As Trump’s victory odds rise, the underperformance of European equities deepens. How negative would a global trade war be for European assets?

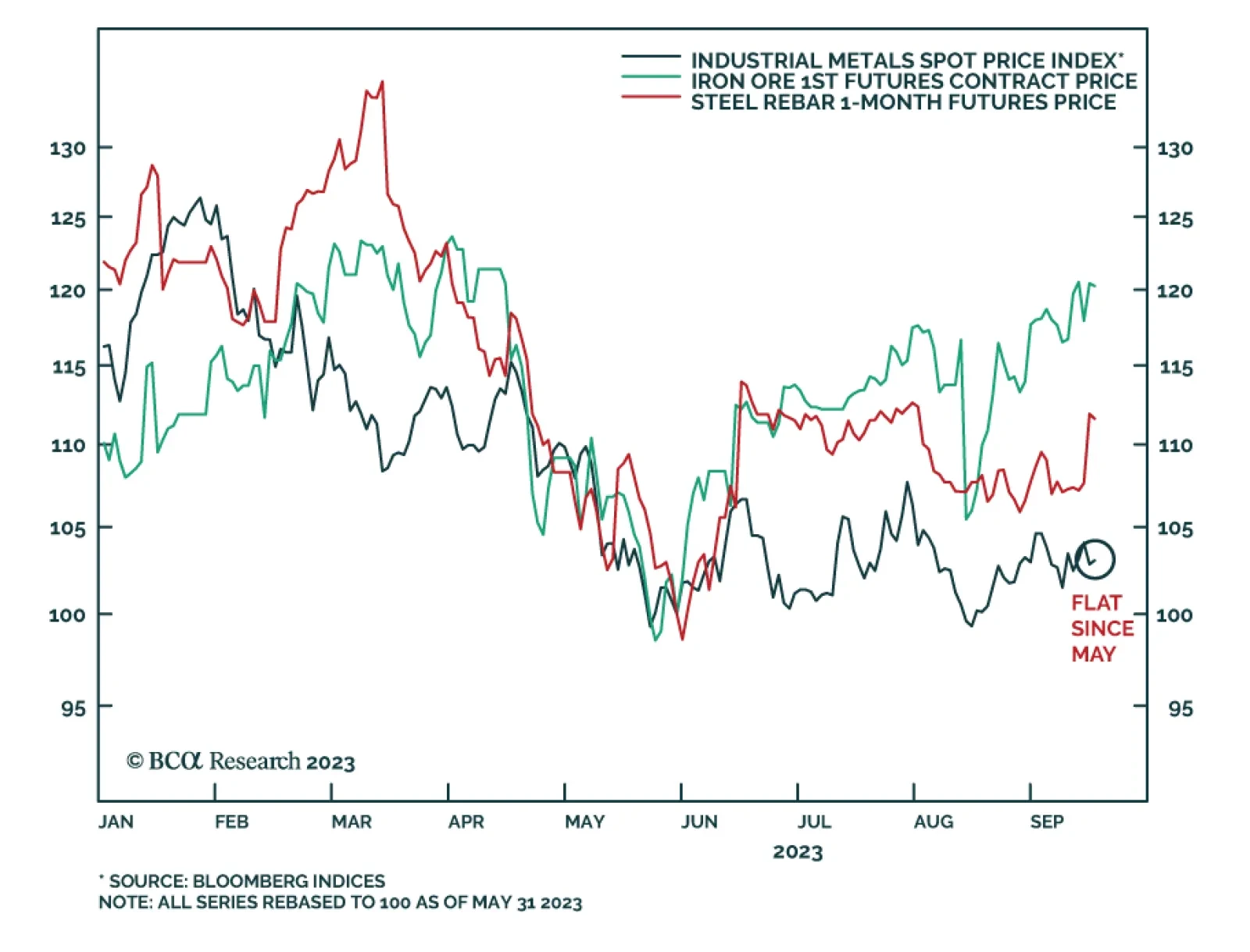

Over the past few months a schism has emerged in the industrial metals complex. On the one hand, the Bloomberg Industrial Metals Index – which is composed of futures contracts on copper, aluminum, zinc, nickel, and lead…

Highlights Over the short term – 1-2 years – the pick-up in re-infection rates in Asia and LatAm states with large-scale deployments of Sinopharm and Sinovac COVID-19 vaccines will re-focus attention on demand-side risks to…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

Highlights Political and corporate climate activism will increase the cost of developing the resources required to produce and deliver energy going forward – e.g., oil and gas wells; pipelines; copper mines, and refineries. Over…

Highlights China's high-profile jawboning draws attention to tightness in metals markets, and raises the odds the State Reserve Board (SRB) will release some of its massive copper and aluminum stockpiles in the near future. Over…

Highlights The Biden Administration's $2.25 trillion infrastructure plan rolled out yesterday will, at the margin, boost global demand for energy and base metals more than expected later this year and next. Global GDP growth…

Highlights Yesterday we published a Special Report titled EM: Foreign Currency Debt Strains. We are upgrading our stance on EM local currency bonds from negative to neutral. Before upgrading to a bullish stance, we would first need…

Highlights Bulk commodity markets – chiefly iron ore and steel – could see sharp rallies once Chinese authorities give the all-clear on COVID-19 (the WHO’s official name for the coronavirus). These markets rallied…