In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

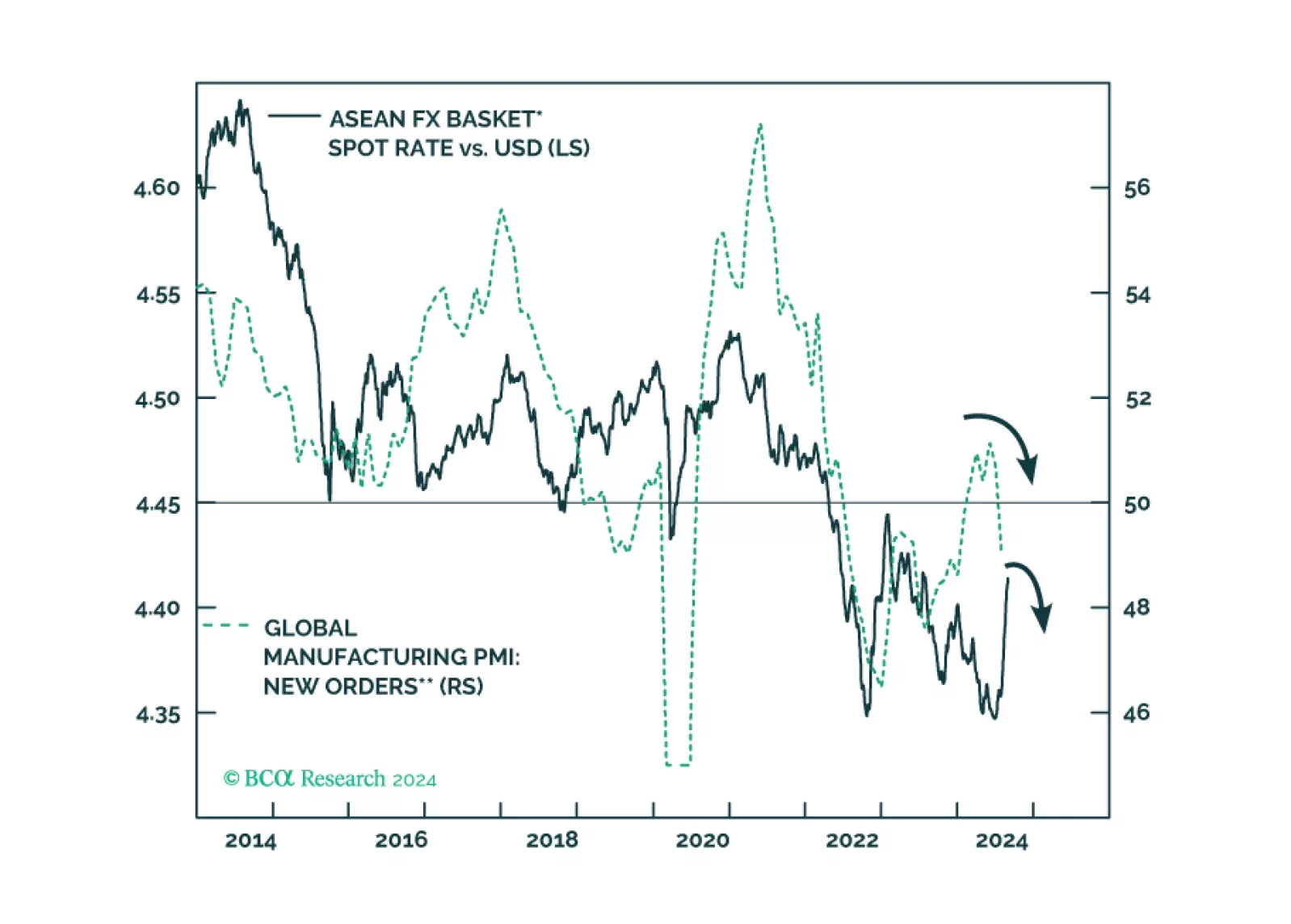

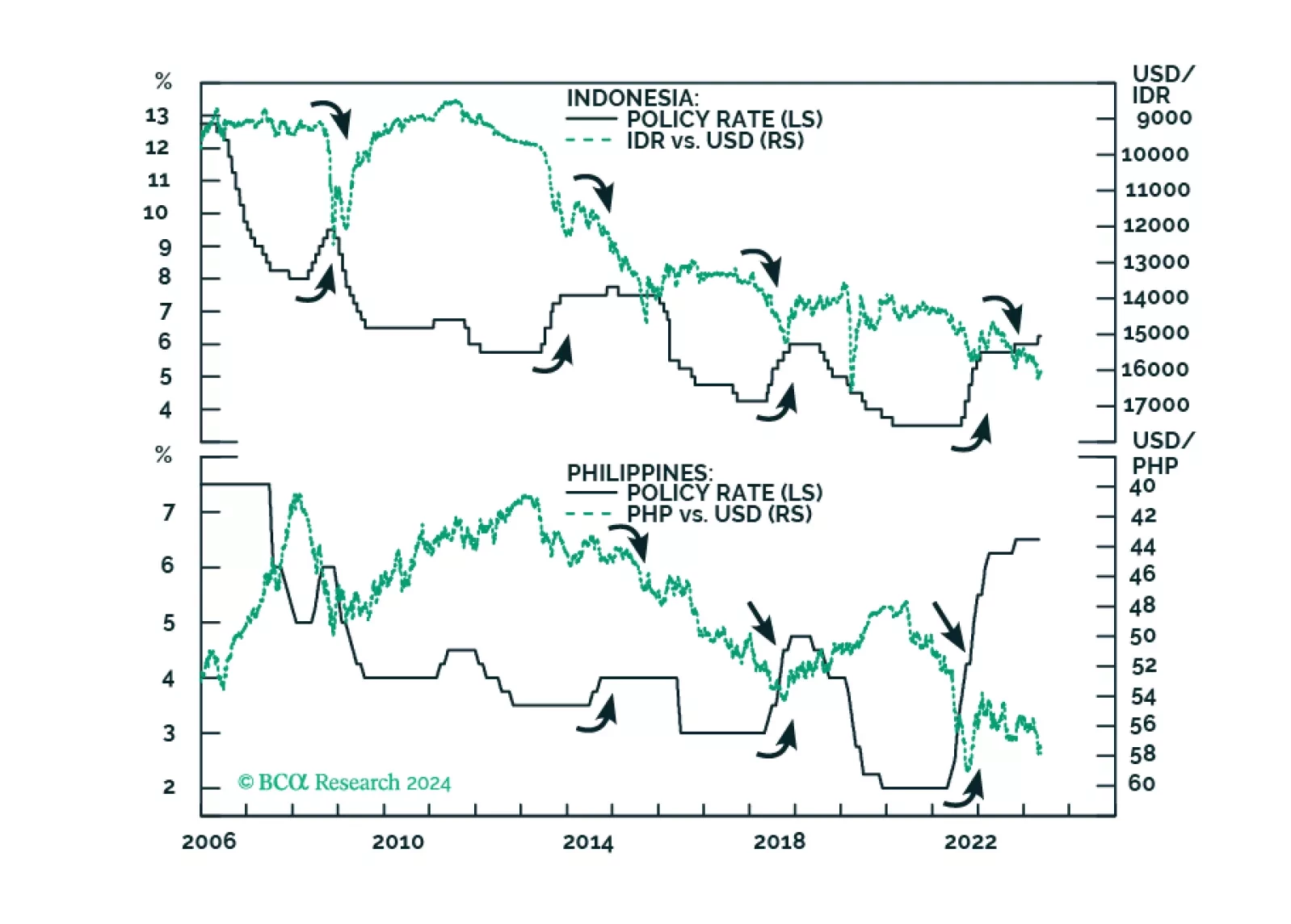

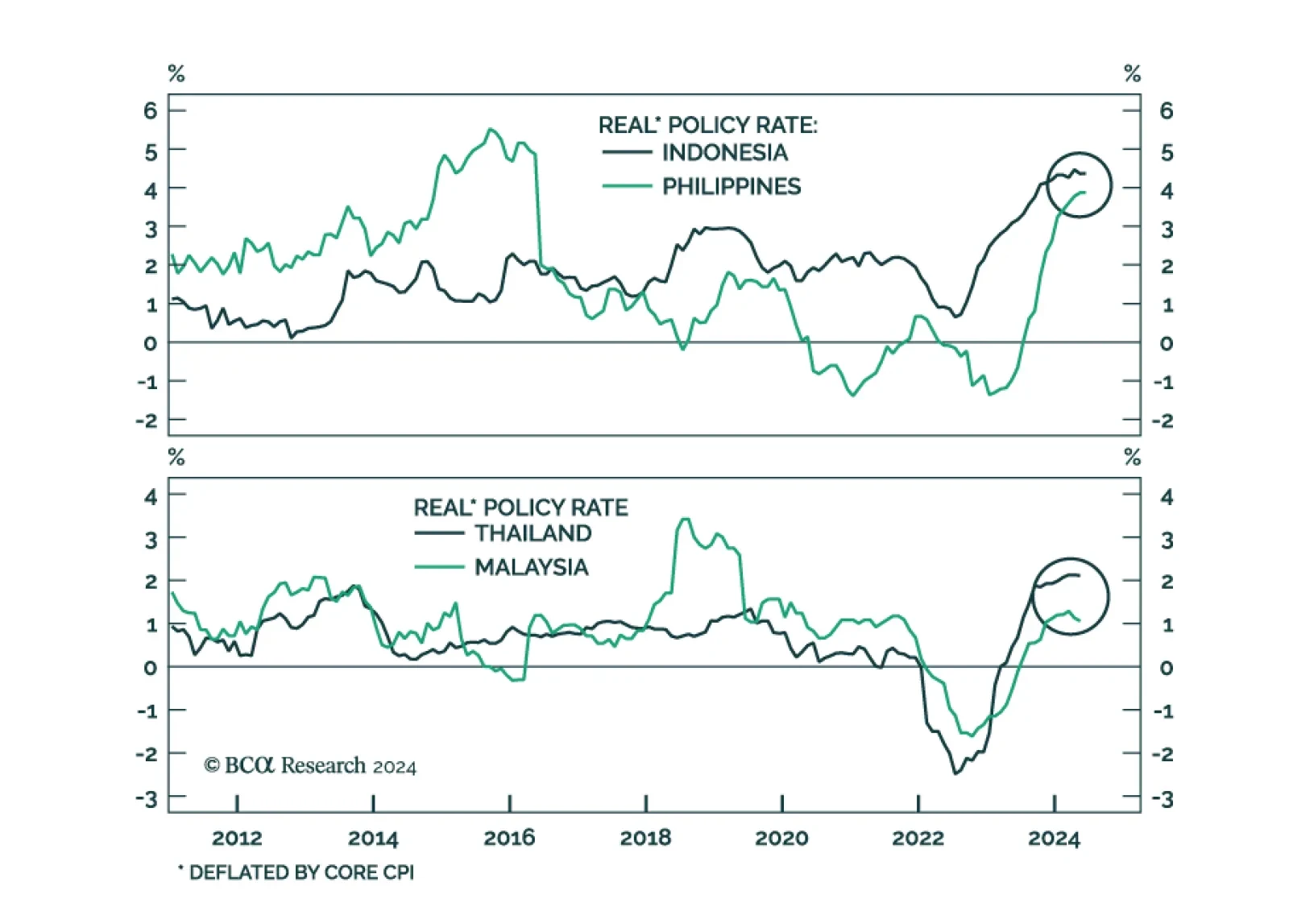

The ongoing rally in ASEAN currencies will fizzle sooner rather than later as they are not supported by fundamentals. The ringgit and the baht, however, will fare better than the peso and the rupiah during the coming global risk-off…

The four ASEAN stock markets (Indonesia, Malaysia, Thailand, and the Philippines) have fallen in absolute terms over the past year despite the powerful rally in the developed markets. They have also underperformed their EM…

ASEAN stocks and currencies will weaken further as these economies face multiple headwinds. Raising policy rates did not stop a sliding currency in the past, it is unlikely to do so now.

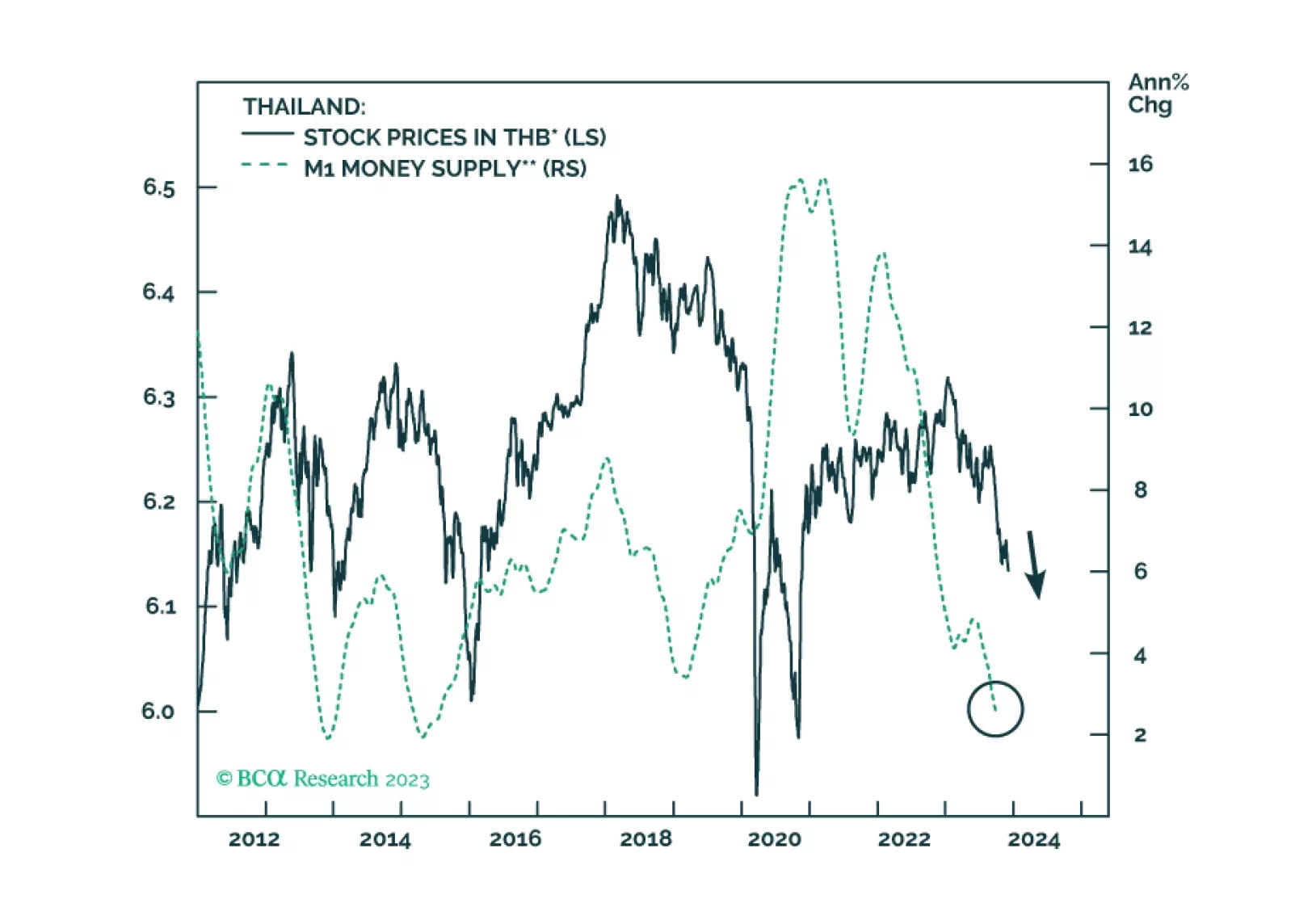

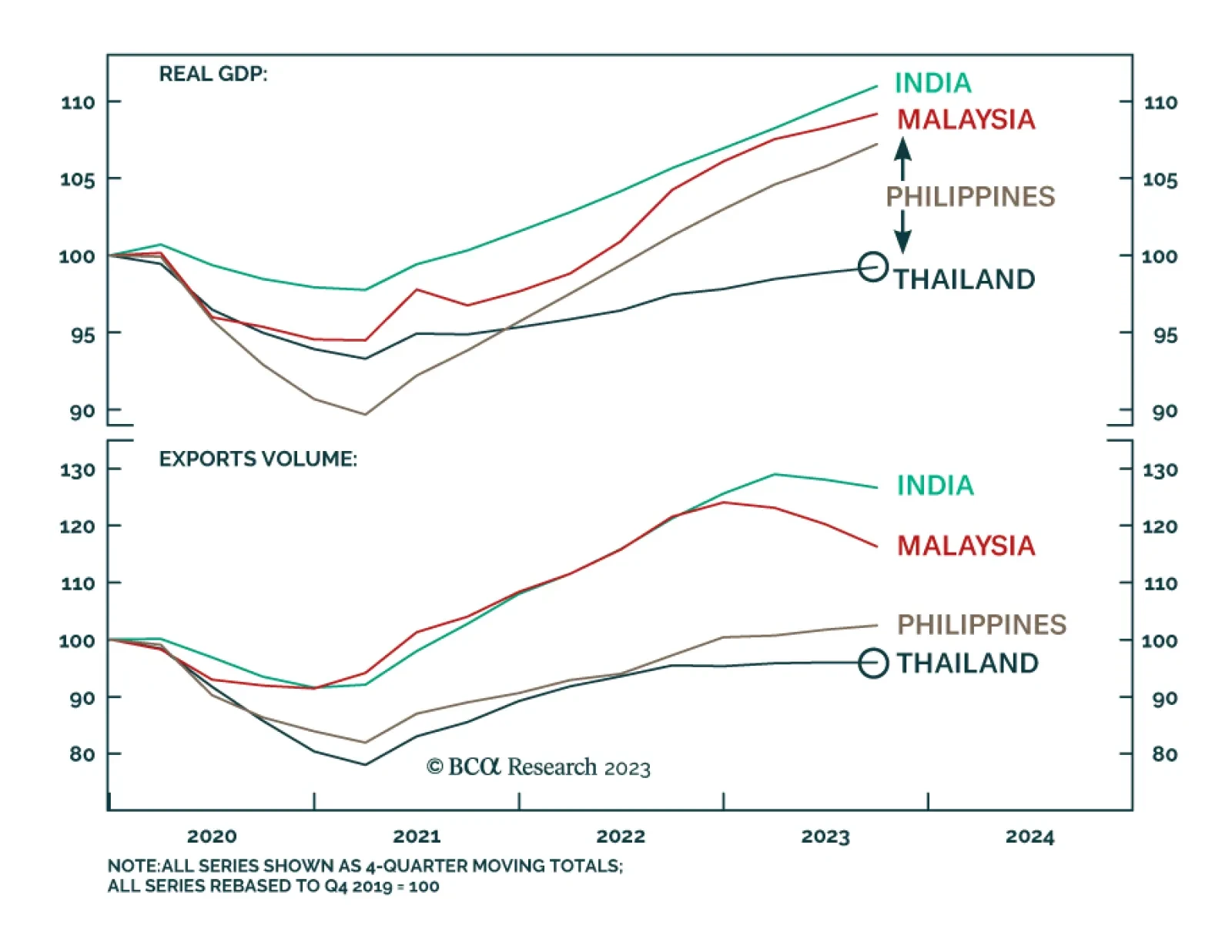

The Thai economy has continued to underwhelm its ASEAN peers since the pandemic. It grew at a measly 1.5% in Q3 this year compared to the same period last year. Thai stocks and the currency have sold off as well. That said,…

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

The Turkish presidential election will go to a runoff in two weeks, but President Erdogan outperformed his opinion polls. His party, the incumbent AKP, won a majority in parliament. This outcome rewards Turkey’s inflationary policies…

Macro and geopolitical risks may spoil the narrow window for a stock market rally before recessionary trends rise to the fore.