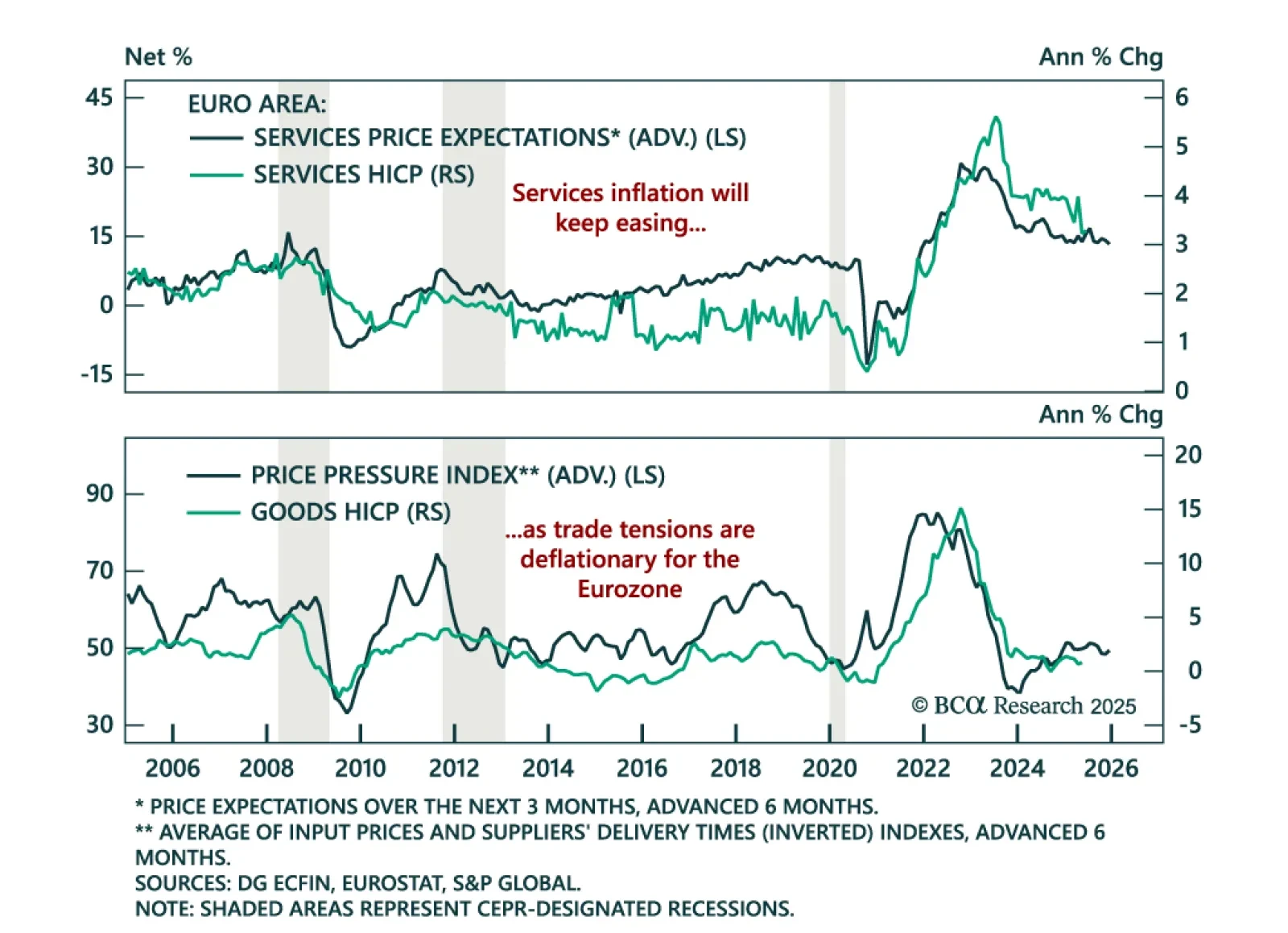

June Eurozone inflation data and soft growth backdrop support further ECB easing and reinforce the case for long European bond exposure. Flash HICP inflation ticked up to 2.0% y/y from 1.9%, while core inflation held steady at 2.3%,…

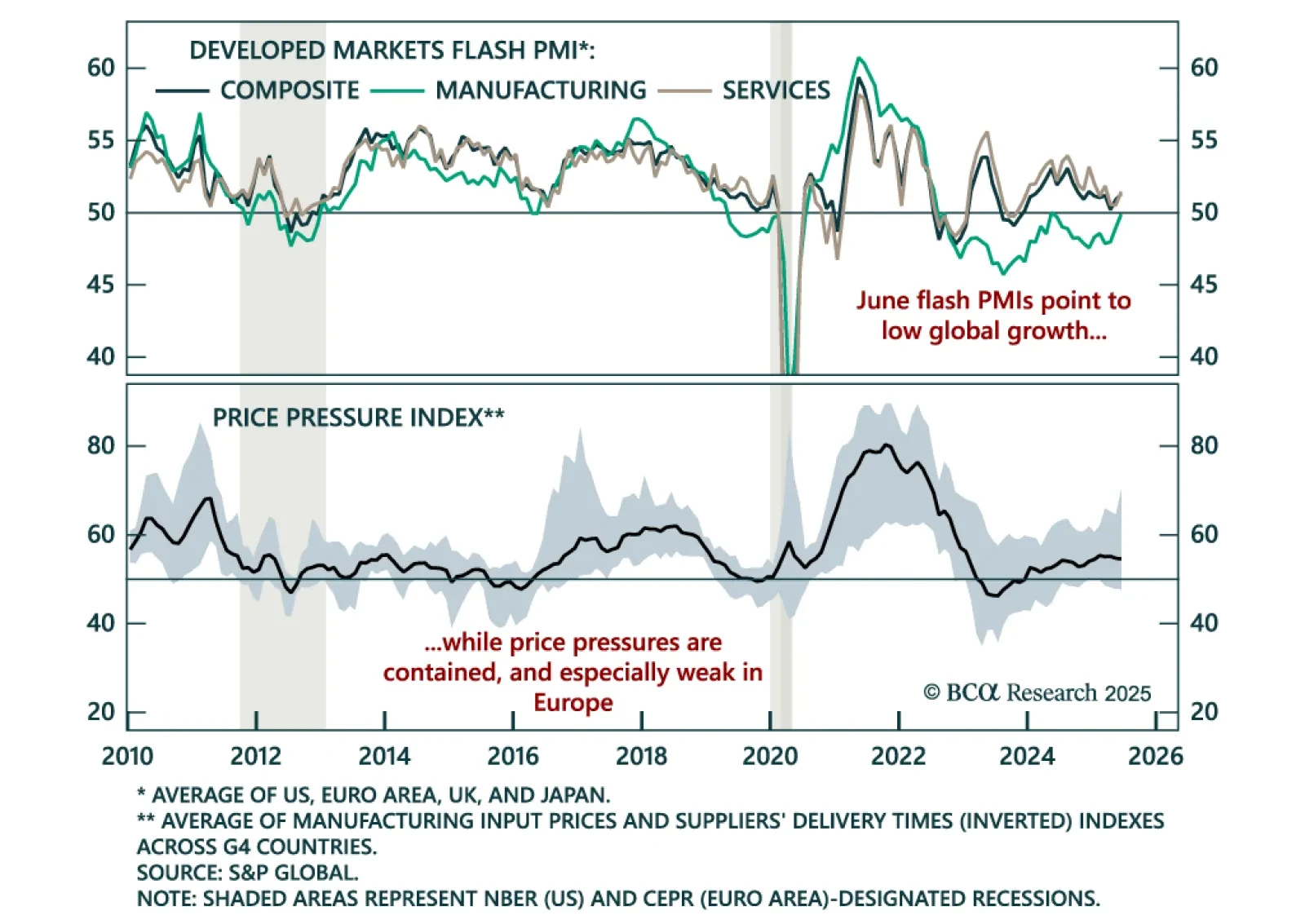

June PMIs confirm low global growth and support a long duration stance as price pressures remain contained. The flash PMIs were mixed across DMs: Sideways in the US and euro area, but firmer in the UK and Japan. Yet the overall…

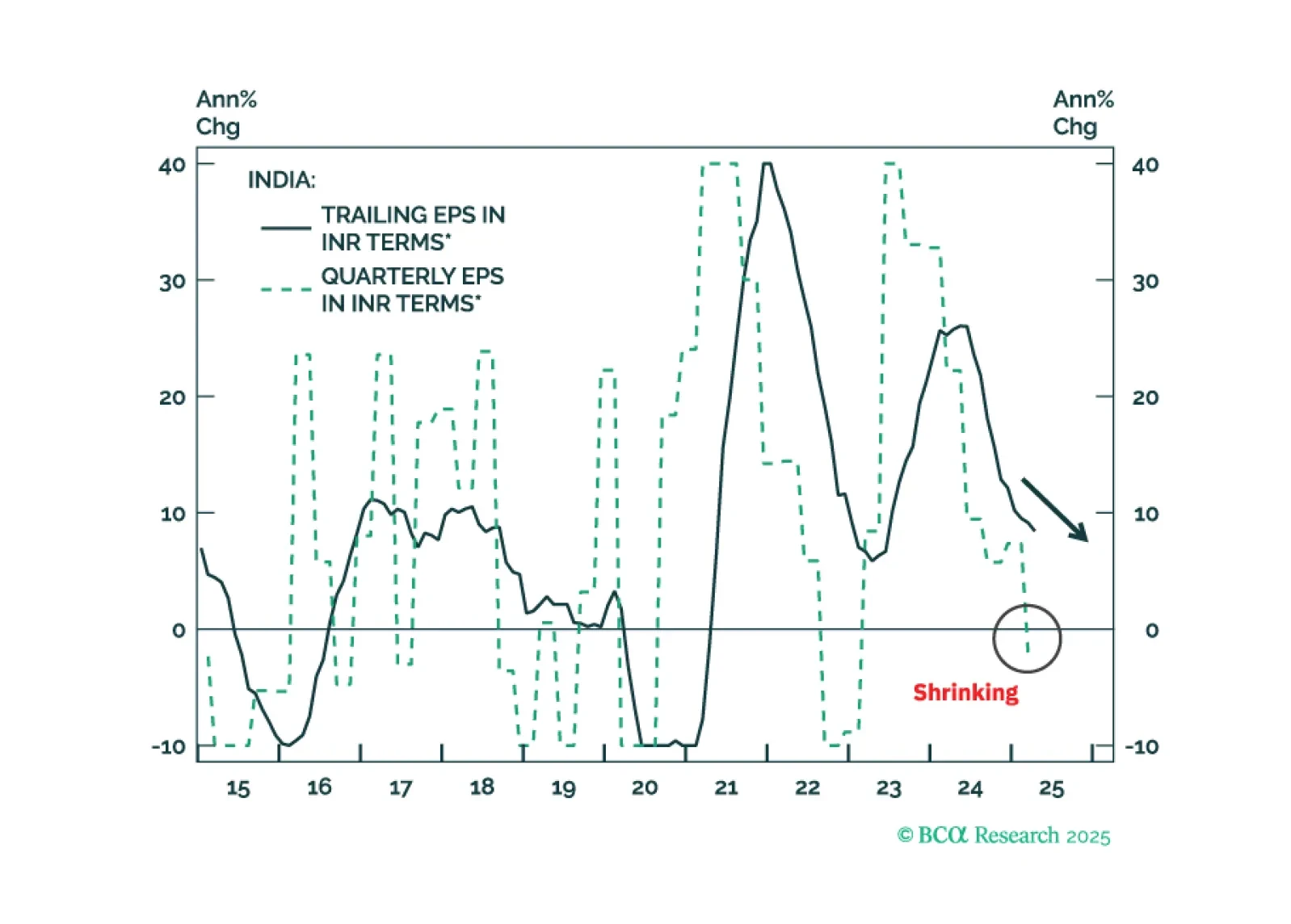

India's IT service exports have been booming and will continue to do so despite wider AI usage. Indian IT stocks, however, will not benefit from it as the expanding Global Capability Centers (GCCs) in India compete with the nation’s…

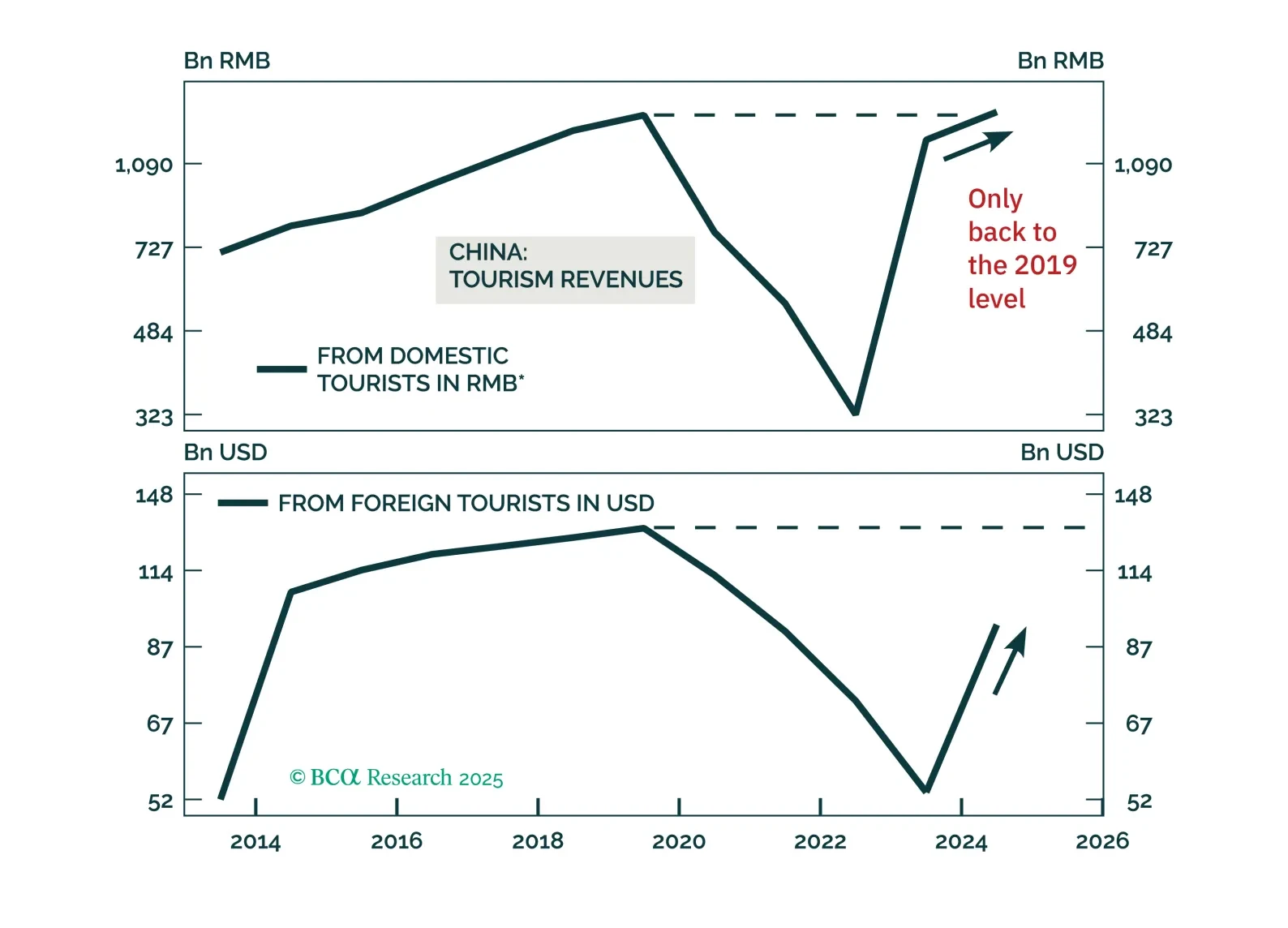

Chinese tourism will continue growing, but investors should be mindful not to overpay for Chinese tourism stocks by extrapolating their past double-digit revenue growth into the future.

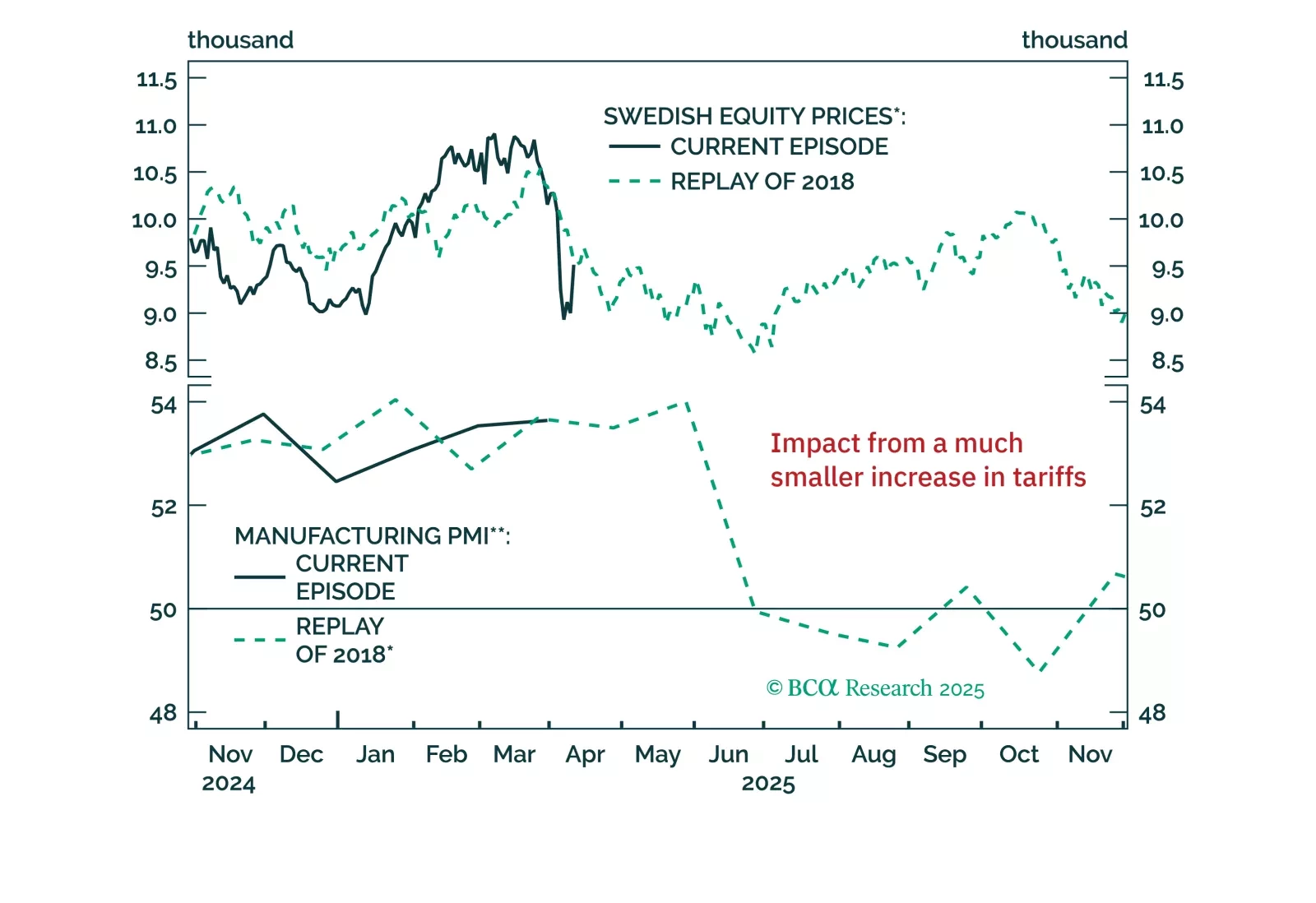

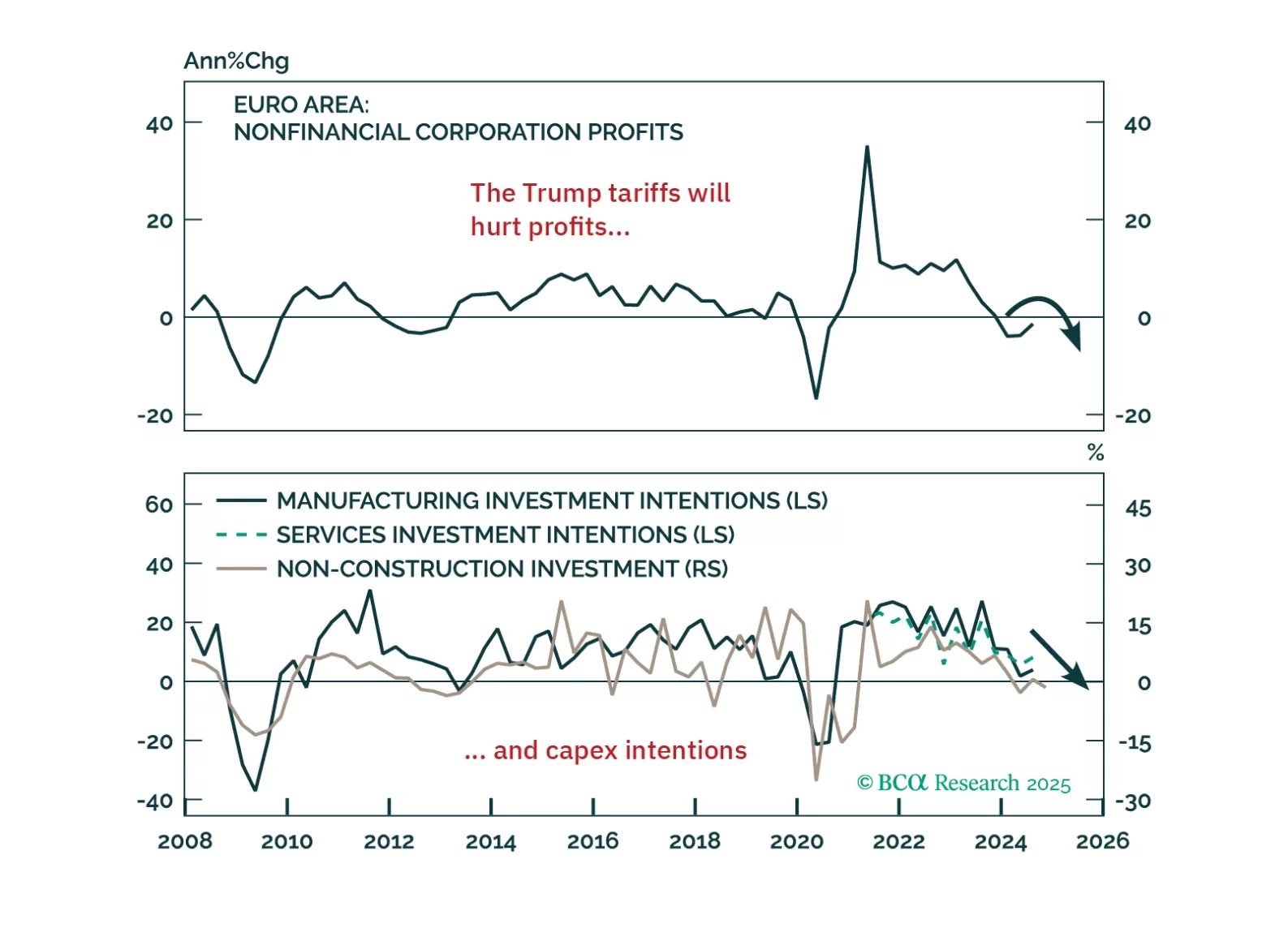

Trump’s tariff shock will push Europe into recession — but it’s also triggering a powerful integration response. In this report, we lay out the tactical case for staying defensive and the structural case for going long European…

In this Second Quarter Strategy Outlook, we explore the major trends that are set to drive financial markets for the rest of 2025 and beyond.

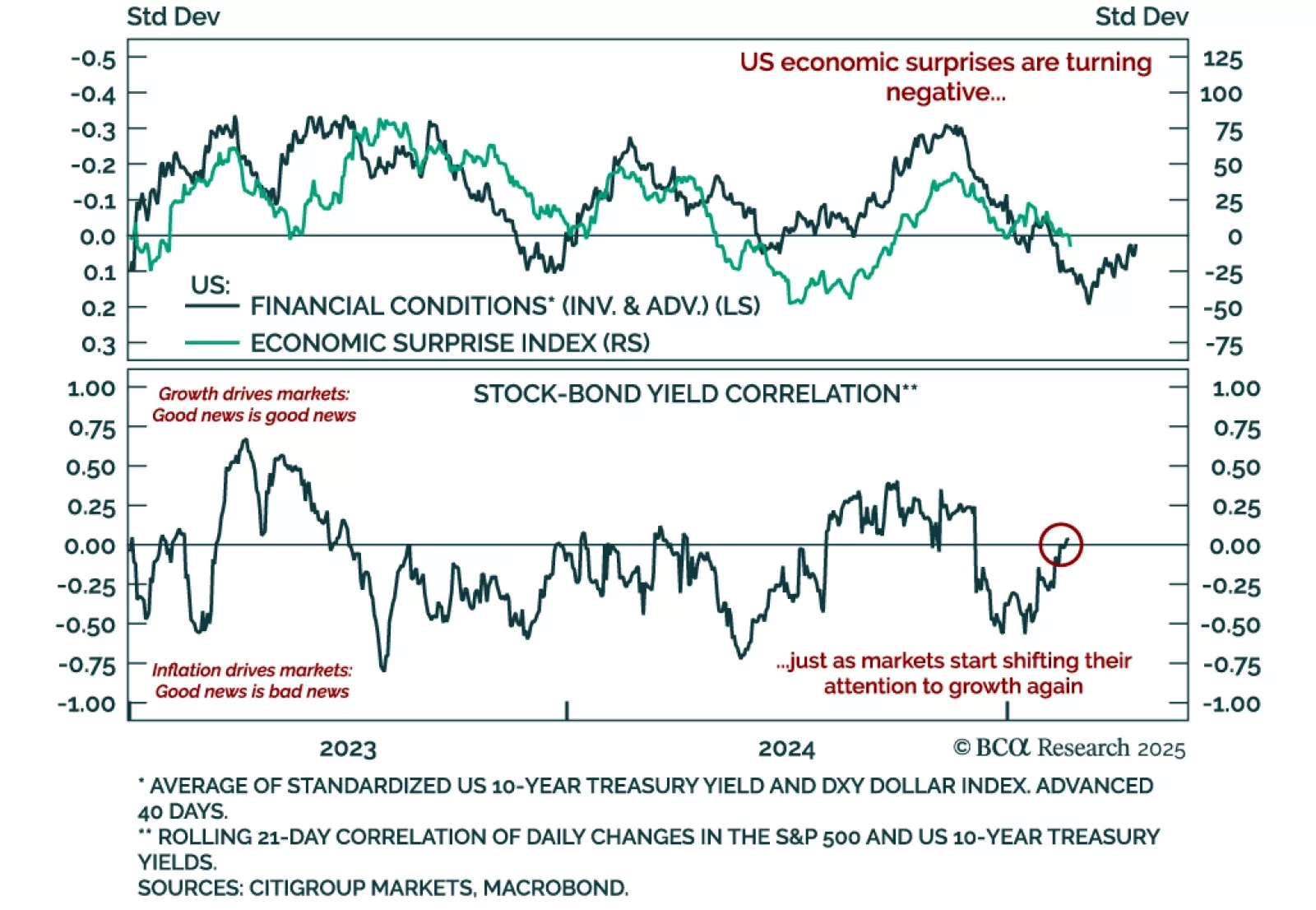

Two of our favorite indicators recently sent important signals. The first one, the short-term stock-bond yield correlation, recently drifted back to neutral territory after being negative. The correlation had been negative since…

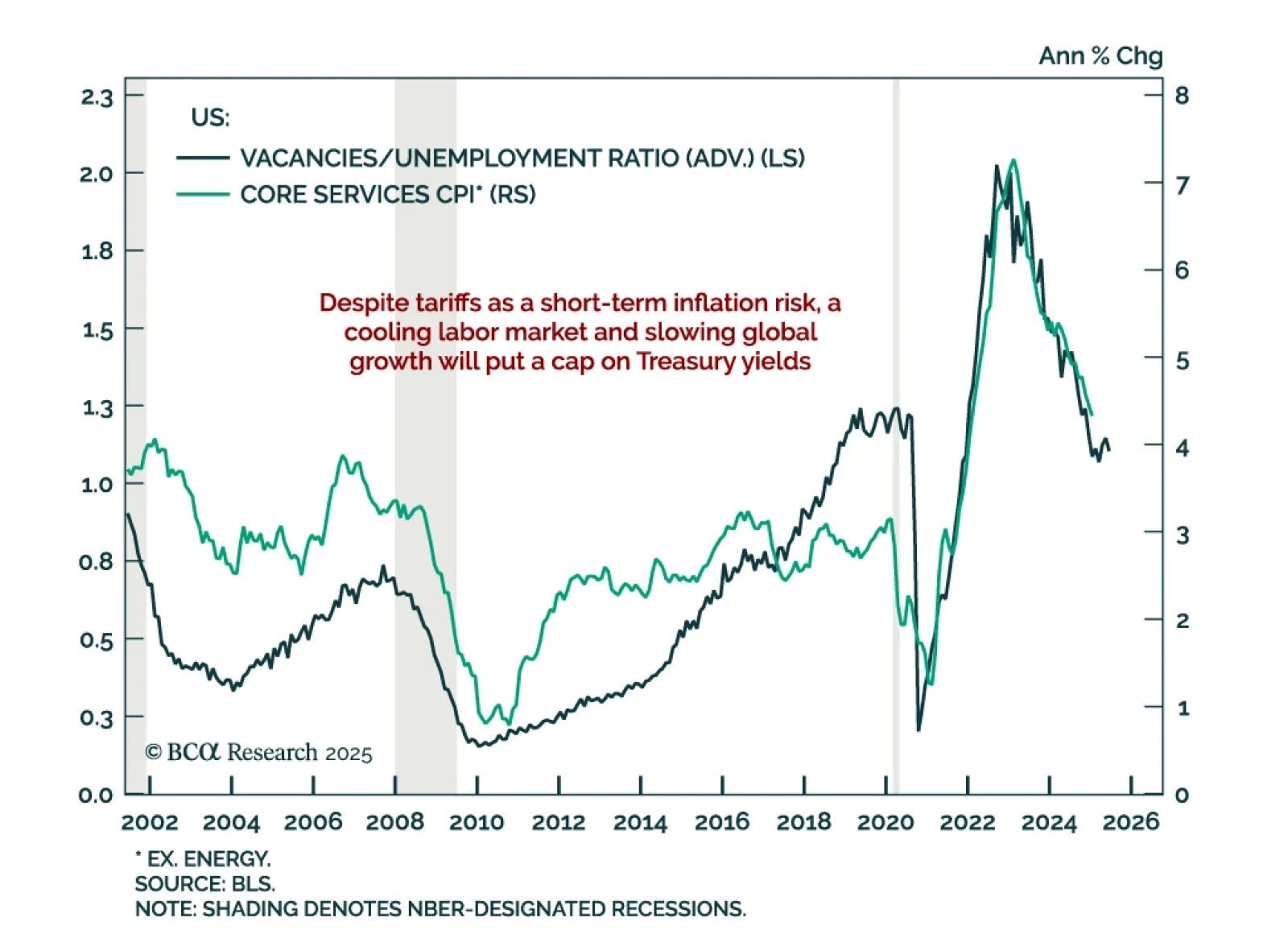

The January US CPI came in hotter than expected. Headline inflation accelerated to 0.5% m/m (3.0% y/y), and core to 0.4% m/m (3.3% y/y). Core goods and services inflation also moved higher, with the latter boosted by a sharp increase…

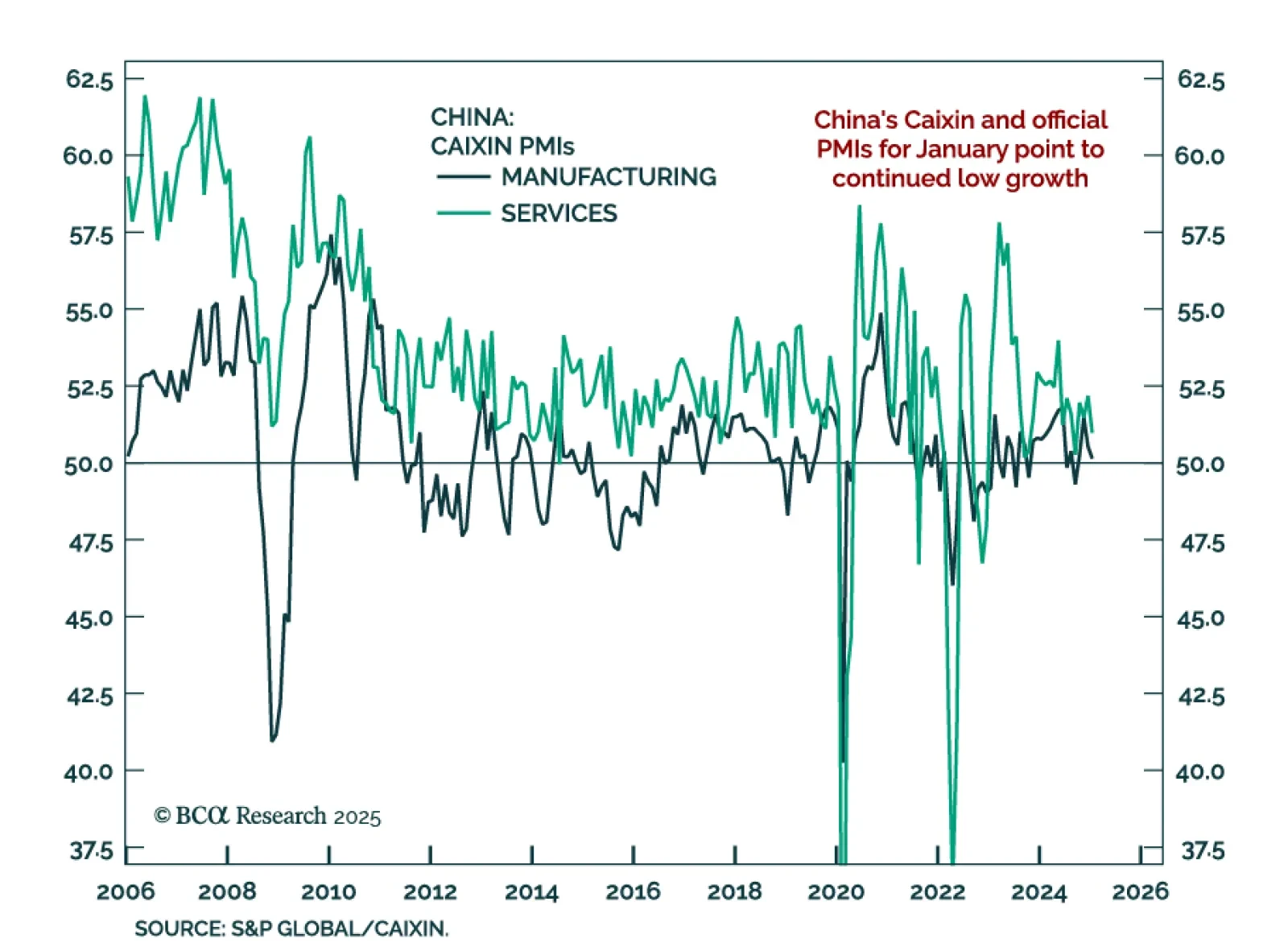

China’s Caixin PMIs decelerated in January, with the composite ticking down to 51.1 from 51.4. The decrease was driven by both manufacturing, which fell to 50.1 from 50.5, and services, which fell from 52.2 to 51.0. The data is…