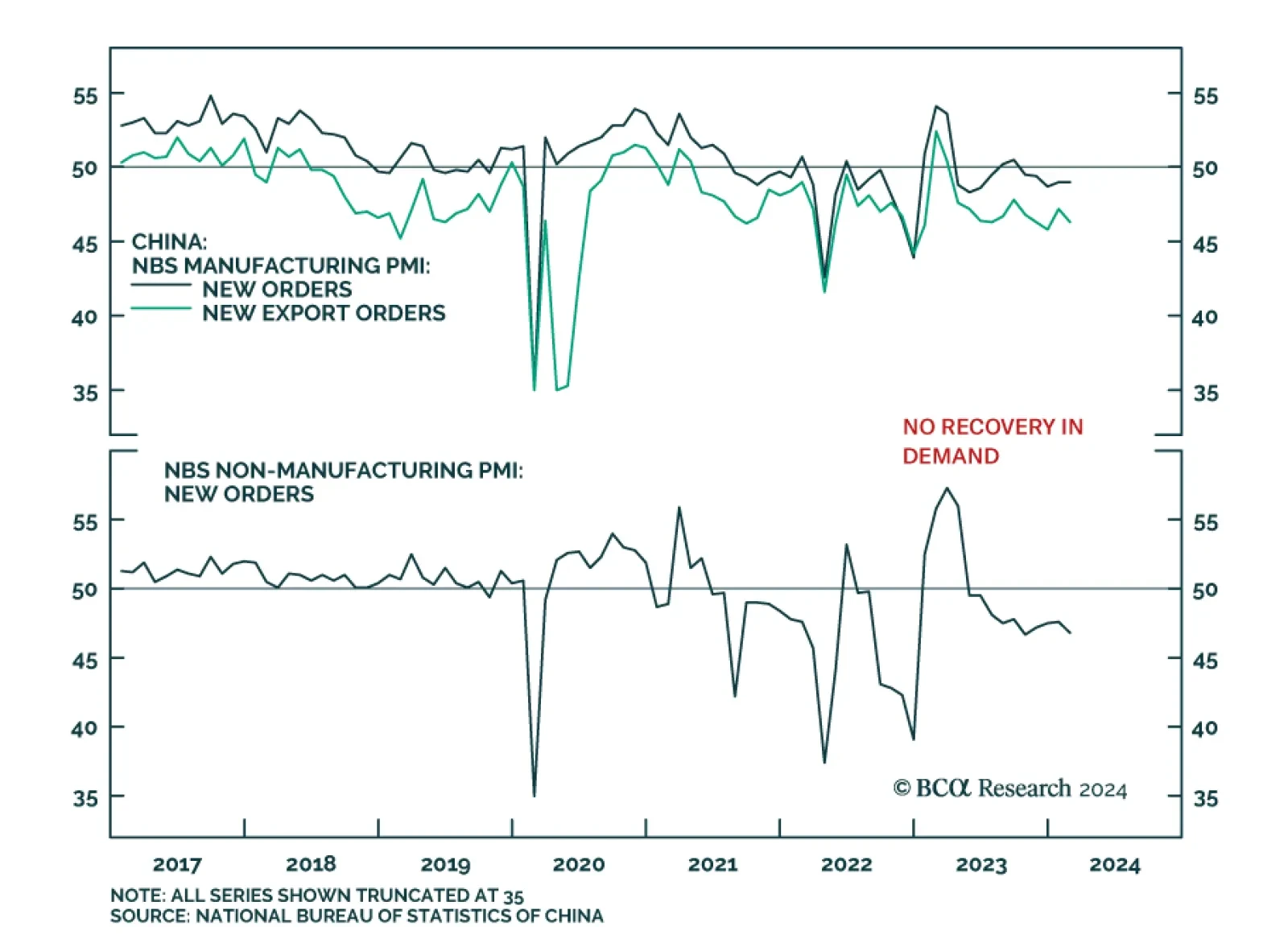

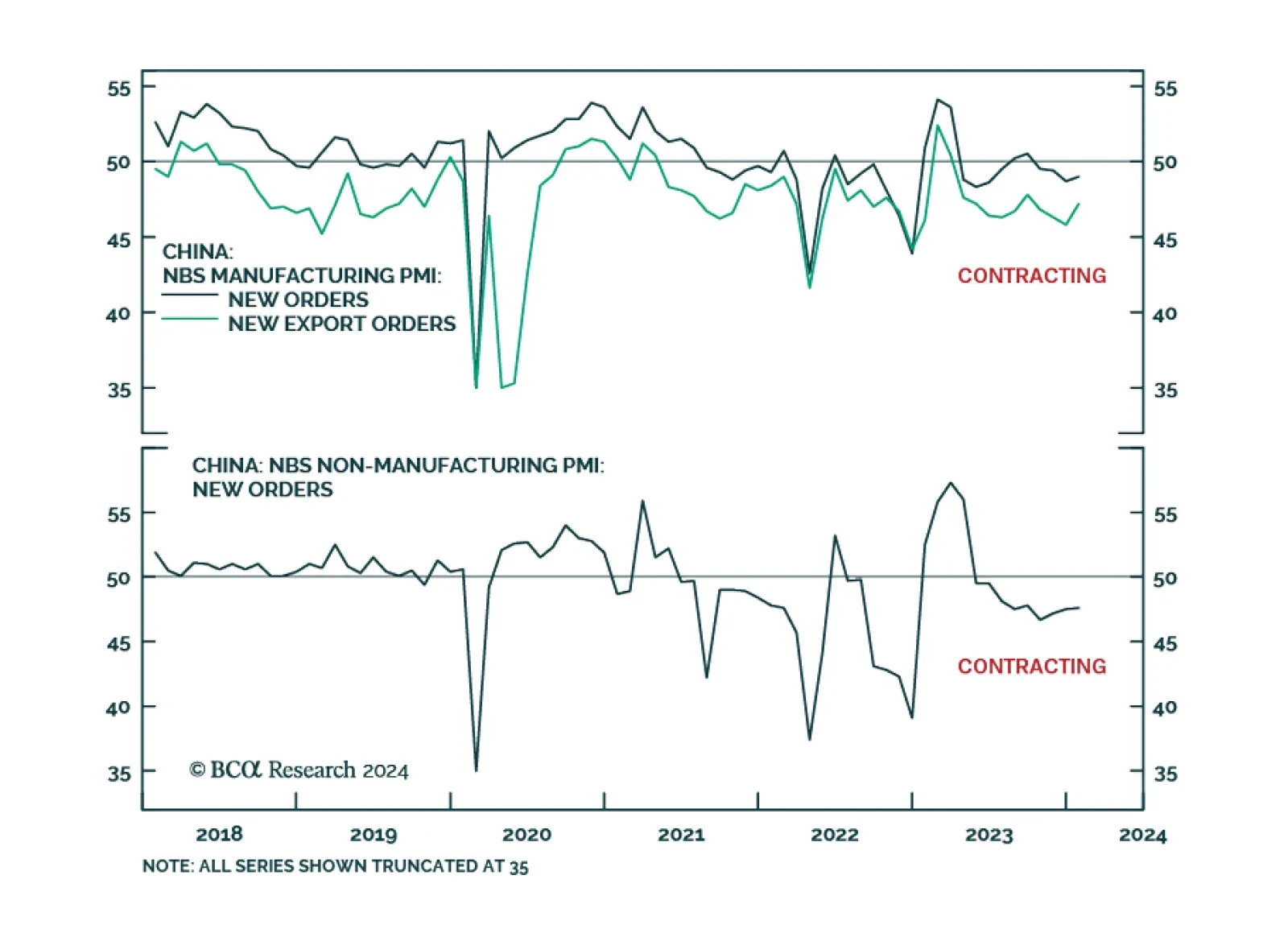

China’s NBS PMI release indicates that the Chinese growth is stabilizing at a low level. The composite PMI came in at 50.9 – unchanged from January. The stabilization was led by the non-manufacturing sector though…

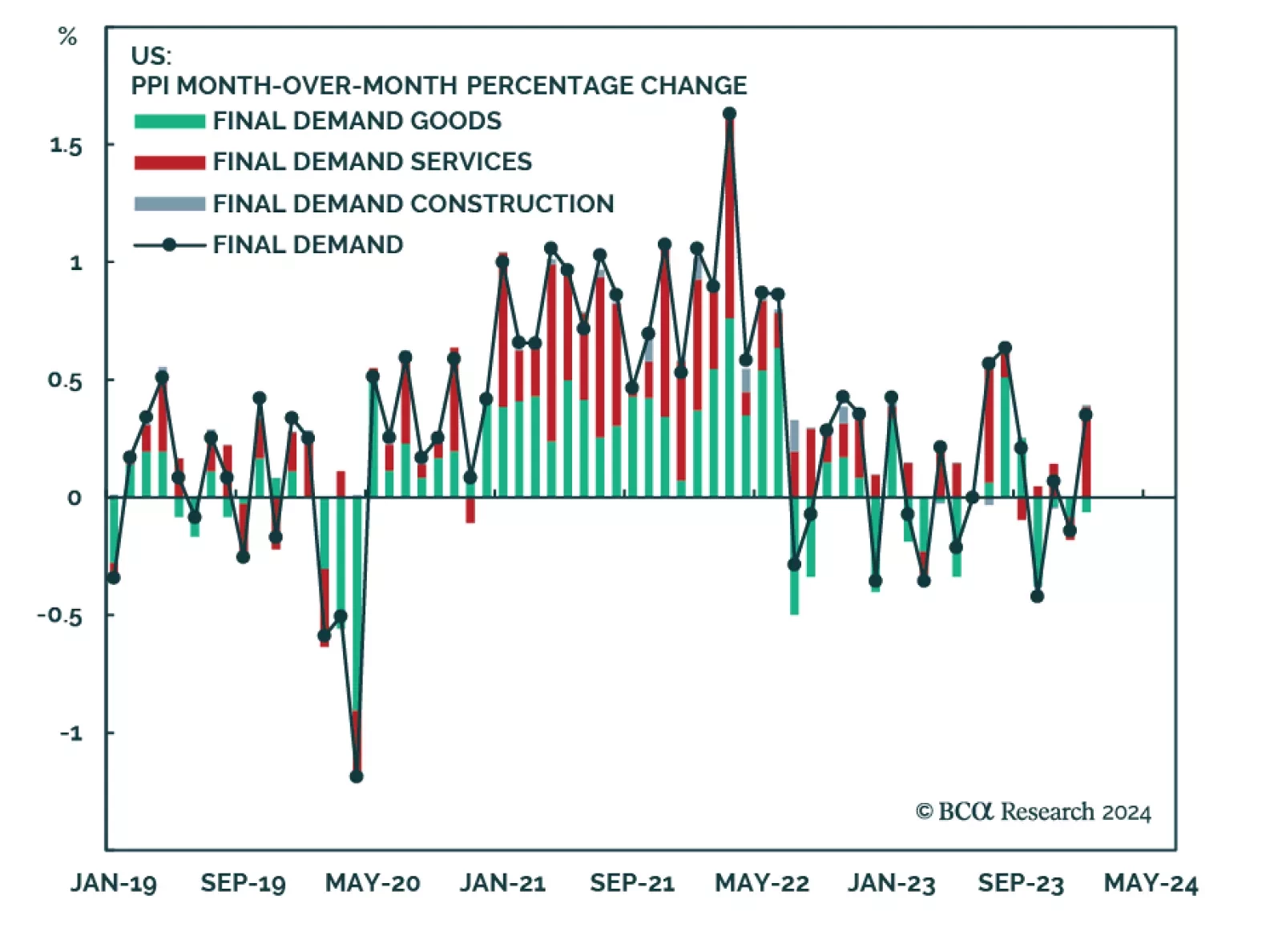

The hotter-than-anticipated US PPI report for January prompted a selloff in Treasuries on Friday. The monthly and annual changes in both the headline as well as the core measures of final demand PPI came in above expectations.…

China’s official NBS PMI indicates that growth conditions remain sluggish. Although the composite index ticked up from 50.3 to 50.9, it is still barely in expansionary territory. Notably, the manufacturing PMI – which…

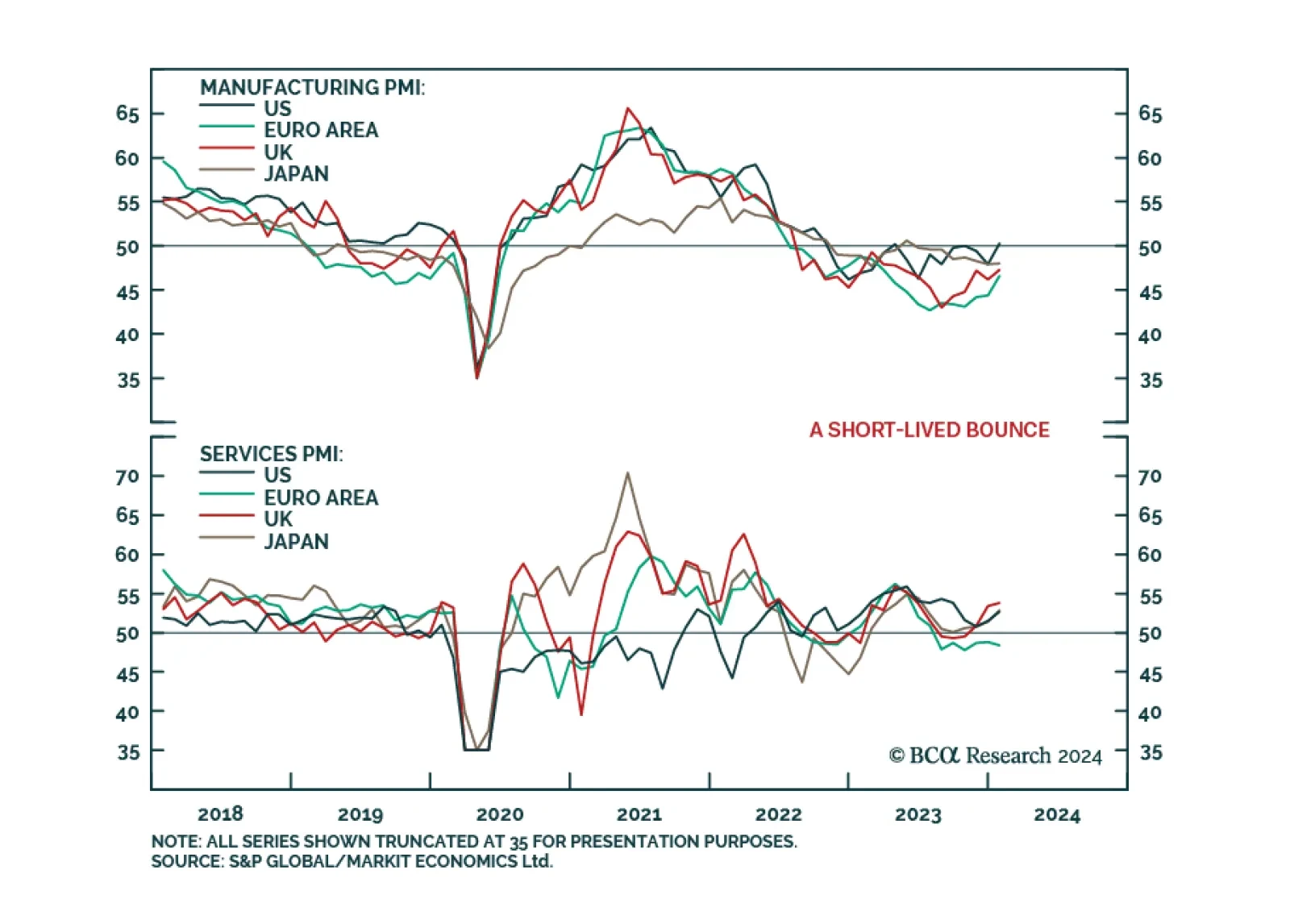

Flash PMIs sent a generally positive update on economic activity across major DM economies in January – particularly in the case of manufacturing. In the US, the composite index rose to a 7-month high of 52.3, beating…

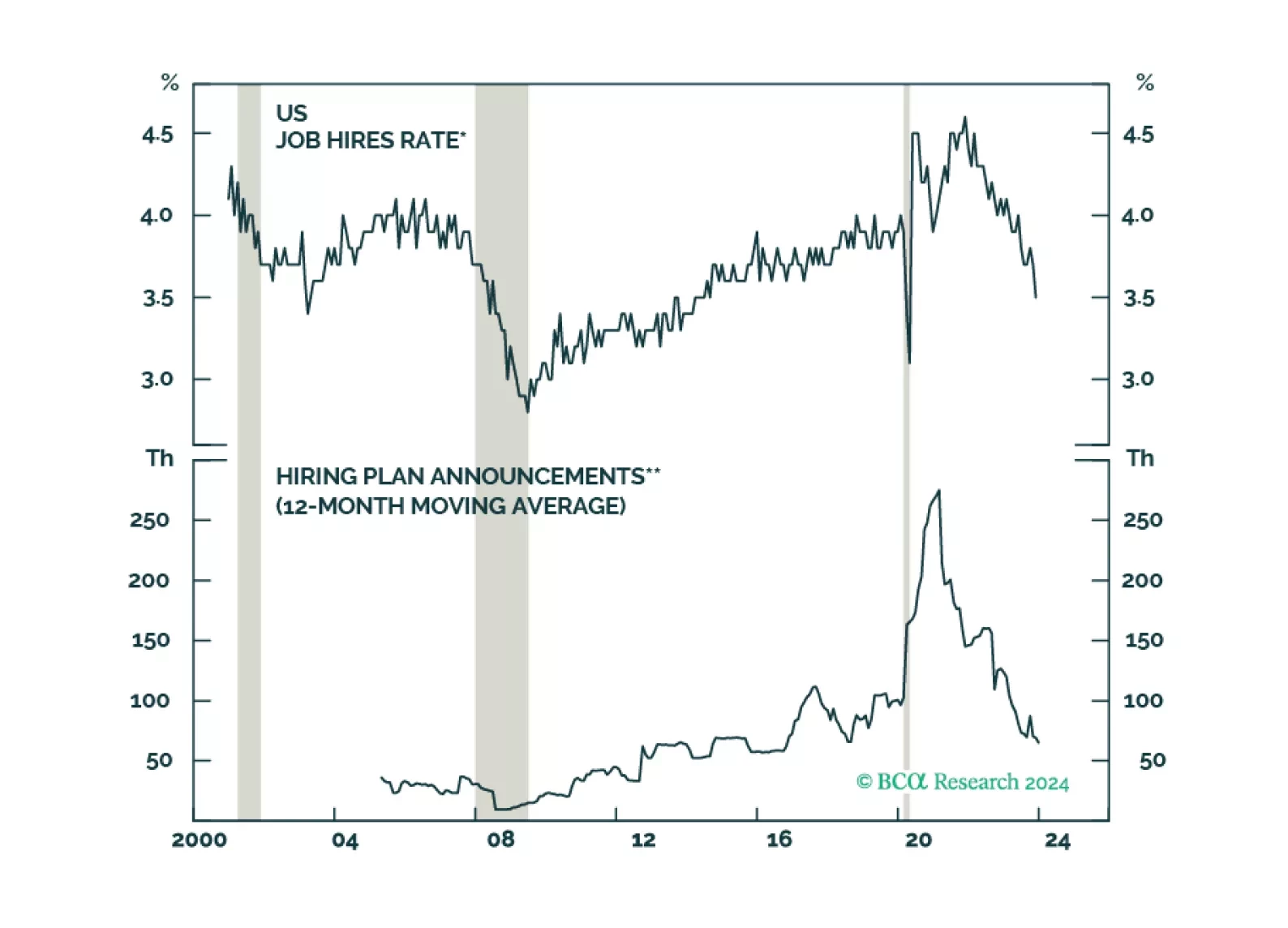

Investors have taken comfort in the fact that unemployment has remained low in the major economies. But underneath the surface, there are clear signs that labor demand is weakening. The clock keeps ticking towards our H2 2024…

The market’s pricing of a soft landing means that geopolitical risks are becoming more, not less, relevant in 2024. US domestic divisions will invite challenges as foreign powers rightly fear that US policy will turn more hawkish…

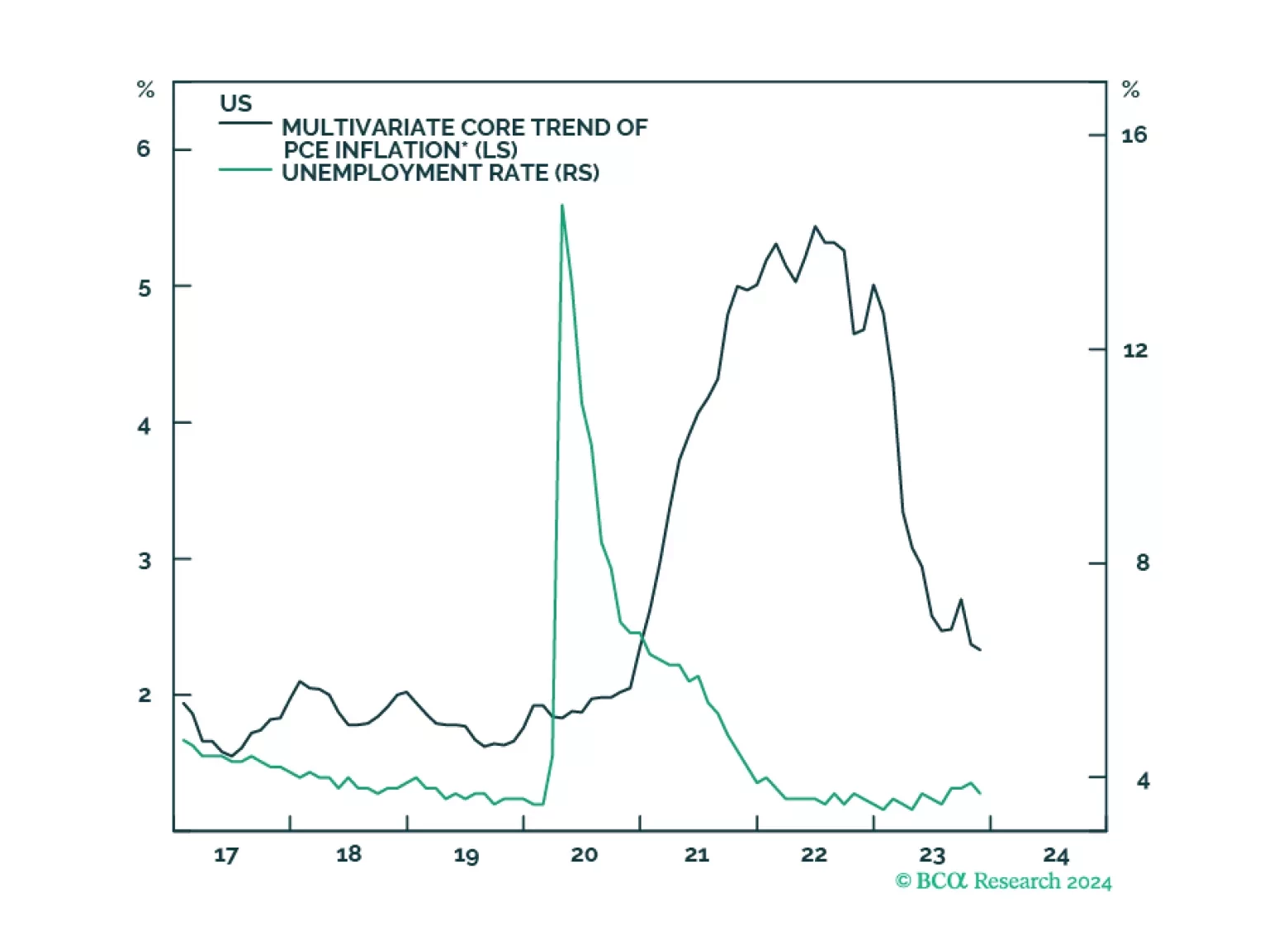

A soft landing can be achieved but not maintained. We are cutting our tactical recommendation on stocks from overweight to neutral and scaling back our long-duration stance.

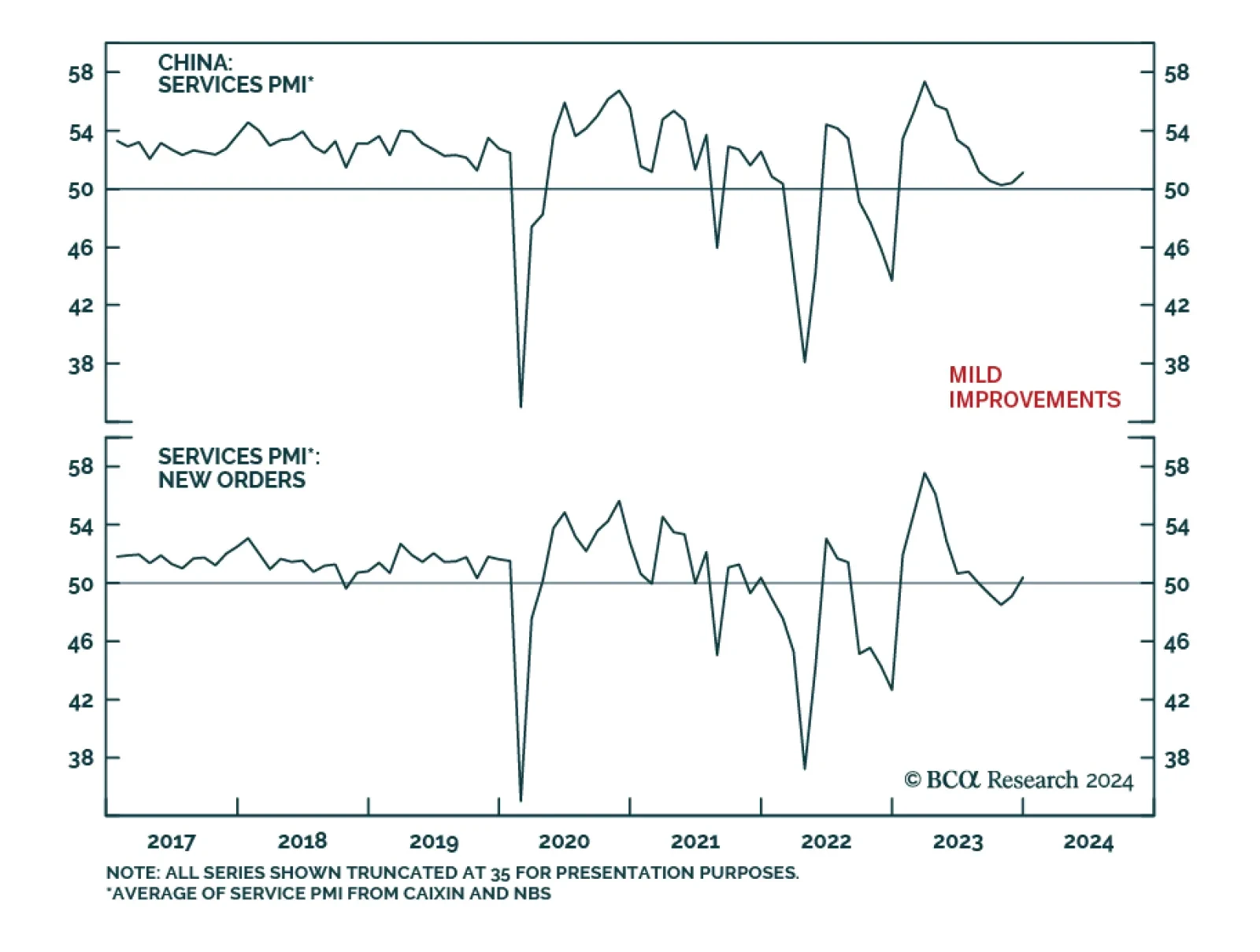

China’s Caixin PMI delivered a positive signal on Thursday. The Services index climbed from 51.5 to 52.9 in December, beating expectations it would remain more or less unchanged. The improvement in the Services PMI lifted…

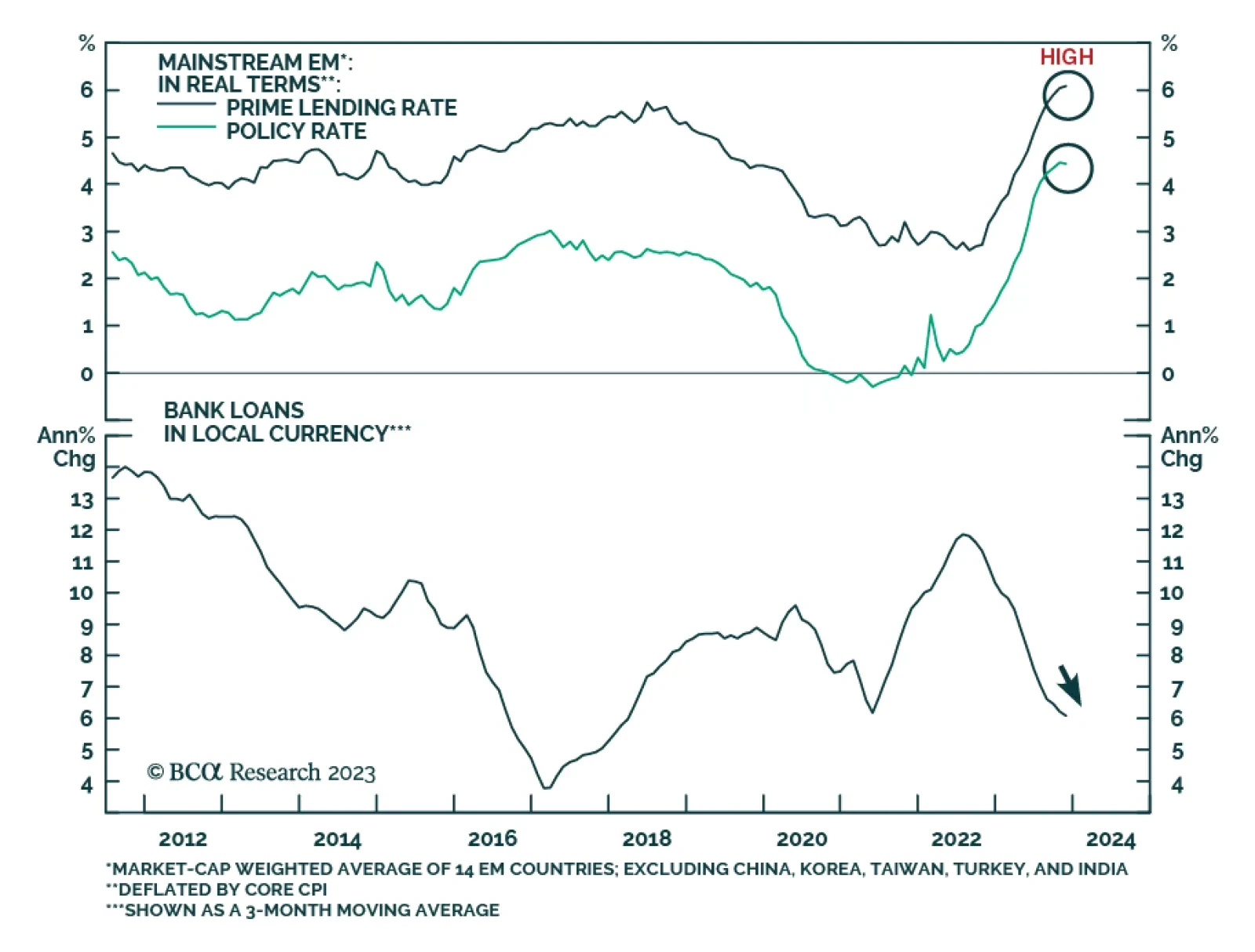

According to BCA Research’s Emerging Markets Strategy service, domestic demand and corporate profits will disappoint across mainstream Emerging Market economies (excluding China, India, Korea, and Taiwan) in H1 2024.…

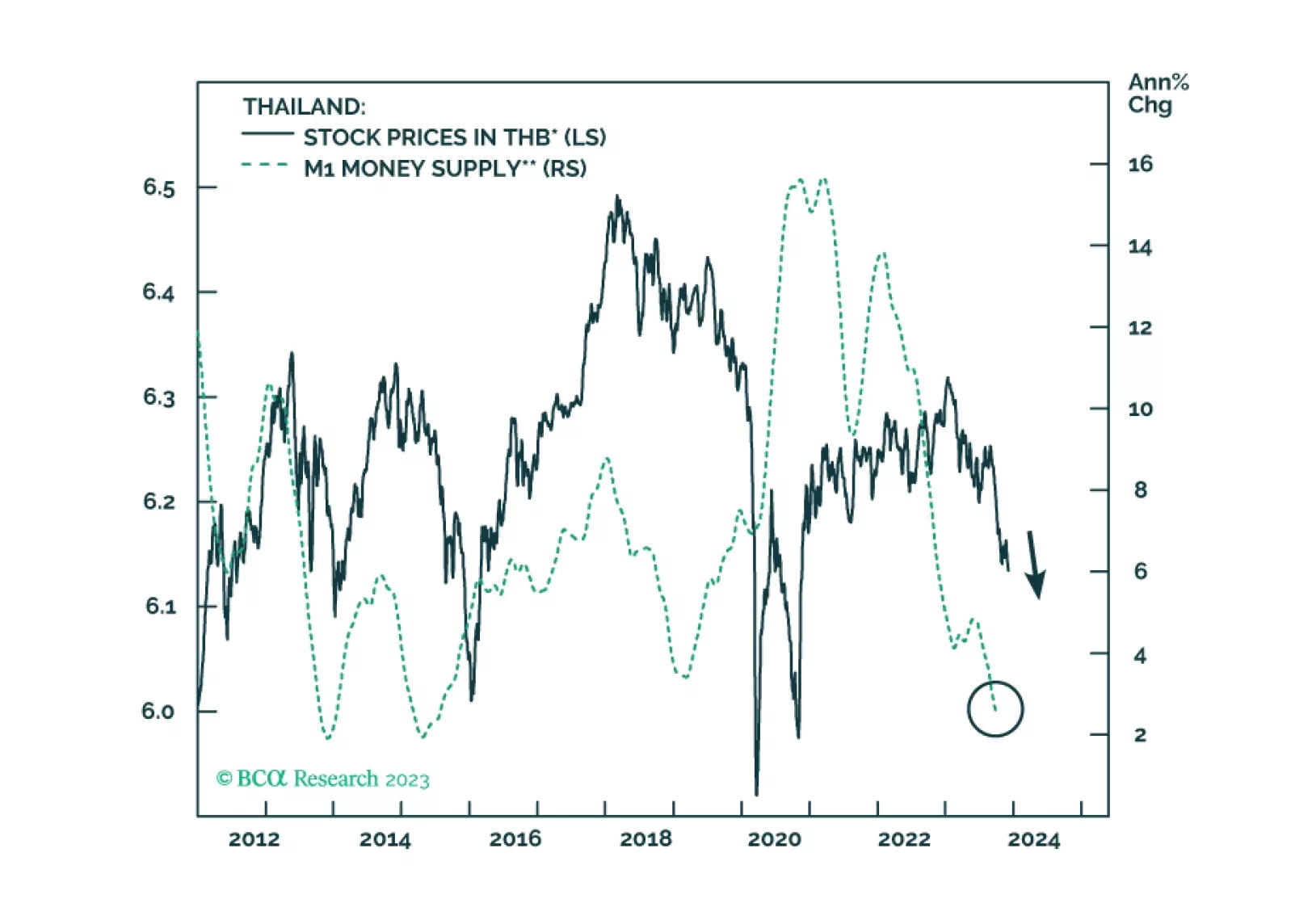

Meager credit growth and shrinking real wages will keep Thai inflation very low in the coming months. The currency will get support from an improving current account surplus. Fixed-income investors should upgrade Thailand from…