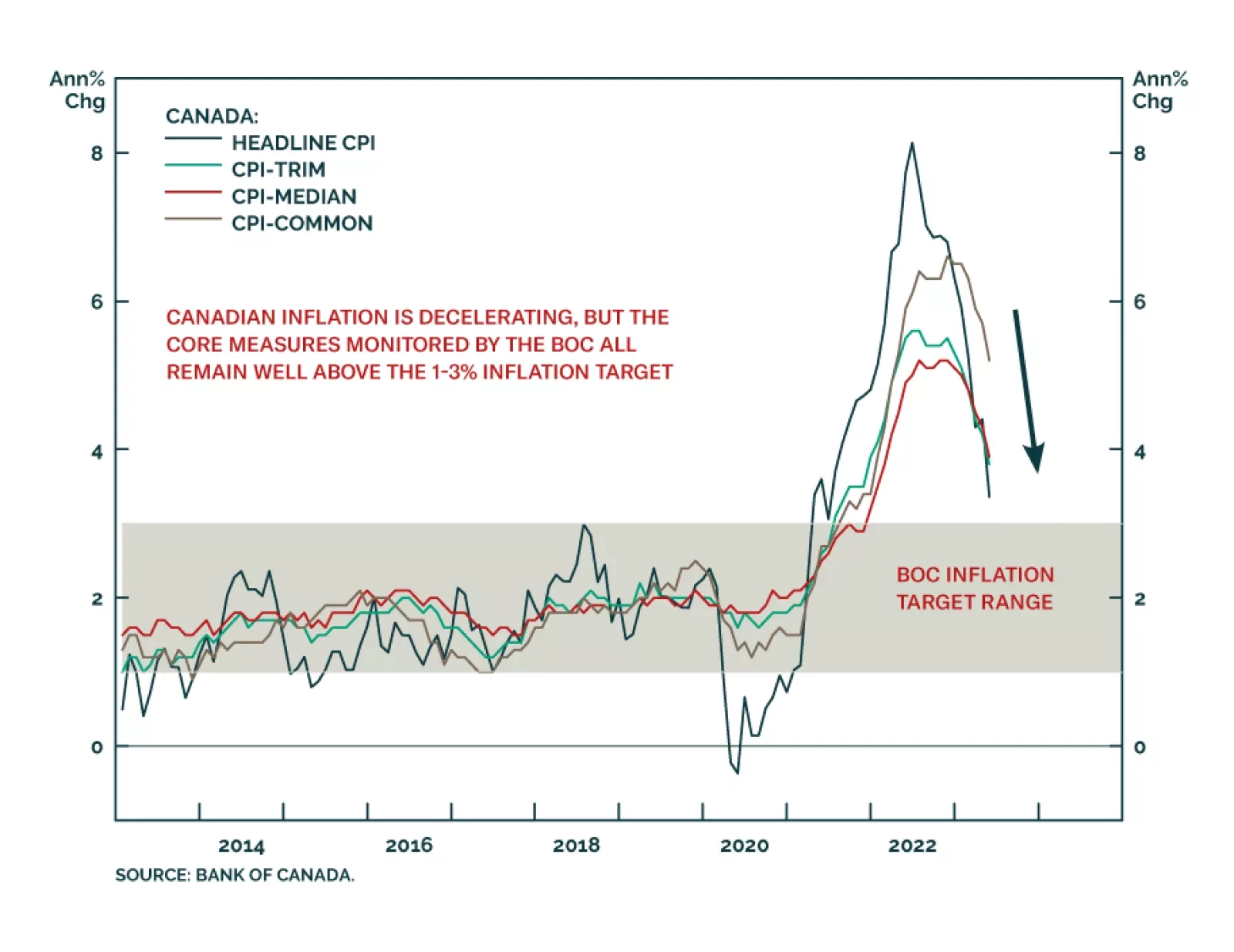

Canadian inflation slowed in May, slowing to 3.4% on a year-over-year basis from 4.4% in April. This matched market expectations, with the monthly increase of 0.4% (versus 0.7% in April), slightly lower than the 0.5% consensus…

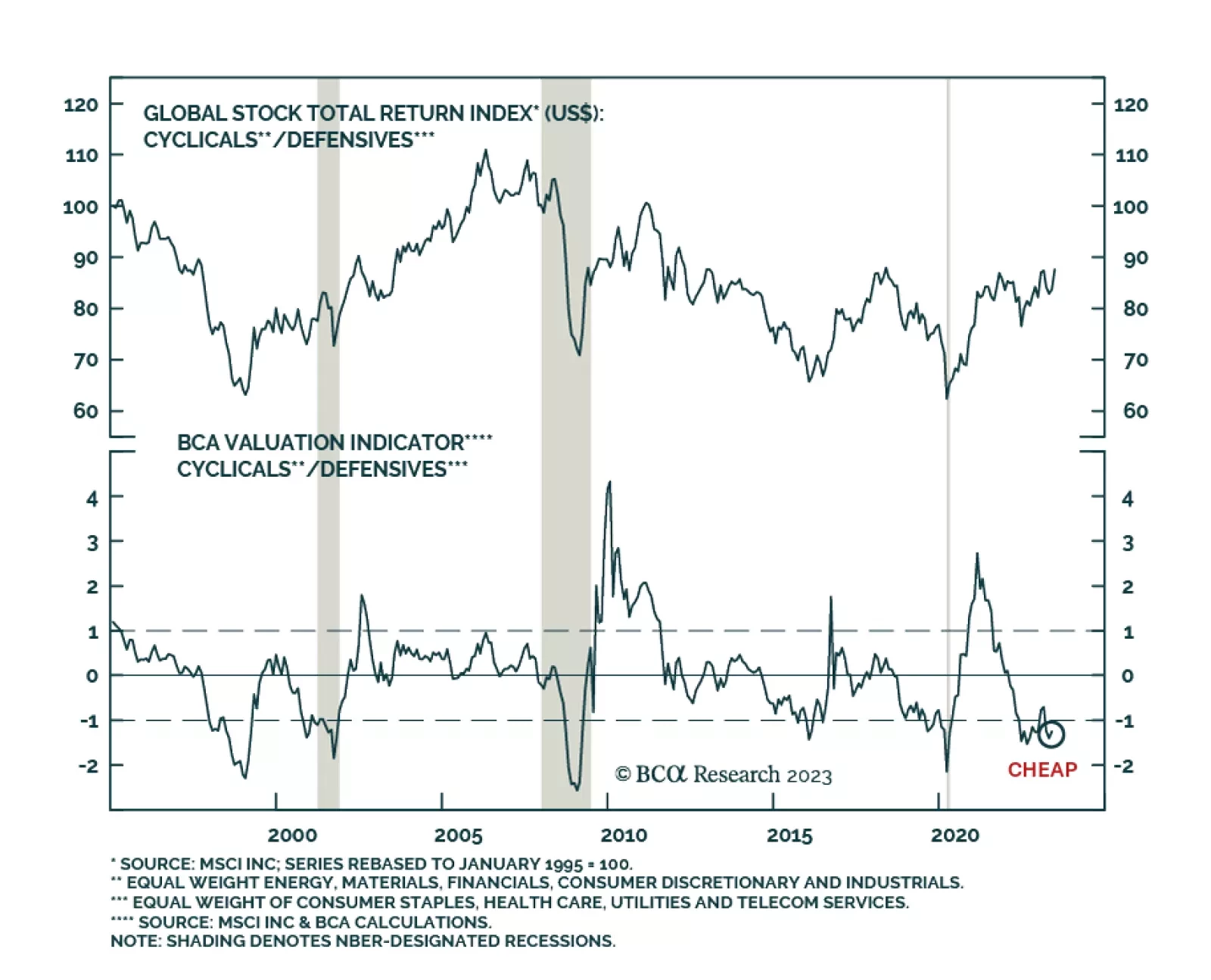

Once again, global cyclical stocks have recently been outperforming defensive sectors. This comes after the late-2022/early-2023 relative rally in cyclical stocks was cut short by the emergence of bank turmoil in early March.…

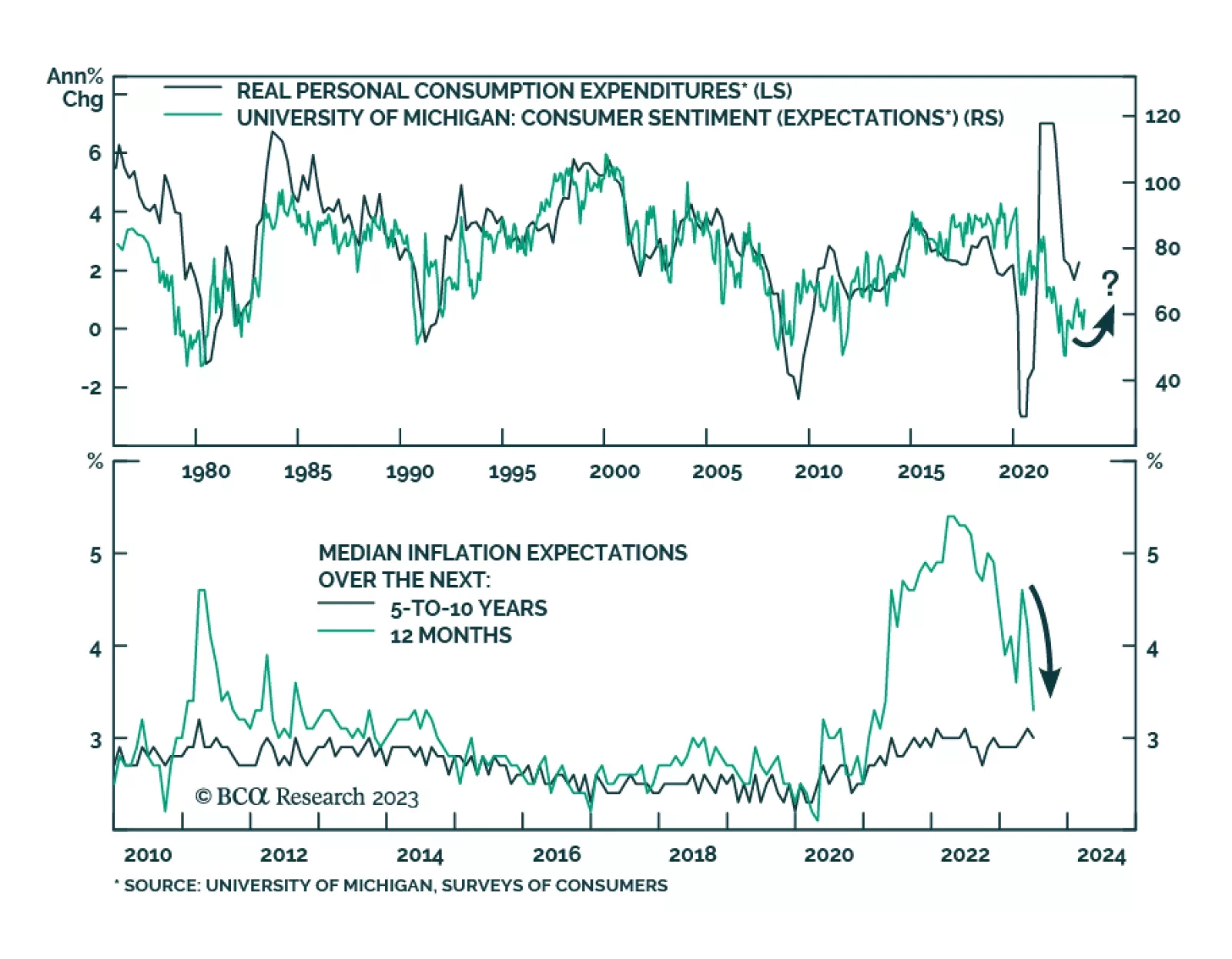

Preliminary results of the University of Michigan Consumer Sentiment survey sent a positive signal about household morale in June. The Sentiment index rose by a greater-than-anticipated 4.7 points to 63.9 on the back of…

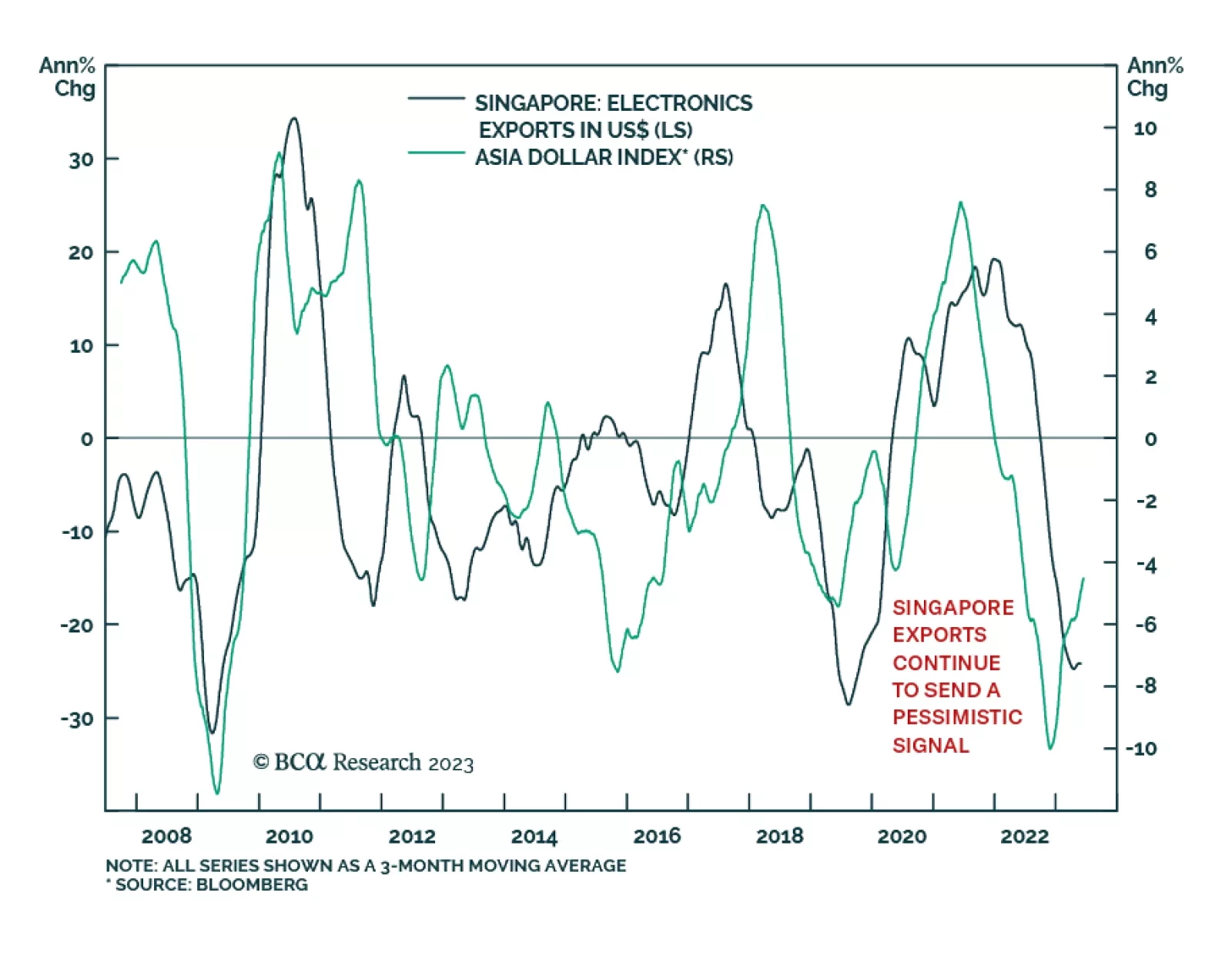

Singapore’s exports have historically acted as a good gauge for the health of the global economy. As a small open economy that is extremely exposed to fluctuations in the Asian and global manufacturing cycles, Singapore…

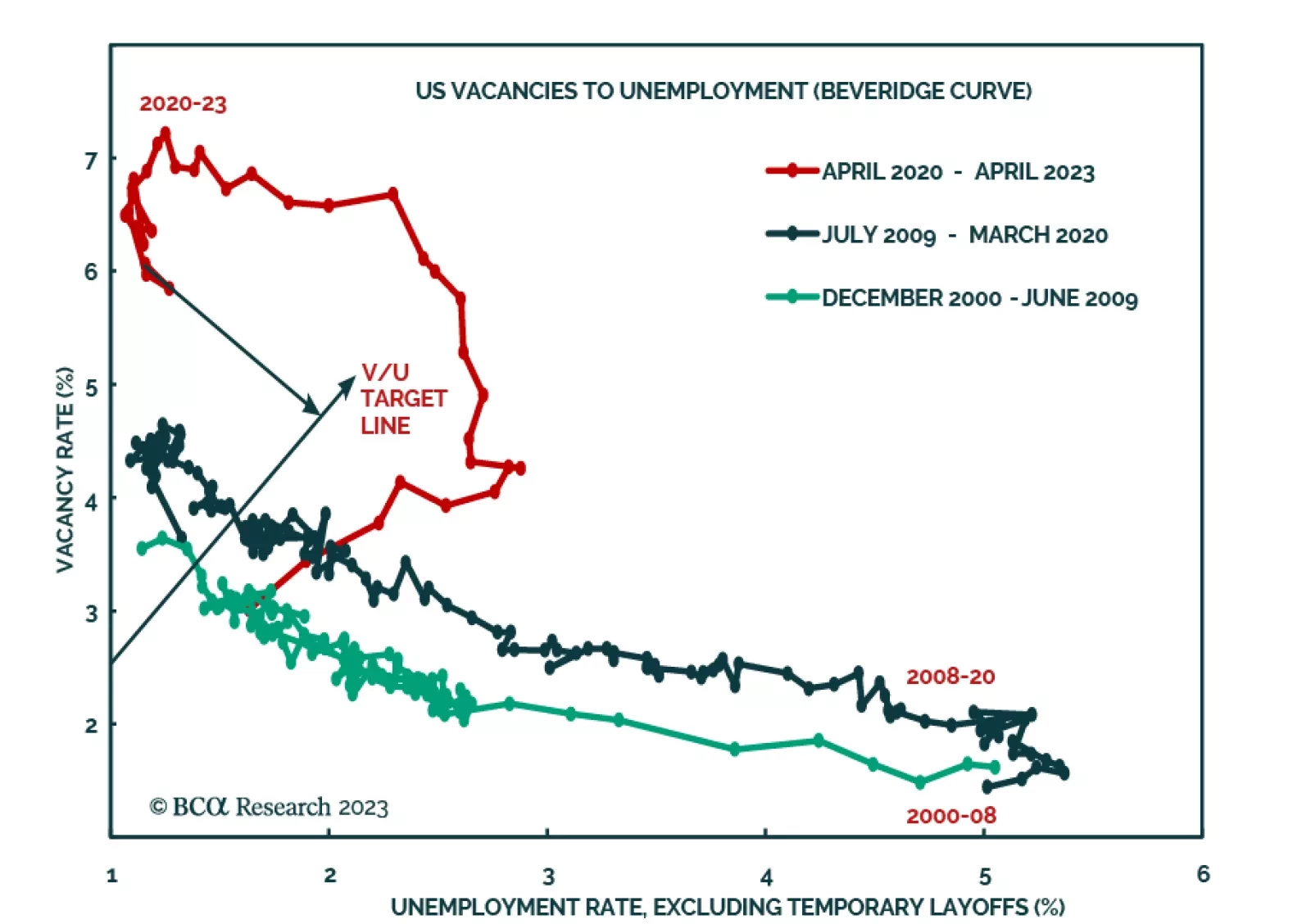

According to BCA Research’s Counterpoint service, making inflation imperceptible will require making unemployment perceptible, meaning a recession. Our non-linear world often surprises our linear-thinking minds. For…

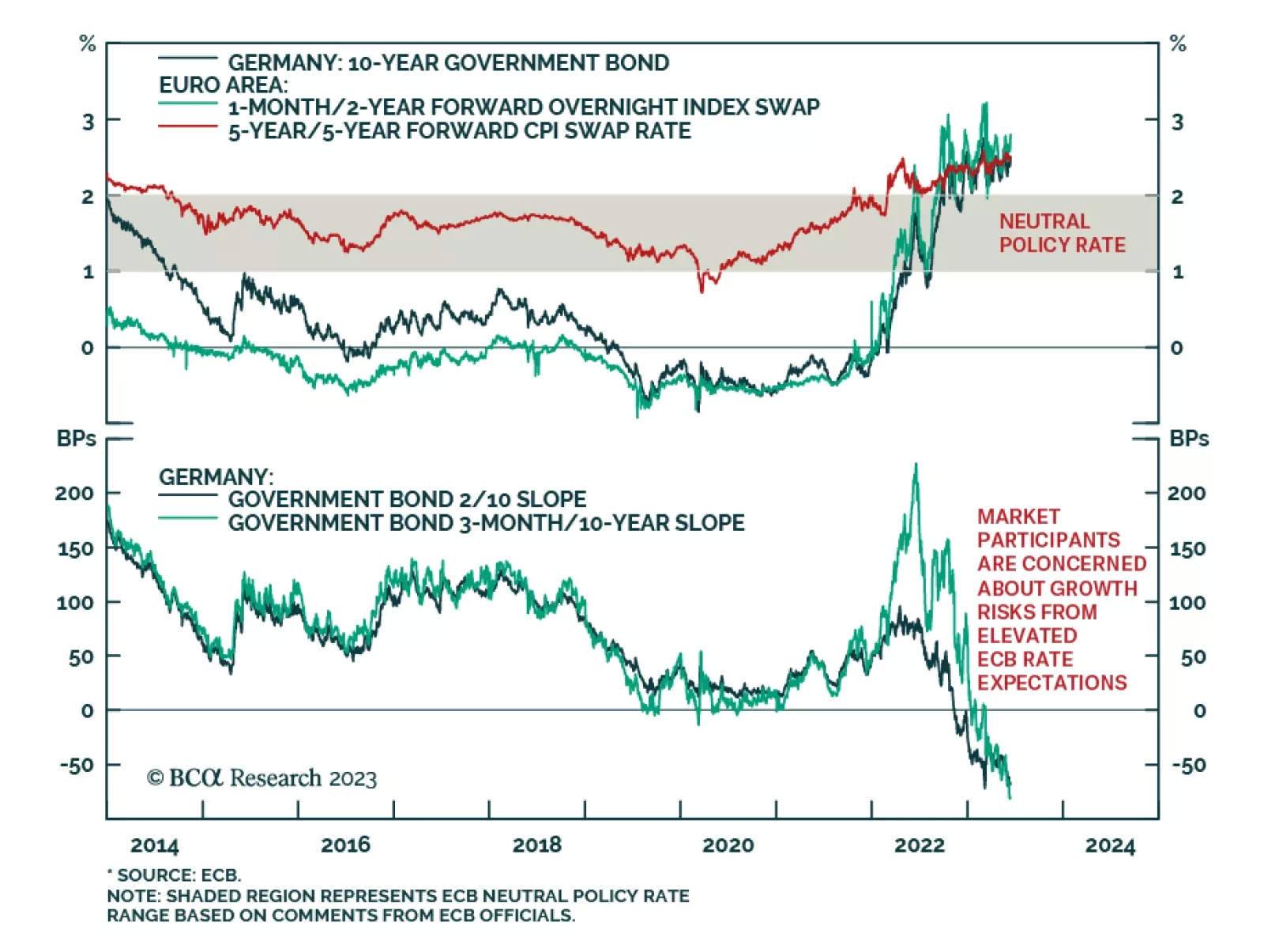

As expected, the European Central Bank (ECB) delivered a 25bps rate hike on Thursday, raising the policy rate to 3.5% — the highest since August 2001. Moreover, the central bank maintained a hawkish bias, signaling…

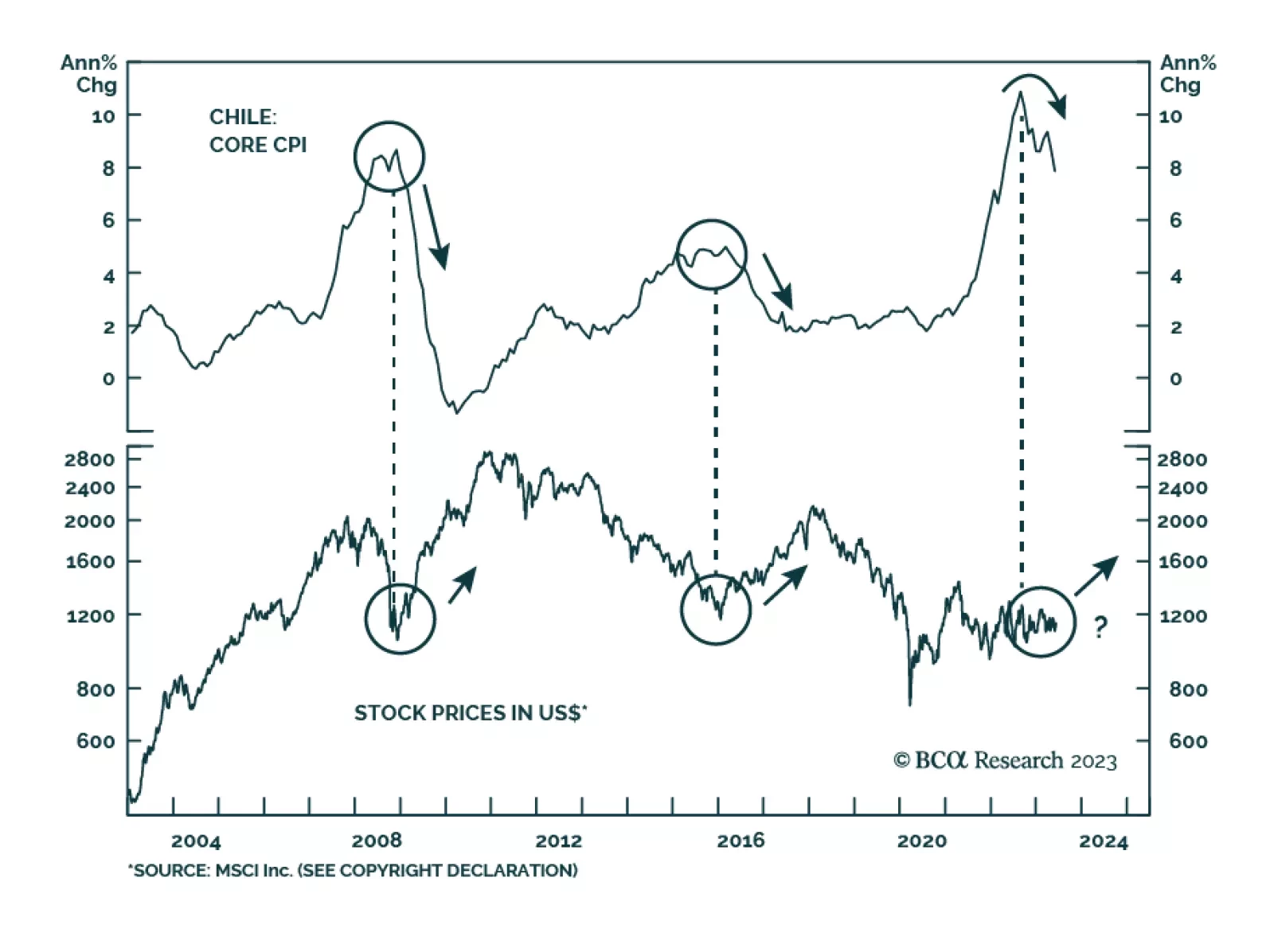

The Chilean economy is entering a recession. After two years of tightening fiscal and monetary policies, real economic growth is beginning to contract and inflation is tumbling. Our Emerging Markets strategists expect the…

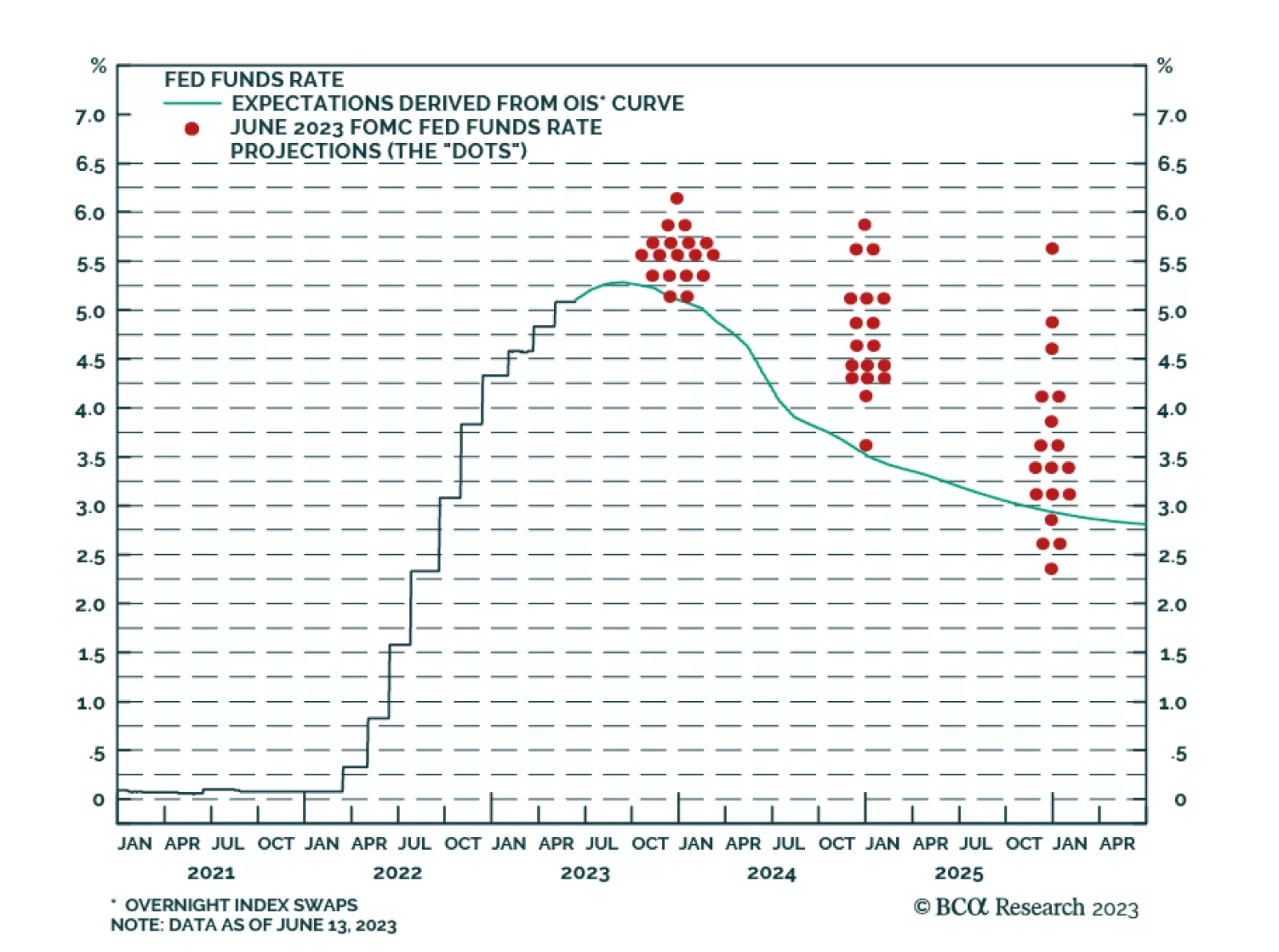

As expected, the Fed kept interest rates unchanged on Wednesday in order to give policymakers time to assess the impact of the aggressive tightening cycle. Chair Powell indicated that the decision to pause is consistent with…

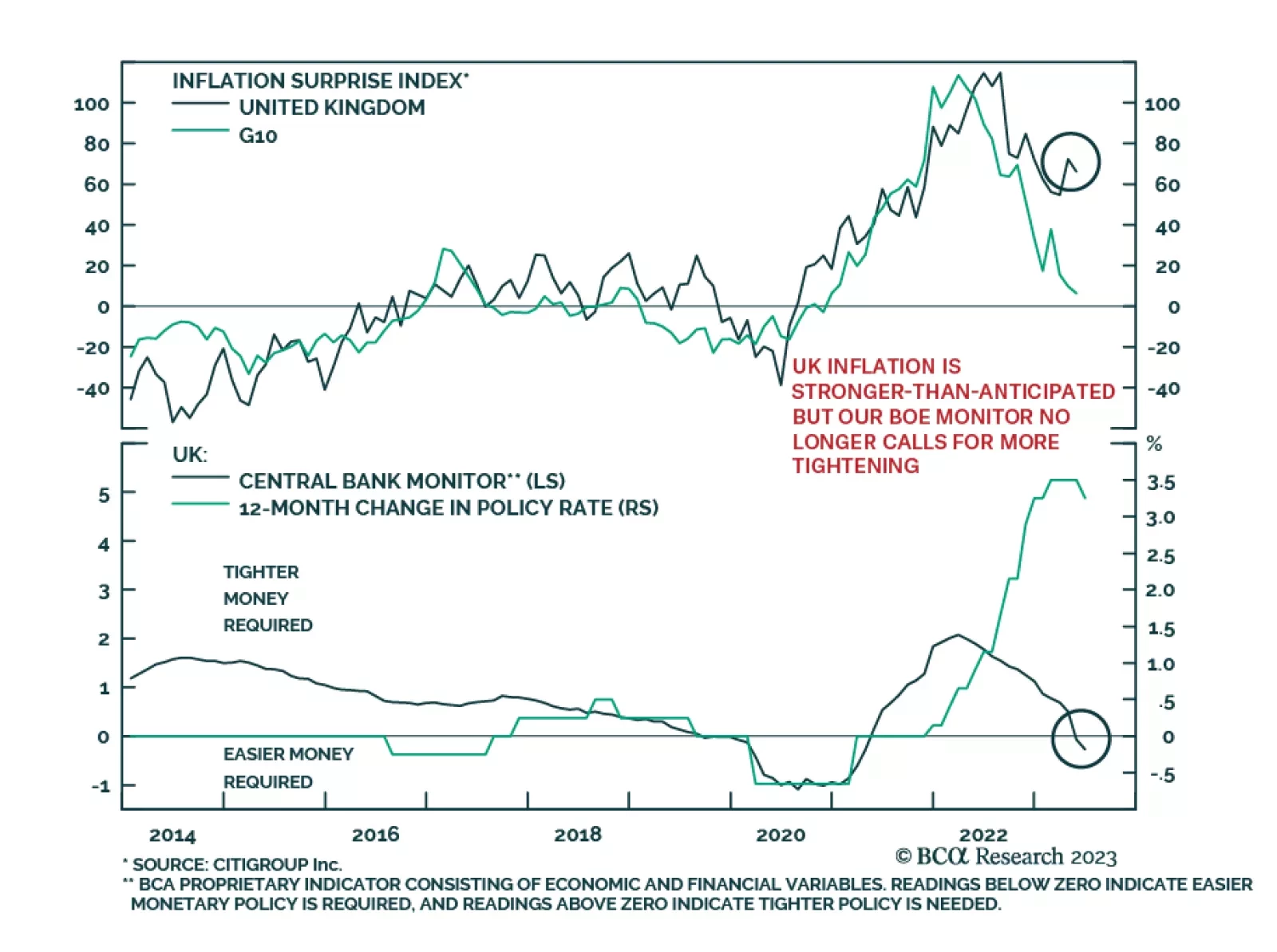

UK gilts have sold off sharply over the past month, particularly at the short end of the yield curve. The two-year yield has risen by over 100bps since mid-May, while 10-year yields have increased by just over 70bps –…

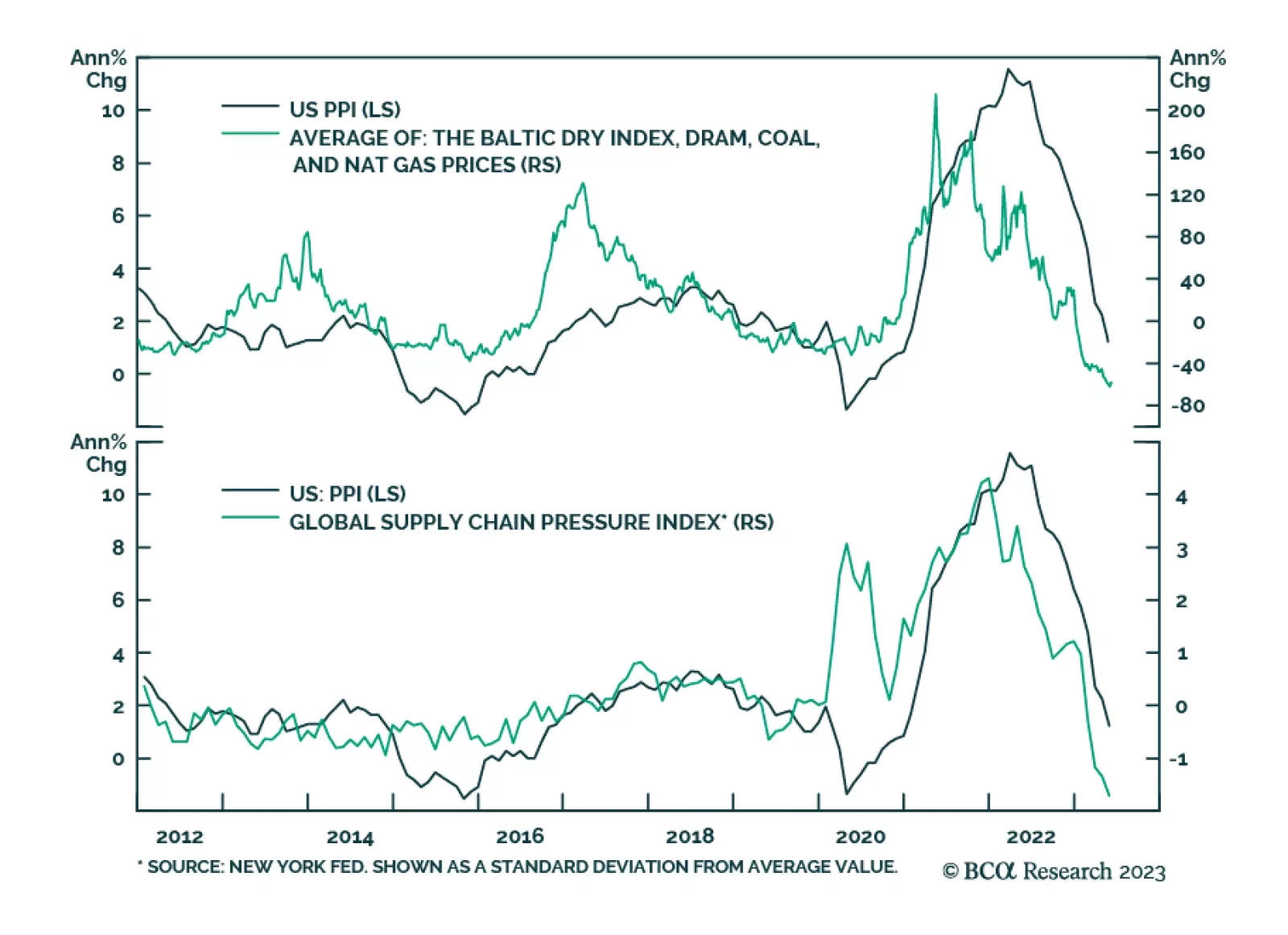

The US May PPI report indicates that pipeline inflationary pressures are cooling. Headline PPI inflation fell from 2.3% y/y to 1.1% y/y – below expectations of 1.5% y/y and the lowest since December 2020. PPI for final…