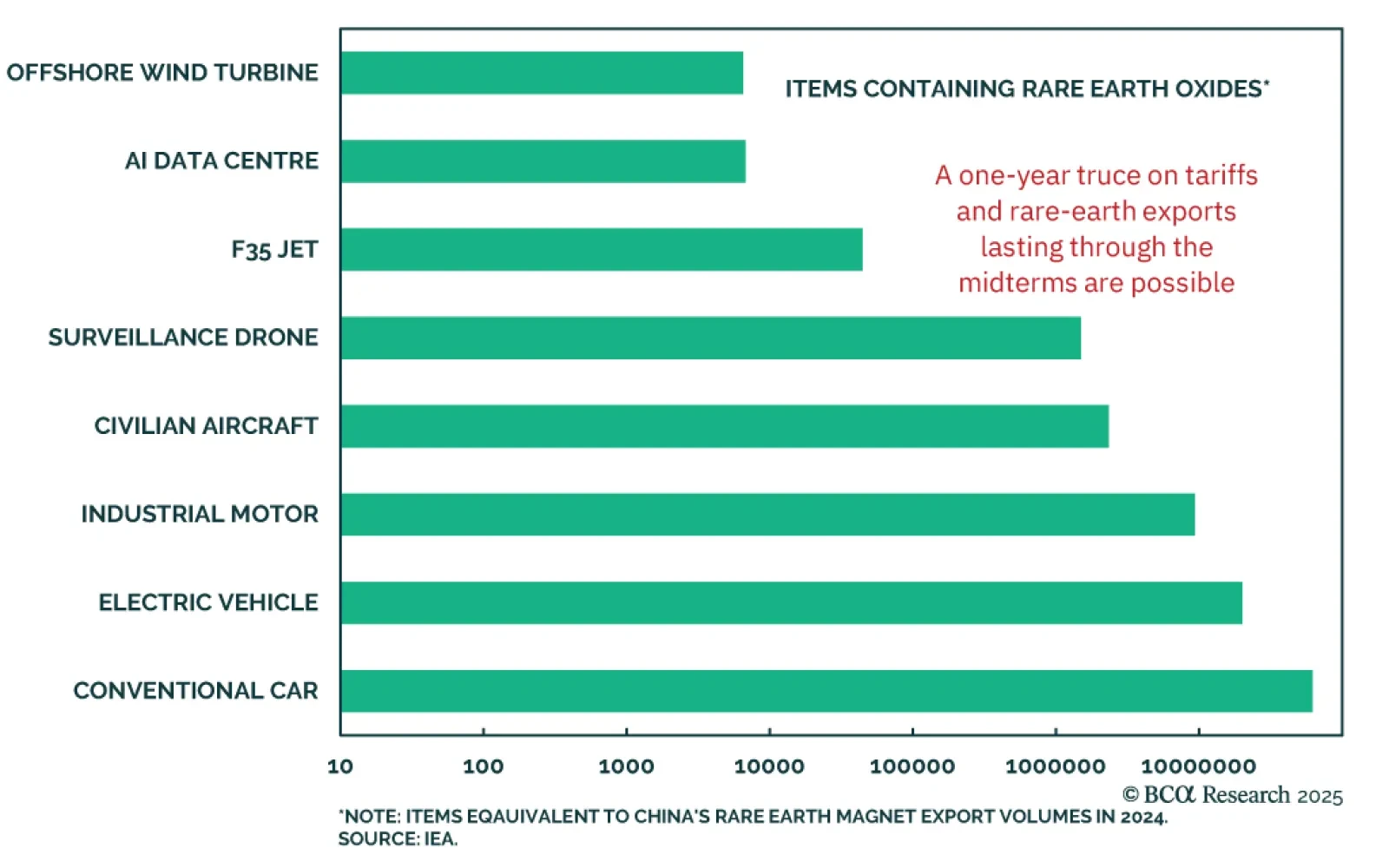

The US and China appear to be moving toward a trade deal, though it remains unclear whether the goal is simply damage control or a genuine expansion of market access. Presidents Trump and Xi are scheduled to meet on October 30 in…

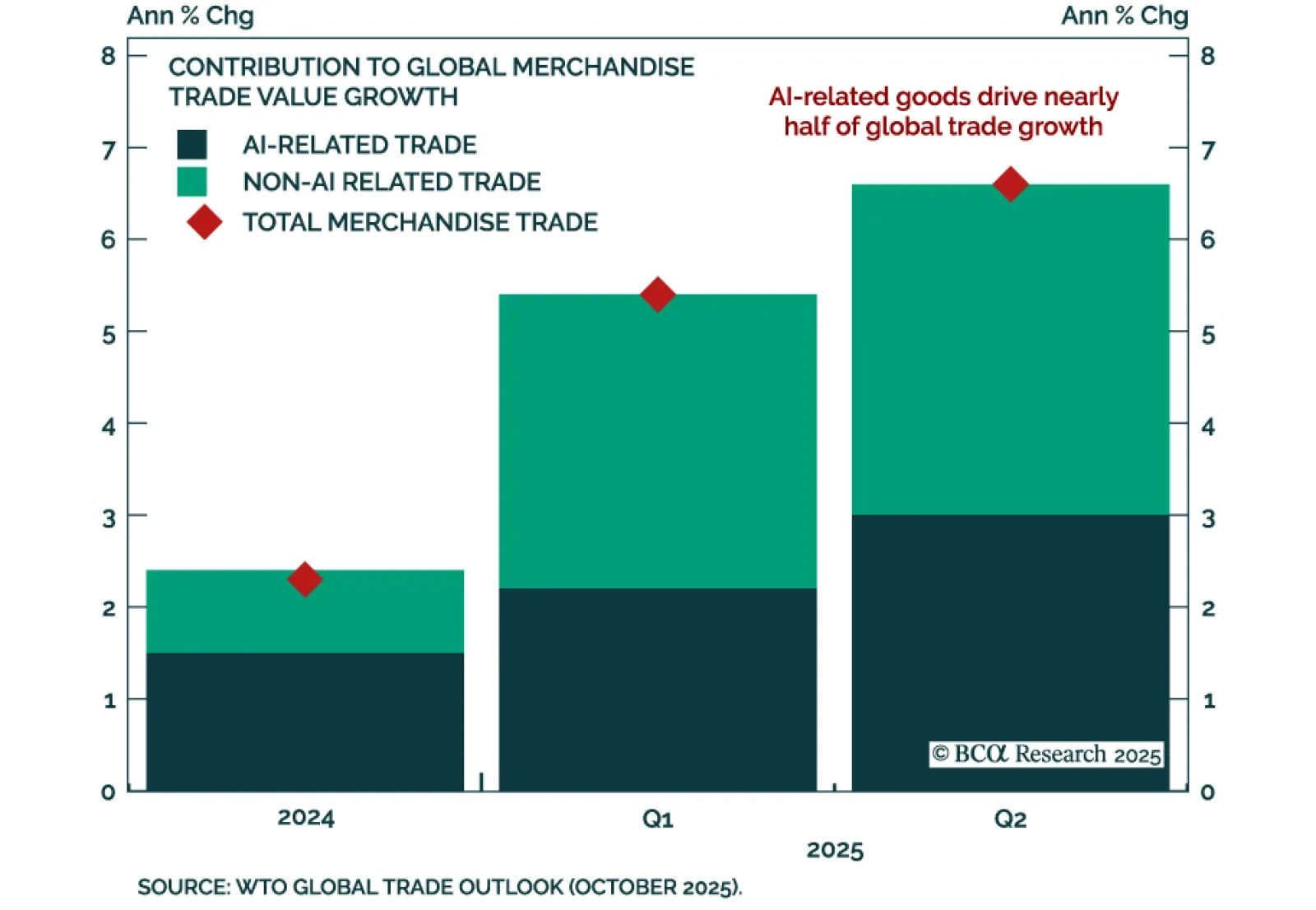

AI-related trade and frontloading lifted global trade growth in 2025 but also increased the risk of a slowdown next year, according to the WTO’s latest Global Trade Outlook. The organization sharply revised up its forecast for 2025…

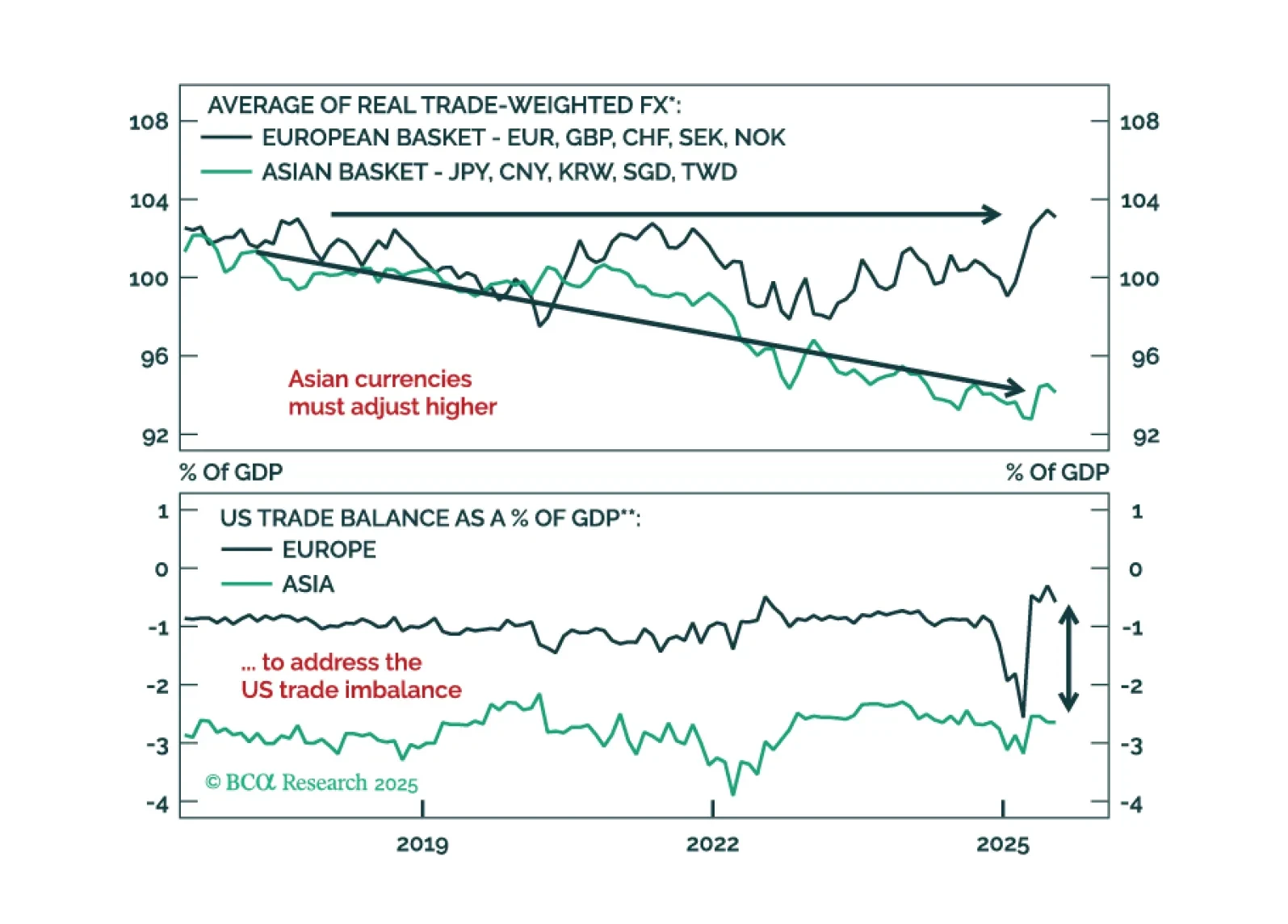

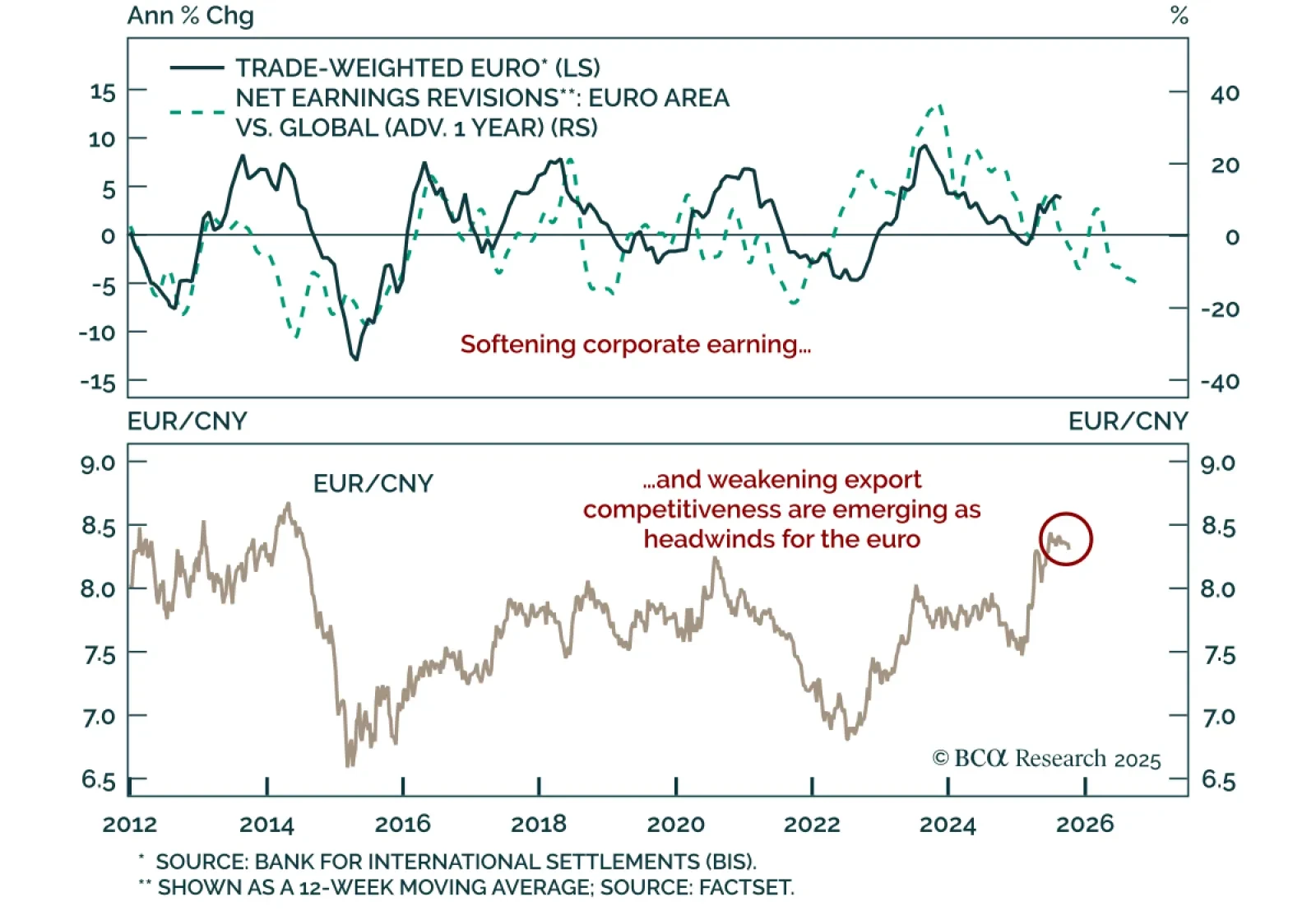

The euro’s strong performance this year remains underpinned by structural forces, but near-term headwinds are starting to emerge, arguing for patience in adding exposure.The euro’s sharp 10% appreciation against the Chinese yuan this…

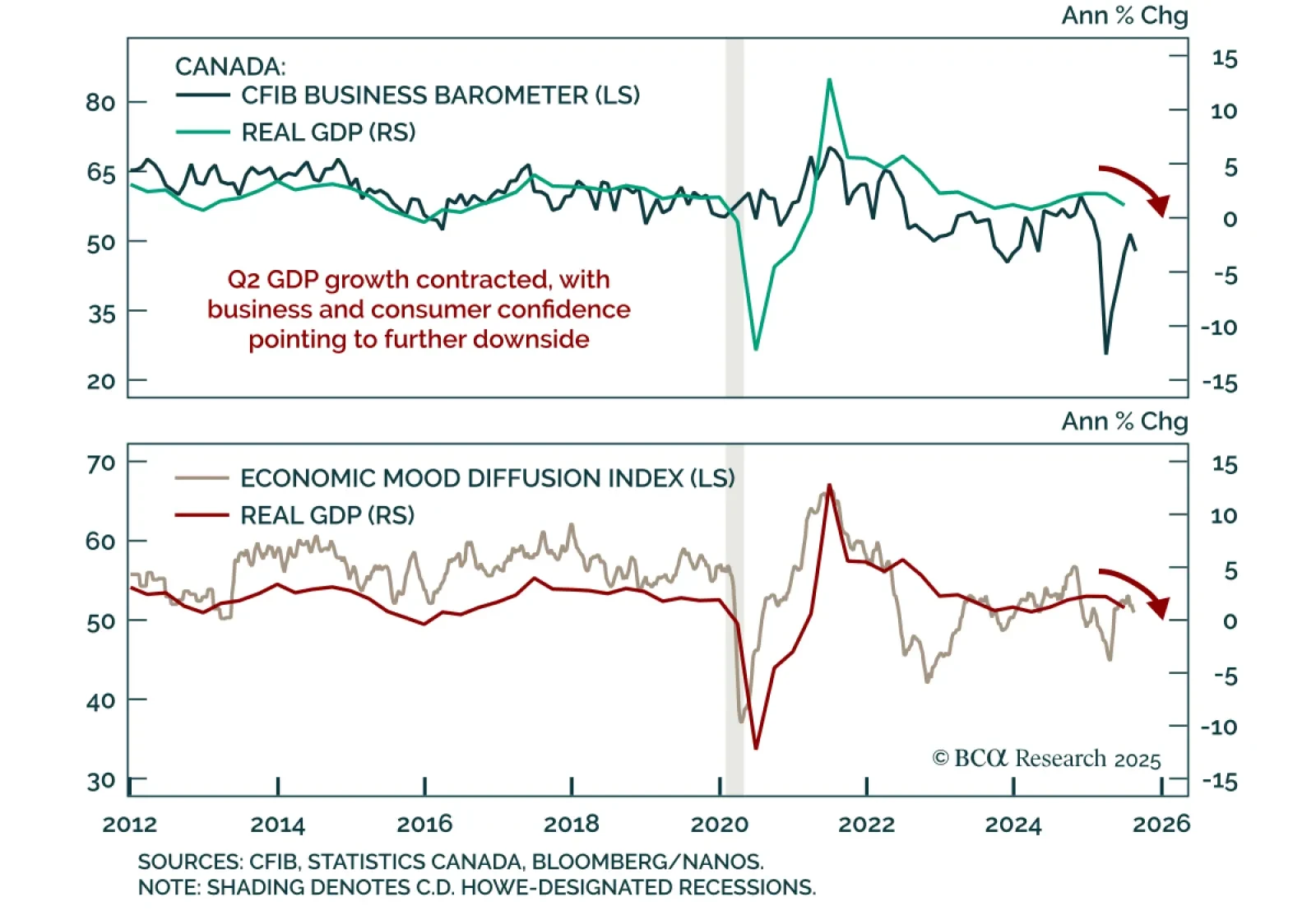

Trade concerns continue to weigh on Canada, reinforcing a cautious macro outlook with near term downside for bond yields and the CAD, though the currency selloff is getting stretched and could soon present an attractive entry point.…

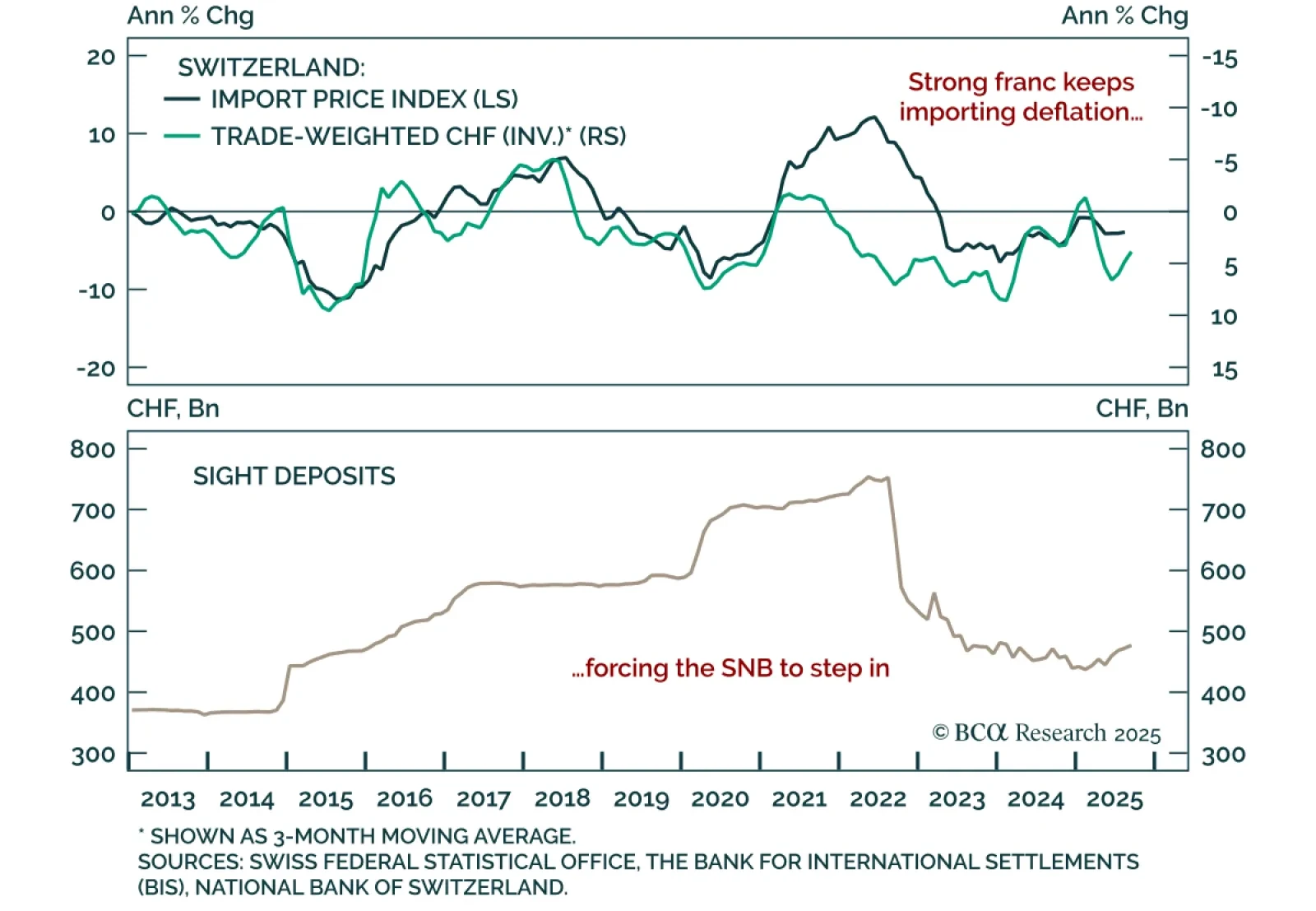

Expect greater currency interventions and negative policy rates from the Swiss National Bank (SNB), reinforcing a neutral stance on CHF and Swiss sovereign debt over the next 12 months. In recent joint statement on foreign…

A fleeting greenback rally post Fed rate cut will offer a final chance to reset short dollar exposures. See why undervalued Asian FX are poised to lead the next leg lower in USD and how to position now.

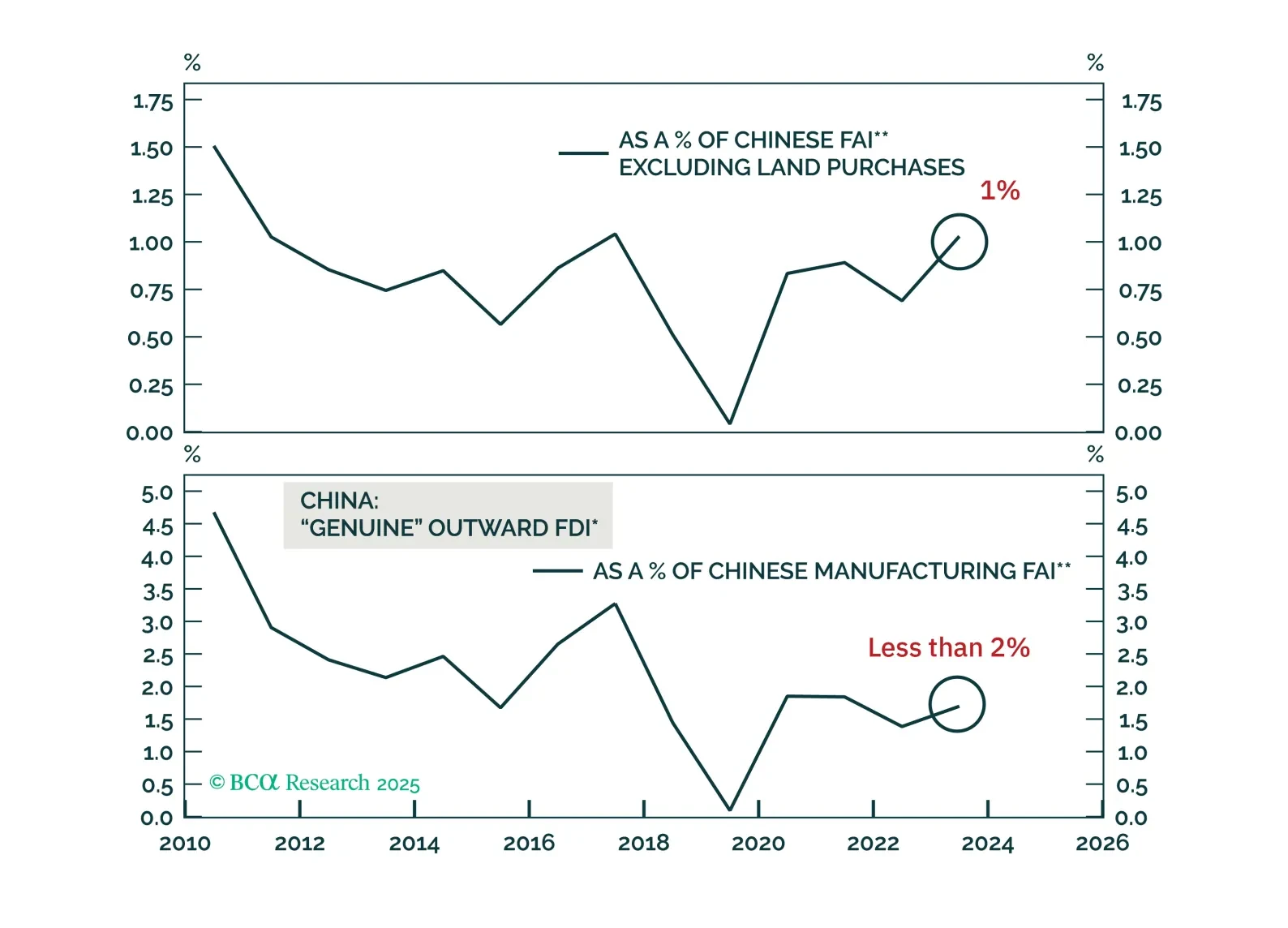

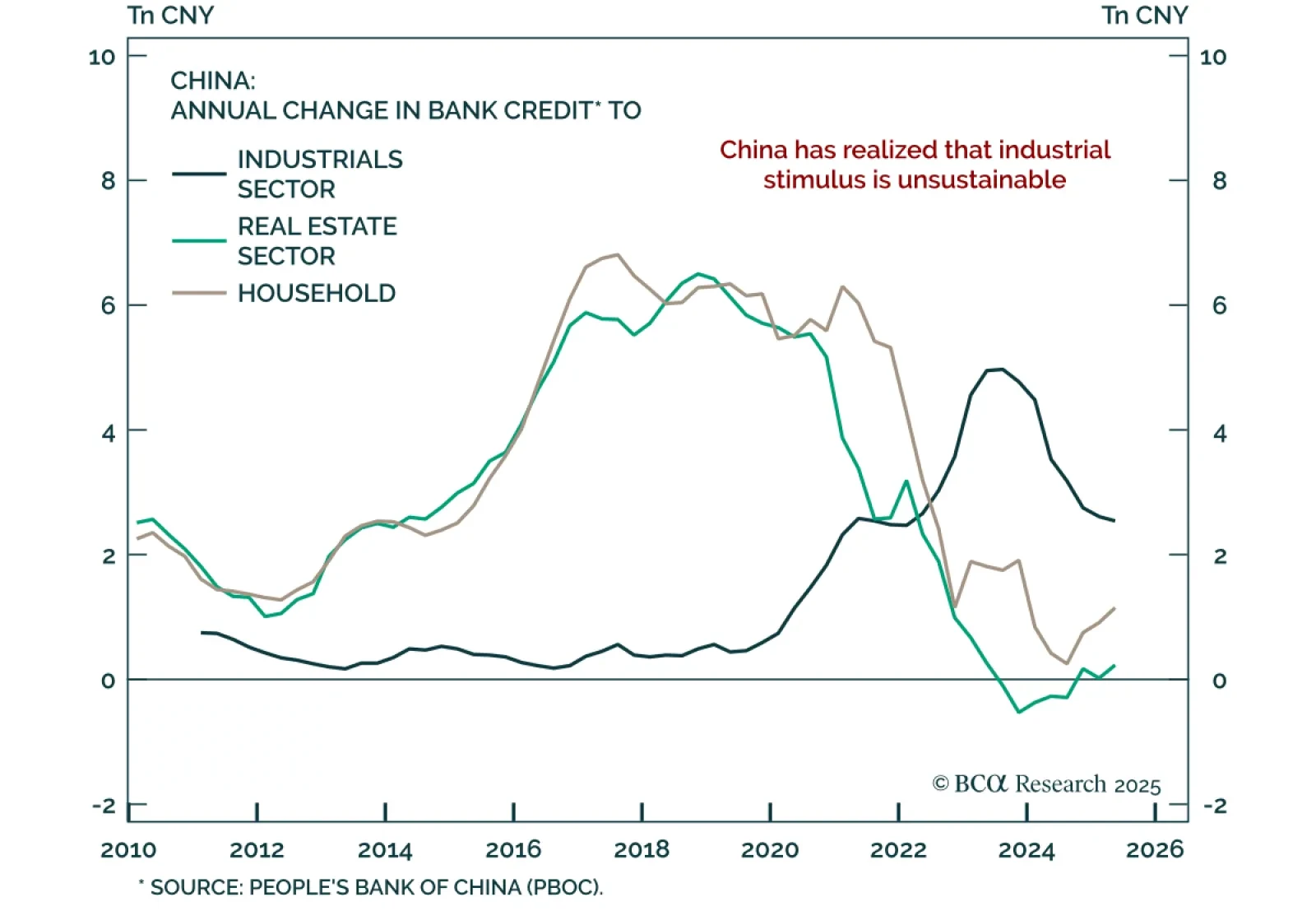

Our Global Asset Allocation strategists upgrade the Chinese yuan to overweight as global imbalances between production and consumption begin to reverse. The US continues to overconsume and underproduce, while China overproduces and…

Canada’s Q2 GDP contraction underscores a fragile backdrop where growth risks will outweigh inflation, supporting further BoC easing. Real GDP contracted at an annualized 1.6% after expanding 2.2% in Q1, consistent with survey data…