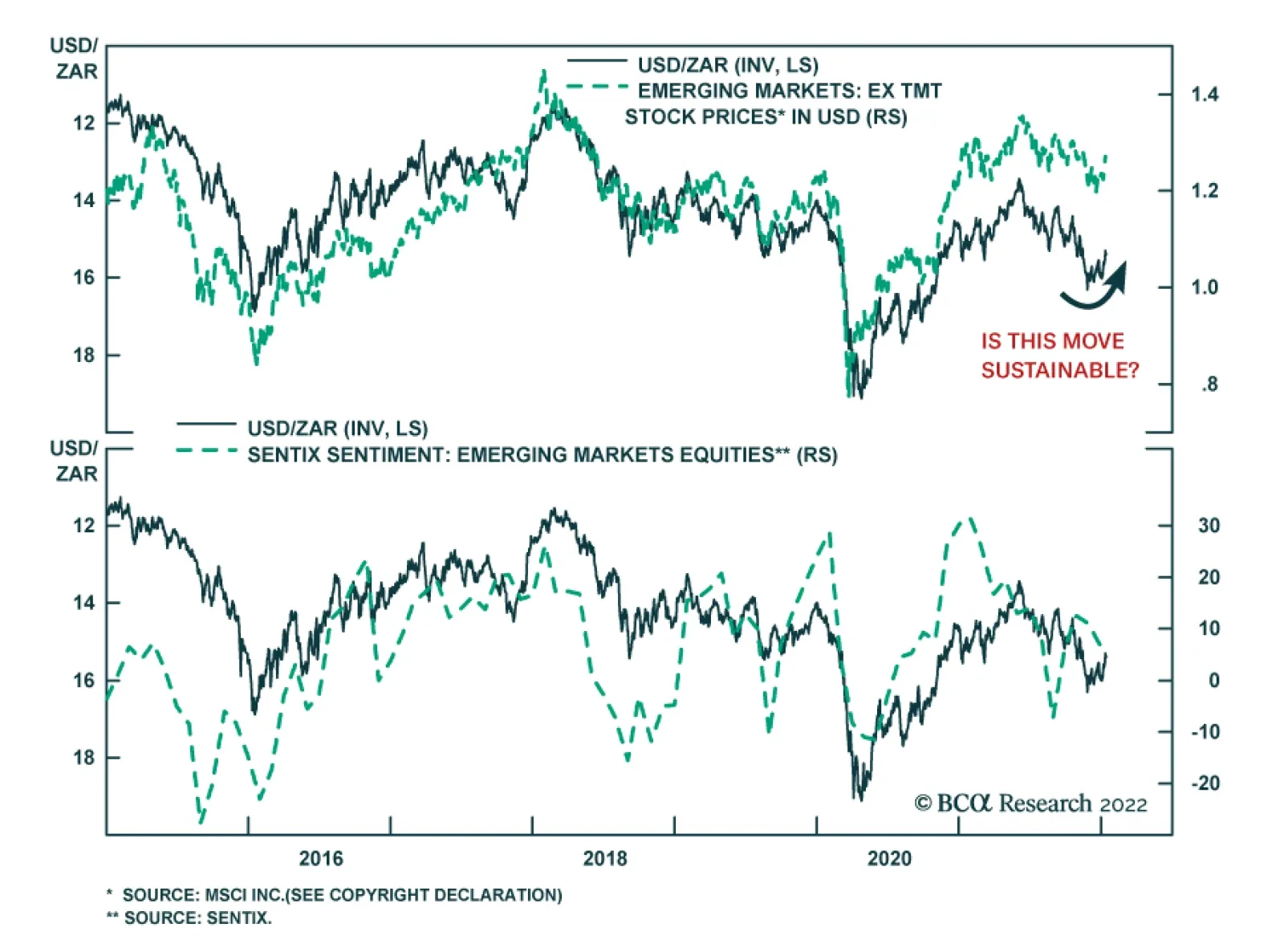

After a resilient first quarter, the South African rand experienced a sharp late-April selloff that brought it back down near late-2021 lows. However, the currency has been appreciating over the past week, recouping some of the…

Executive Summary German GeoRisk Indicator Russia and Germany have begun cutting off each other’s energy in a major escalation of strategic tensions. The odds of Finland and Sweden joining NATO have shot up. A halt…

Executive Summary Several indicators point to overly bullish equity market sentiment. That is why, we are reluctant to chase South African share prices higher both in absolute terms and relative to the EM benchmark. Tight macro…

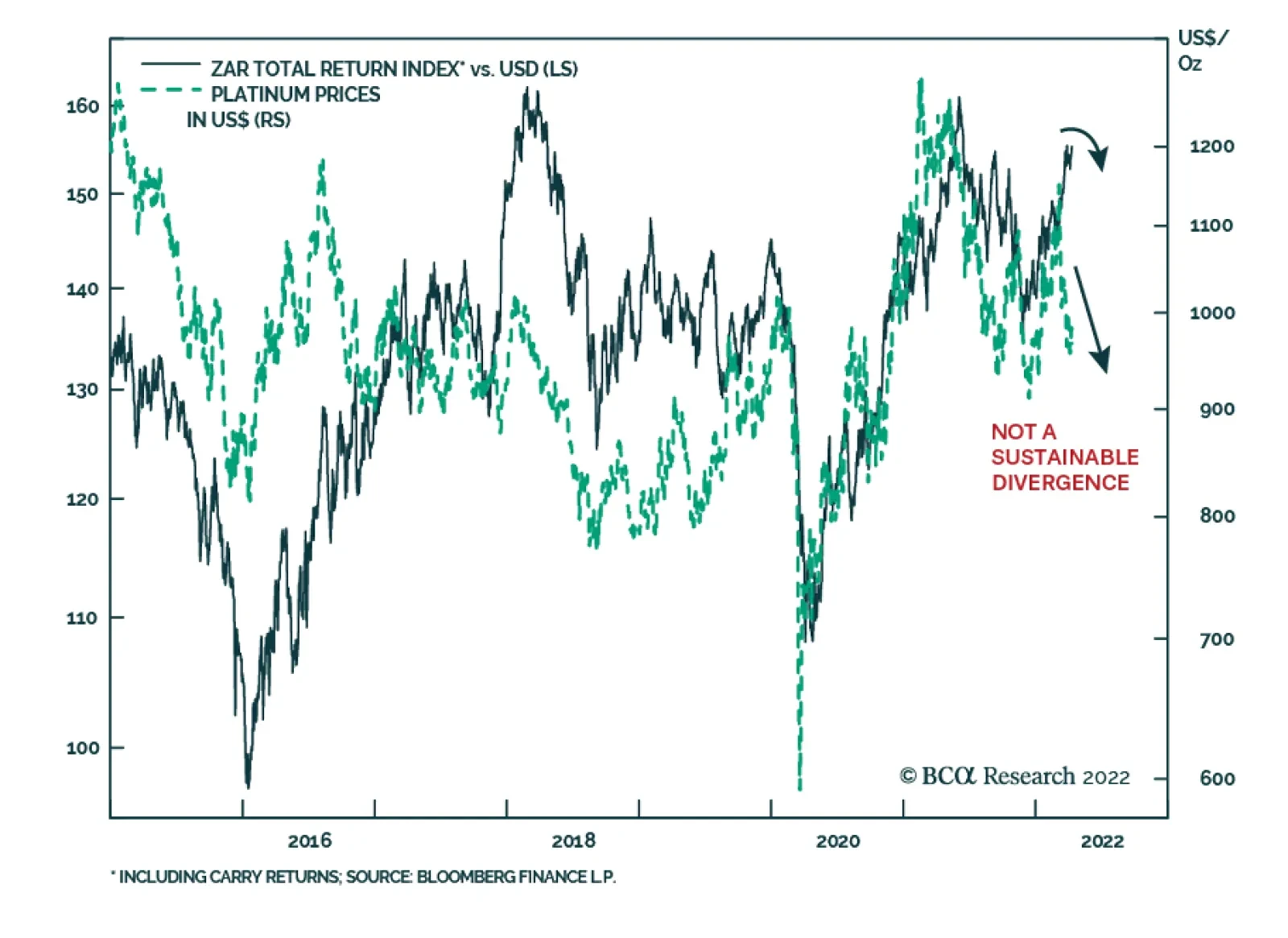

South African financial markets have shot up and have dramatically outperformed their EM peers. The rotation into commodities following Russia’s invasion of Ukraine has greatly benefited commodity plays like South Africa…

The South African rand depreciated 15% versus the greenback between June and November 2021. However, this trend has reversed in recent weeks and it is now up 3% since then. The ZAR’s latest move coincides with measures to…

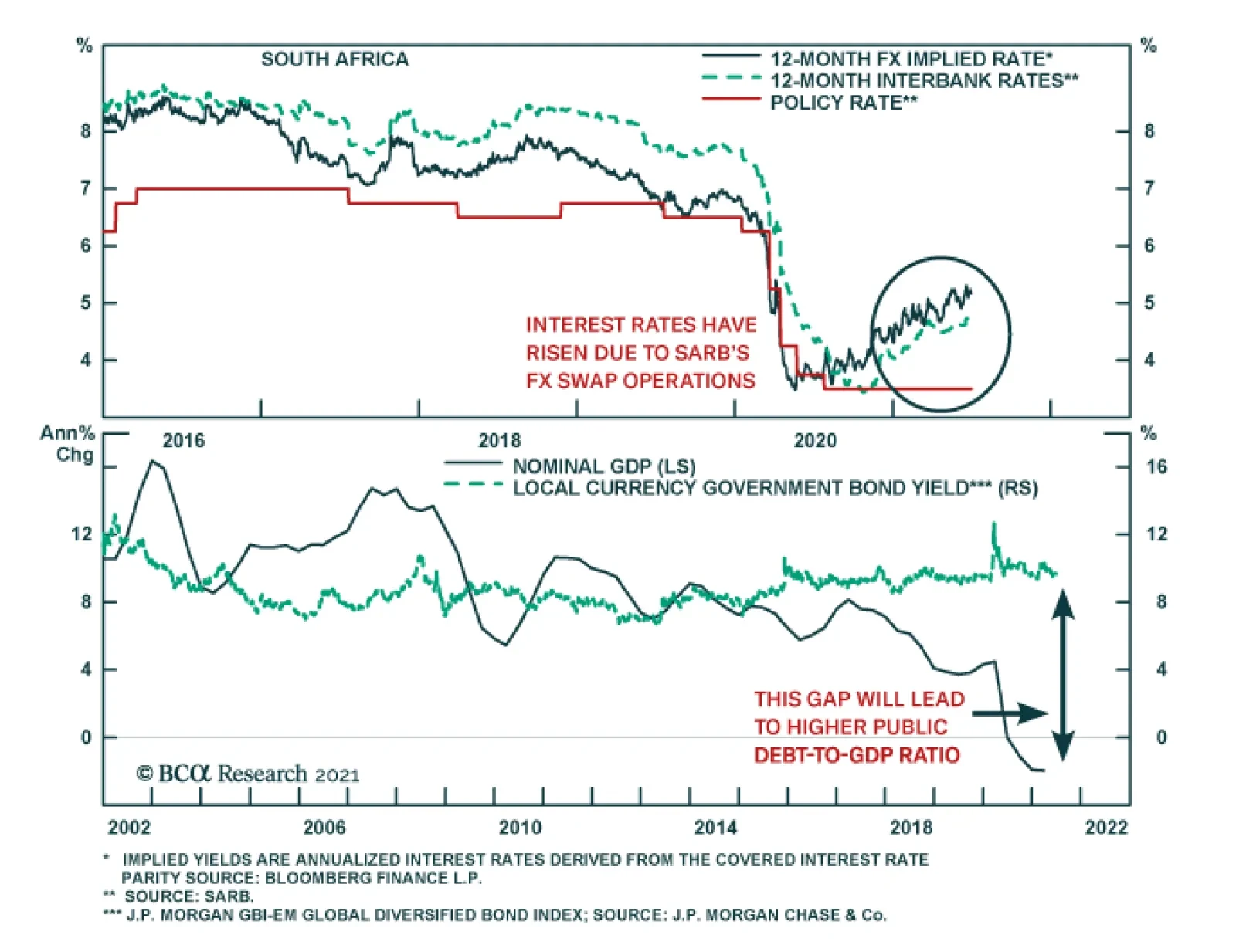

The central bank’s efforts to sterilize inflows of US dollars from the IMF have inadvertently led to considerably tighter monetary conditions. Not only has the currency appreciated a lot but also market interest rates have…

Highlights The central bank’s efforts to sterilize inflows of US dollars from the IMF have inadvertently led to considerably tighter monetary conditions. Fiscal tightening, large currency appreciation and high lending rates will…

Highlights US labor-market disappointments notwithstanding, the global recovery being propelled by real GDP growth in the world's major economies is on track to be the strongest in 80 years. This growth will fuel commodity demand,…

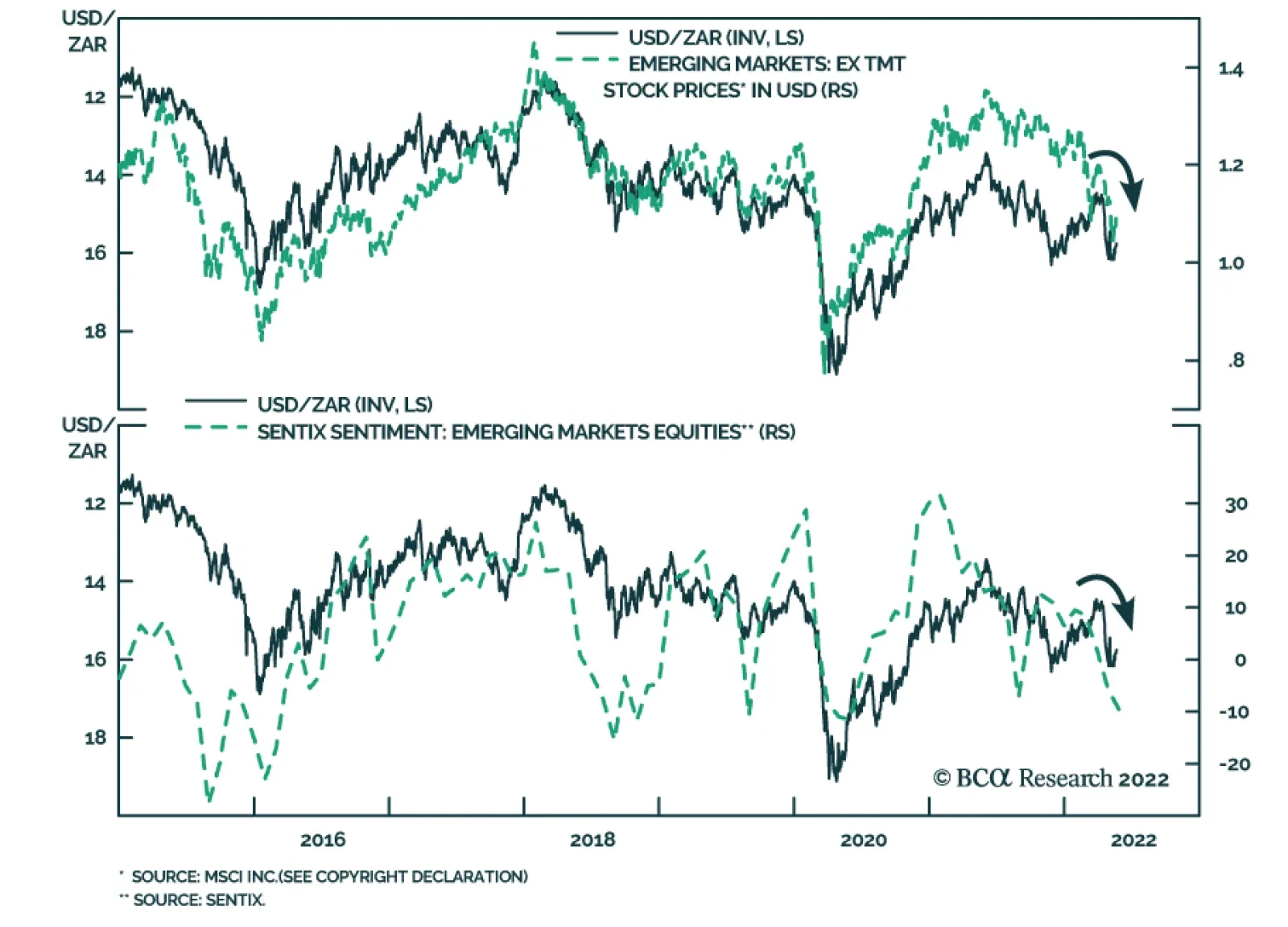

After bottoming in April 2020, the South African rand surged versus the US dollar for the remainder of the year. However, since December, the USD/ZAR has been stuck between 14.5-15.5. The ZAR’s fluctuations coincided…