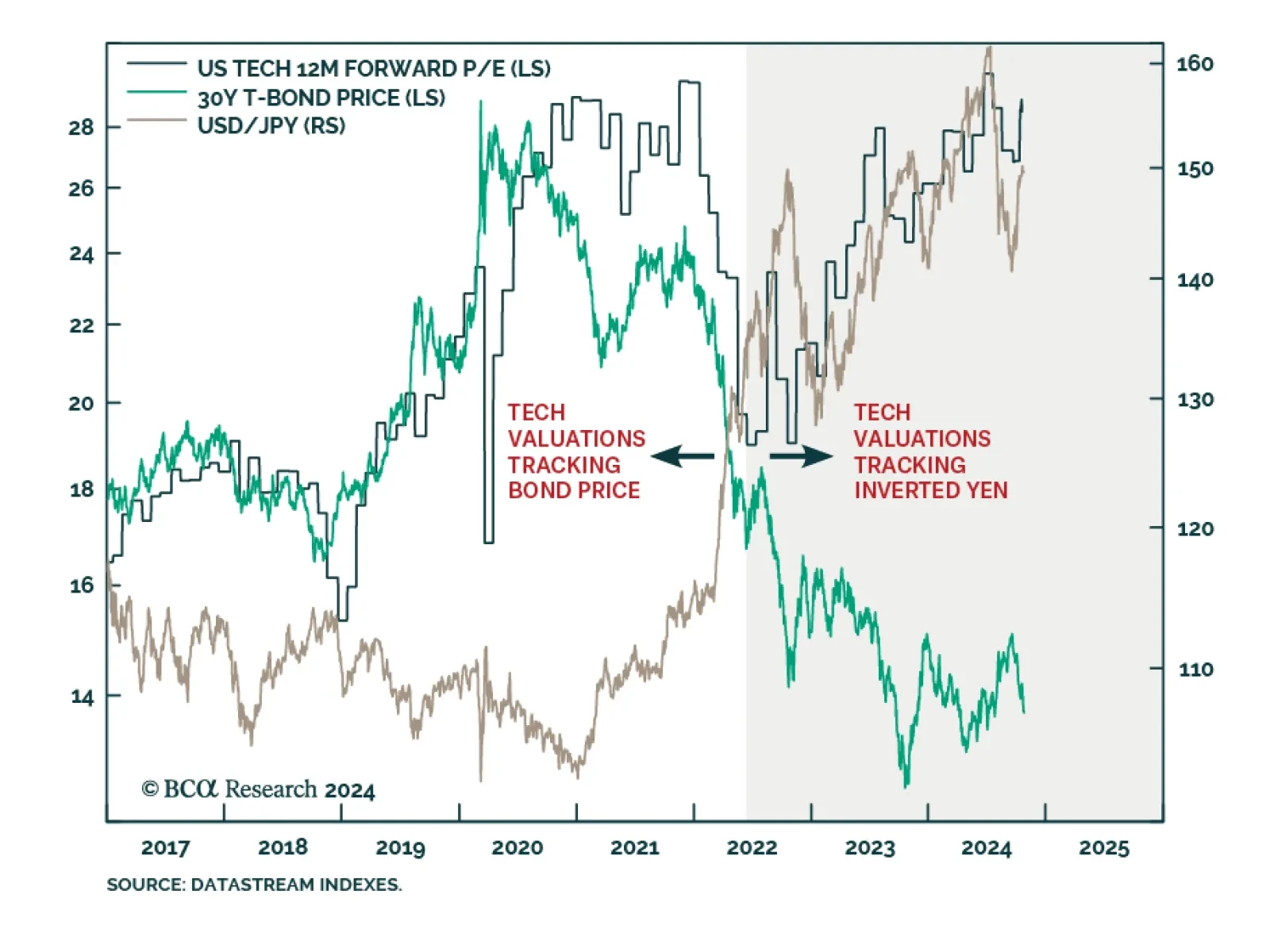

Our Counterpoint Strategy team believes the equity bull market’s biggest risk is the reversal of the divergence between Japanese and US real yields. Japan’s real policy interest rate differential versus the US…

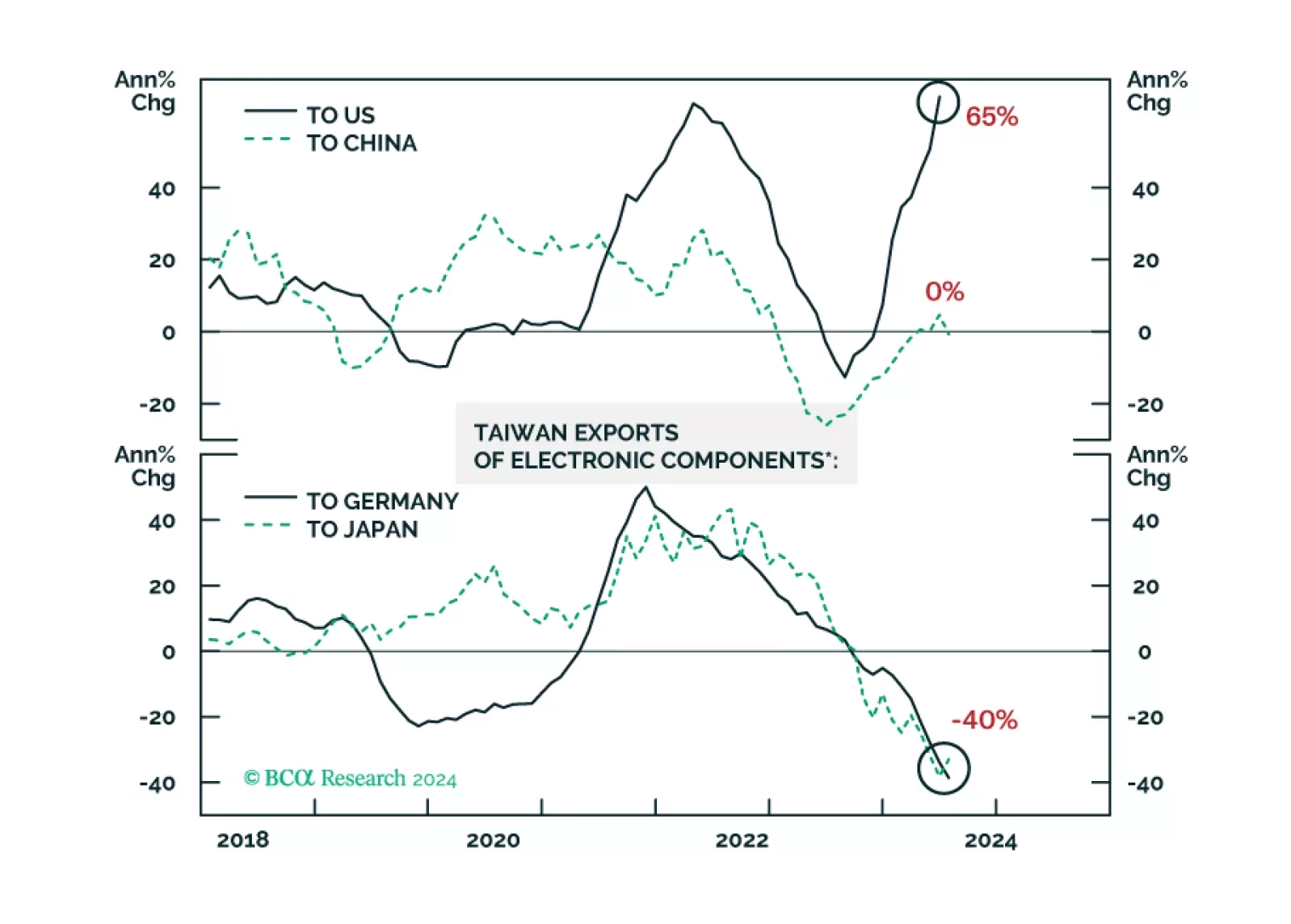

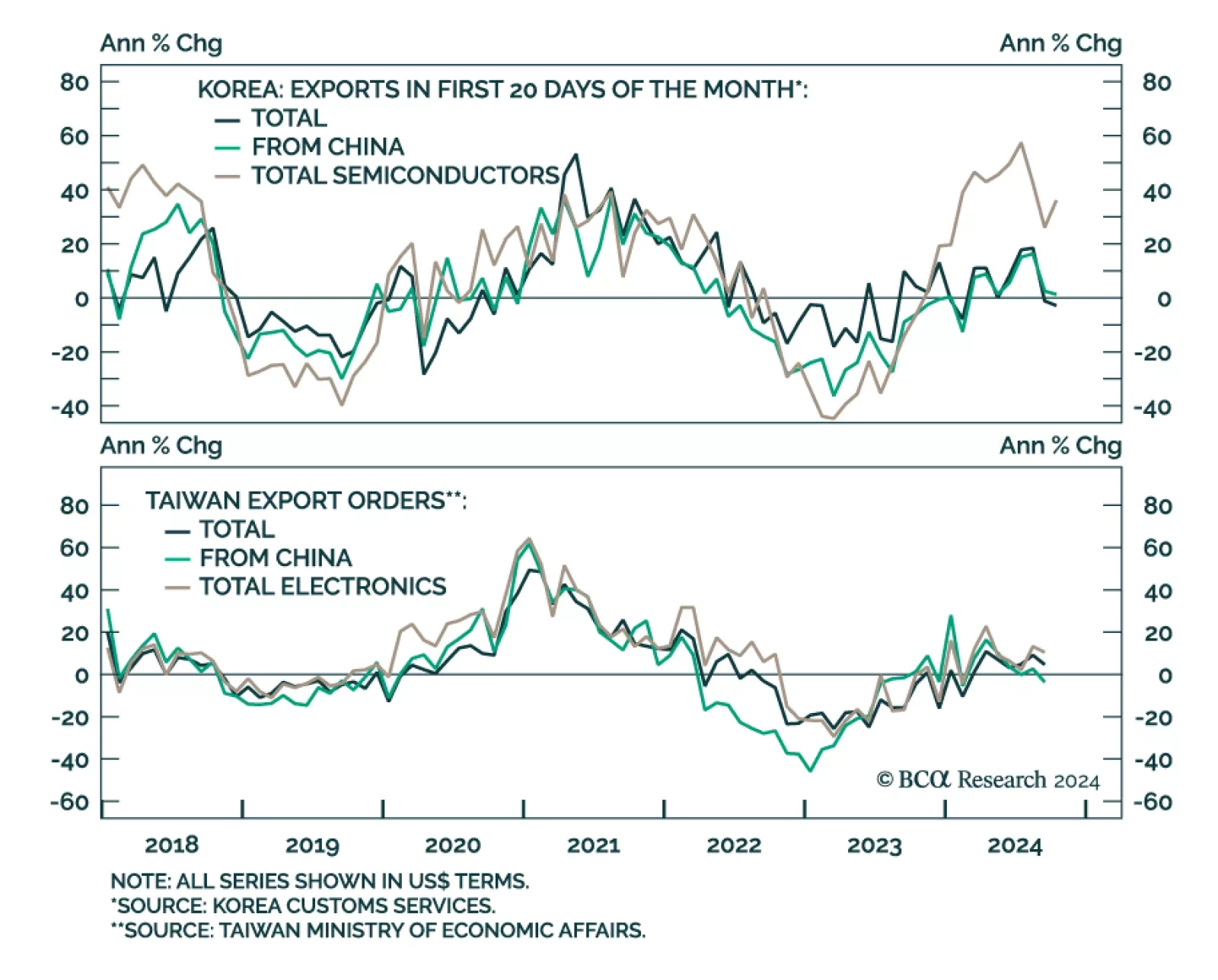

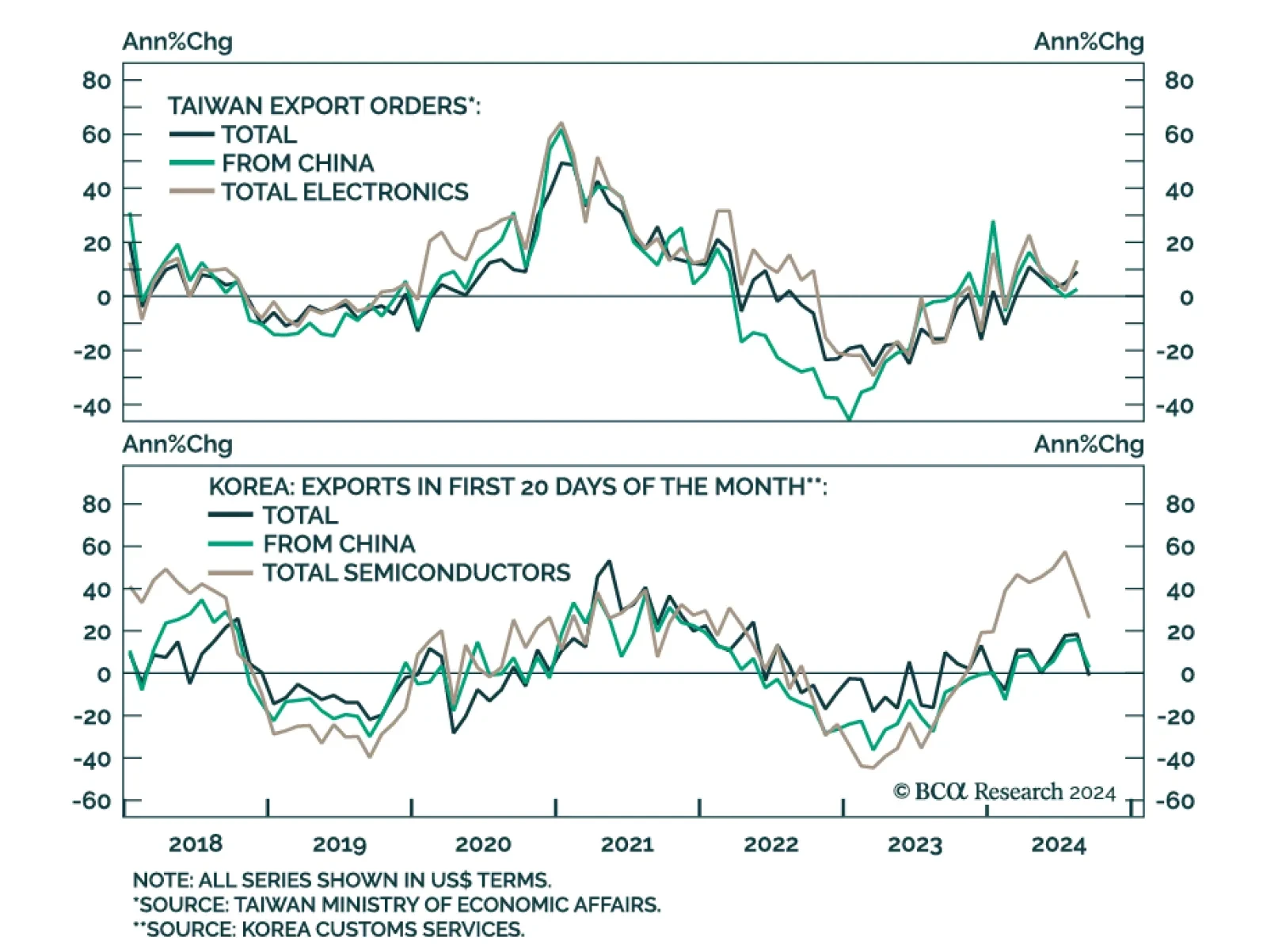

The recent slump in globally- and tech-sensitive East Asian trade shows no respite, with advanced October Korean exports and September Taiwanese export orders data disappointing. Korean exports for the first 20 days of October…

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders accelerated from 4.8% y/y to a faster-than-anticipated 9.1% in August. The faster pace of growth was also broad…

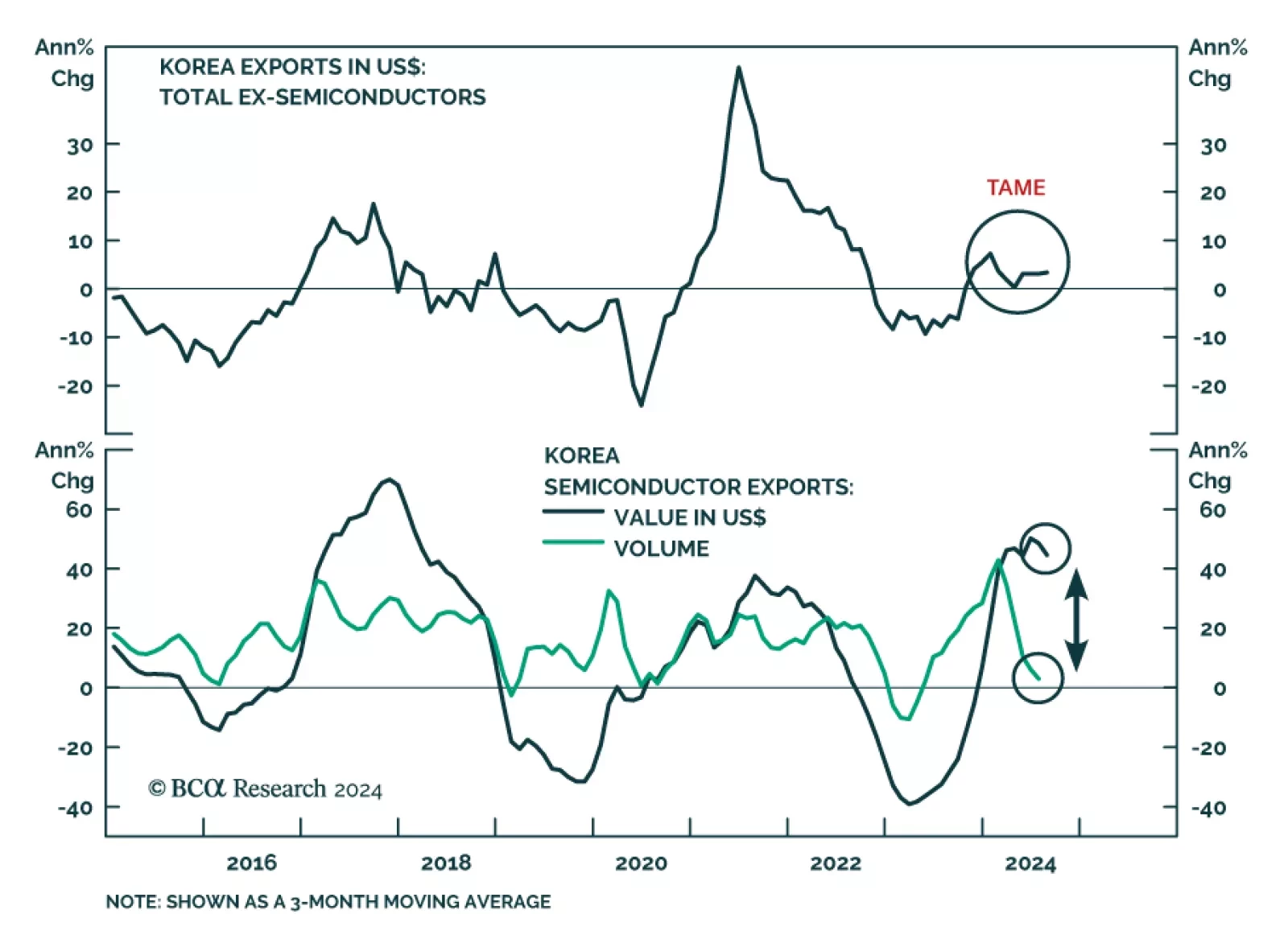

Trade data from small open economies act as a bellwether for global growth developments. In August, Korean exports expanded by 11.4% y/y in USD and 5.7% y/y in KRW terms, marking their eleventh and eighth consecutive month of…

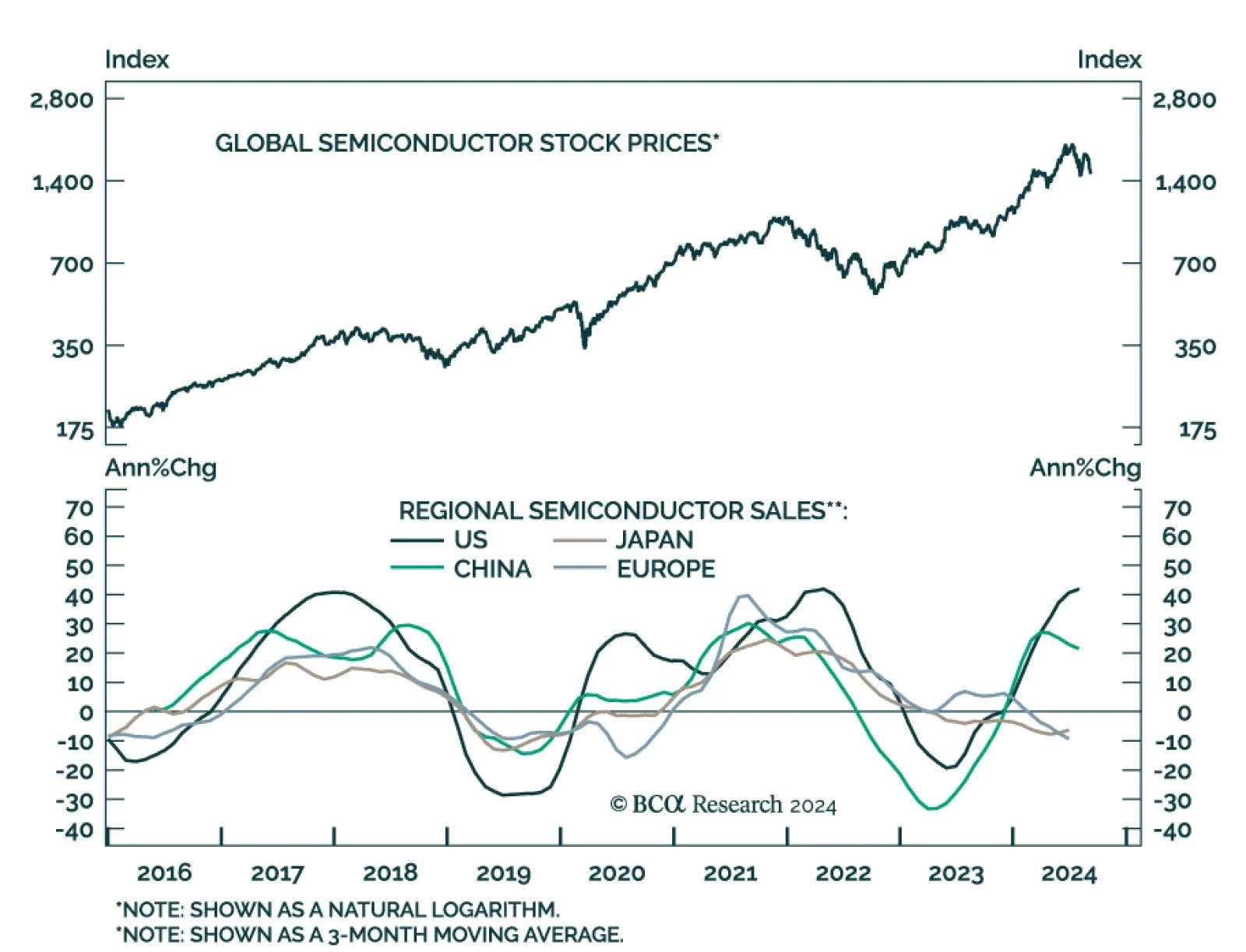

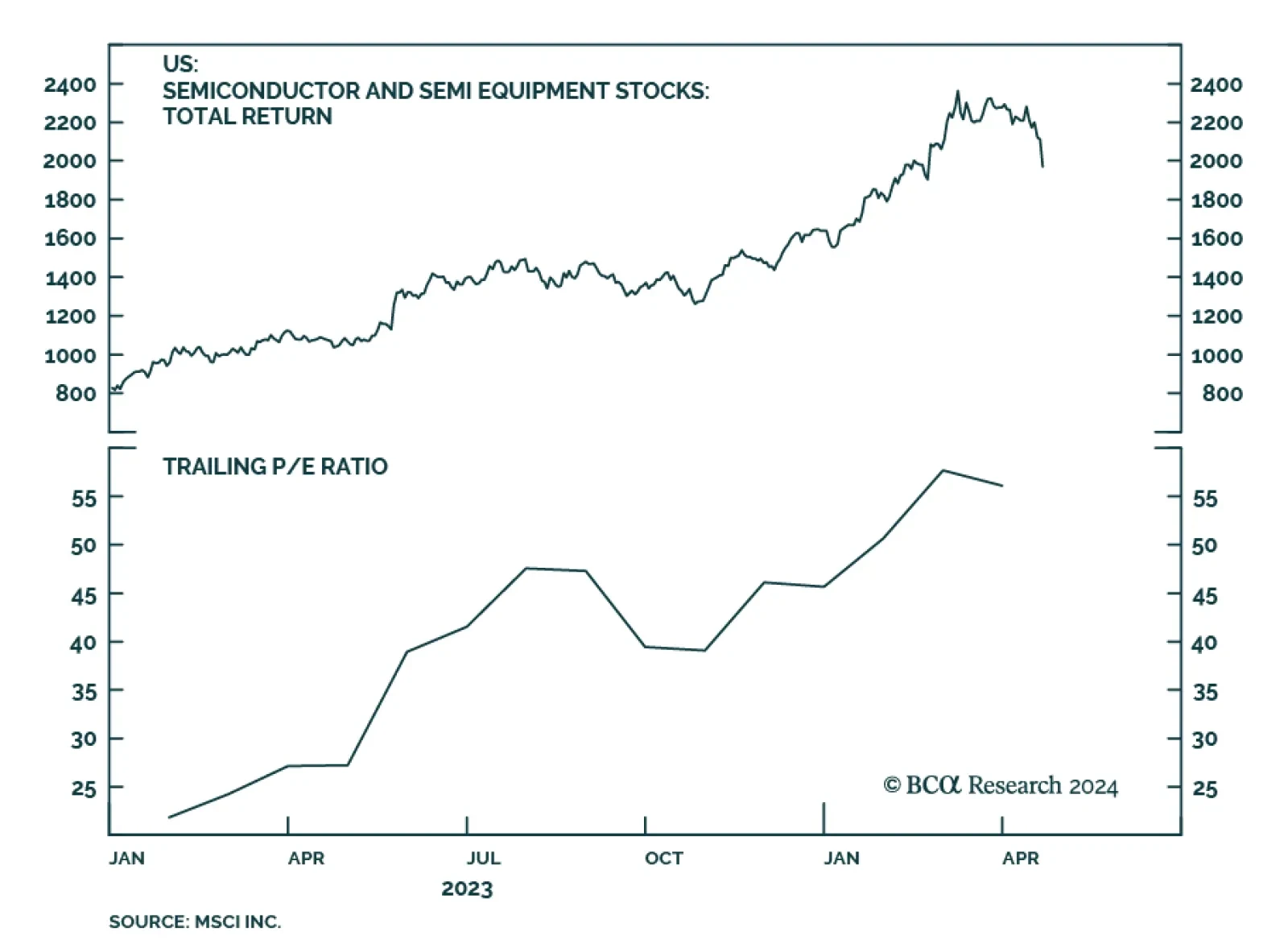

Global semiconductor stocks have returned 50% YTD in USD terms, and a whopping 200% since their September 2022 lows. However, they may have peaked back in July. Our Emerging Market strategists highlight a significant…

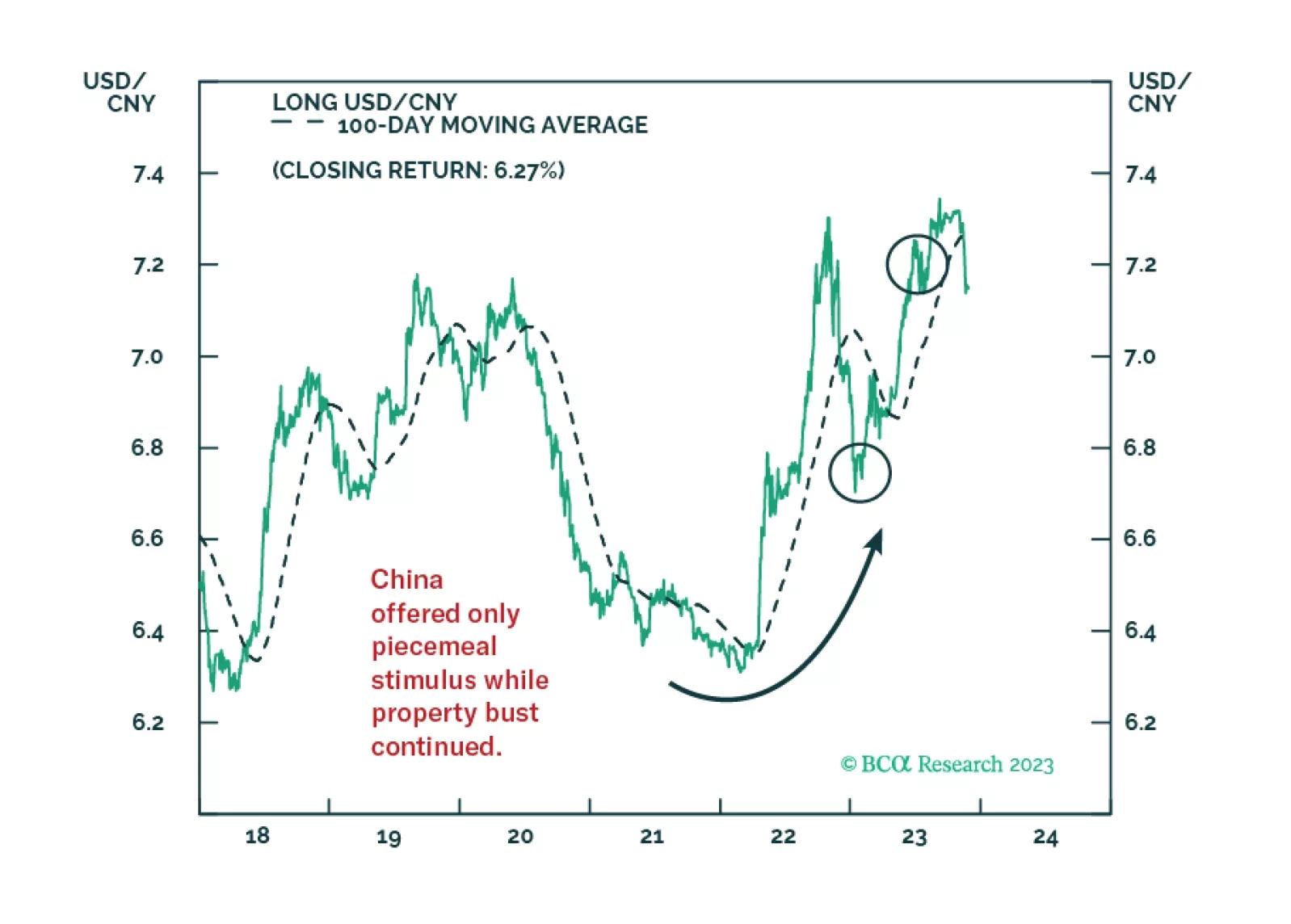

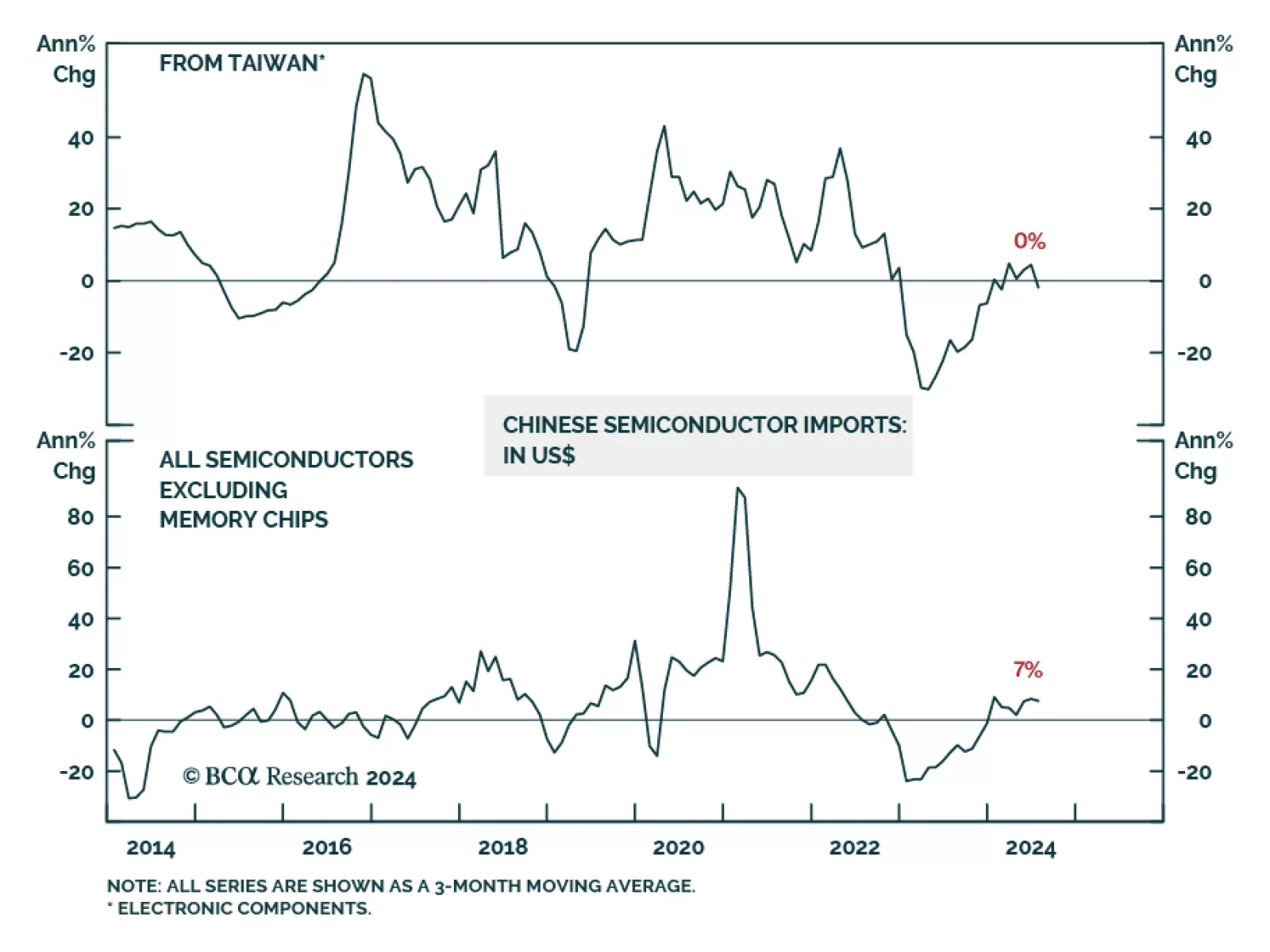

According to BCA Research’s Emerging Markets Strategy Service, China has been accumulating high-value memory semiconductors in anticipation of further US restrictions. Since October 2022, the US has been tightening rules…

Over the last weeks, US semiconductor stocks have plunged by over 17%. In a way, this correction should be expected. Semiconductor stocks had skyrocketed this year. Even after the recent pullback, semi stocks…

Our political forecasting scored wins in 2023 but we failed to capitalize on it adequately in our trade recommendations.