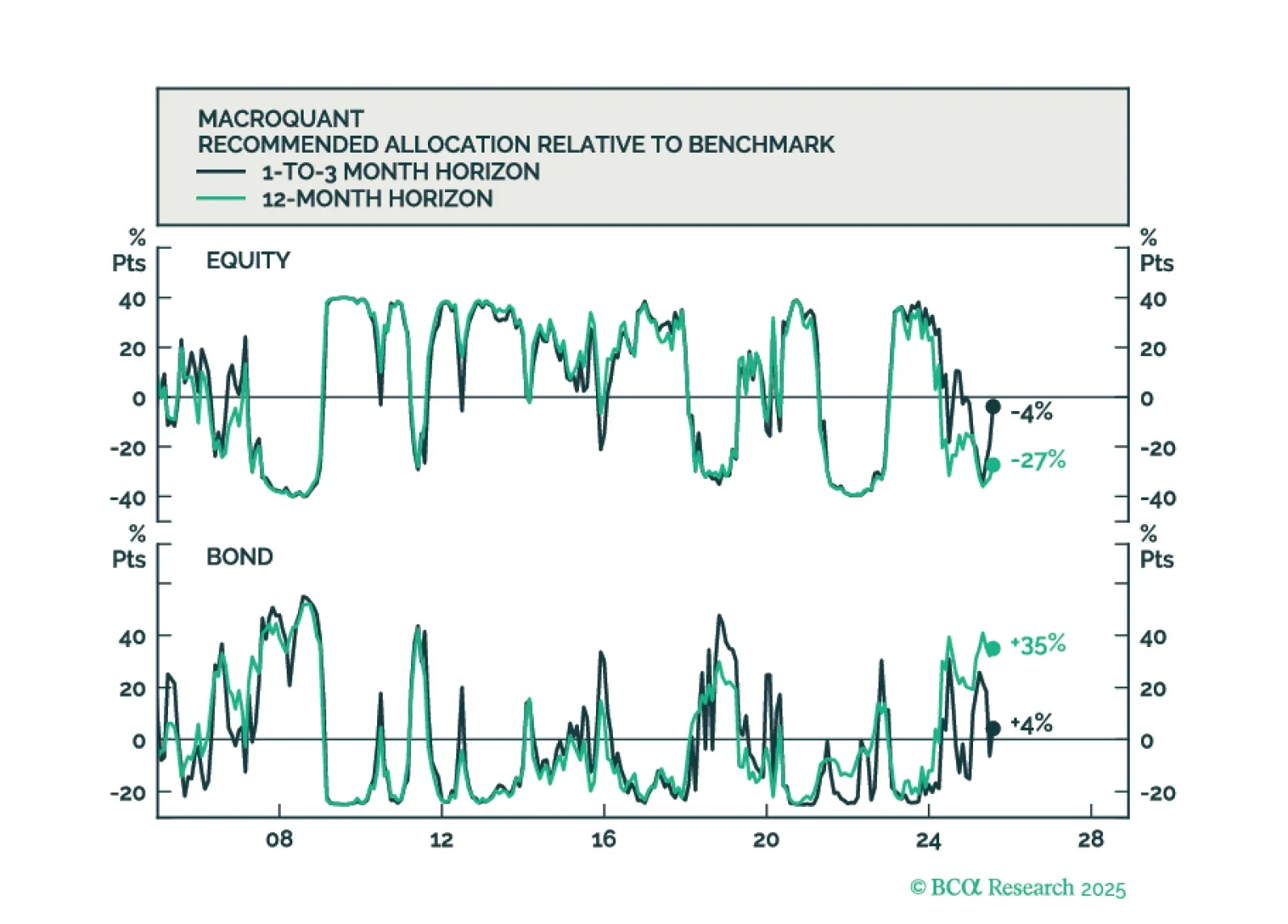

MacroQuant has downgraded equities to underweight, favors a below-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is still bullish on gold.

MacroQuant remains tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold.

Disparities between households and between companies’ earnings and equity performance are widening, but the overall status quo remains in place. We reiterate our neutral asset class recommendations while watching for early signs of…

MacroQuant is tactically overweight equities, favors an above-benchmark duration stance in fixed-income portfolios, remains bearish on the US dollar, and is bullish on gold and copper.

In this Q4 Strategy Outlook, we discuss where we stand on our recession call, the outlook for stocks and bonds in various scenarios, why investors are misunderstanding the impact of AI on corporate profits, whether the US dollar has…

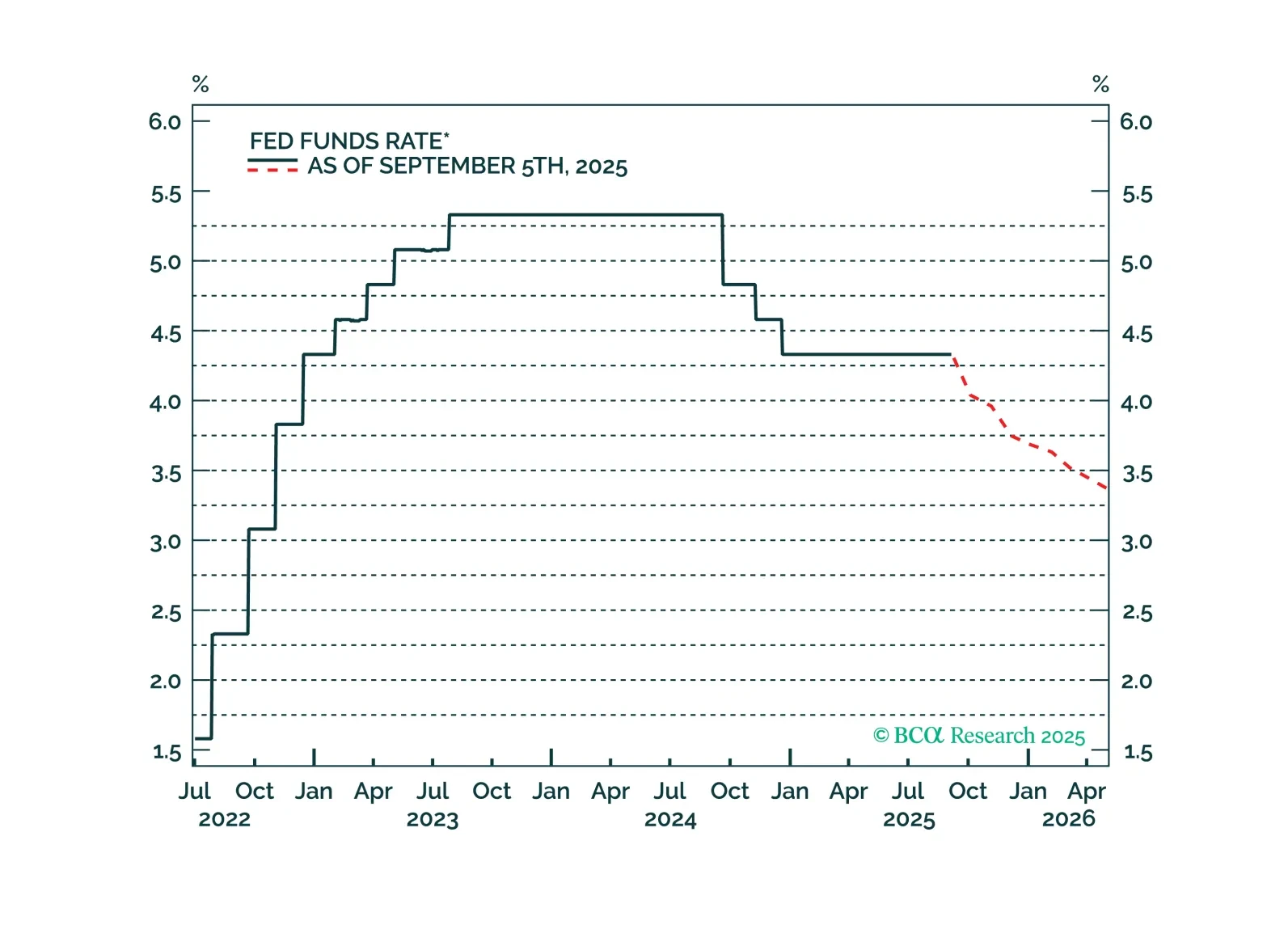

The economy is slowing, but not collapsing, and monetary easing is imminent — a backdrop that will benefit equities. We remain strategically bullish, with a close eye on GenAI and resilient earnings, even amid numerous risks. However…

Our Portfolio Allocation Summary for September 2025.

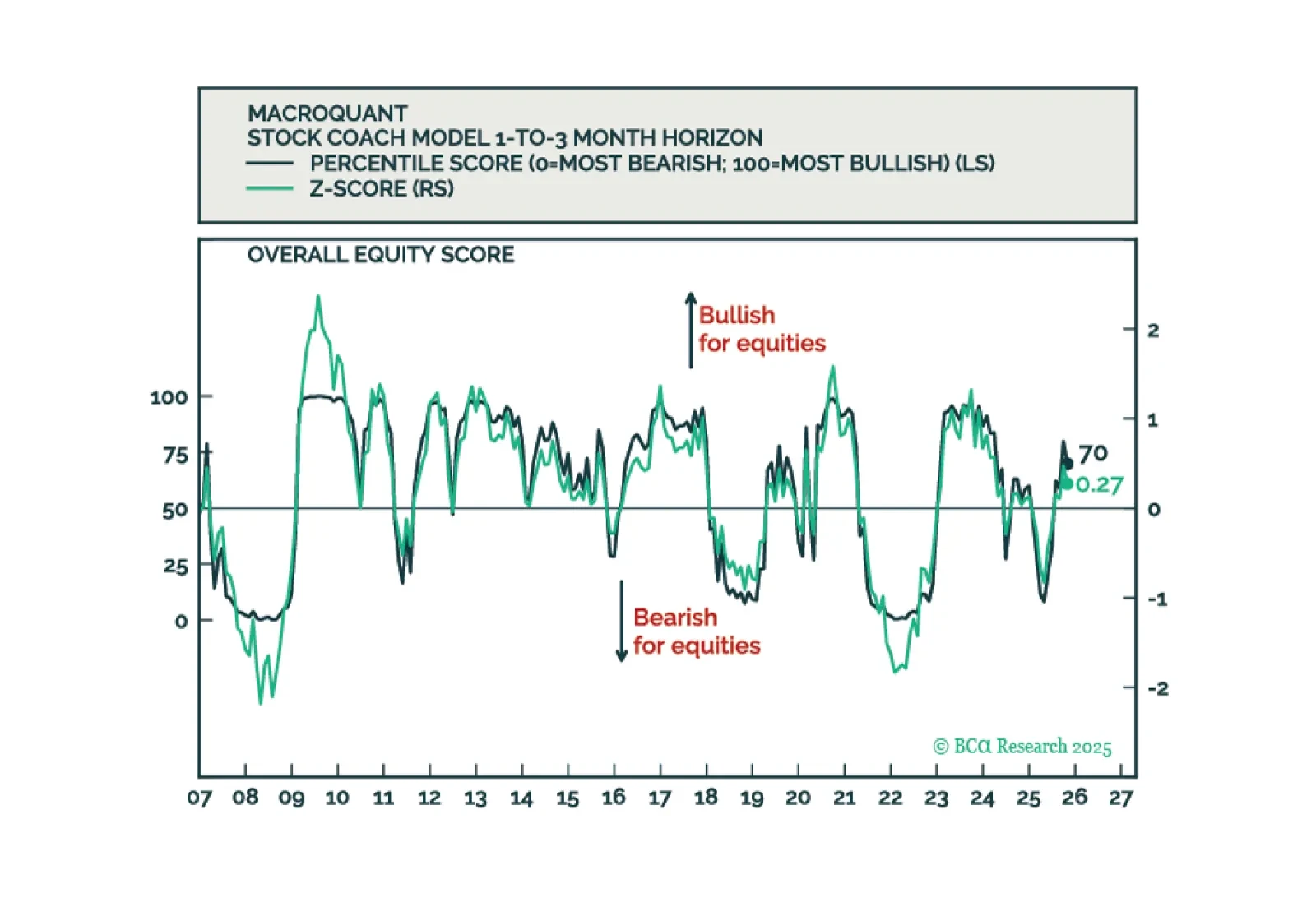

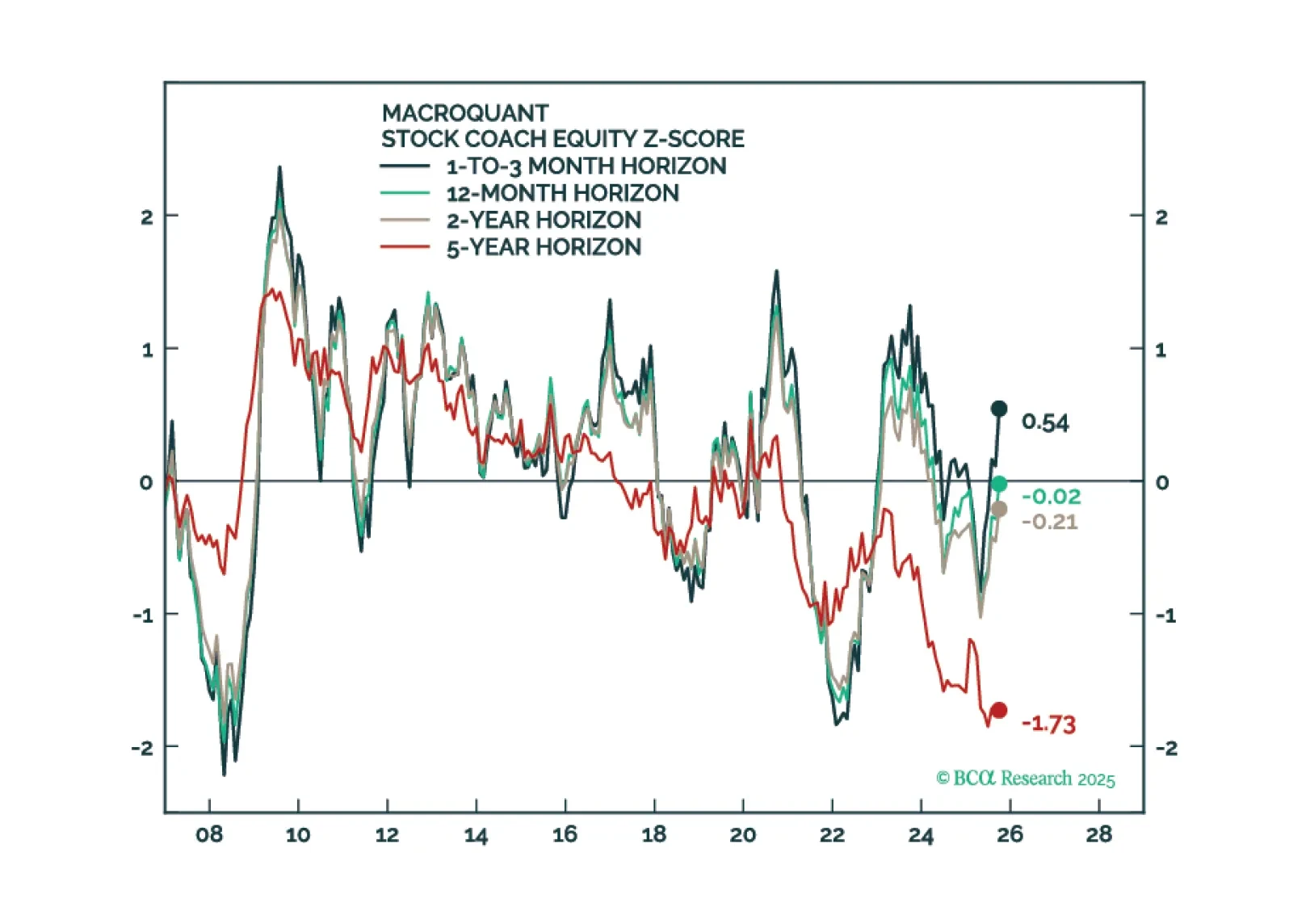

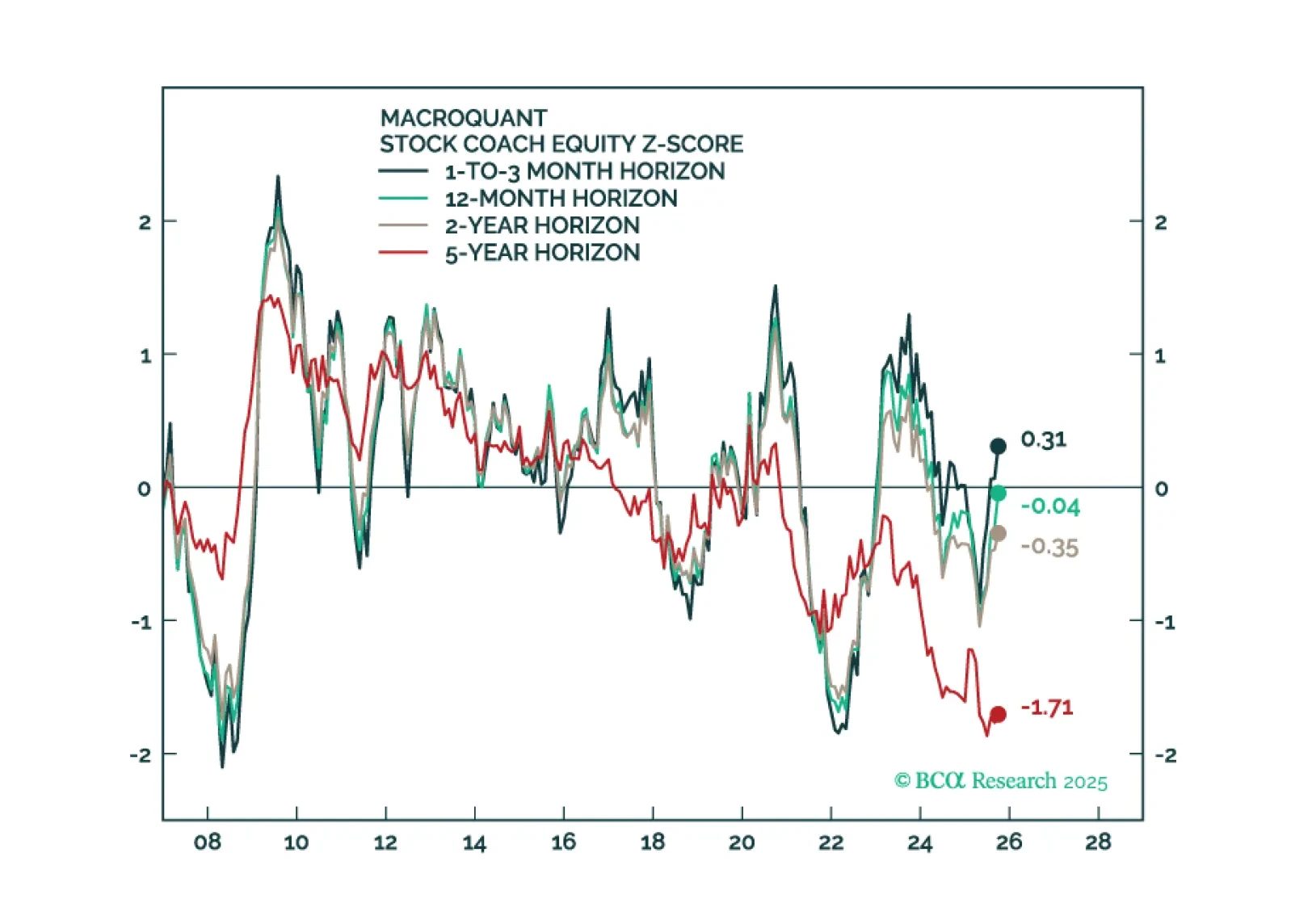

MacroQuant sees downside risks to stocks over a long-term horizon but is not yet saying that we are at imminent risk of an equity bear market.

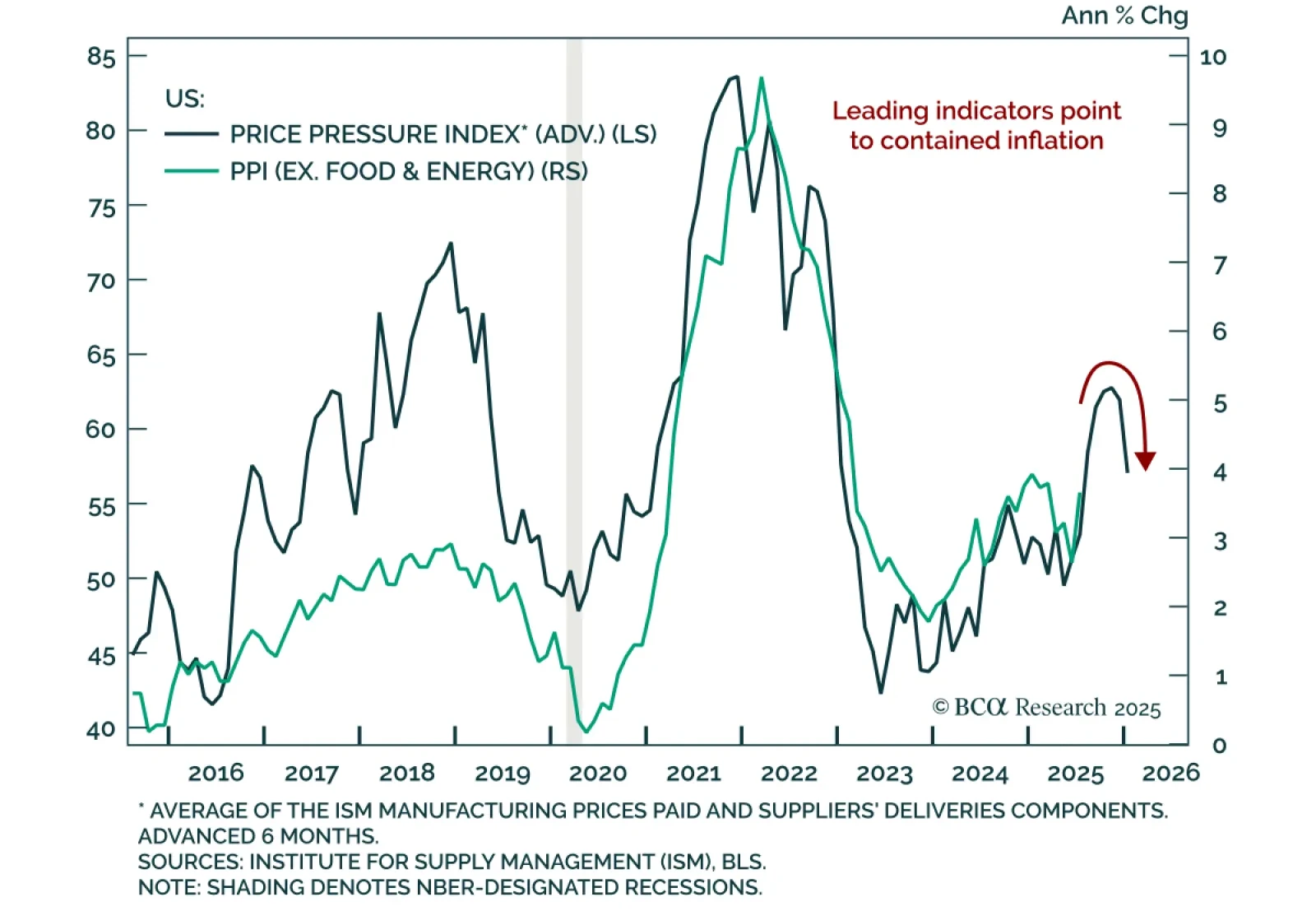

July PPI surprised sharply to the upside, but inflation pressures are likely to remain limited. Headline PPI rose 0.9% m/m (3.3% y/y) in July from 0.0% m/m (2.3% y/y) in June, while core PPI gained 0.6% m/m (2.8% y/y). PPI components…