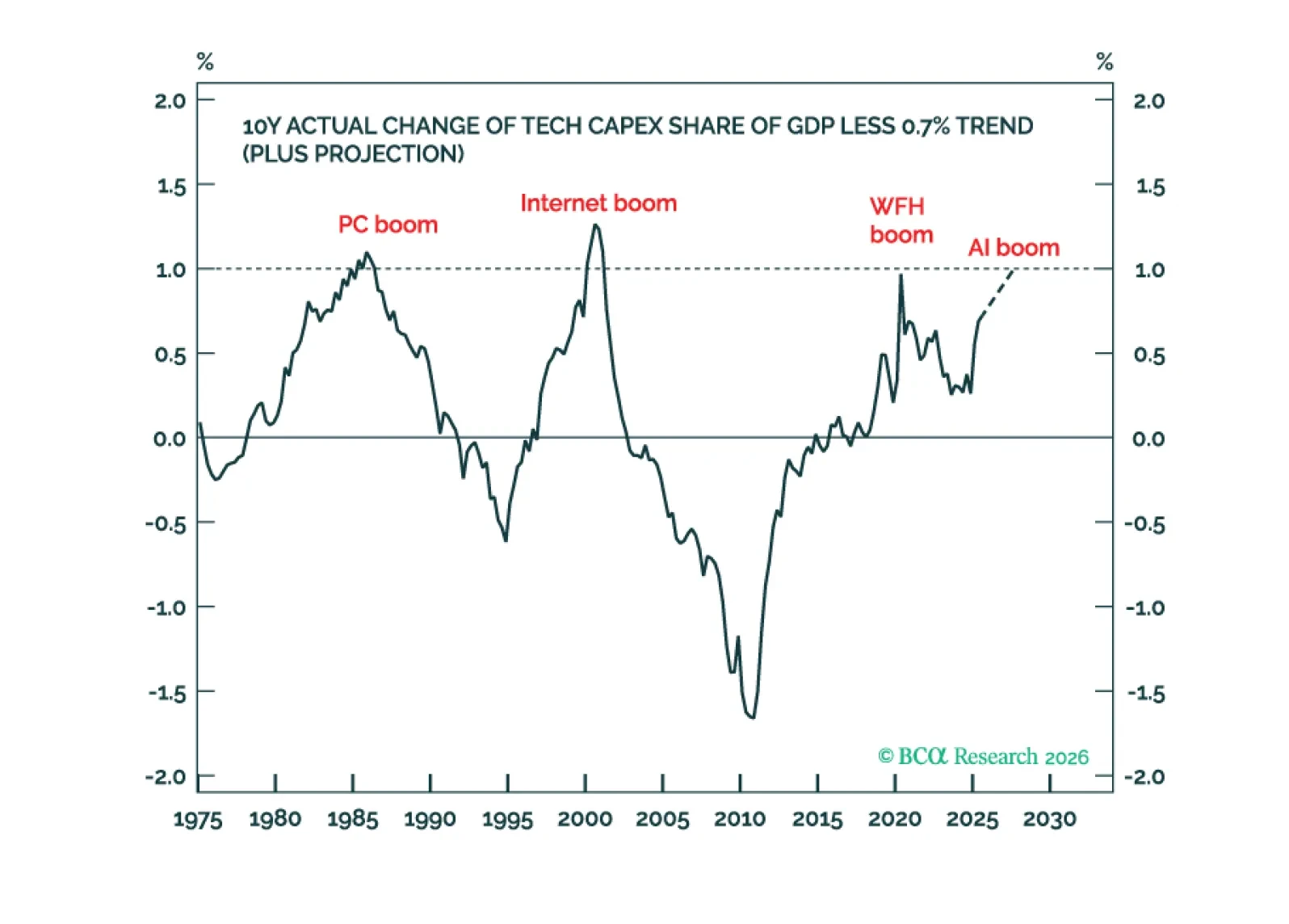

2026 has closer parallels with 2021 than with 2000 because an ultra-accommodative Fed can prolong the stock market rally even as a tech capex boom ends. Plus, a new tactical trade is short silver versus gold.

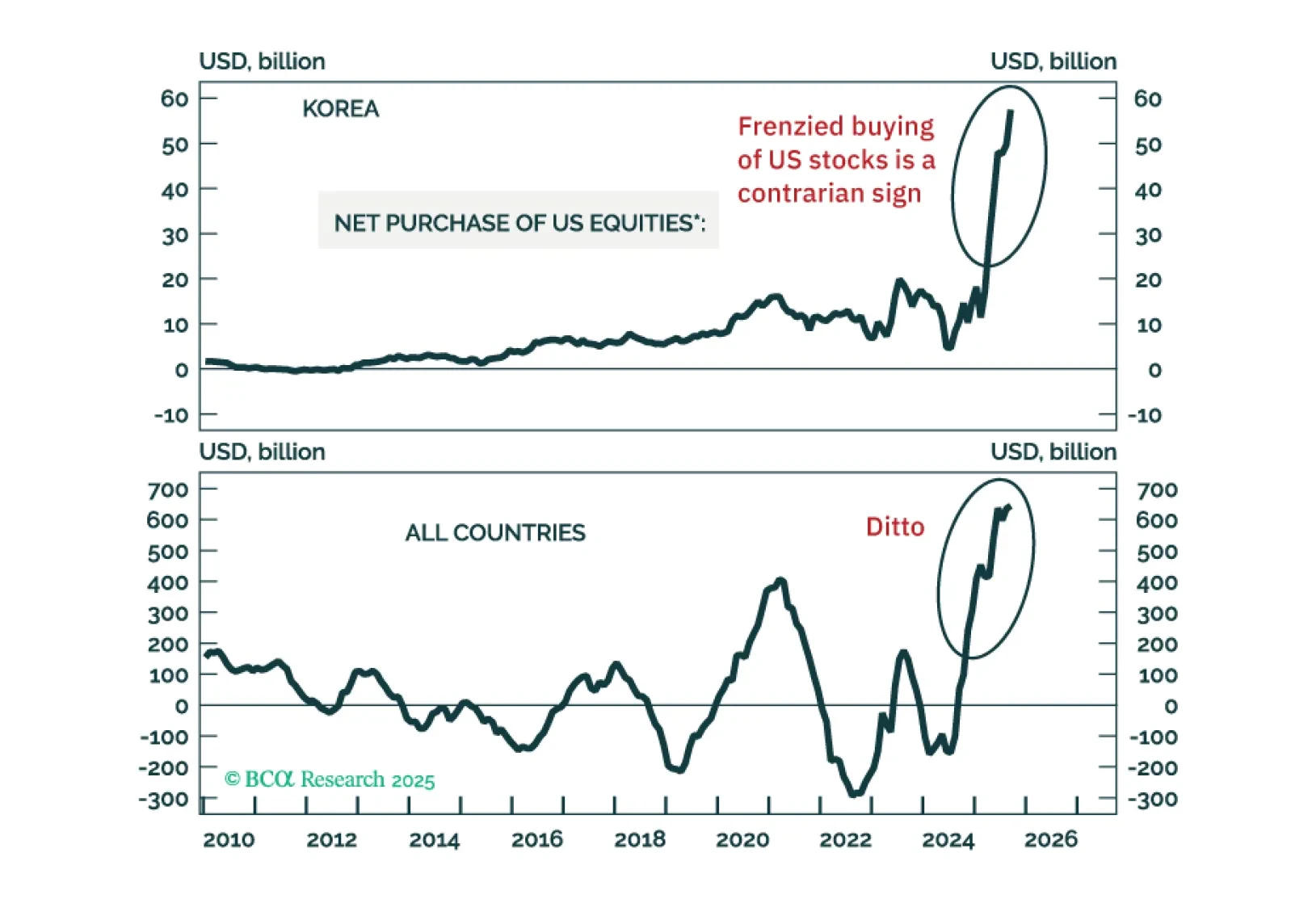

Many key equity indexes have failed to break above major resistance levels, while risky segments have begun to crack. Altogether, this suggests that a major peak in risk assets has probably been made. Short the MSCI EM stock index…

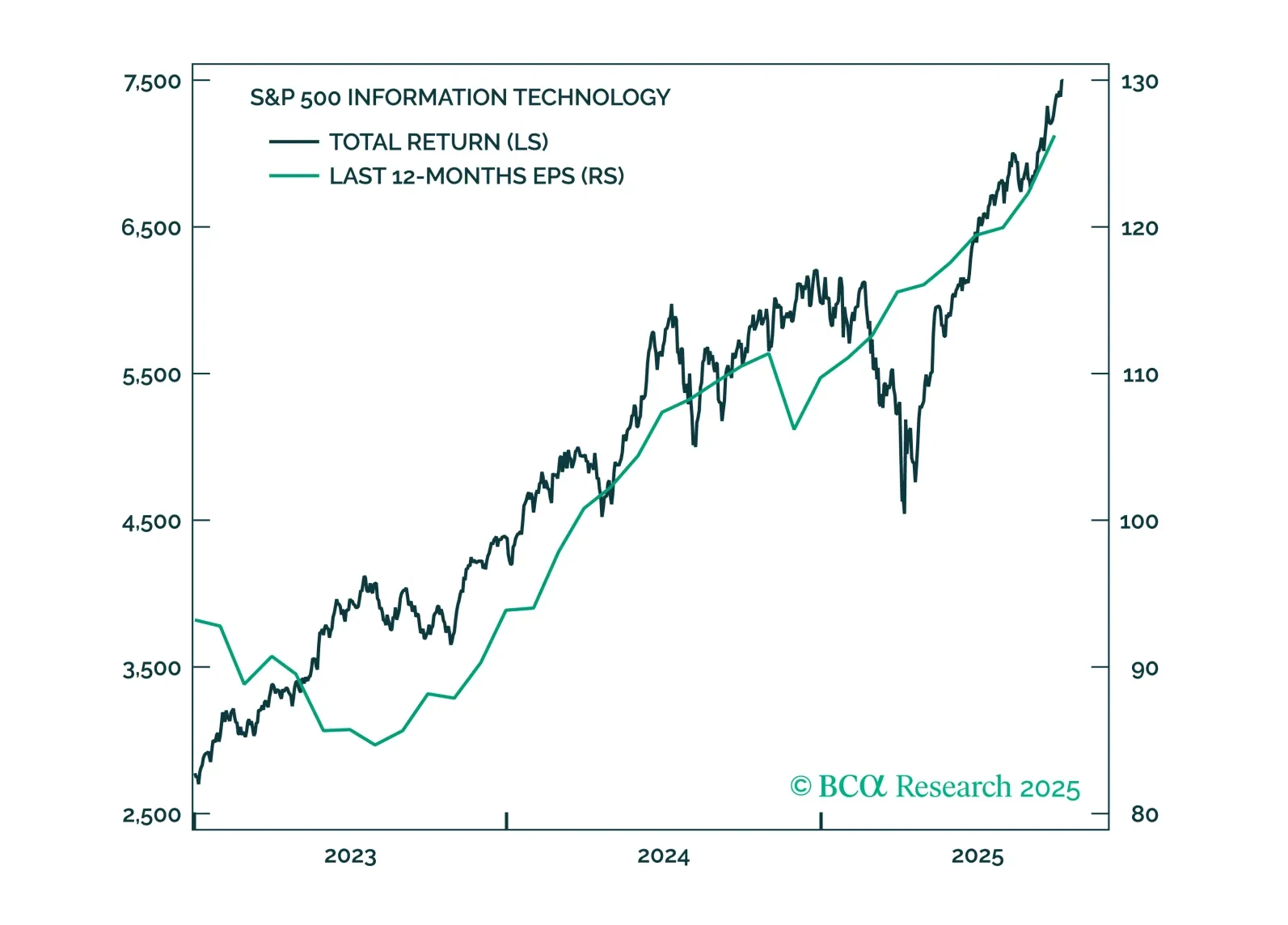

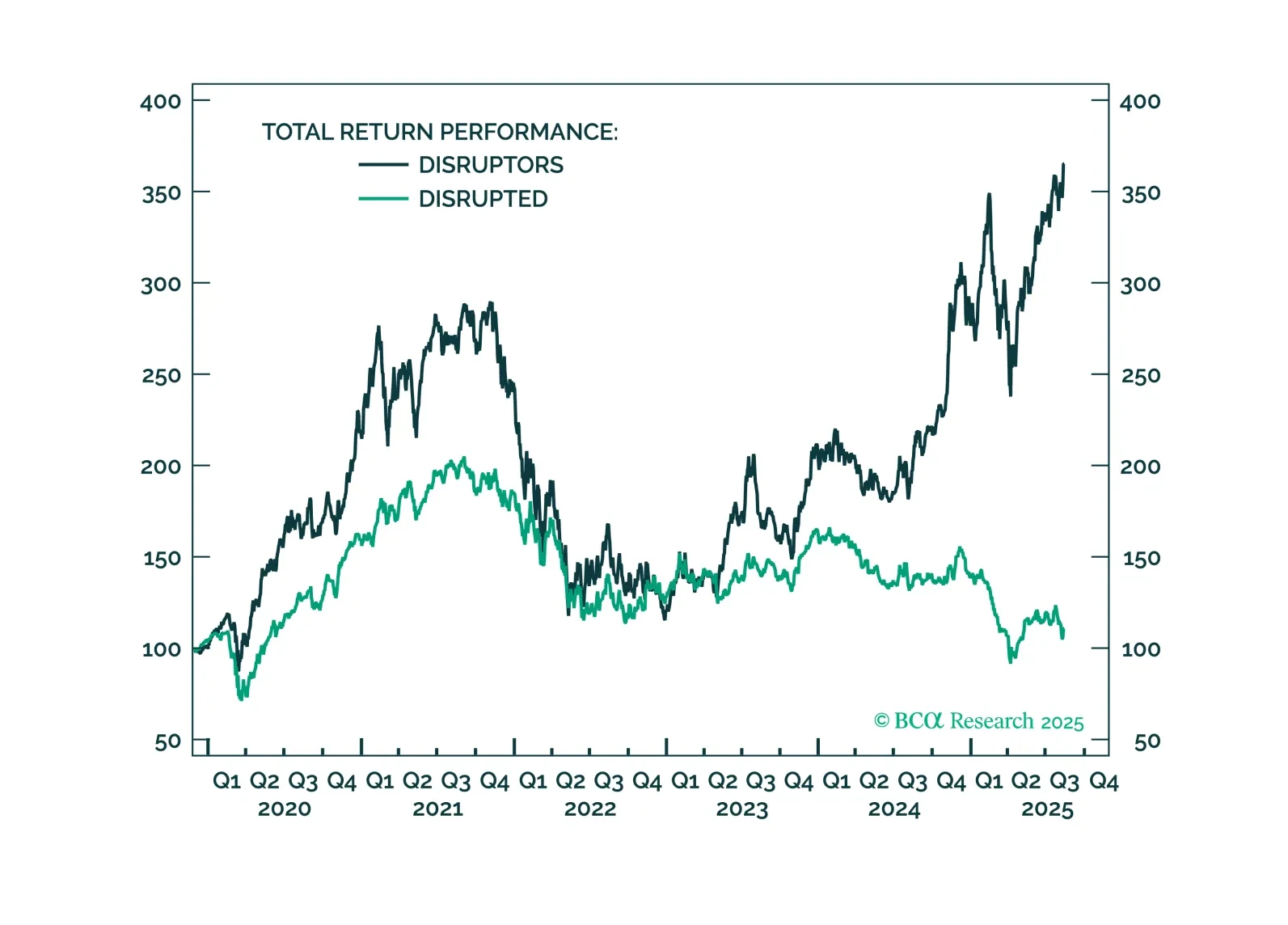

We recommend a new relative tech equity trade that will likely produce positive returns over the next six to 12 months, regardless of whether the AI hype continues or reverses.

Broad GenAI adoption and monetization, alongside falling inference costs, should make hyperscalers’ and enterprise investments worthwhile. While the GenAI boom echoes the dot-com era, it differs in key ways: Valuations are elevated…

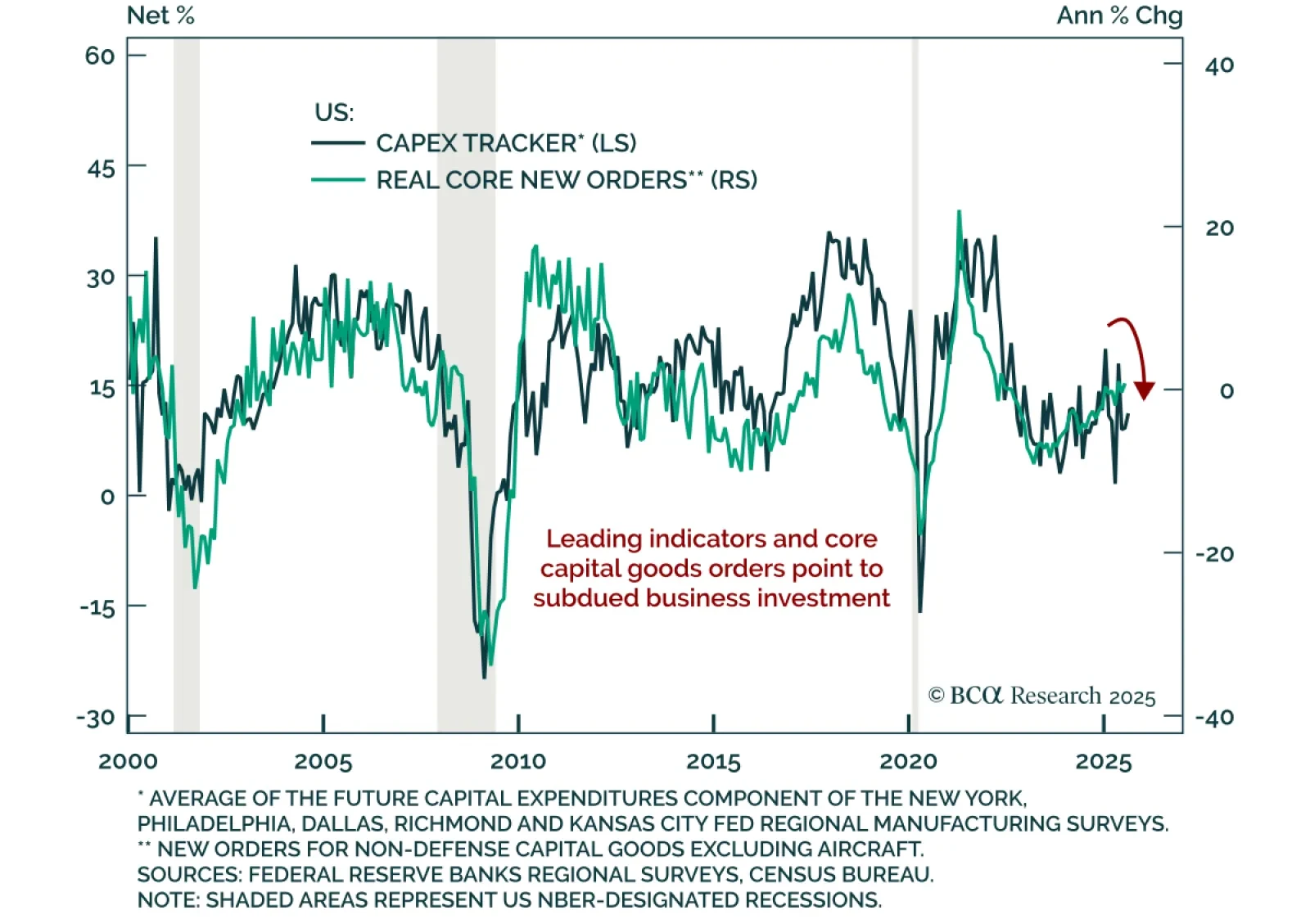

July US durable goods orders rebounded, but investment signals remain subdued and favor duration and tech. Orders fell 2.8% m/m after a 9.4% June drop, better than expected. Core measures excluding volatile components were…

GenAI momentum is building. Many companies are already reaping benefits from the technology. GenAI is disrupting entire industries, such as education, image generation, and staffing. Investors should prefer our “disruptors” basket…

The S&P 500 recently breached new highs, but narrow leadership and a slowing labor market reinforce caution on risk assets. Equities rebounded from their post-Liberation Day lows, but the rally has been led mostly by the tech…

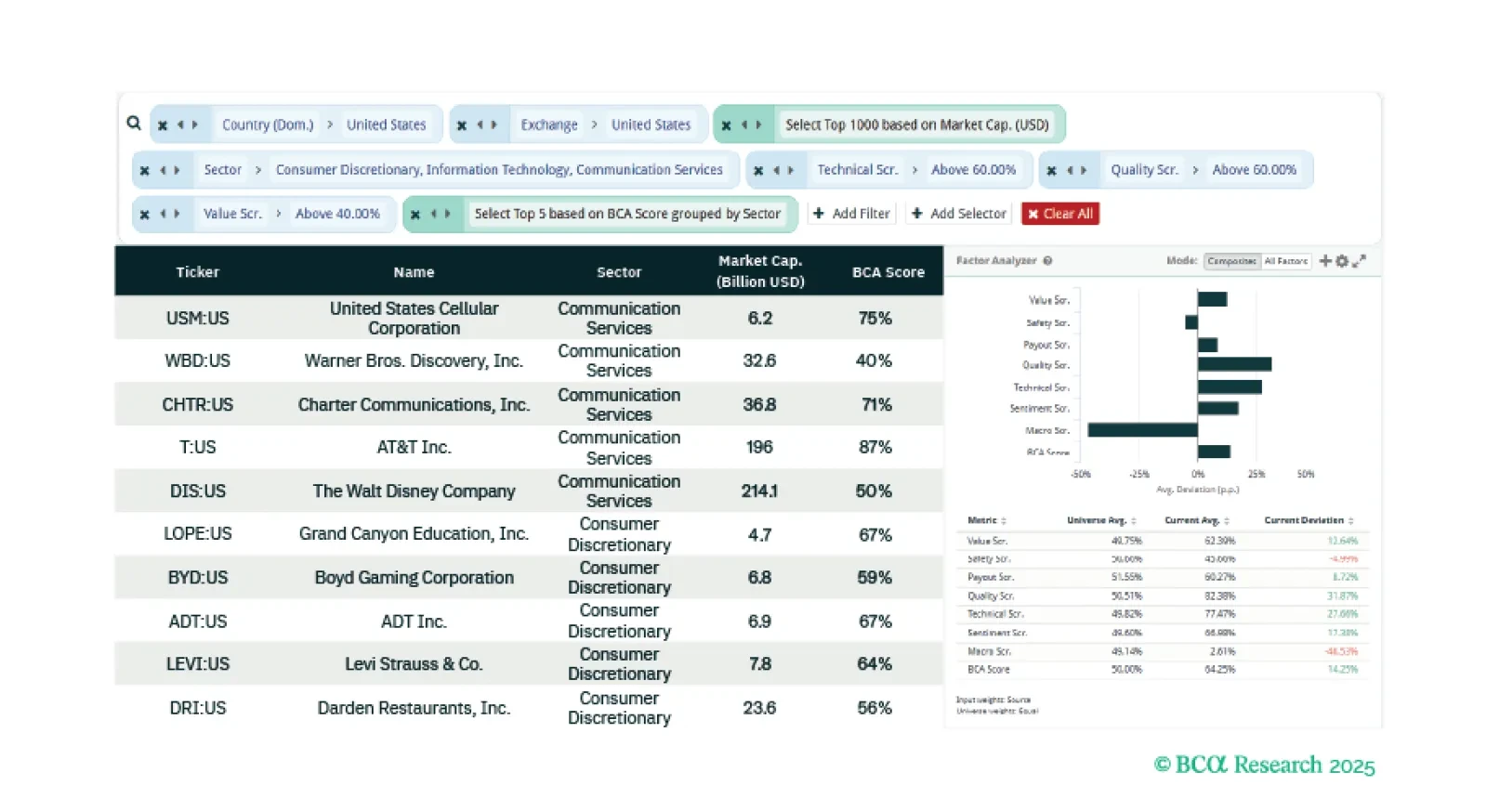

This week our three screeners identify: Broader and more accessible tech-driven equities, US equities exposed to cryptocurrencies, and doubling-down on top-decile stocks.

Microsoft has gone up in a worryingly near-perfect straight line with dimension 1.098. Take August off before making a big commitment to stocks. Plus: a new tactical trade is to go long USD/HUF.

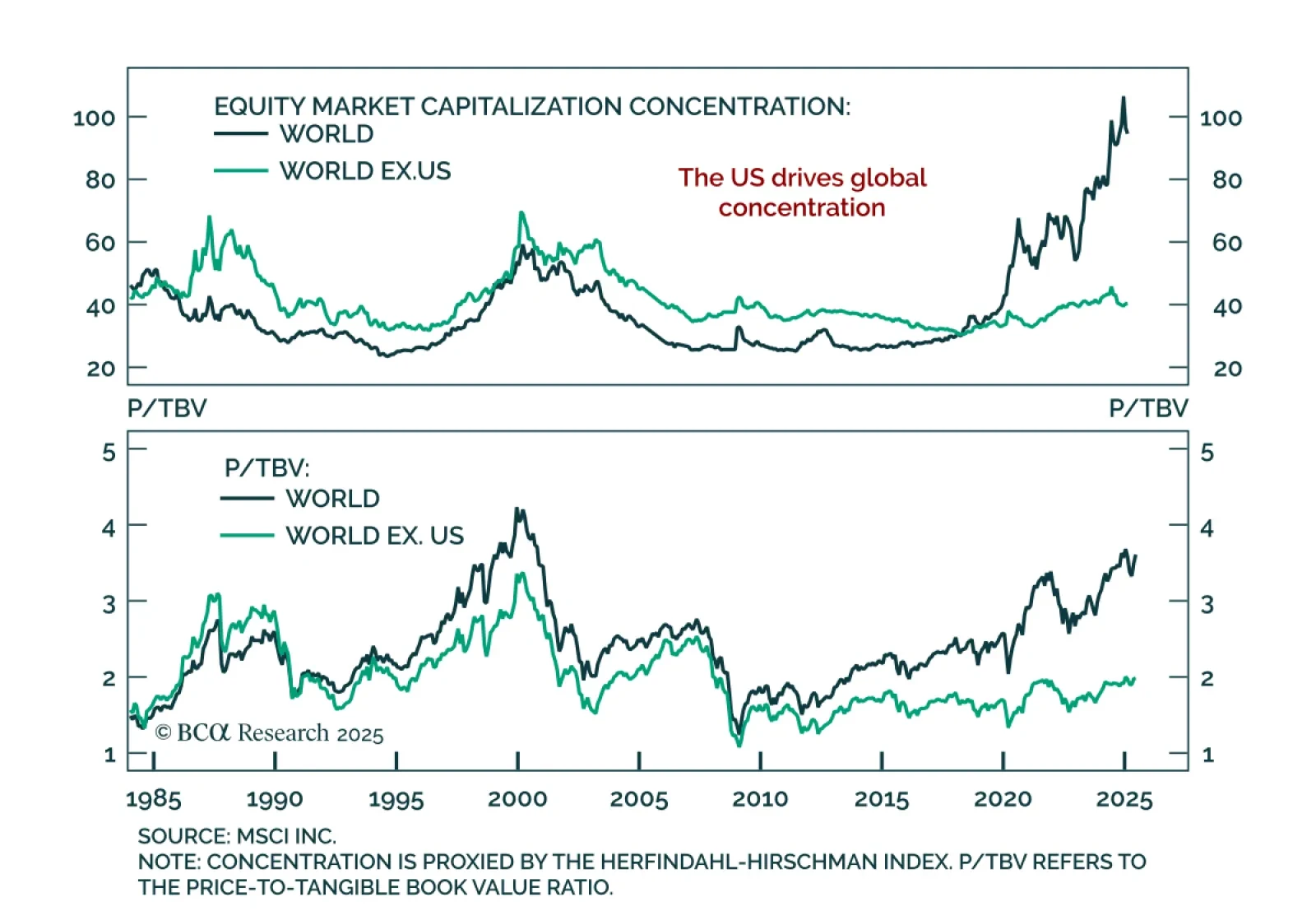

Our Global Asset Allocation strategists argue that equity market concentration is not a meaningful risk factor and does not help forecast returns. Cross-sectional concentration reflects index size, with smaller indices typically…