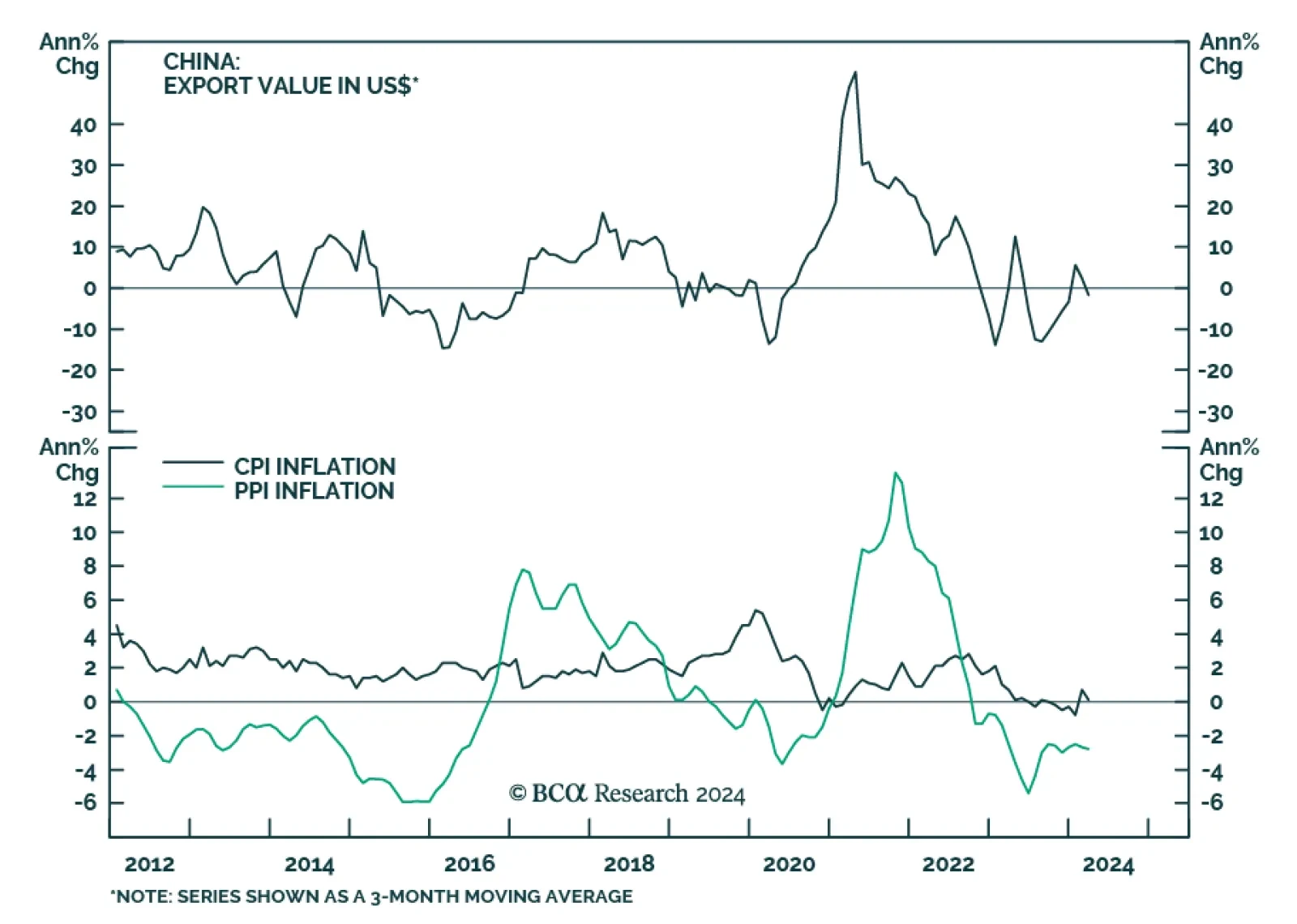

Chinese trade and credit data delivered a negative surprise for March. On the trade front, the 7.5% y/y drop in exports came in below expectations of a 1.9% y/y decline following four consecutive months of growth. While the jump…

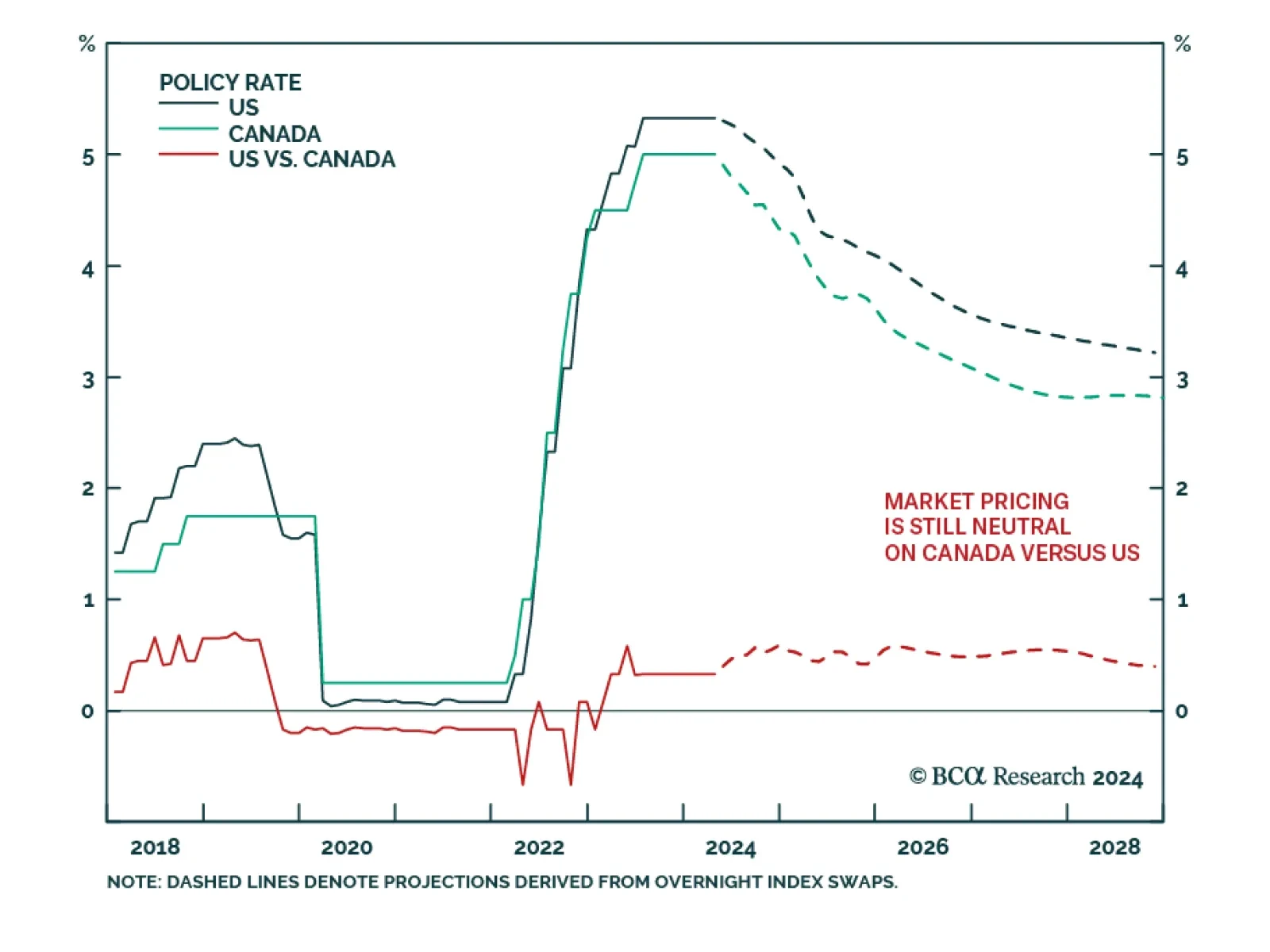

In terms of interest rate bets, markets are now roughly neutral on whether the Fed or Bank of Canada move the most in the next 12 months. BCA Research’s Foreign Exchange Strategy service’s bias is that it will be the…

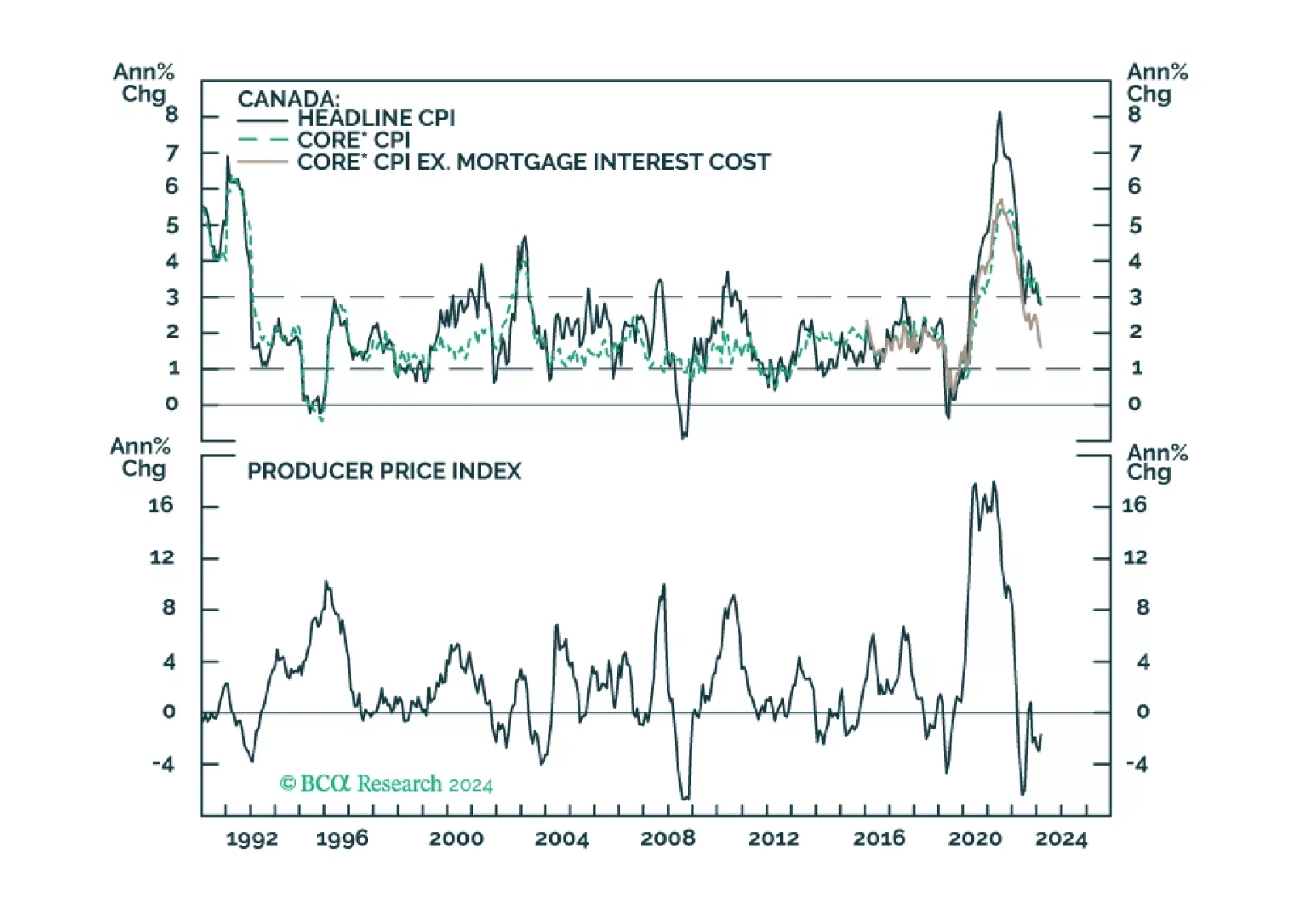

In this insight, we calibrate our investment views based on the latest Bank of Canada decision.

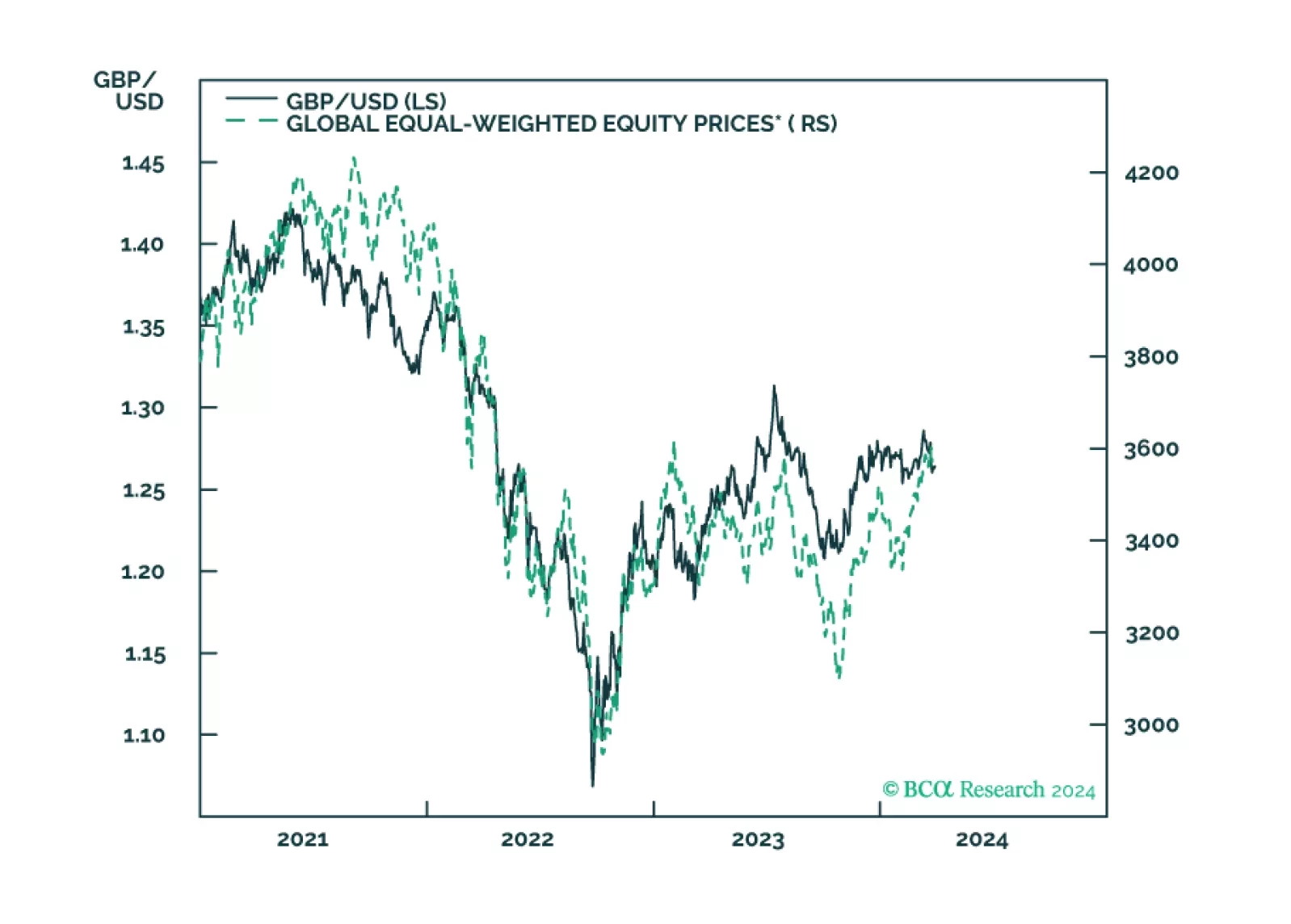

In this Insight, we discuss our rationale for a short sterling position.

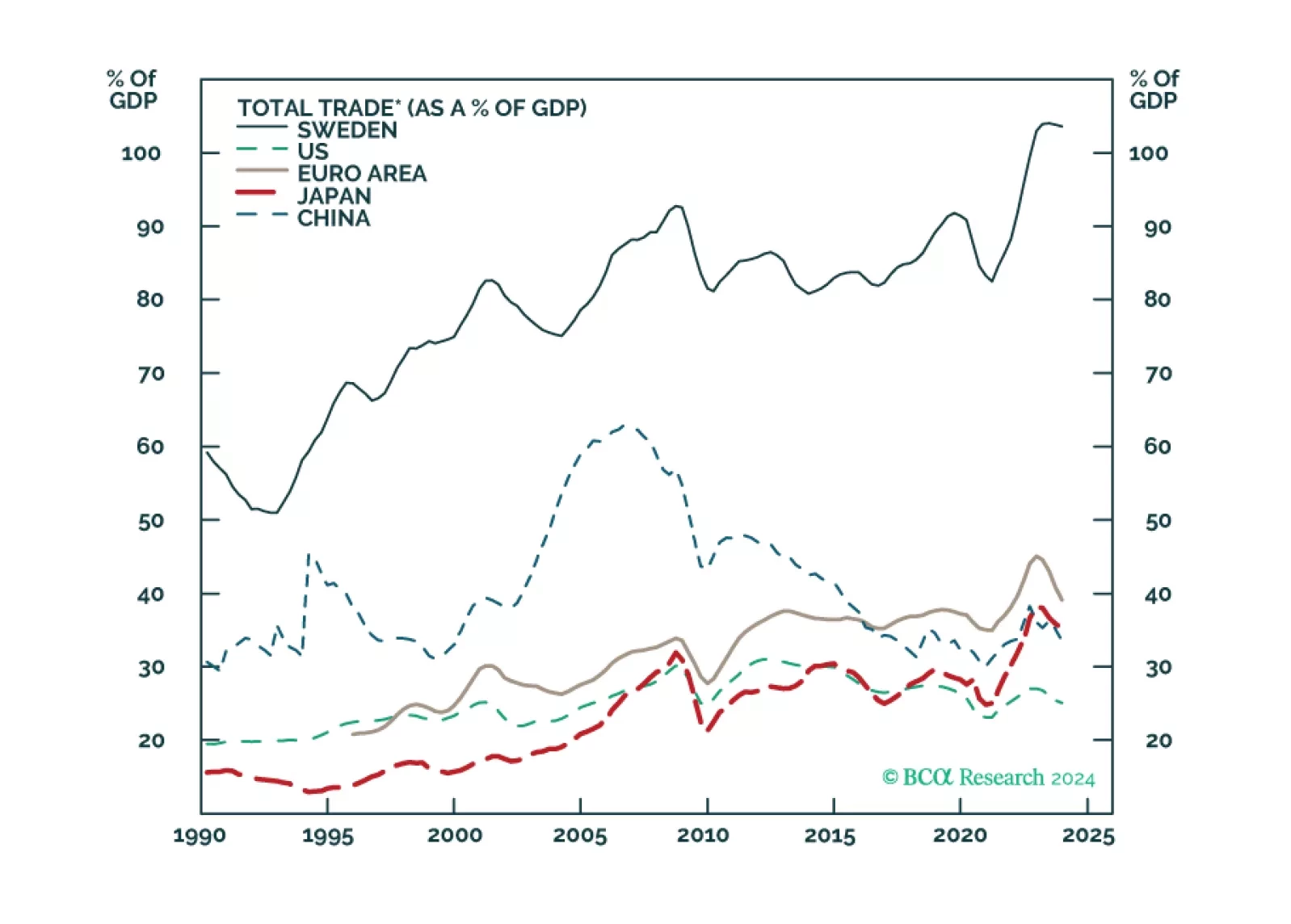

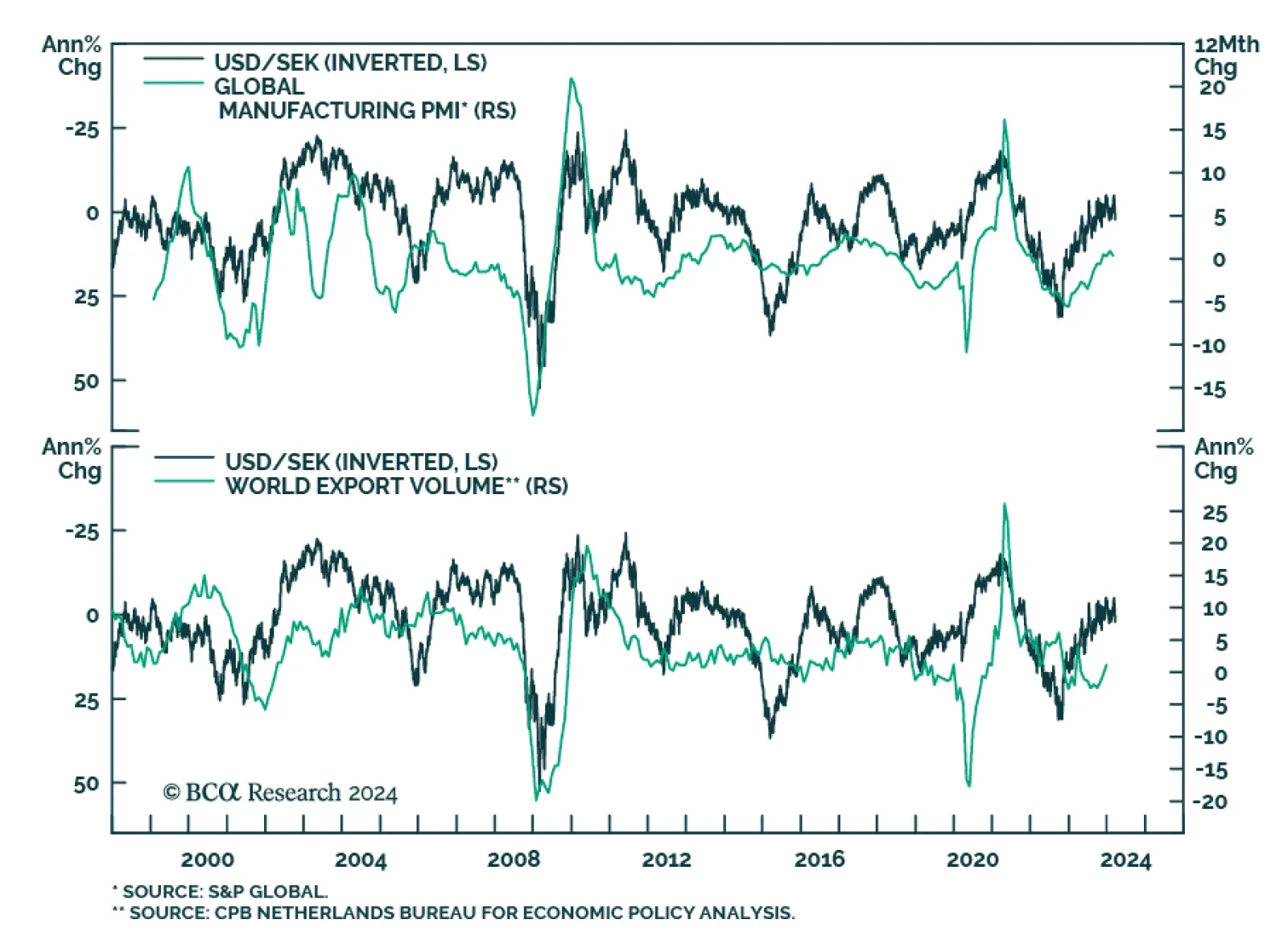

Swedish economic data is usually good at sniffing out the outlook for global growth. Looking at a broad swath of indicators, from domestic conditions to barometers of external demand, our colleagues from BCA’s Foreign…

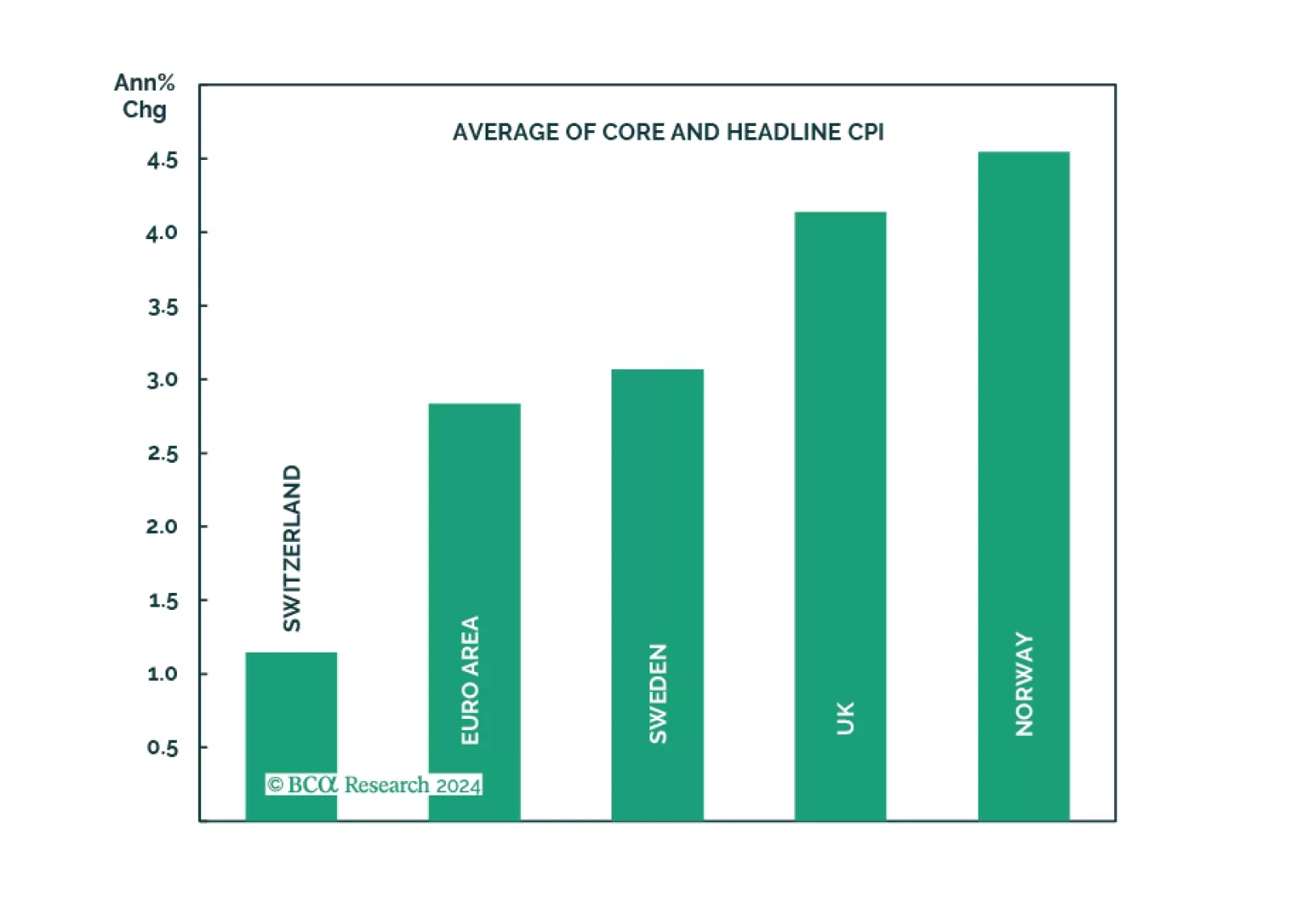

Does the recent surprise rate cut by the Swiss National Bank augur other dovish surprises among major central banks in Europe?

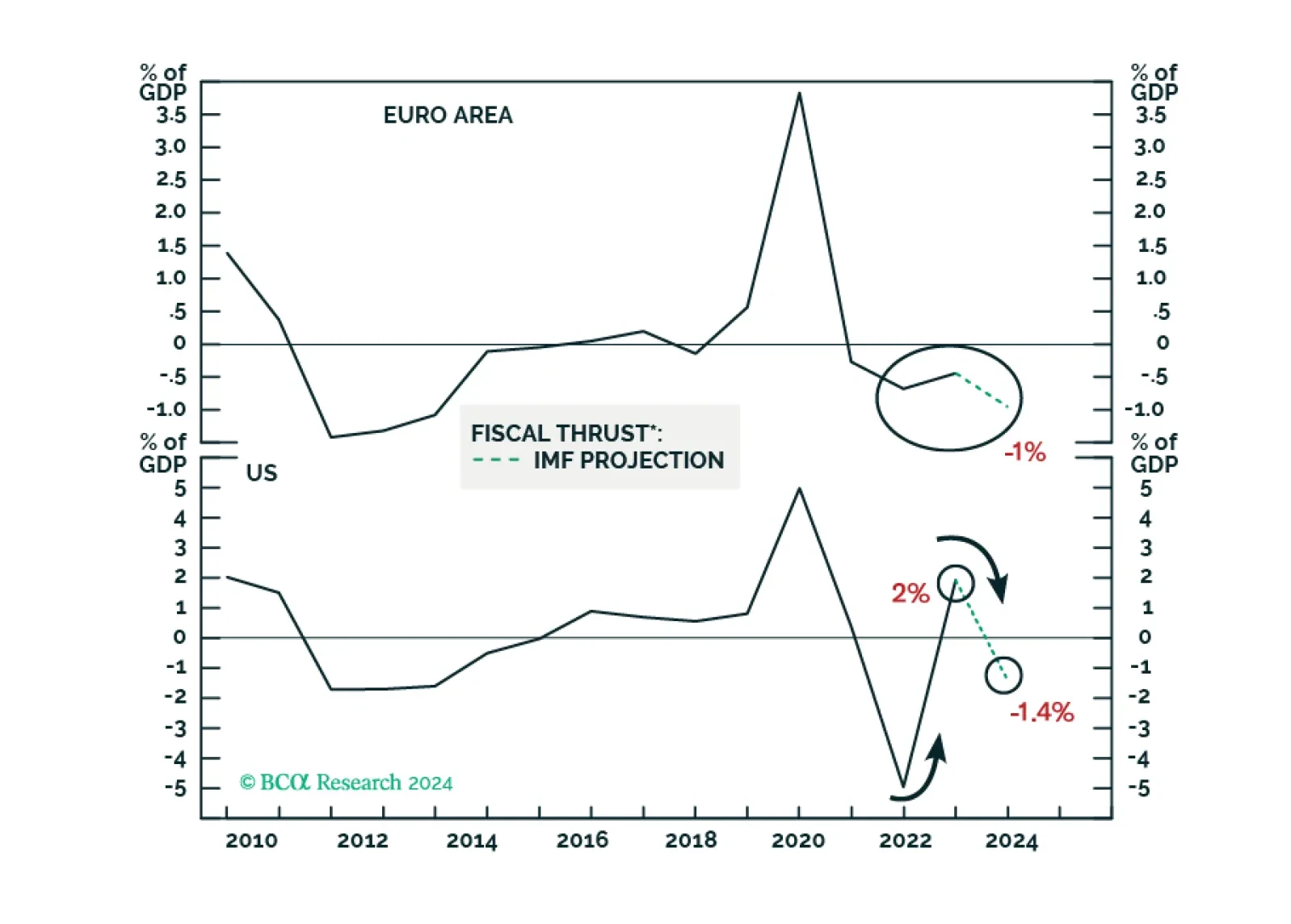

Despite a couple of rate cuts in H2 2024, borrowing costs will remain elevated in real terms amid lower inflation in the US and Europe. This and tightening fiscal policy will hinder domestic demand in advanced economies. Domestic…

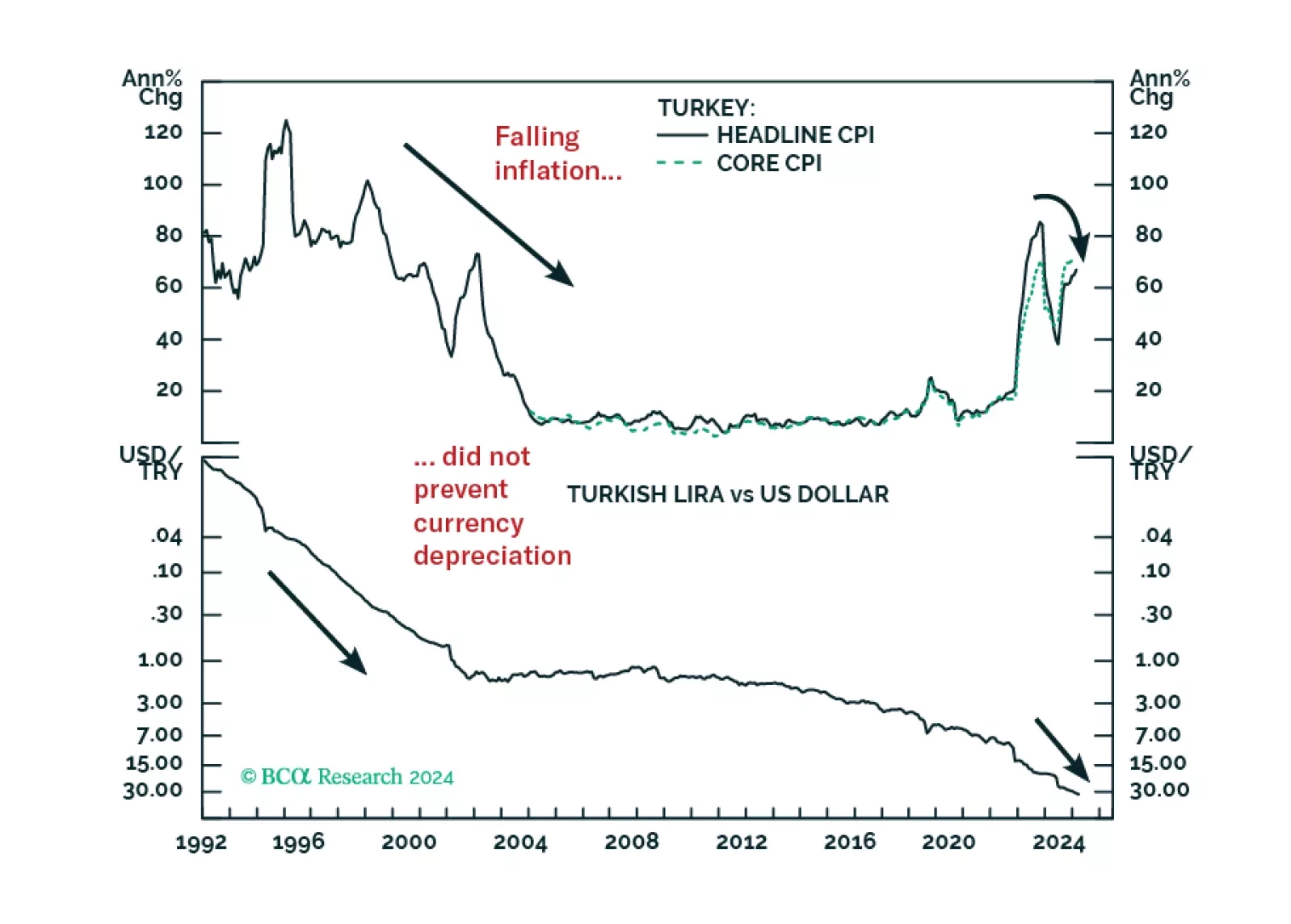

Turkey’s macro policy stance can hardly be called orthodox. And yet, corporate profit margins will contract meaningfully this year. The lira can also fall massively even if inflation eases from the extremely high levels – just as it…

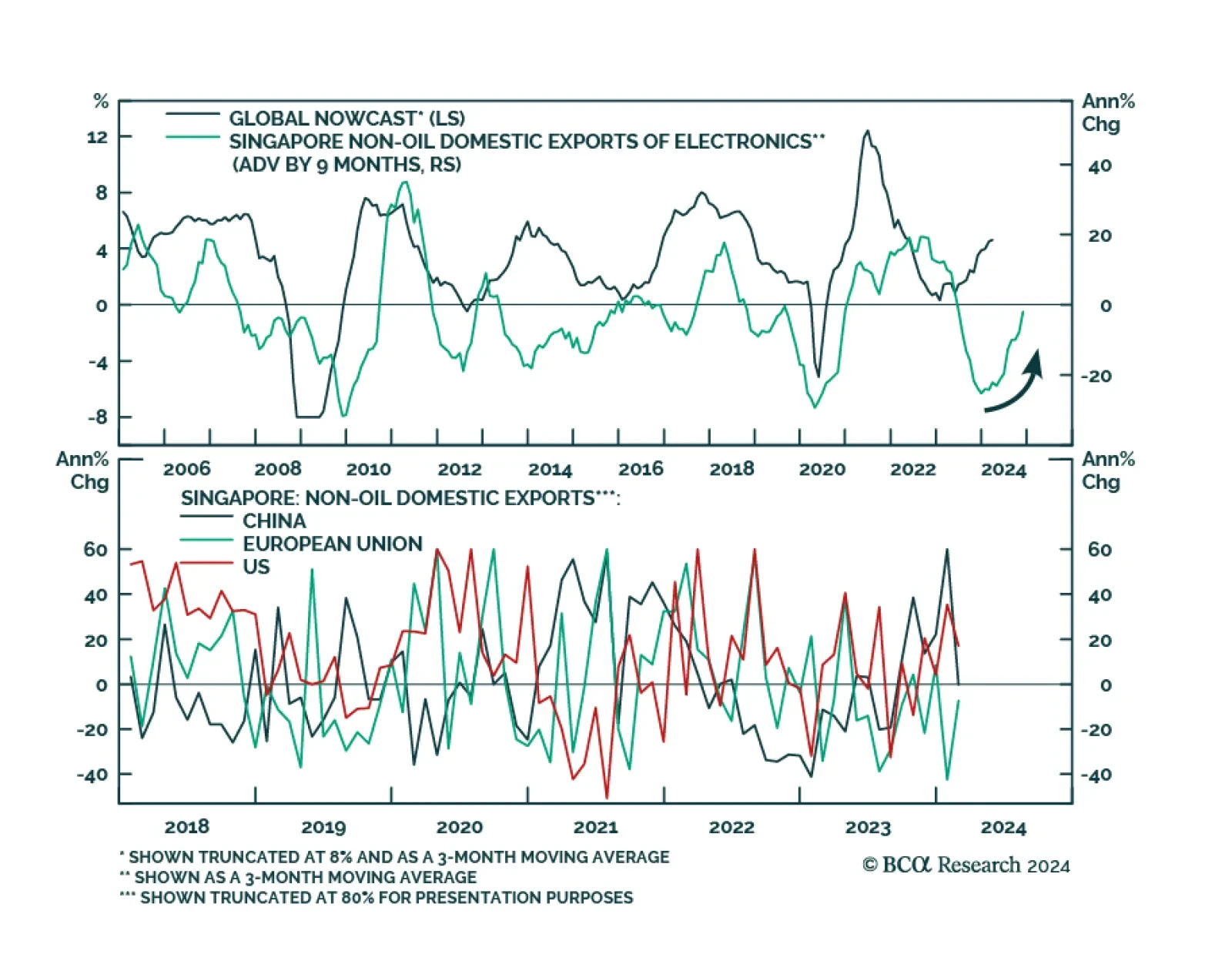

Singapore non-oil exports (NODX) largely disappointed in February, contracting by 4.8% m/m following a 2.3% m/m expansion in January, and falling below expectations of a milder 0.5% m/m decline. In a similar vein, the 0.1% y/y…