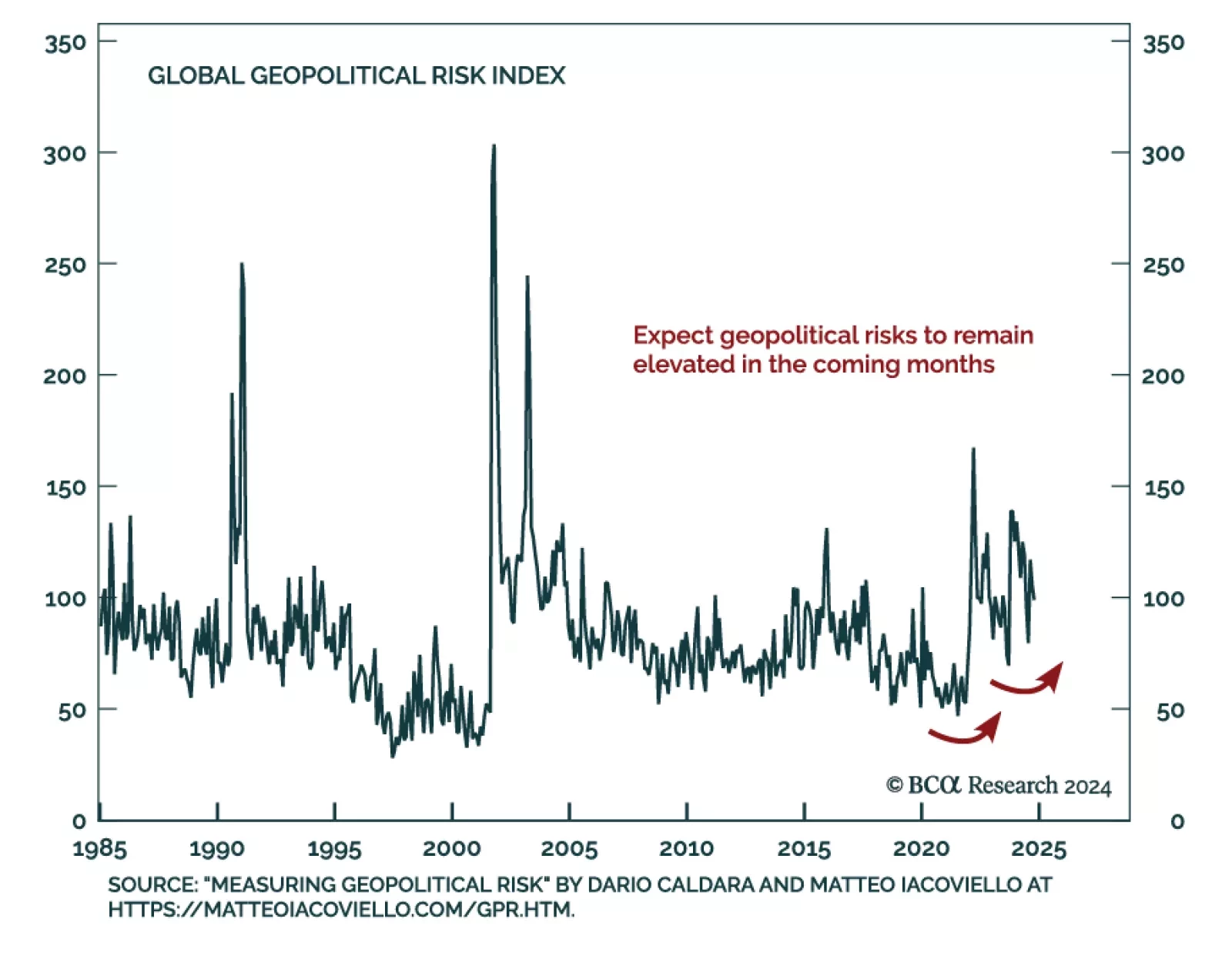

With cross-asset price action mainly revolving around the Trump trade since the election, Tuesday’s headlines surrounding Russia and Ukraine brought investors’ attention back abroad. As predicted by our Geopolitical…

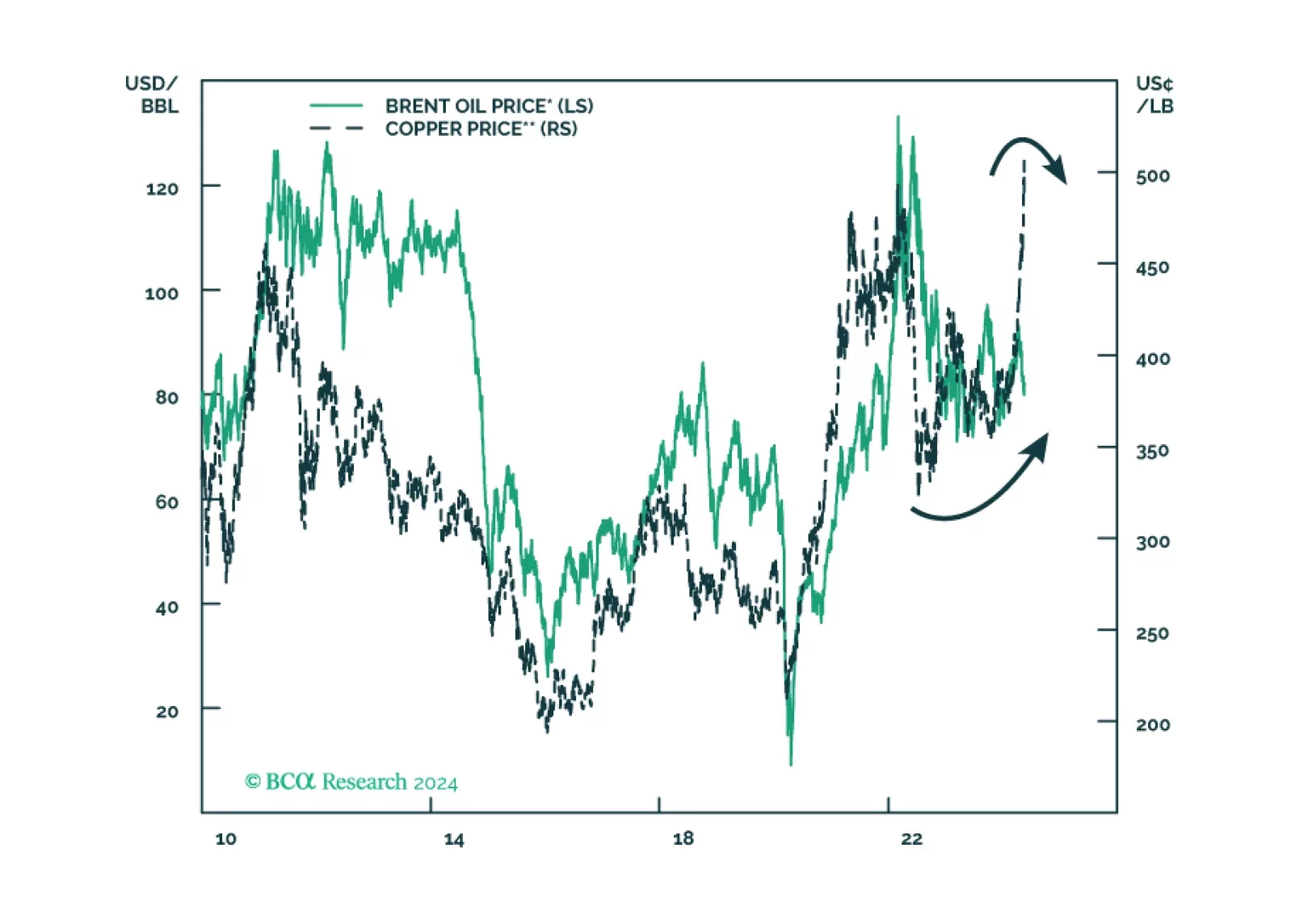

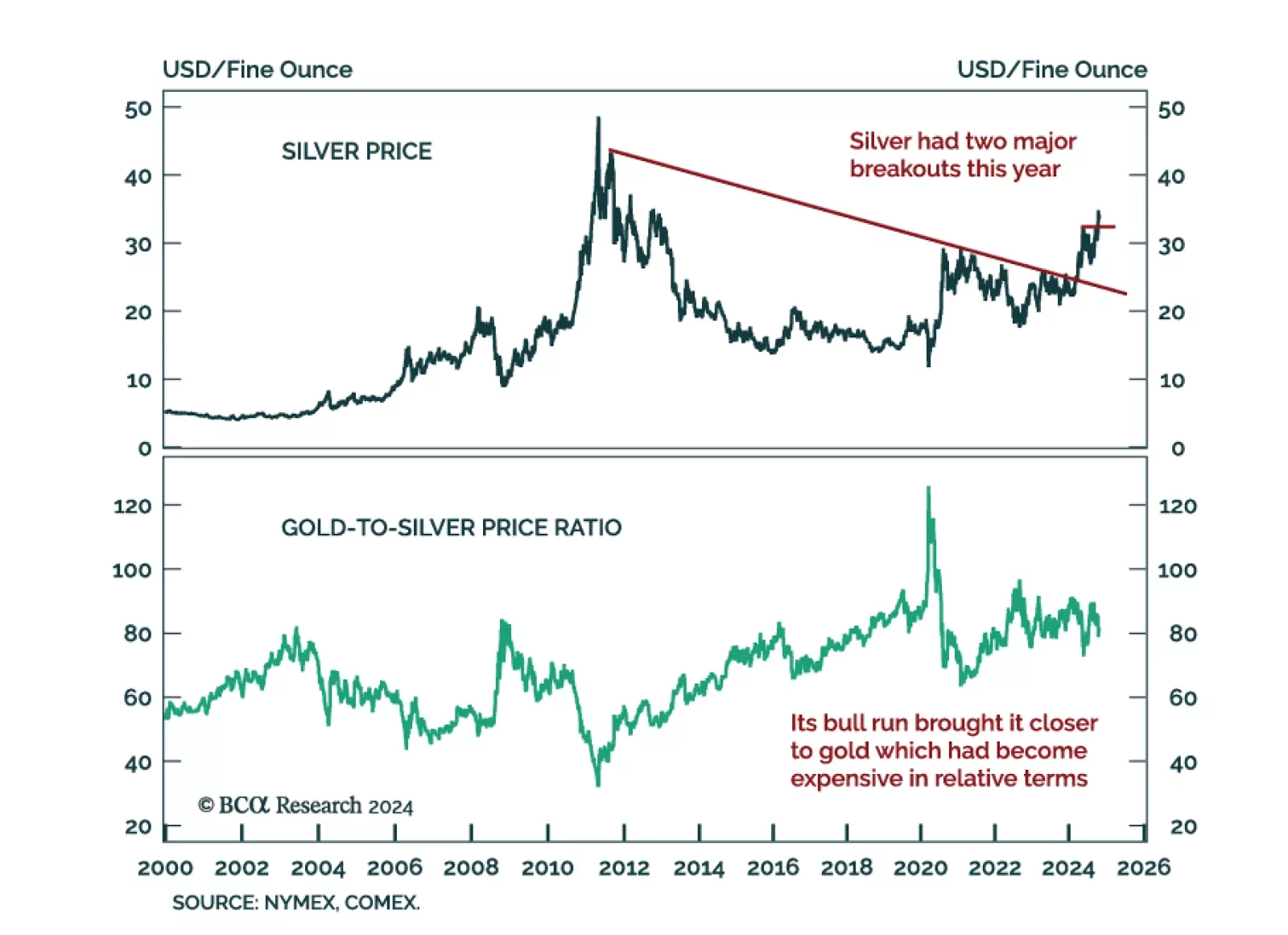

Silver has shone this year, especially after it breached a multi-decade downward slopping trendline. Silver is a precious metal, but its heavy usage in industrial processes makes us wonder whether it is sending a bullish message…

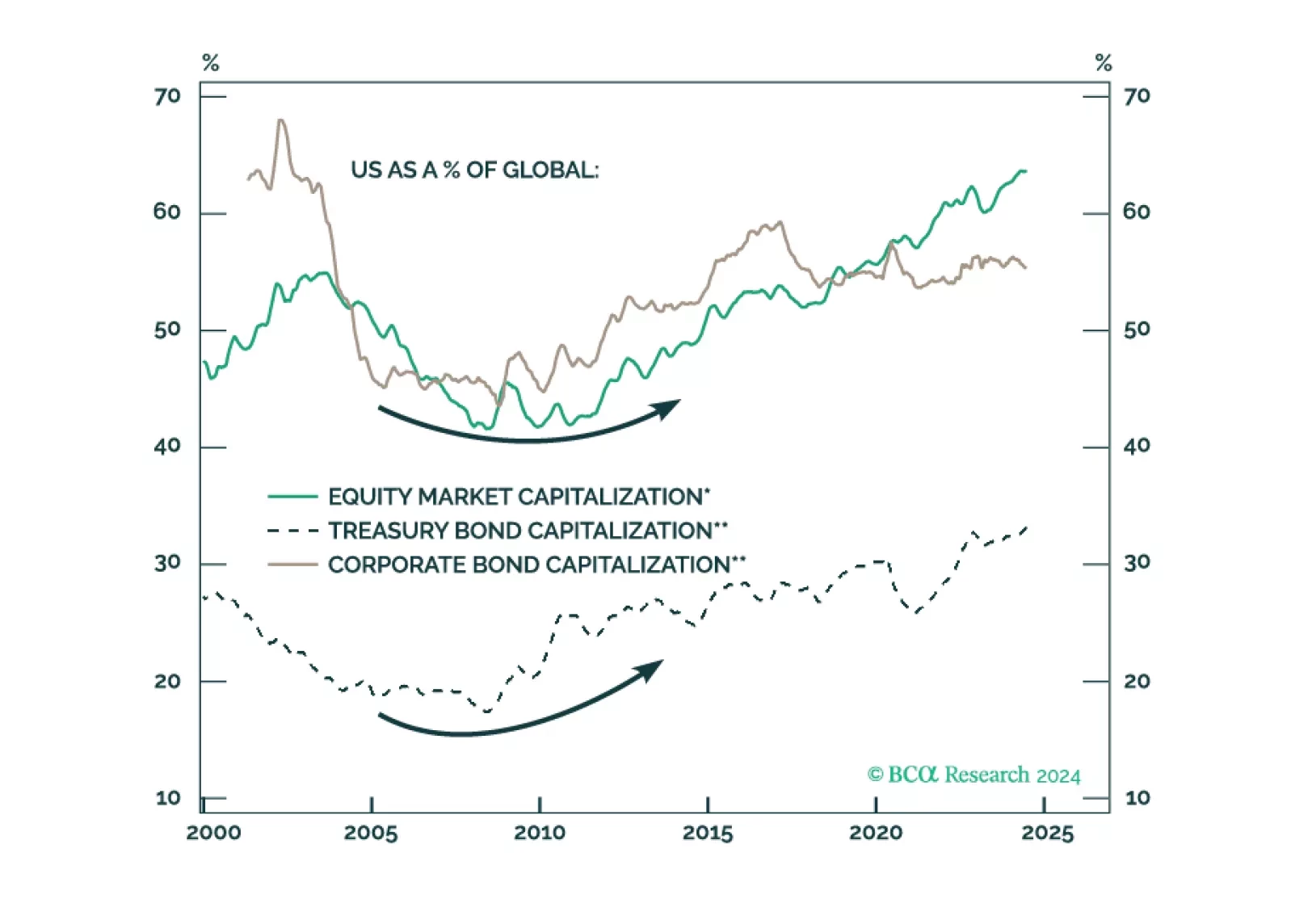

The global political system is destabilizing and the US will turn more hawkish in foreign policy, trade policy, or both, regardless of the election outcome. Tactically go long the dollar.

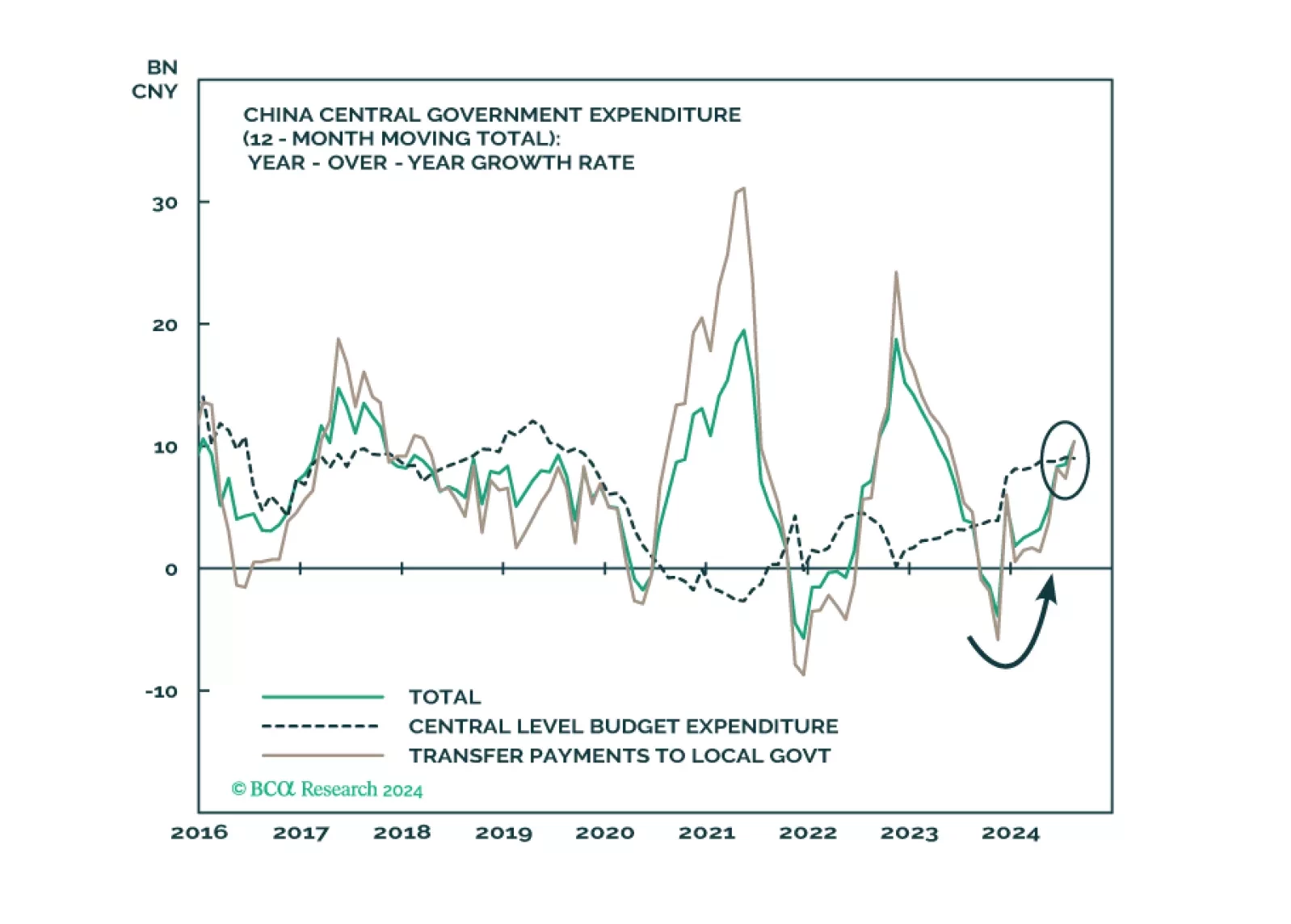

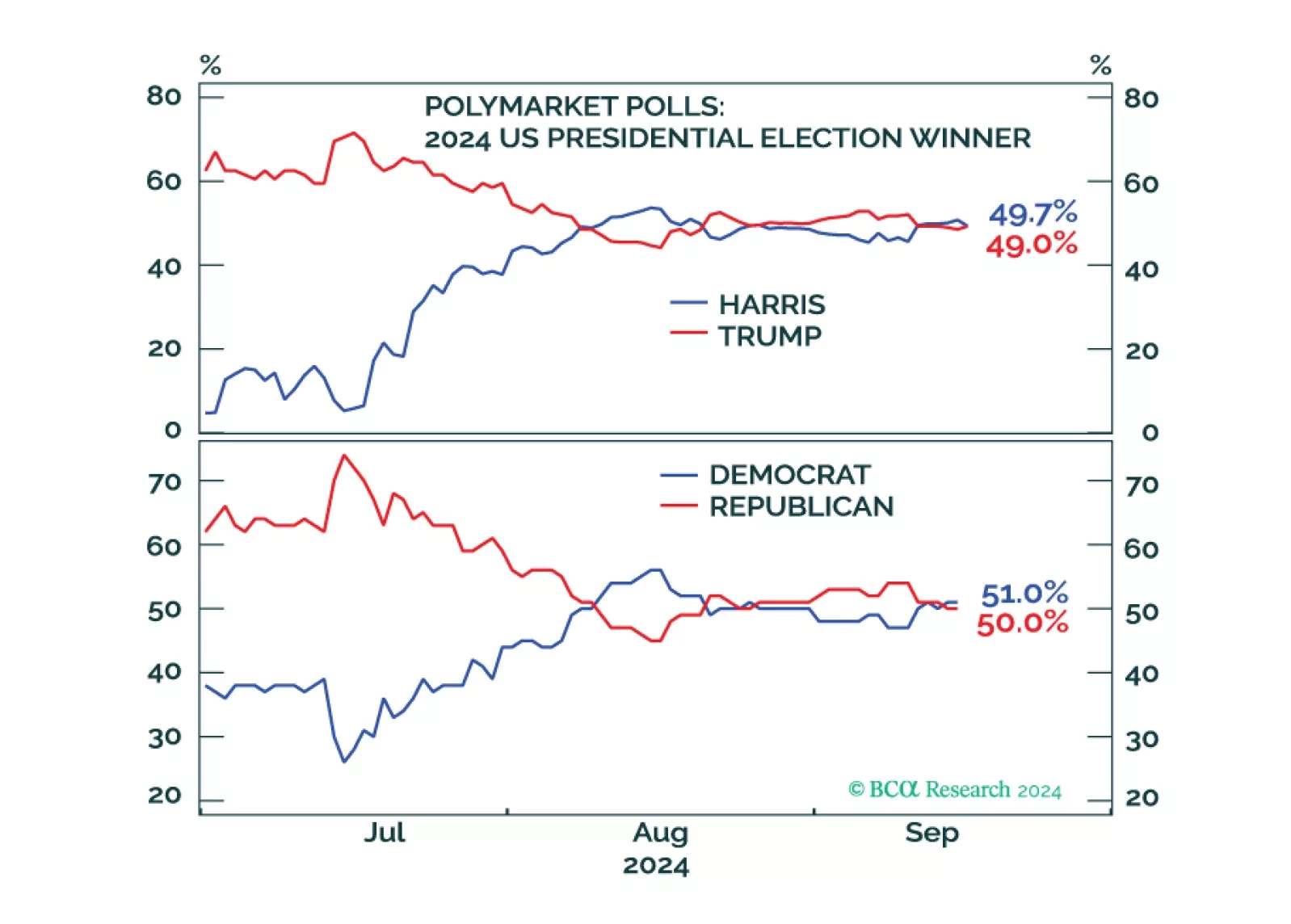

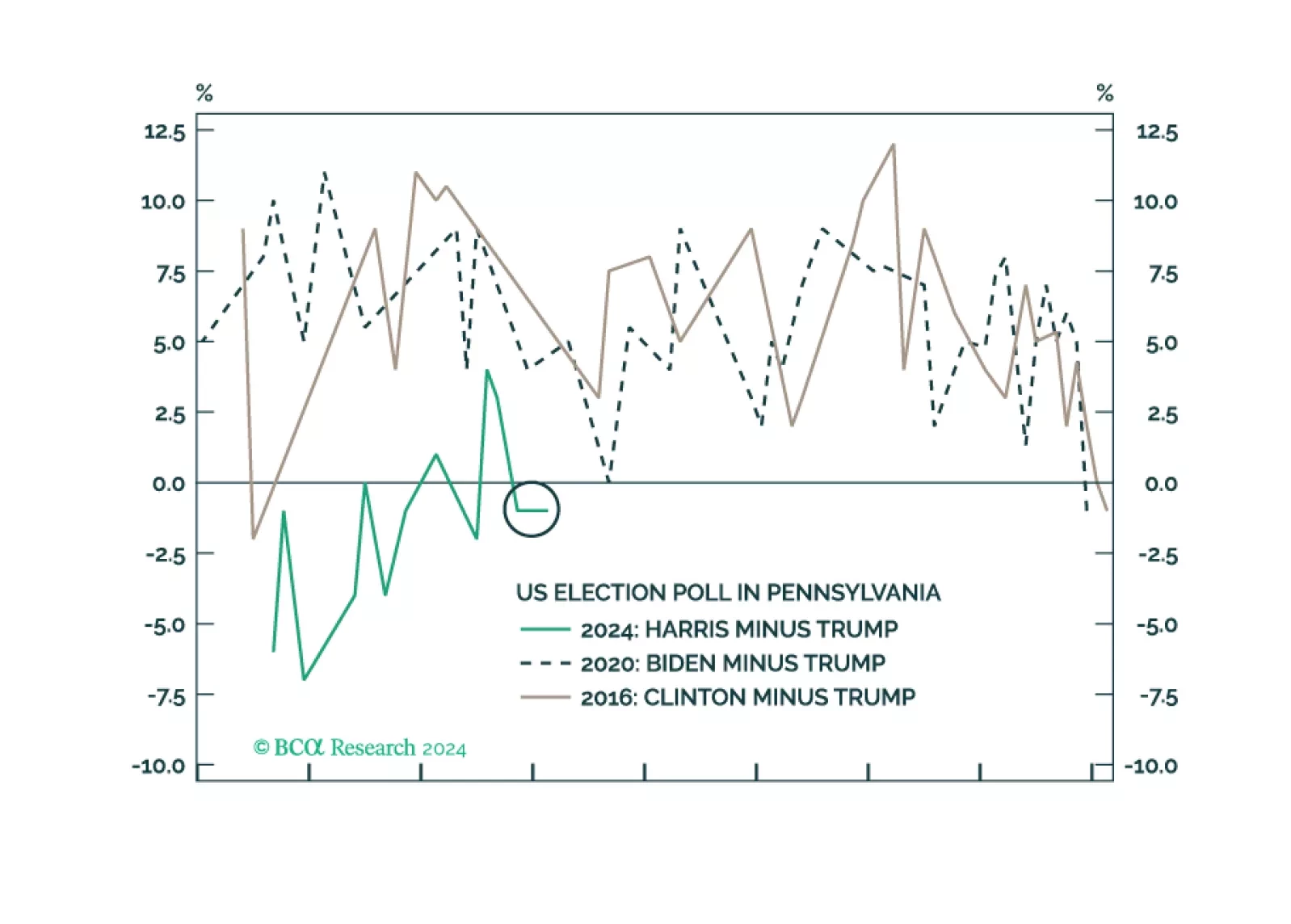

Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

Investors should de-risk tactically in expectation of shocks and surprises ahead of the US election and an uncertain aftermath. Democratic victory with a gridlocked Congress is our base case but would bring minor tax hikes and…

According to BCA Research’s Geopolitical Strategy service, the logic of pursuing one’s interest against US interests in the final hours of the election mostly applies to states that will suffer a significant loss to…

Investors should buy protection against further volatility. The shakeup in early August was a taste of things to come. The US election is a pivotal moment in modern history that will drive up uncertainty, while other countries take…

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

The death of the Iranian president reinforces our base case view of Middle Eastern instability and at least minor oil supply shocks. Rapid geopolitical developments in recent weeks are pointing to a new bout of global instability.…