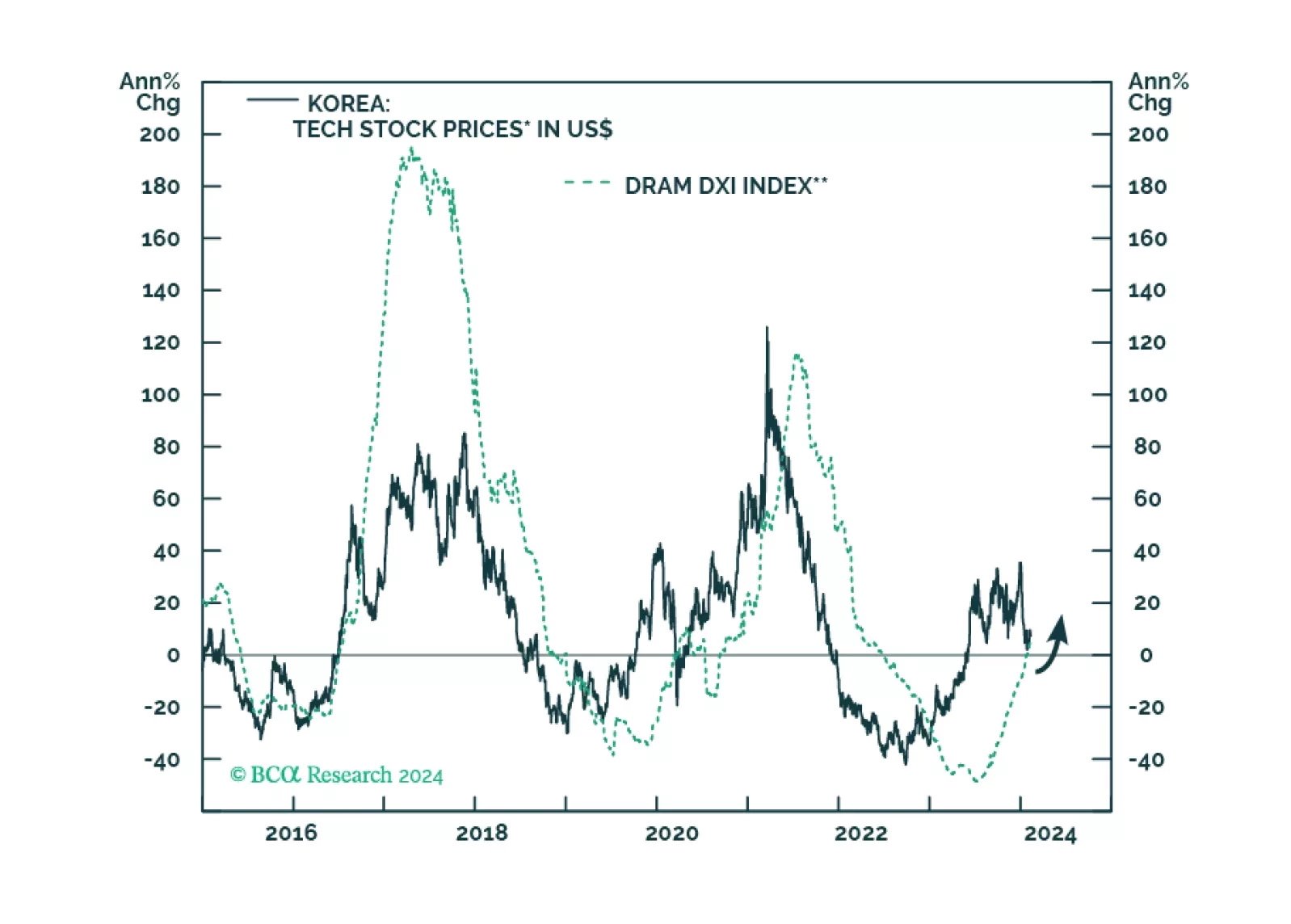

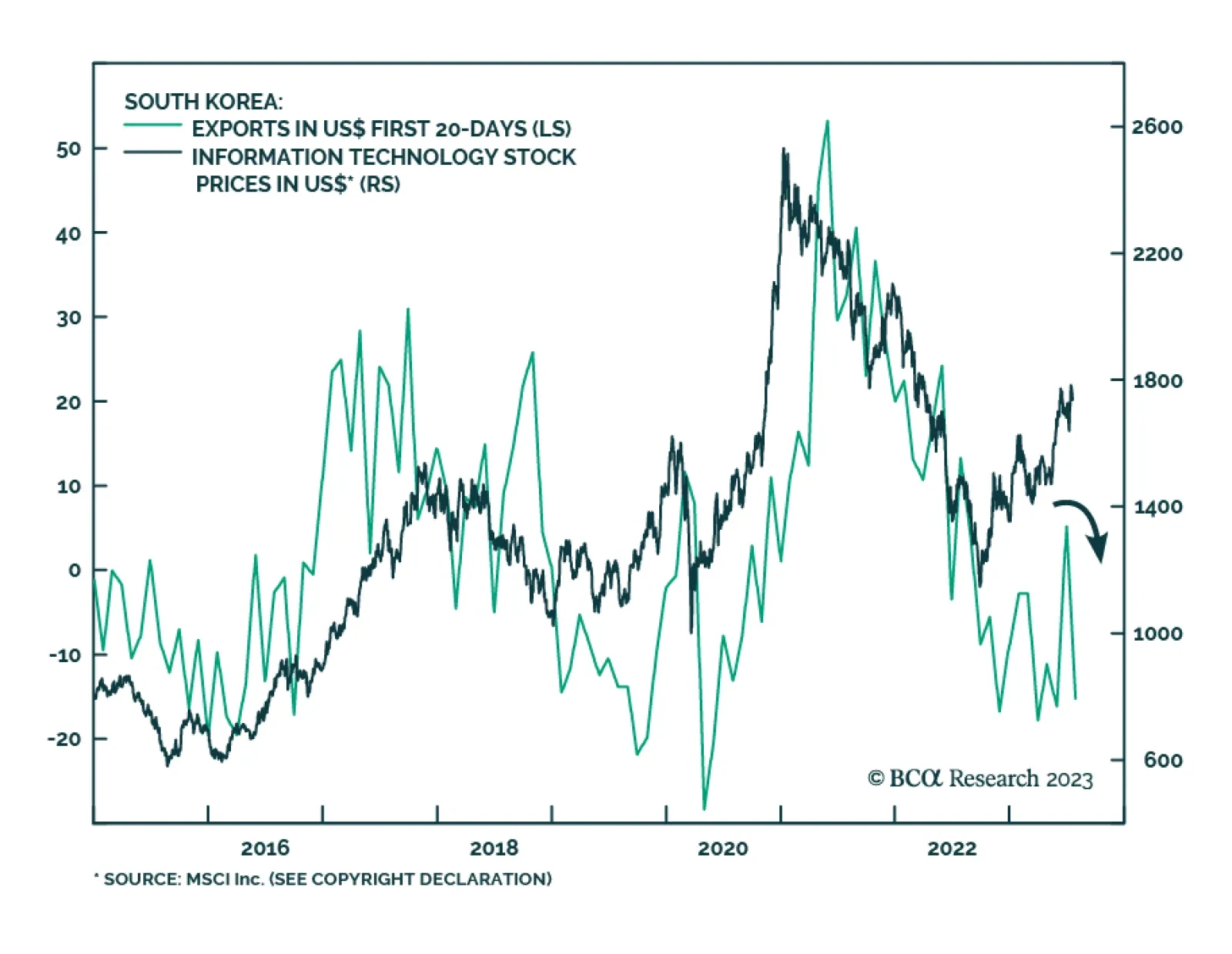

According to BCA Research’s Emerging Markets Strategy service, barring a pullback in global share prices, Korean tech stock prices will likely have more upside this year. The memory chip market will improve in 2024,…

Middle East conflict, extreme US policy uncertainty, Chinese economic slowdown, US-Russian proxy war, and Asian military conflicts do not create a stable investment backdrop for 2024. Our top five “black swan” risks may be highly…

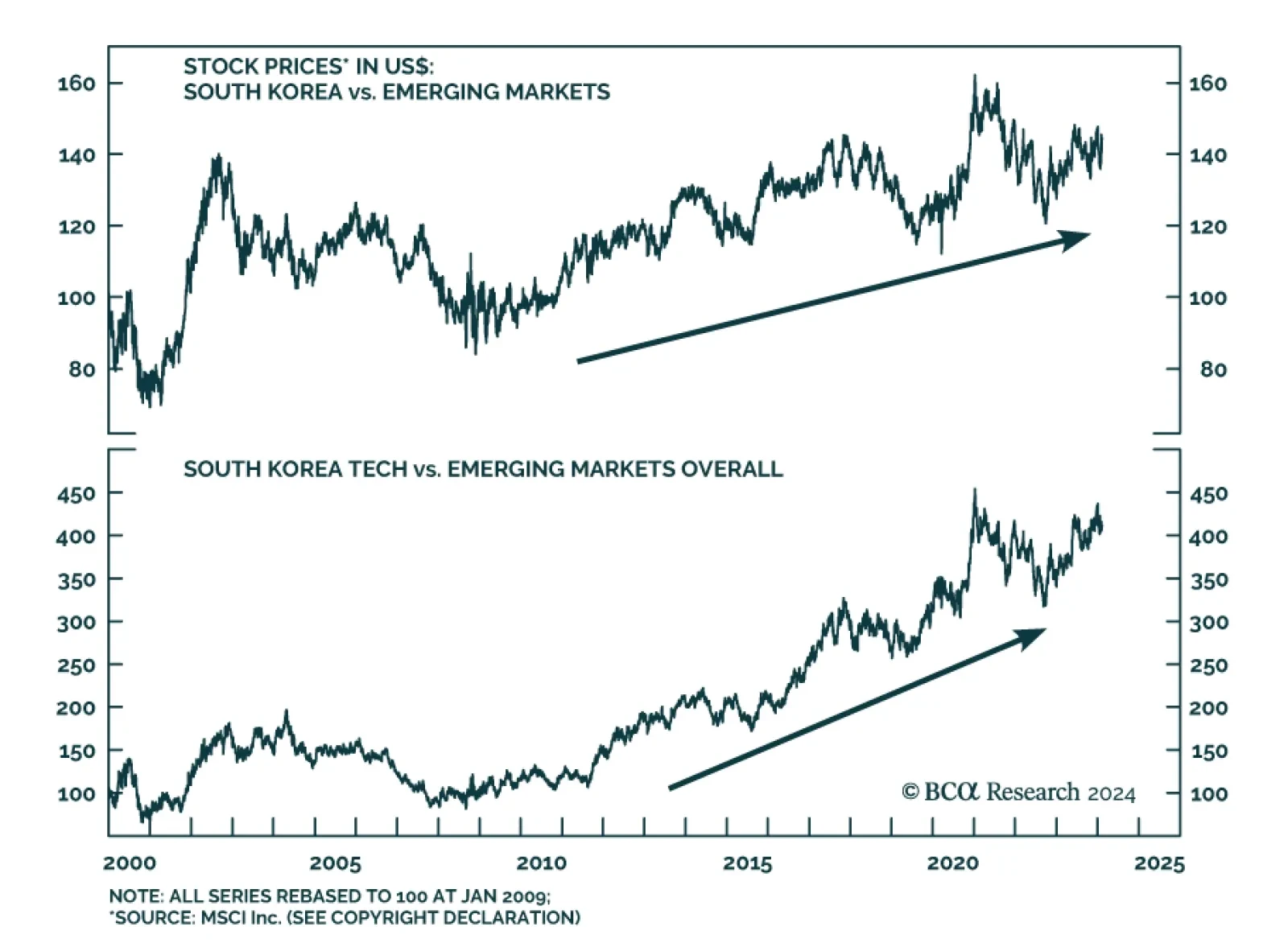

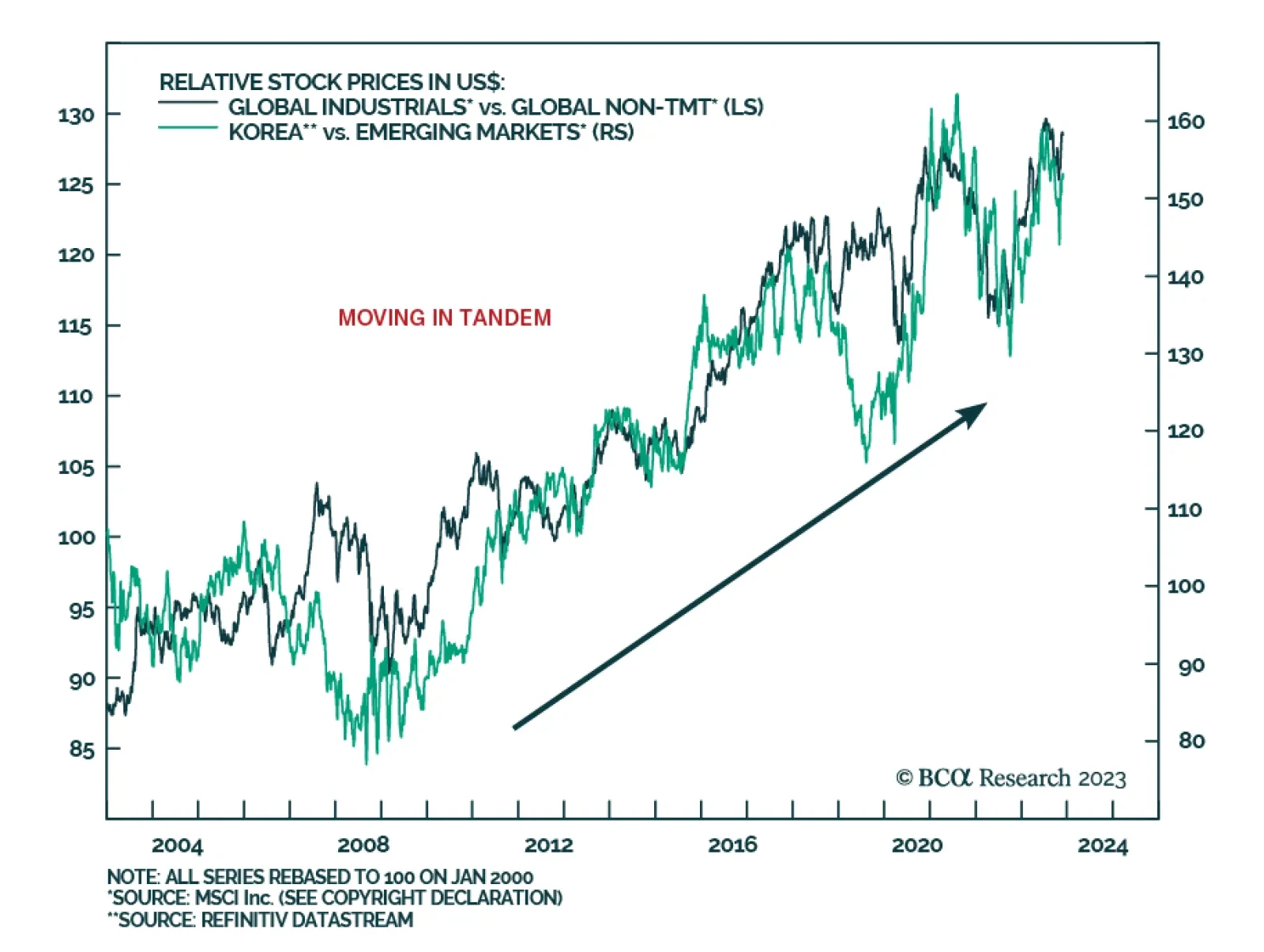

BCA Research’s Emerging Markets Strategy service recommends overweighting Korea within an EM equity portfolio. Korean equity valuations are neutral in absolute and relative terms. Hence, other factors rather than…

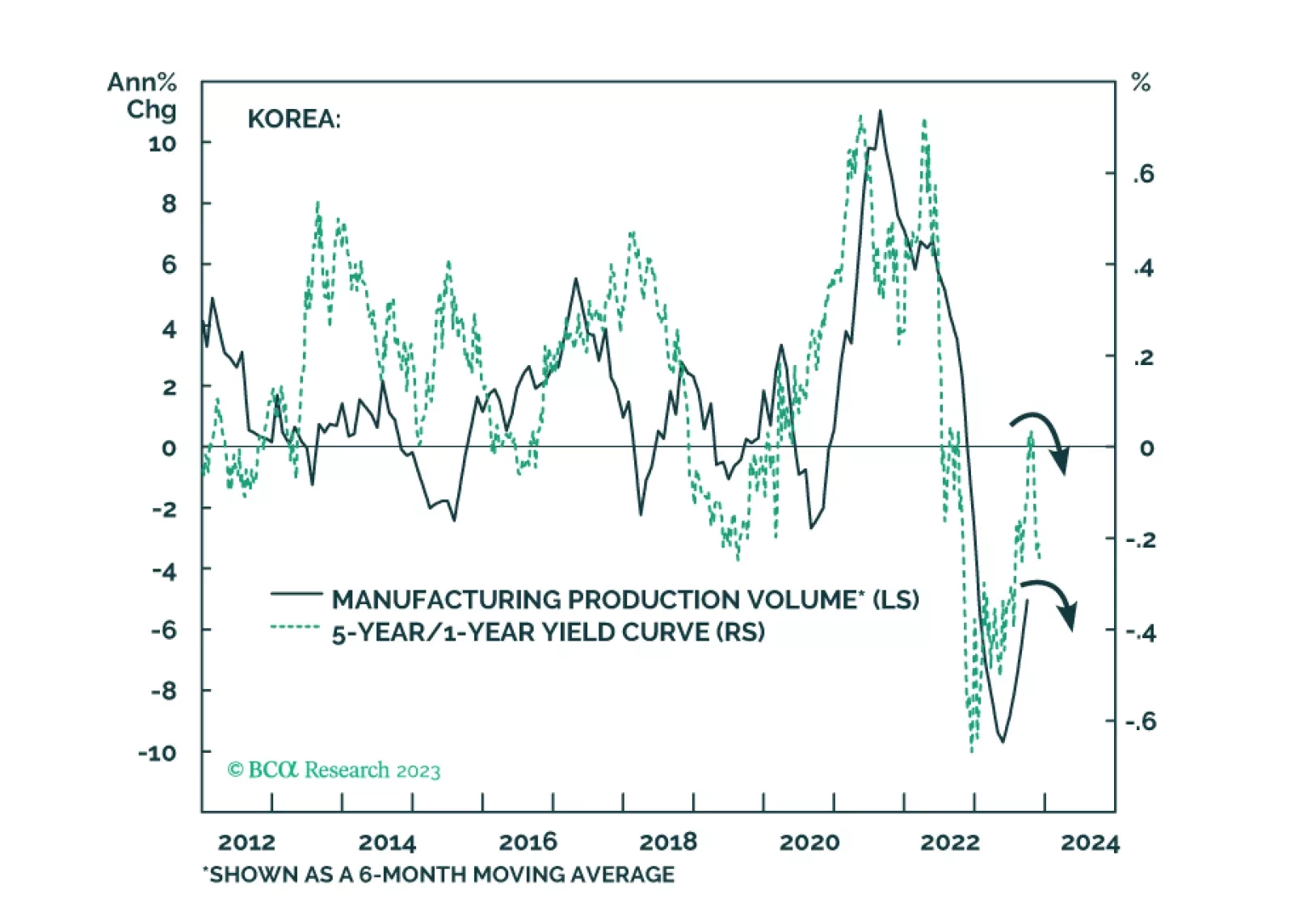

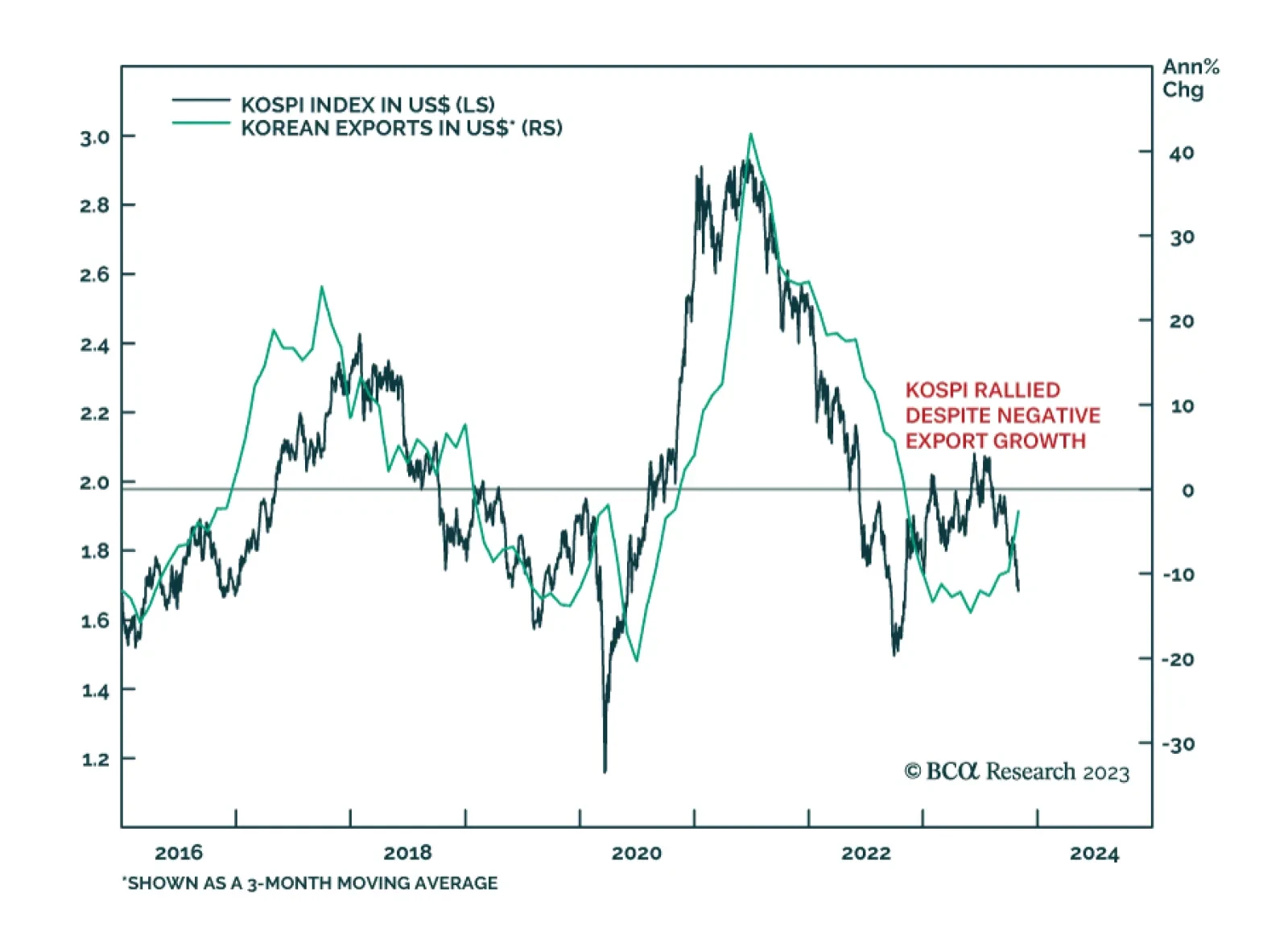

The recent increase in Korean exports will likely prove to be a mid-cycle rebound within a cyclical downtrend. Korea’s households and enterprises are among the most indebted globally, and their debt service ratio is among the highest…

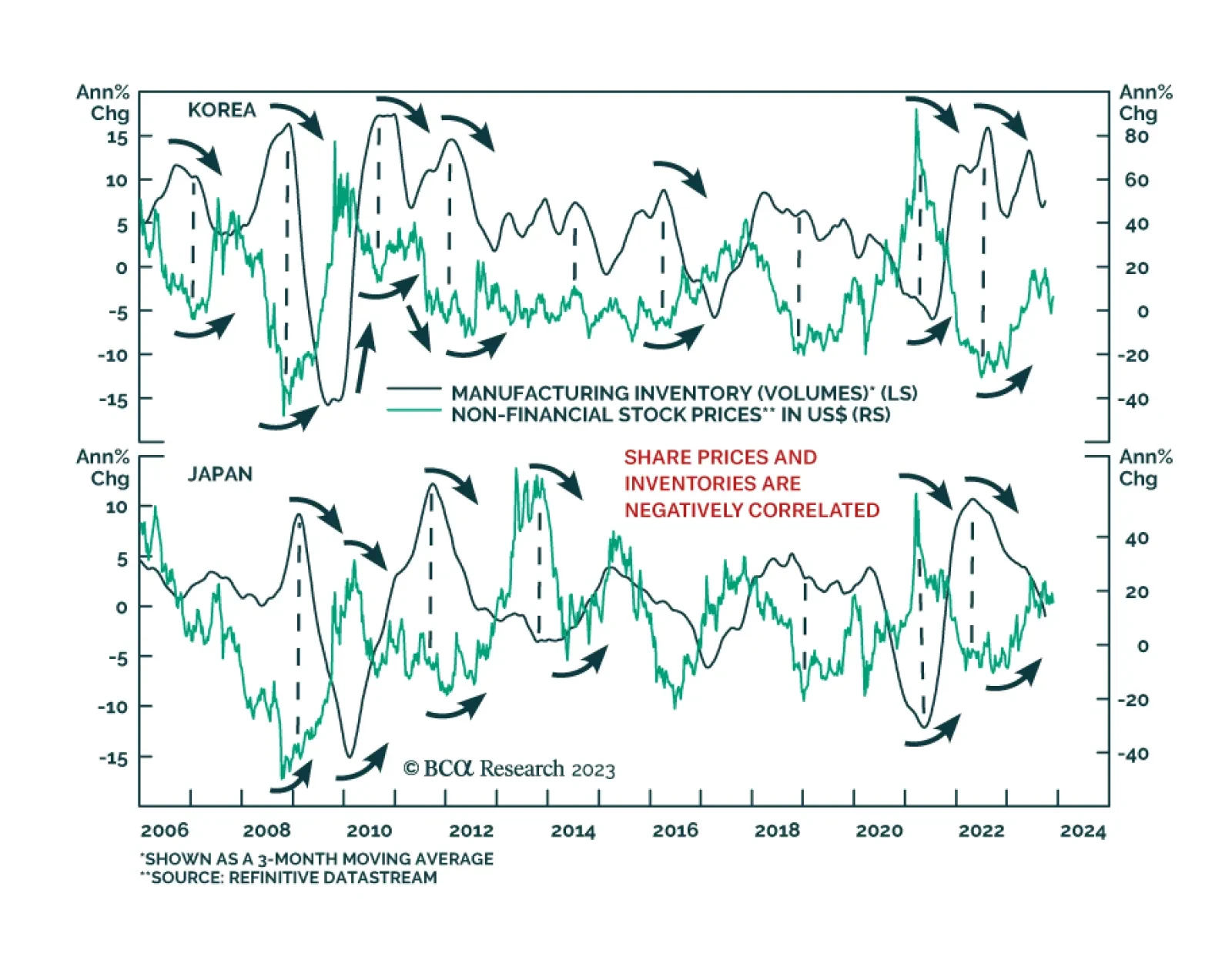

According to BCA Research's Emerging Markets Strategy service, investors should focus on fluctuations in final demand rather than inventories. A common narrative endorsed by many market participants is that inventory…

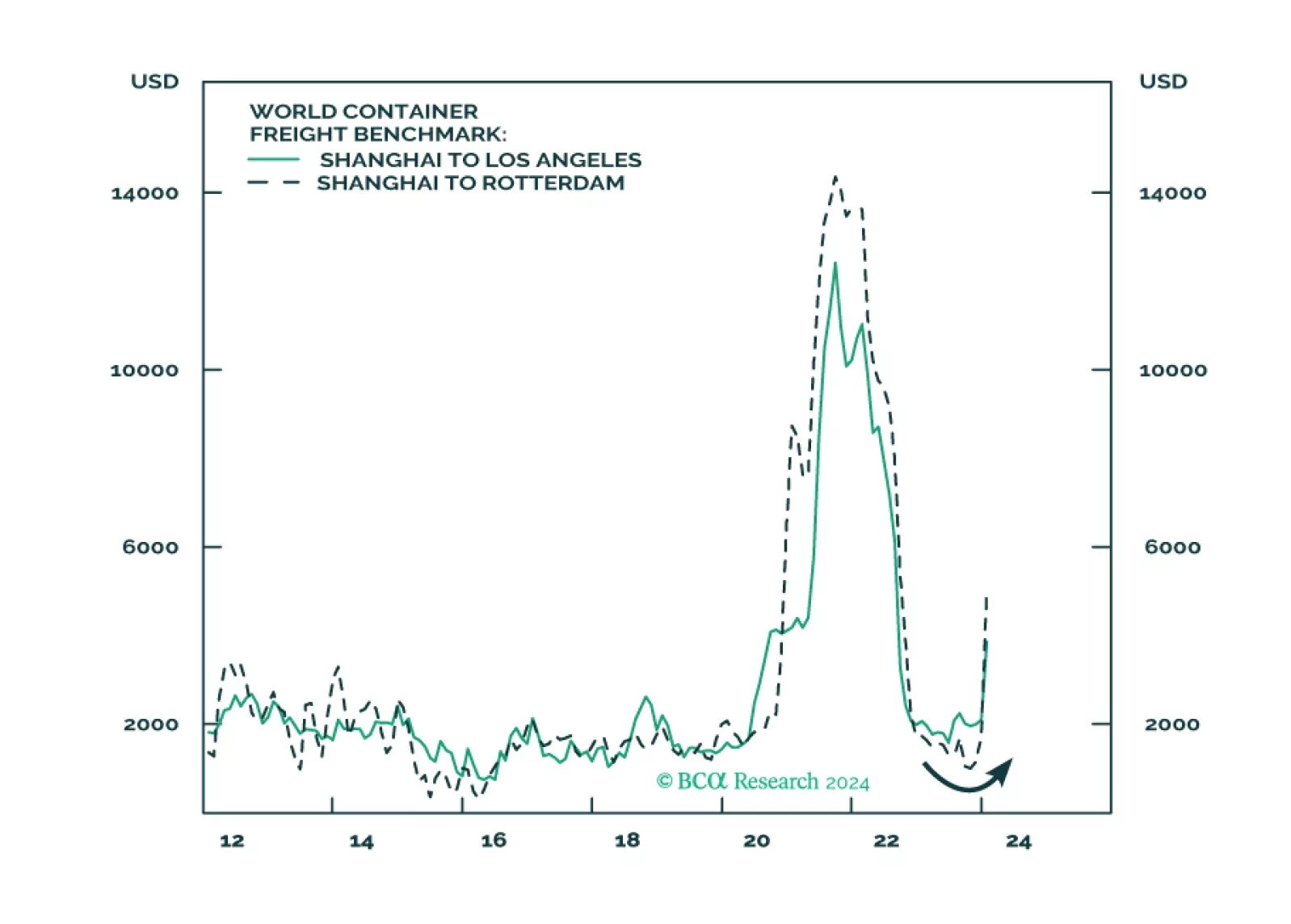

South Korean exports are the latest in a series of Asian trade data suggesting that the global trade cycle is bottoming. The 5.1% y/y increase in October marks the first return to growth since September 2022. Among South Korea…

The global economy will not enjoy an “immaculate disinflation” but will suffer a very maculate one due to China’s growth slowdown and restrictive monetary policy in the developed world. Investors should stay overweight low-beta…

South Korean exports in the first 20 days of July corroborate the signal from Taiwanese export orders that Asian trade conditions remain weak. The former declined by -15.3% y/y, undoing the optimism following a 5.3% y/y increase…

Executive Summary New Orders Of Chips Are Downbeat Emerging Asian semiconductor (semi) stocks have rallied considerably. While momentum could push them higher in the short term, stock prices are vulnerable to the downside…