Highlights Portfolio Strategy Interest rates are one of the most important macro drivers of overall equity returns via valuations. BCA’s view of a selloff in the bond market is a key factor underpinning most of our 2020 high-…

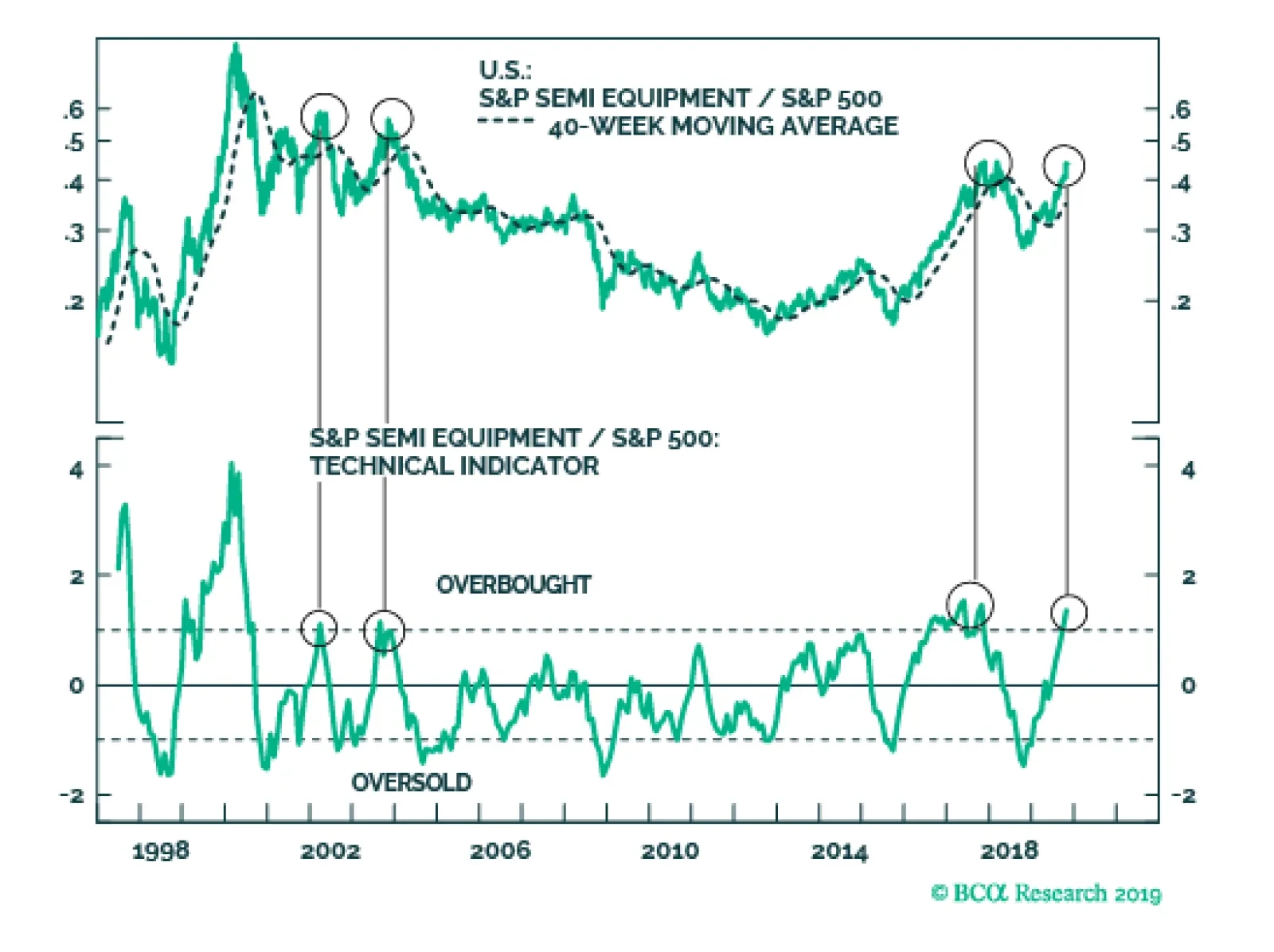

Underweight We reiterate our recent downgrade in the S&P semi equipment index to underweight. Our previous mid-year attempt to fight this rally in chip equipment stocks fell short, but thankfully our prudent risk management metric…

Underweight The S&P semi equipment index has made the headlines reaching fresh cycle-highs. While bulls would buy this breakout, we are sticking our heads out and recommend selling the strength and warn that the S&P…

The contracting ISM manufacturing survey signals that relative share price momentum running at a 60%/annum clip is unwarranted and bound to return to earth. The same holds true for relative forward profit and revenue growth…

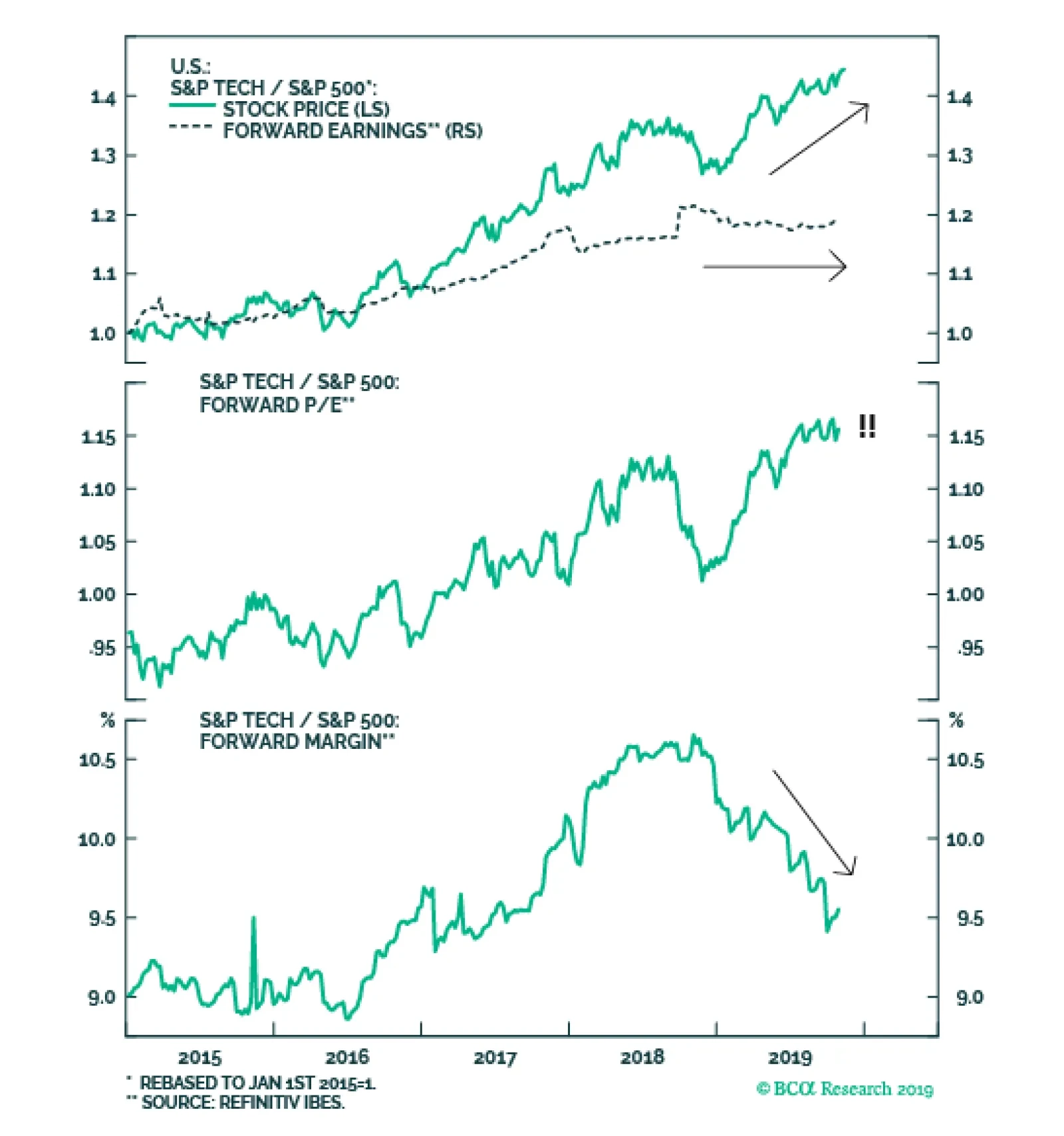

Tech stocks have been on a tear with the sector besting the SPX by over 40% since 2015. Such a breakneck pace is unsustainable without support from earnings. Despite the sector’s share price outperformance, expected tech…

Highlights Portfolio Strategy Lack of profit growth, deficient industry demand, perky valuations and extremely overbought conditions all suggest that the time is ripe for an underweight stance in the S&P semi equipment index. The…

Last Thursday we were stopped out from our tactical S&P semi equipment underweight position as it hit our -7% stop loss (bottom panel). We are obeying the stop loss and are returning this index to a neutral weighting as…

Underweight A tactical trading opportunity has re-emerged in semi equipment stocks. This week we recommended trimming the S&P semi equipment index to underweight on a three-to-six month time horizon, but with a tight stop…