Our US Equity strategists preview the 2024 Q4 earnings season, and look at the results from banks. Q4 earnings growth is set to impress, with small and mid-cap earnings surging and S&P 493 growth turning positive, though…

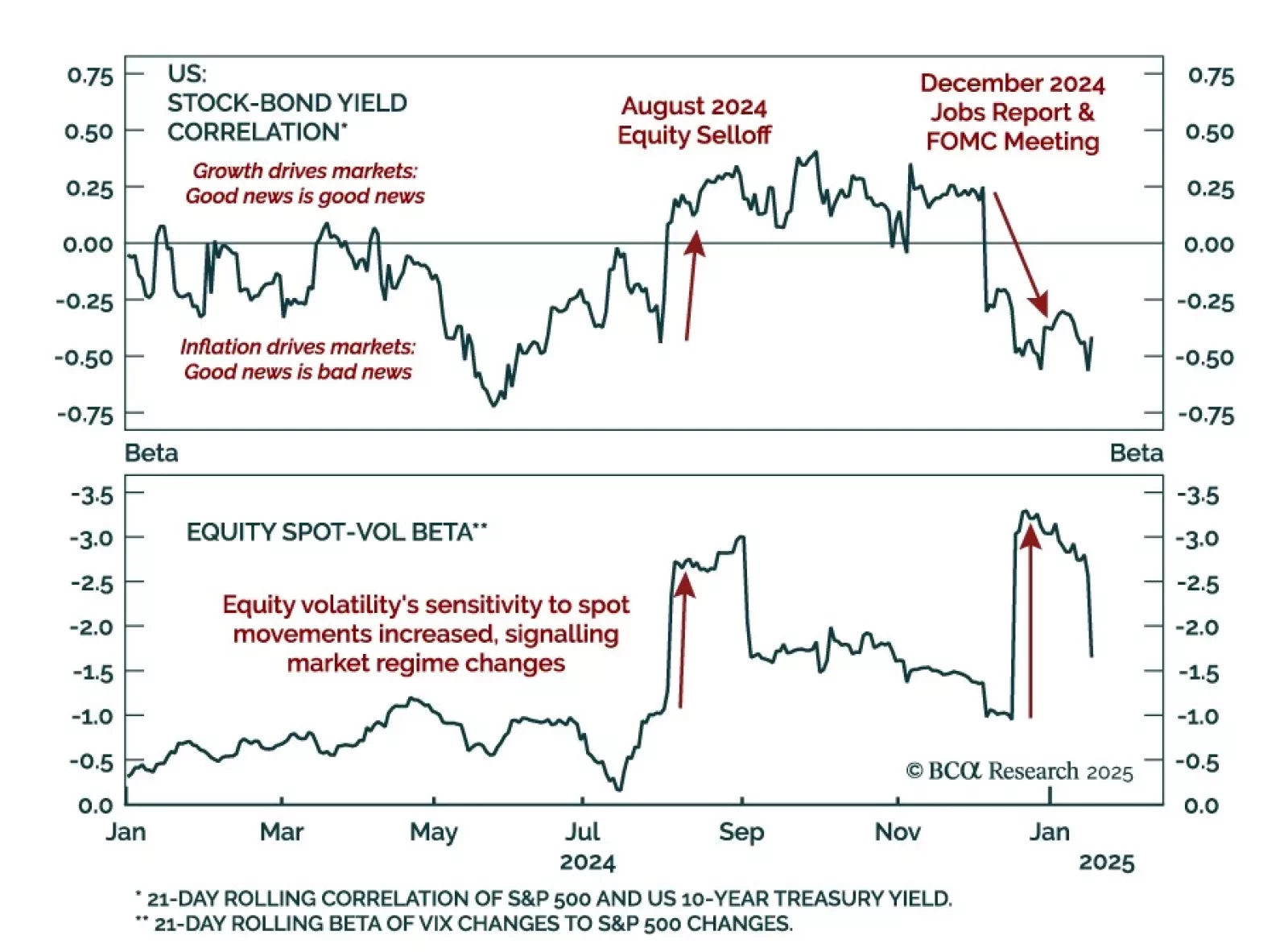

Two main market events defined 2024, highlighting how assets will react to economic data on the tactical horizon. The August 2024 selloff marked a positive shift in the stock-bond yield correlation, as higher odds of a “hard landing…

Our Global Investment Strategy (GIS) team believes the US economy is not as strong as commonly believed, and that equity valuations offer little buffer given the risk of incoming macro shocks. The US economy is more fragile than…

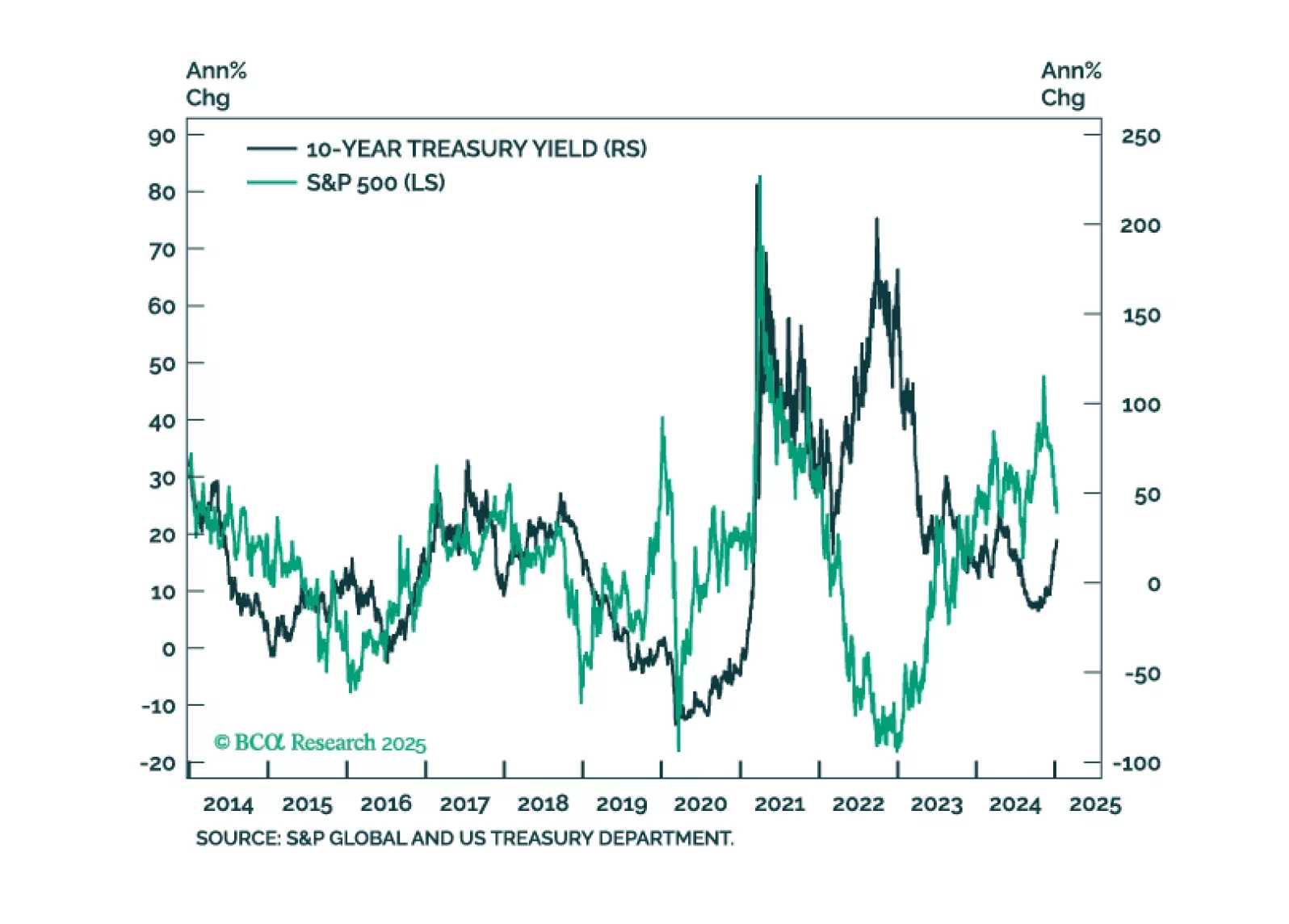

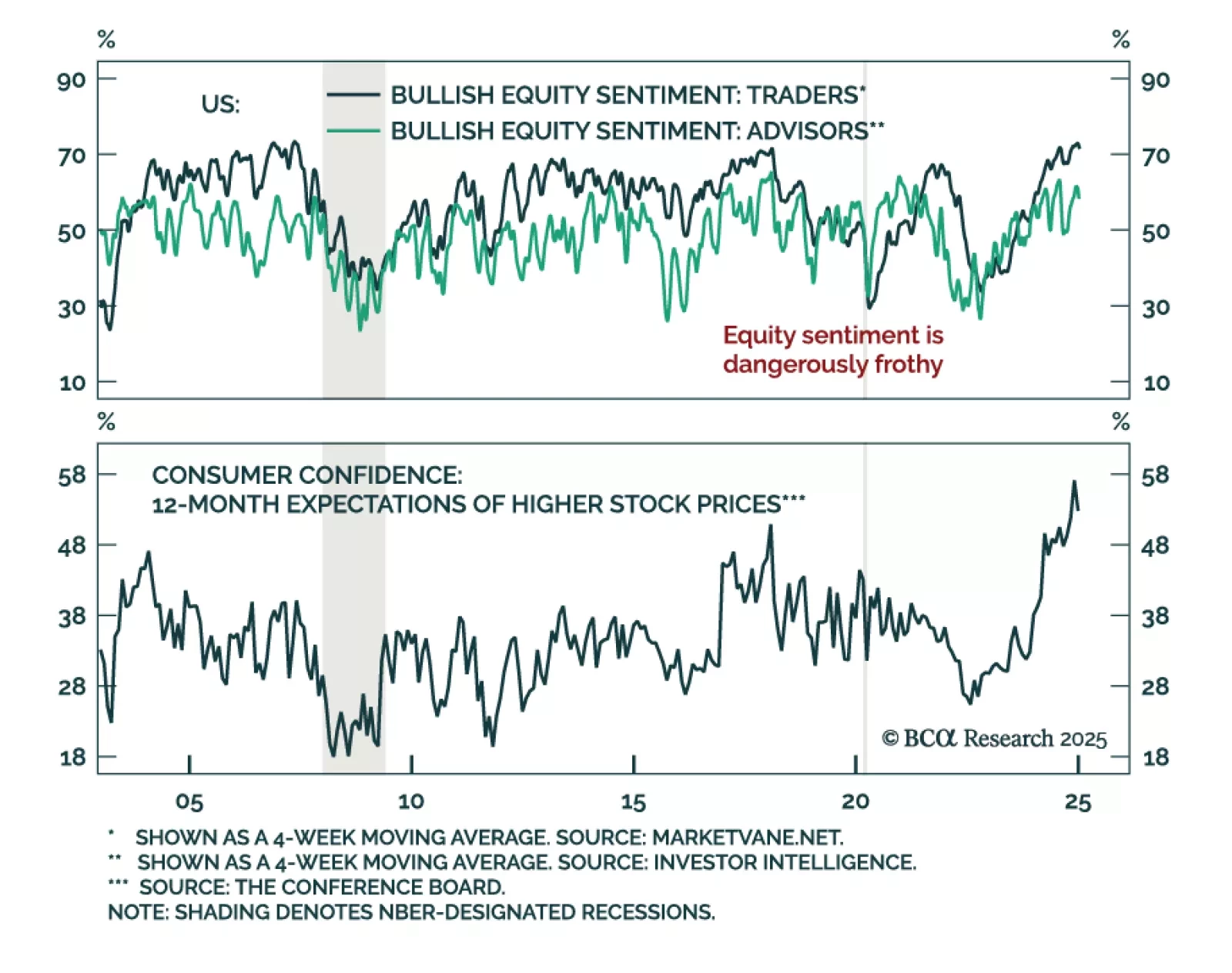

In this first presentation of 2025, we start with an overview of the 2025 outlook webcast polls, and a brief post-mortem of the 2024 market performance. Then, we shift gears and examine what is behind the recent surge in bond yields…

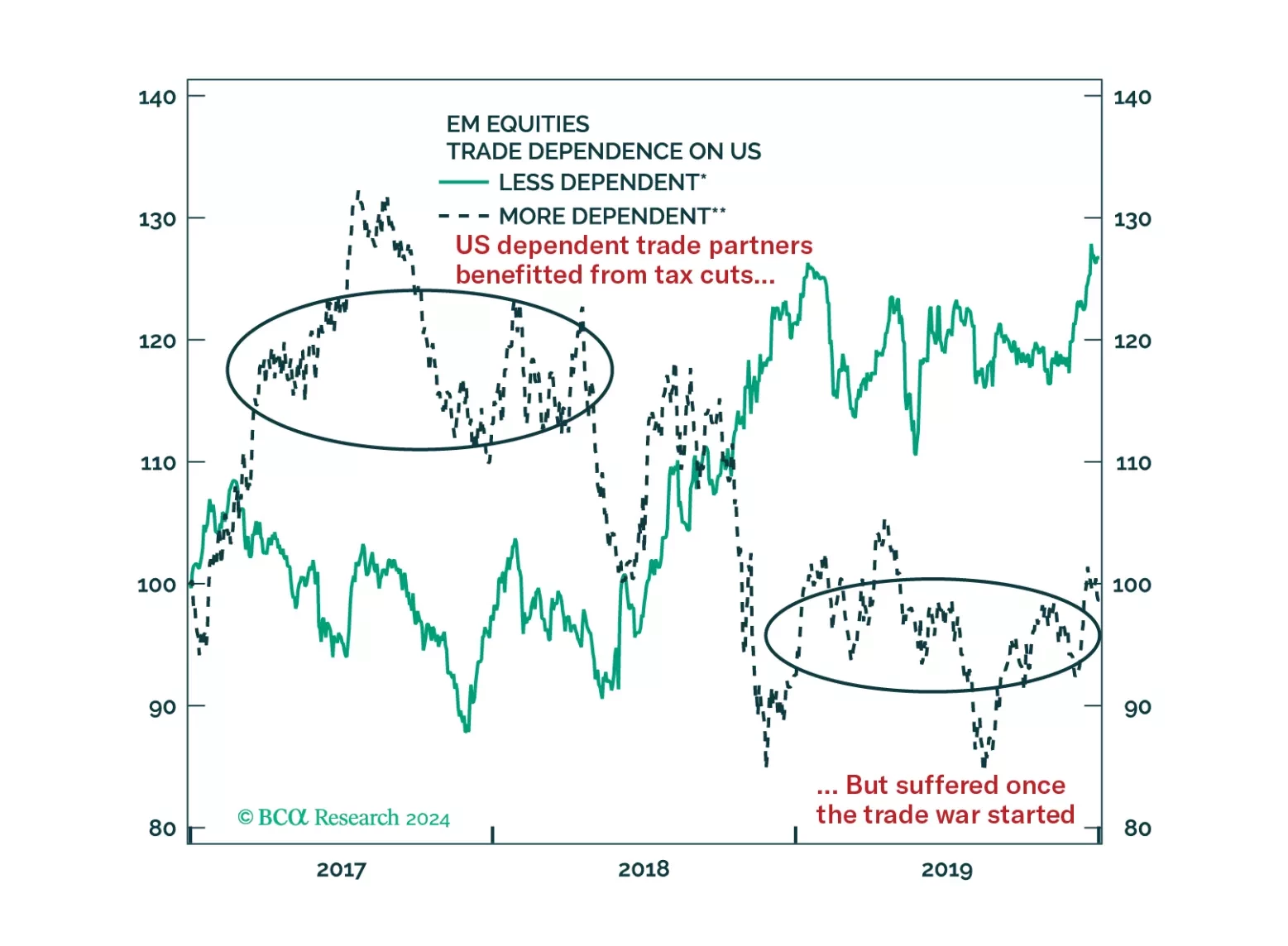

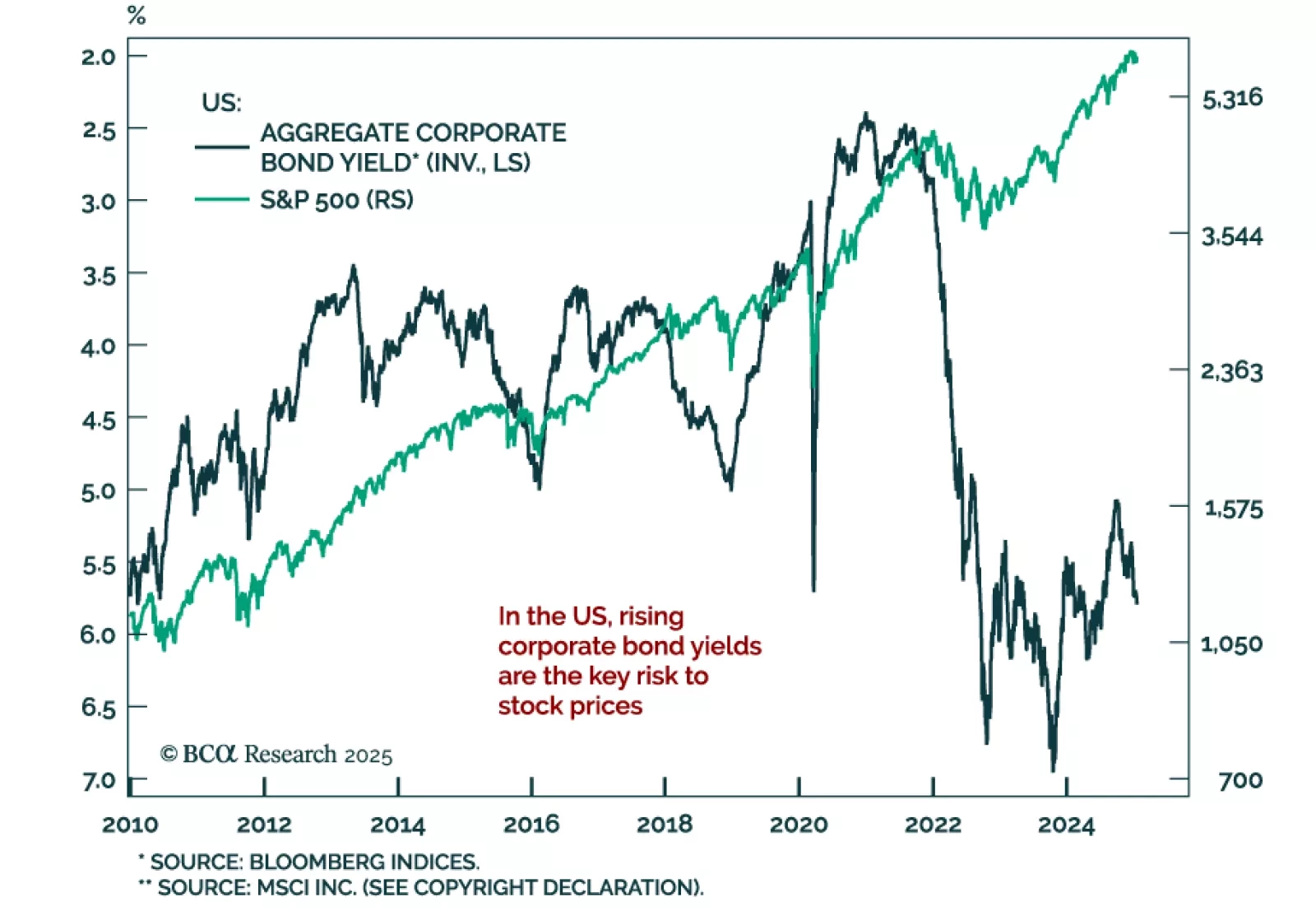

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist for our Emerging Markets Strategy service. Arthur discusses the relationship between corporate bond yields and stock prices. Historically, US stocks suffer when…

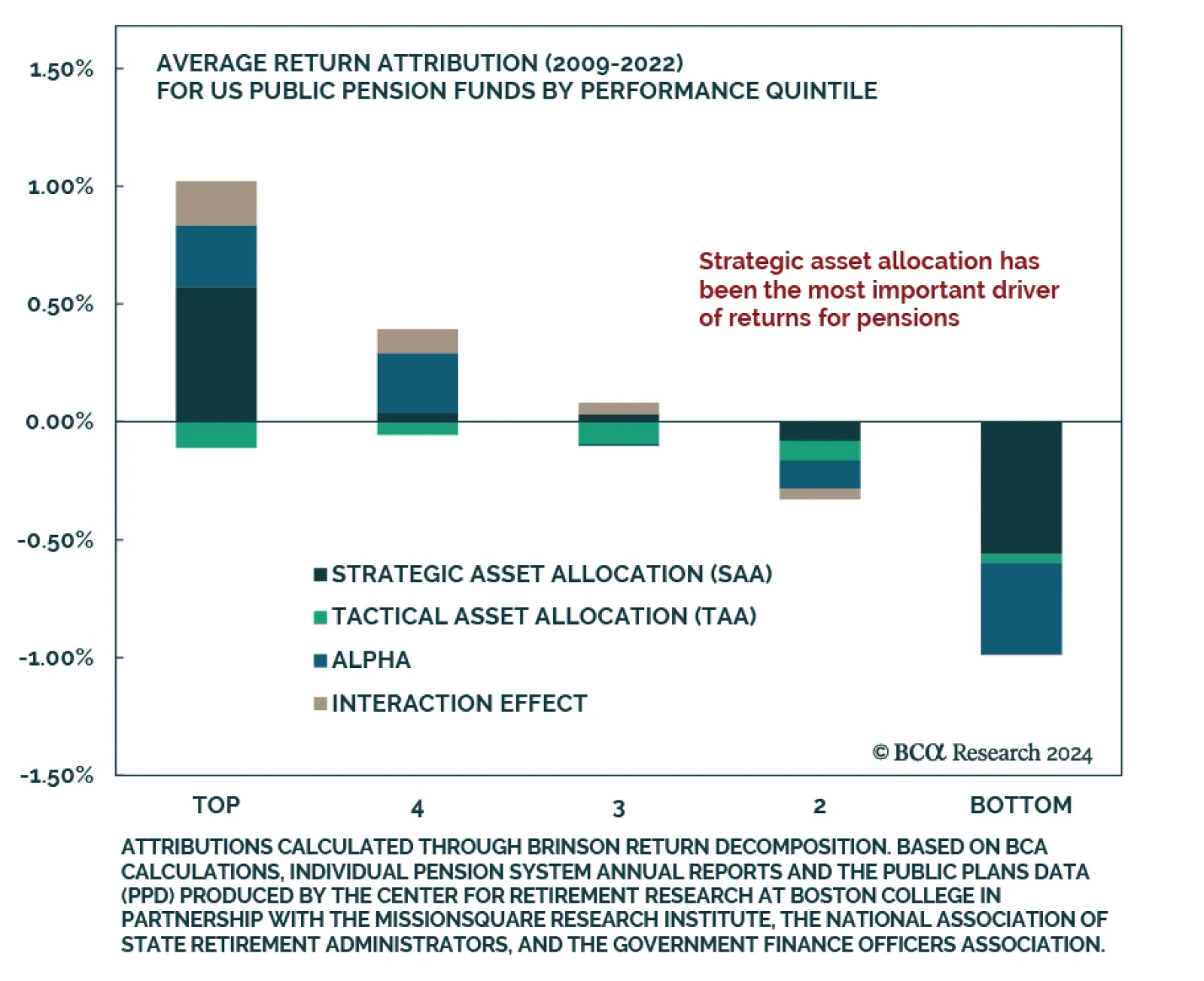

Our Global Asset Allocation team analyzed the performance and allocation strategies of 79 US public pension funds, providing insights across governance, scale, and liquidity. Strategic Asset Allocation (SAA) is the most…

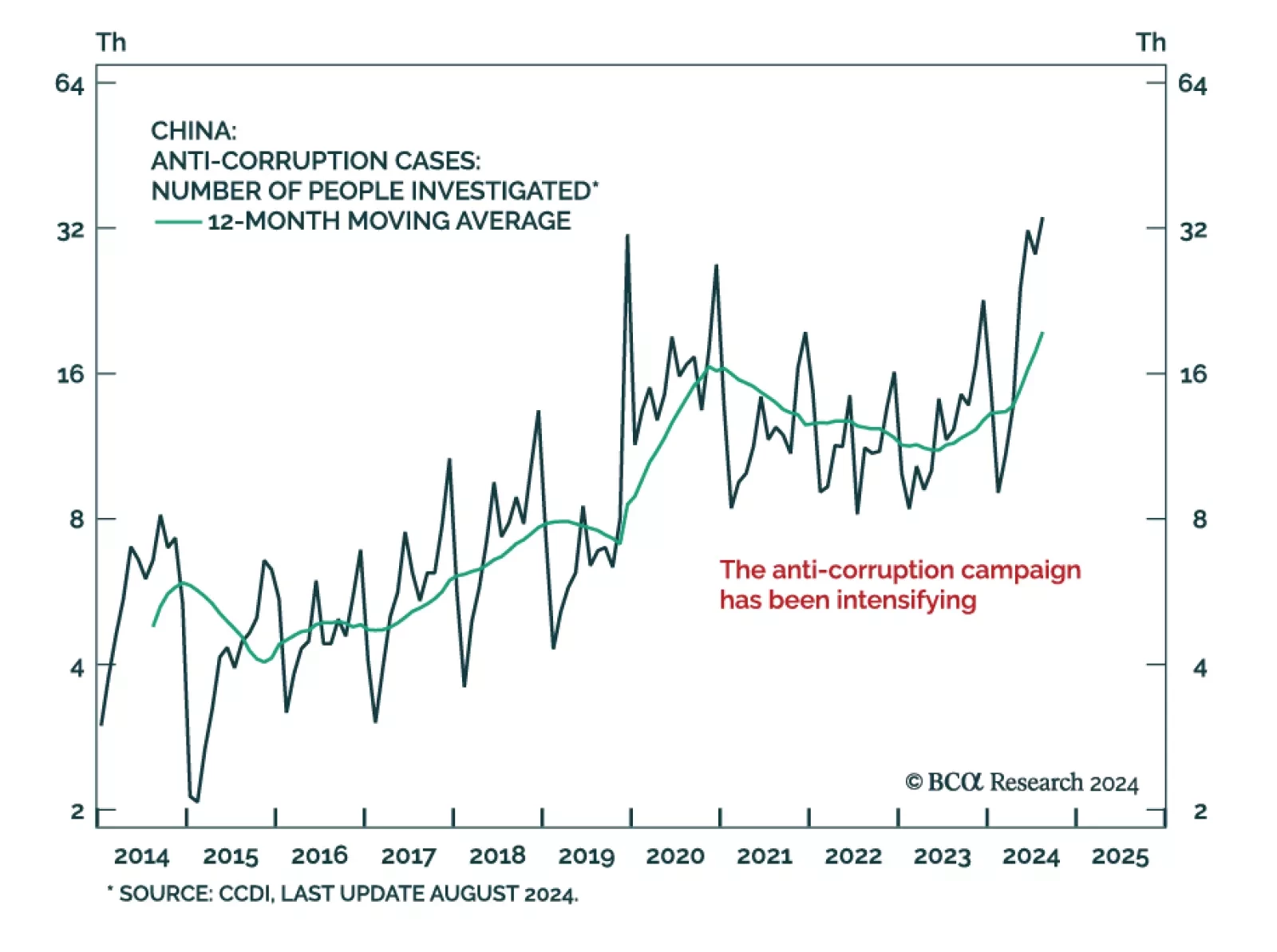

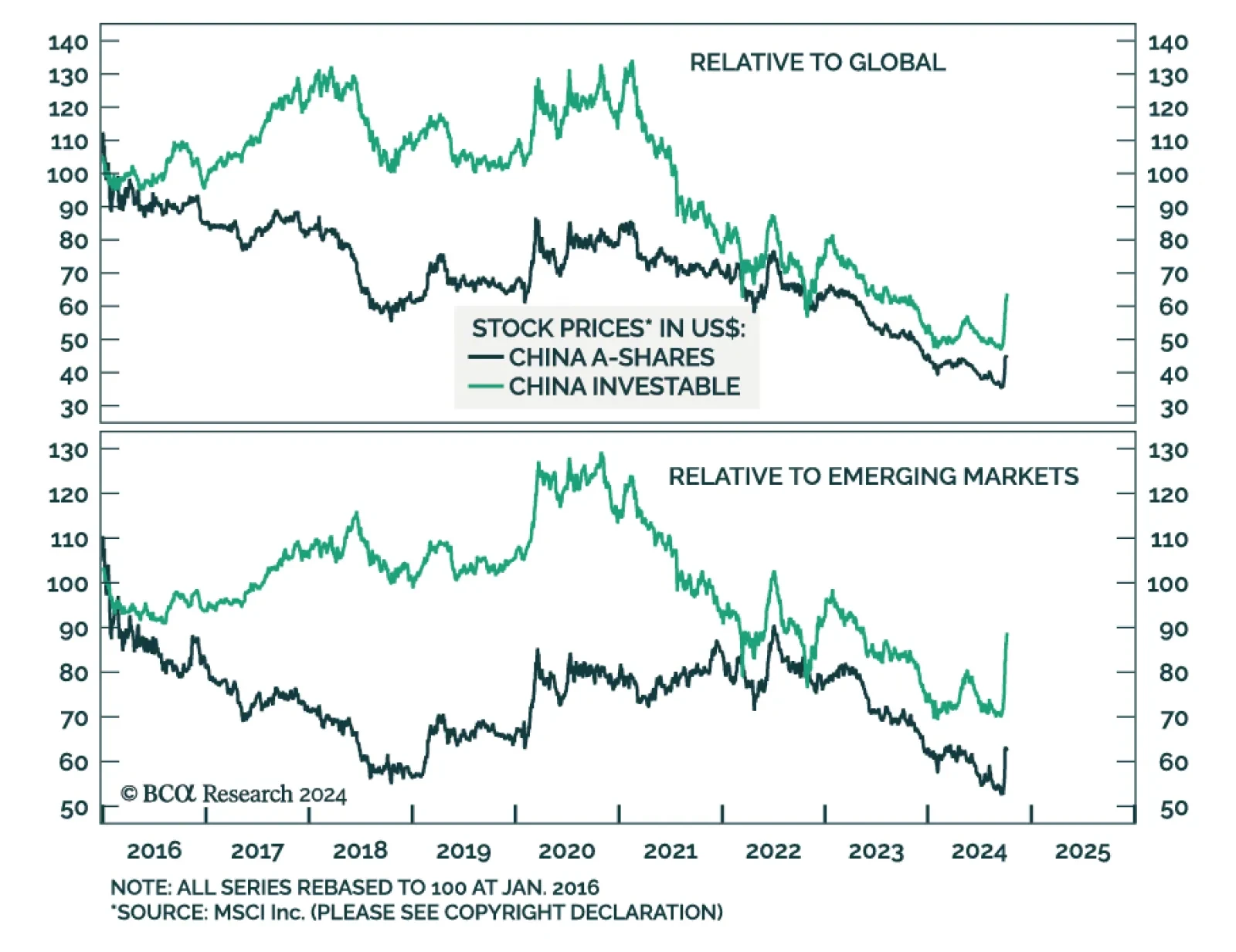

While moving in the right direction, China’s latest stimulus measures are falling short of the mark to reflate the economy. The latest rumors extend this trend. News agencies reported discussions of a CNY 10 trillion…

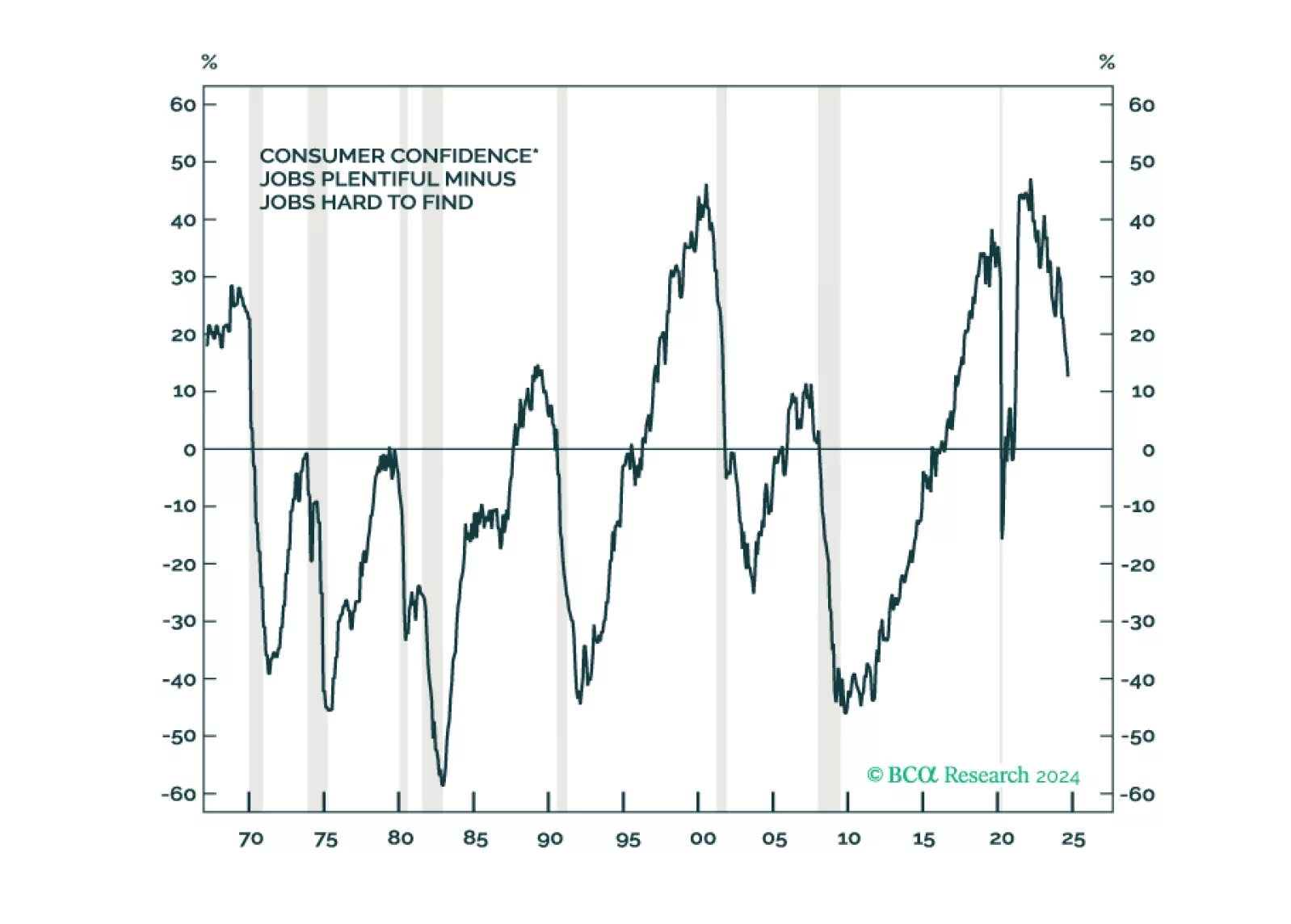

Rising stock prices and improving economic data have us re-examining our bearish thesis, but we still see deterioration in leading labor market indicators and expect it will eventually culminate in a recession. We reiterate our…

China’s National Development and Reform Commission (NDRC) provided no insights Tuesday on the size or nature of the fiscal stimulus Beijing promised in late September. The key takeaway of the authorities' first briefing…