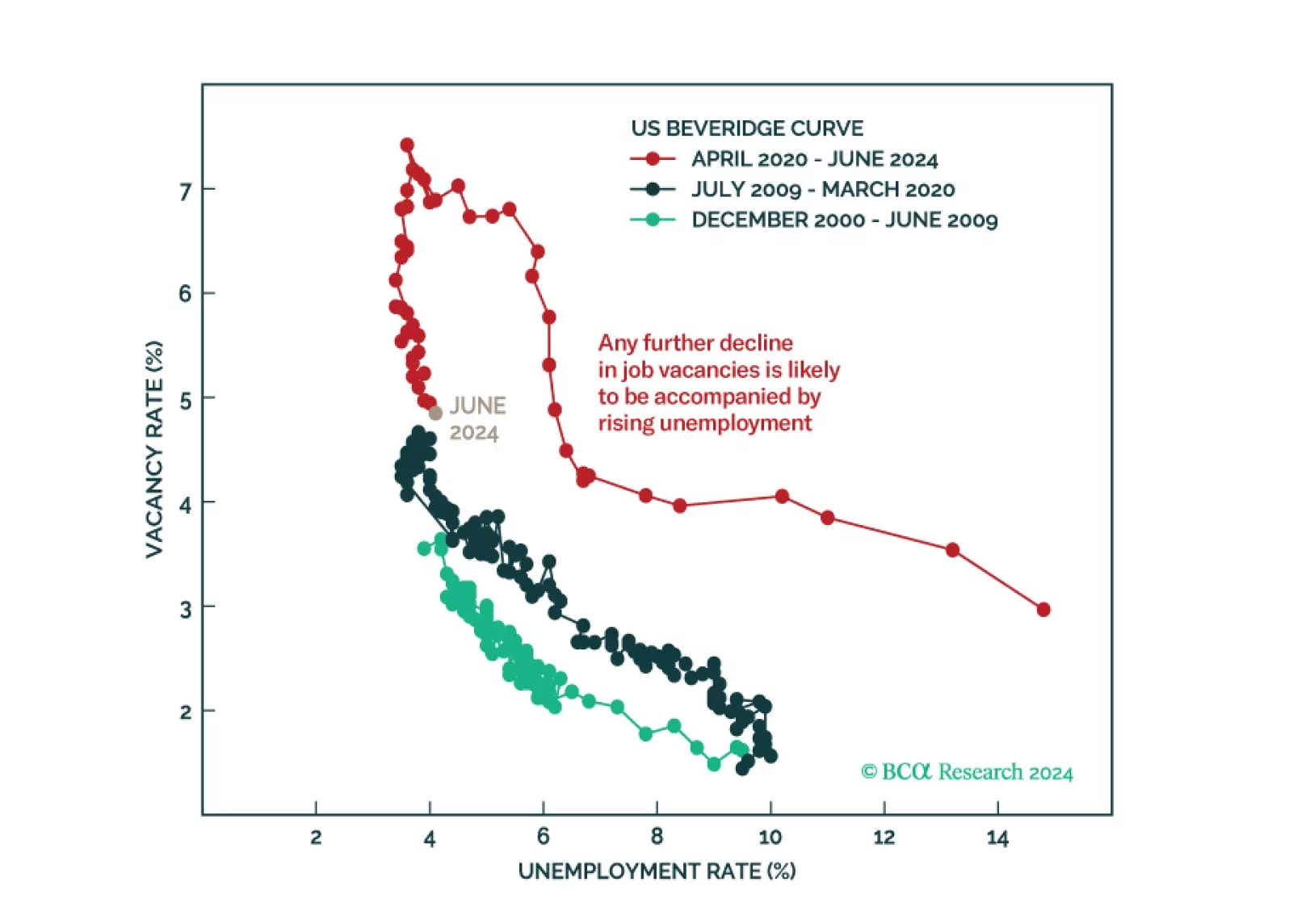

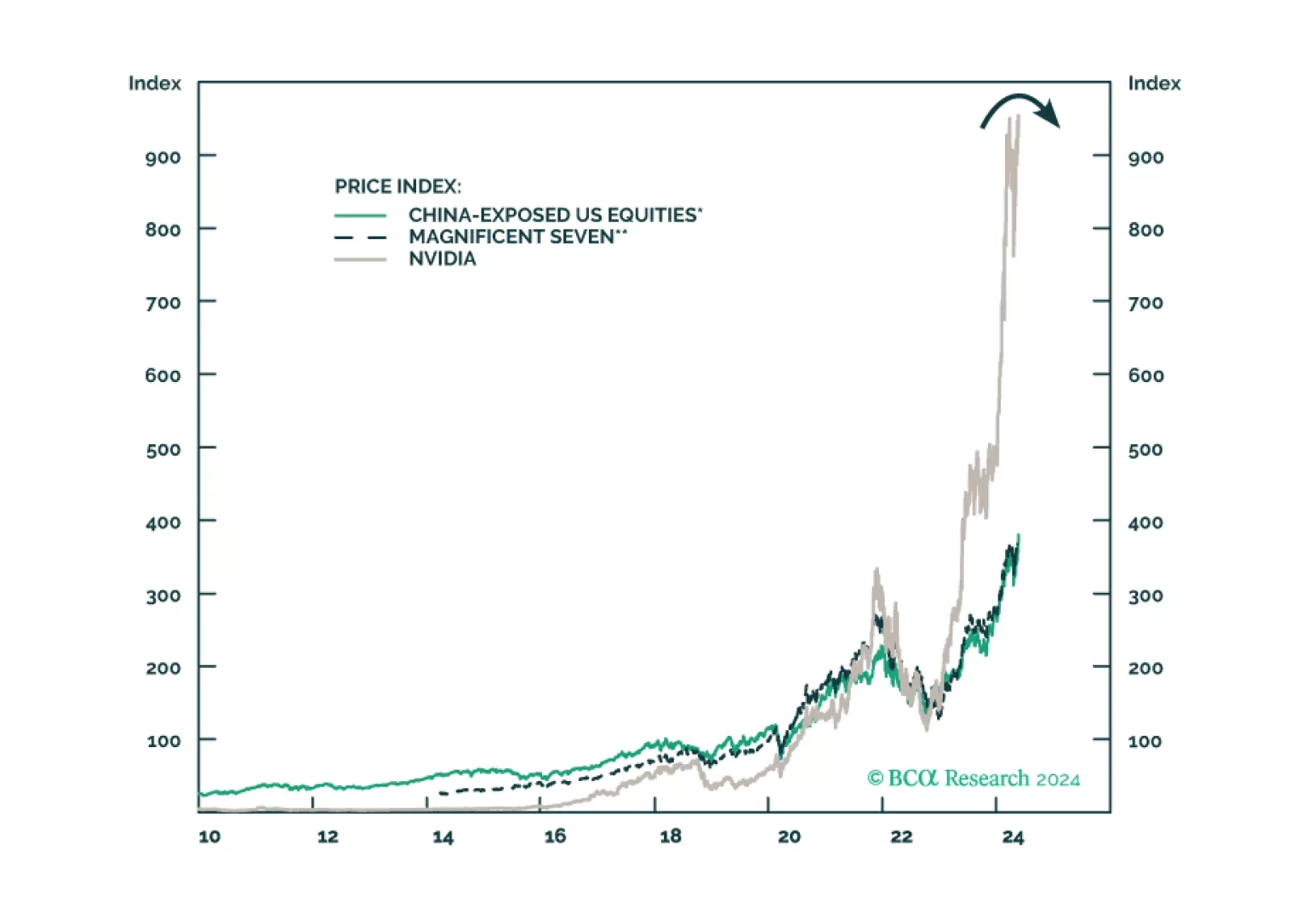

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

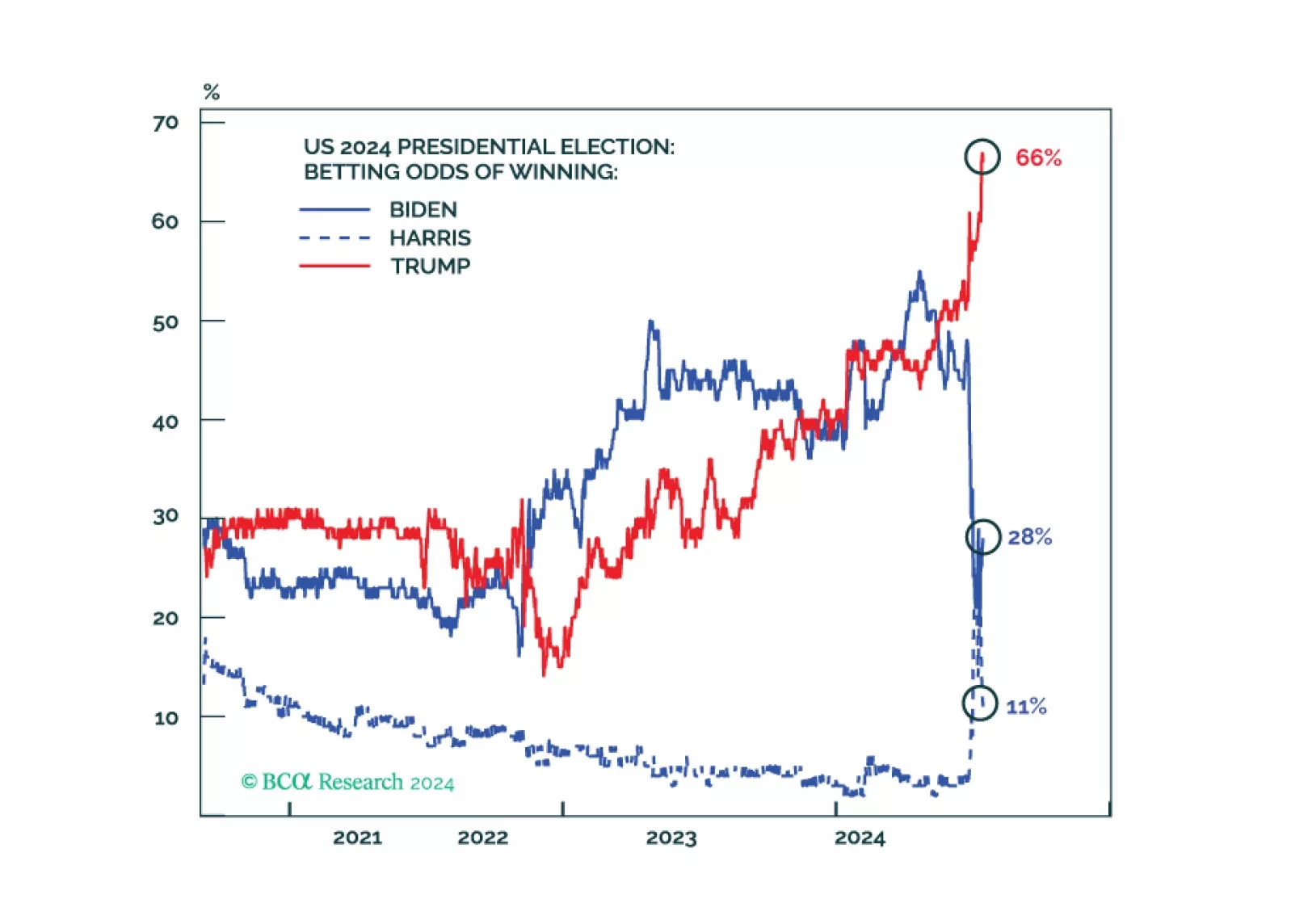

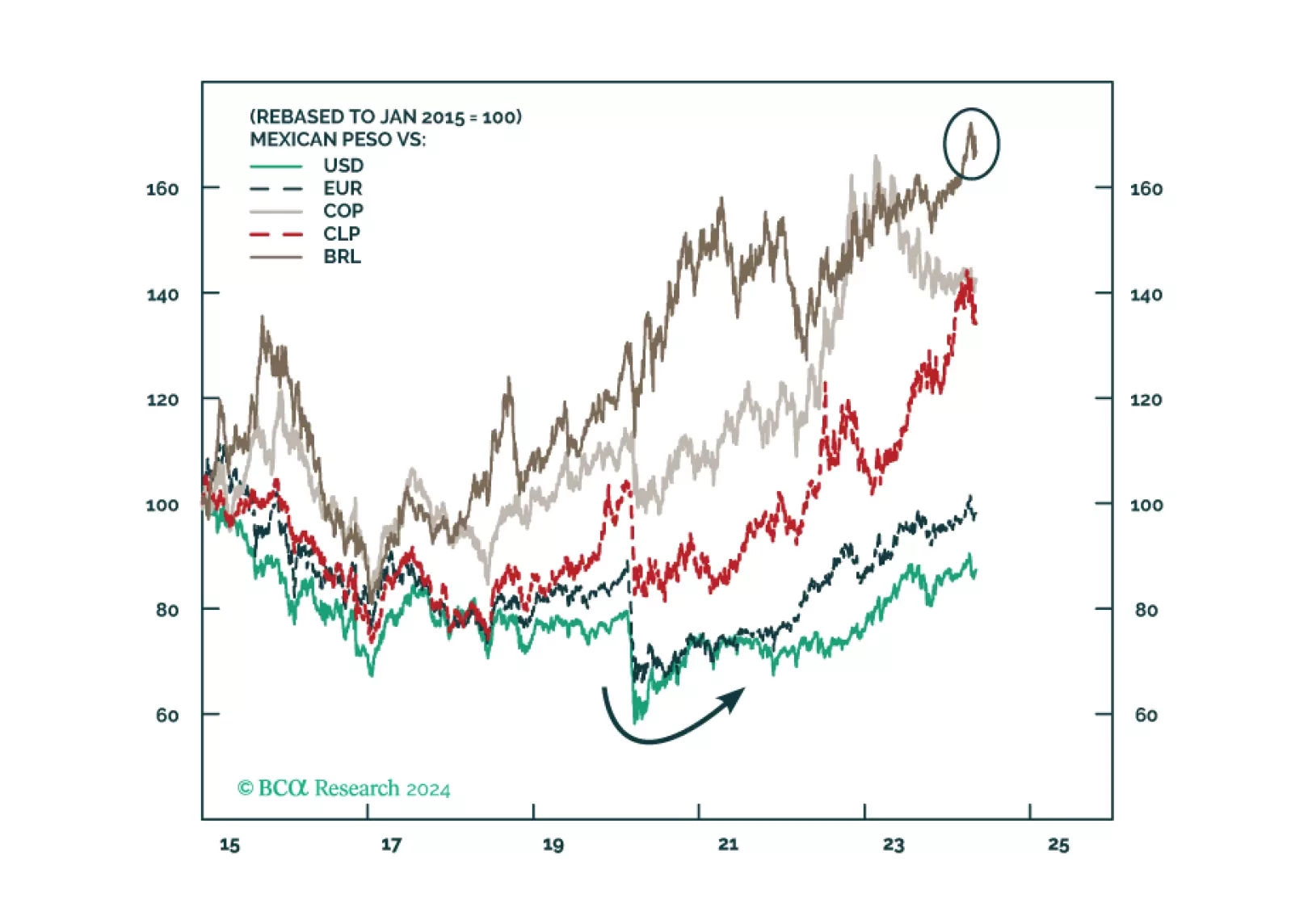

The cyclical economy is slowing today. Republicans are now more likely to win a full sweep, crack down on immigration and trade, and at least modestly stimulate the economy. Uncertainty and volatility will rise.

The conventional wisdom is wrong: Trump is not going to substantially cut taxes once in office; he is going to raise taxes by jacking up tariffs. To the extent that this dampens economic activity, it is bad news for stocks but good…

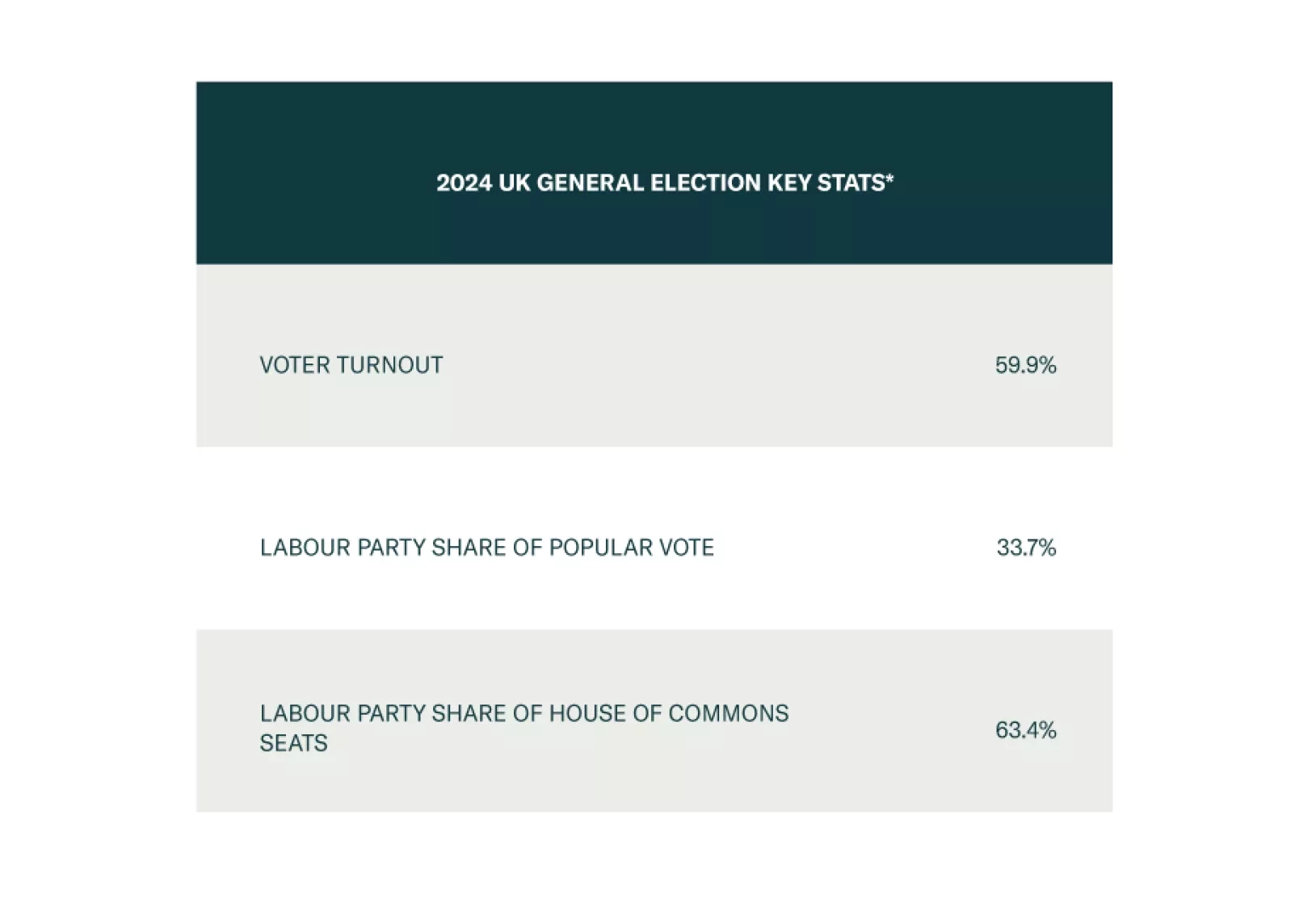

The new Labour government will have flexibility to respond to macro shocks, which is positive for the UK in general, namely GBP-EUR, and also gilts in absolute terms. But over the long run, tax hikes will likely surprise to the…

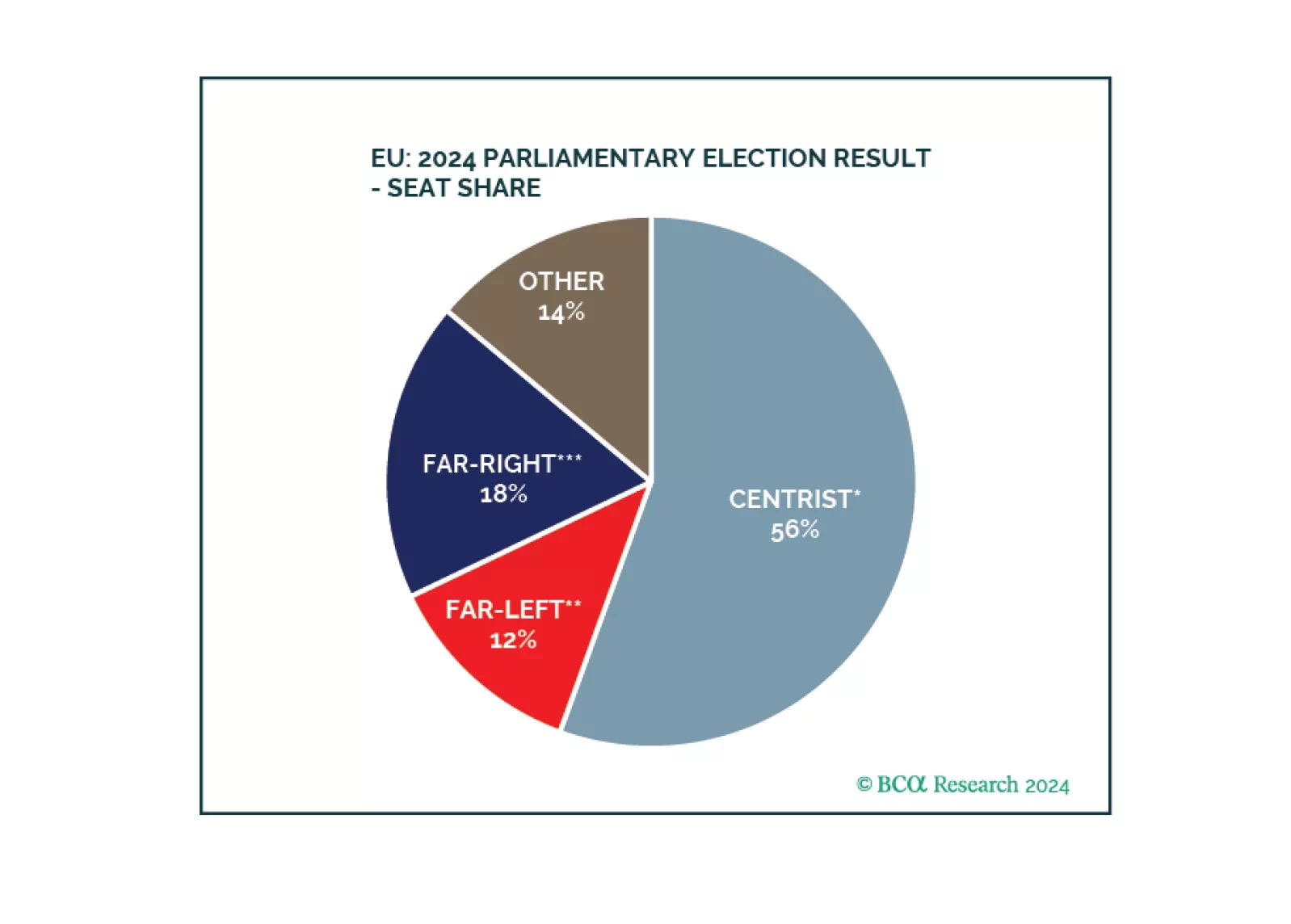

Europe did not witness a major policy reversal. Inflationary pressures are coming down, enabling the ECB to cut rates and European states to maintain soft budgets. Geopolitical challenges ensure that European parties continue to…

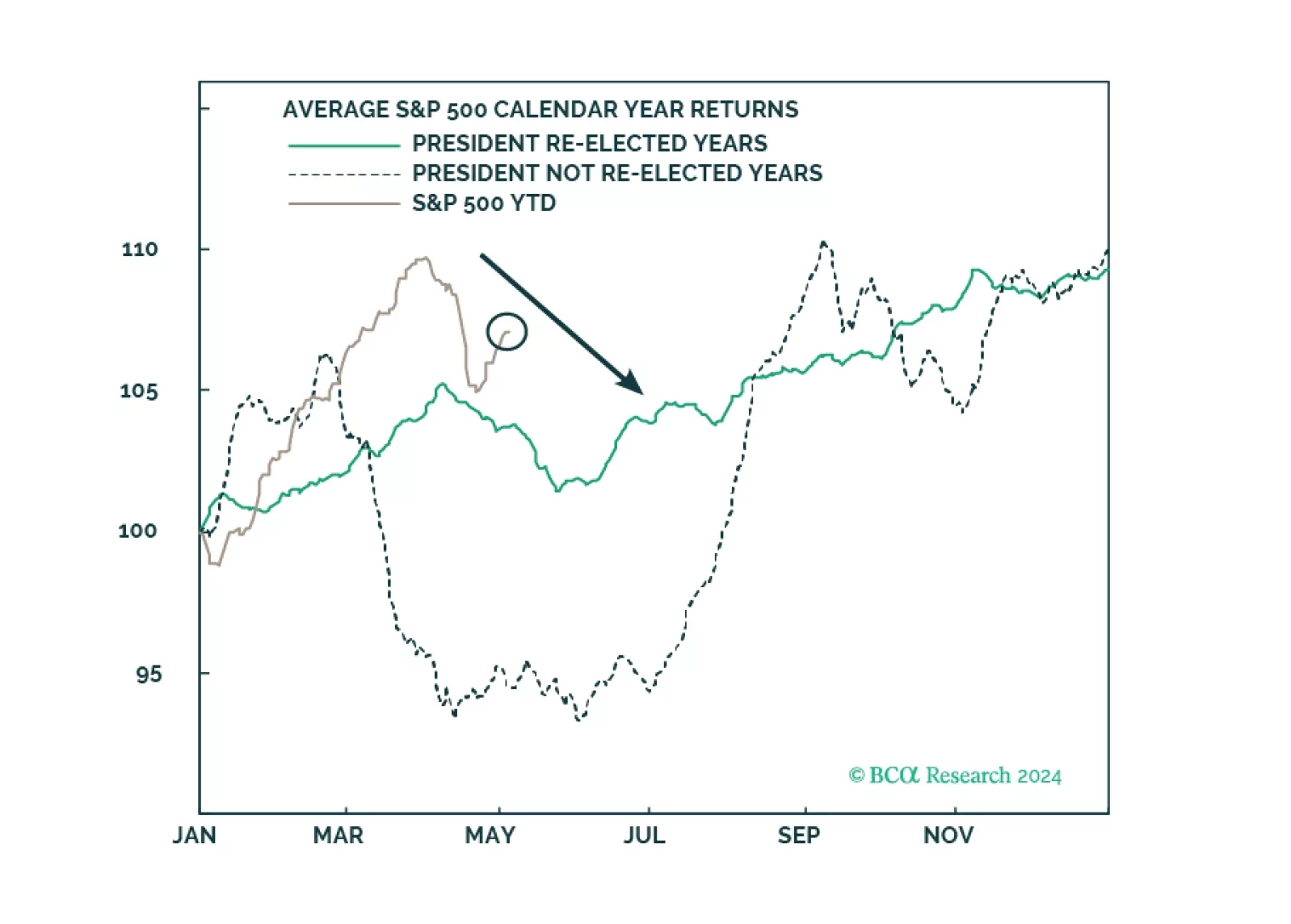

Investors should prepare for economic data to weaken even as policy uncertainty and geopolitical risk skyrocket ahead of the US election.