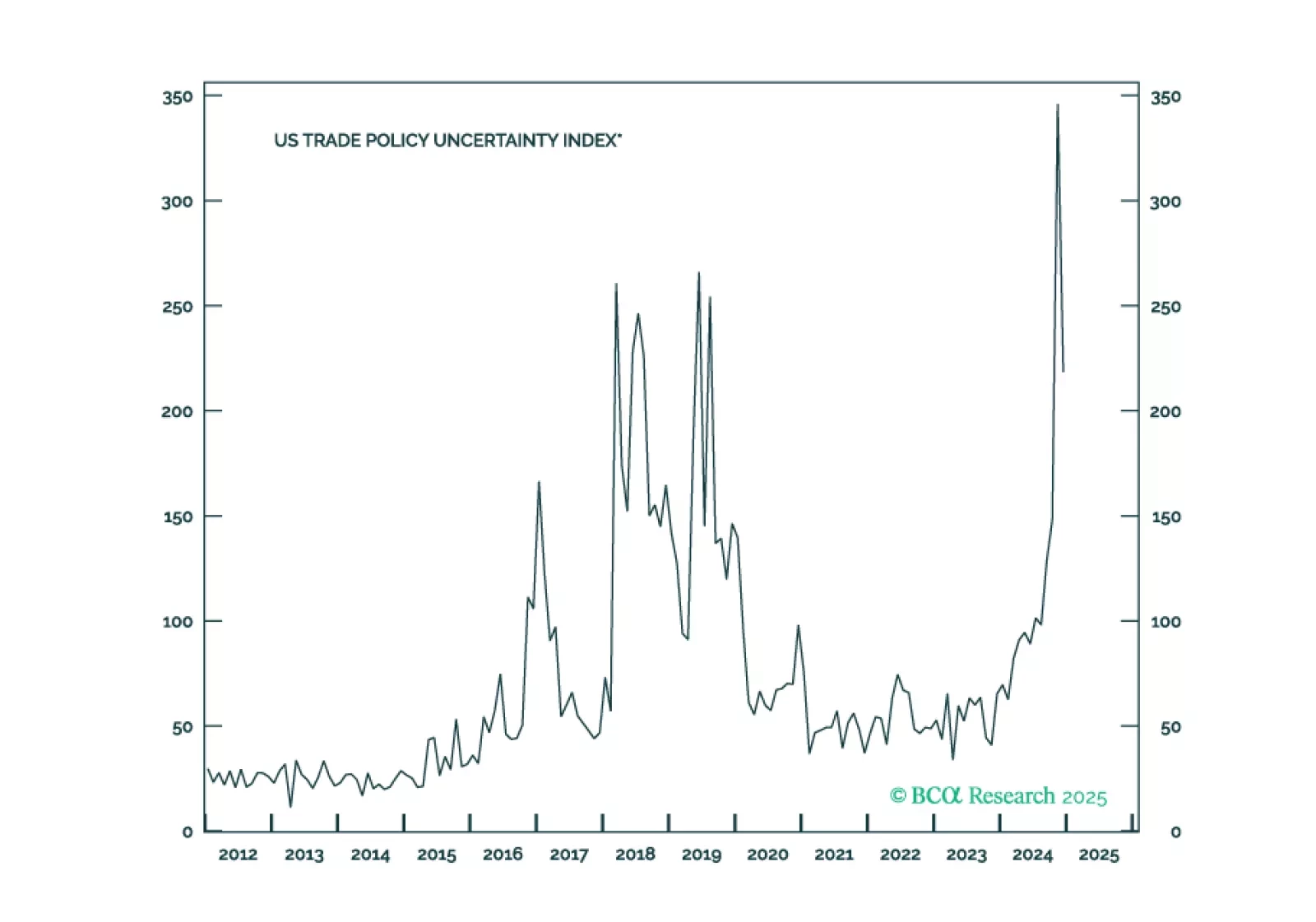

We expect market volatility to remain elevated due to uncertain economic, monetary, and trade policies. Barbell is the best portfolio strategy at this time. We recommend boosting defensive allocations to lower portfolio beta. …

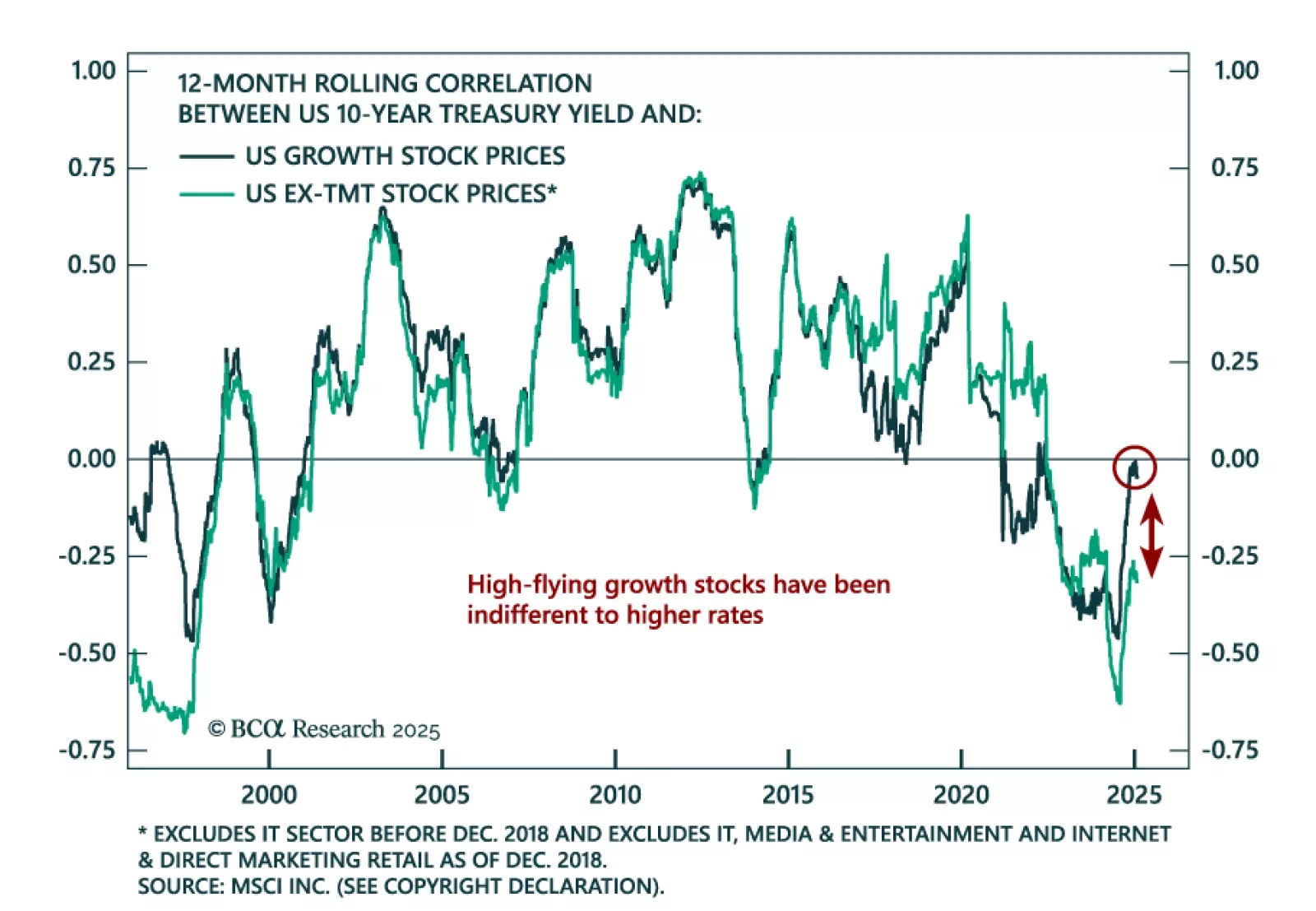

Our Chart Of The Week comes from Arthur Budaghyan, Chief Strategist of our Emerging Markets and China Investment Strategy services. Arthur highlights an important dichotomy in the US stock-bond yield correlation. In the past 12…

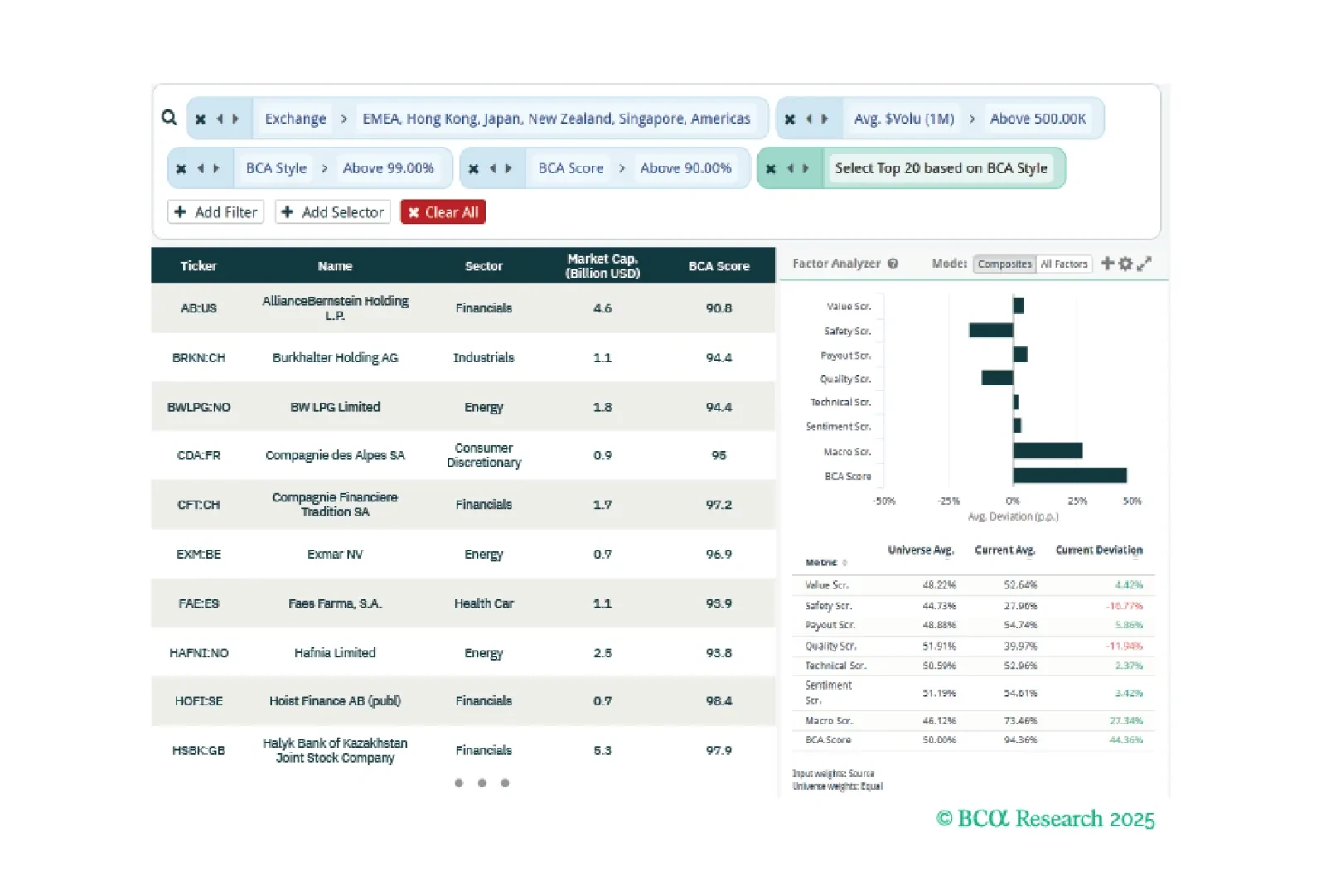

This week, our three screeners explore global small-cap value stocks, European equities, and BCA’s nuclear energy themed equity baskets.

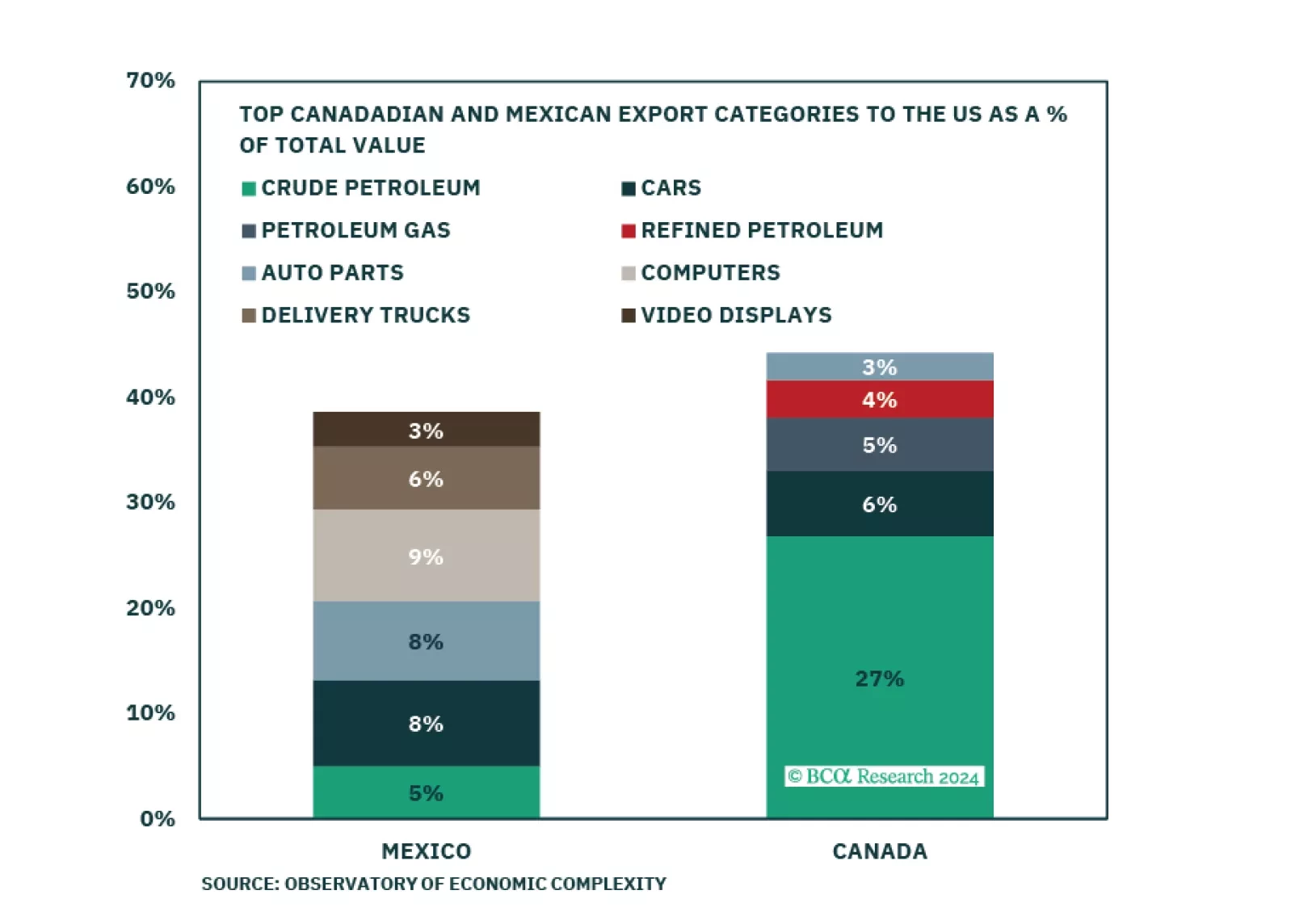

In Section I, Doug highlights that recent trade developments and news from the AI space are both consistent with a conservative investment stance. US final demand was robust in Q4, but the economy is still walking a tightrope as…

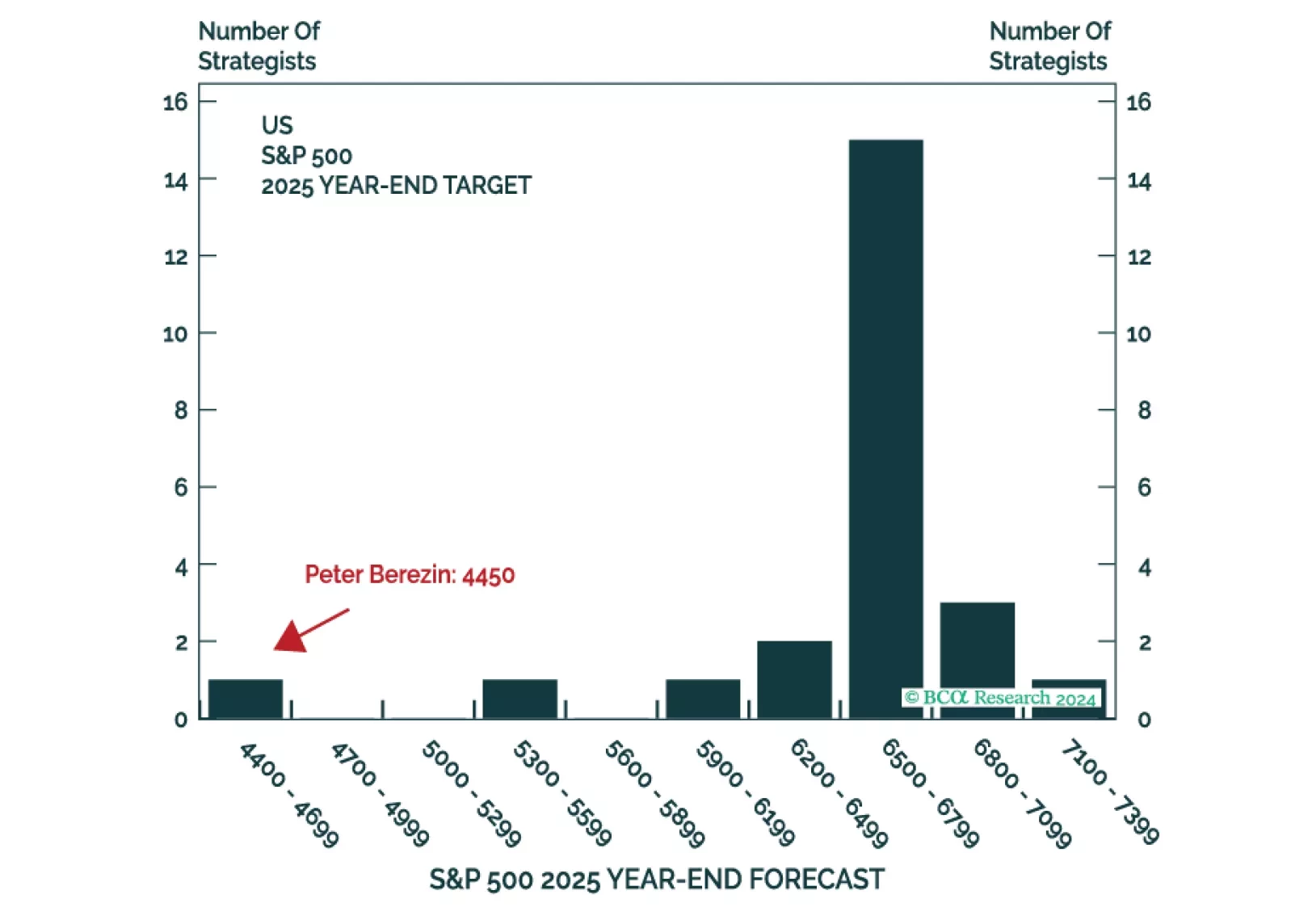

This is the time of the year when strategists are busy sending out their annual outlooks. Here on the Global Investment Strategy team, we decided to go one step further. Rather than pontificating about what could happen in 2025, we…

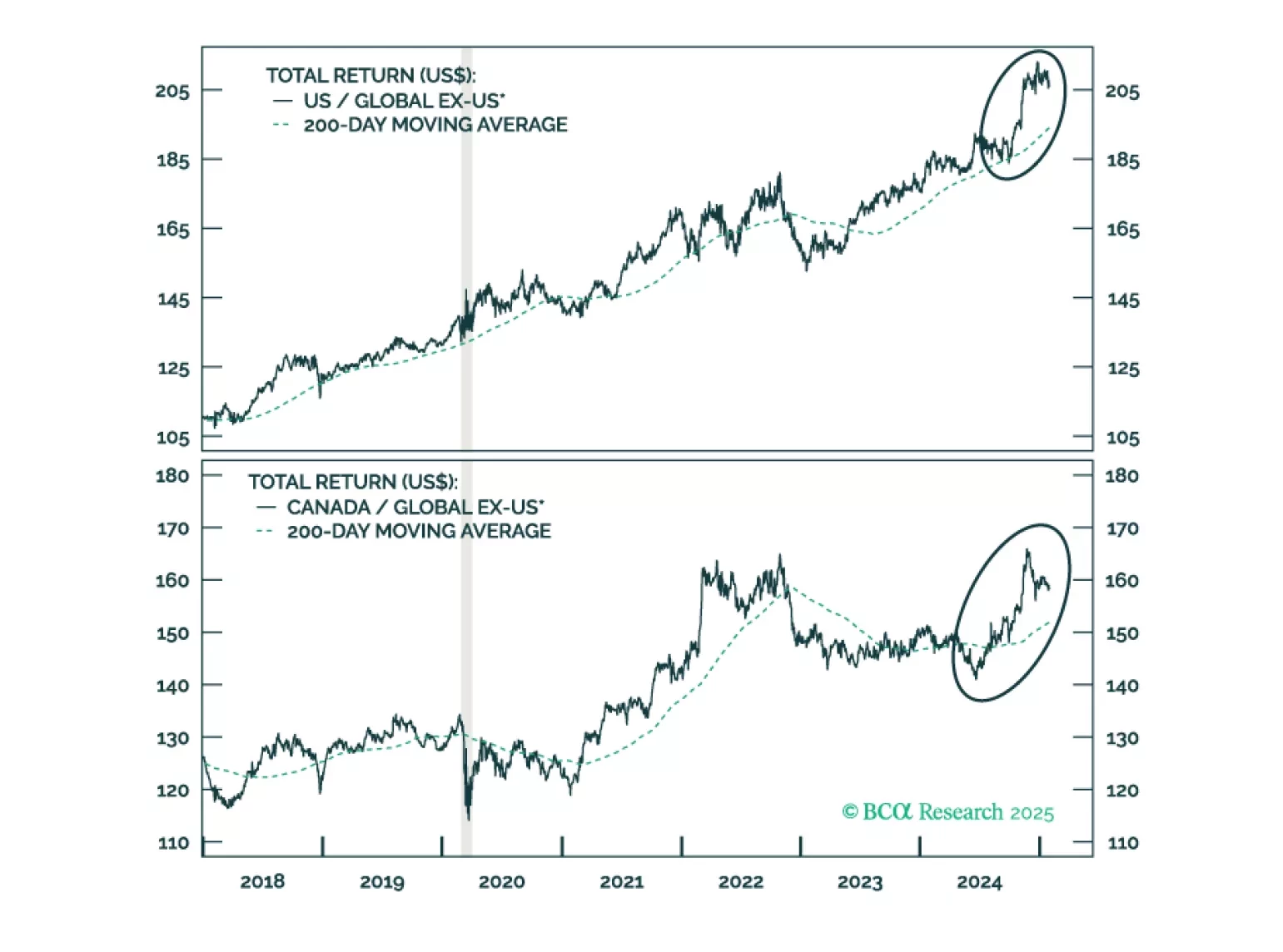

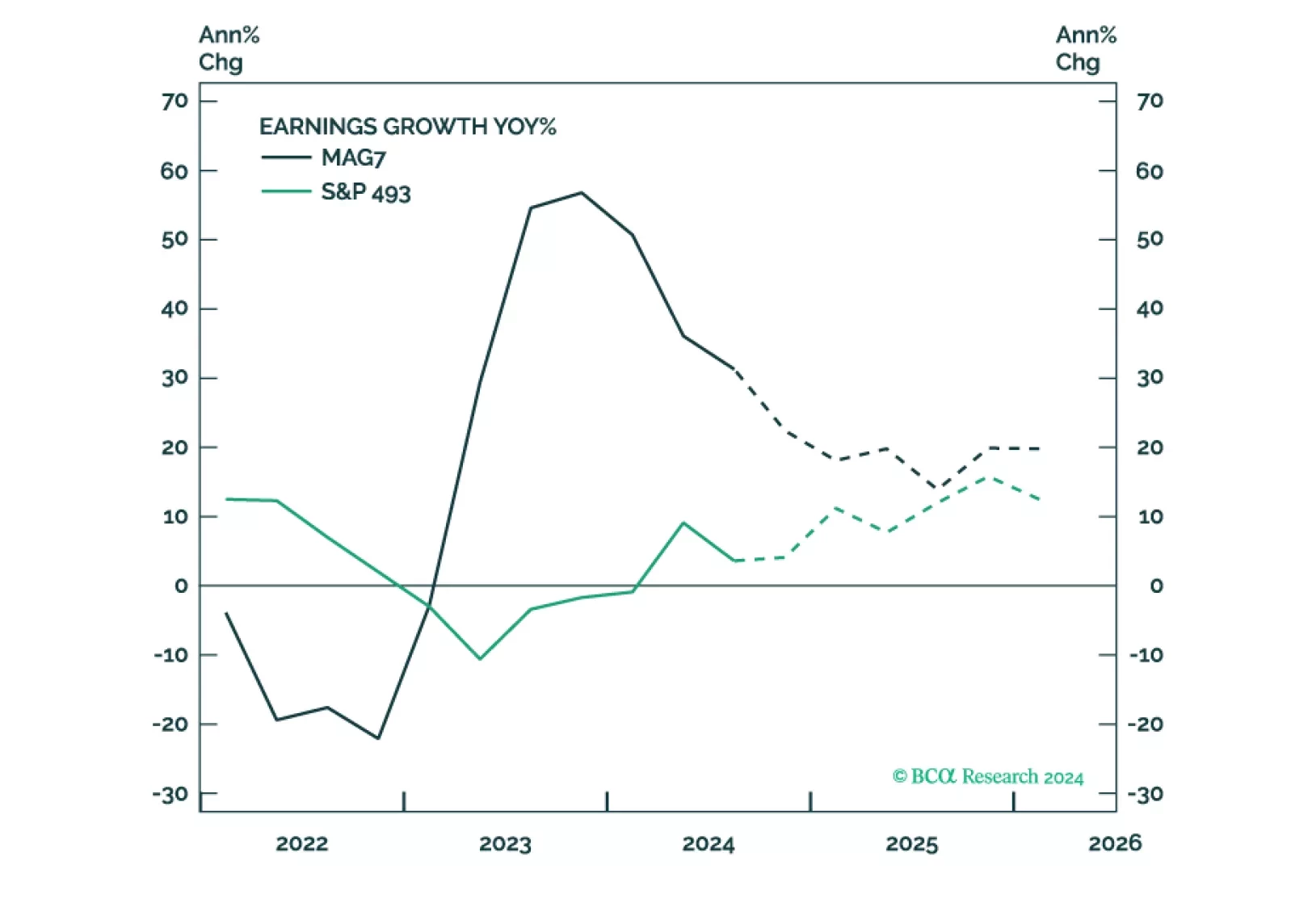

Trump's policies aim to support domestic producers and will be pro-growth and inflationary, at least initially. This environment is supportive of equities. Earnings will likely be strong, but elevated valuations make equities prone…

Investors have given up on European assets, which now suffer exceptional discounts to US ones. However, tighter US fiscal policy, the end of Europe’s austerity and deleveraging, the LNG Tsunami about to hit European shores, and the…

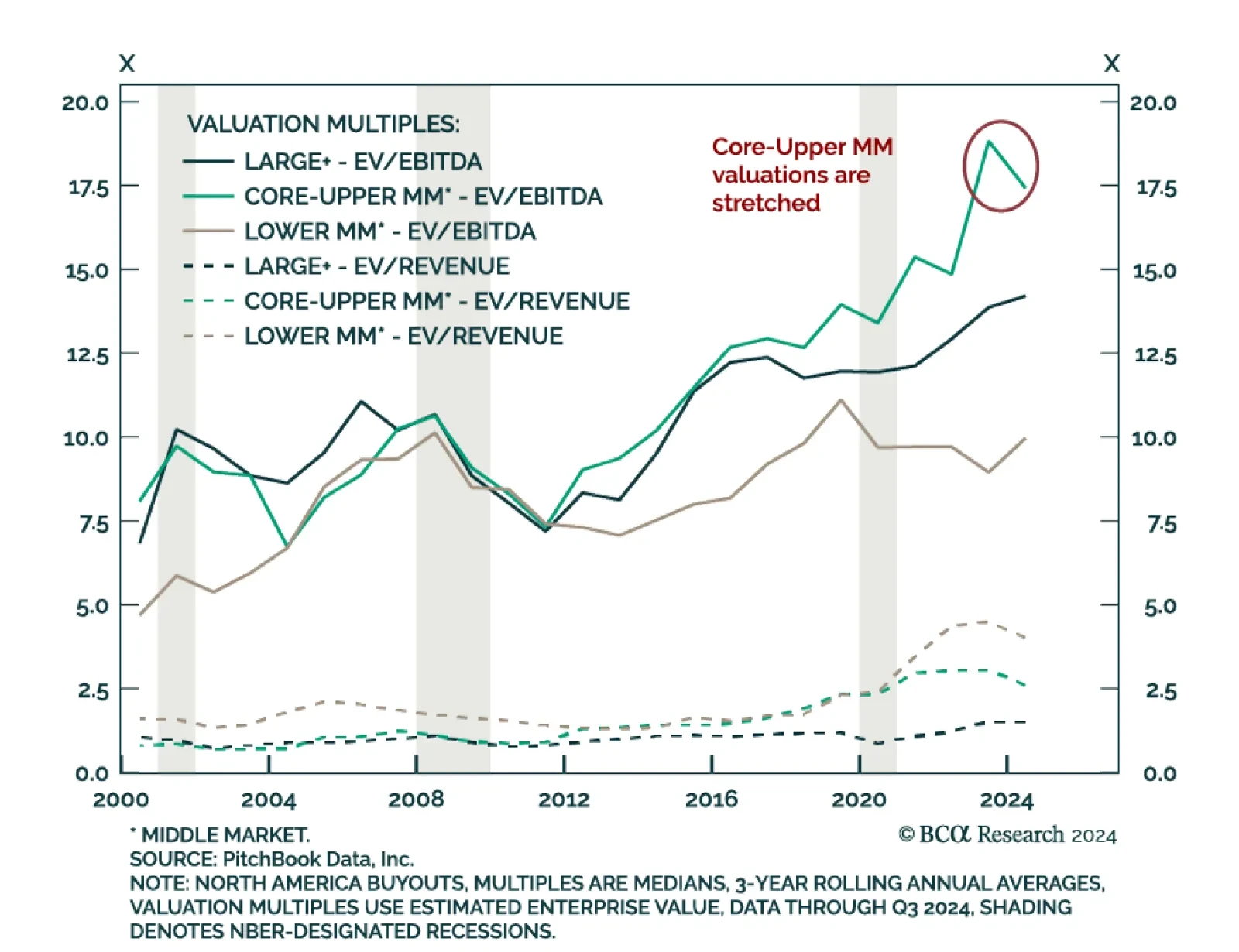

Our Private Markets & Alternatives strategists have delved into the North American Buyouts market, concluding that the investment playbook needs rewriting. The performance of Middle Market Buyouts has been exceptional,…