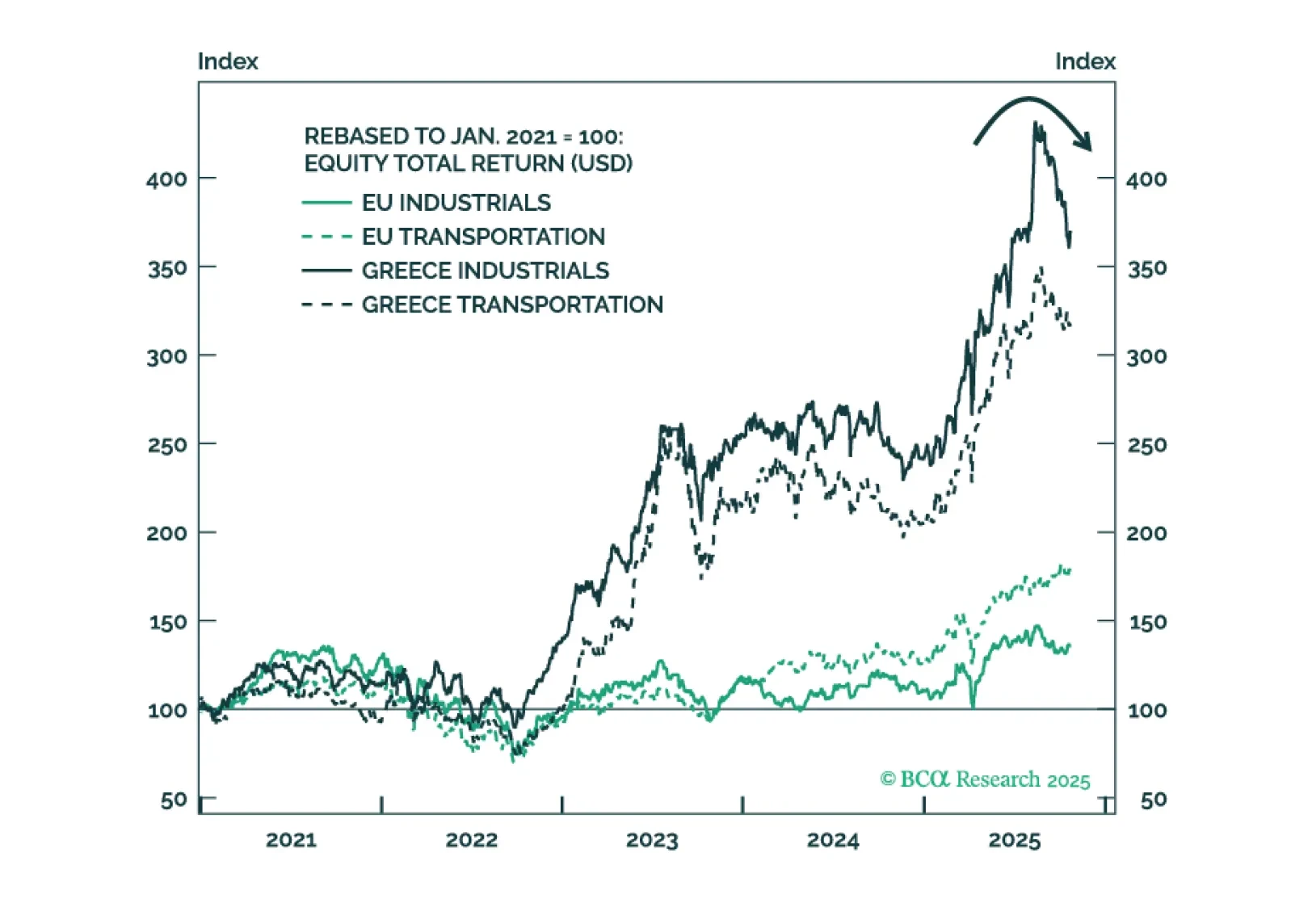

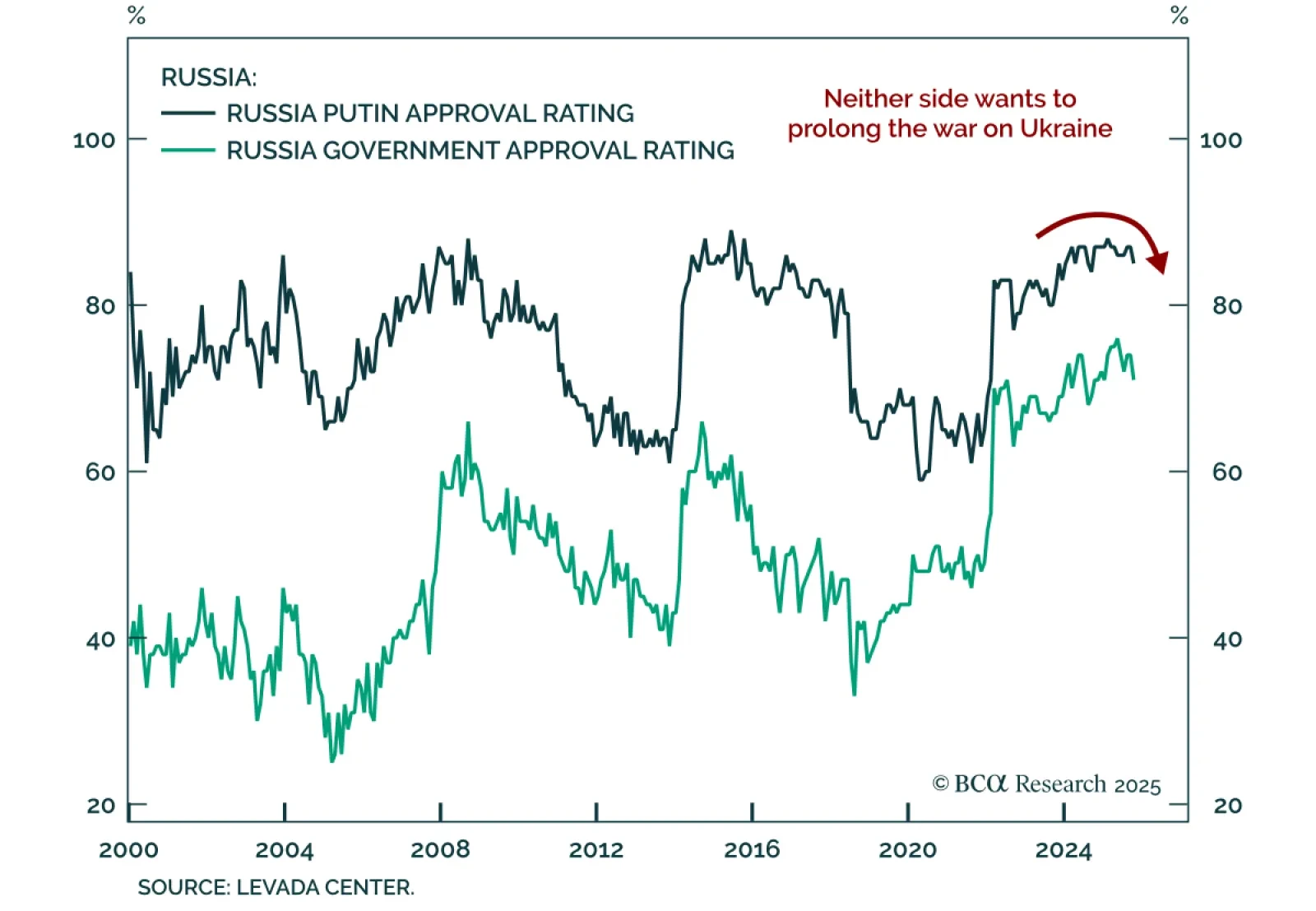

Behind-the-scenes Ukraine peace negotiations suggest rising odds of a ceasefire, posing downside risks for European defense equities. Despite President Zelensky’s public rejection of the proposal, talks continue privately. The draft…

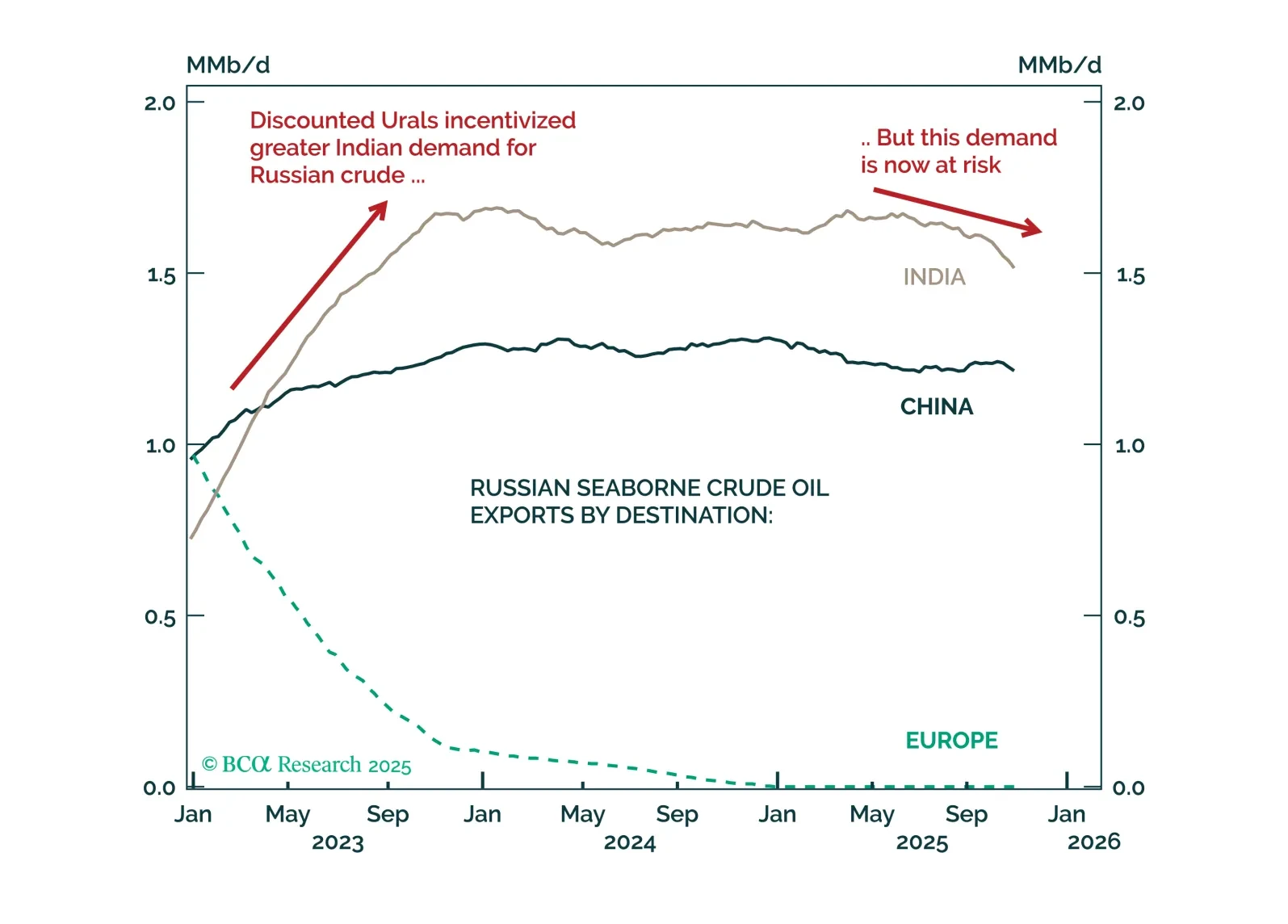

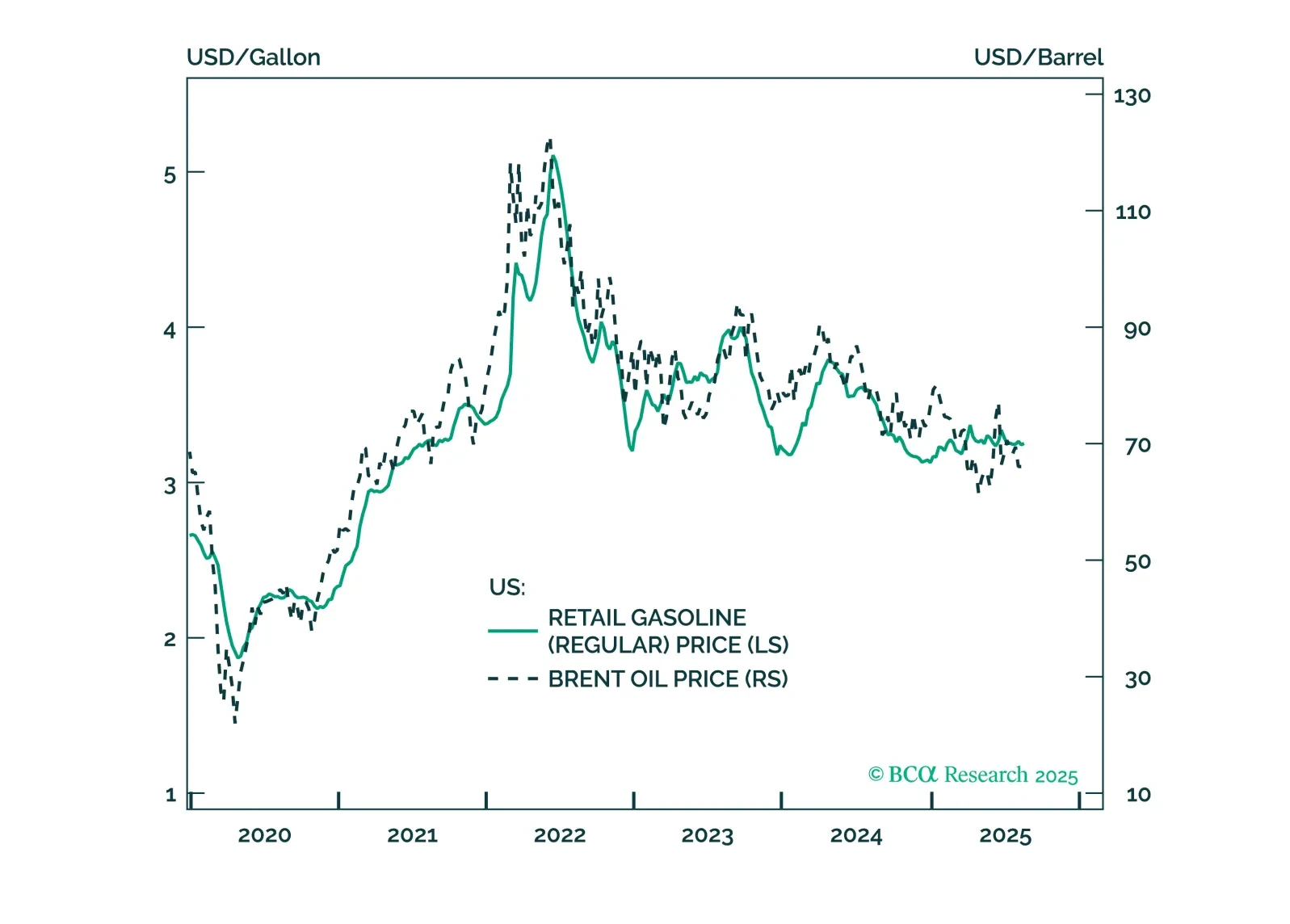

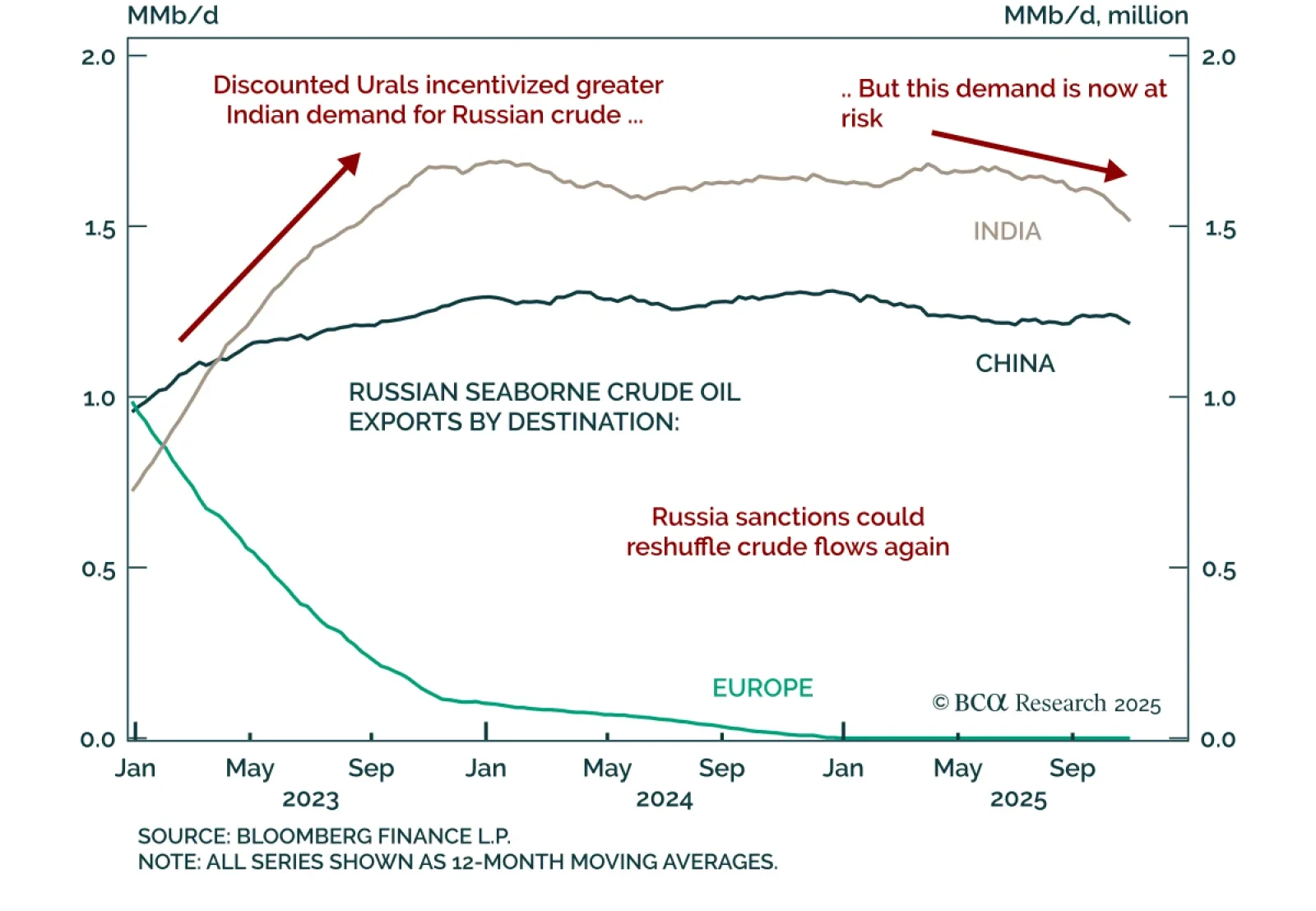

Our Commodity strategists advise staying short Brent, with a stop-loss at $73/bbl, as US sanctions on Russian crude are unlikely to meaningfully impact prices over a cyclical horizon. While new restrictions on Rosneft and Lukoil…

US restrictions on Russian crude exports could disrupt global oil supplies and trade flows over the near term. However, they are unlikely to have a meaningful impact on crude prices over a cyclical timeframe. Stay short Brent.…

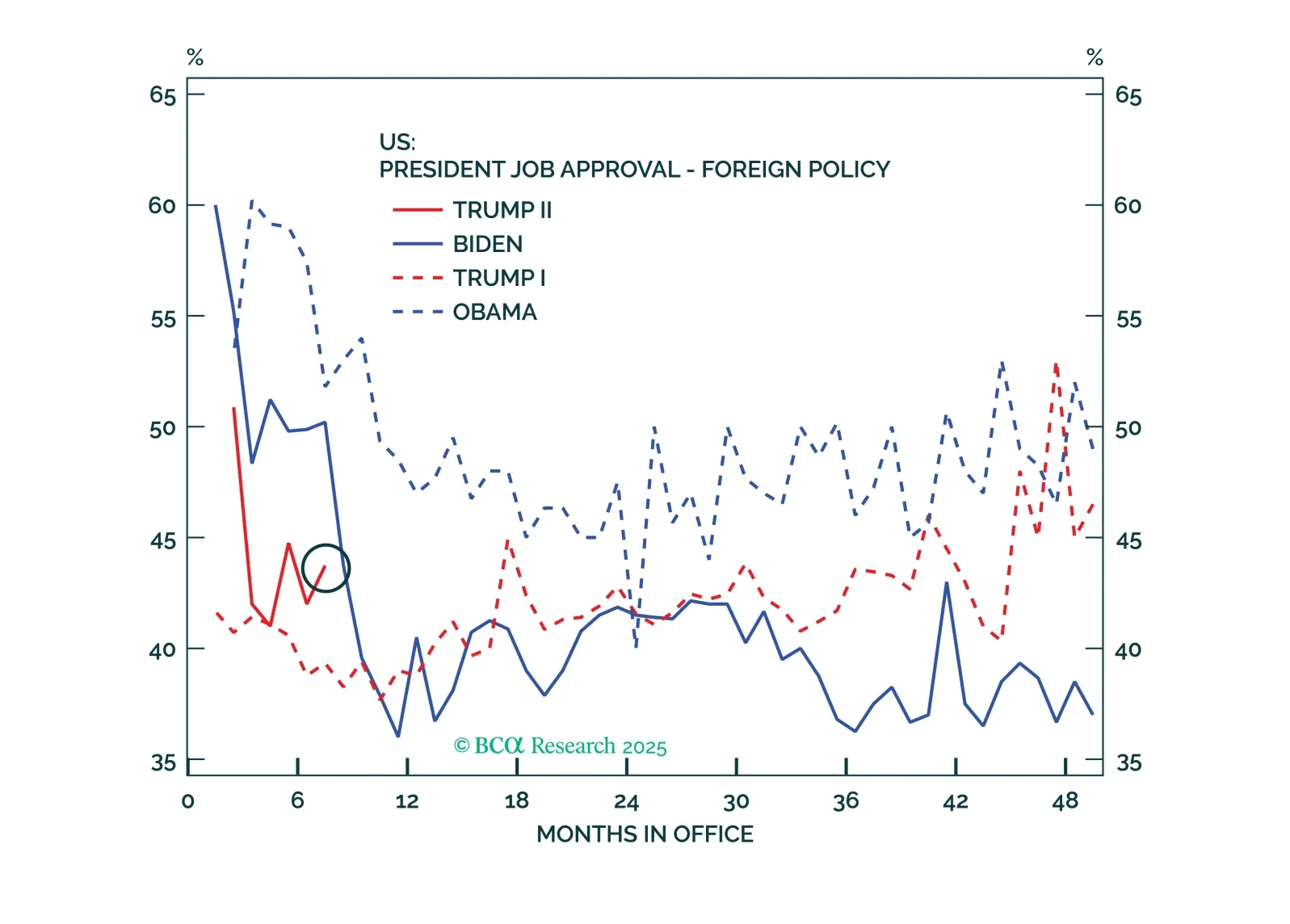

Reduce risk exposure in the very near term as President Trump's ceasefire effort falters, Russia tensions spike, and US-China trade prospects suffer.

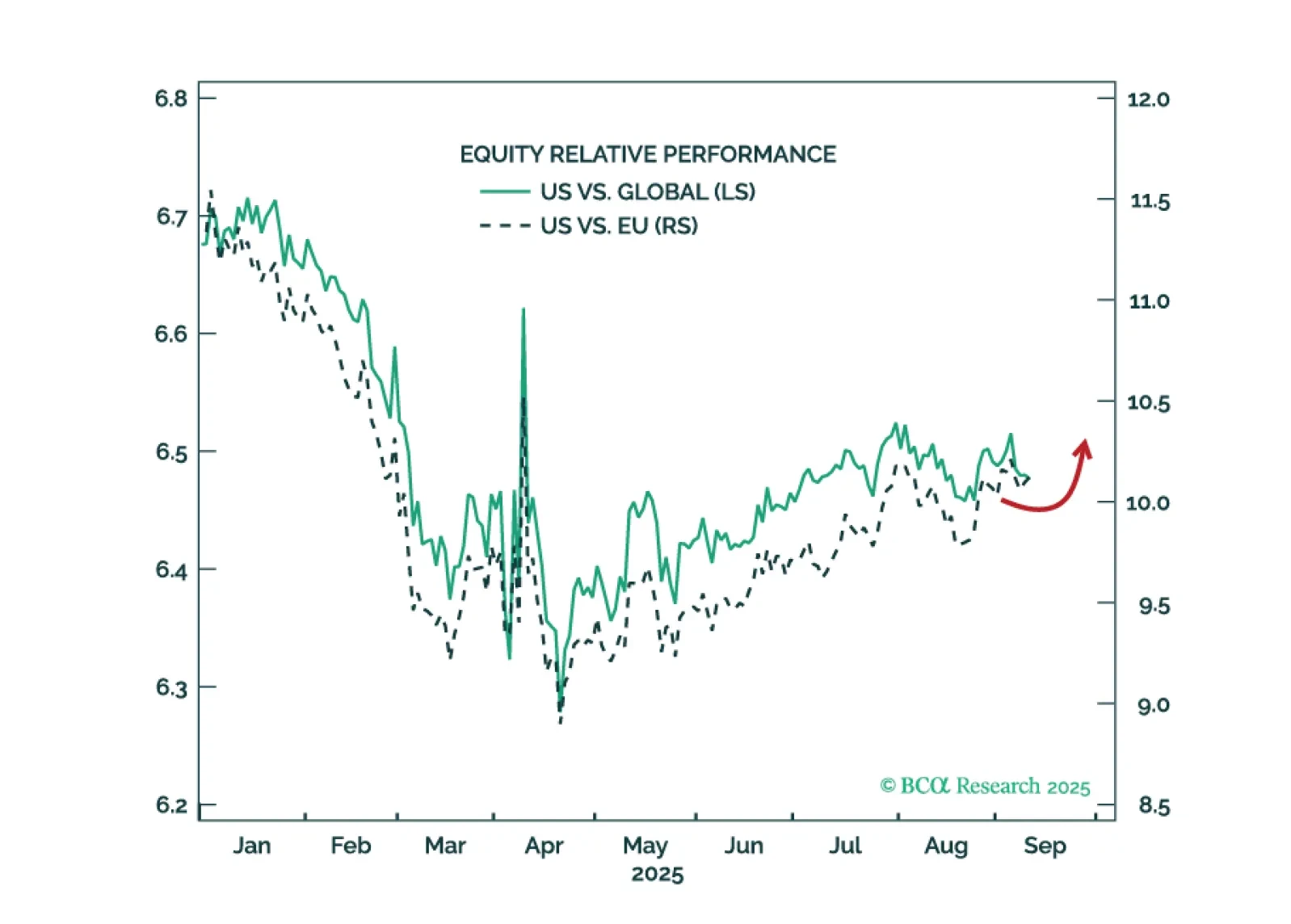

A world of political churn favors safe havens — buy yen, stay overweight US stocks, and avoid chasing the fragile rally in China.

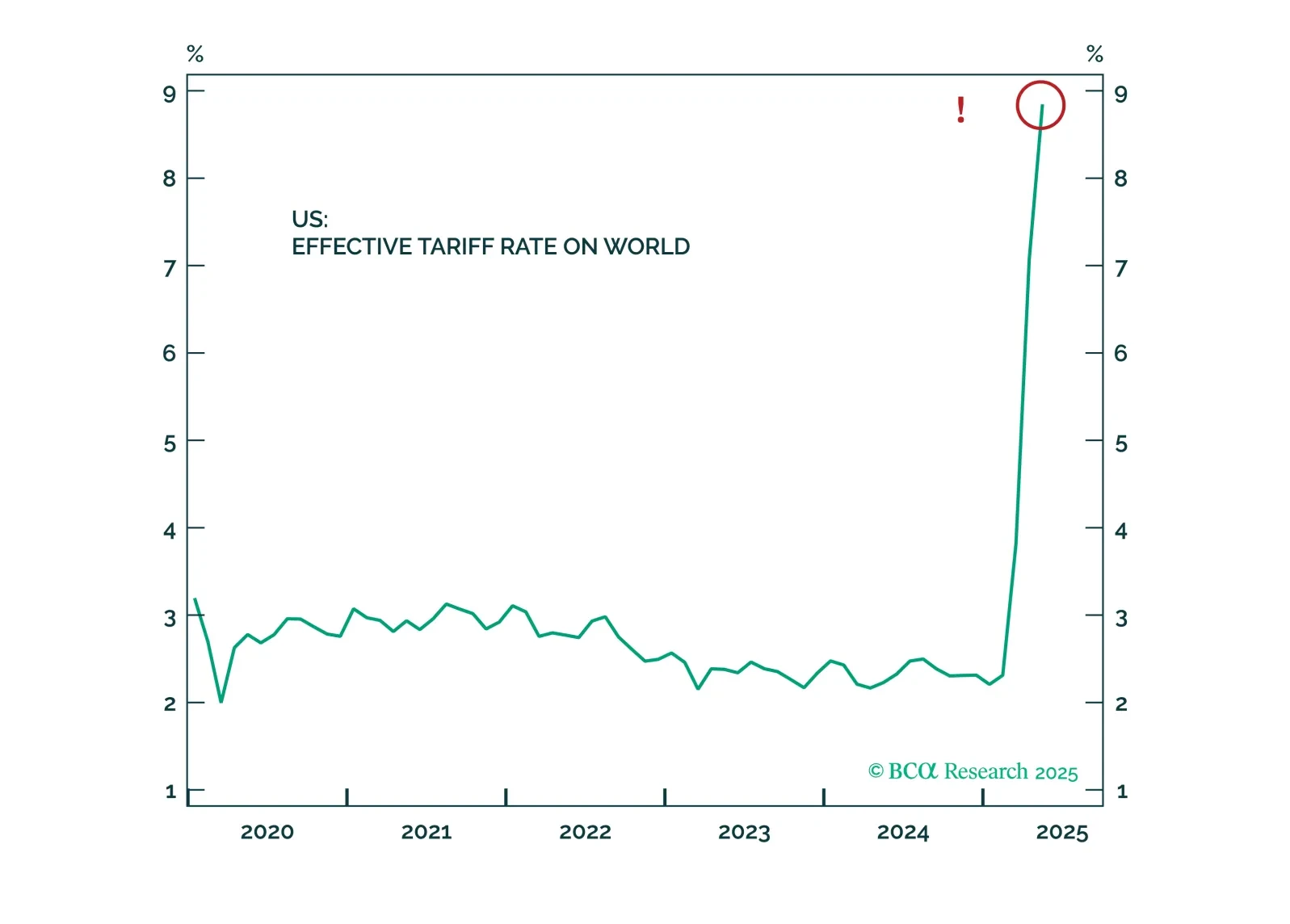

Rising Russia-NATO risks, tactical oil/gold trades, tougher sanctions on Russia (maybe China), China stimulus with ~5% growth target, and US checks on Trump’s ambitions will define Q4.

Russia’s recalcitrance will probably trigger a near-term global stock market correction by prompting larger sanctions and derailing US-China talks. But Israel’s actions do not raise our odds of a major oil shock.

Trump, the Fed, the Russo-China bloc, Venezuela, and France are all seeing developments that imply some contrarian tactical views: Long USD, overweight US versus Europe, overweight Europe versus China, and short oil.

The media is missing the big picture: the war is already contained. The falling oil price confirms that. We fully expect cold feet and volatility incidents in the very near term but there is only a 5% chance of Russia triggering a…

Investors should stick to a defensive stance in the very near term as the Russia-Ukraine conflict and persistent trade tensions cause market volatility.