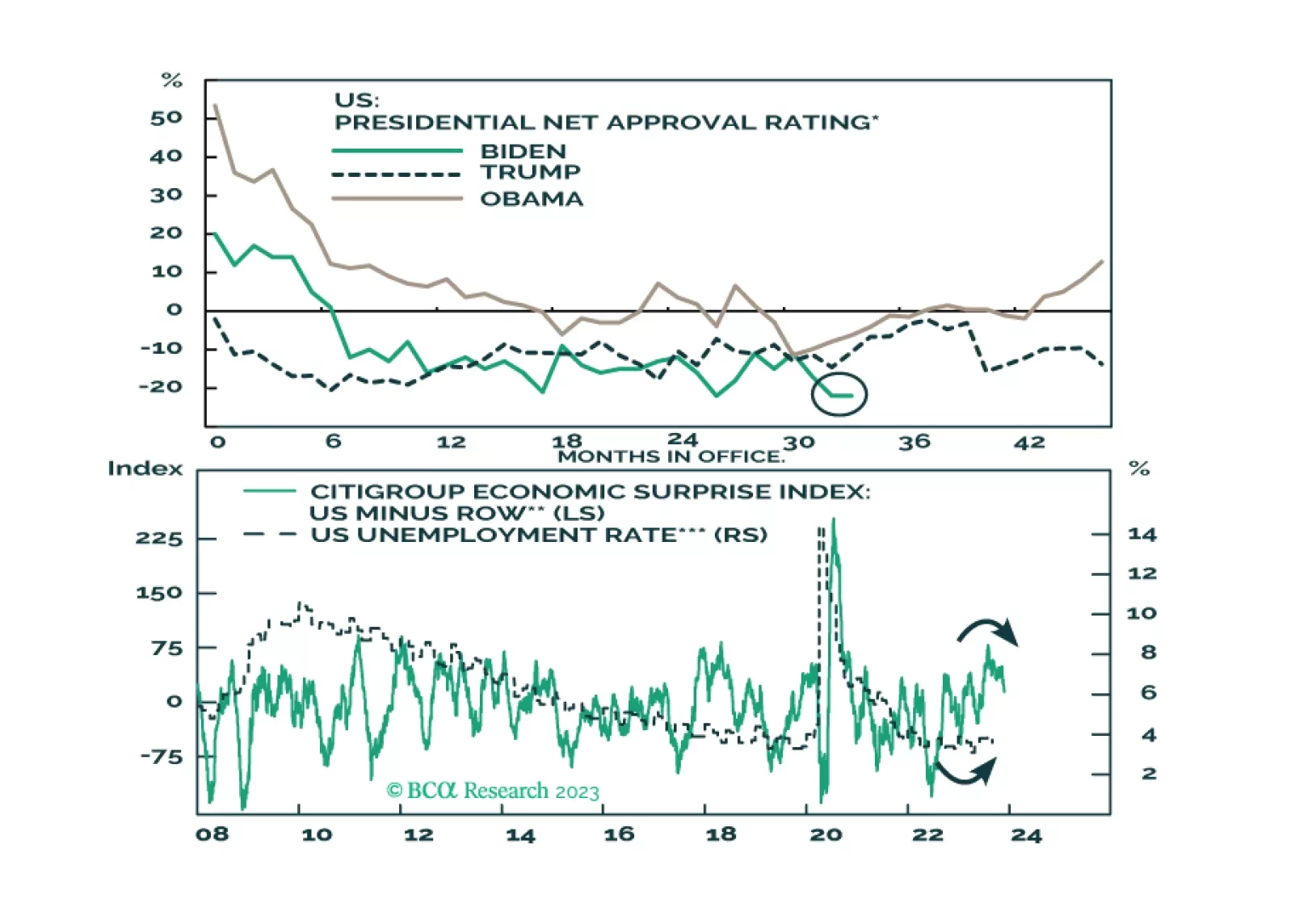

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

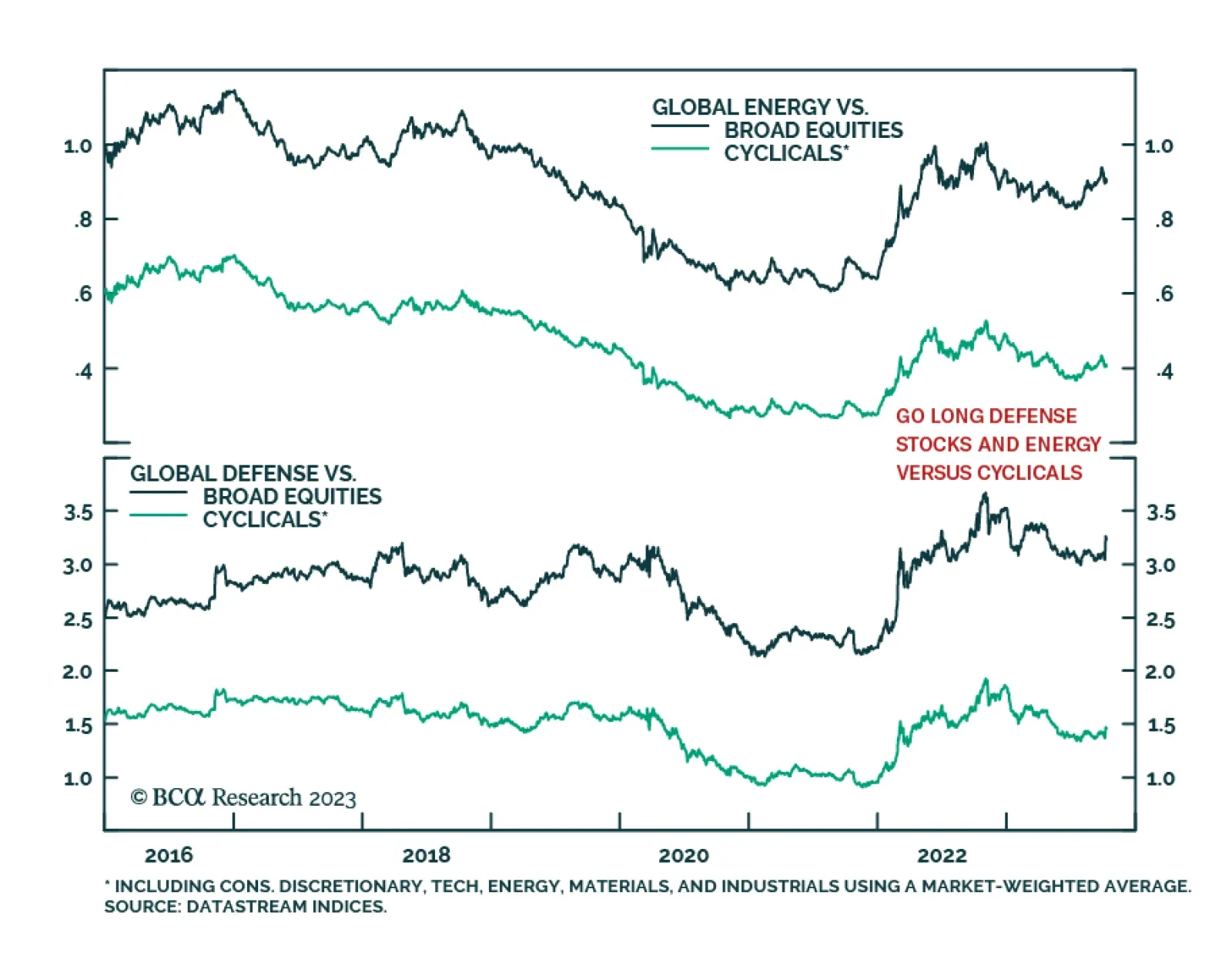

According to BCA Research's Geopolitical Strategy service, investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the…

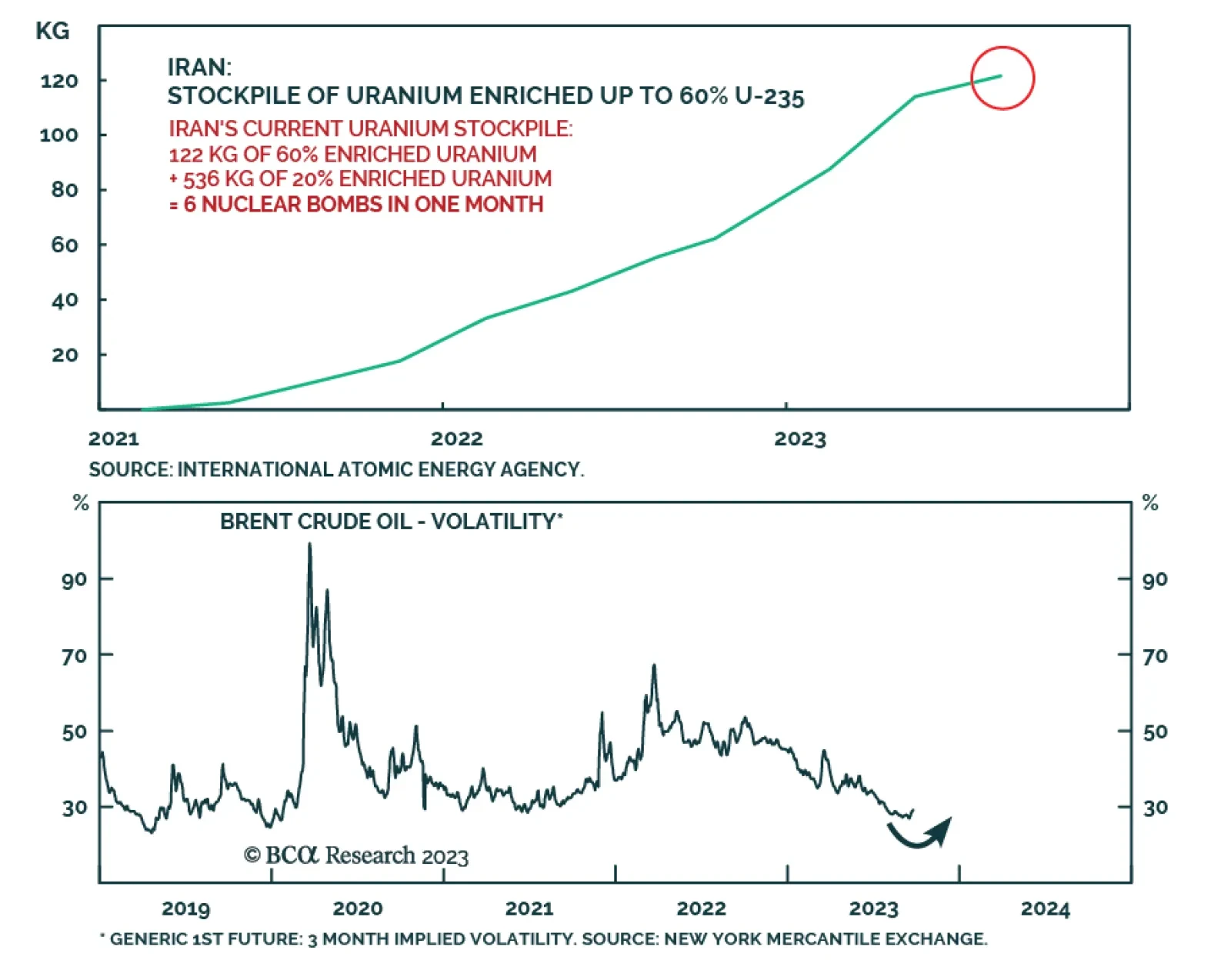

Investors should reduce risk, increase allocation to safe havens, and brace for oil price volatility and supply disruptions stemming from the Middle East over the next zero-to-12 months.

According to BCA Research’s Geopolitical Strategy service, Israel’s retaliation against Hamas has a 70% chance of expanding beyond Gaza in some form over the coming 12 months. The team’s scenarios and…

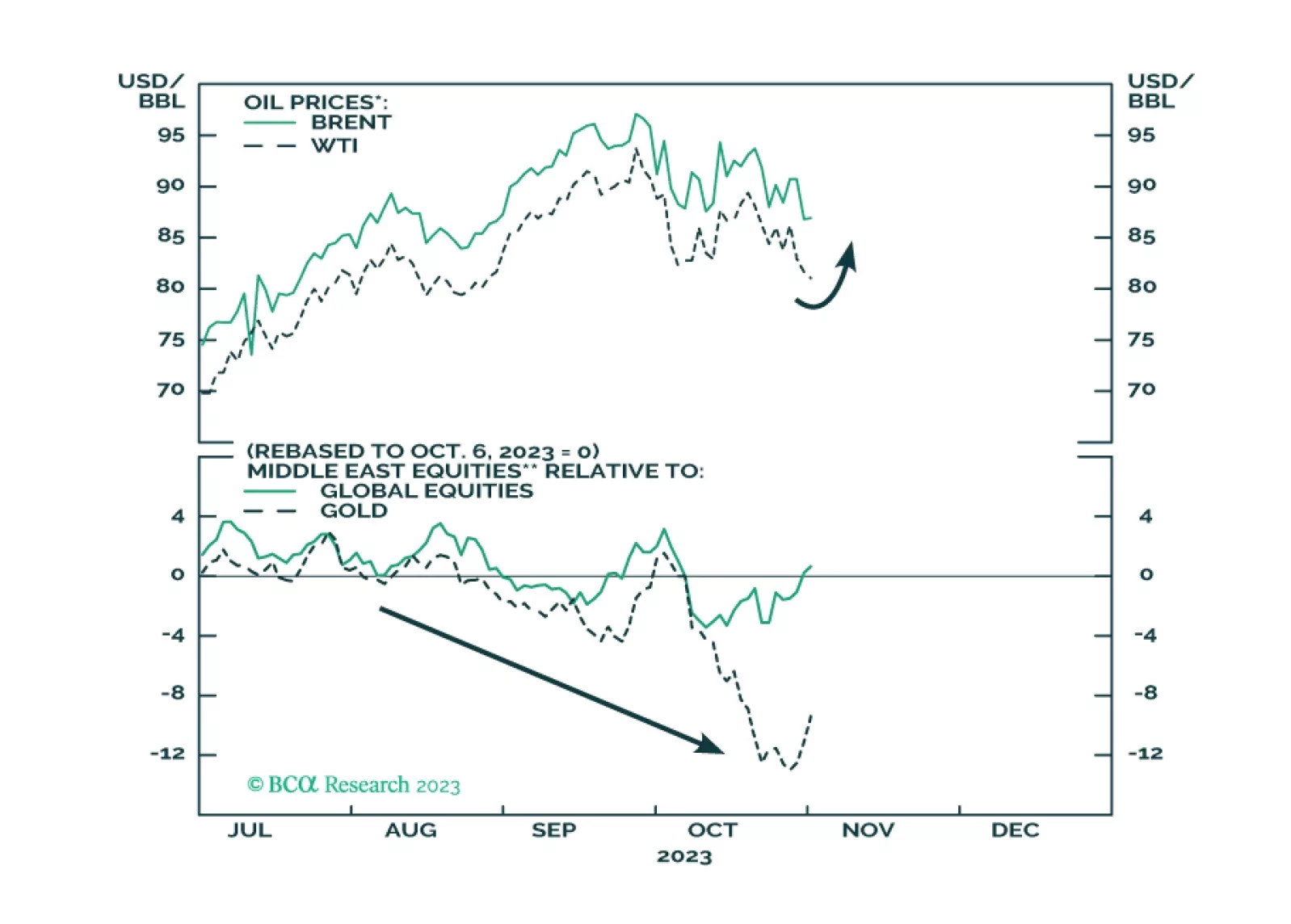

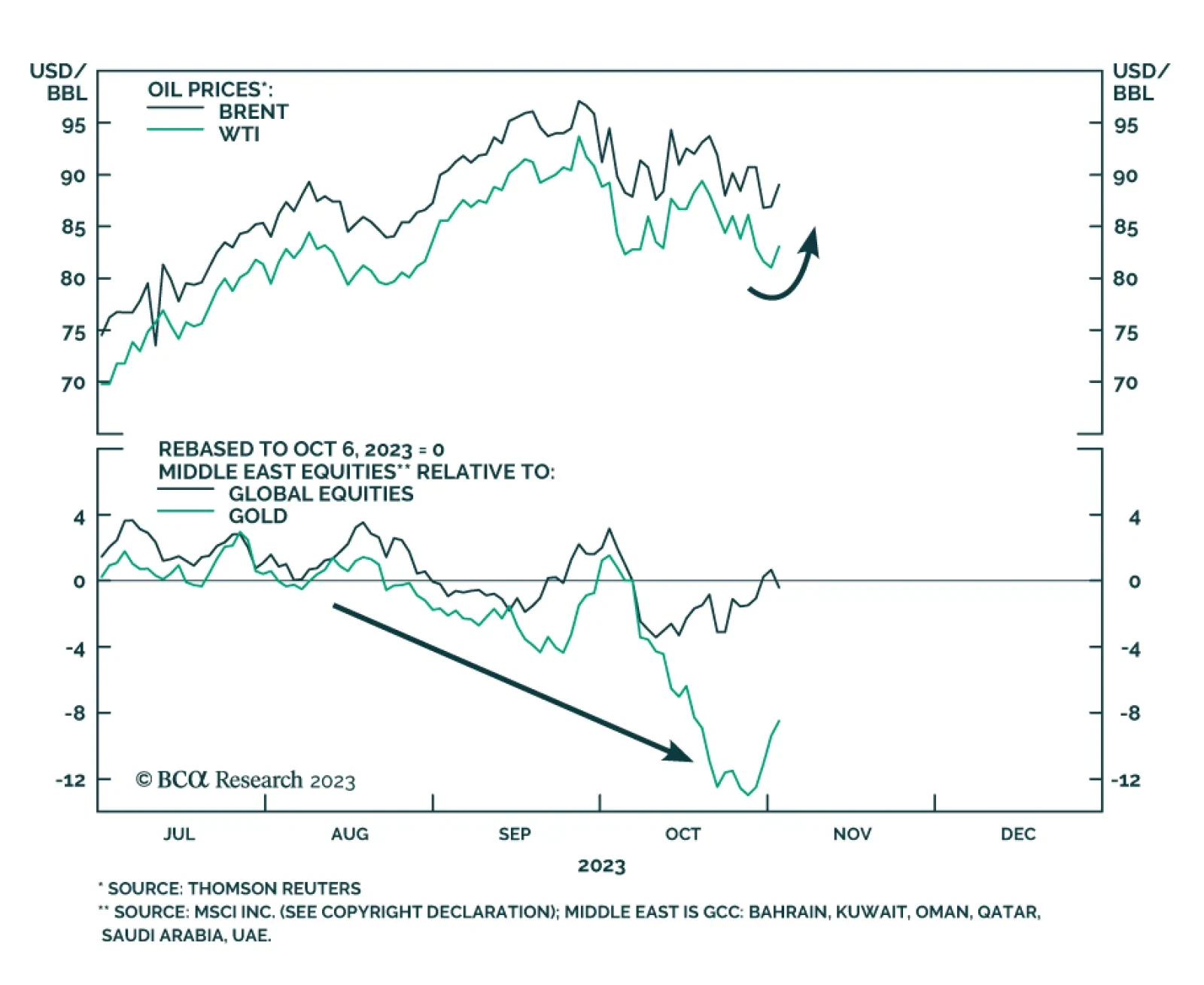

According to BCA Research’s Geopolitical Strategy service, volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. Everything depends on whether…

Volatility will remain the key dynamic in oil markets in the aftermath of the surprise Hamas attacks against Israel on October 7. The risk of a major oil supply shock has gone up, but meanwhile supply constraints will remain at…

Investors should underweight global equities and risk assets; overweight US stocks relative to global; and overweight defensive sectors versus cyclicals.