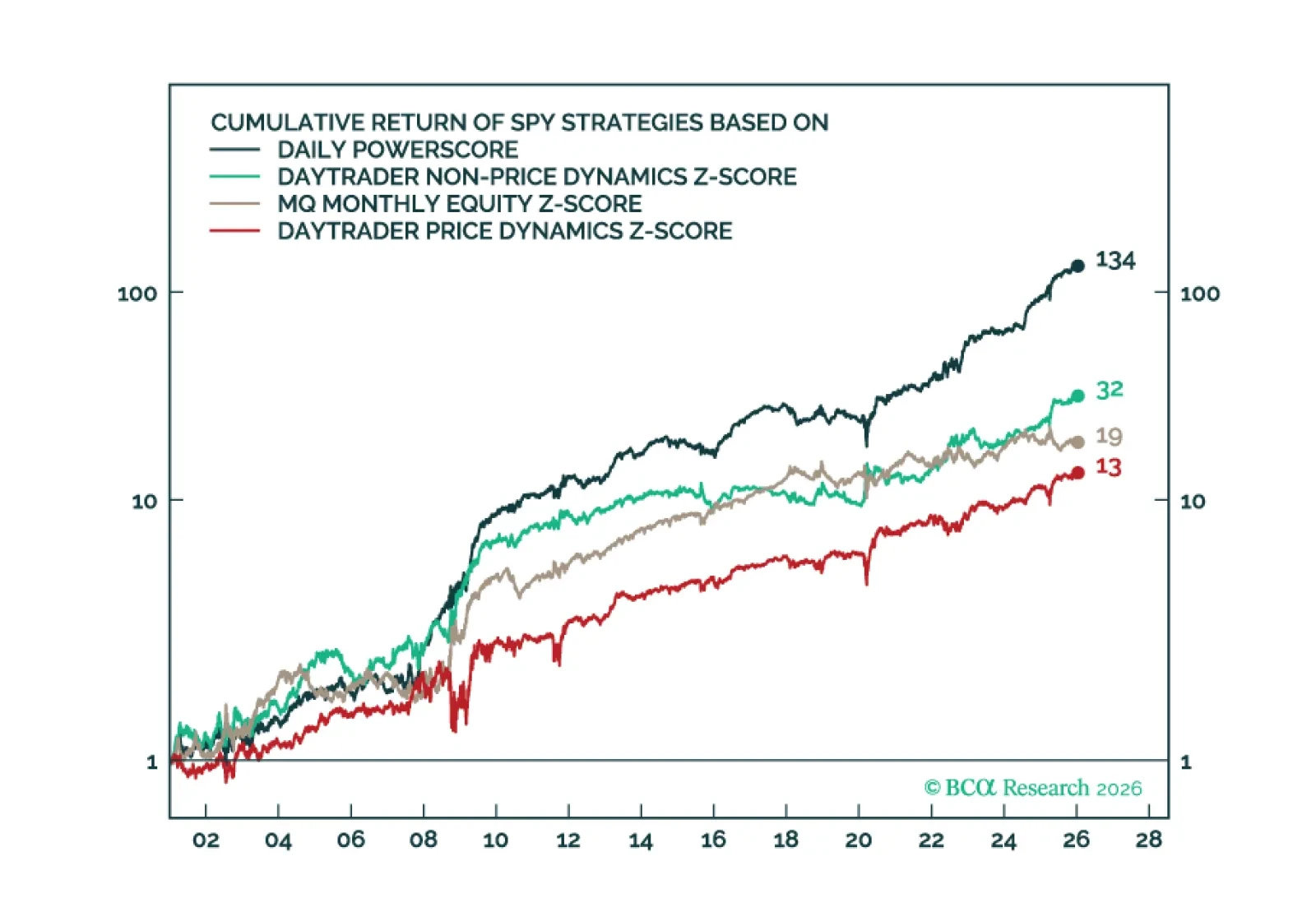

Over the past few months, we have been deploying new market-timing tools aimed at improving the accuracy of our calls. Today’s report highlights our ultra high-frequency Daily Oscillators, which provide daily signals on the near-term…

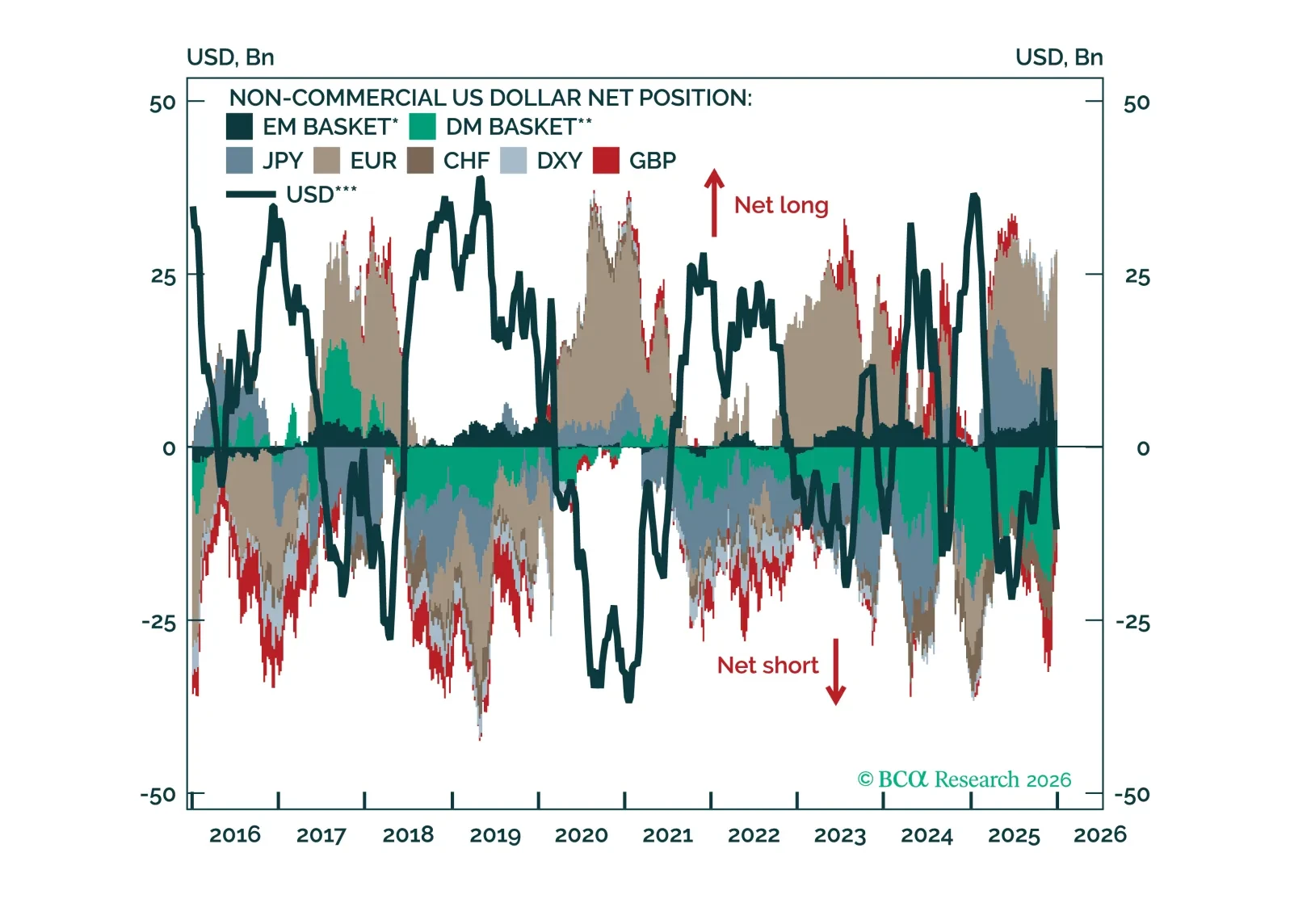

With FX volatility near cycle lows, this Insight examines where positioning has become most stretched across G10, EM FX, and precious metals – and what that implies for near-term moves and reversal risks.

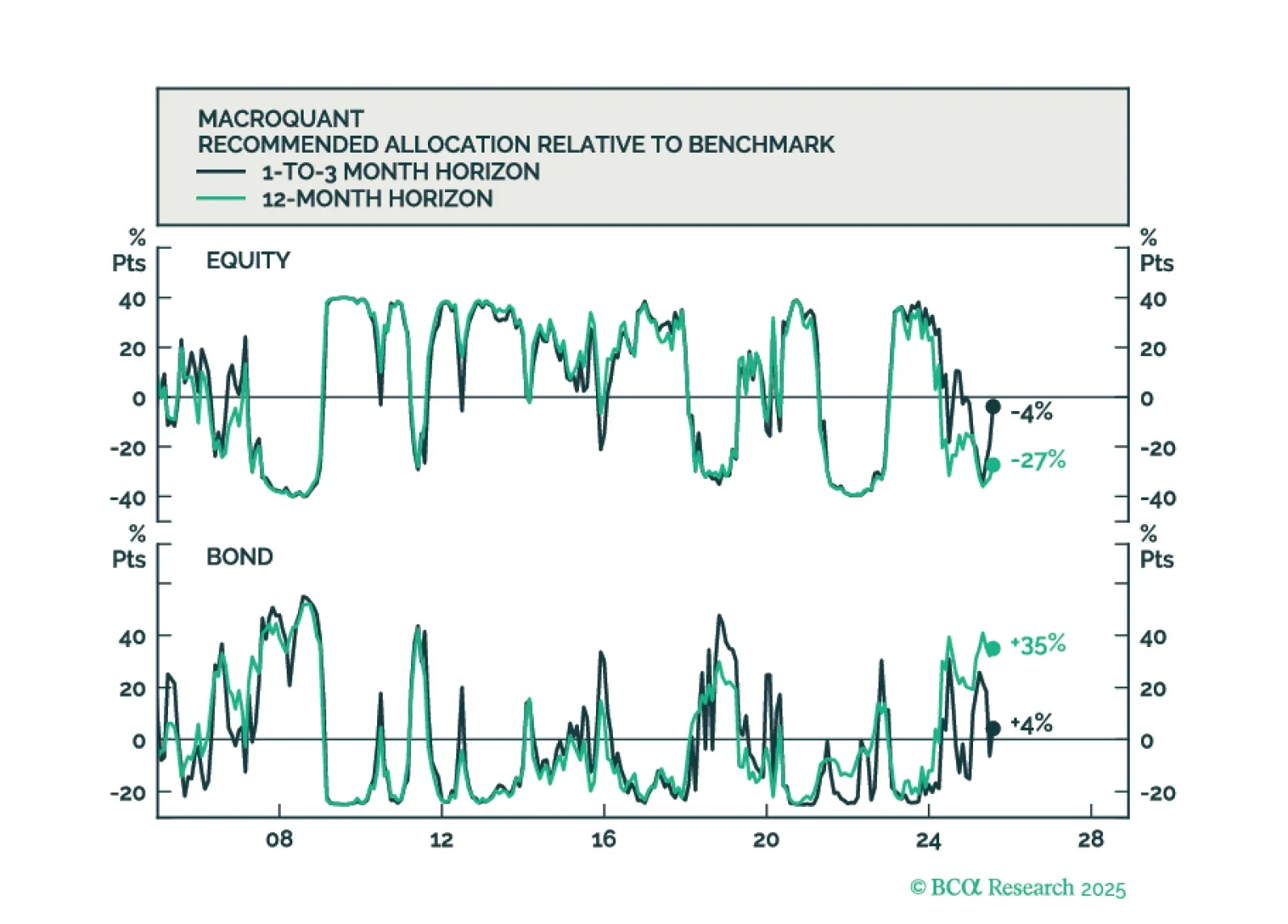

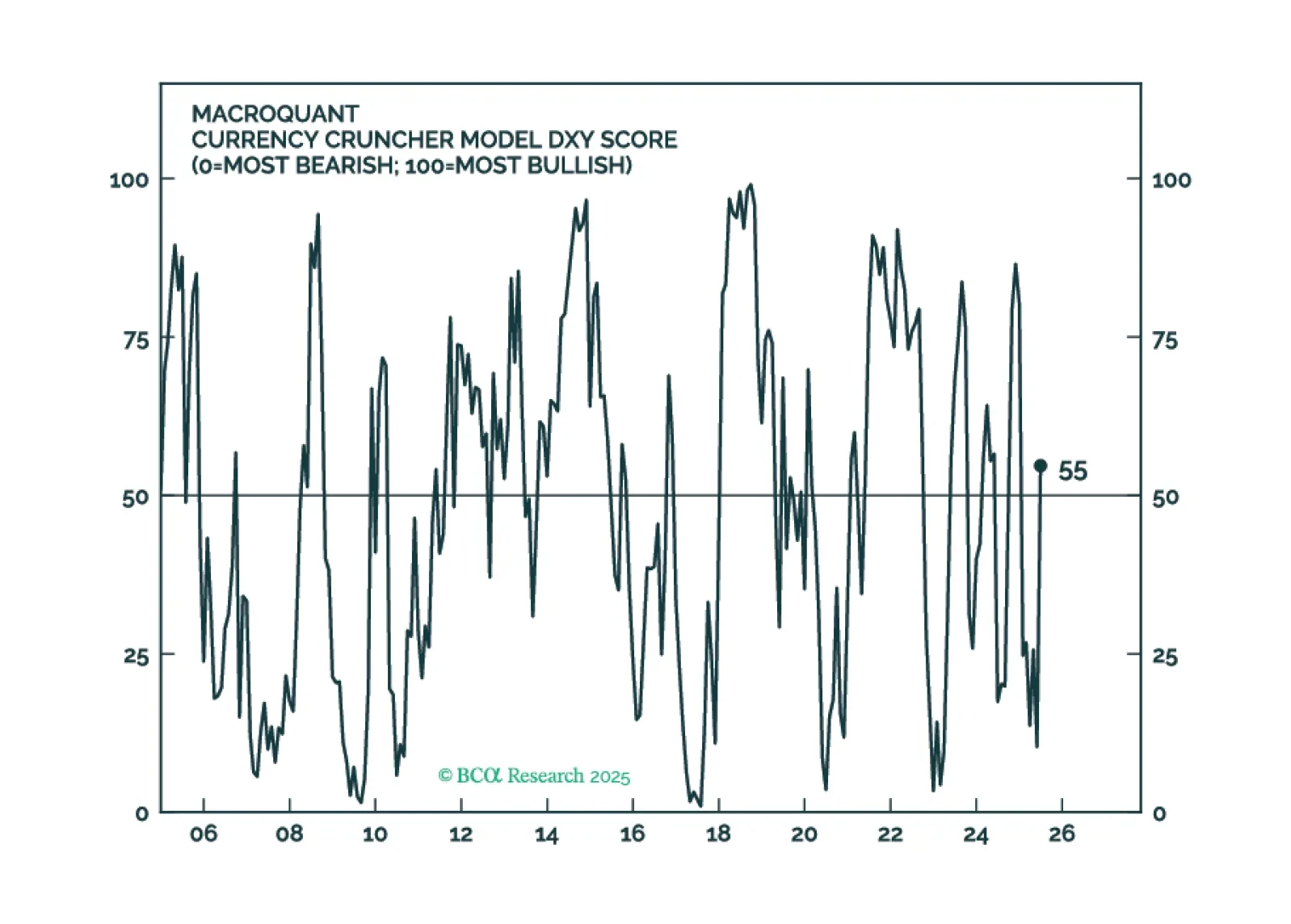

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

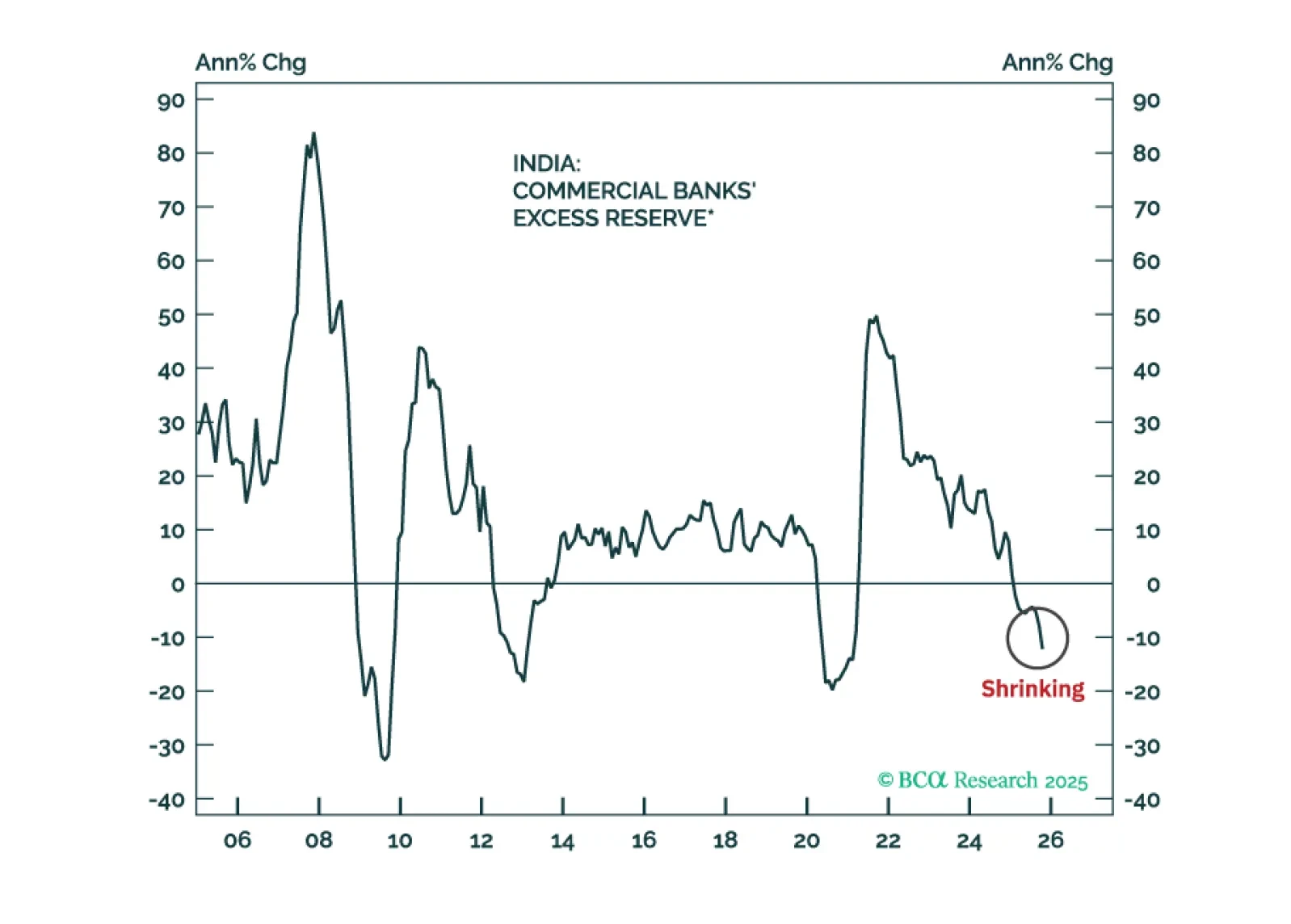

Indian stocks have further downside in absolute terms as profits disappoint. Their underperformance versus the EM equity benchmark, however, is late, which warrants a shift from underweight to neutral allocation.

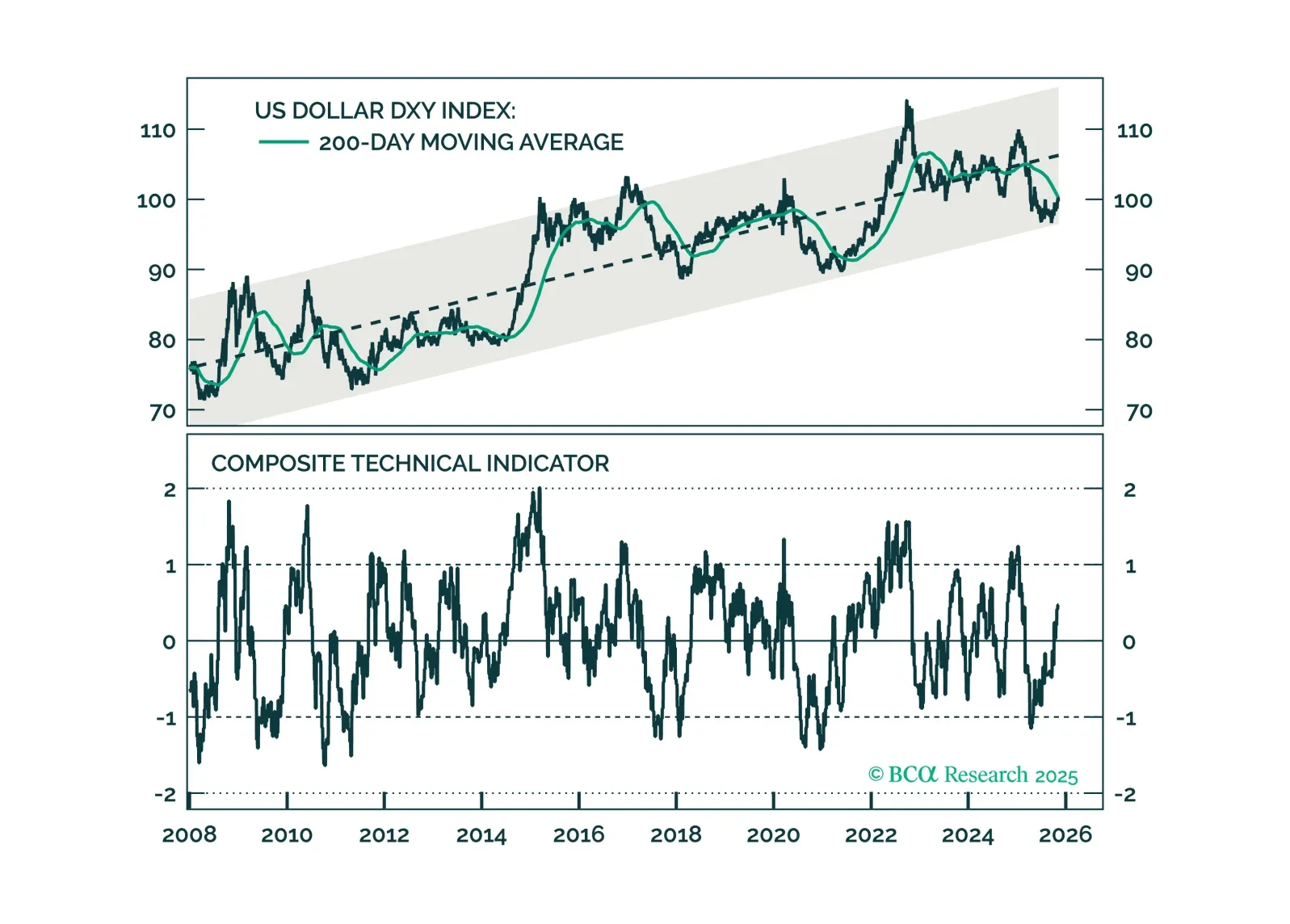

The dollar rebound has paused, but not yet peaked. With near-term momentum still intact, we see room for further upside before structural headwinds reassert, favoring selling into strength.

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

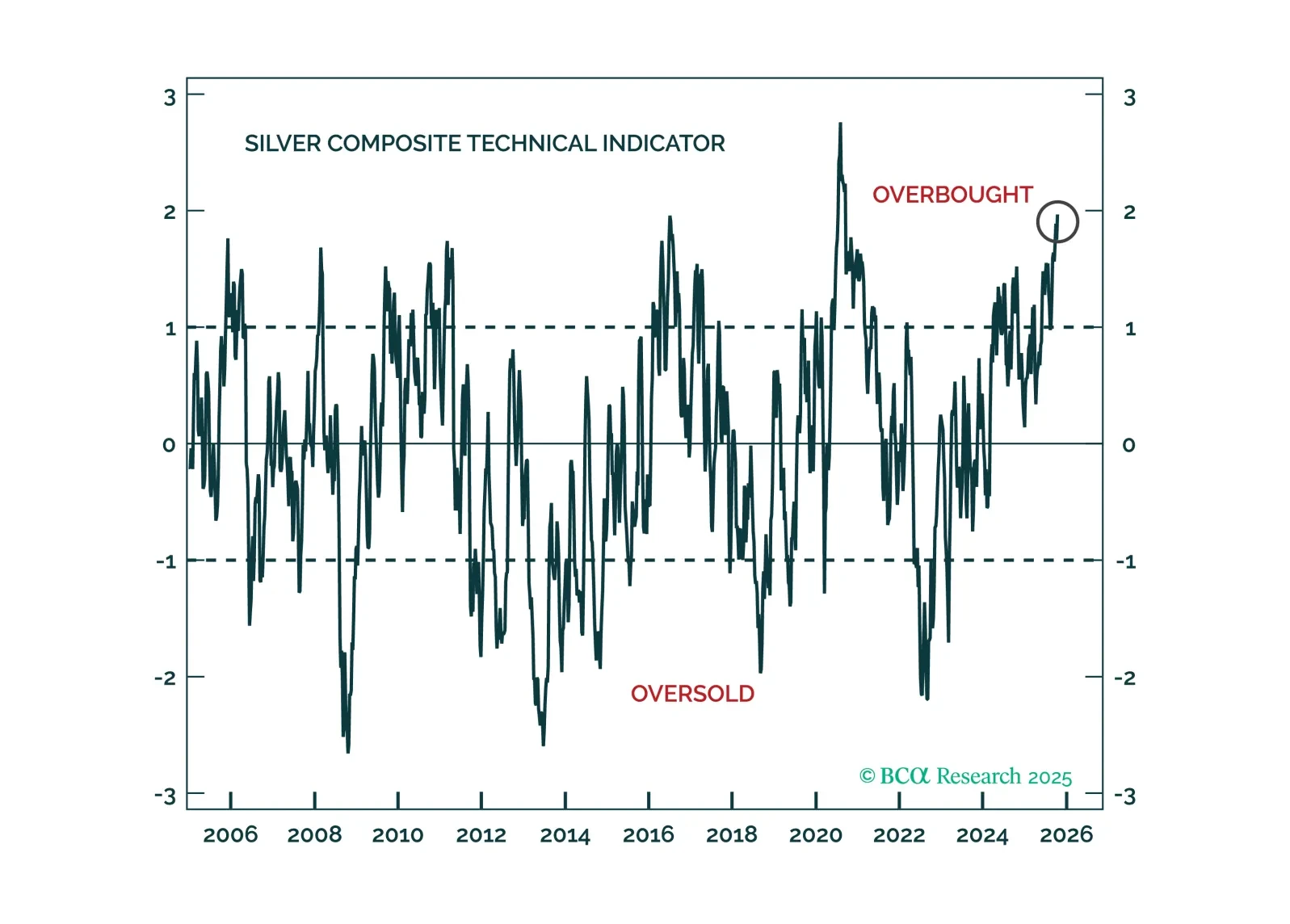

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

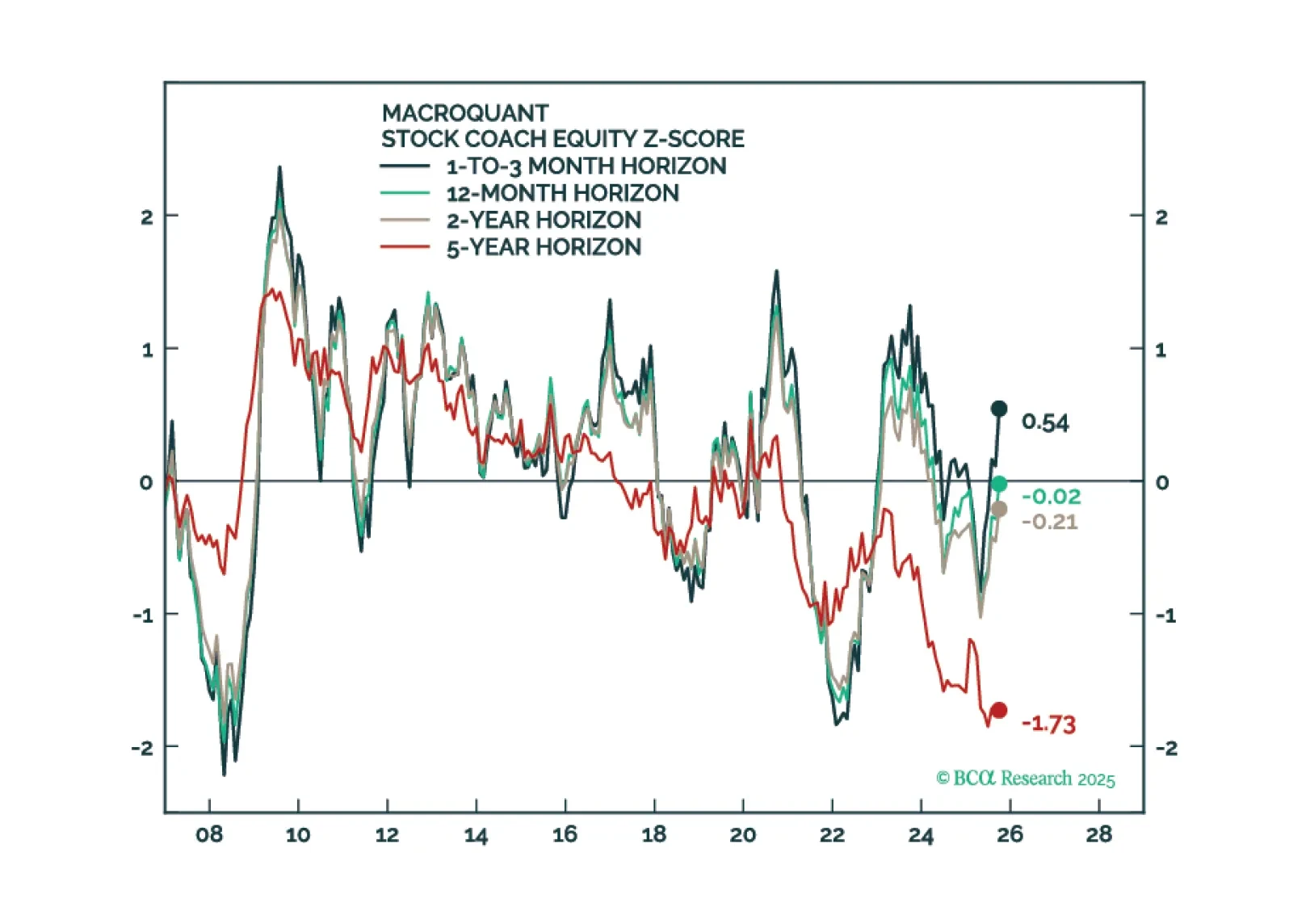

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

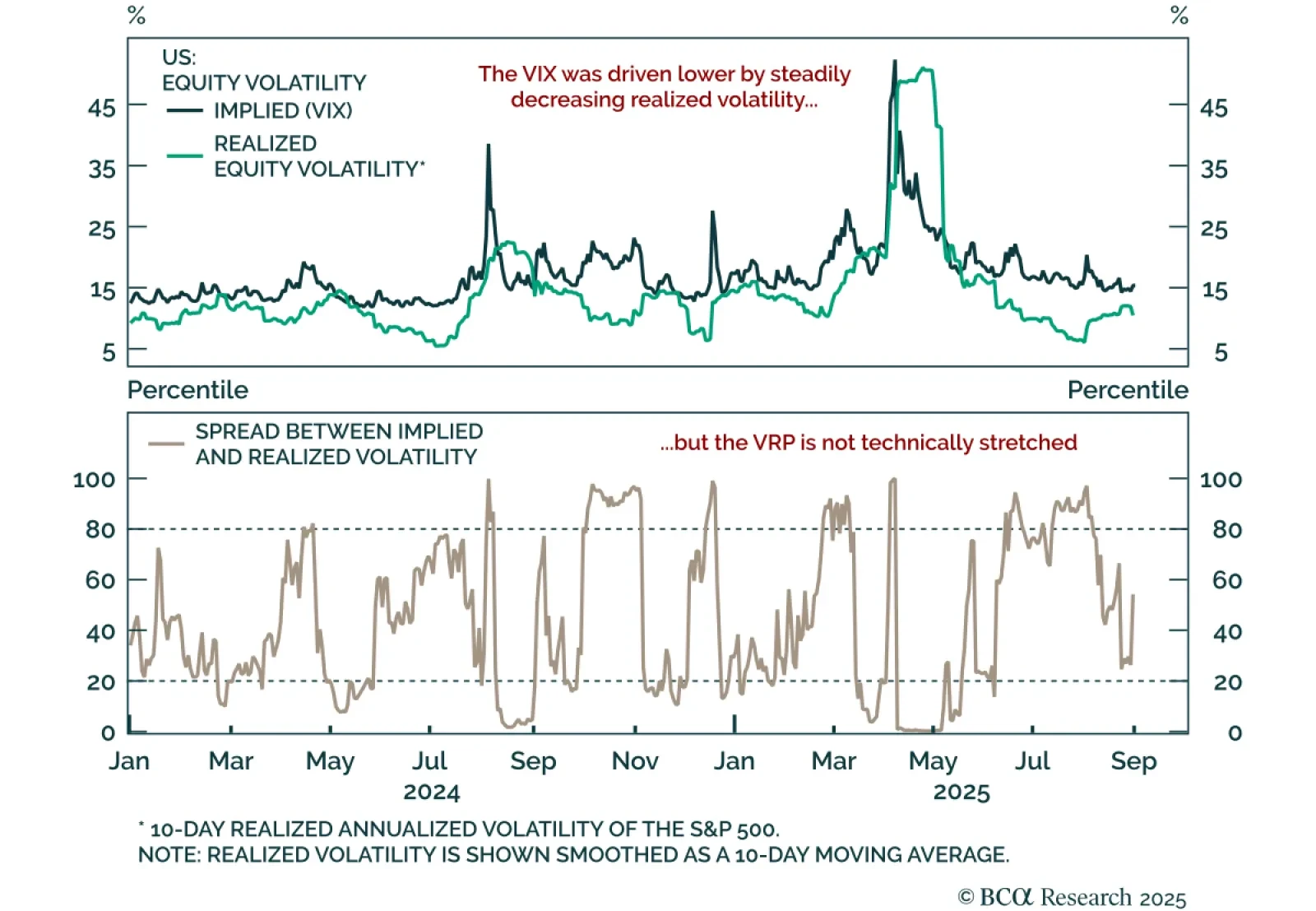

A smooth S&P 500 rally has crushed volatility, but stretched signals argue for buying protection. The index has climbed back to all-time highs with almost no drawdown, producing a steady decline in realized volatility. This…

MacroQuant is recommending that equity investors keep their finger near the eject button but avoid pressing it for now. The model is warming up to the dollar again and sees scope for oil prices to rise.