Listen to a short summary of this report. Executive Summary A Tremendous Inflow Into US Government Bonds Multiple frameworks exist for managing currencies. These include forecasting growth…

Executive Summary Summarizing Our Main Investment Themes In One Chart Our current strategic recommendations are centered around four key themes: global inflation will slow over the rest of 2022, Europe remains too weak to…

Executive Summary A Good Time For A Pause In The Bond Bear Market The global government bond selloff looks stretched from a technical perspective, and a consolidation phase is likely over the next few months as global…

Executive Summary The Market Has Priced An Aggressive Path For US Rate Hikes The Federal Reserve has joined other G10 central banks in increasing interest rates this week. However, this has been well priced by both the…

Highlights Indonesian domestic demand is struggling to recover in the face of a very tight policy settings. Exceptionally high real borrowing costs continue to hurt non-financial sectors. This will hurt banks too as credit is stymied…

Highlights Bank of Canada: Rising inflation, high capacity utilization, and monetary policy constraints will force the Bank of Canada to taper further and move up the timing of its first rate hike to H1/2022. Stay underweight Canadian…

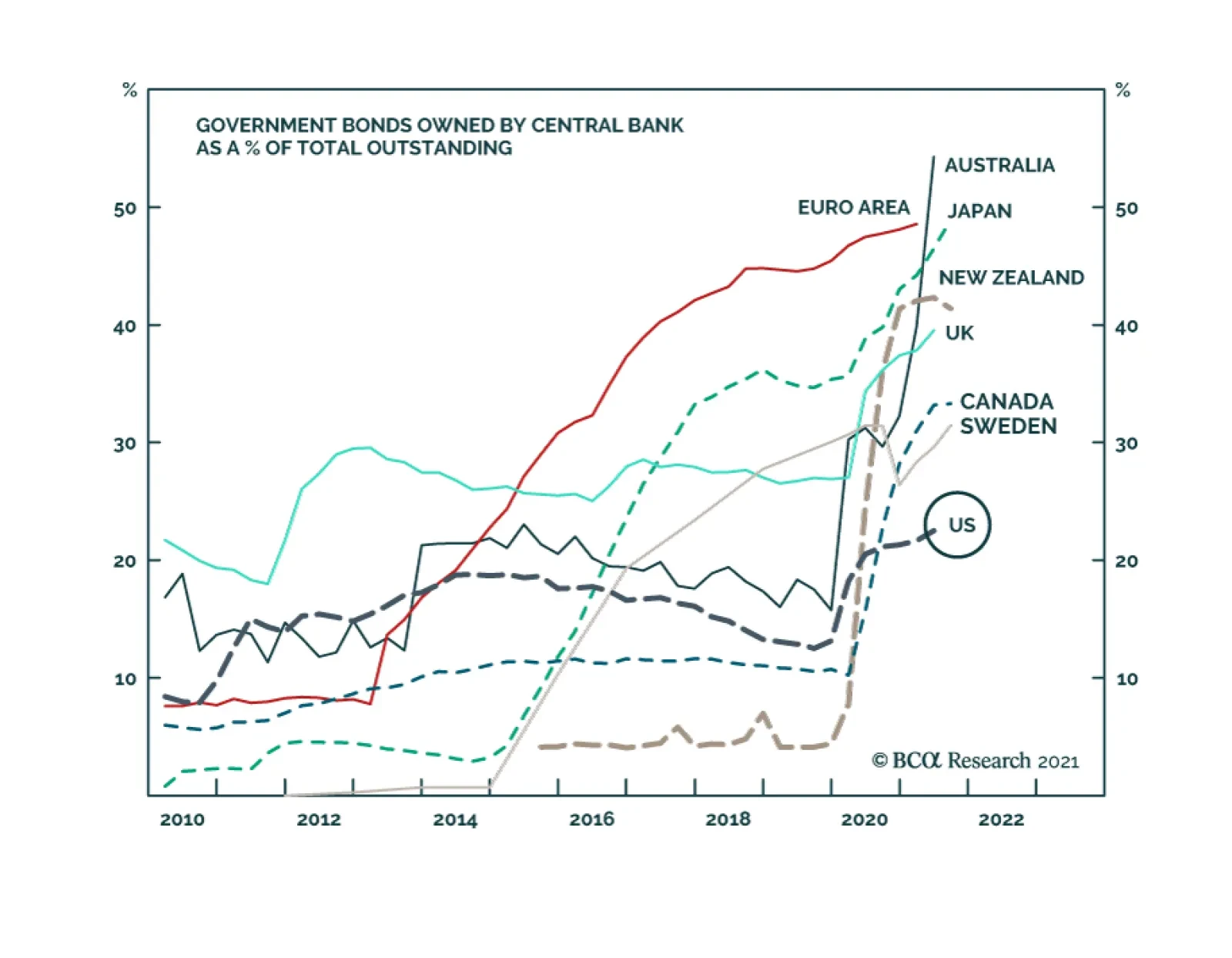

Highlights Cross-Atlantic Policy Divergence: A steadily tightening US labor market means that the Fed remains on track to formally announce tapering next month. Meanwhile, the ECB is signaling that they are in no hurry to do the same…

Highlights Q3/2021 Performance Breakdown: Our recommended model bond portfolio outperformed the custom benchmark index by +8bps during the third quarter of the year. Winners & Losers: The government bond side of the portfolio…

BCA Research’s Foreign Exchange Strategy service expects the Fed’s tapering of asset purchases to be a non-event for the US dollar. While the Fed is still considering tapering asset purchases (and would very likely do so…

Highlights Global Inflation: Most central banks, led by the Fed, have stuck to the narrative that surging inflation is a temporary phenomenon that will not require an aggressive monetary policy response. However, global supply chain…