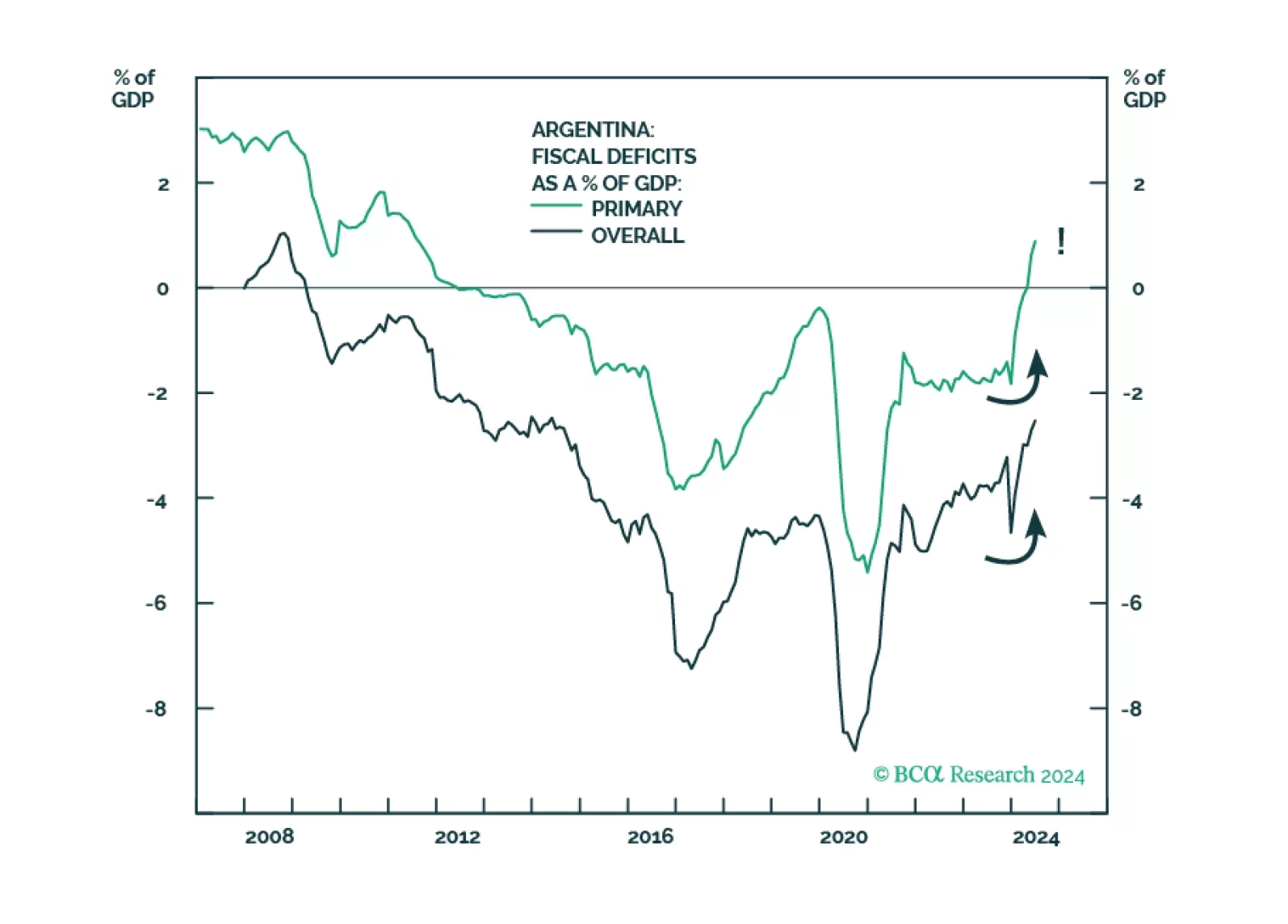

GeoMacro team partners with BCA’s Emerging Markets Strategy to examine political reforms in Argentina. Our colleague Juan Egaña argues that the time is not right to go long Argentinian assets and that Buenos Aires must avoid the…

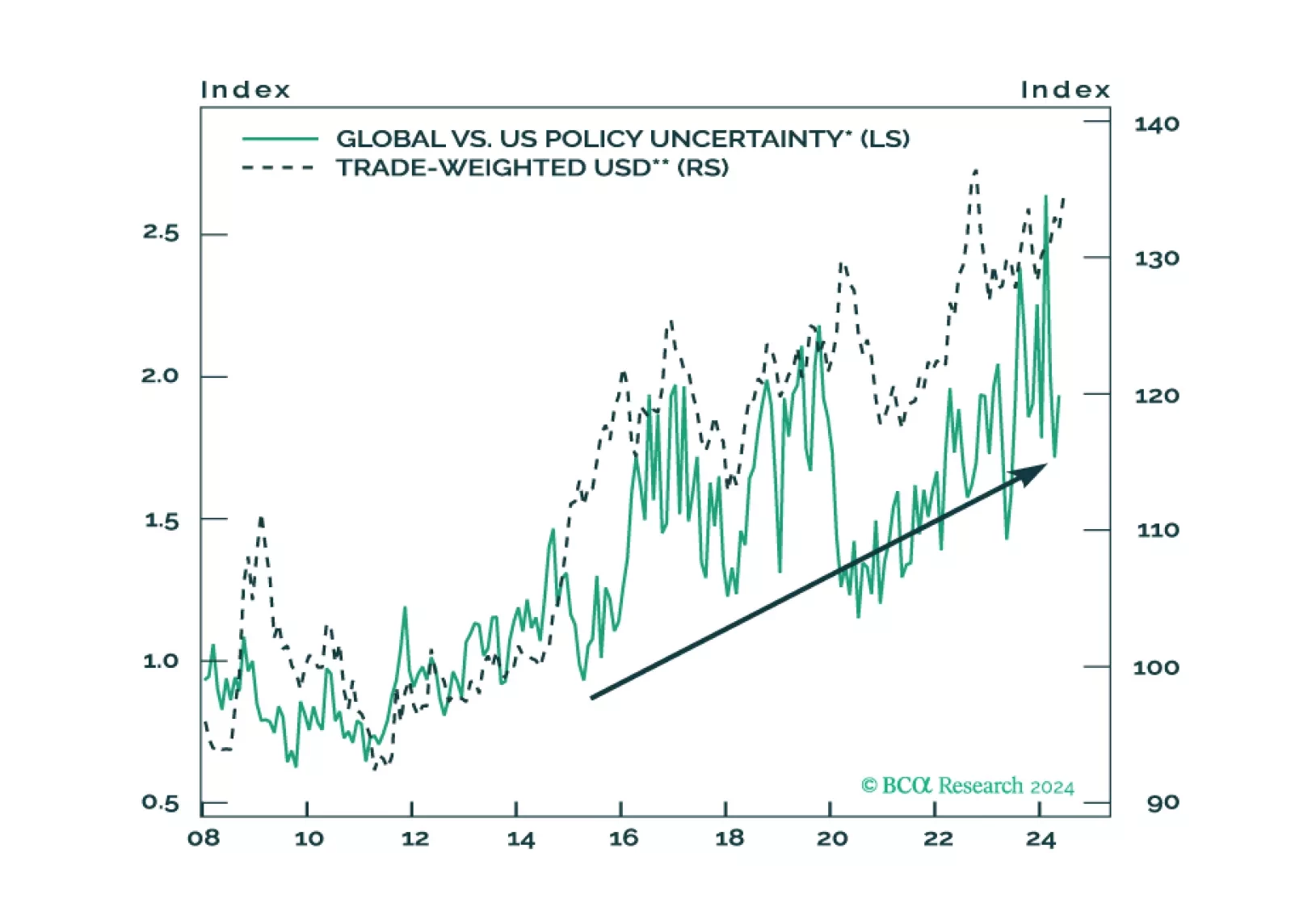

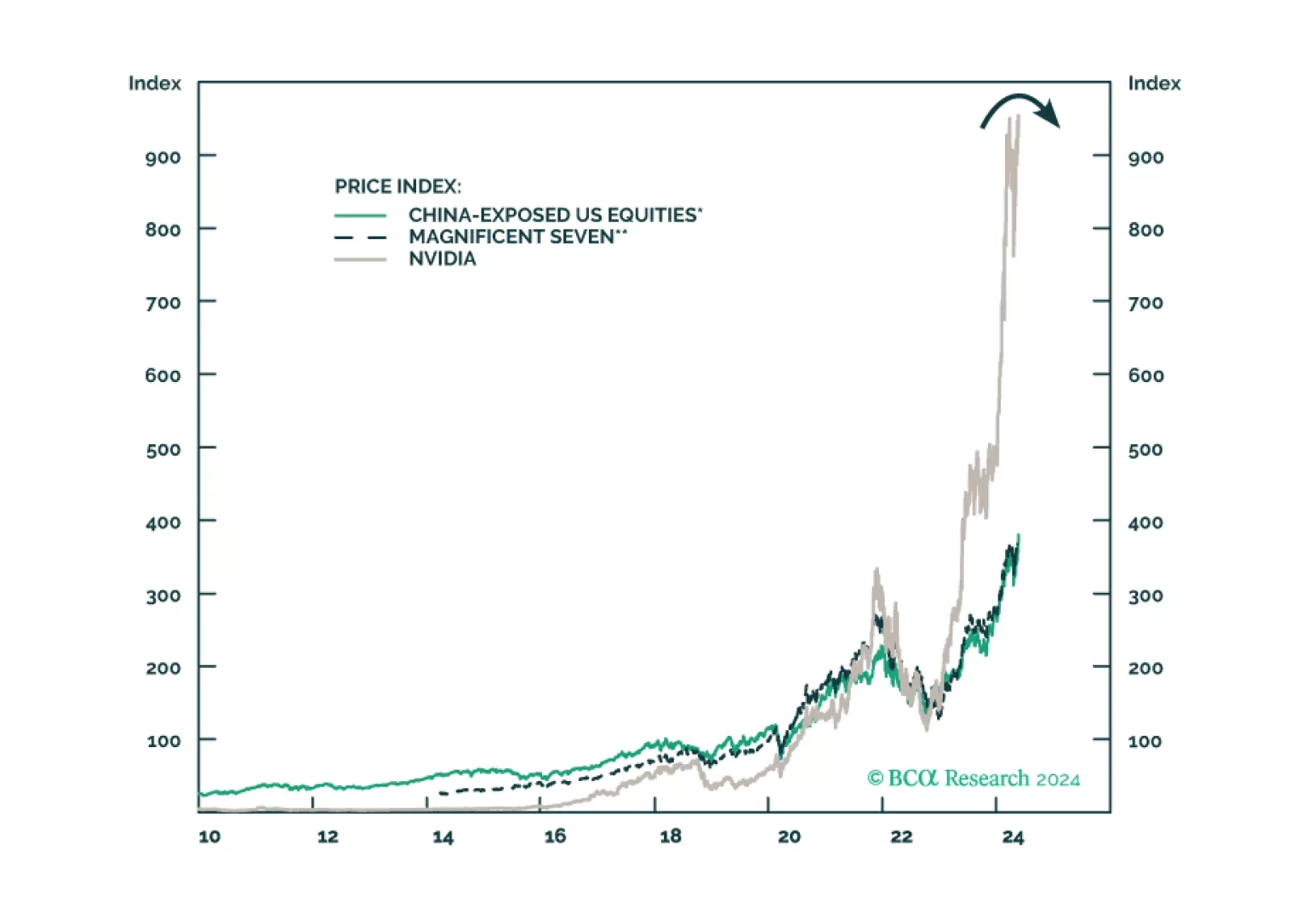

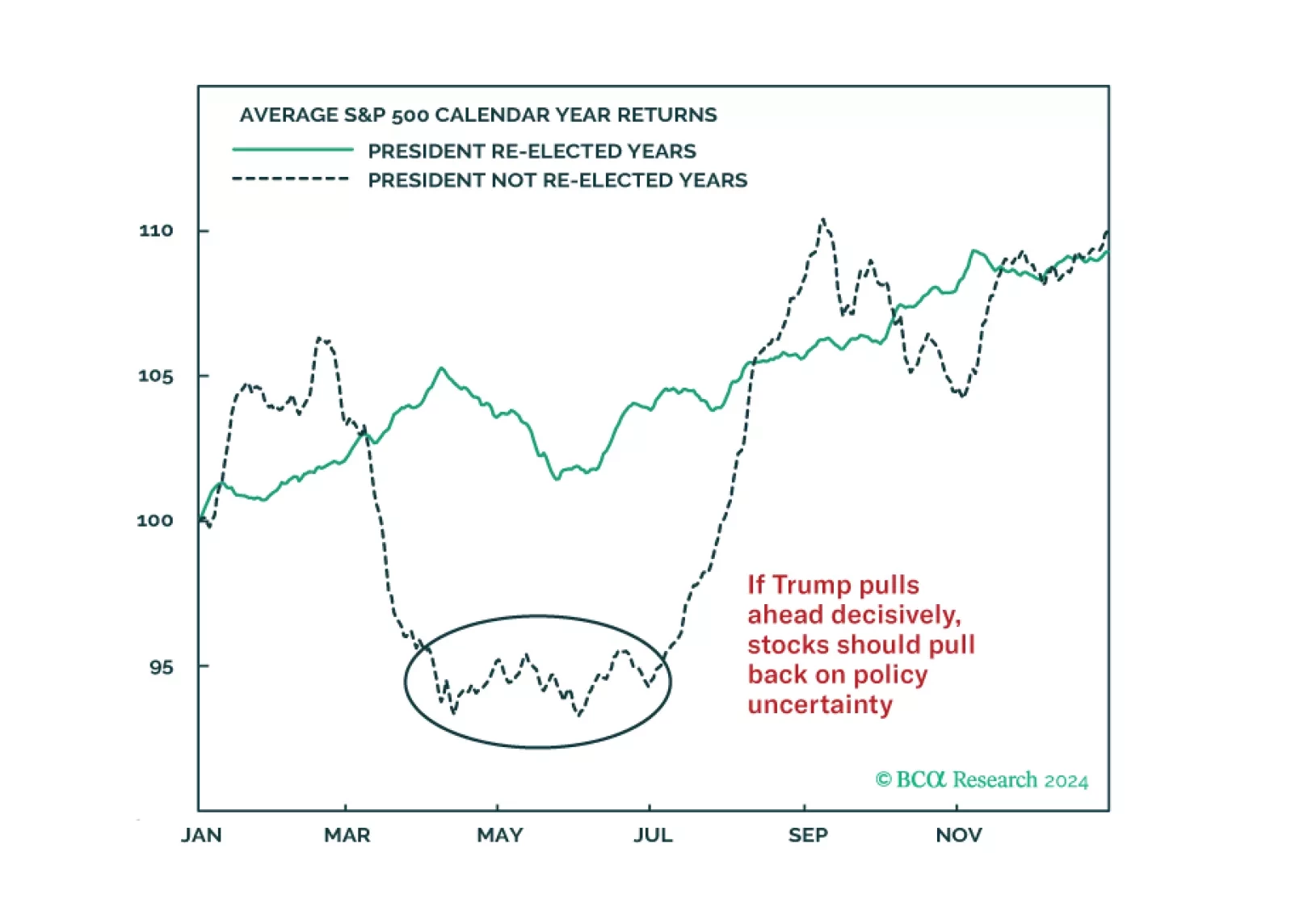

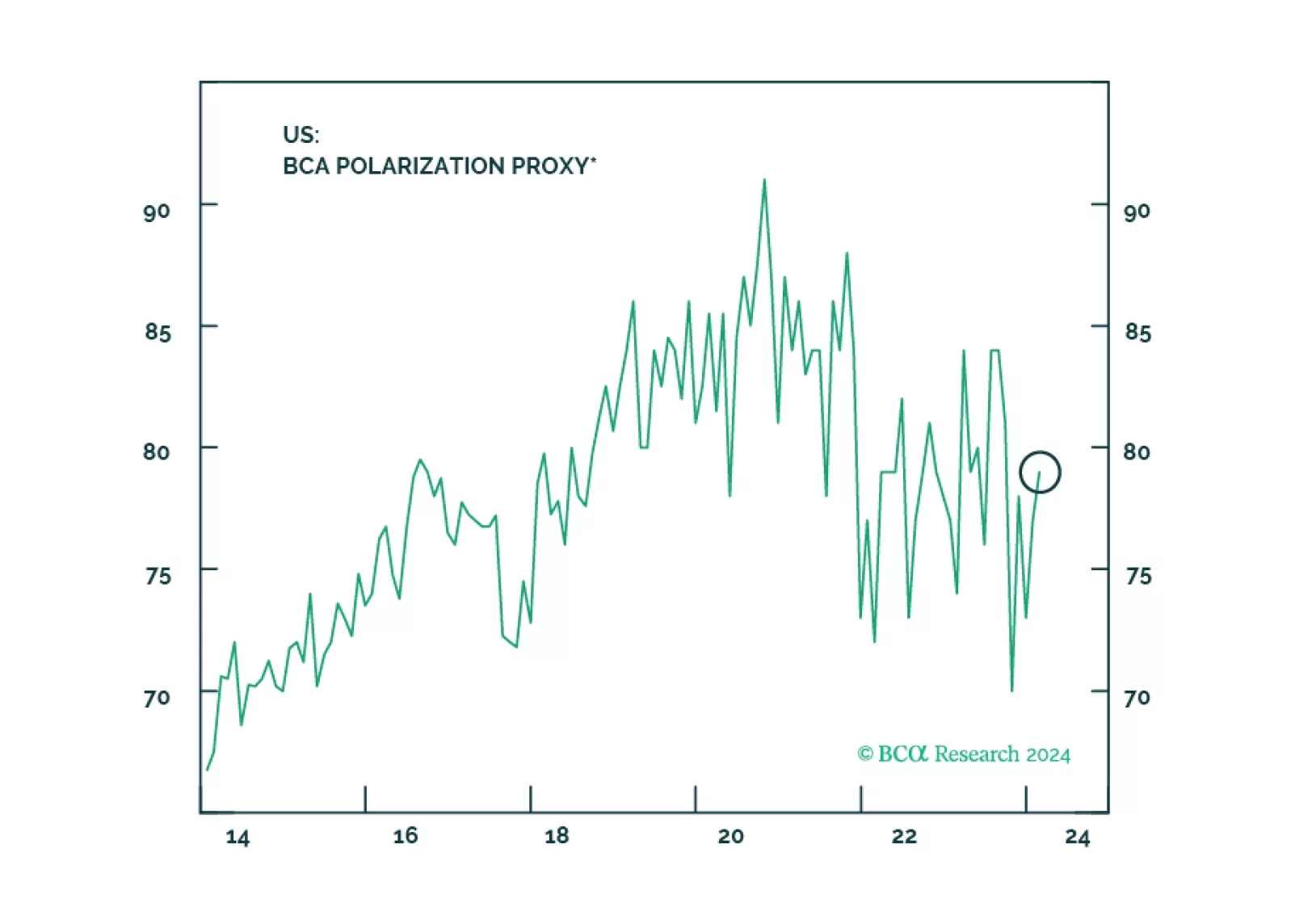

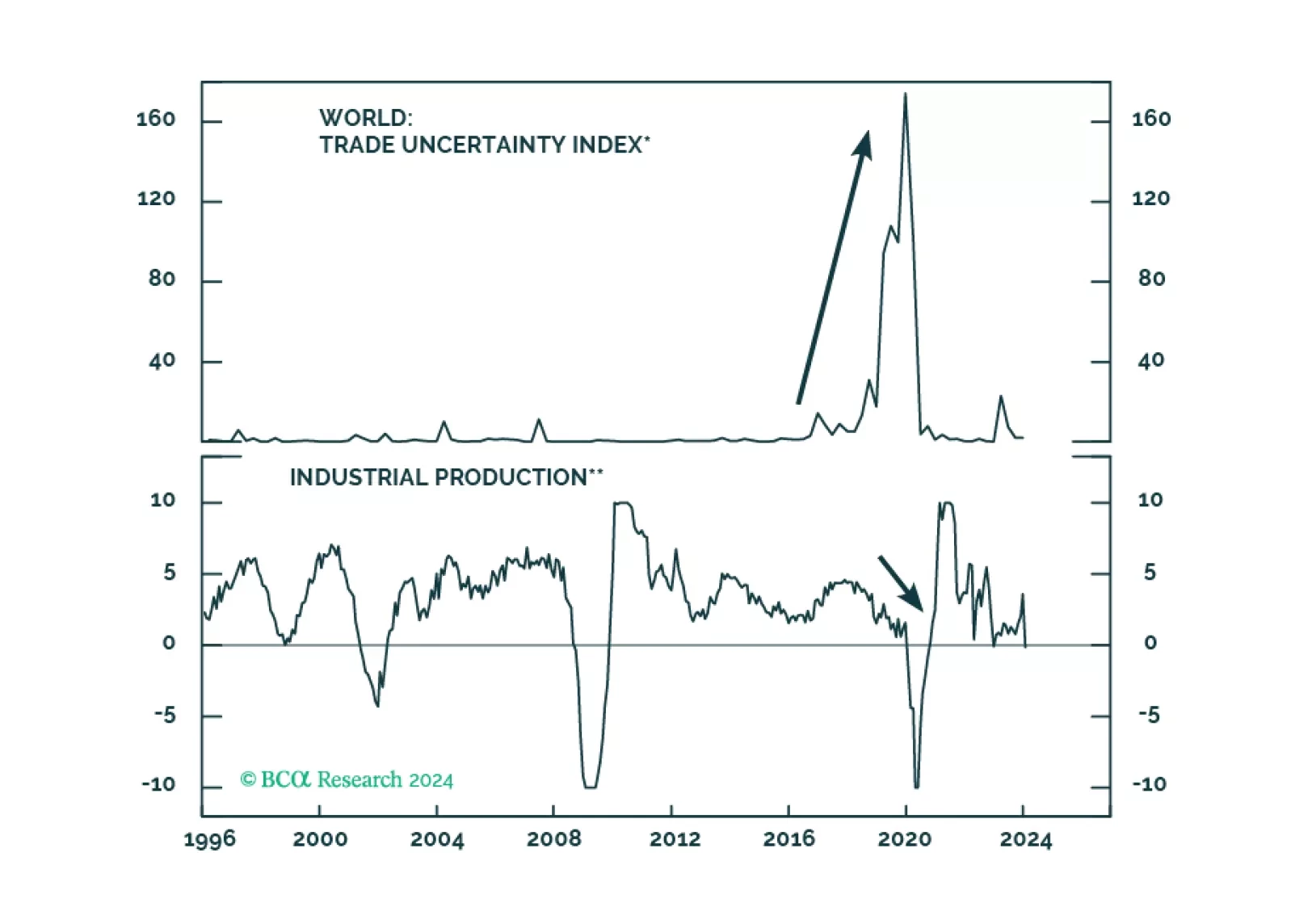

Investors should overweight US assets and de-risk their portfolios in anticipation of a major increase in policy uncertainty and geopolitical risk surrounding the US election and its global ramifications.

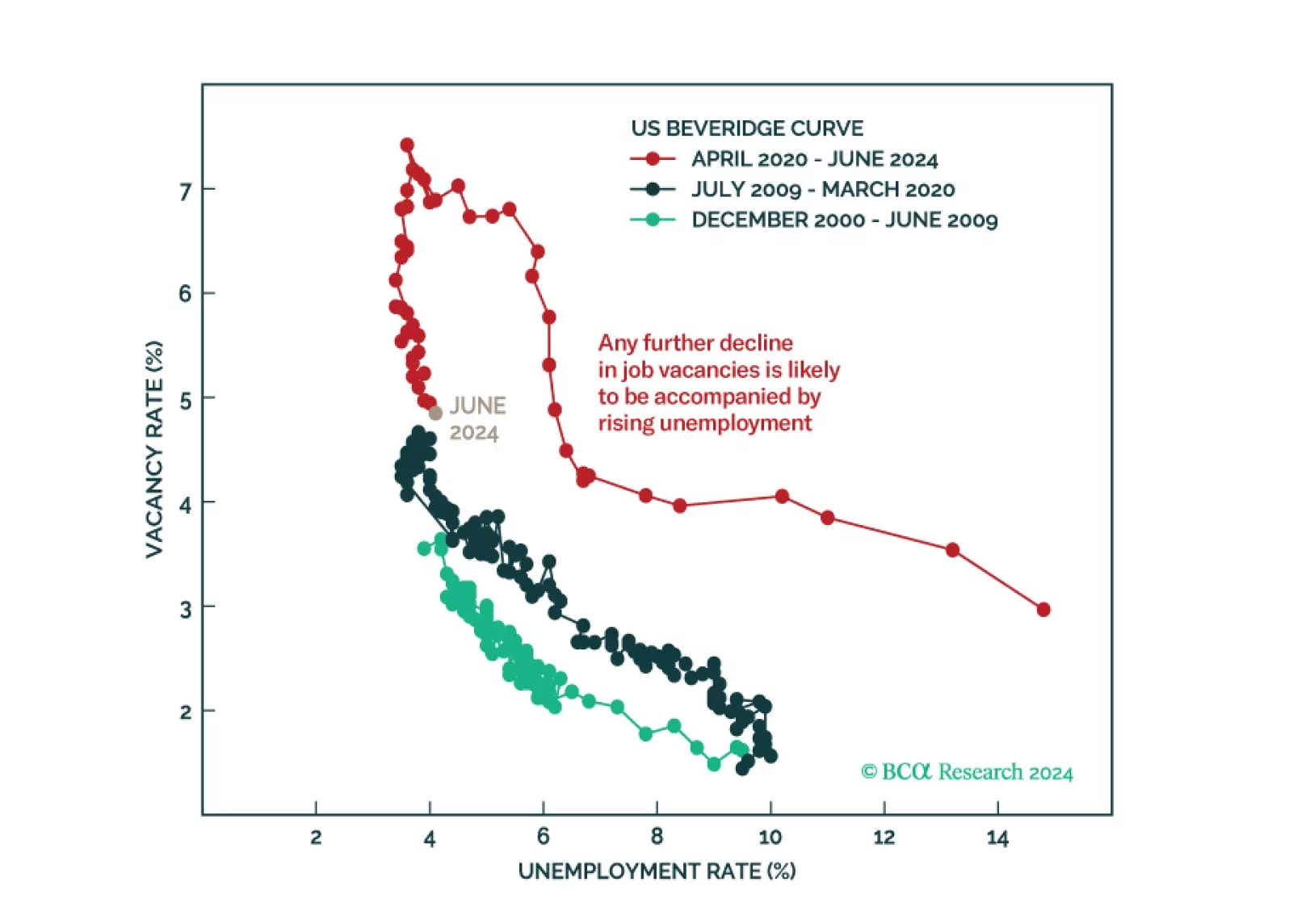

Don't buy the dip. The equity bull market is over. The US will enter a recession in late 2024 or in early 2025.

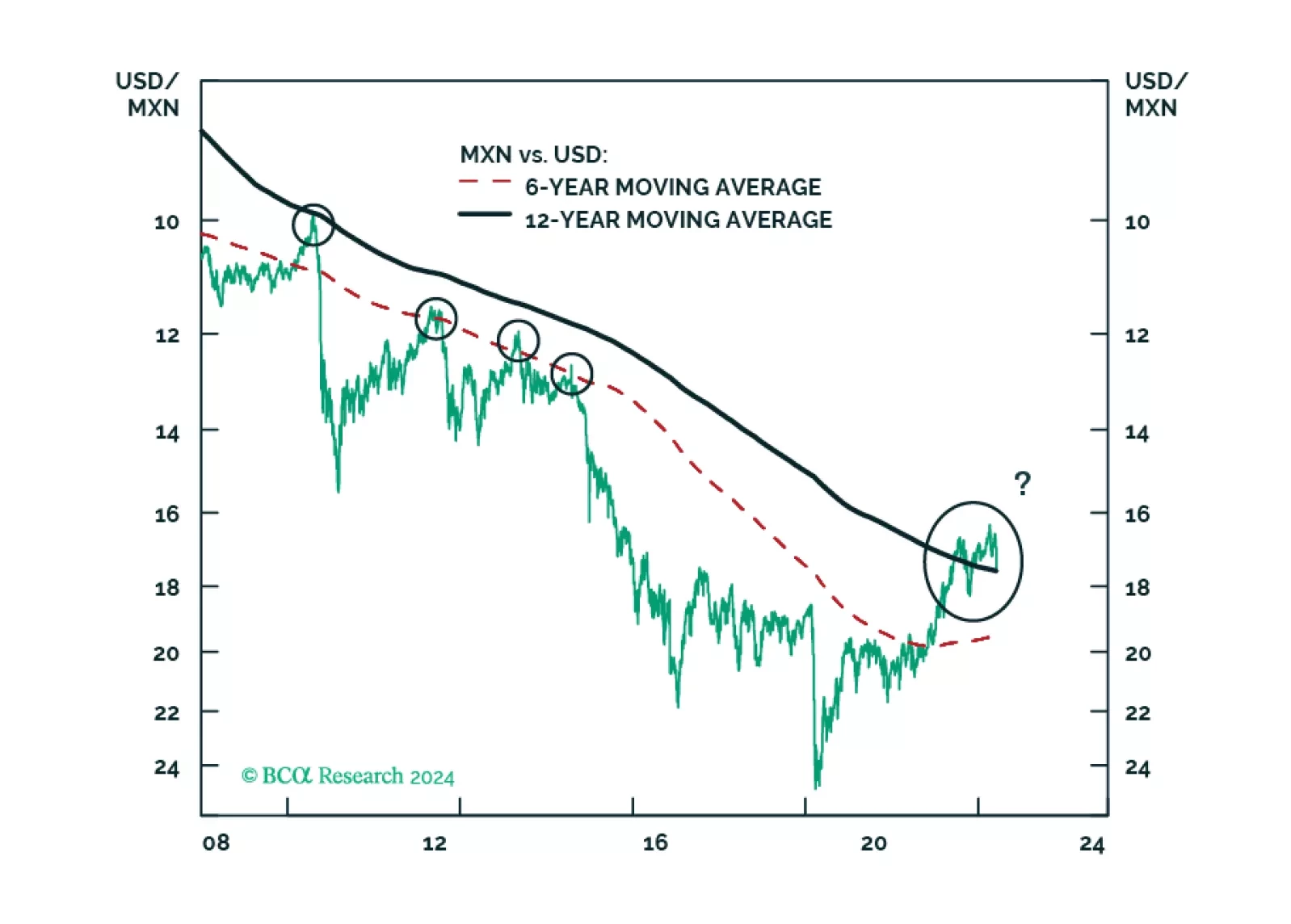

MORENA has once again swept the Mexican election: Claudia Sheinbaum will be president, with little to no constraint in Congress. All in all, Mexican politics will remain stable and overall supportive of markets. In the medium term,…

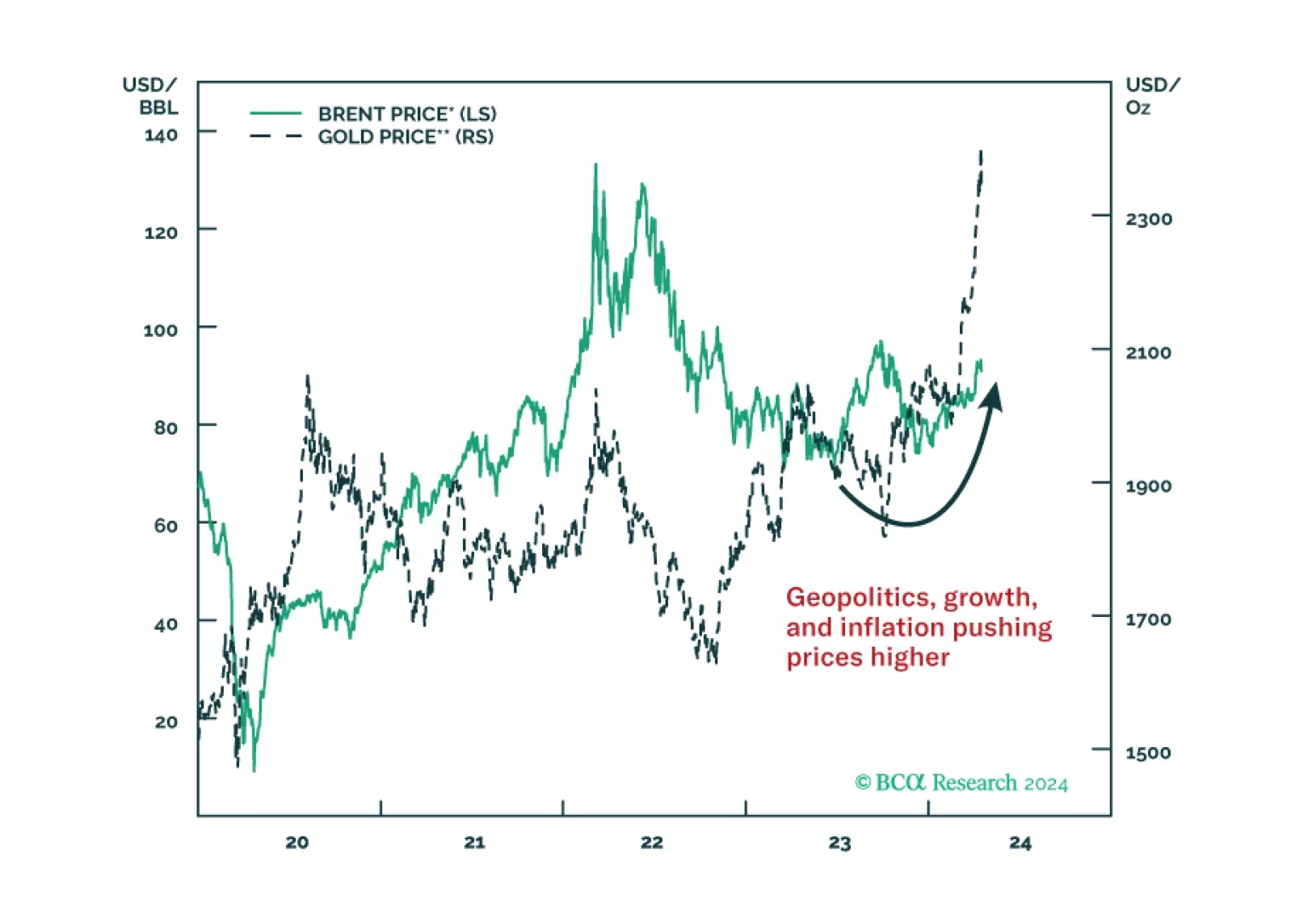

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…

The US Presidential election is eight months away. In this report, we will be looking at what is left of President Biden’s political capital and his room for actions in the next few months which may include market-negative actions…