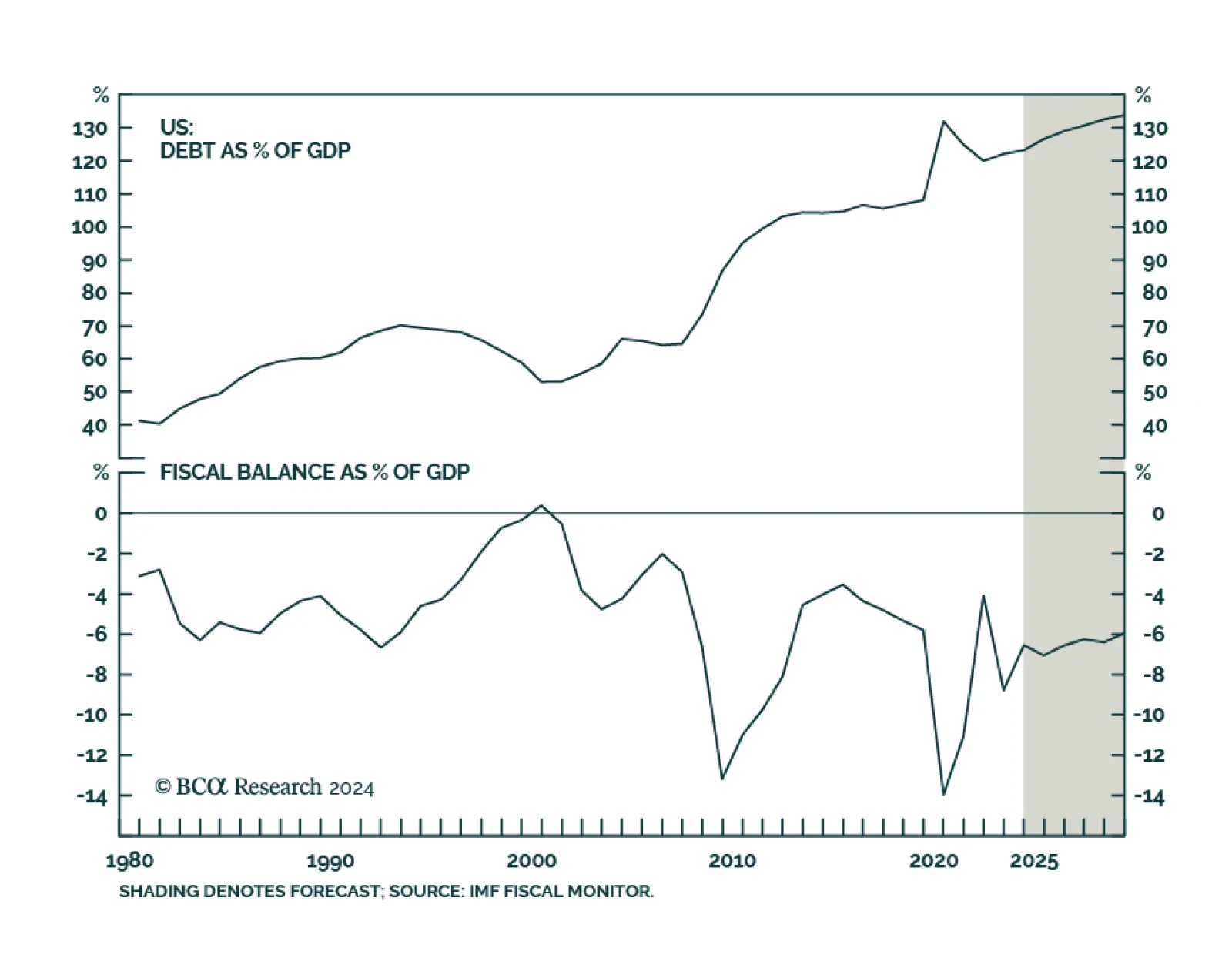

The IMF’s latest fiscal monitor report highlighted the dangers that rising sovereign debt alongside rising deficits pose to advanced economies. The United States, in particular, is at risk. The IMF projects that fiscal…

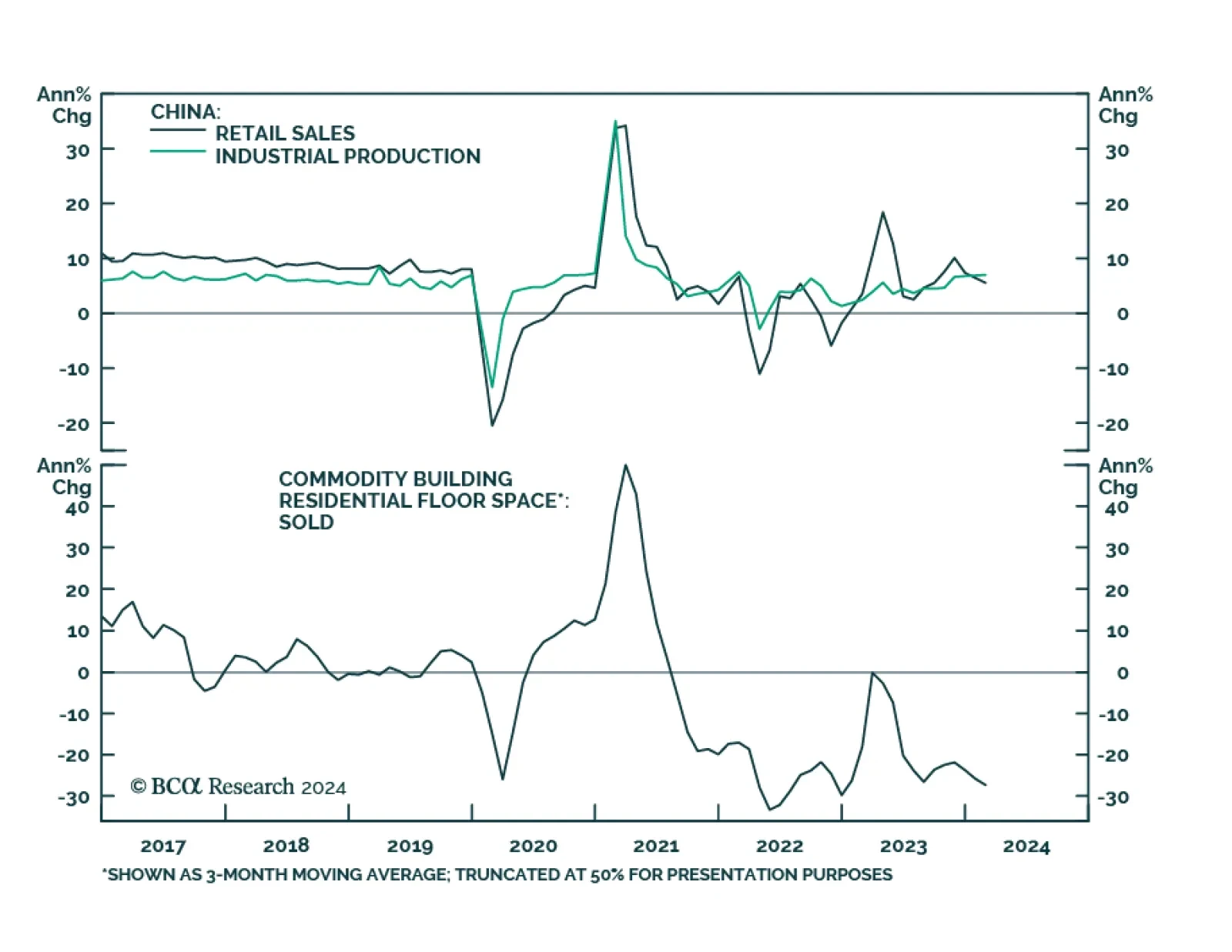

Chinese economic data for the first two months of the year were mixed. On the one hand, industrial production and fixed asset investment growth came in above consensus estimates, accelerating to 7.0% y/y (vs. expectations of 5.2…

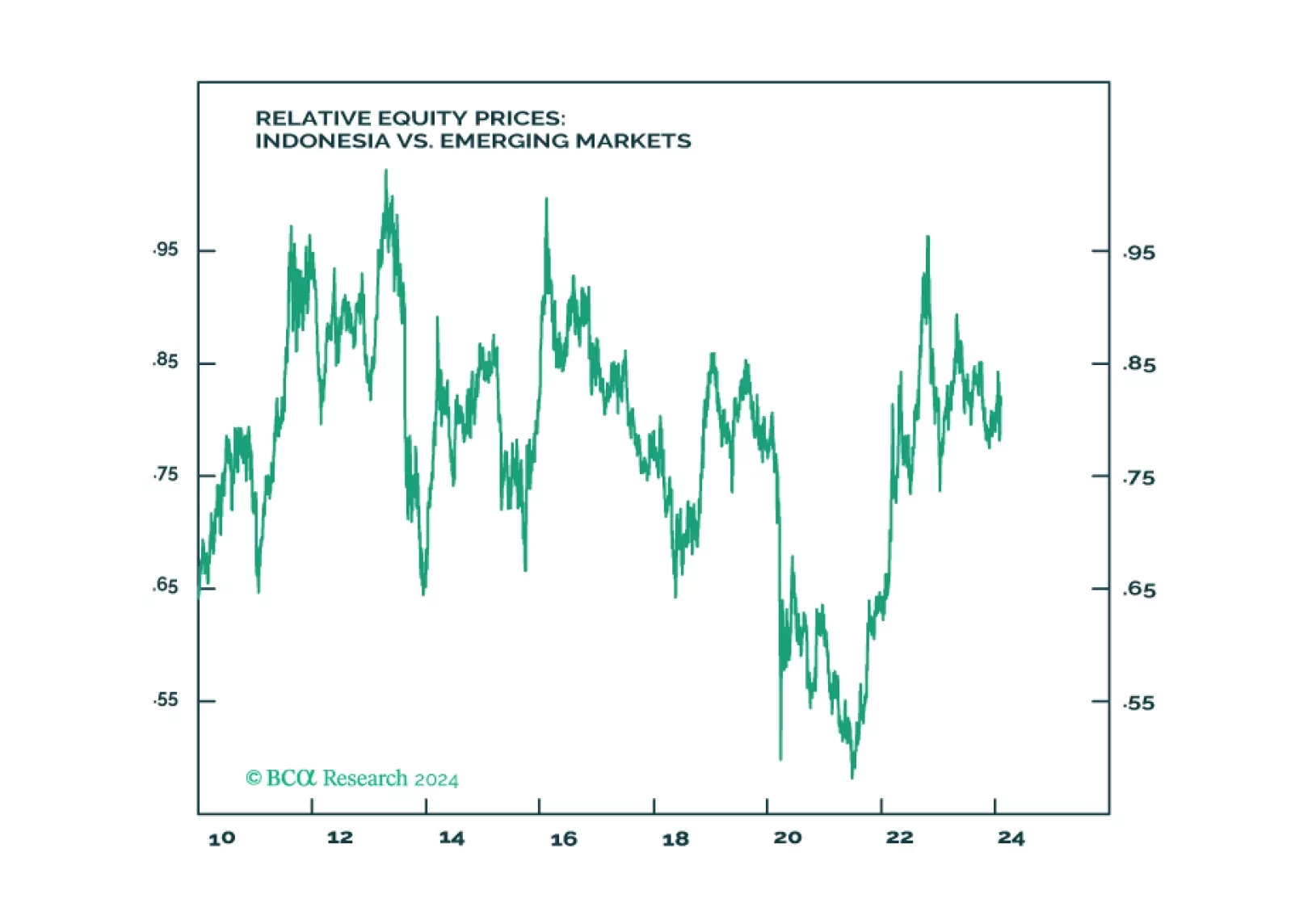

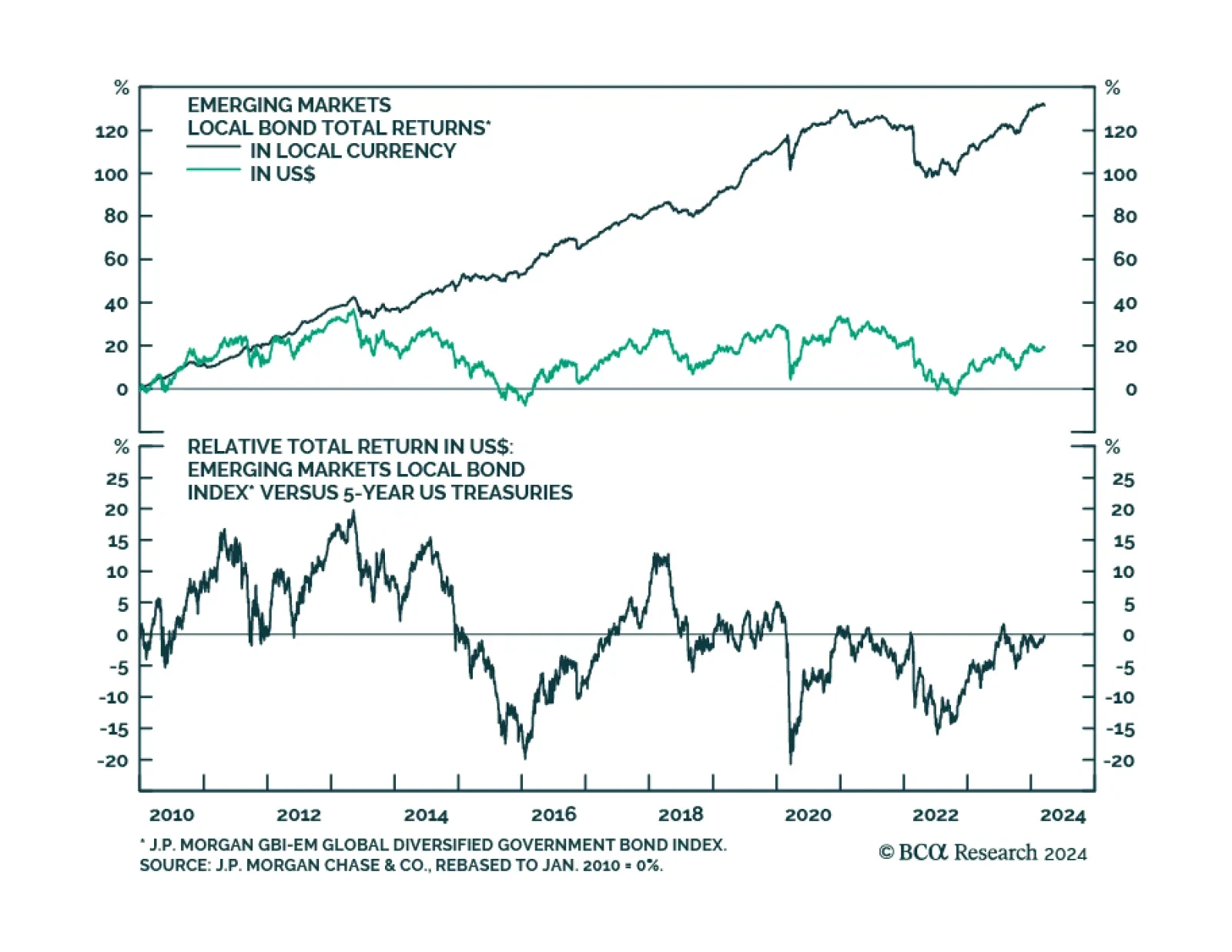

According to BCA Research’s Global Asset Allocation service, the impact of the global savings glut is among the four structural trends that will drive EM debt going forward. As an asset traditionally further out on the…

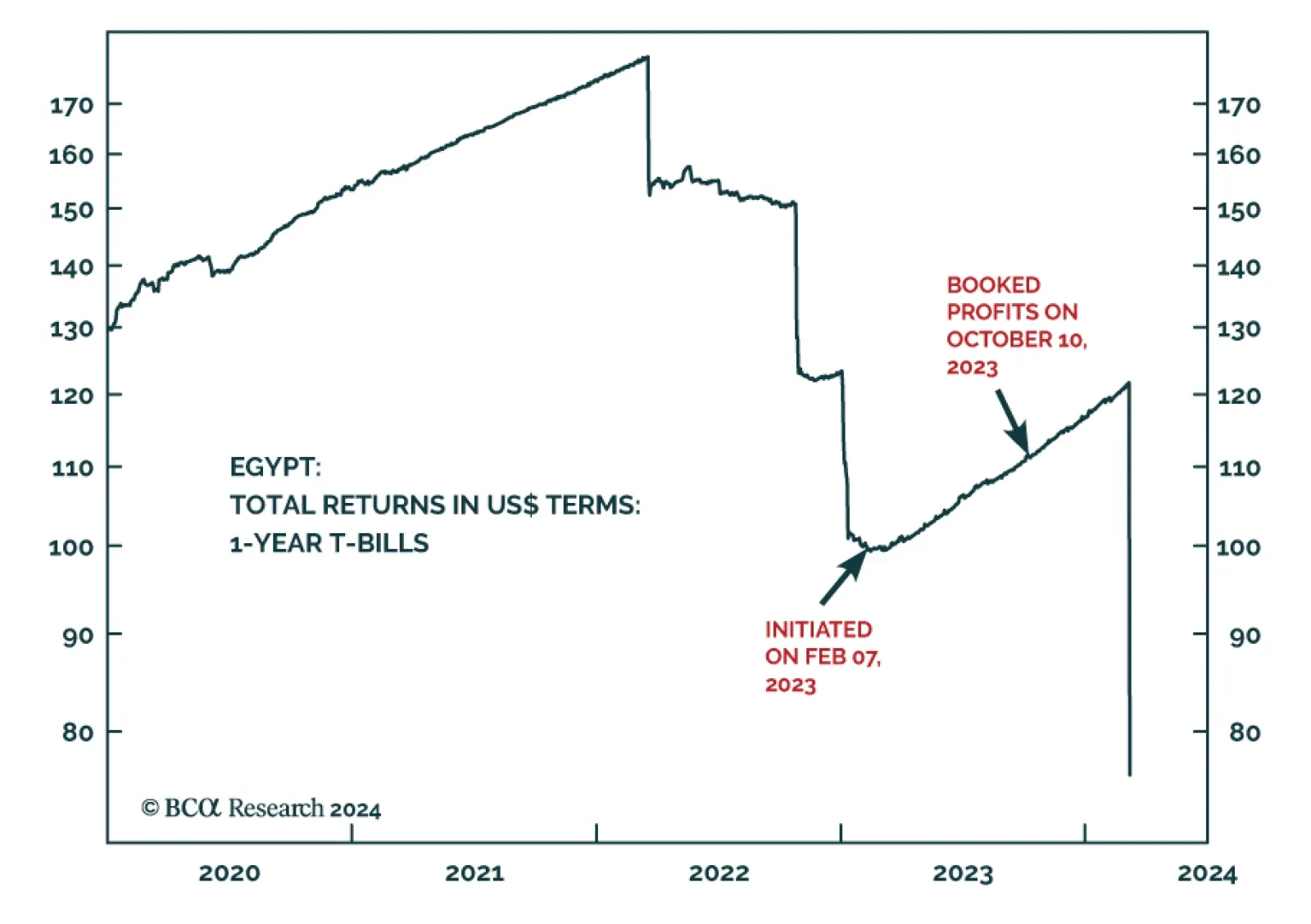

Our Emerging Market Strategy (EMS) colleagues recommended booking an 11.4% gain on their Egyptian T-bill trade initiated earlier in the year. Now that currency-devaluation risk has been removed from the picture for the…

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…