A tactical trading opportunity has re-emerged, and today our U.S. Equity Strategy team recommends trimming the S&P semi equipment index to underweight on a three-to-six month time horizon, but with a tight stop at the -7%…

Highlights Portfolio Strategy Rising lumber prices, melting interest rates and profit-augmenting industry productivity gains all signal that it no longer pays to be bearish the S&P home improvement retail (HIR) index. Poor…

Neutral There are high odds that the chip cycle will soon take a turn for the better. Global chip sales have been decelerating for 17 months and are now on the cusp of contraction (middle panel). Over the past two decades,…

Highlights Portfolio Strategy The ongoing capex upcycle, resurgent credit growth, easy Chinese policy trifecta, upbeat signals from high frequency financial market data and depressed technicals, all suggest that a re-rating phase…

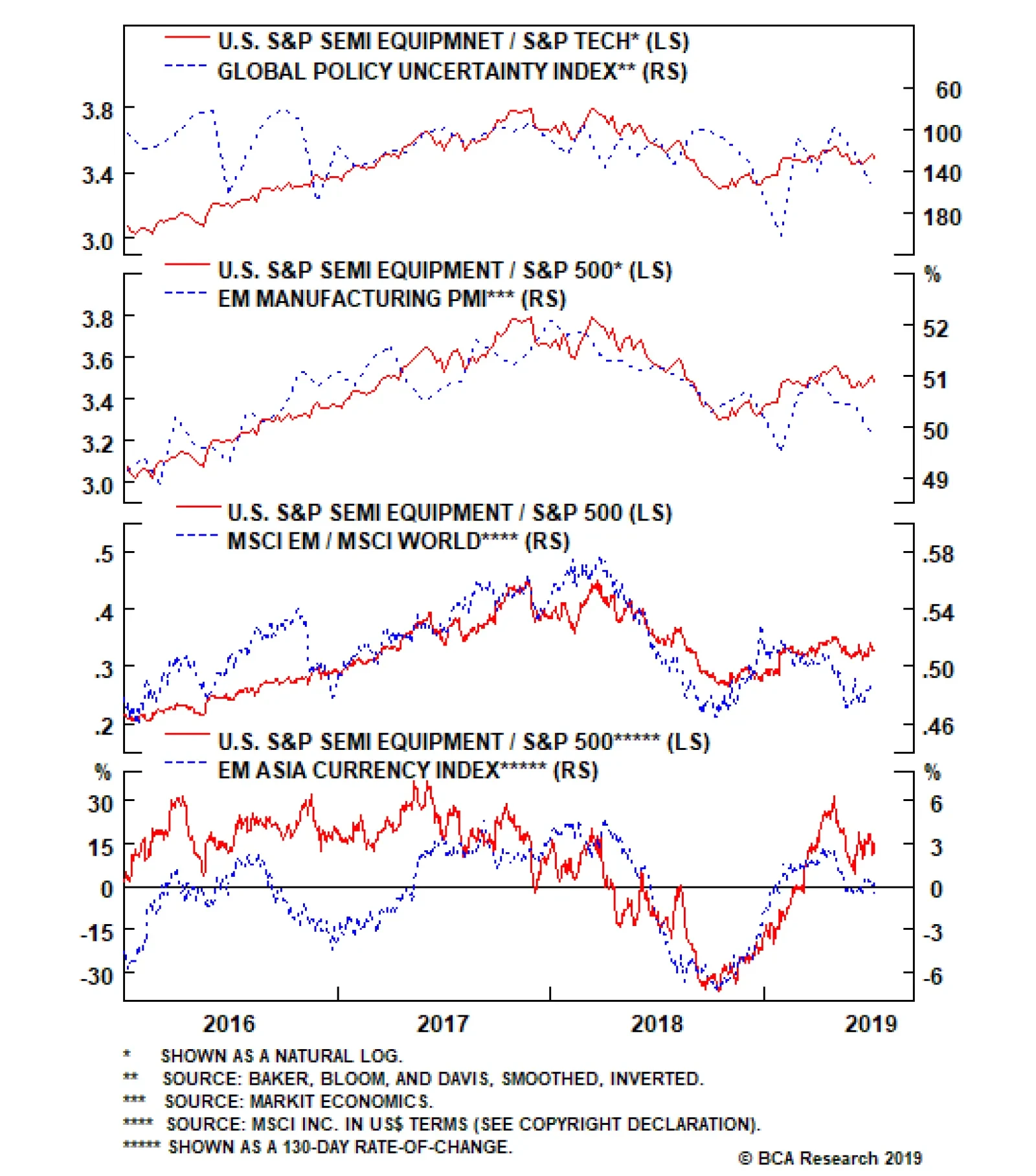

These high-octane, highly-cyclical tech stocks move in lockstep with other volatile assets. Rebounding emerging market (EM) stocks and FX not only confirm the S&P semi equipment breakout, they also signal additional gains in…

Overweight In this week’s Weekly Report, we highlight three macro factors that, should they sustain their recent trajectories, would serve to catalyze the semi equipment group. First, trade policy uncertainty has dealt…

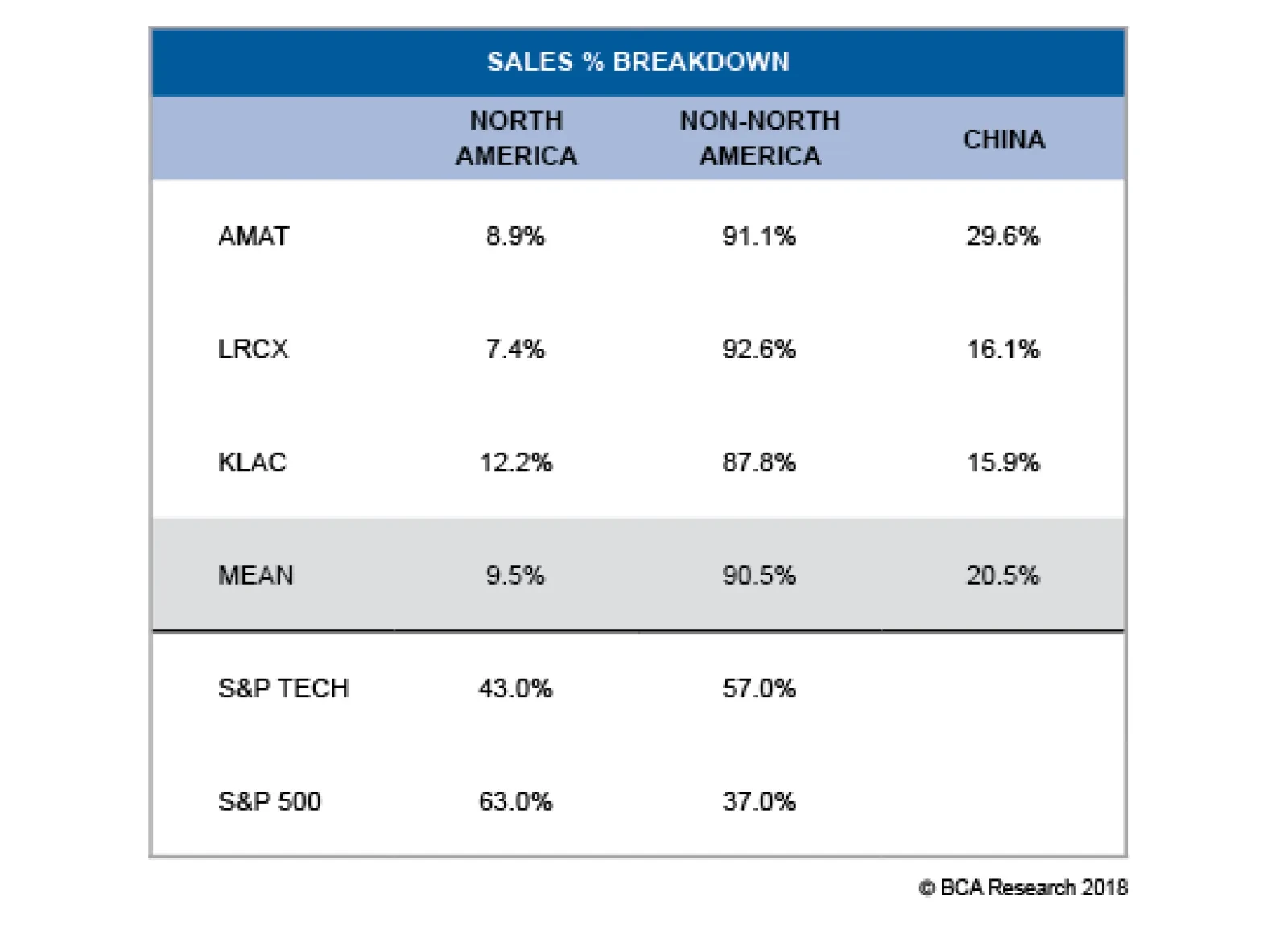

First, trade policy uncertainty has dealt a blow to this tech subindex. Not only are 90% of sales foreign sourced, but a large chunk is also China-related sales. The table highlights the excessive sensitivity these stocks have to…

Highlights Portfolio Strategy The drubbing in the S&P semi equipment index is overdone and even a modest improvement on either the trade policy, industry demand or currency fronts could result in a reflex rebound, warranting an…