The combination of a global manufacturing recession and tight/tightening policy is raising a red flag for global non-TMT stocks. In China, households are entering a liquidity trap, and deflationary pressures are heightening.…

Our US Equity Strategy service looks back at their performance for the first half of the year and assesses what they hit or missed so far and comments on the ongoing rally in the stock market. The team hit on the economic…

Global non-TMT stocks are at risk of a relapse given worsening conditions in global manufacturing and still hawkish policies from the Fed and ECB. According to the preliminary release, manufacturing PMI new orders for advanced…

Momentum, high cash balances, FOMO, and expectations of soft landing drive the market higher. This rally may continue for a while, but macroeconomic headwinds are intensifying and will eventually derail the rally. It is too early to…

A benign disinflation will support equities over the next few quarters. Stocks will fall next year as a recession begins when investors least expect it.

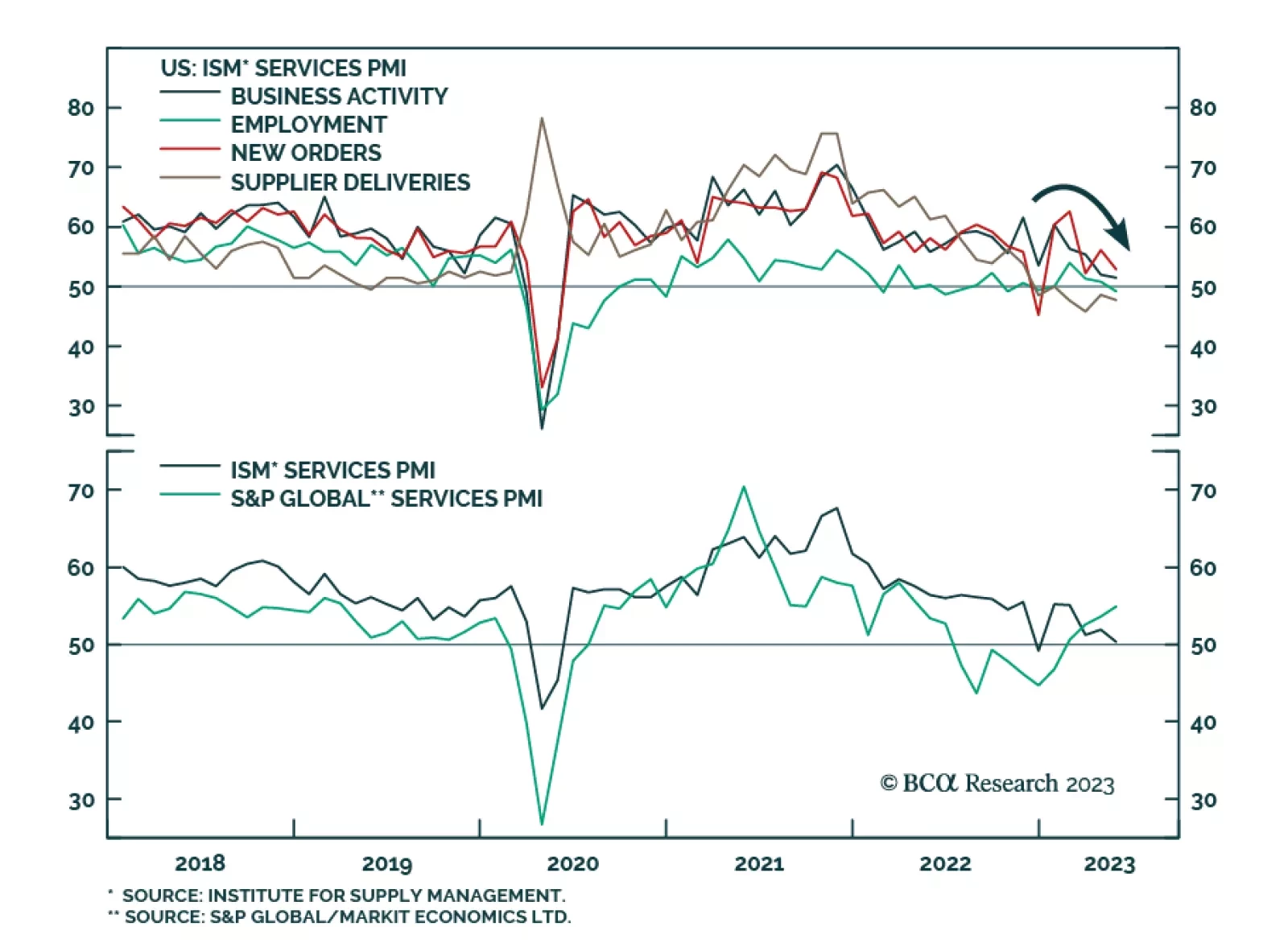

The ISM PMI sent a disappointing signal about US service sector activity in May. The headline index unexpectedly fell from 51.9 to 50.3 – the weakest level since December and surprising expectations of an improvement to 52.…

Indian EPS growth is set for major disappointments vis-à-vis the lofty expectations. Weak domestic demand amid tight fiscal and monetary policy entails more downside in stock prices. Stay underweight.

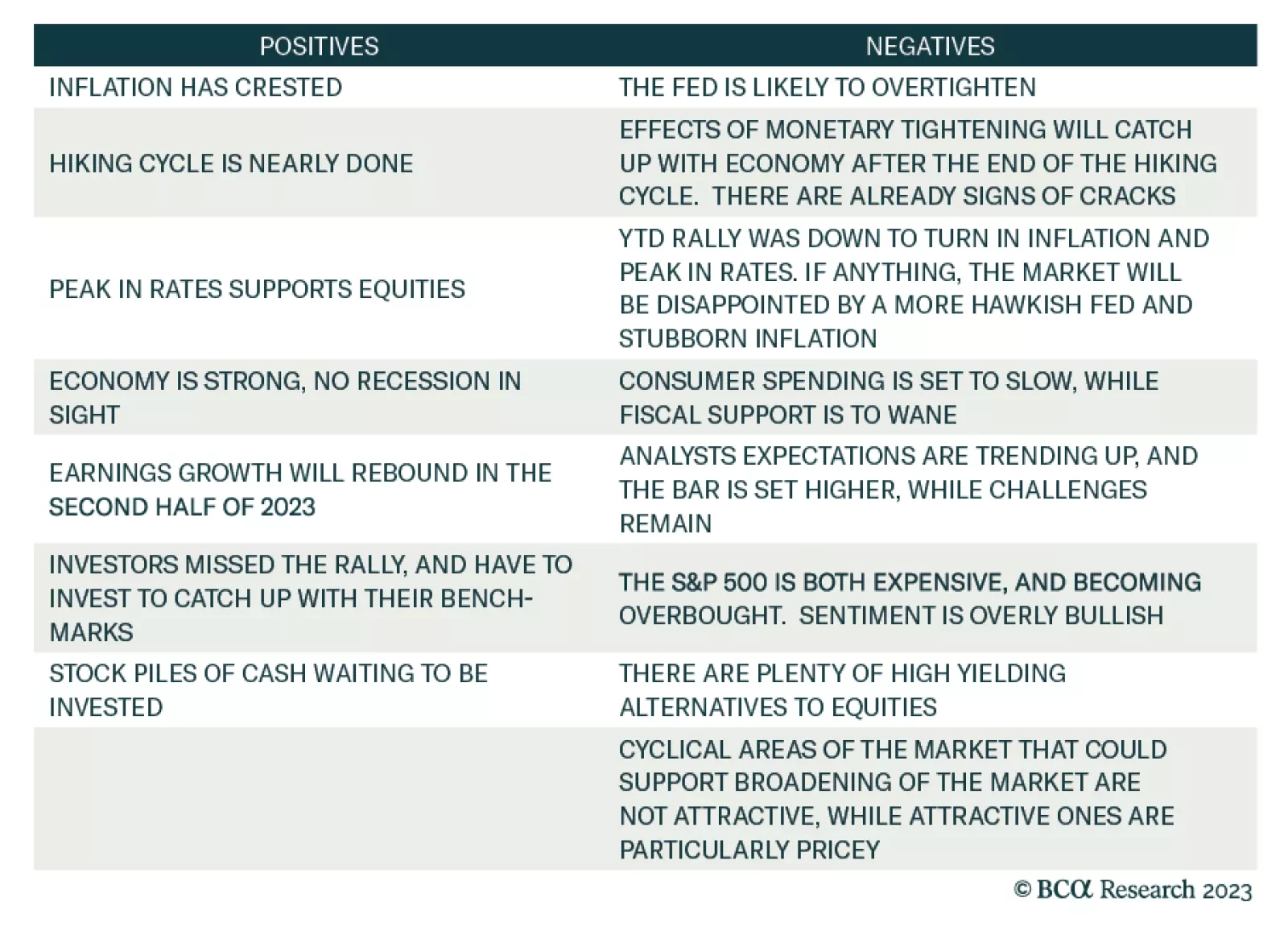

The most important question investors need to answer is whether this is the right time to shift the portfolio to a more aggressive and cyclical stance now that the end of the hiking cycle is in sight. To answer this question, we…

In this Strategy Outlook, we present the major investment themes and views we see playing out next year and beyond.