Russia poses an immediate risk to global financial markets, and then perhaps a buying opportunity. Trump is pivoting to ceasefires and trade deals, but Russia could trigger a new tariff shock first.

BCA’s Geopolitical strategists advise investors to remain open to the possibility that a new Cold War dynamic is forming in global trade. While the US-China rivalry does not map perfectly onto the original Cold War, the analogy…

Acute geopolitical risks, like a massive oil shock, may be abating. But structural geopolitical risk remains high and could upset a blithe market. Cyclical economic risks are underrated as the US slows down and China continues to…

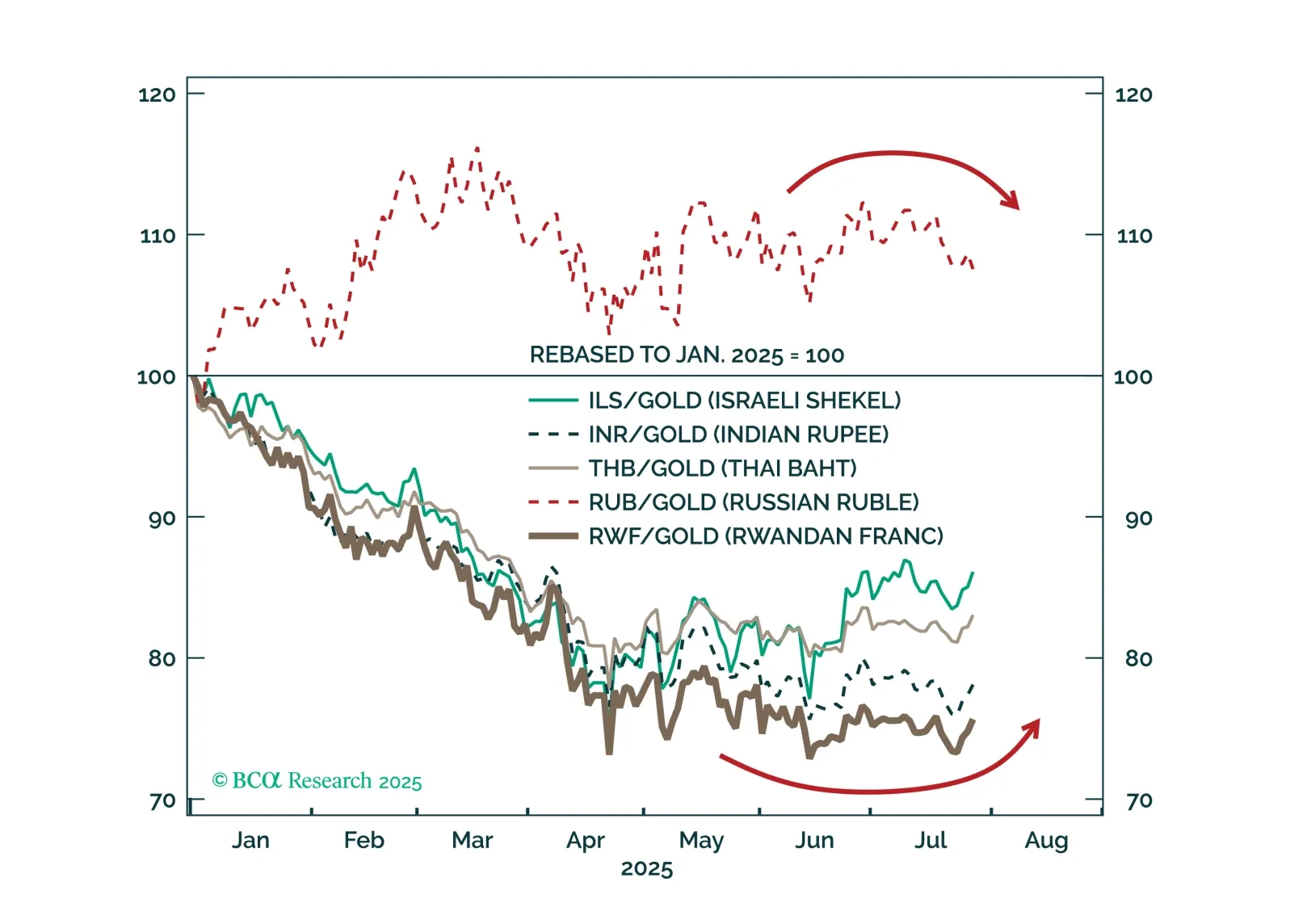

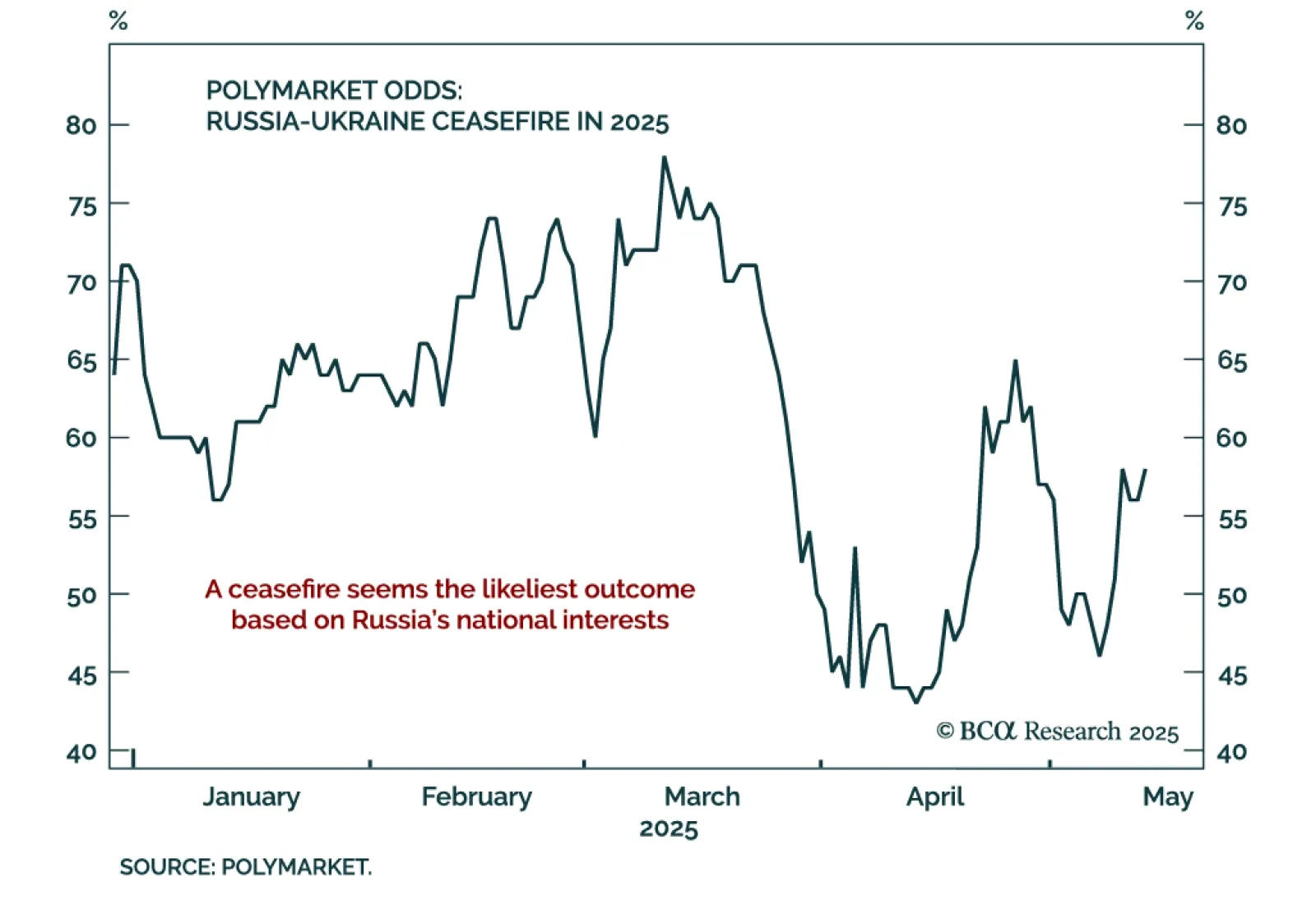

Our Geopolitical strategists expect a Ukraine ceasefire as Russia’s economic weakness compels Putin to shift focus from war to domestic stability. The likely outcome is not peace, but a frozen conflict that enables Russia to…

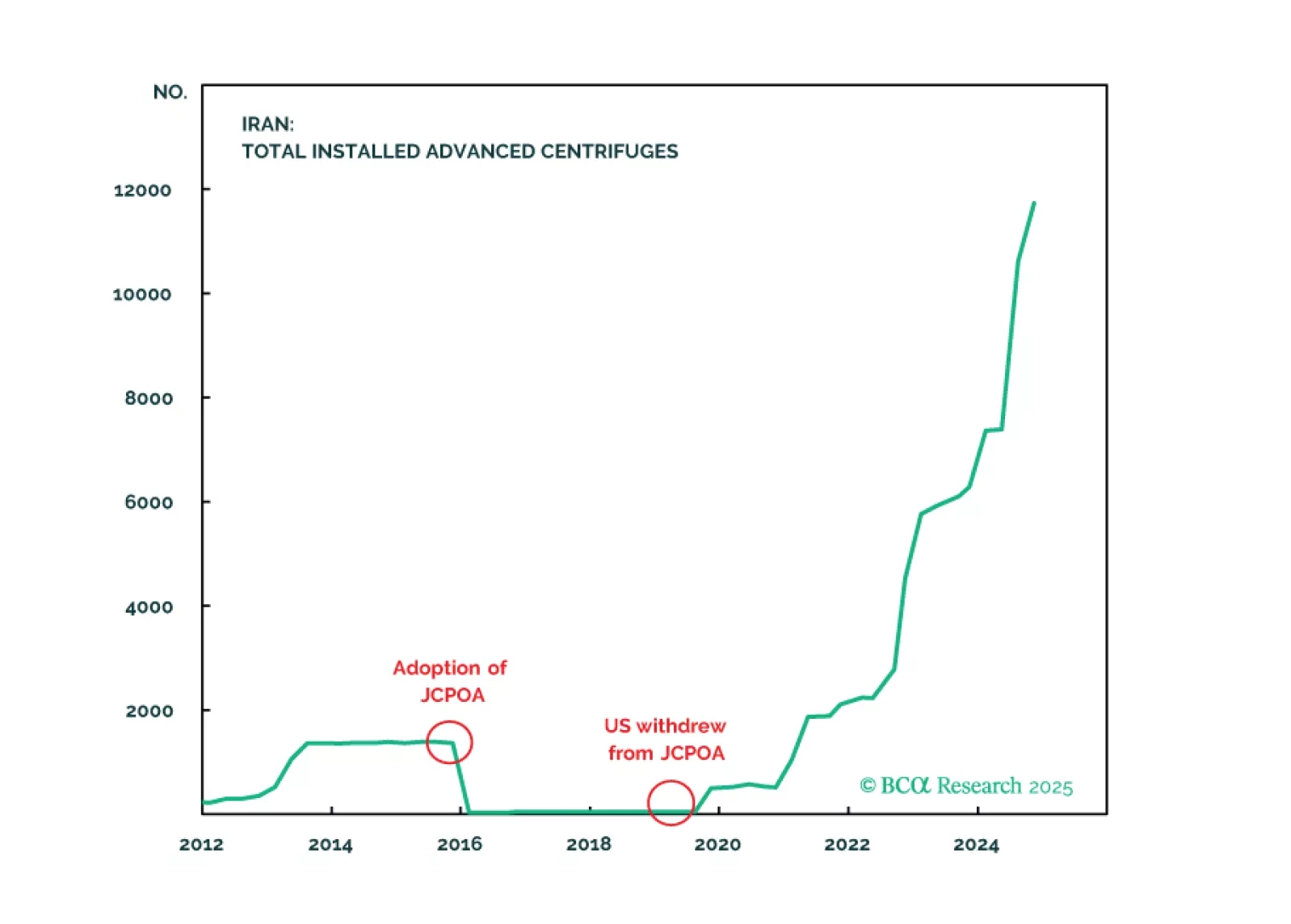

Negotiations on trade, Iran, and Ukraine will prove critical this month. Markets will remain volatile because positive data surprises enable the White House to press its hawkish tariff hikes, while negative surprises force the White…

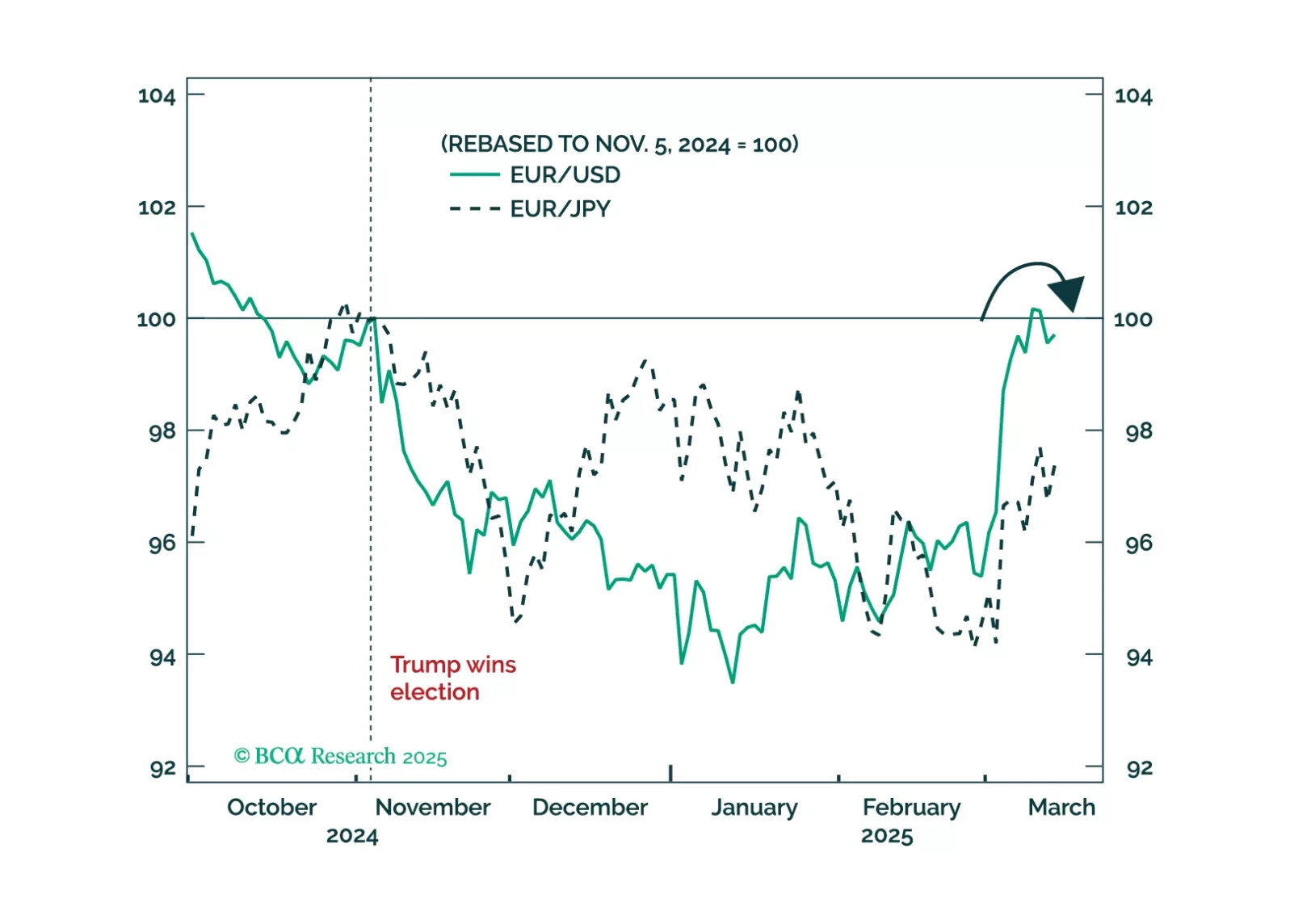

Trump’s foreign policy can be explained by rational US interests, but it requires settling the trade war with allies sooner rather than later. Book gains on EUR-USD for now.

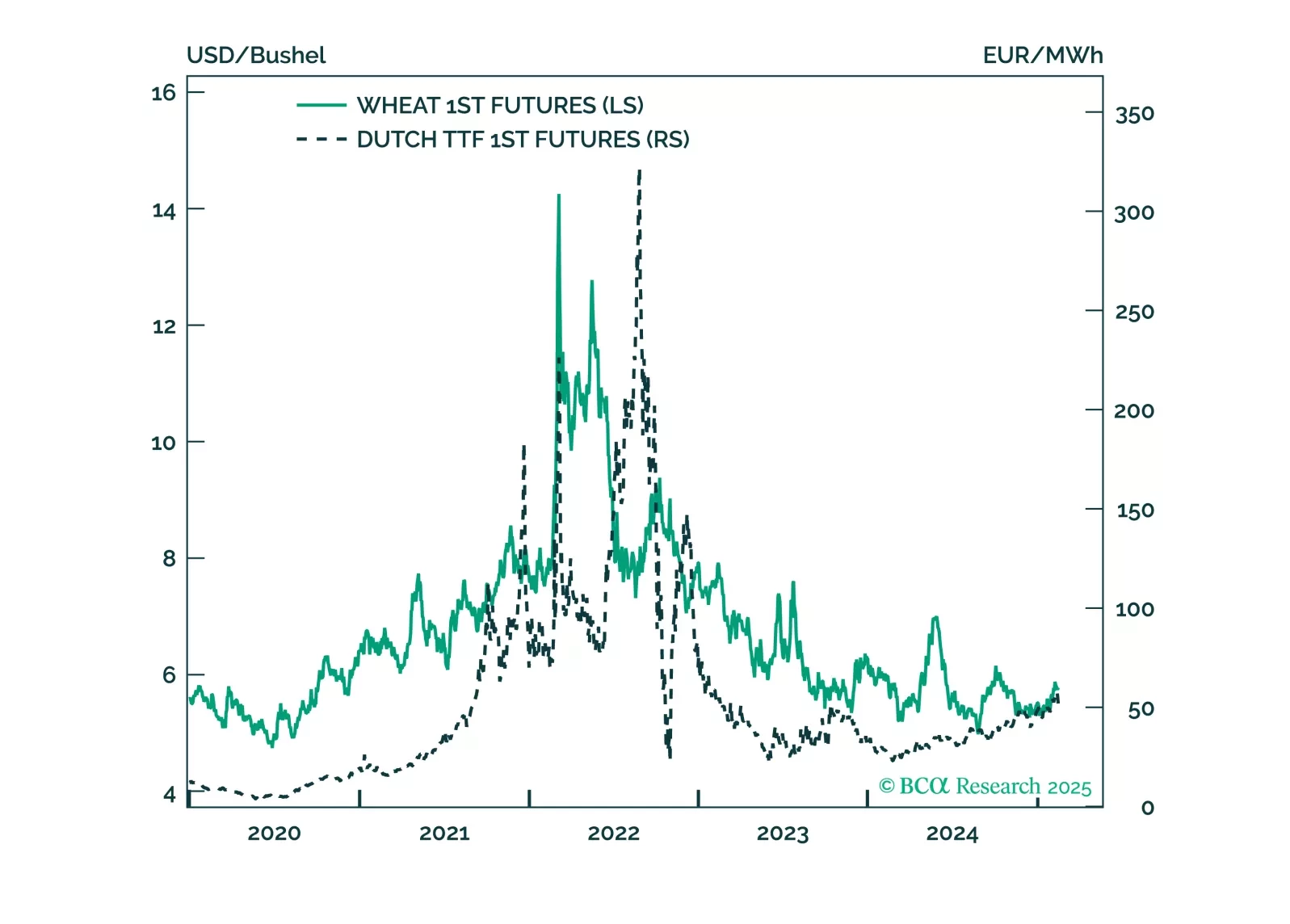

President Trump is negotiating a ceasefire in Ukraine. This will be a marginal headwind to some commodities which benefitted from the conflict like natural gas and wheat, and will be a marginal tailwind for European assets,…

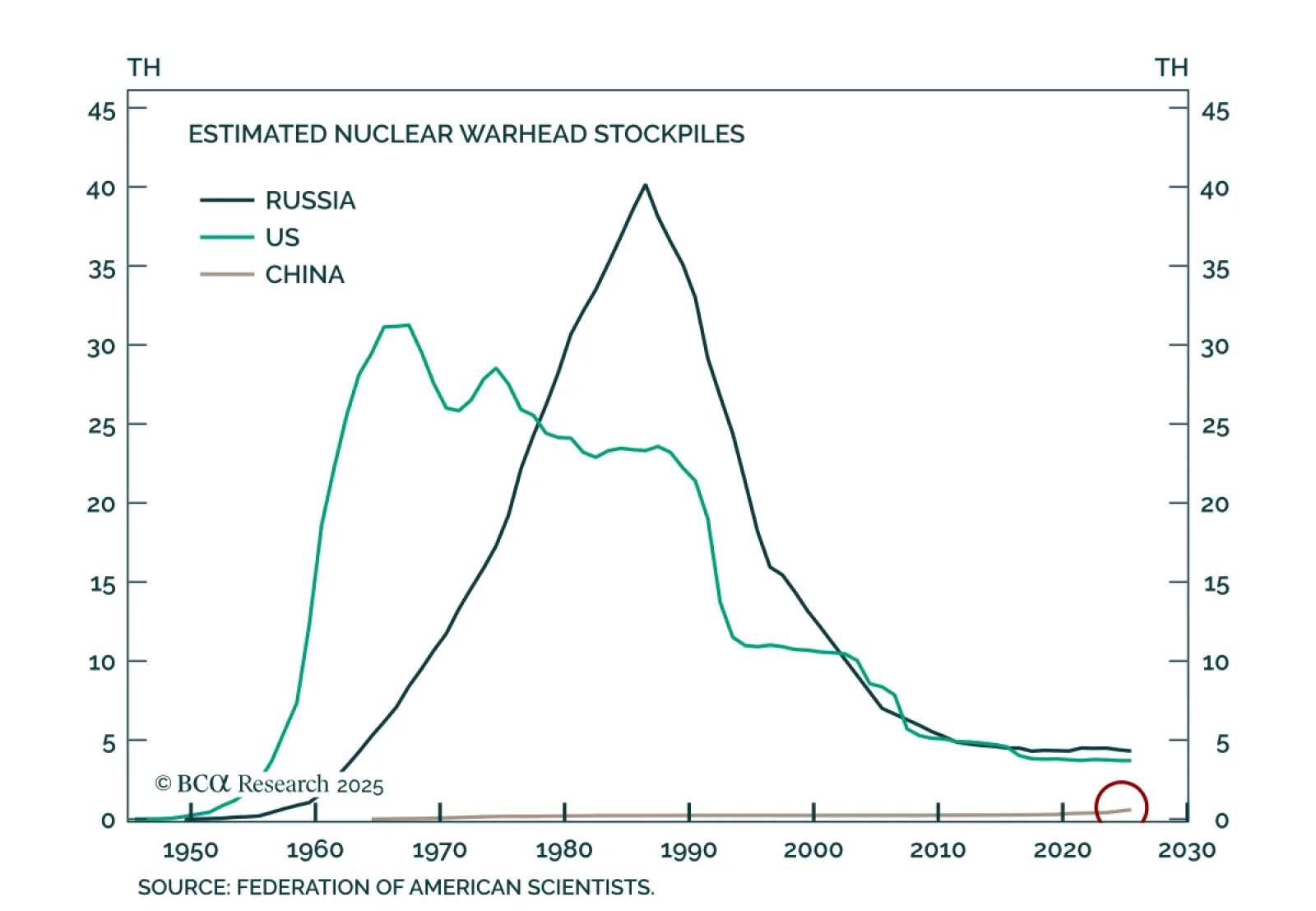

Every year we highlight five low-odds scenarios that would have a major impact on global financial markets if they happened. This year we contemplate a total reversal of Chinese policy, a US-Iran nuclear deal, a breakdown of NATO, US…

Congress will pass tax cuts by end of 2025 producing a fiscal thrust of about 0.9% of GDP in 2026. Trump will count on that stimulus as a basis for slapping tariffs on leading trade partners.China will retaliate against Trump…