Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

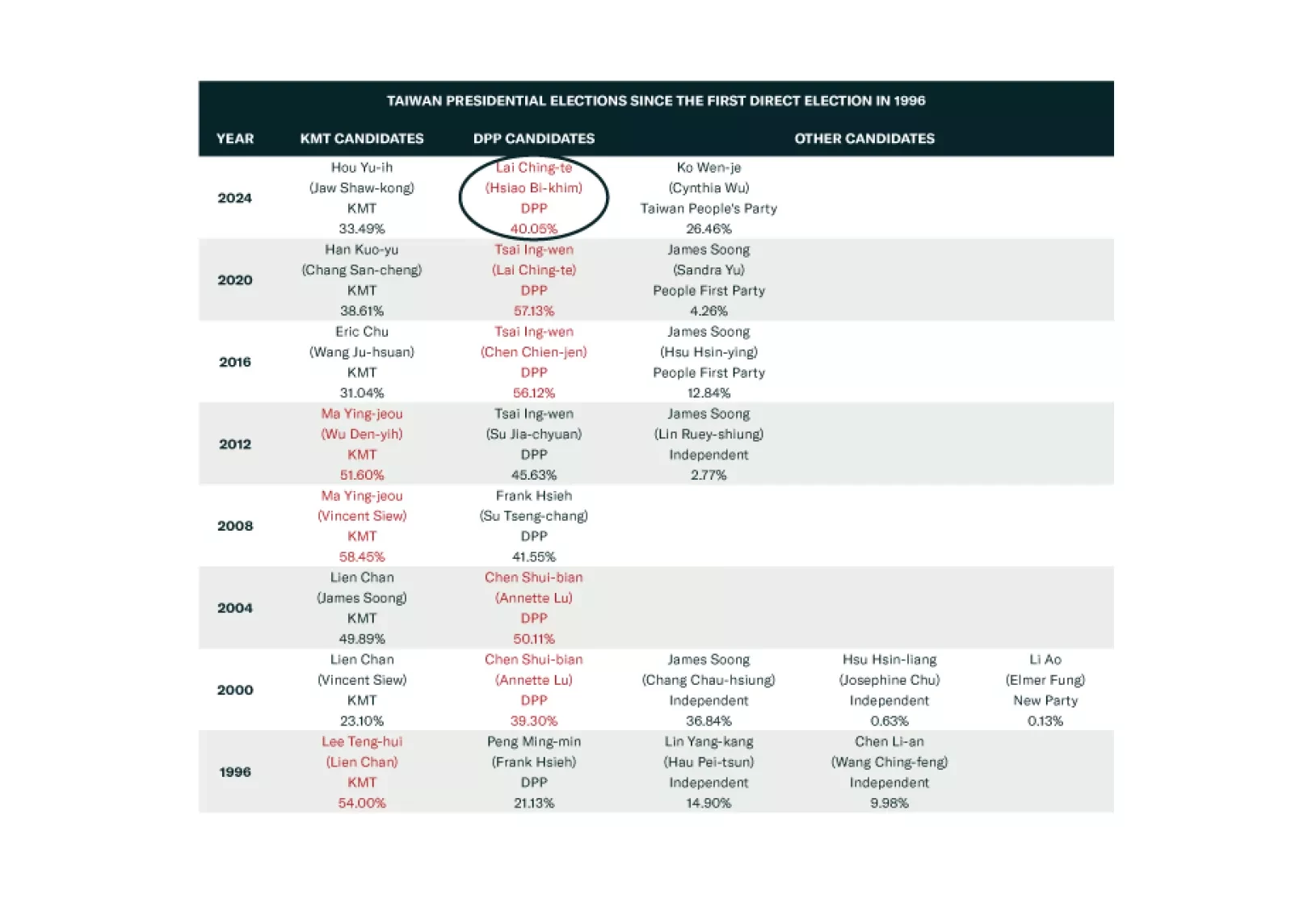

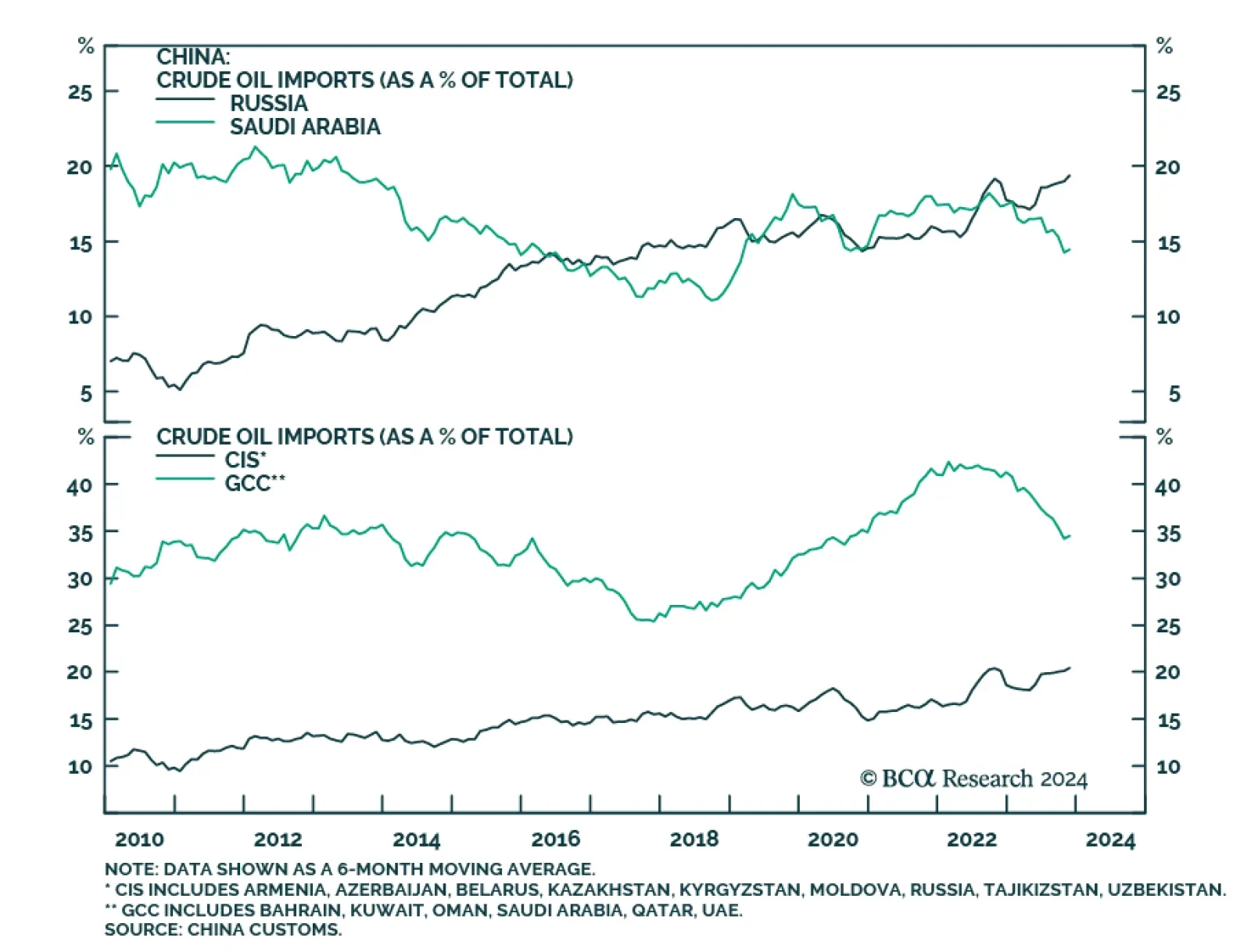

China will increase economic and military pressure on Taiwan but there is no basis for immediate full-scale war. That is the takeaway from the Taiwanese election on January 13, which returned the nominally pro-independence…

Taiwan’s election will lead to serious Chinese military and economic pressure but not full-scale war. War is a long-term concern. Investors should short TWD-USD.

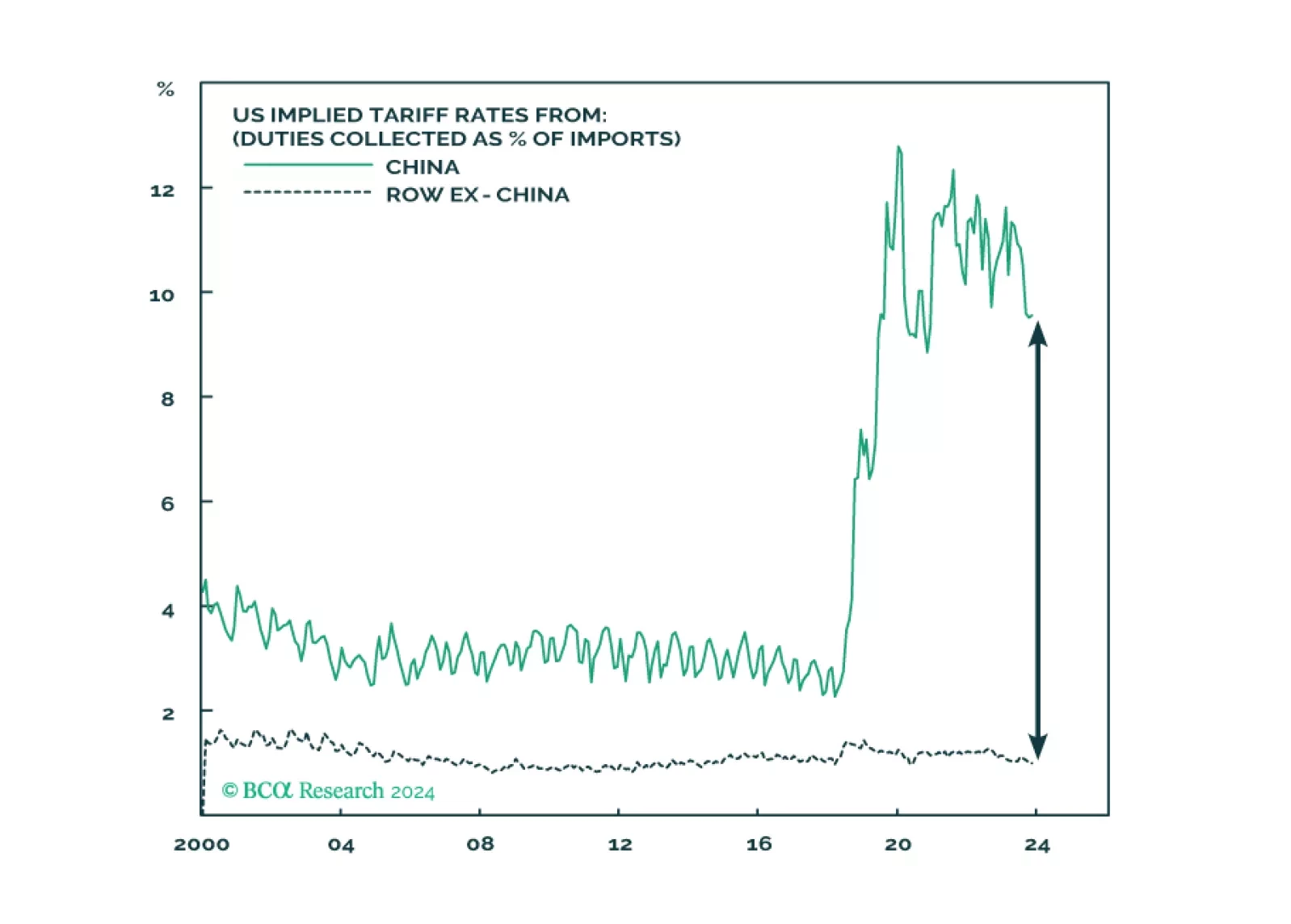

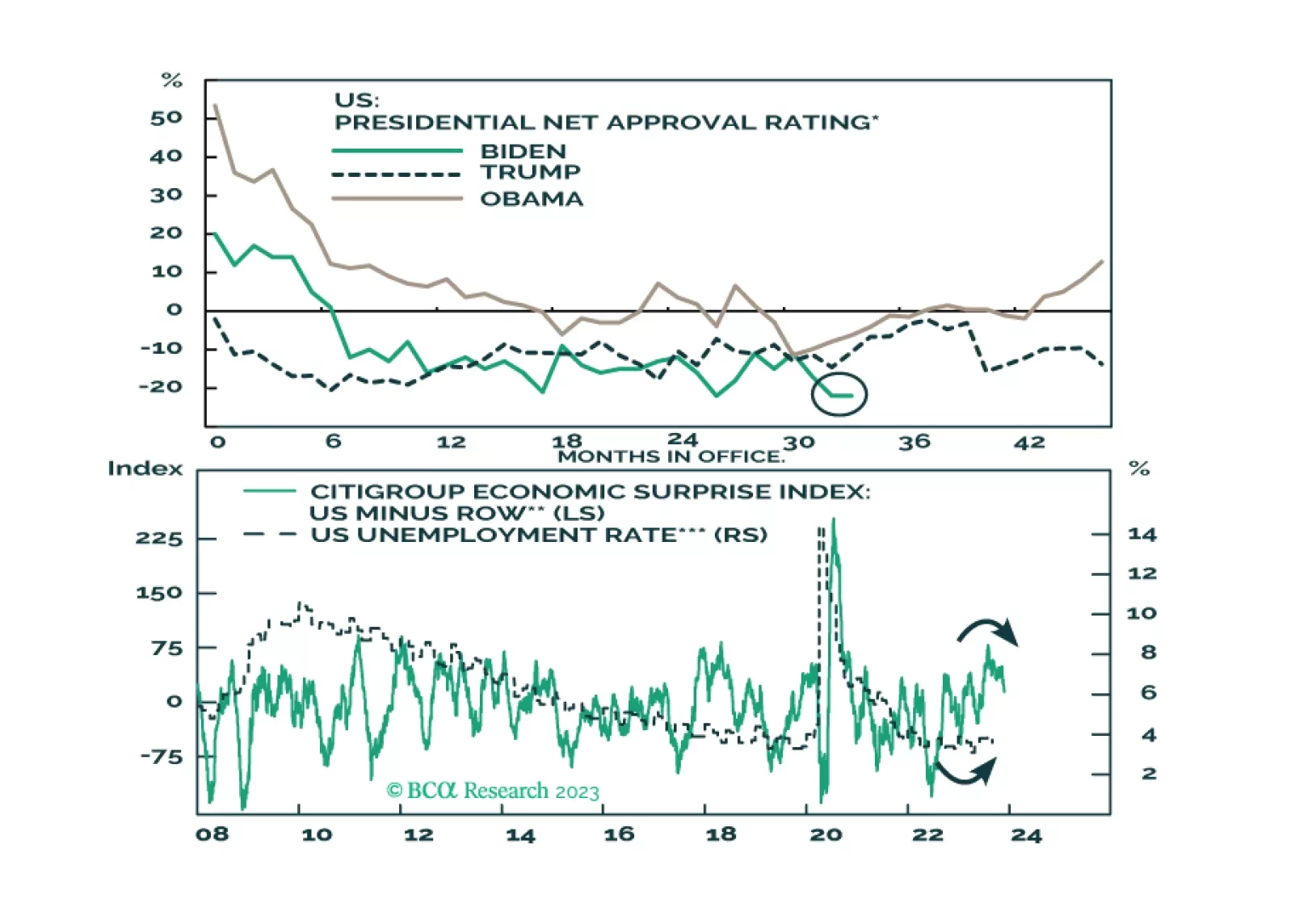

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

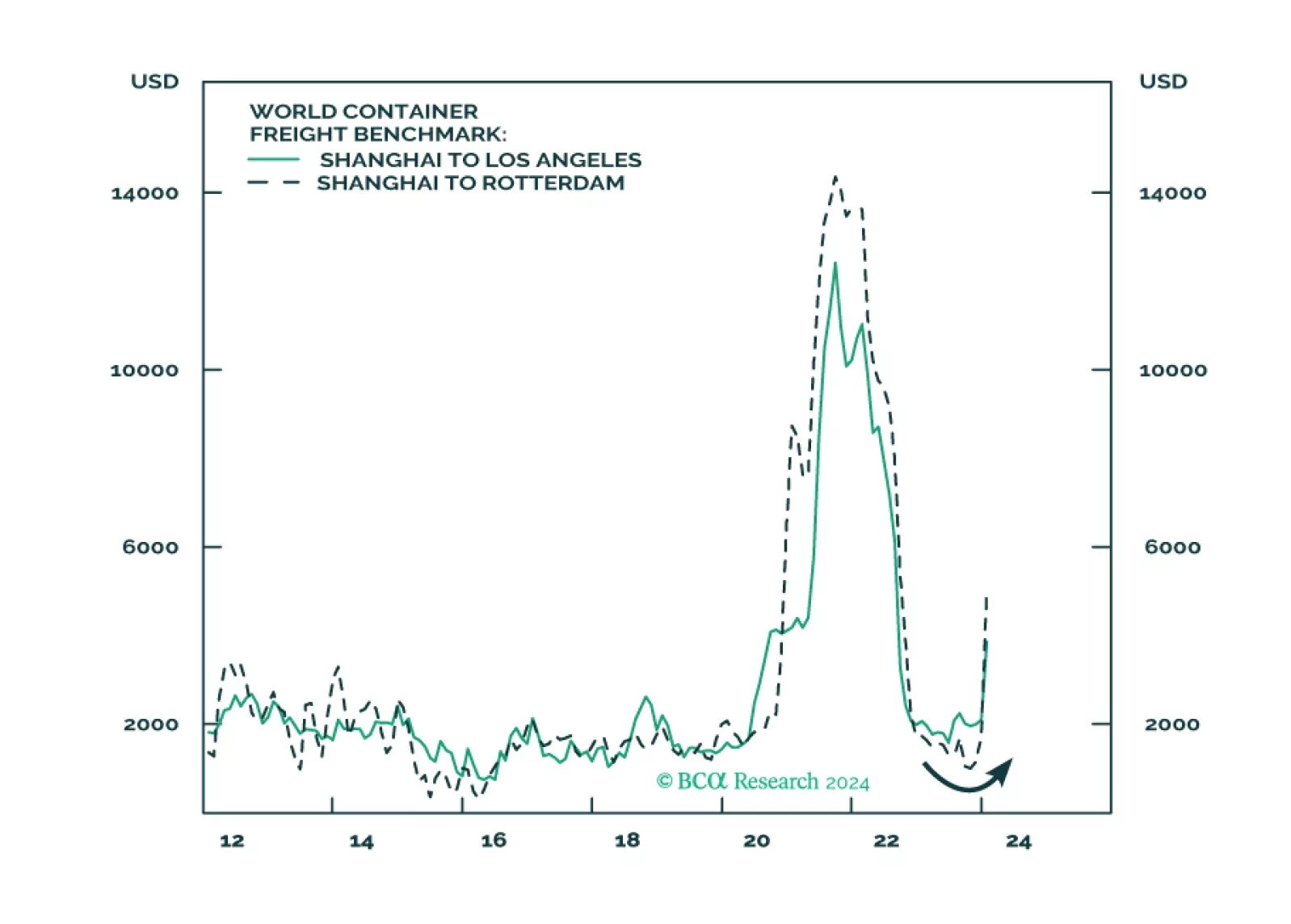

Global instability will continue in 2024 – whatever happens afterward. Slowing economies will exacerbate already high geopolitical risk and policy uncertainty stemming from the US election and foreign challenges to US leadership.…

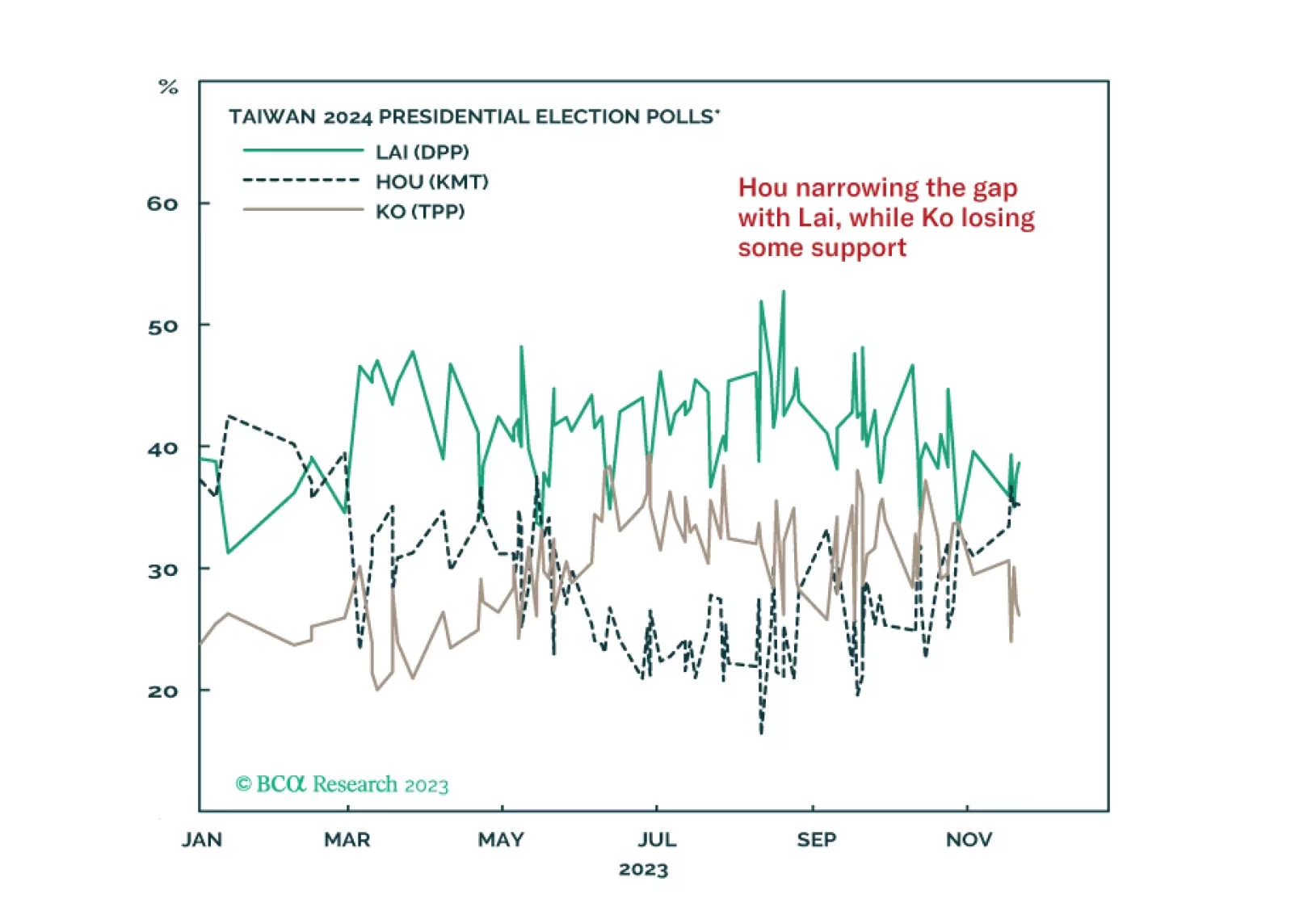

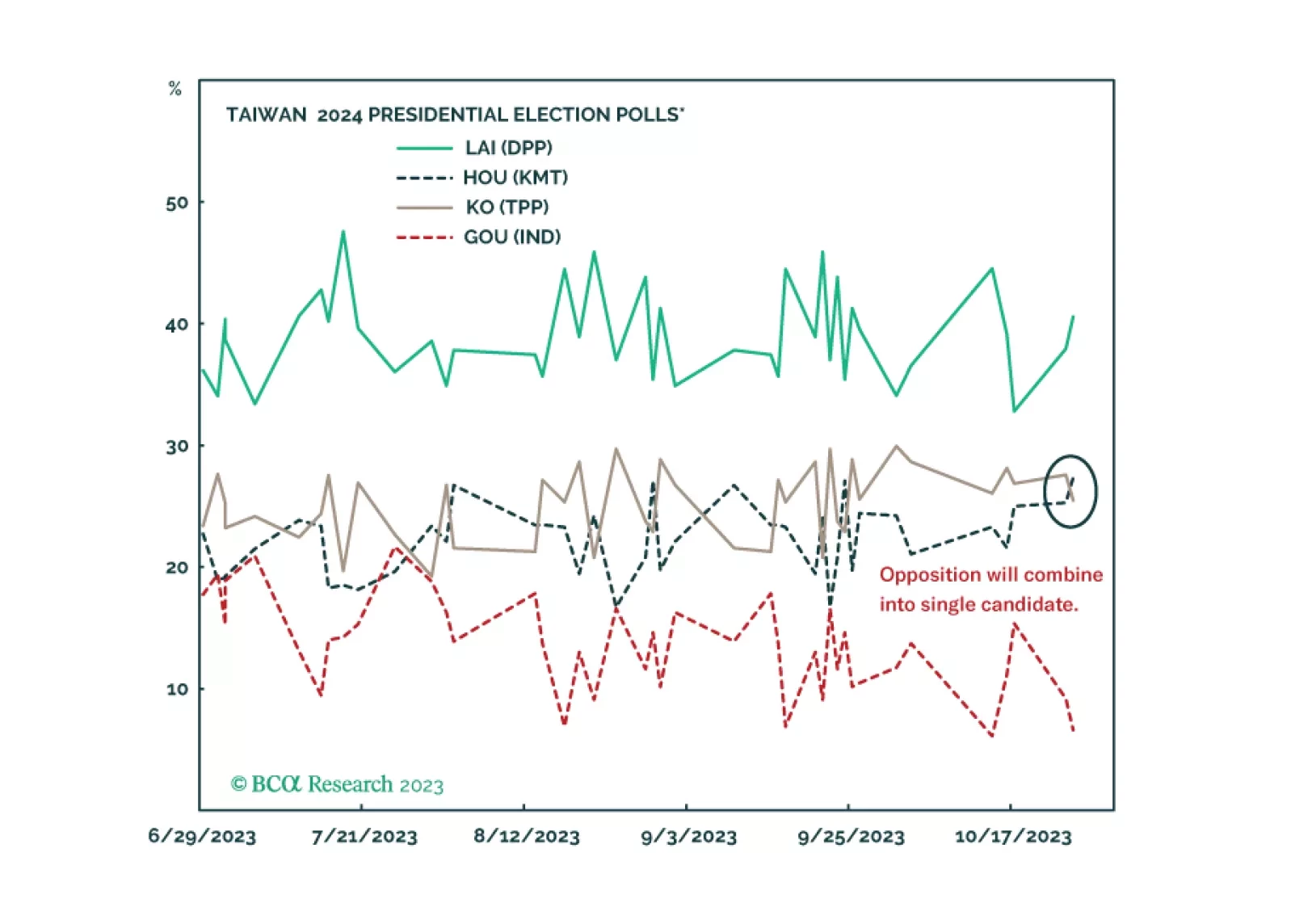

A series of notable events took place over the Thanksgiving holiday but none of them force us to change our fundamental assessments. The conflict in the Middle East is likely to escalate rather than de-escalate, while the Taiwan…

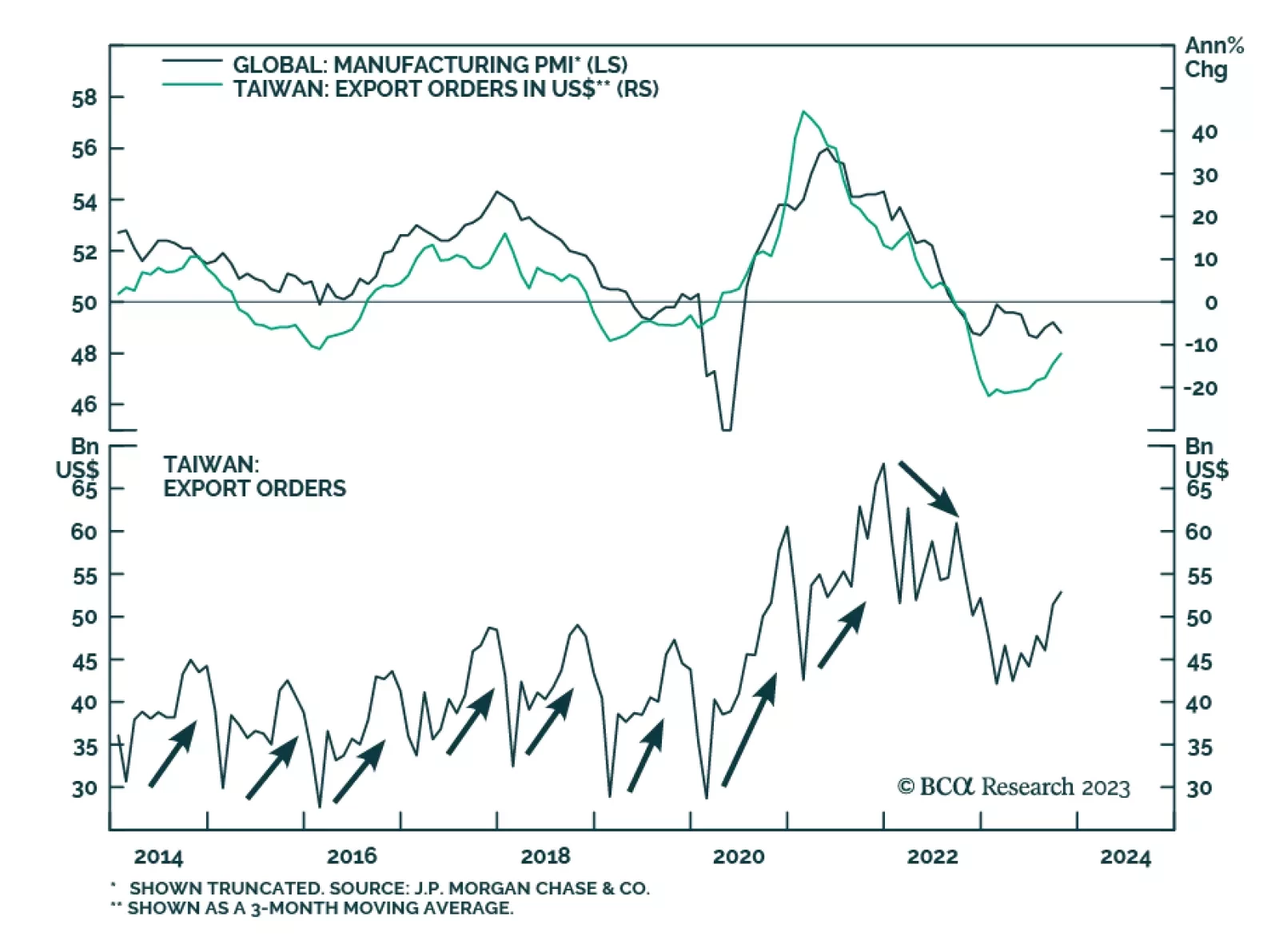

To the extent that Taiwanese export orders act as a bellwether for global trade dynamics, we often monitor the release to gain a sense of the state of the manufacturing cycle. On this front, the October update provided a positive…