Feature Analysis on Korea & South Africa are available on pages 6 and 10, respectively. Mexico: Balancing Pros And Cons We have been overweight Mexican sovereign credit and local currency bonds as well as equities relative to the…

Global semiconductor share prices have continued to hit new highs, even though there has not been any recovery (positive growth) in global semiconductor sales or in their corporate earnings (EPS). Global semiconductor sales bottomed on a…

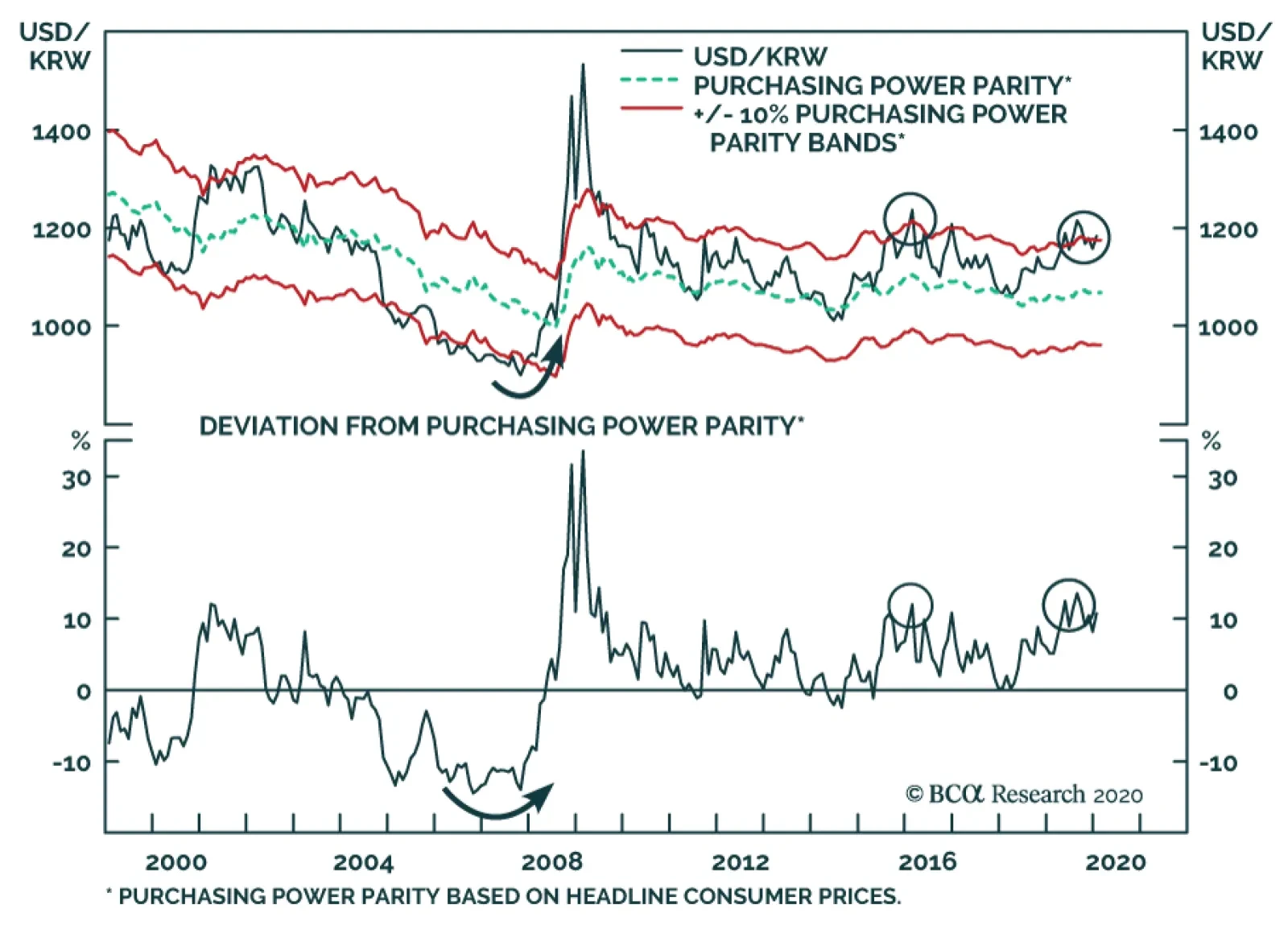

The USD/KRW is trading at a nearly 10% premium to its Purchasing Power Parity equilibrium. Historically, when investors exchange the won at such a discount, they often benefit from FX appreciation in addition to the yield. We do…

Highlights Since early this year, global semiconductor stock prices have been front-running a demand recovery that has not yet begun. There is strong industry optimism surrounding a potential demand boost for semiconductors from the…

Highlights The odds of a cyclical upturn in the global semiconductor sector over the next three to six months are low. Global semiconductor demand will continue to decline due to contracting demand for smartphones, automobiles,…

Highlights So what? Quantifying geopolitical risk just got easier. Why? In this report we introduce 10 proprietary, market-based indicators of country-level political and geopolitical risk. Featured countries include…

Highlights So What? Global divergence will persist beyond the near term. Why? China’s stimulus will be disappointing unless things get much worse. U.S.-China trade war will reignite and strategic tensions will continue.…