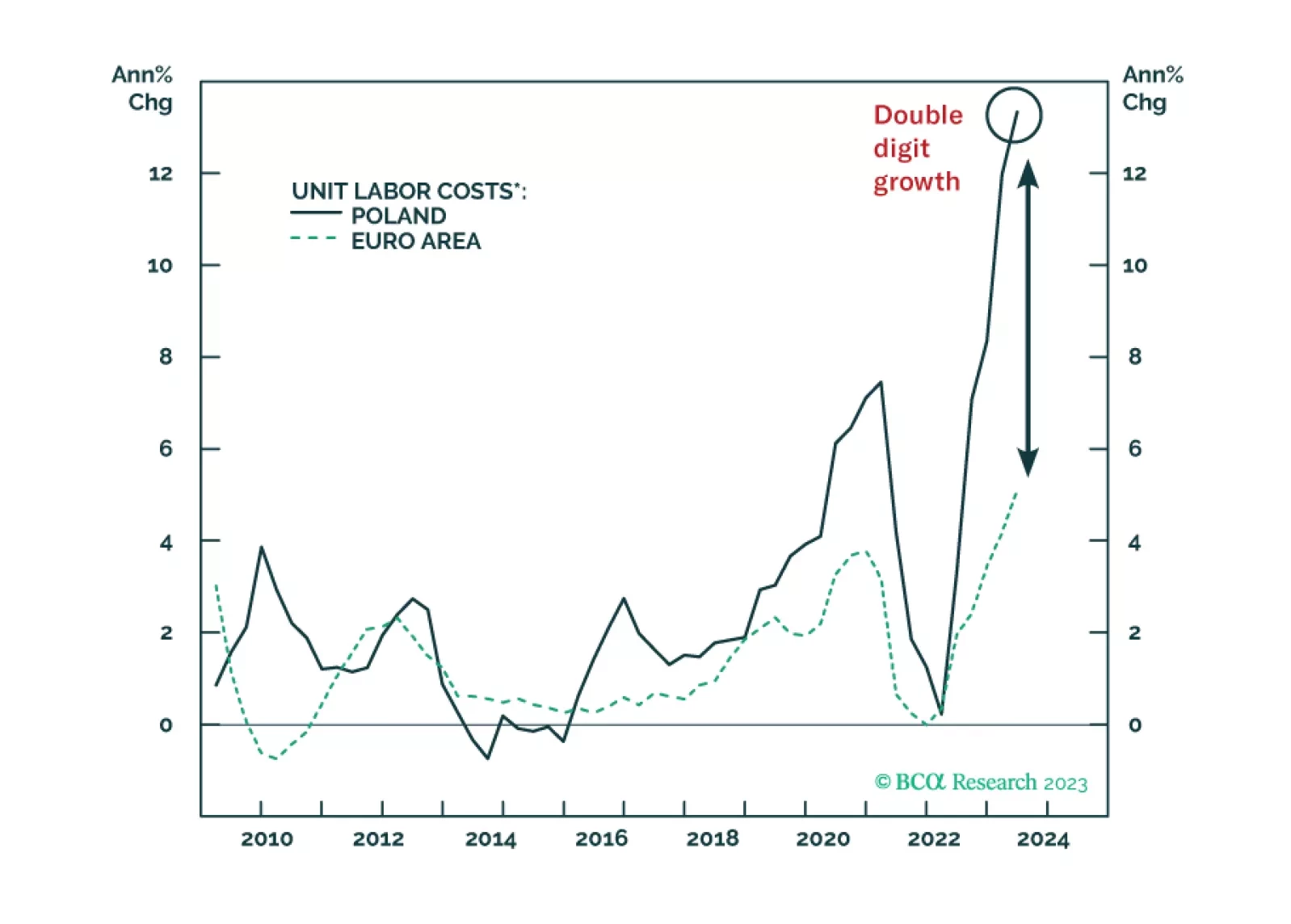

Poland’s inflation will stay elevated. And yet, its return to the European mainstream has improved its financial market outlook. Accordingly, we are recommending new trades on Polish equity, fixed income, and currency.

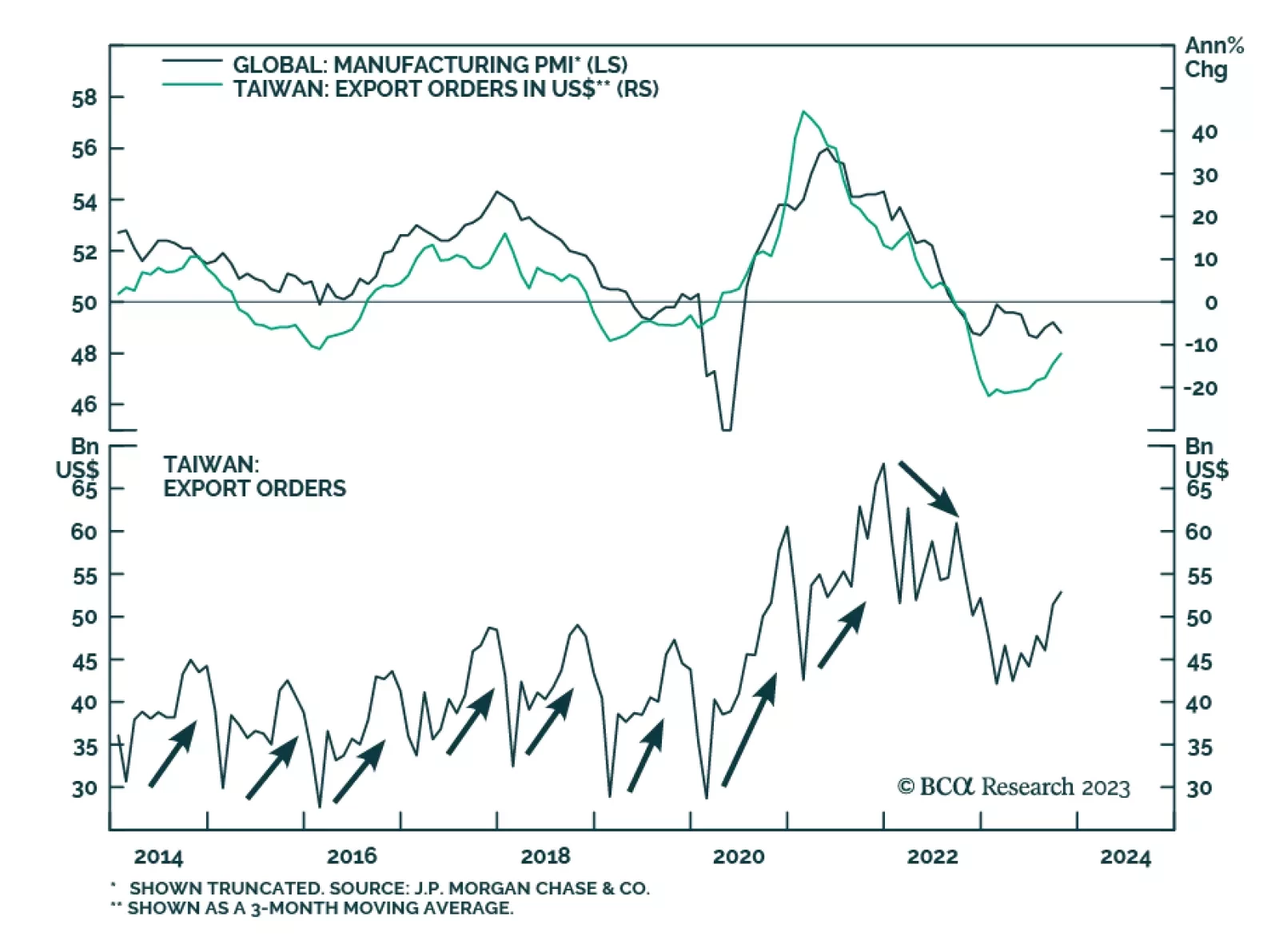

To the extent that Taiwanese export orders act as a bellwether for global trade dynamics, we often monitor the release to gain a sense of the state of the manufacturing cycle. On this front, the October update provided a positive…

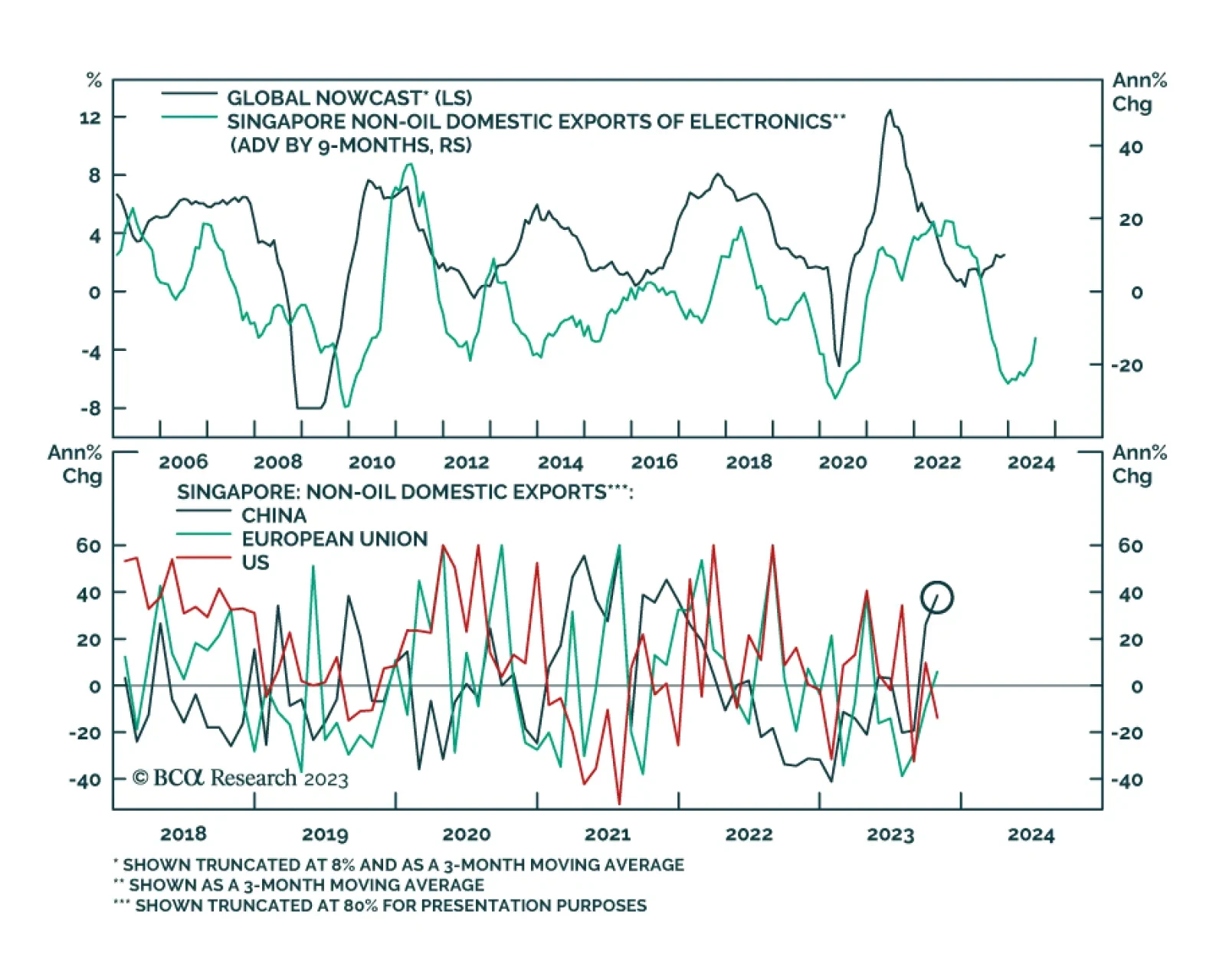

Singapore is a small open economy that is highly sensitive to fluctuations in the global manufacturing activity. As such, Singapore’s non-oil domestic exports (NODX) are a bellwether for global growth. Singapore’s…