We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s…

Our Portfolio Allocation Summary for July 2025.

Our Geopolitical strategists warn that structural and cyclical risks remain elevated despite a fading threat of acute shocks, and recommend booking profits ahead of tariffs and weaker data. President Trump is passing his signature…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

In Section I, Doug underscores that the full weight of tariffs has yet to be felt on the US and global economies, against the dangerous backdrop of a softening labor market. In Section II, Jonathan presents the bullish case for the…

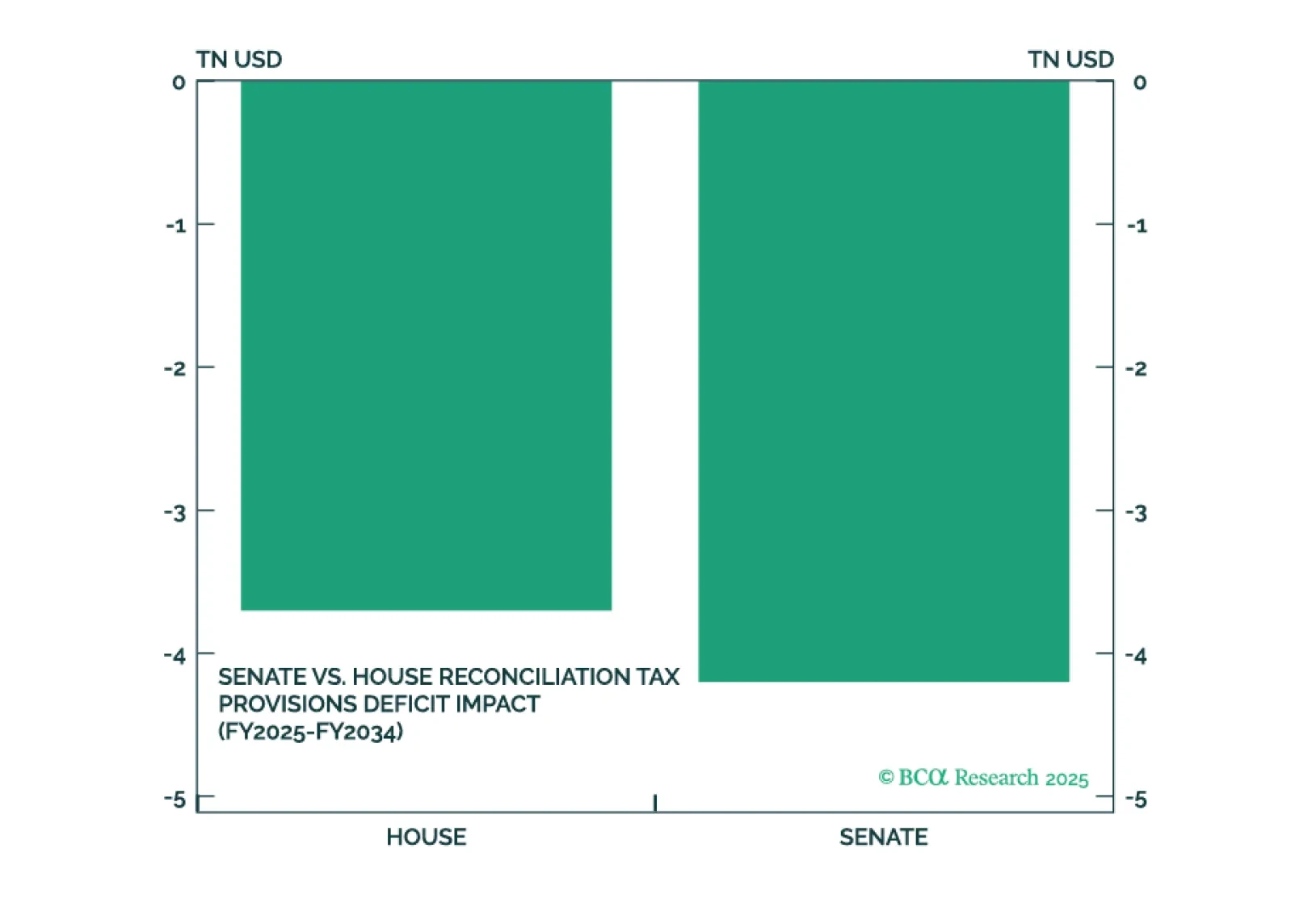

President Trump’s big beautiful bill will pass but faces near-term hurdles and will not tighten the government’s belt. It will combine with renewed tariff implementation to generate near-term risk for both the bond and stock market.…

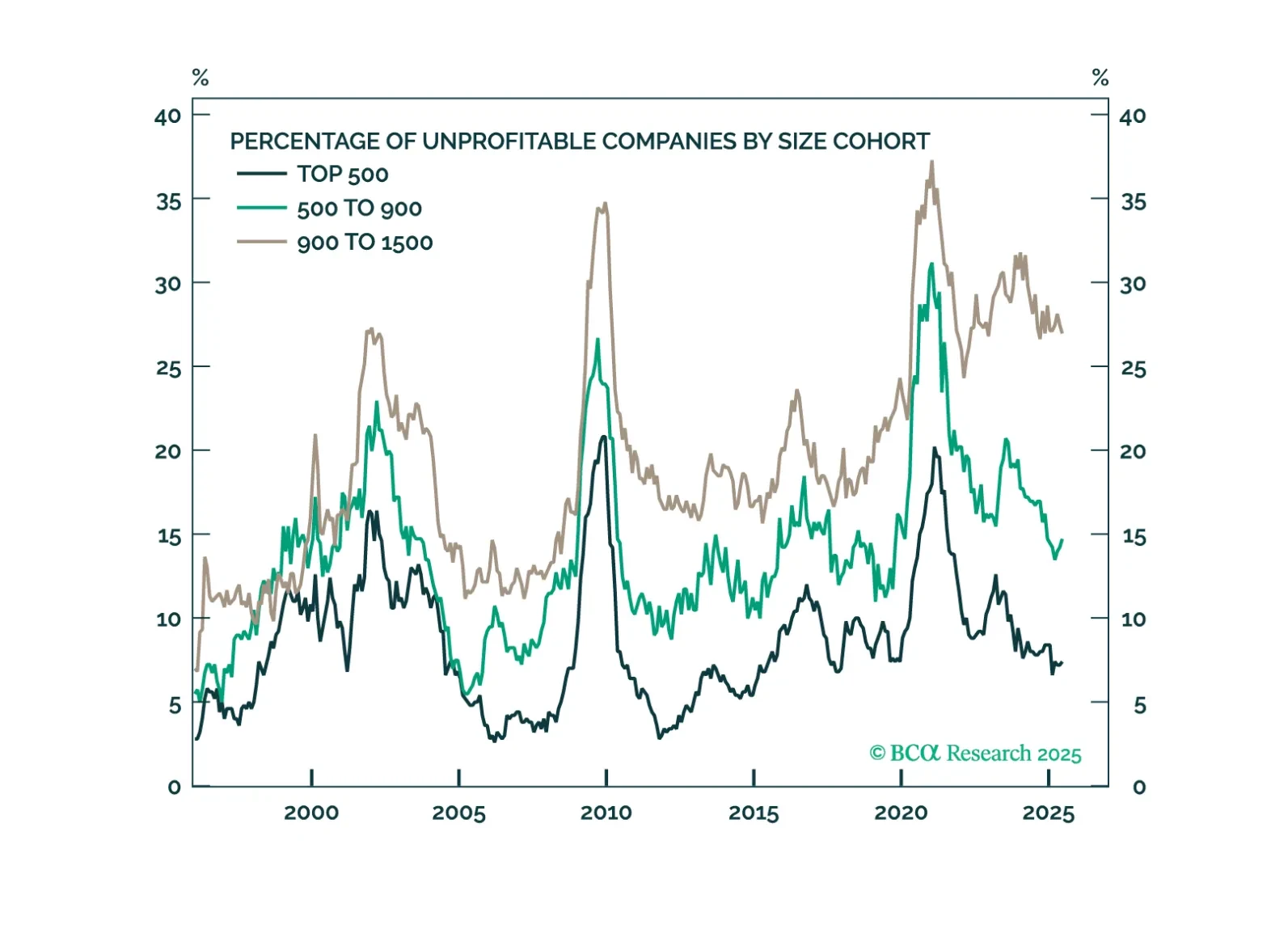

Recently, small-cap stocks have shown signs of outperformance. In this report, we examine whether the rebound is sustainable by analyzing long-term structural trends, the macroeconomic backdrop, the impact of tariffs, and other key…

Following a rapid-fire review of issues related to household balance sheets, durable goods demand, the impact of tariffs, DOGE’s capacity to move the budget needle and the labor market’s ongoing cooling, we reiterate our defensive…