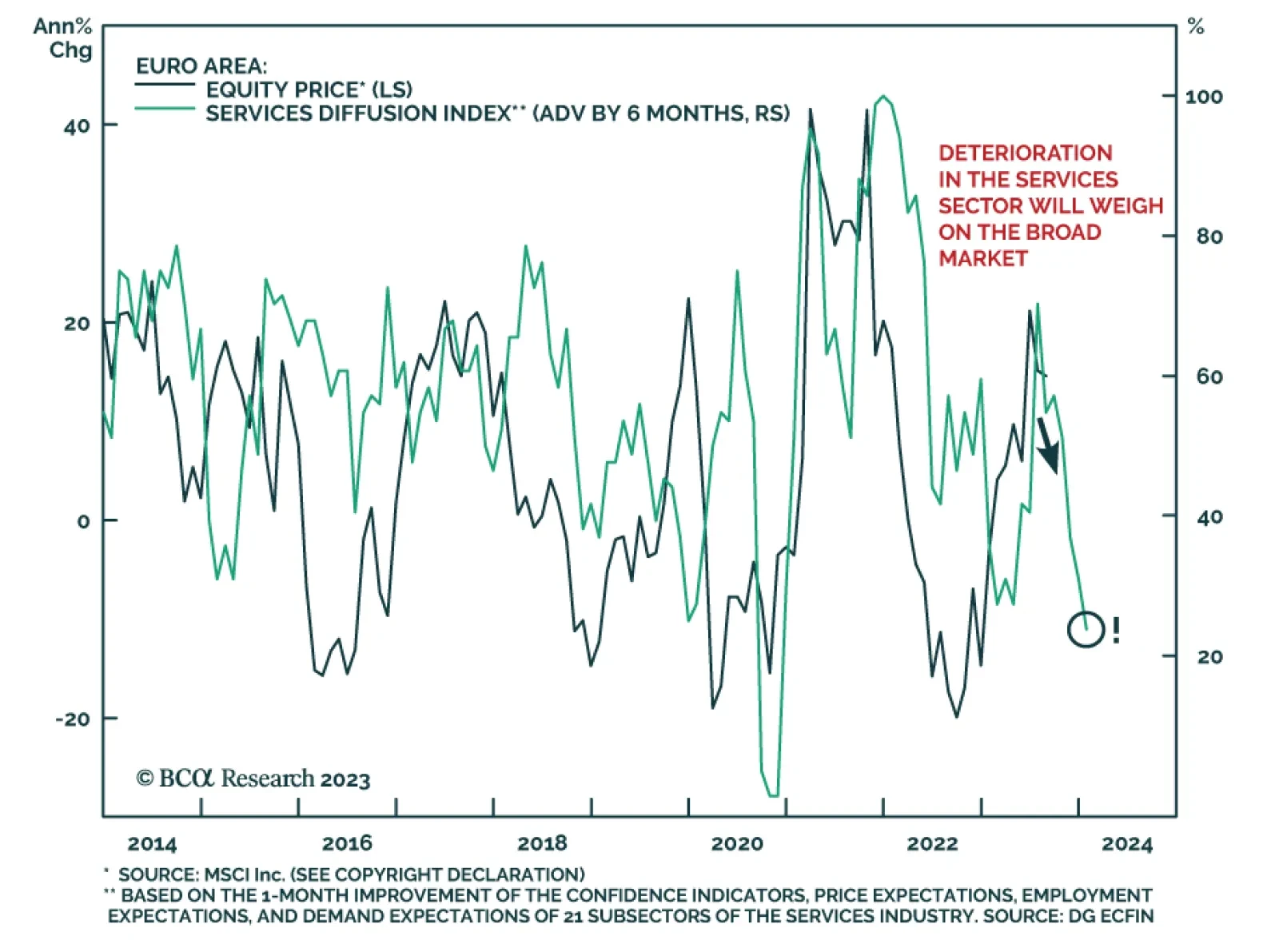

The Eurozone's economy remains soft. Yesterday we highlighted that M3 money supply fell by 0.4% y/y in July, a rate unseen since 2010. This decline was driven by a slowdown in private sector bank lending, which confirms broad…

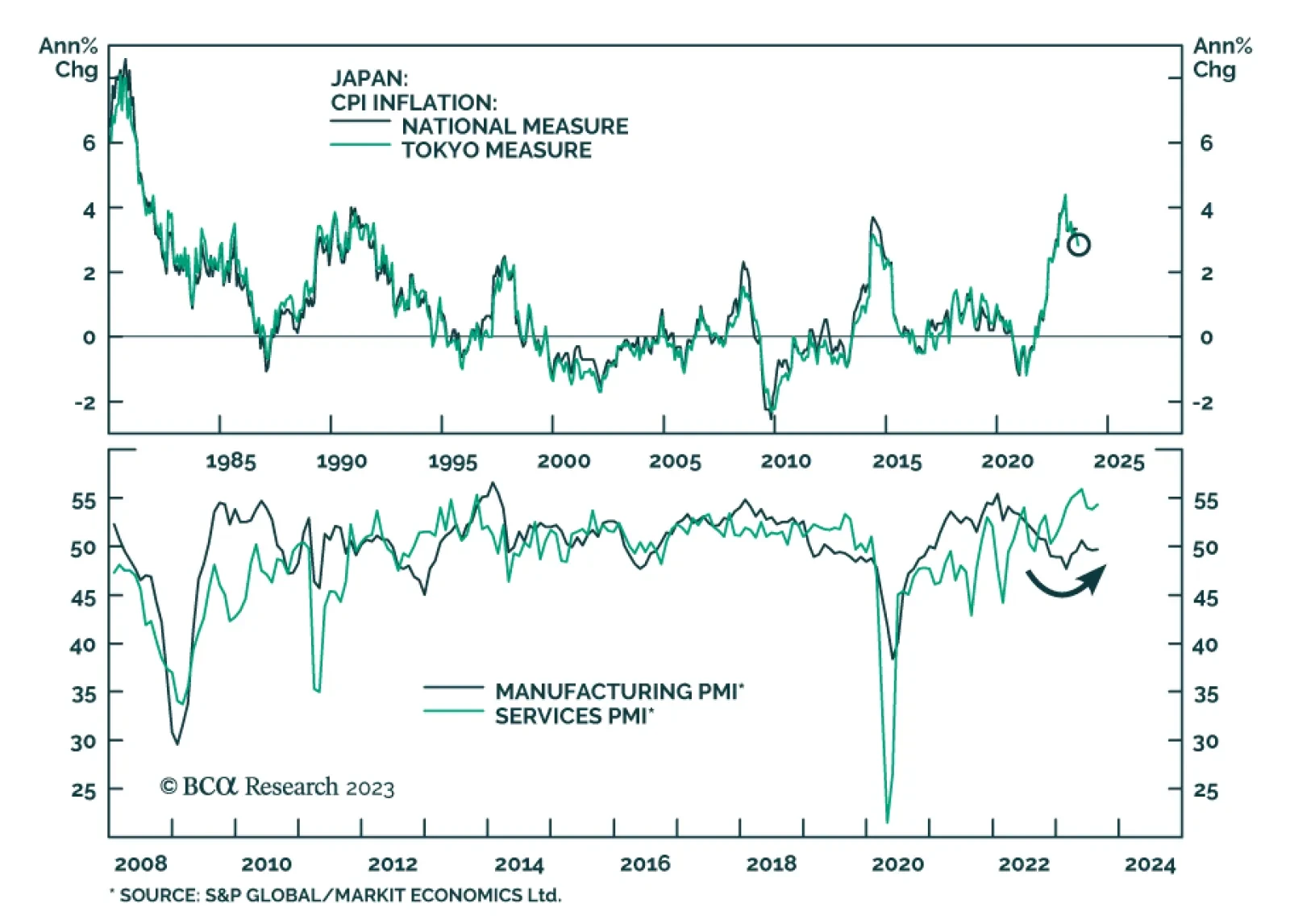

Tokyo’s headline CPI inflation fell below expectations in August, easing from 3.2% y/y to 2.9% y/y – slightly below anticipations of 3.0% y/y and the first dip below 3% in nearly one year. Similarly, the slowdown in…

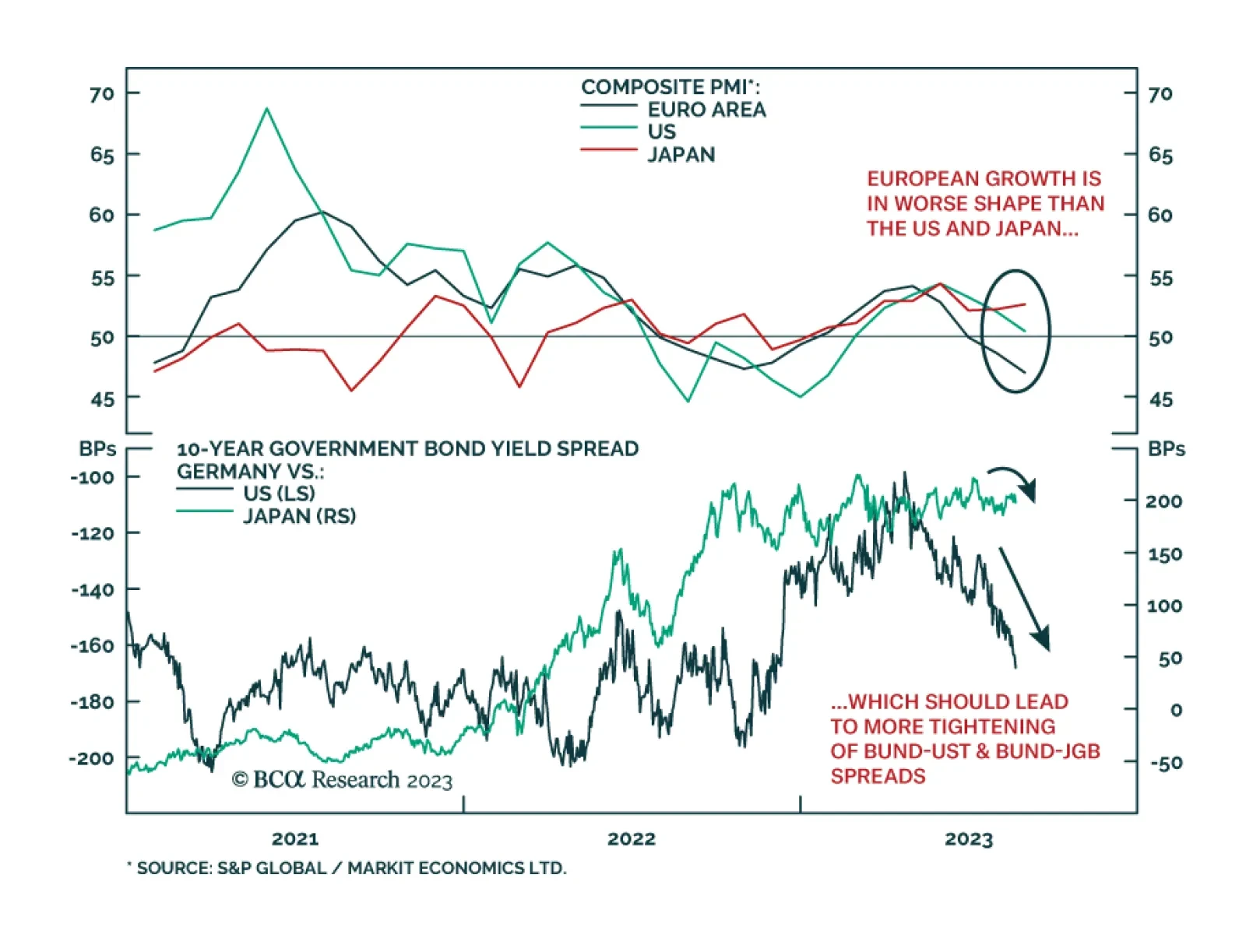

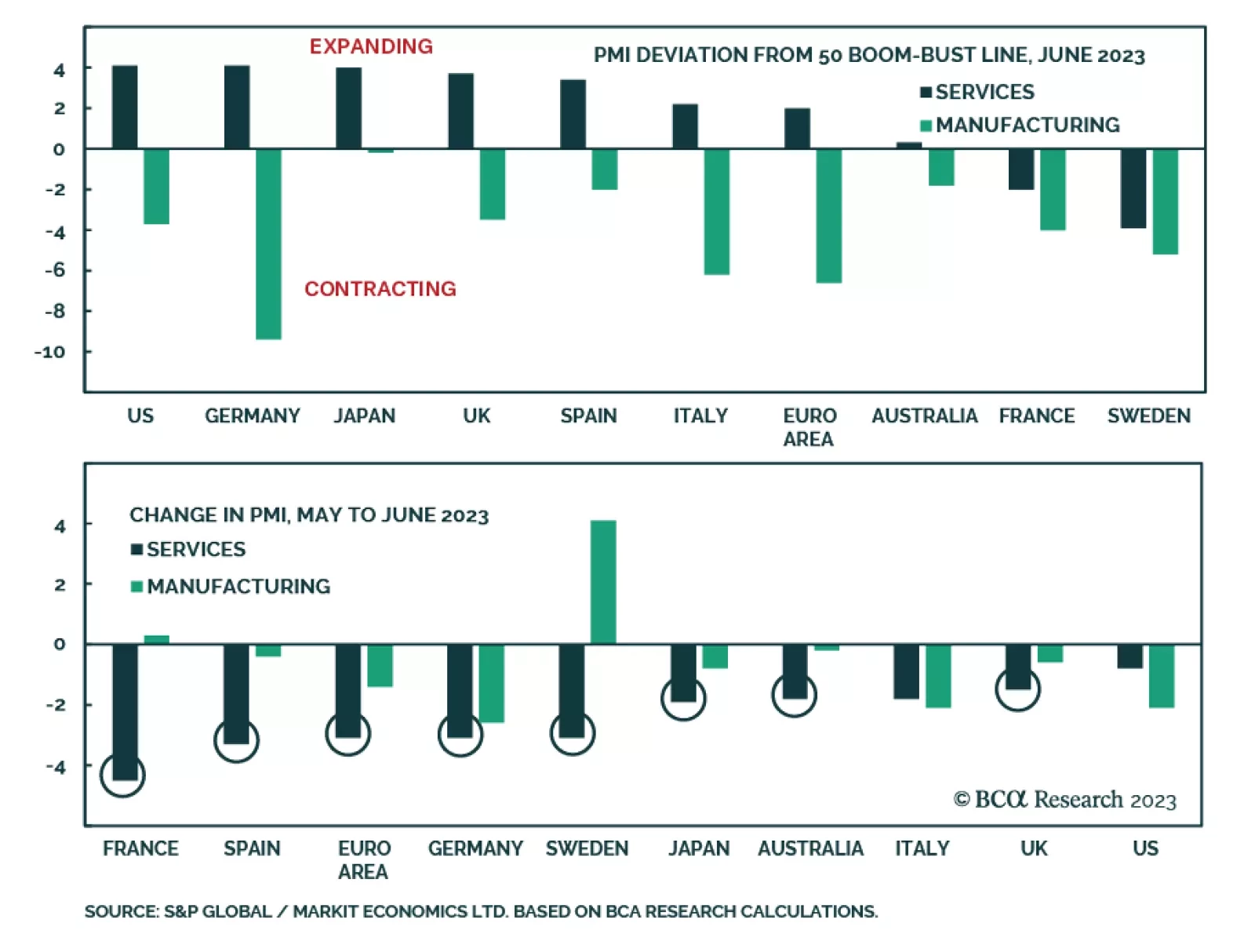

The flash August S&P Global PMI data released on Wednesday painted a picture of softer global growth, while also hinting that Europe is on the cusp of recession. The composite PMI for the euro area fell by 1.6 versus the…

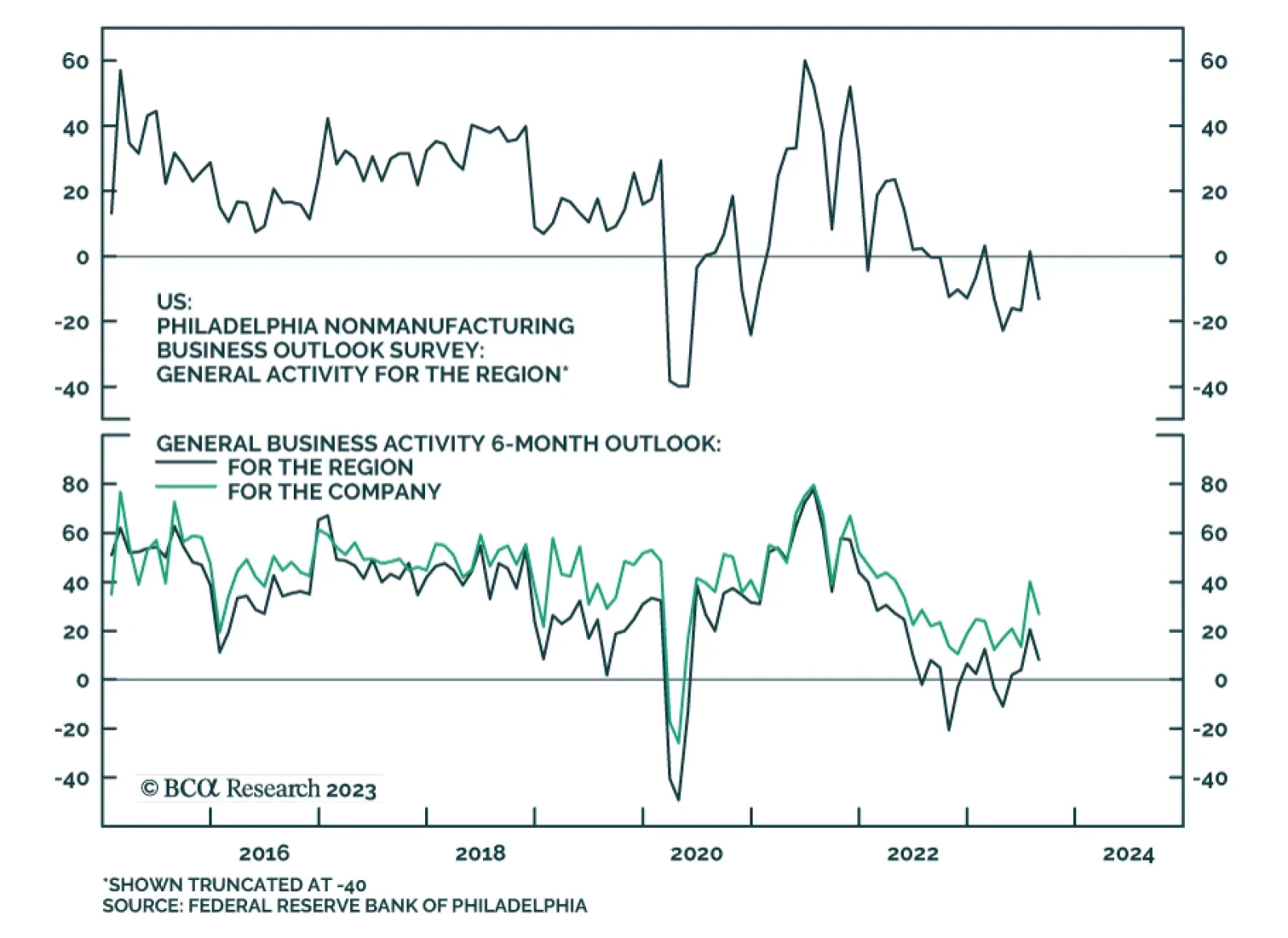

Yesterday we highlighted that the August update of the Philly Fed’s Nonmanufacturing Business Outlook survey sent a negative signal, with the New Orders, Sales, and Employment components all deteriorating. On Wednesday, the…

Results of the Philadelphia Fed’s August Nonmanufacturing Business Outlook Survey sent a negative signal on Tuesday. The diffusion index for firms’ assessment of general business activity across the region relapsed…

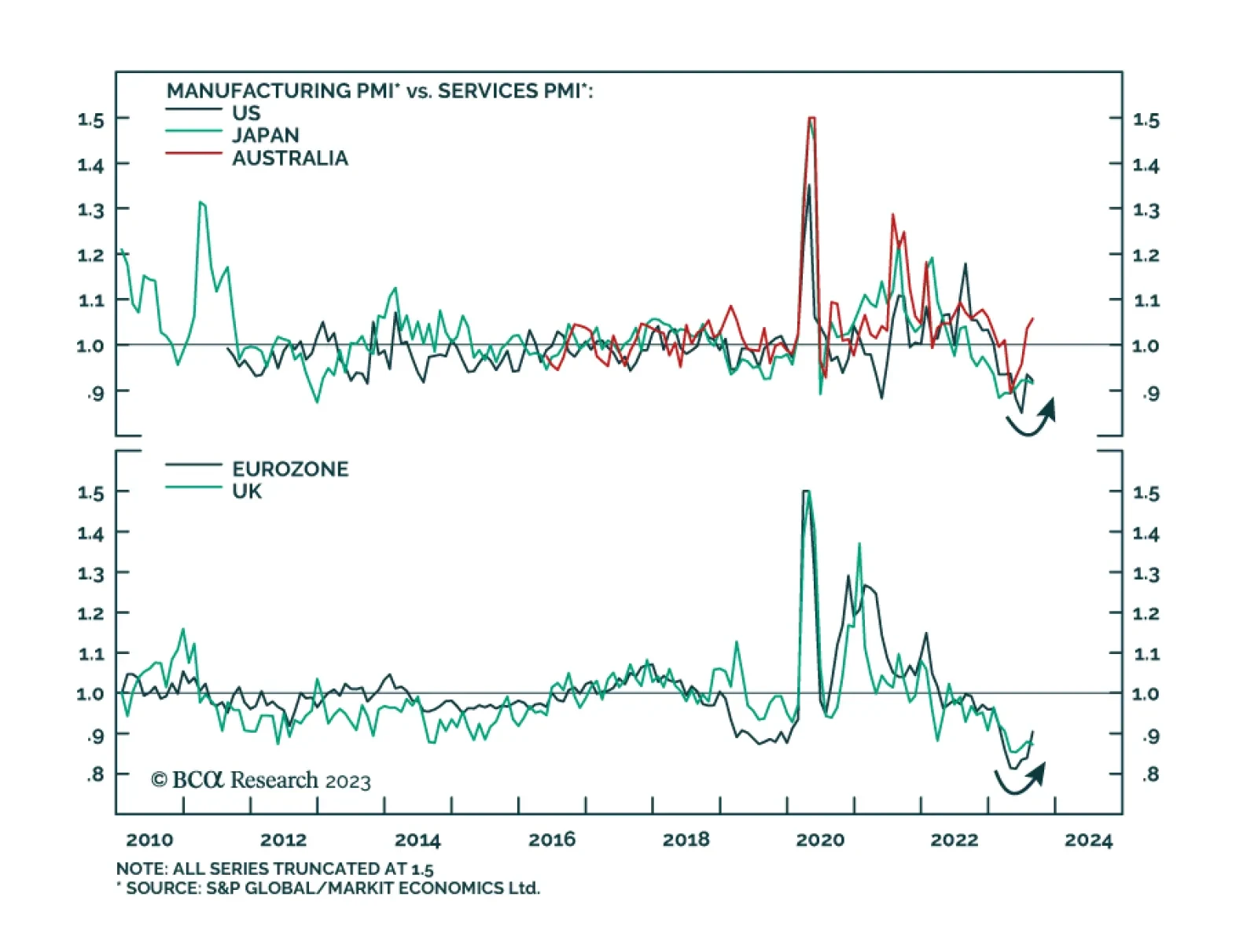

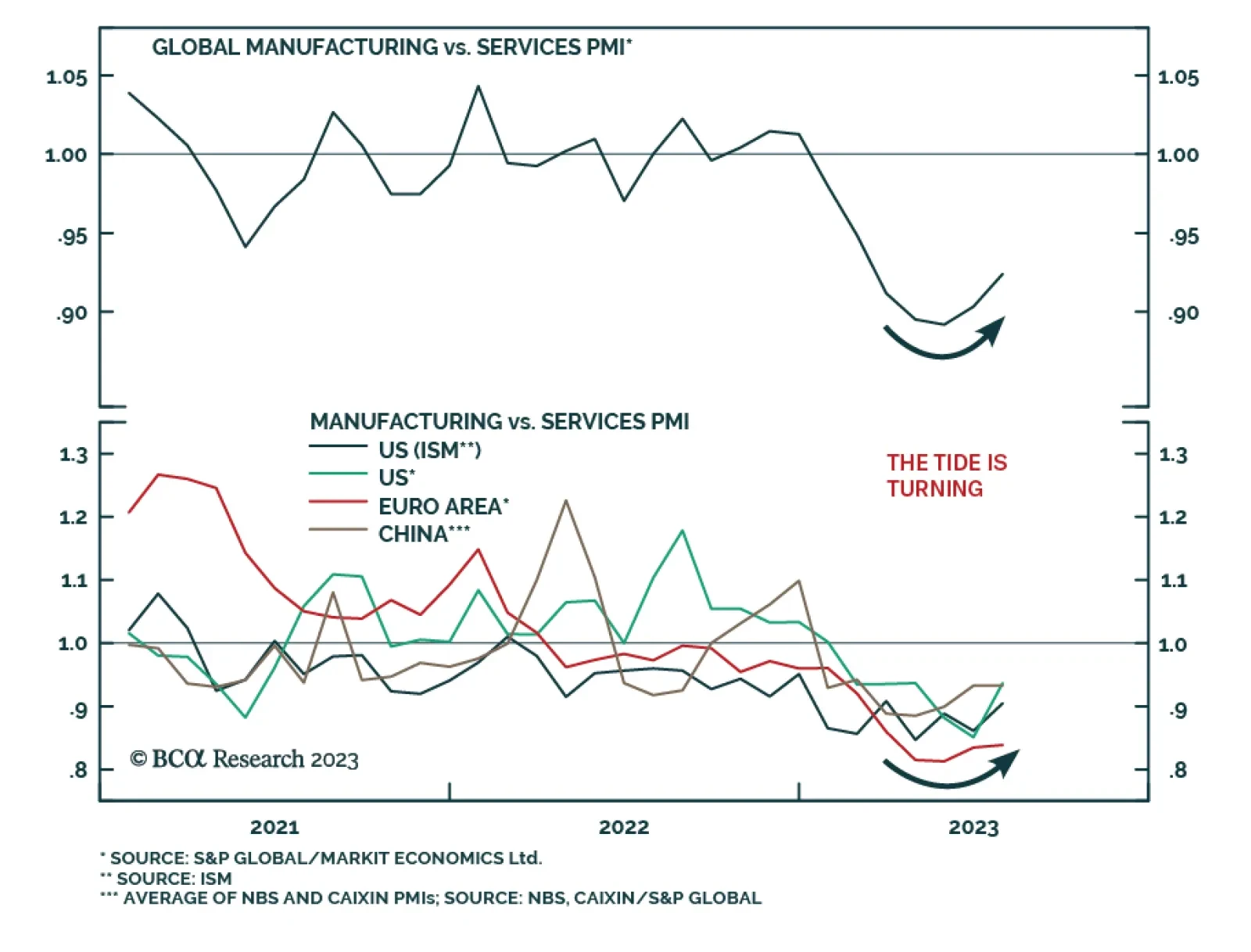

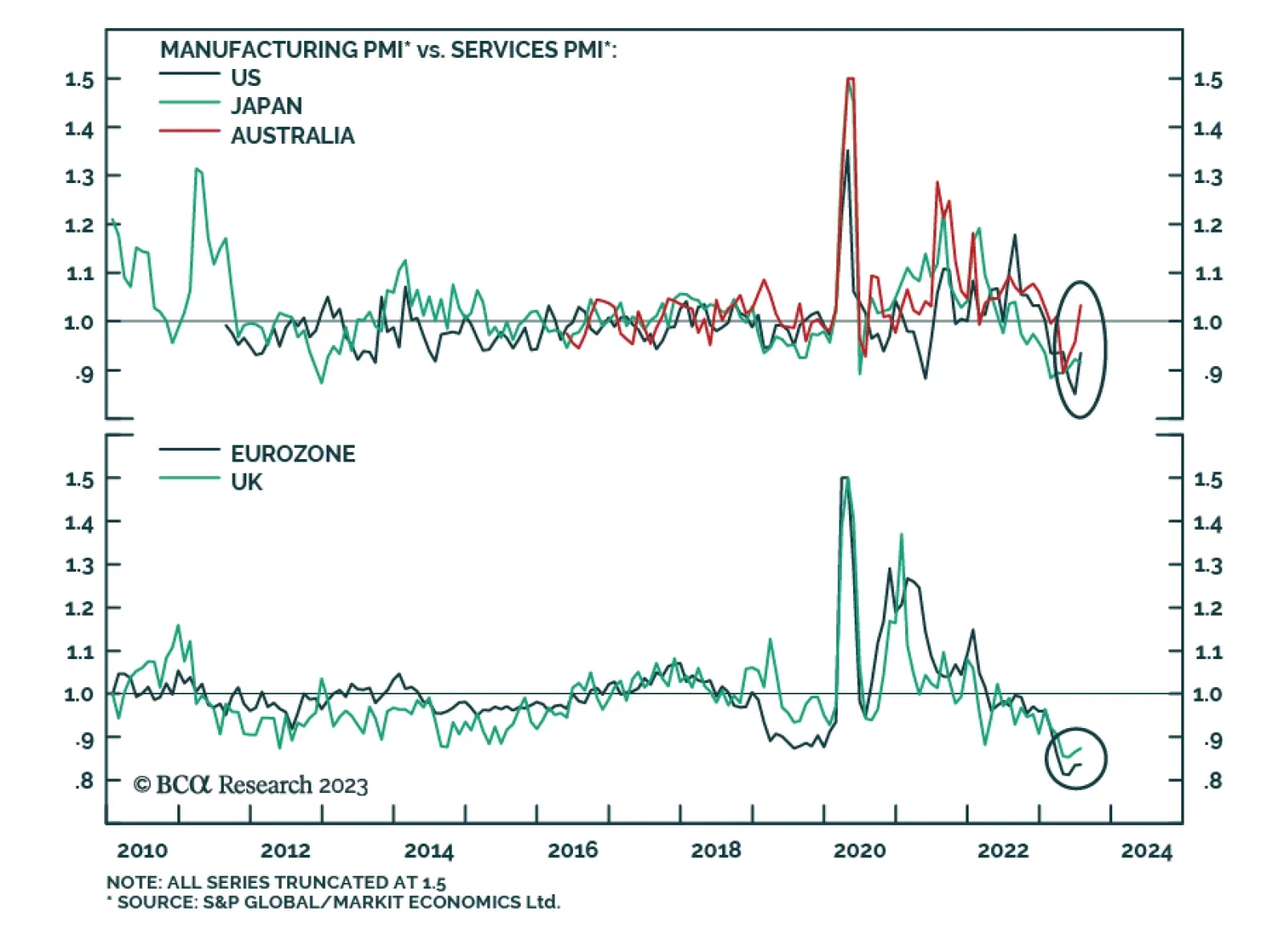

The first half of the year was characterized by a two-speed economy. Manufacturing bore the brunt of the weakness while the services sector remained resilient. However, the global composite PMI corroborates the signal from DM…

Flash PMIs sent a mixed signal about manufacturing and service sector conditions across DM economies in July. The Euro Area release was particularly weak. An unexpected 0.7-point decline in the Manufacturing PMI and a 0.9…

On one hand, China will be exporting deflation to the rest of the world. On the other hand, core inflation is sticky in the US, making the Fed err on the hawkish side. Altogether, these crosscurrents are creating a toxic mix for risk…

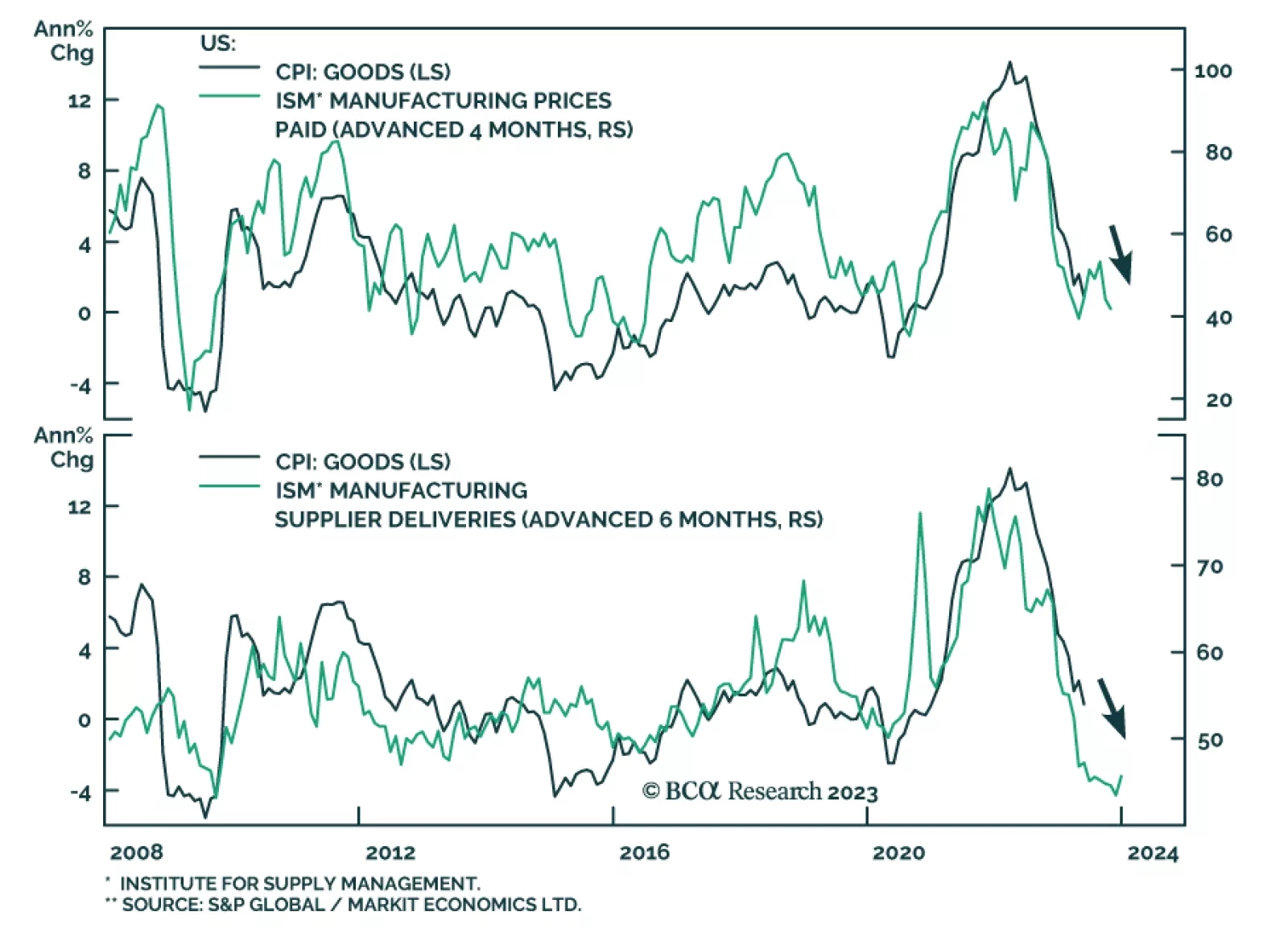

In the past we have highlighted a dichotomy in the global economy characterized by weak manufacturing conditions versus a robust service sector. As goods spending normalized from the pandemic binge, consumption of services…

The ISM PMI sent a pessimistic signal about US manufacturing conditions in June. The headline index dropped 0.9 points to a 3-year low of 46.0 – it eighth consecutive month below the 50 boom-bust line. This is consistent…