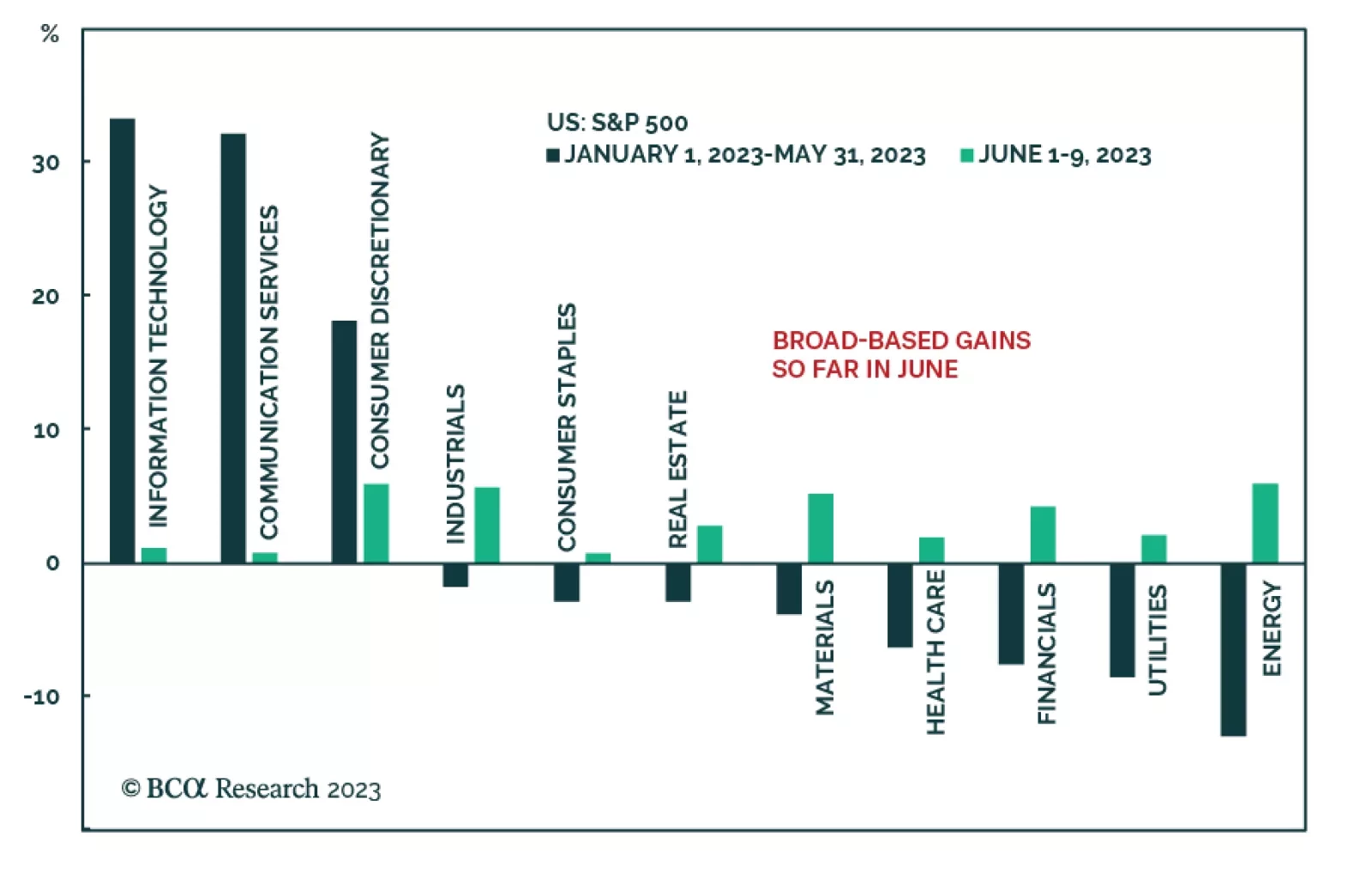

In June, the rally gained momentum and broadened due to positive economic data, particularly in the housing market. We expect cheaper cyclical sectors and styles to mark a change in leadership as the rally broadens, helped on by…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

For the most part, the US equity rally has been rather narrow this year – concentrated among stocks that investors perceive will be the key winners of recent AI developments. In the first five months of the year, only three…

Investors are still cautious and have significant cash that needs to be put to work. Trickle-down of it into the US equity market may extend the rally. Overly bearish futures positioning is also a strong contrarian indicator.…

According to BCA Research’s European Investment Strategy service, the Dutch market will be the main European beneficiary of expanding spending on AI. The crucial factor constraining the deployment and expansion of AI is…

The AI revolution is having a large impact on many US stocks but European equities have not enjoyed the same benefits. Is Europe really devoid of AI plays?

As we’ve highlighted in recent Insights, the S&P 500’s year-to-date rally has been concentrated among a few mega cap stocks. In particular, companies that benefit from the AI craze have driven the gains. This…

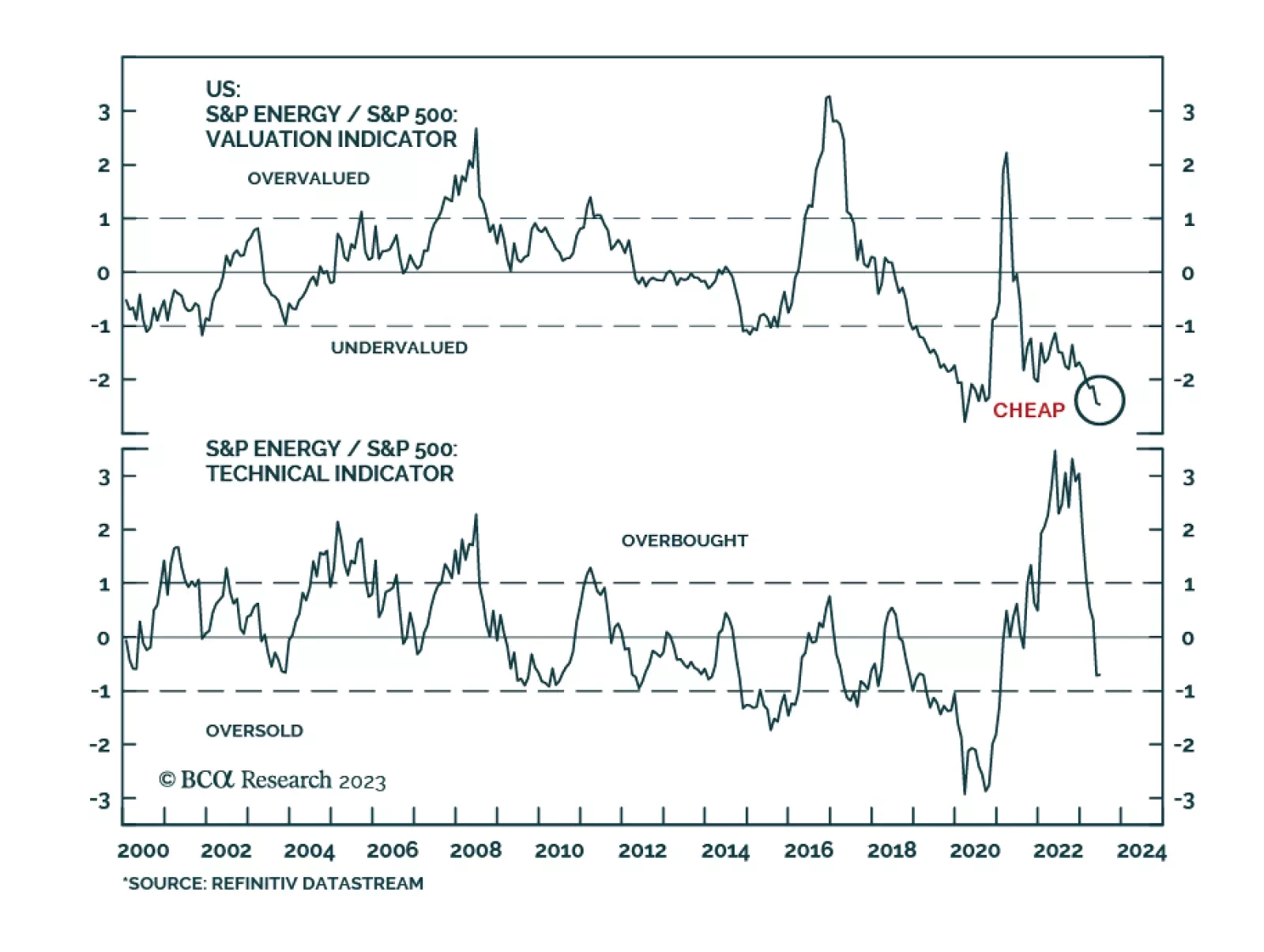

What’s going on? The market-weighted stock market is up. But the equally-weighted stock market is not up. Neither is credit. Neither are industrial metal prices. Neither is the oil price, despite two waves of OPEC output cuts. We…

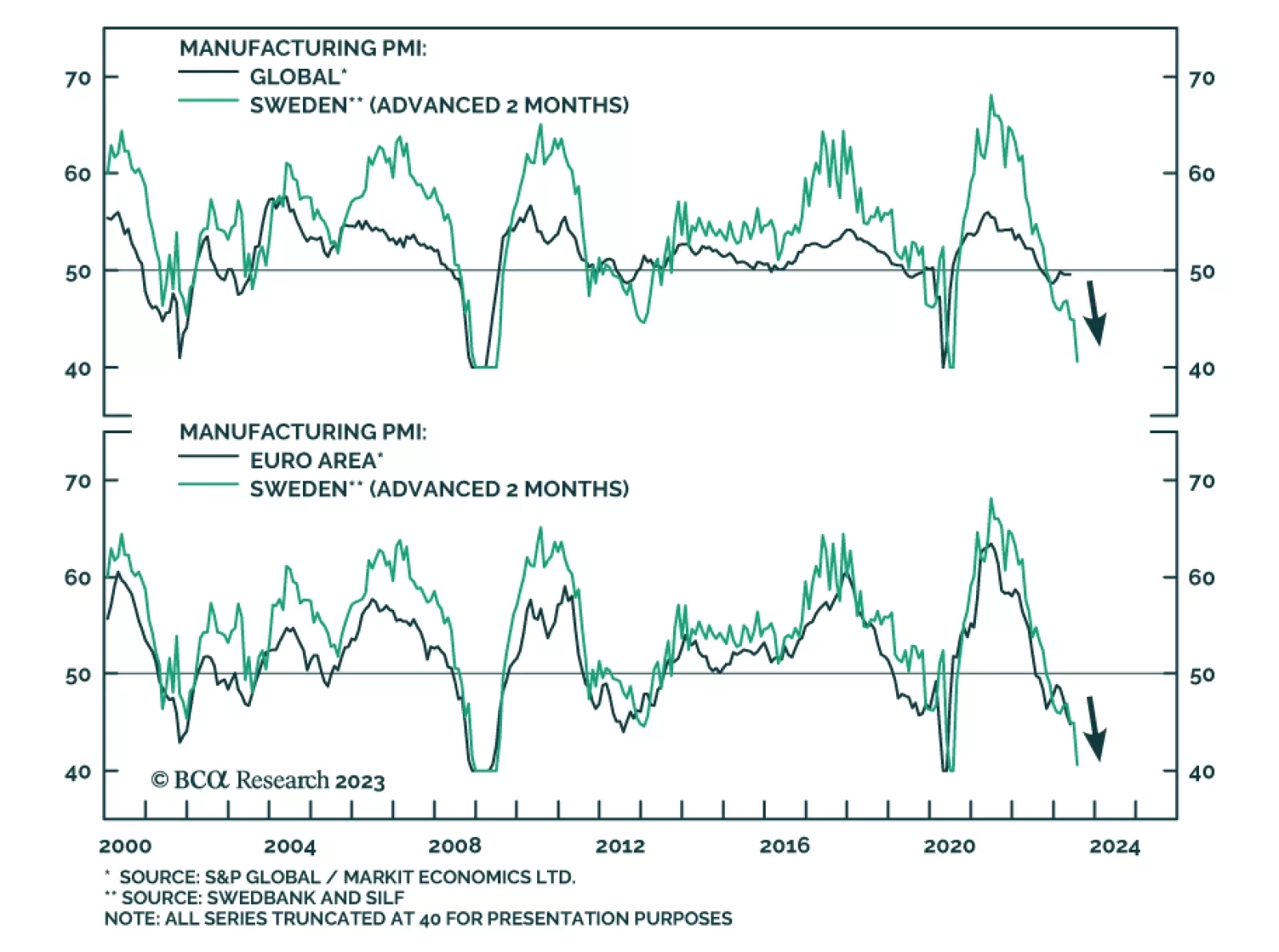

The Swedish manufacturing PMI declined to 40.6 in May, the lowest level since June 2020. This deterioration in Sweden’s manufacturing activity not only reflects the domestic economy, but it also highlights weaknesses in the…