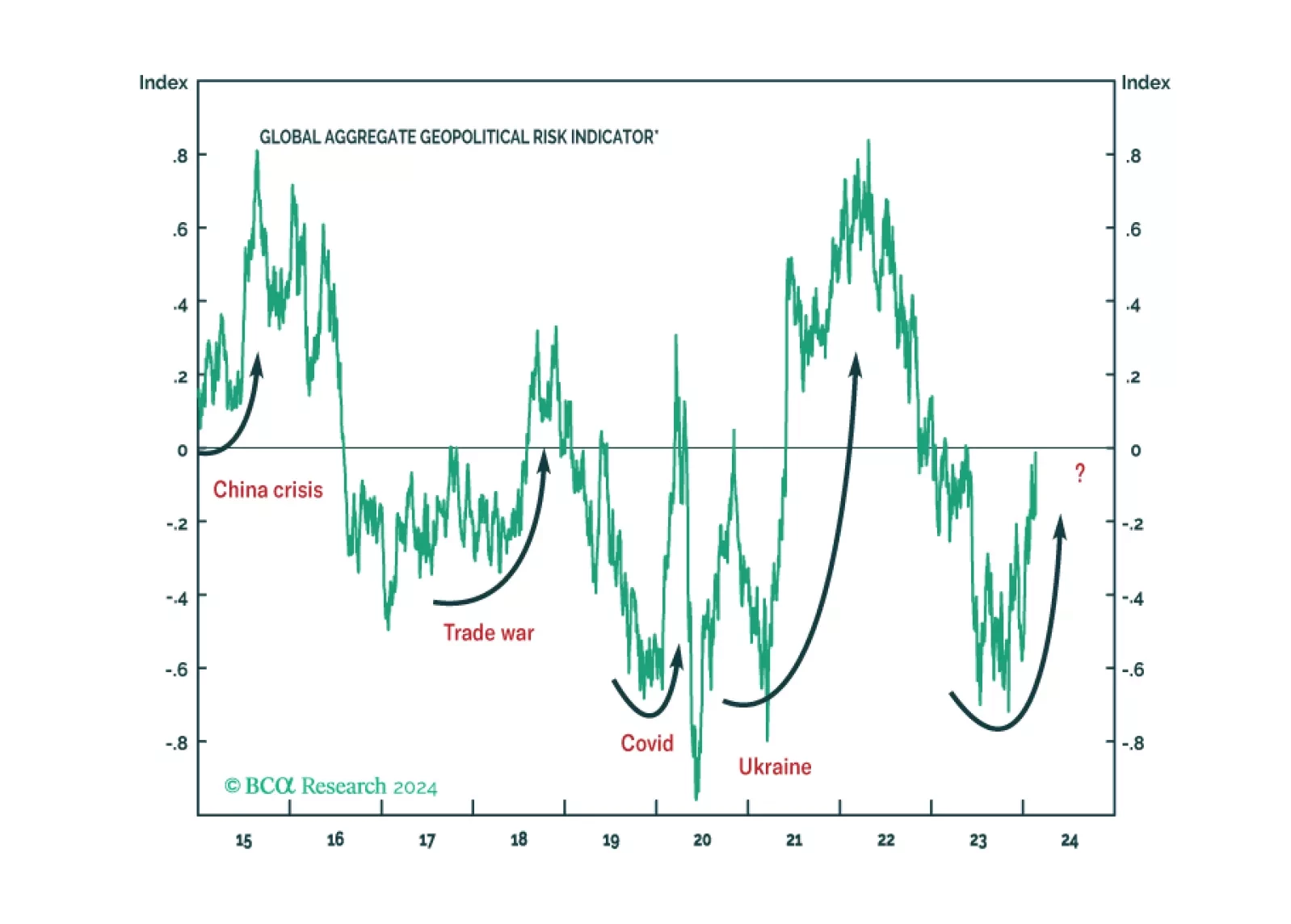

While 2024 will see various election risks, global geopolitical uncertainty is driven by the US election and its struggle with Russia, China, and Iran. The stock market can manage local domestic political risk. But it will correct…

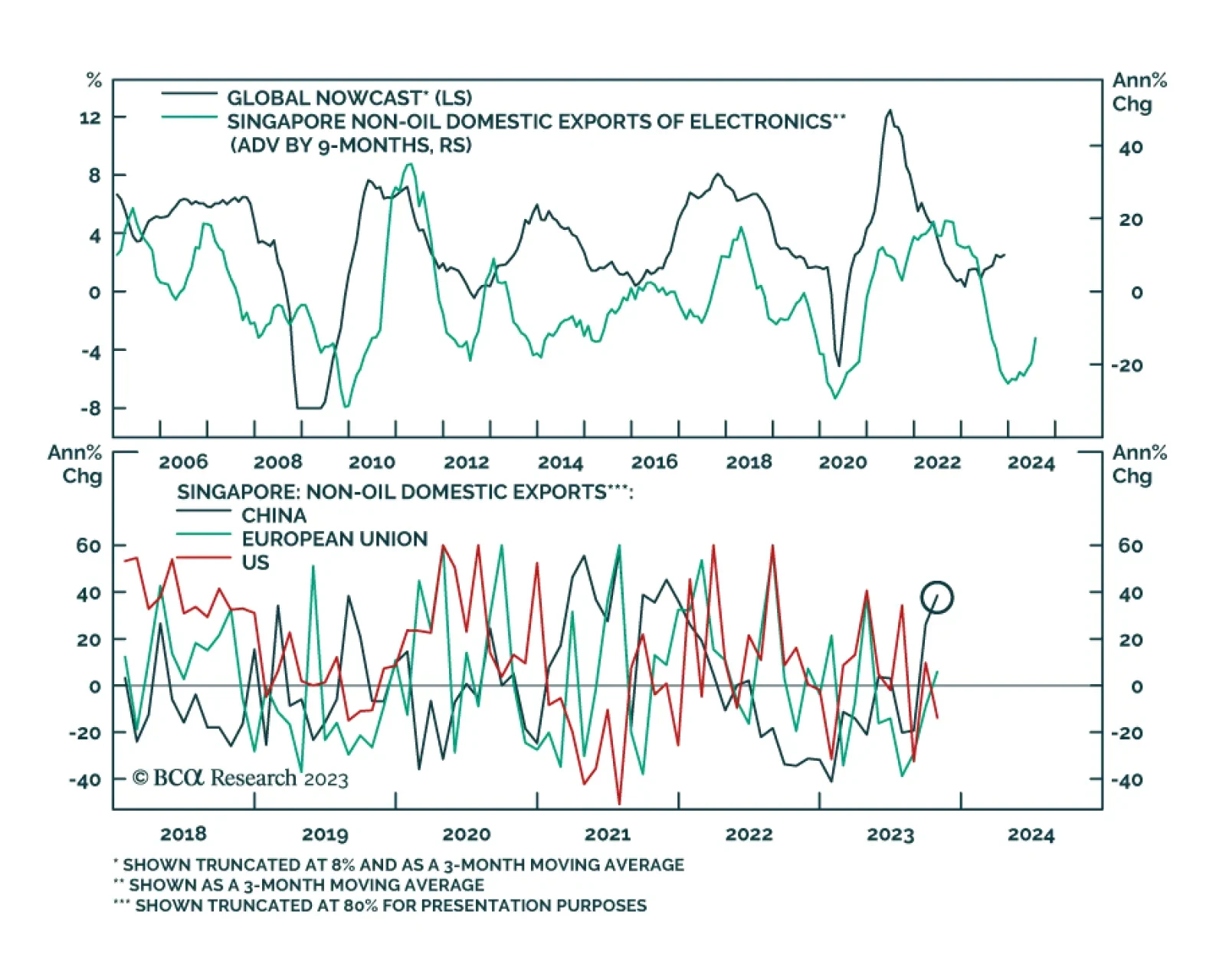

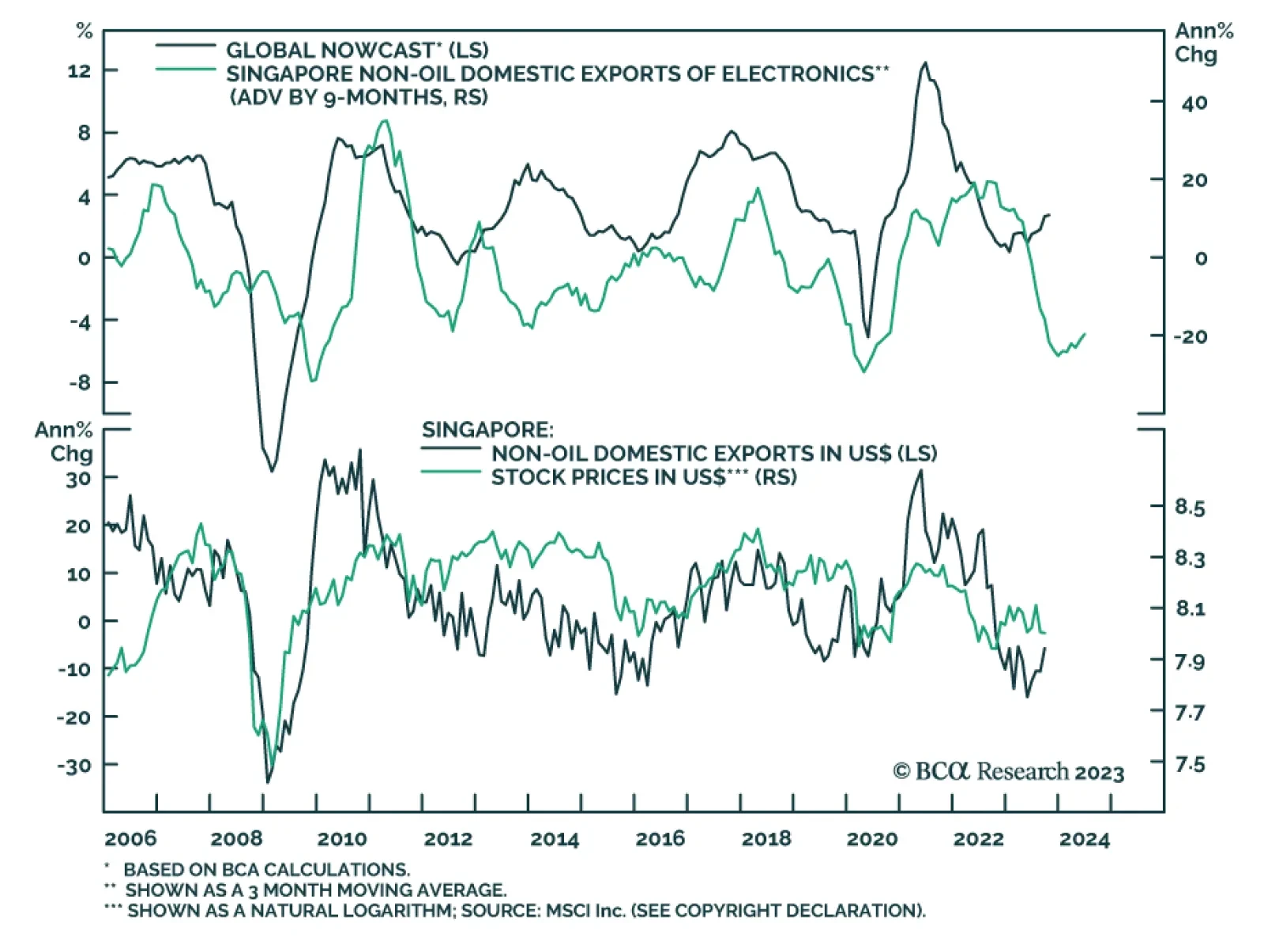

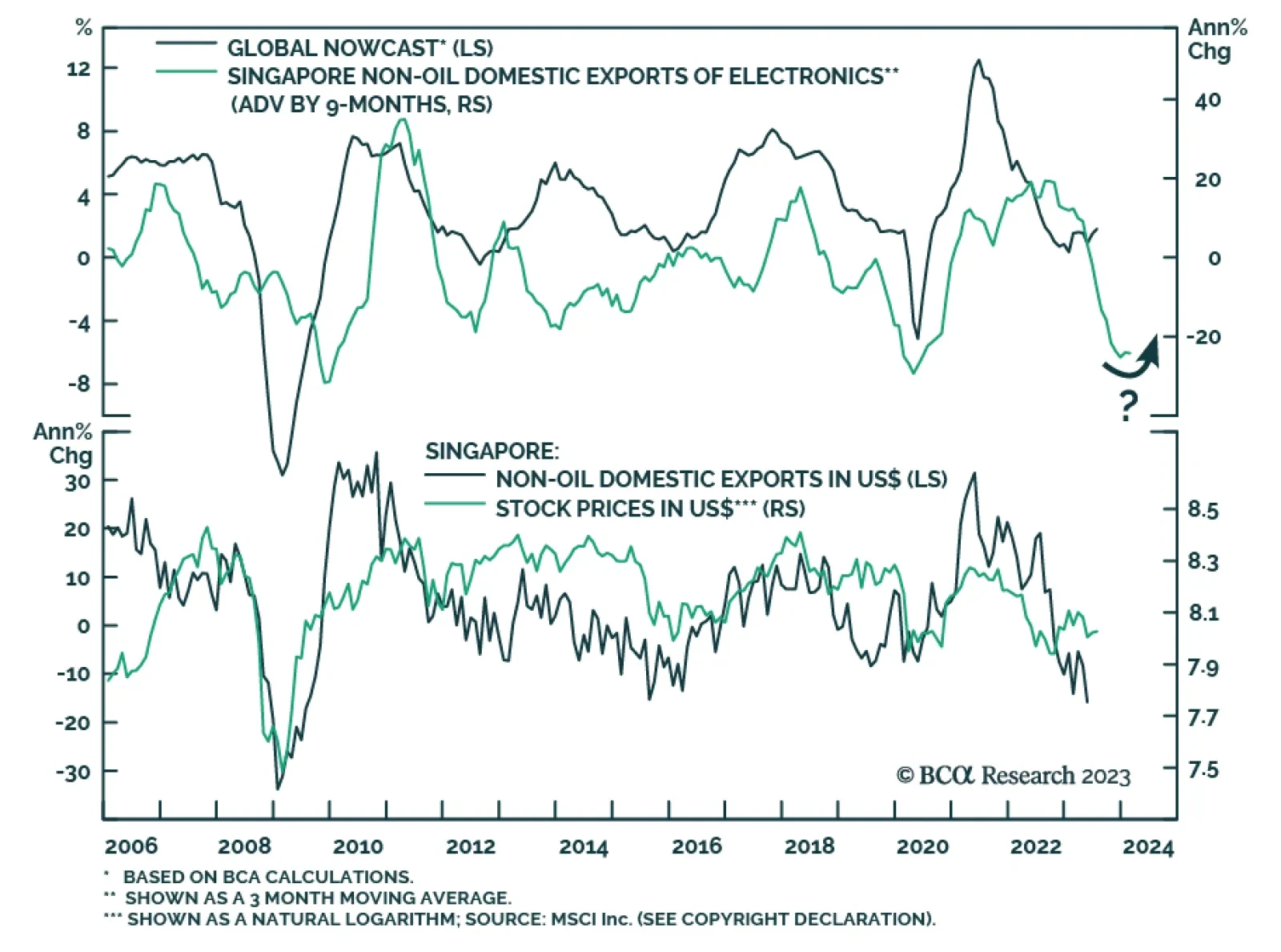

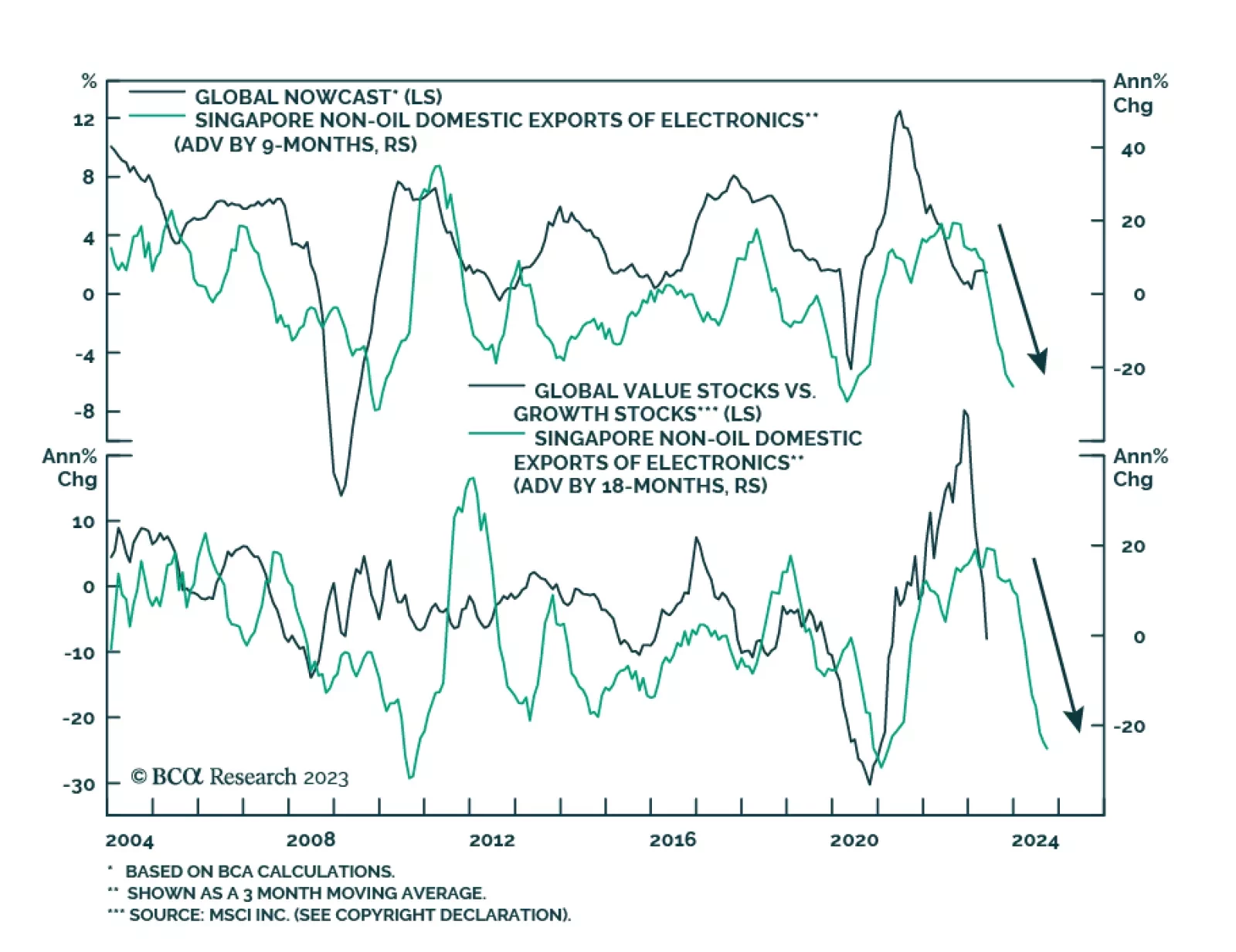

Singapore is a small open economy that is highly sensitive to fluctuations in the global manufacturing activity. As such, Singapore’s non-oil domestic exports (NODX) are a bellwether for global growth. Singapore’s…

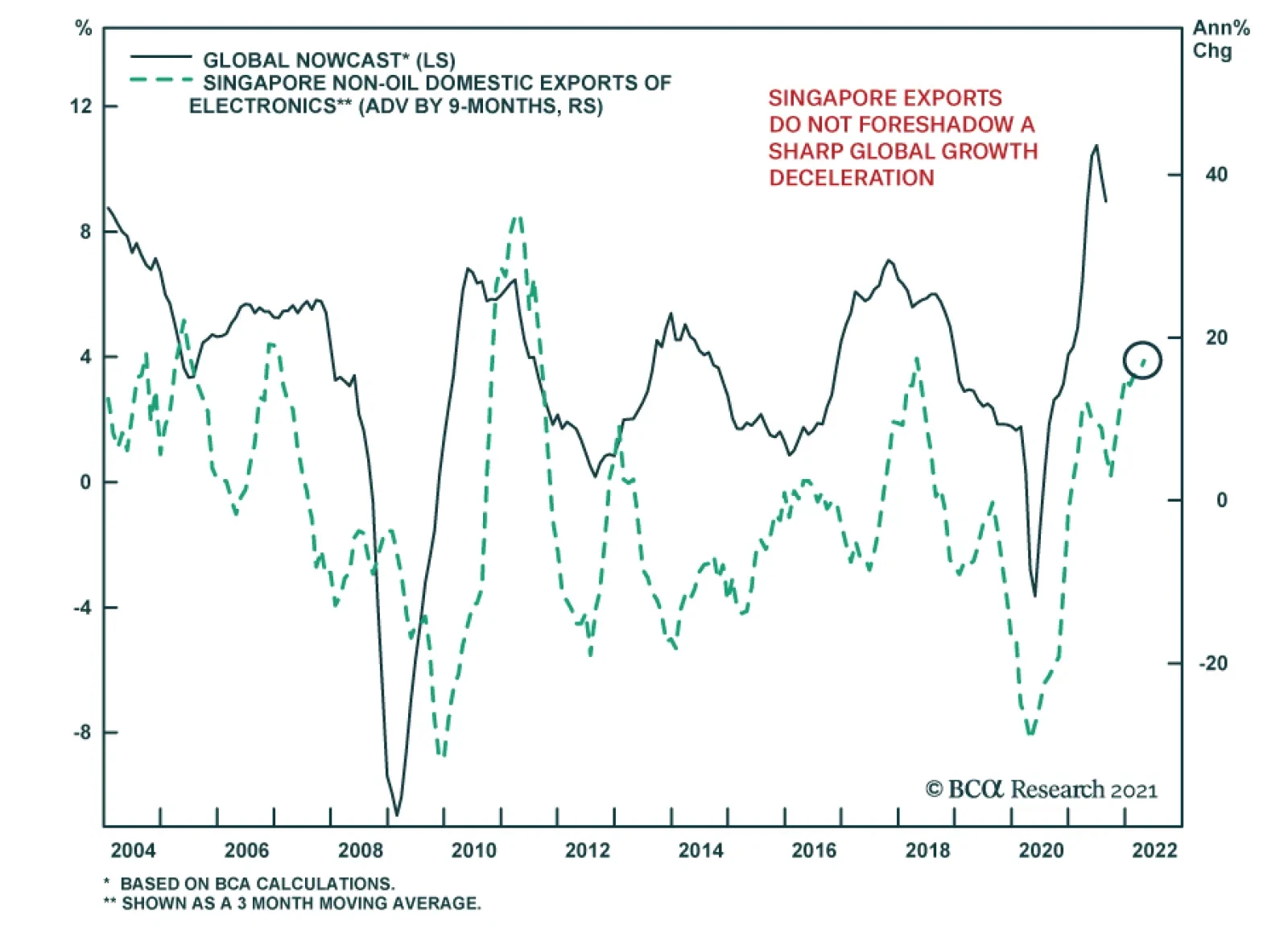

Singapore is a small open economy that is highly sensitive to fluctuations in global and Asian economic activity. This characteristic makes its exports a good bellwether for global growth. On this front, the upside surprise in…

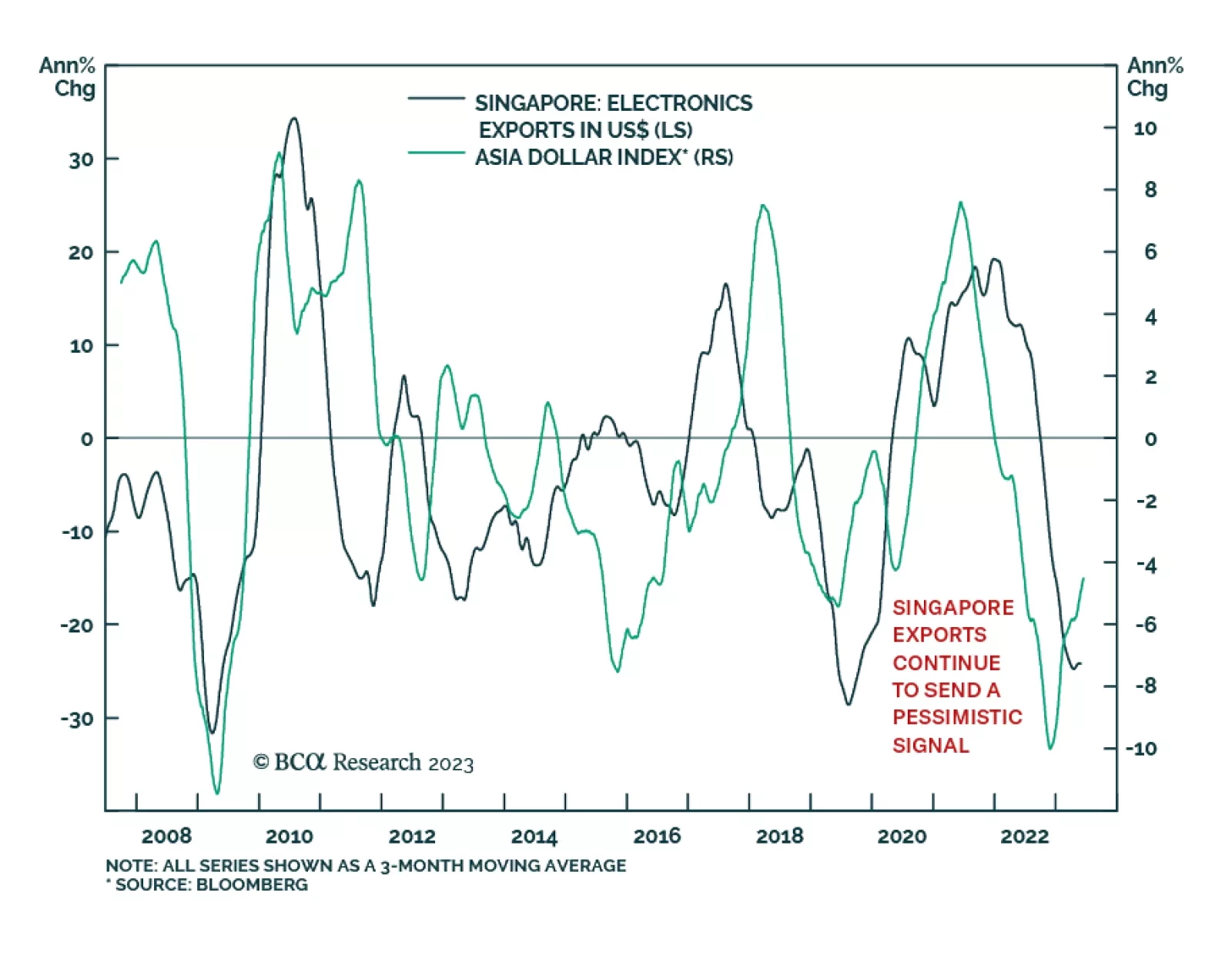

Singapore’s trade data continue to send a pessimistic signal about global manufacturing conditions. The year-over-year contraction in non-oil domestic exports (NODX) deepened to -15.5% y/y in June from -14.8% y/y –…

With easing inflation, Singapore’s domestic liquidity is set to improve meaningfully. Put this bourse on an upgrade watch list. A new trade: go overweight Singapore domestic bonds relative to EM.

Singapore’s exports have historically acted as a good gauge for the health of the global economy. As a small open economy that is extremely exposed to fluctuations in the Asian and global manufacturing cycles, Singapore…

Singapore’s trade numbers continue to send a warning for the global economy. The year-on-year pace of decline in non-oil domestic exports deepened in April after slowing in the prior two months. Importantly, the weakness…

Executive Summary Singapore stocks are at risk as an impending contraction in global trade will hurt this very open economy and its markets. The country’s foreign reserves are already shrinking as the balance of payments has…

Singapore is a small open economy that is extremely sensitive to fluctuations in the Asian and global manufacturing cycles. The country’s exports have historically been a good leading indicator of global economic activity. This…