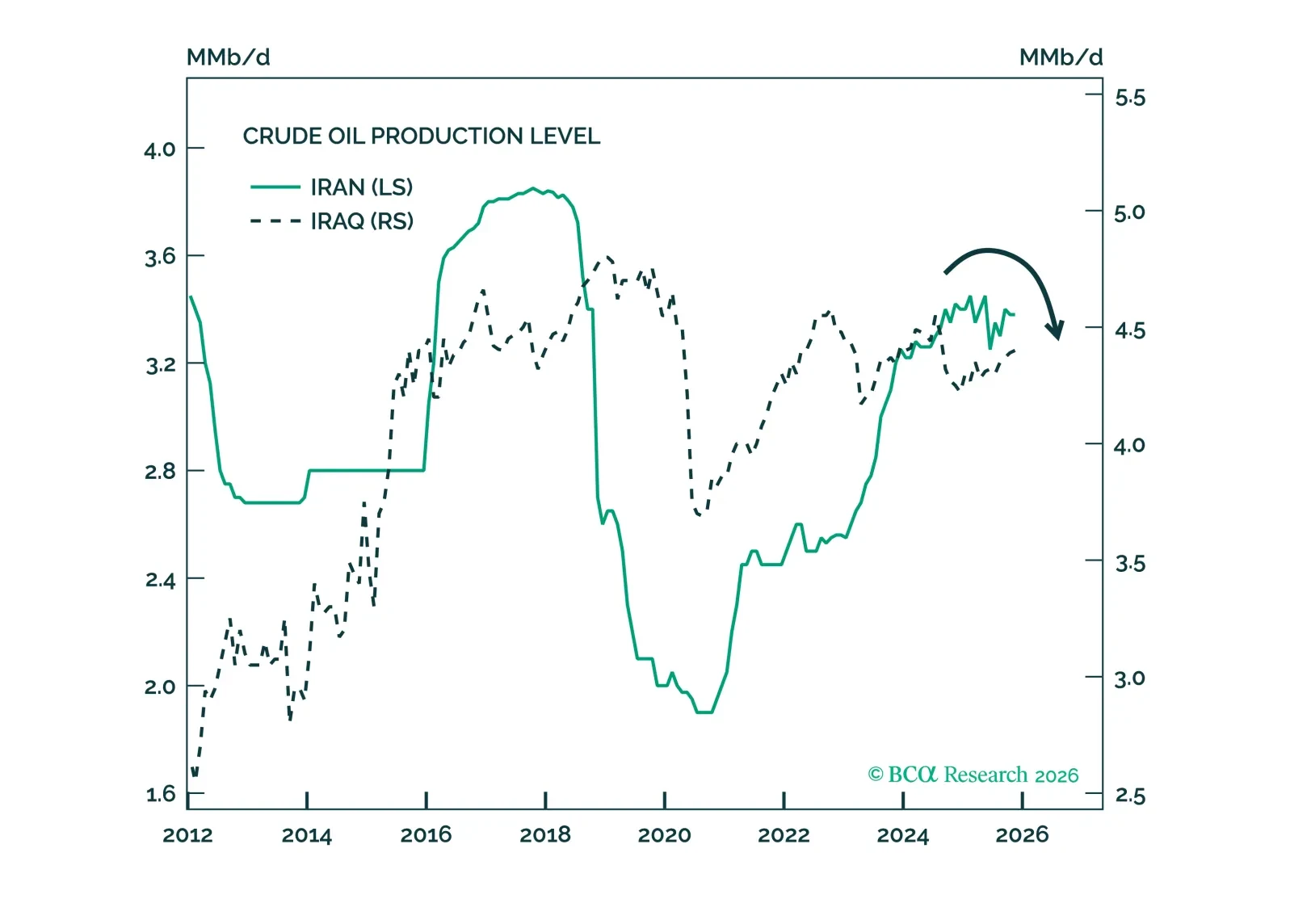

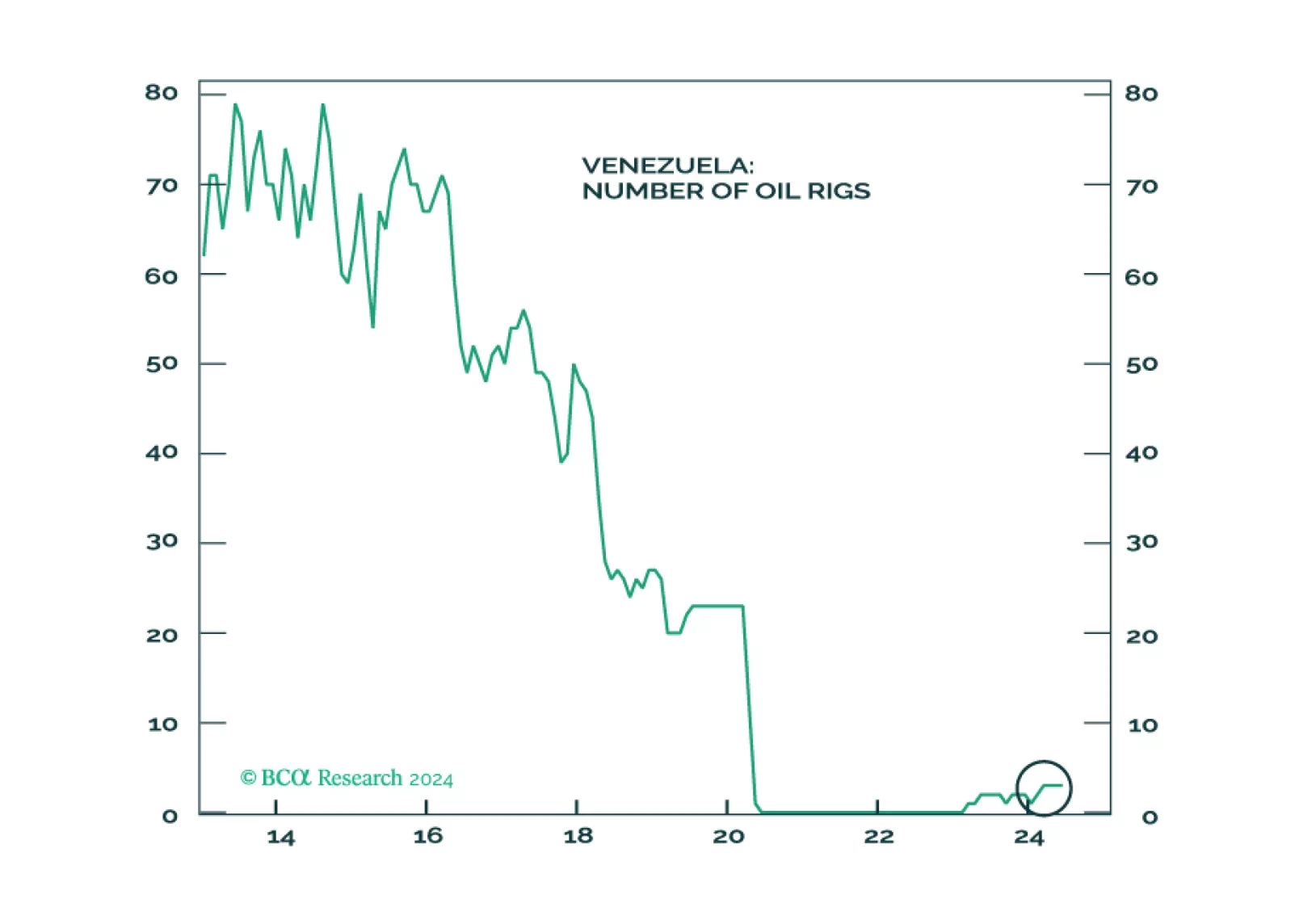

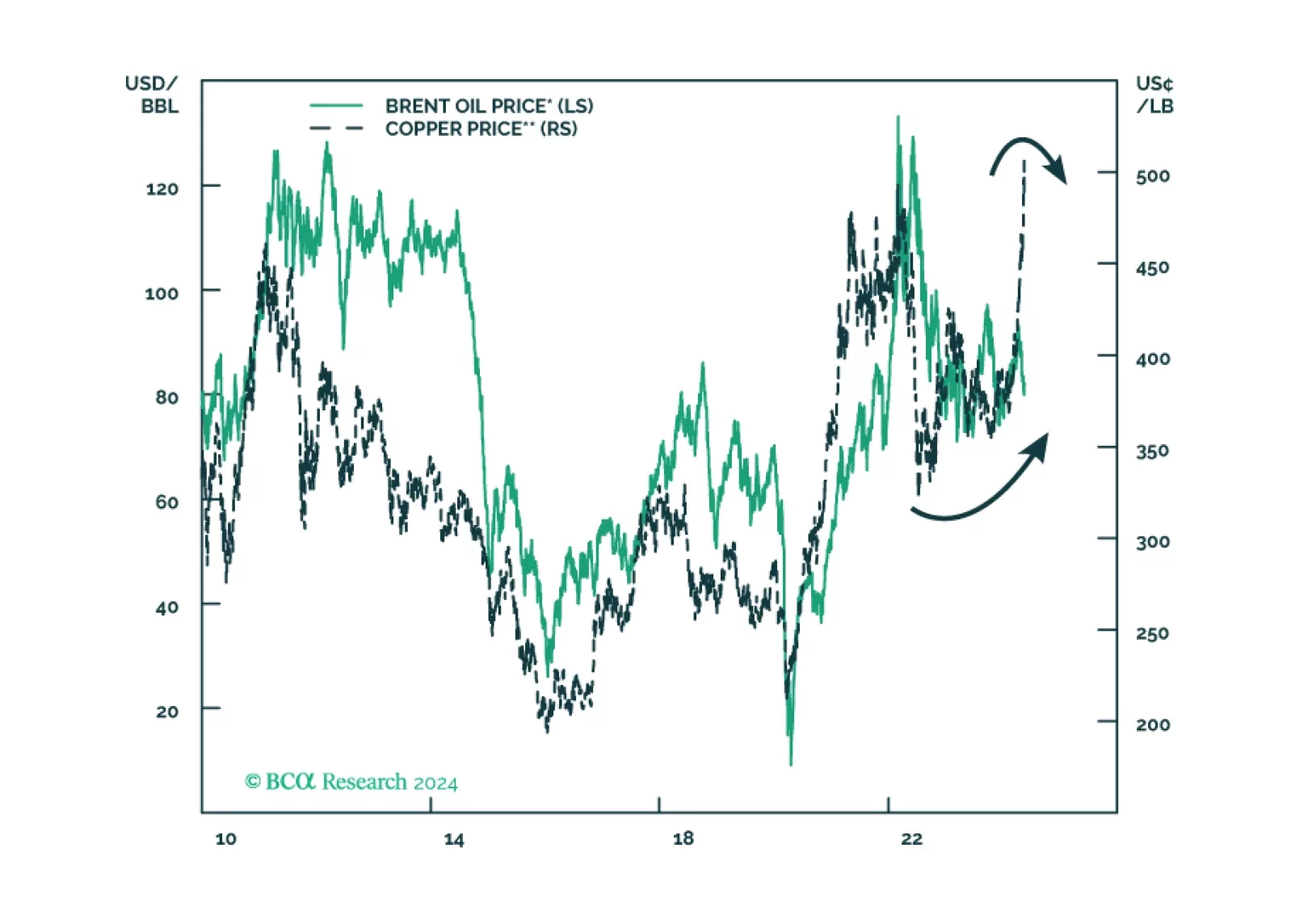

The risk to Iran's regime survival raises the probability of a massive global oil supply shock back to around 40%, where we put it last year.

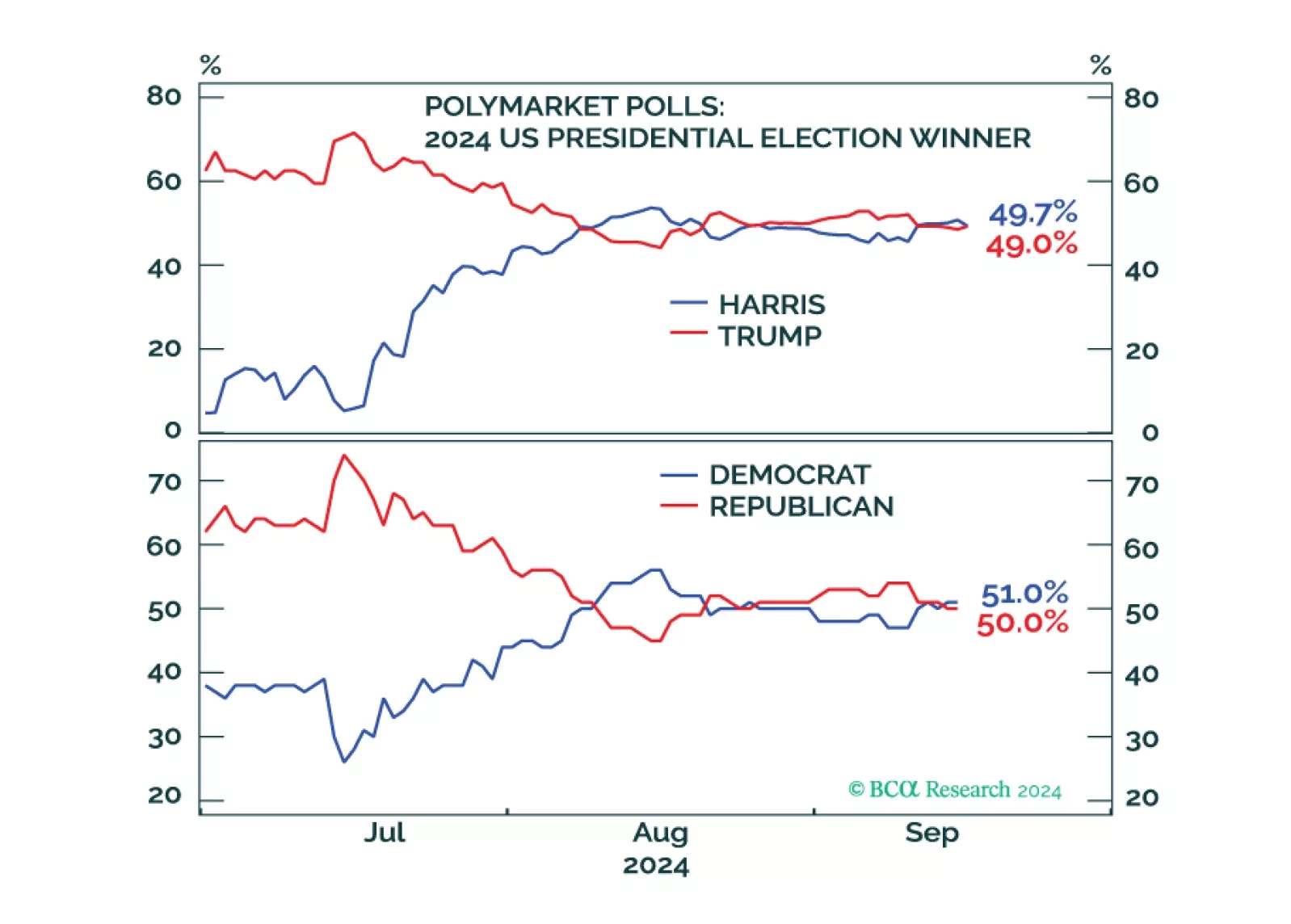

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…