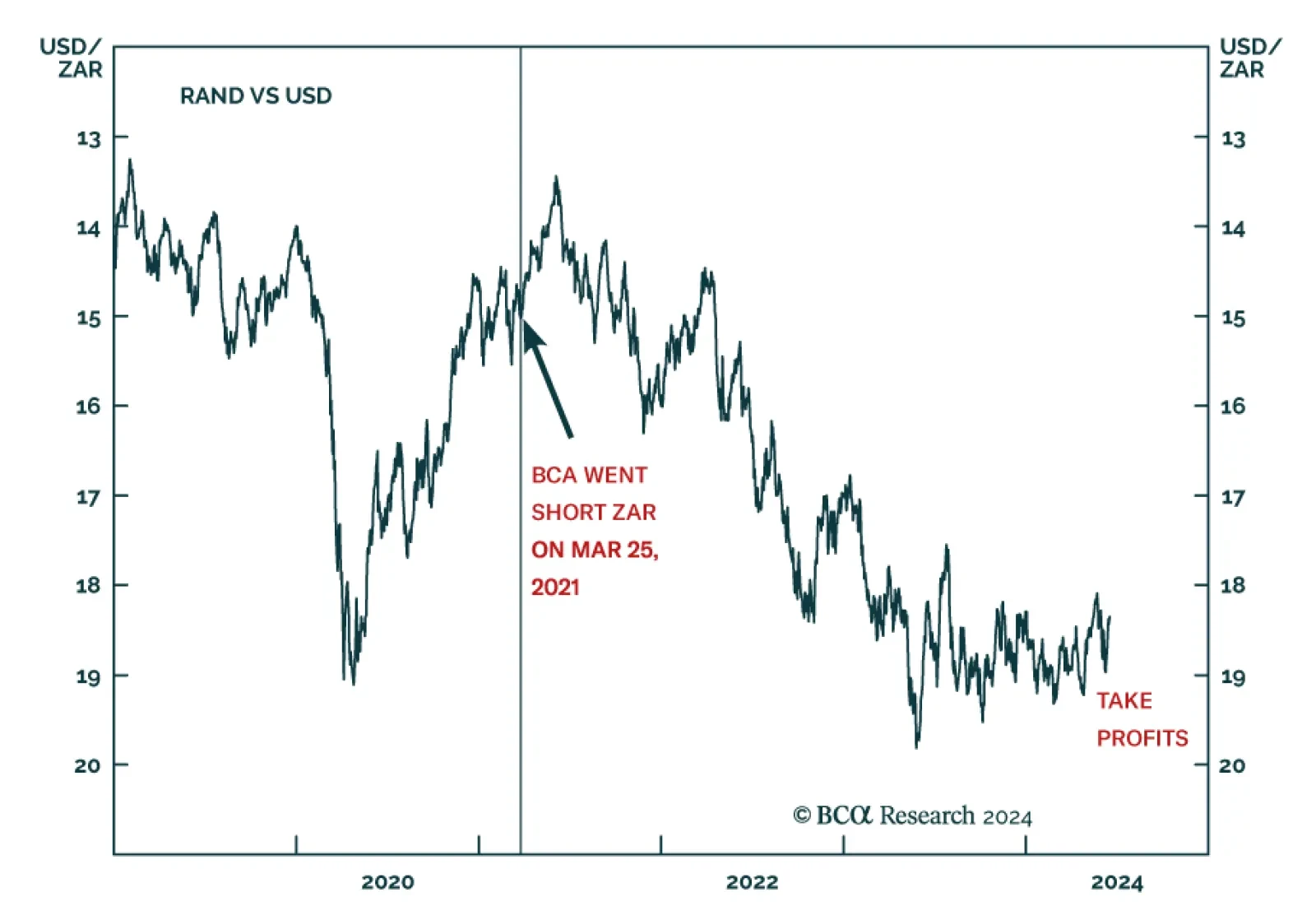

Our EM strategists recommend staying underweight South Africa across EM equity, domestic bond, and sovereign credit portfolios, and continuing to short the rand versus an equal-weighted basket of the US dollar, euro, and yen. Despite…

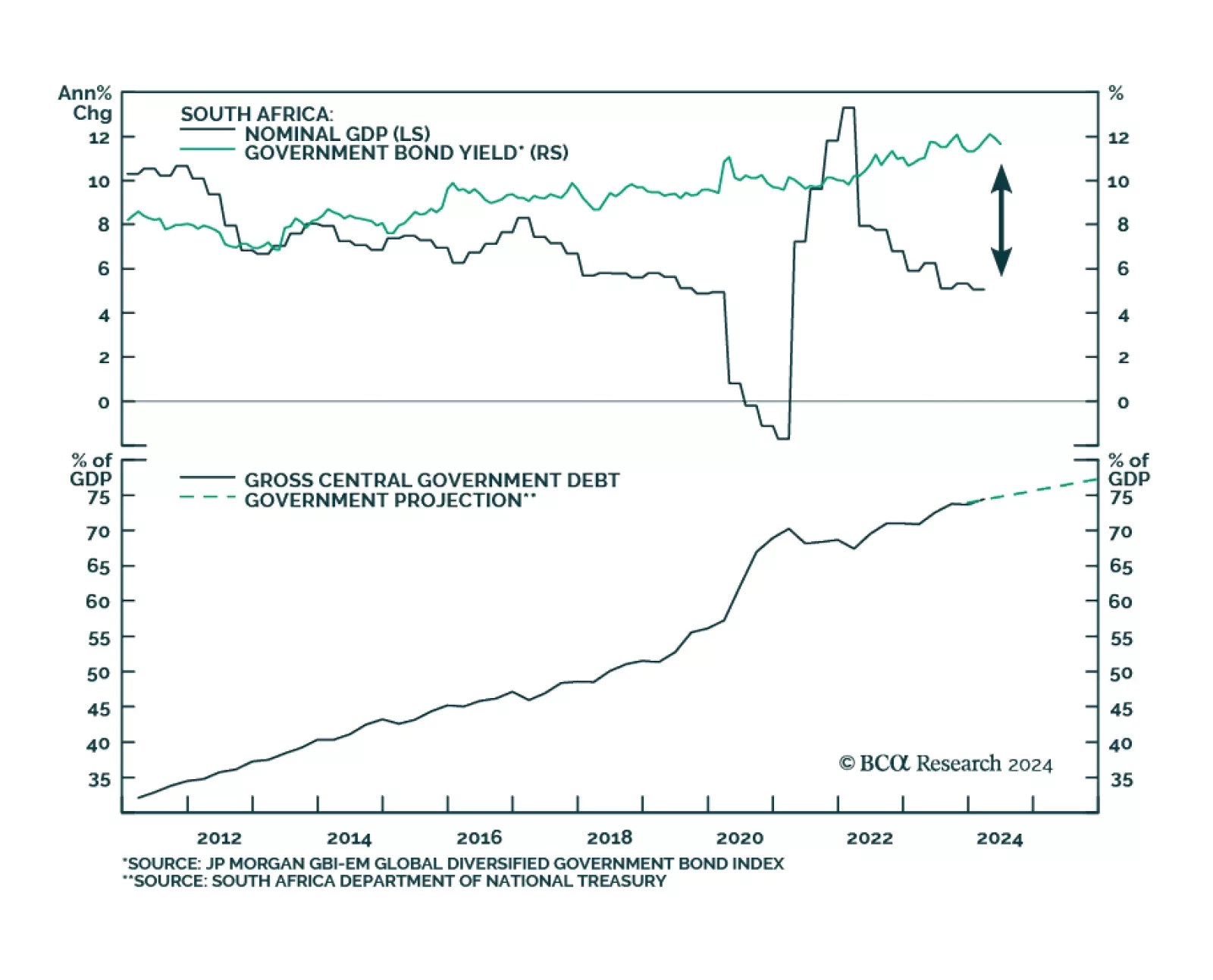

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

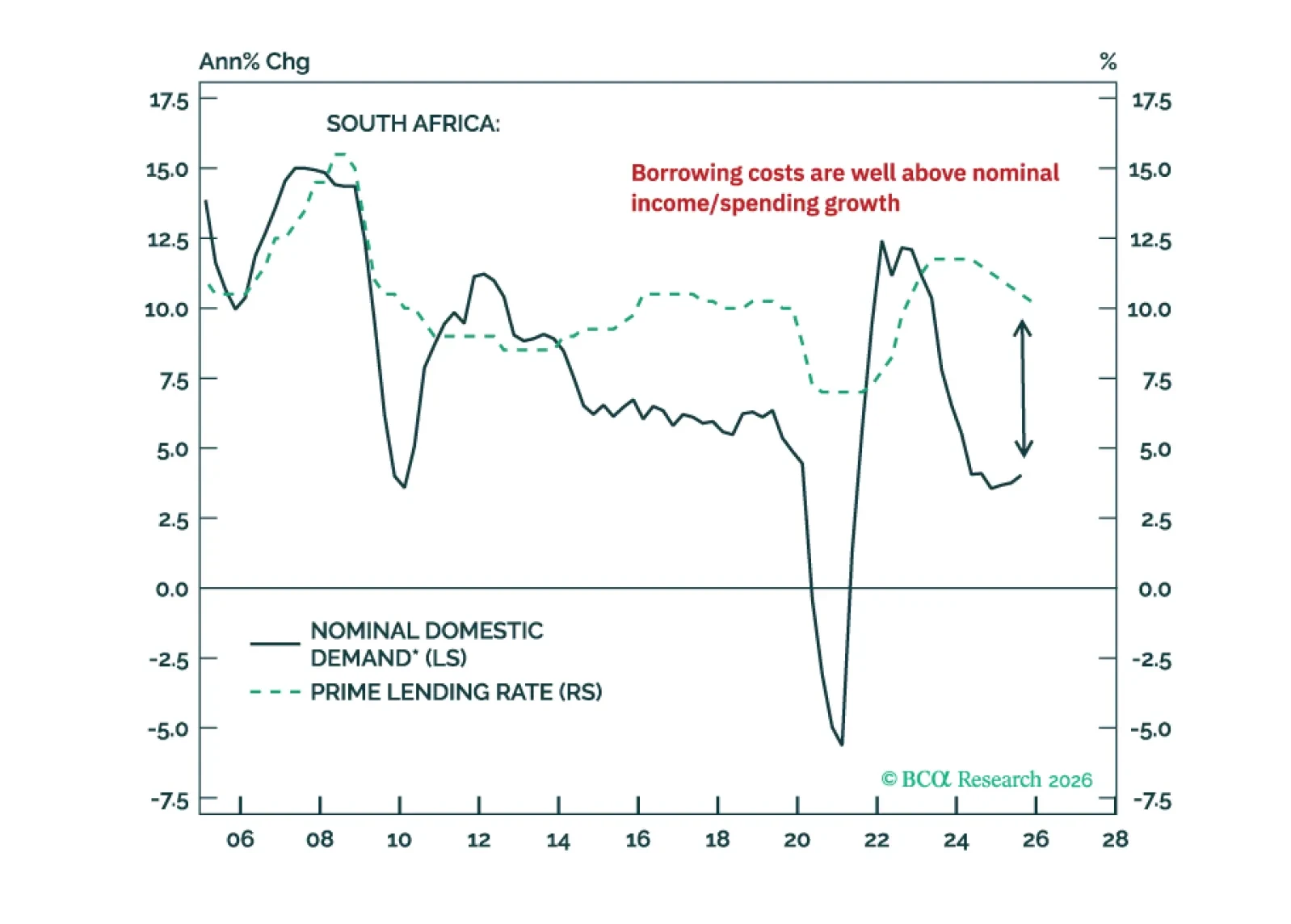

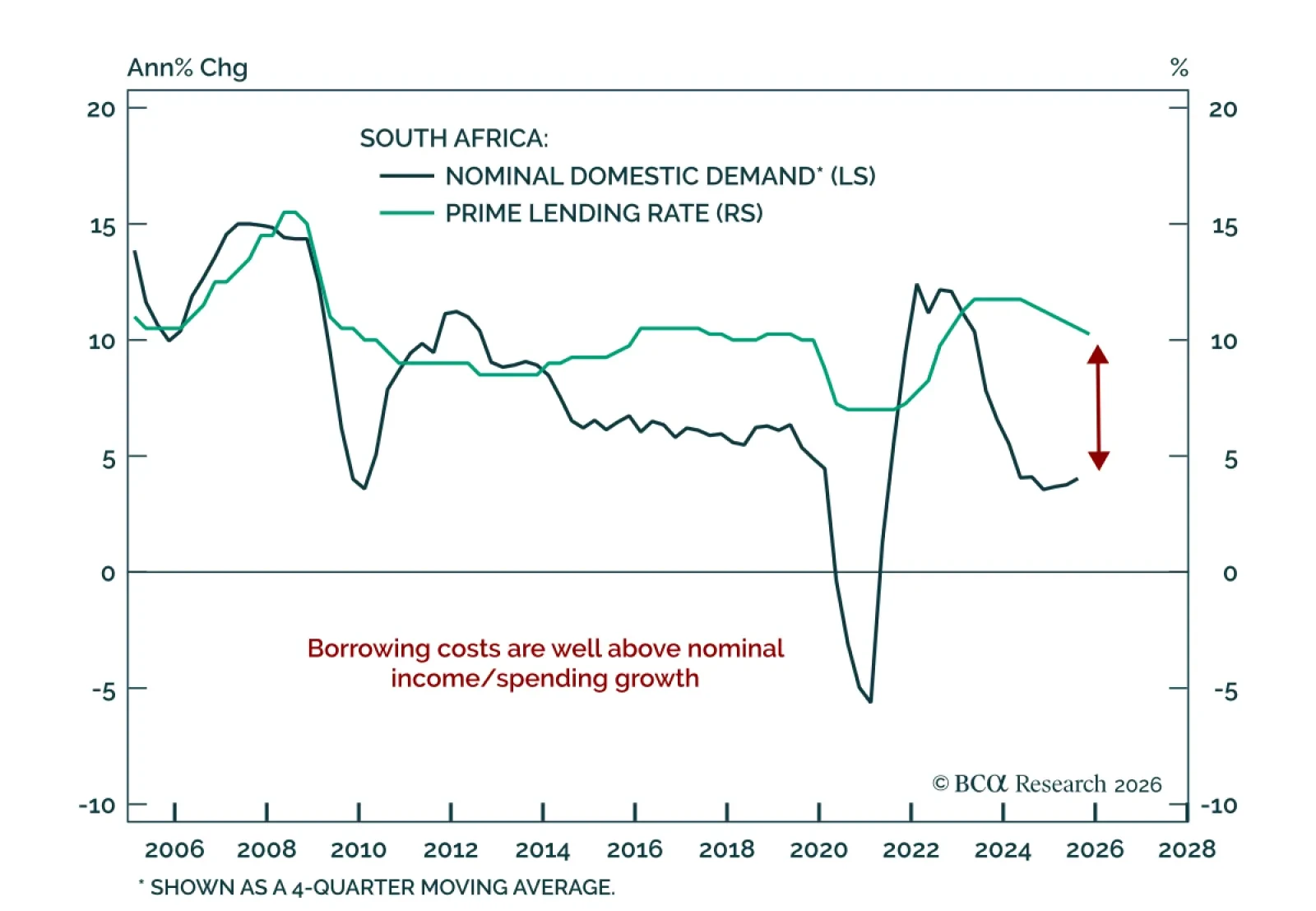

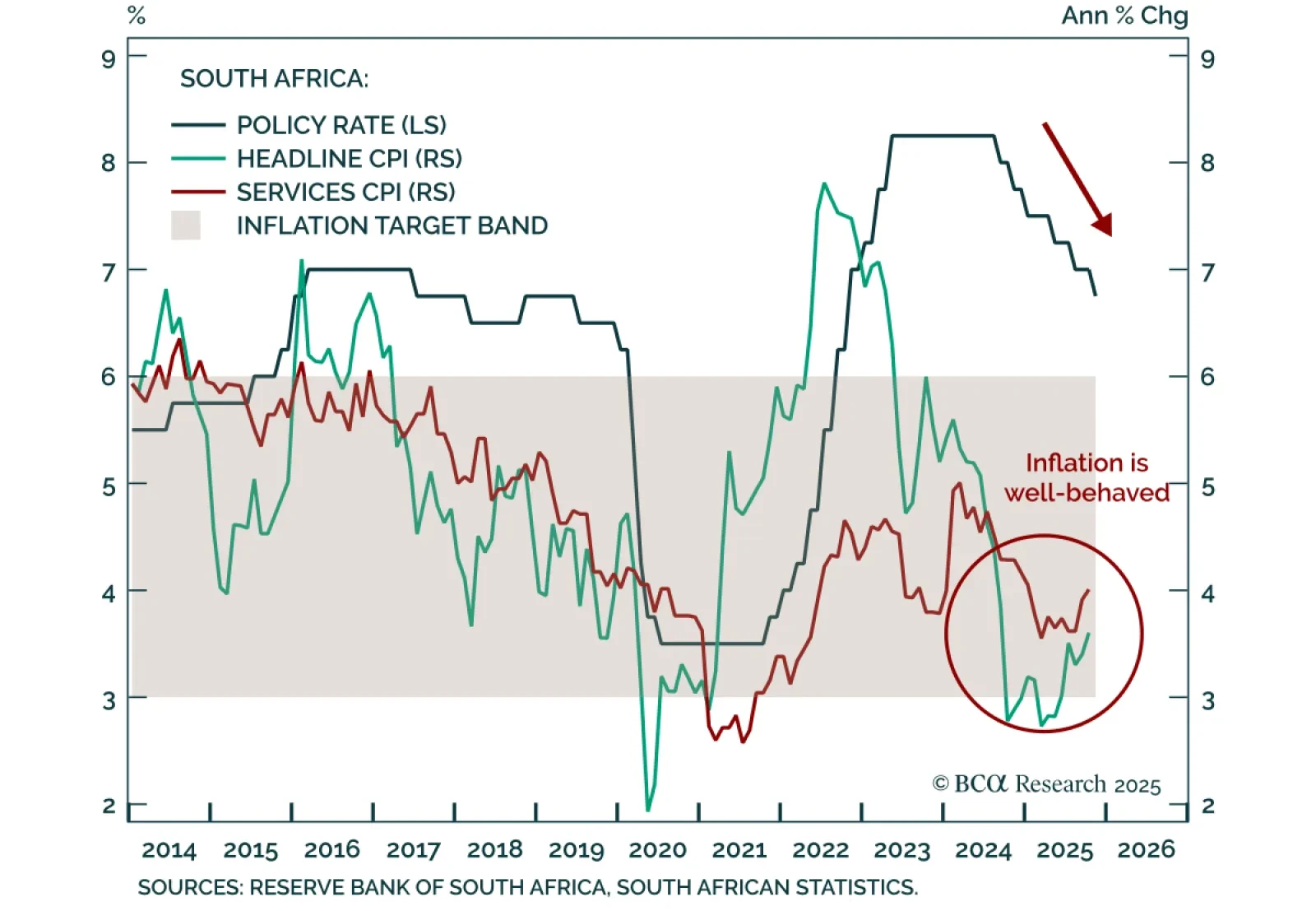

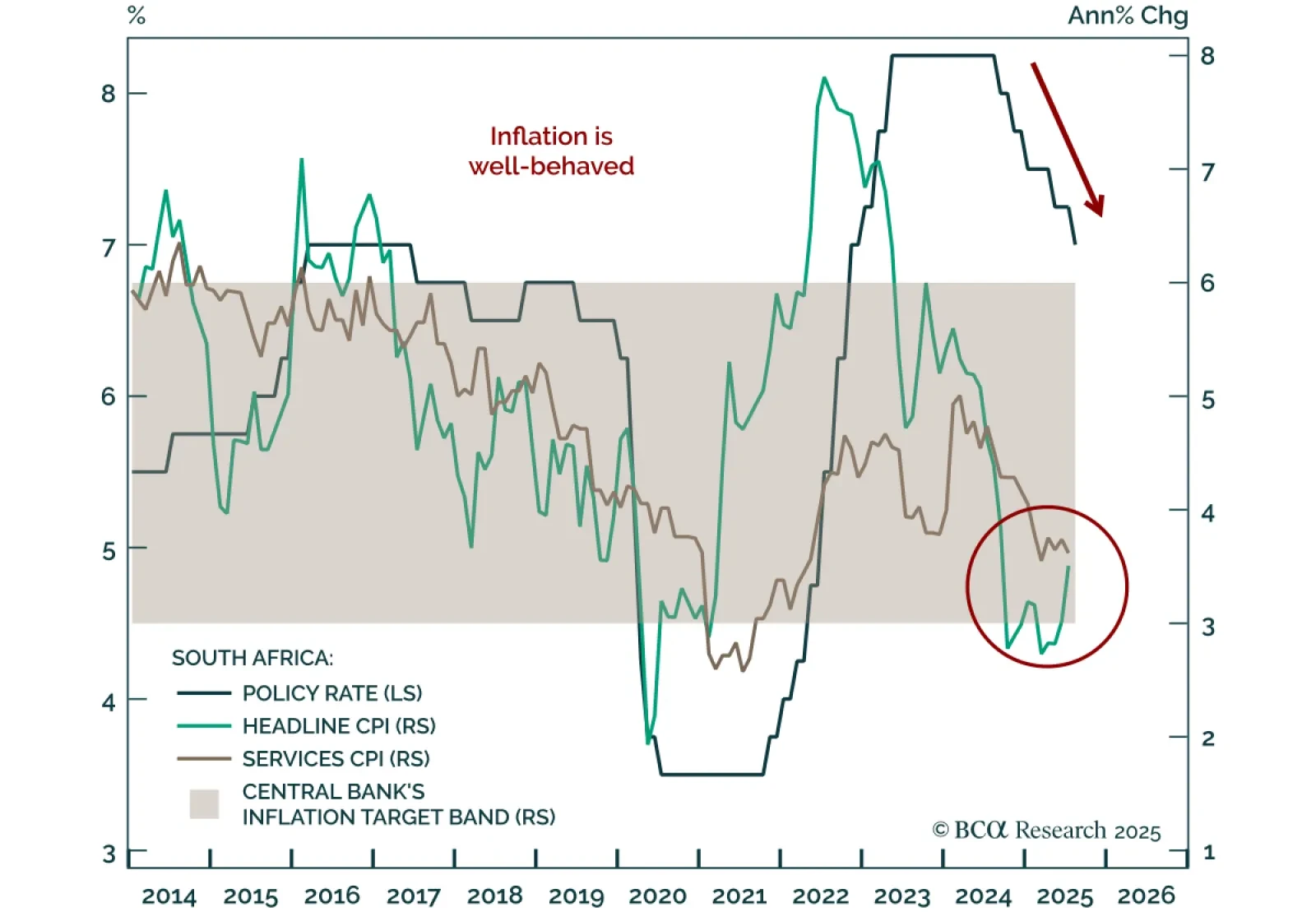

The South African Reserve Bank cut rates by 25 bps to 6.75%, with more easing expected as growth slows and inflation stays contained. The move aligns with our Emerging Markets strategists’ view that borrowing costs remain too…

South African inflation will remain at the bottom of the SARB target range, allowing further easing. July CPI came in line with expectations at 3.5% y/y, with core at 3.0%. Our Emerging Markets strategists expect the…

The SARB cut rates by 25 bps to 7.00%; our EM strategists expect further easing and recommends short ZAR exposure. Real interest rates remain elevated, and high borrowing costs are intensifying debt sustainability concerns, with…

In this chartbook, we look at the balance of payments across DM and EM countries. The US does not fare well, but neither do a few other countries.

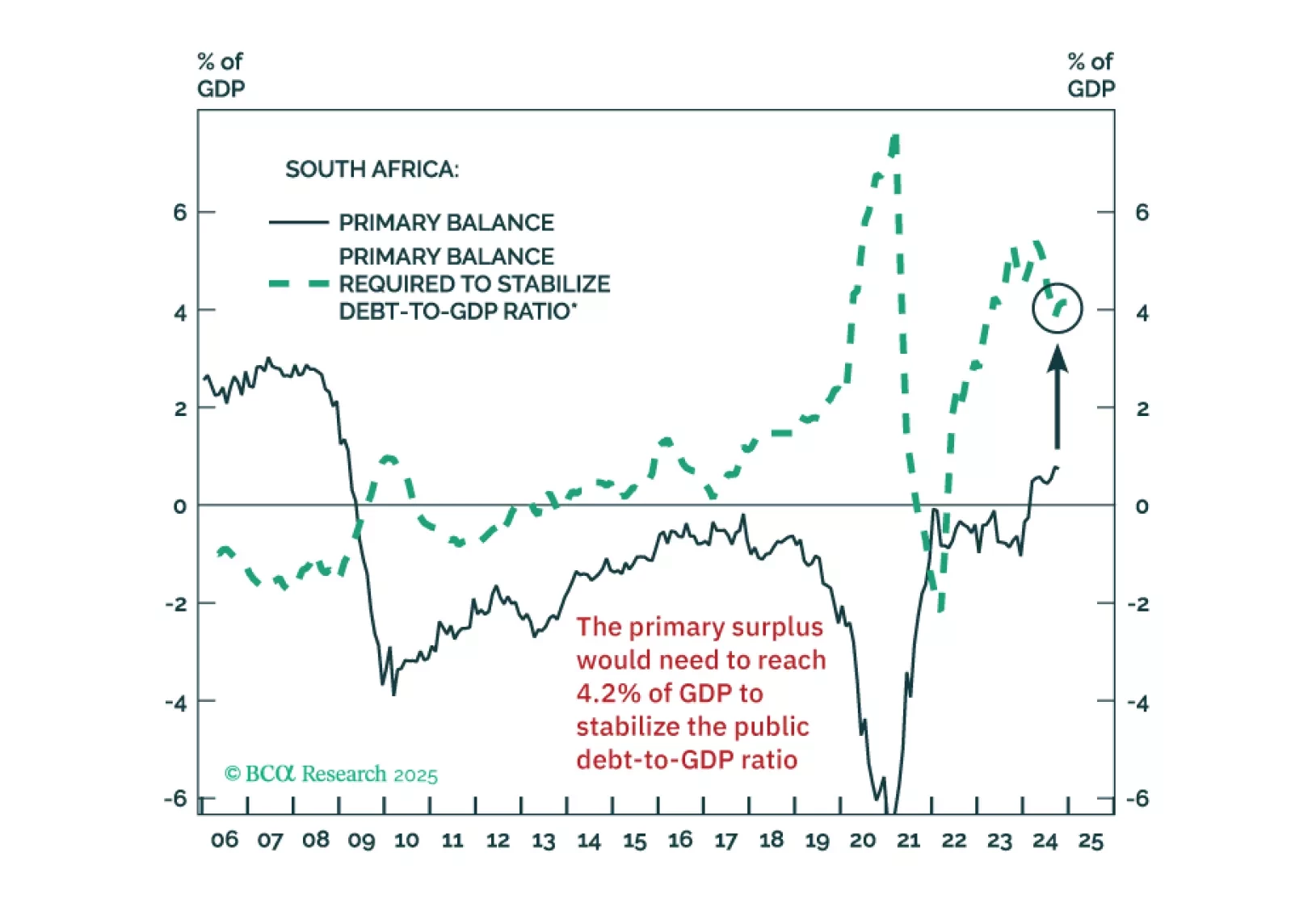

The South African government seems to believe that some fiscal retrenchment can stabilize the public debt-to-GDP ratio. But that’s a misconception. The country will need draconian spending cuts to achieve this.

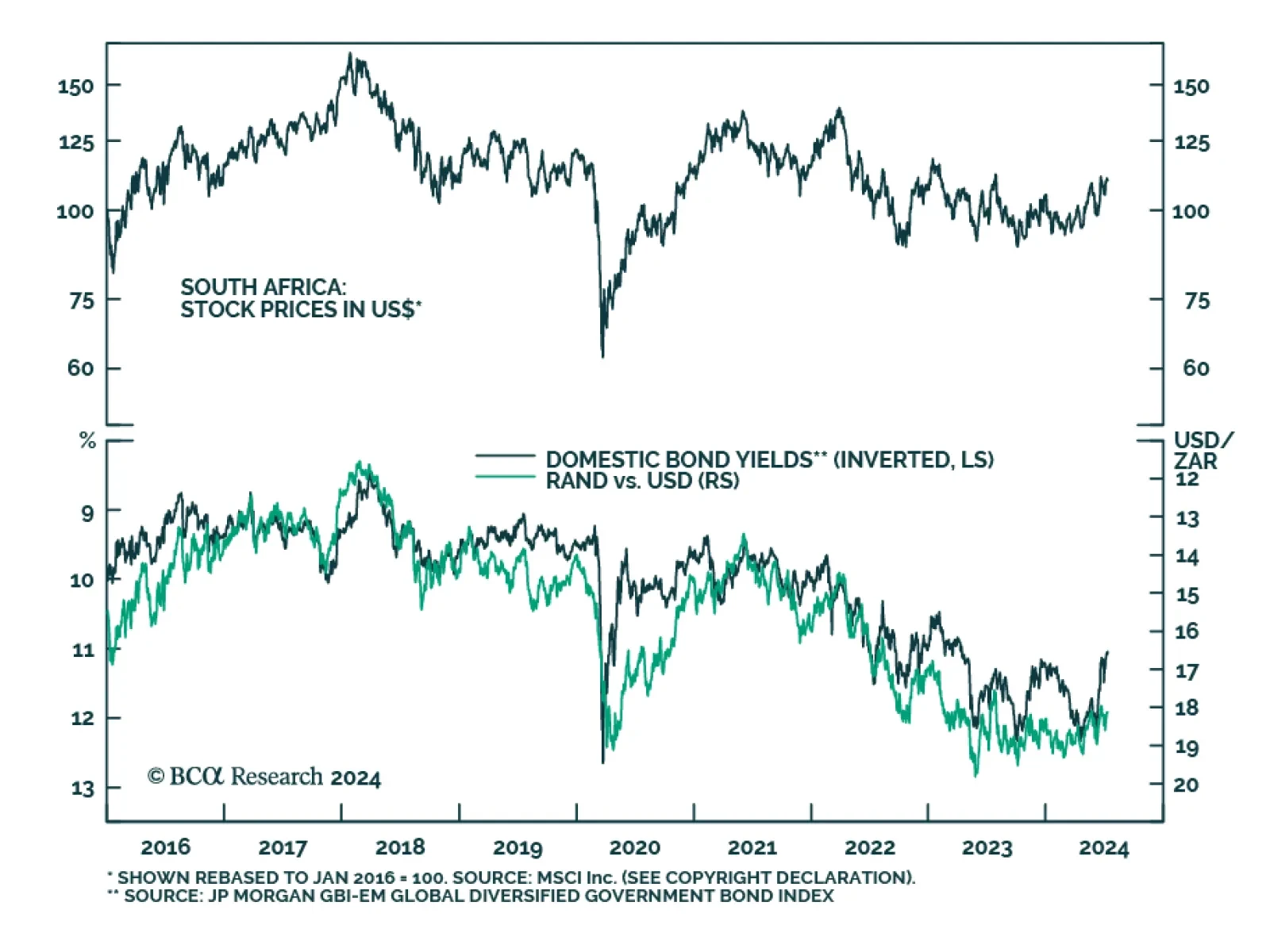

South African stocks, domestic bonds, and currency have all rallied since BCA’s Emerging Markets Strategy team upgraded South African assets last month following the formation of the new national unity government. The rally…

In a recent report, BCA Research’s Emerging Markets Strategy team recommended upgrading South African assets. The team argued that the new national unity government has an opportunity to ease the restrictive policies and…

According to BCA Research’s Geopolitical Strategy service, the South African election presents a window of opportunity for productivity-boosting structural reforms, such as privatization, to coincide with monetary and…