In Section I, we examine some concerning signs of US economic weakness that emerged in June. We also discuss portfolio positioning in the face of falling interest rates and cross-check our recommended US equity overweight in the face…

The consensus soft-landing narrative is wrong. The US will fall into a recession in late 2024 or early 2025. We were tactically bullish on stocks most of last year, turned neutral earlier this year, and are going underweight today.…

The EU's import tariff increases on Chinese EVs are expected to have a minimal impact on China's overall exports. We anticipate that most Western-brand EV shipments from China will be less affected by the EU import tax hike. Beijing…

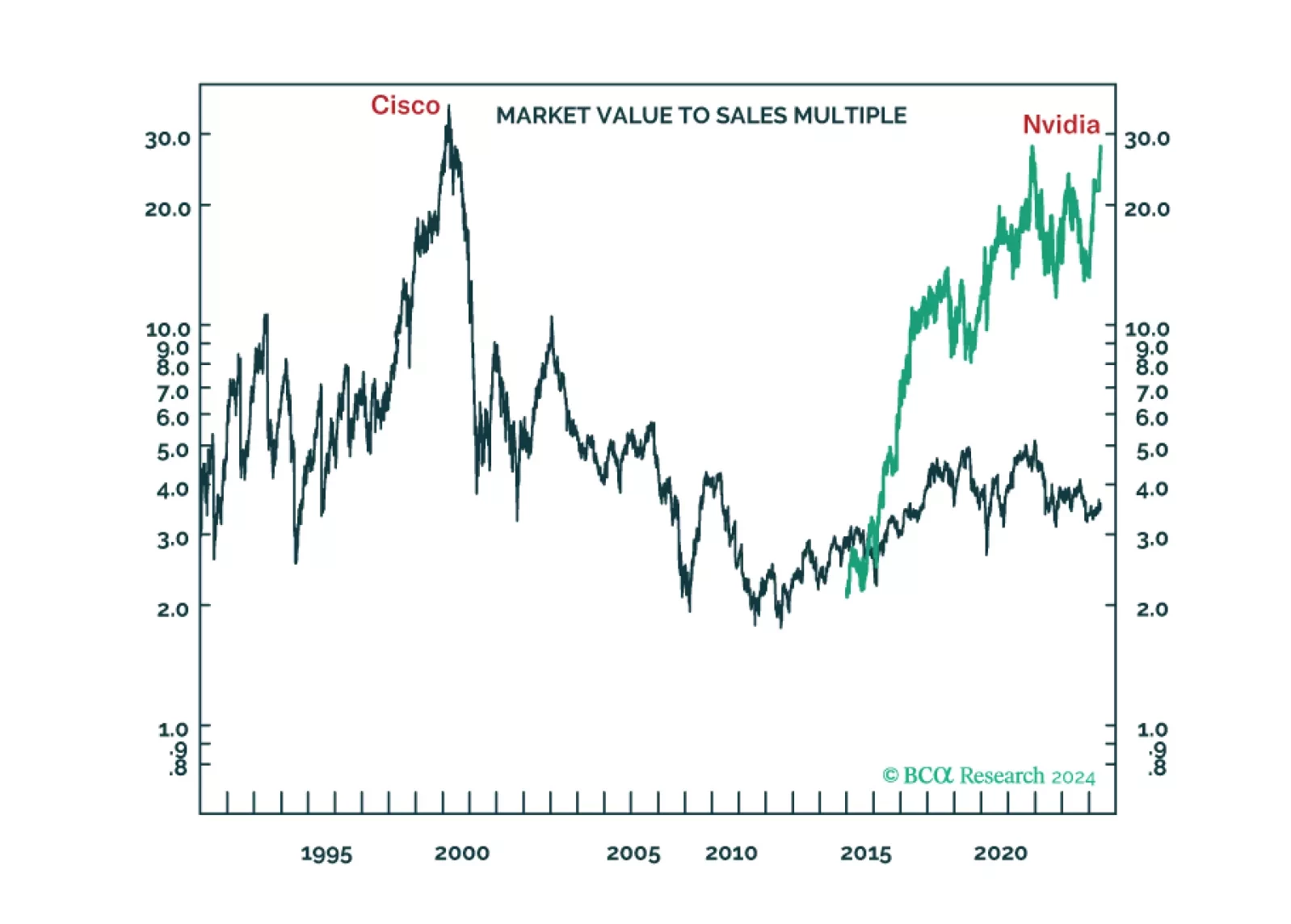

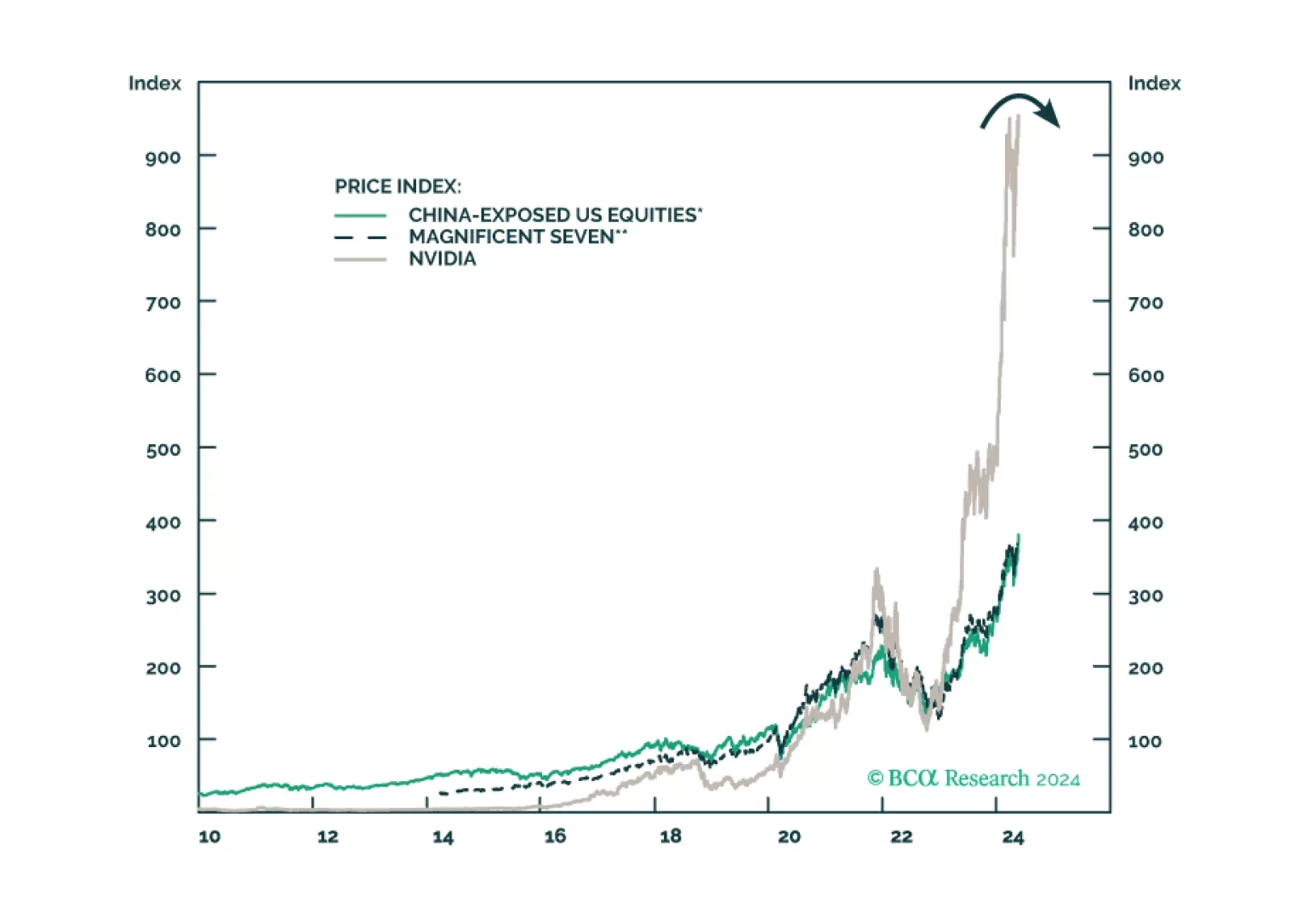

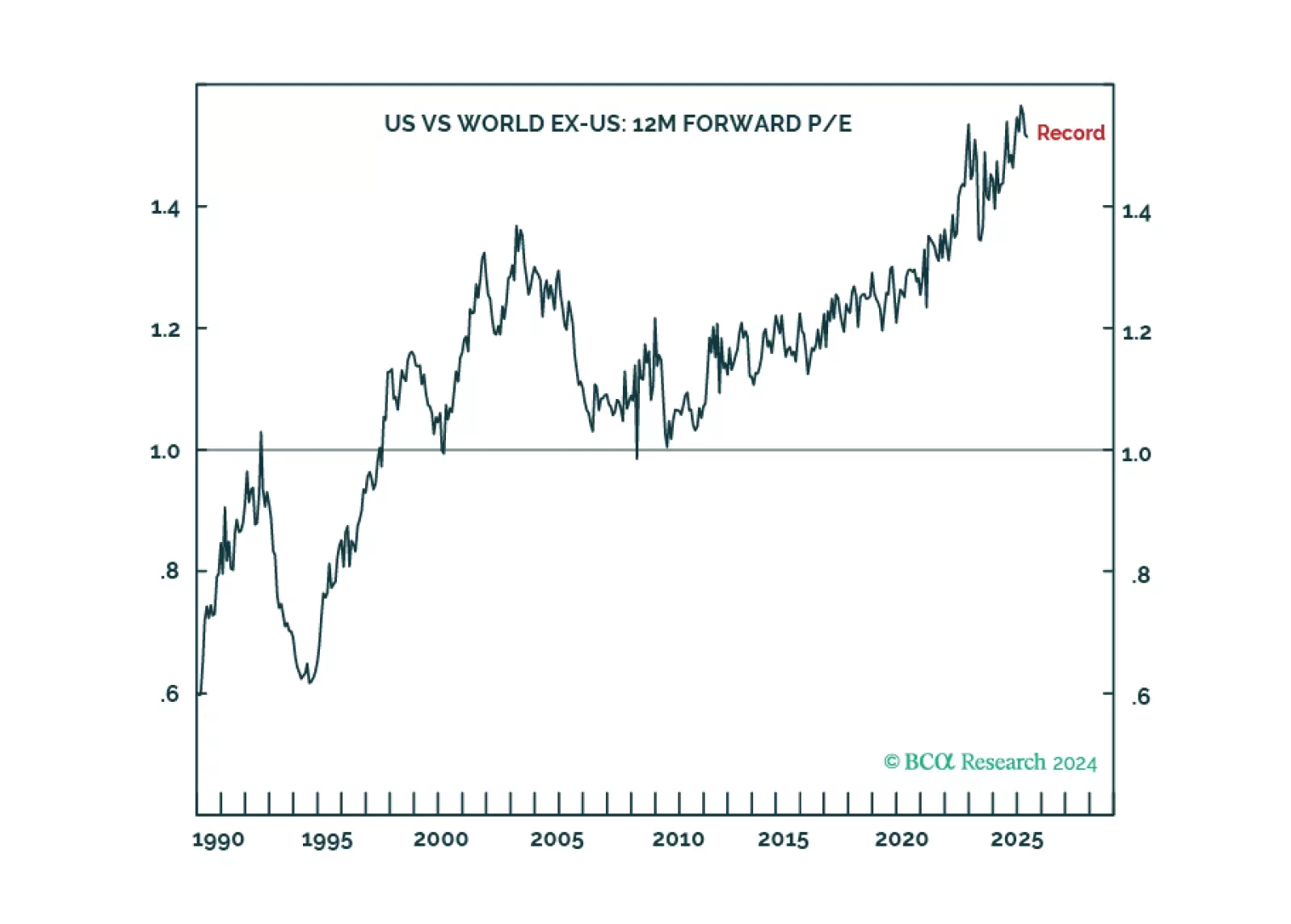

The long-term winners from the generative-AI gold rush are unlikely to be the ‘picks and shovels’ stock Nvidia or the overvalued US superstars of Web 2.0. We discuss the structural investment implications. Plus: time to go tactically…

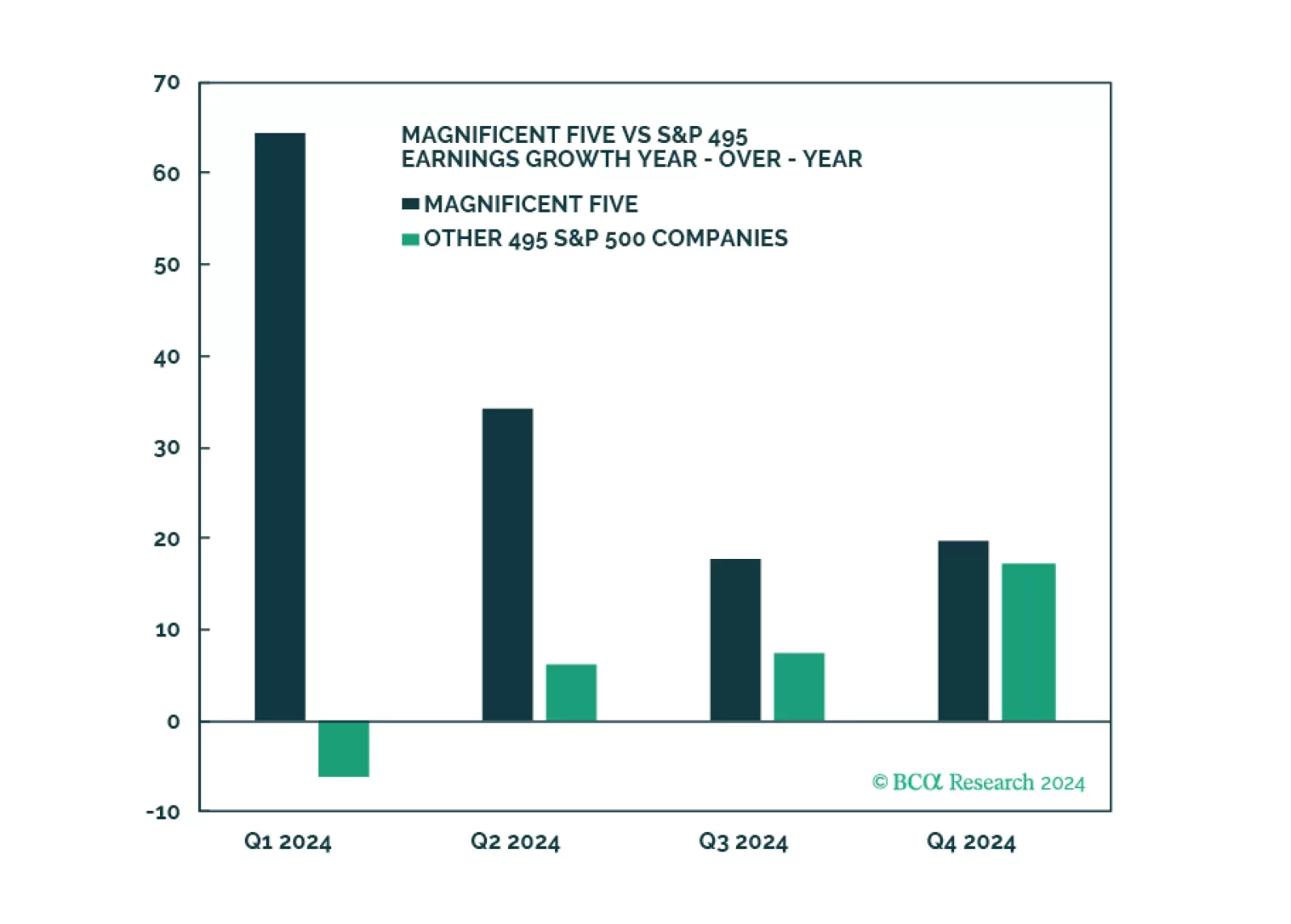

Q1 Earnings and sales growth were strong, but the devil is in the details: Without the Magnificent Five, earnings growth for the index would have been negative. On a positive note, margins have stabilized, and earnings growth is…