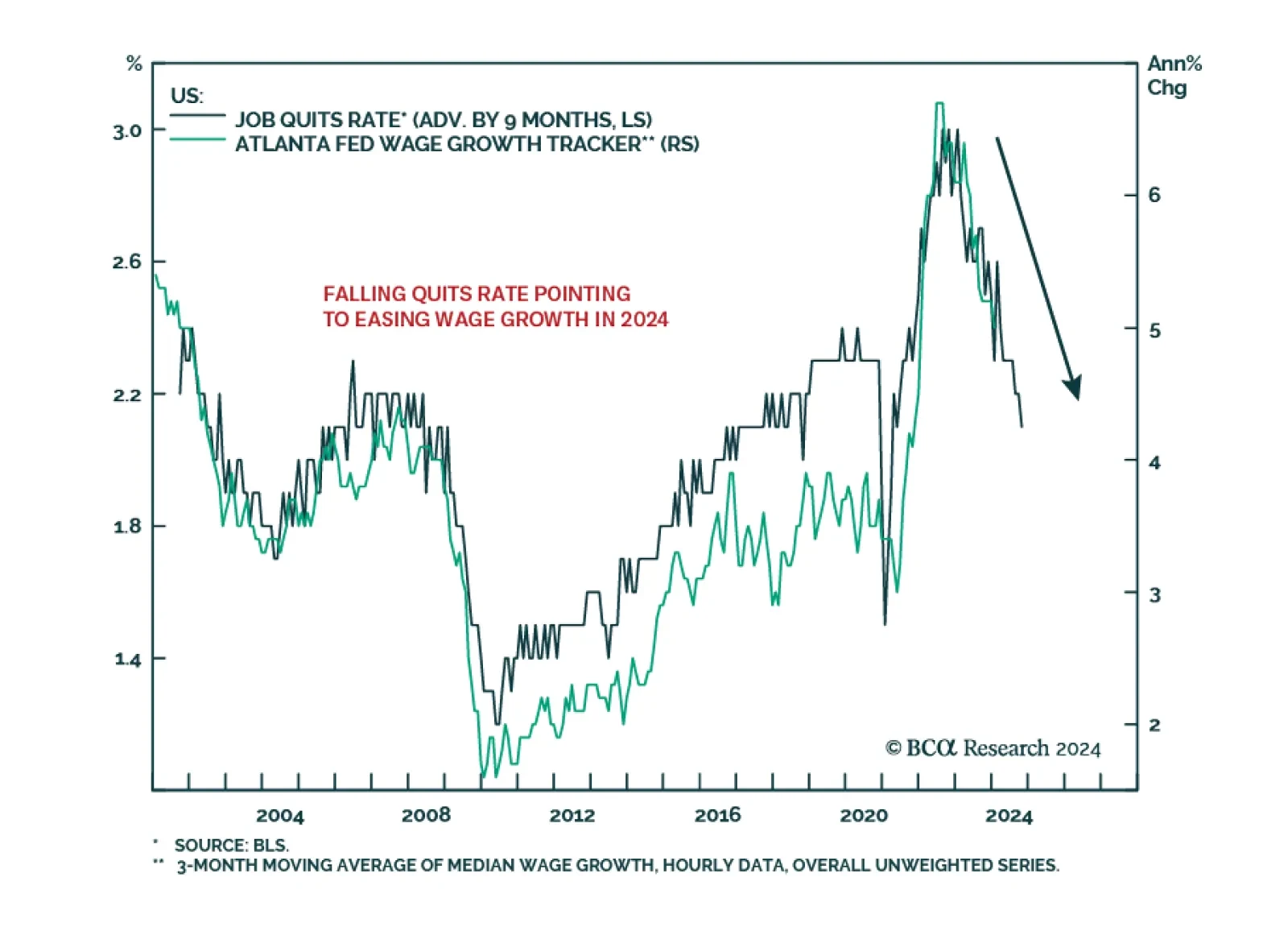

The US January JOLTS data released yesterday was in line with expectations, with job openings clocking in at 8.86 million versus a downwardly-revised 8.89 million in December. Importantly, US job openings are likely to continue…

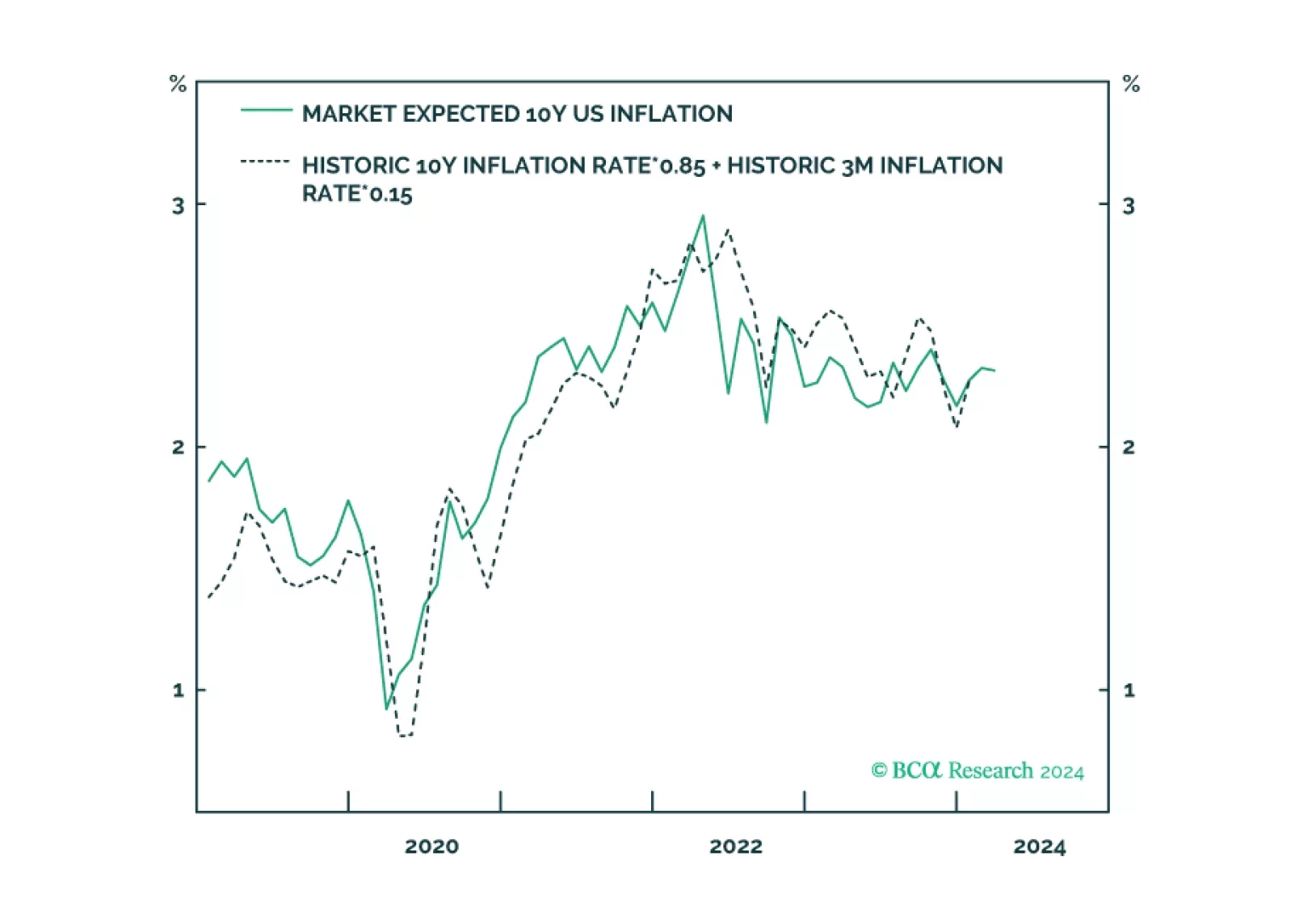

Expected inflation has surged to its highest level in a year. This has surprised many people, but expected inflation is behaving just as expected. Expected inflation is not a prophecy, it is just a mathematical function of delivered…

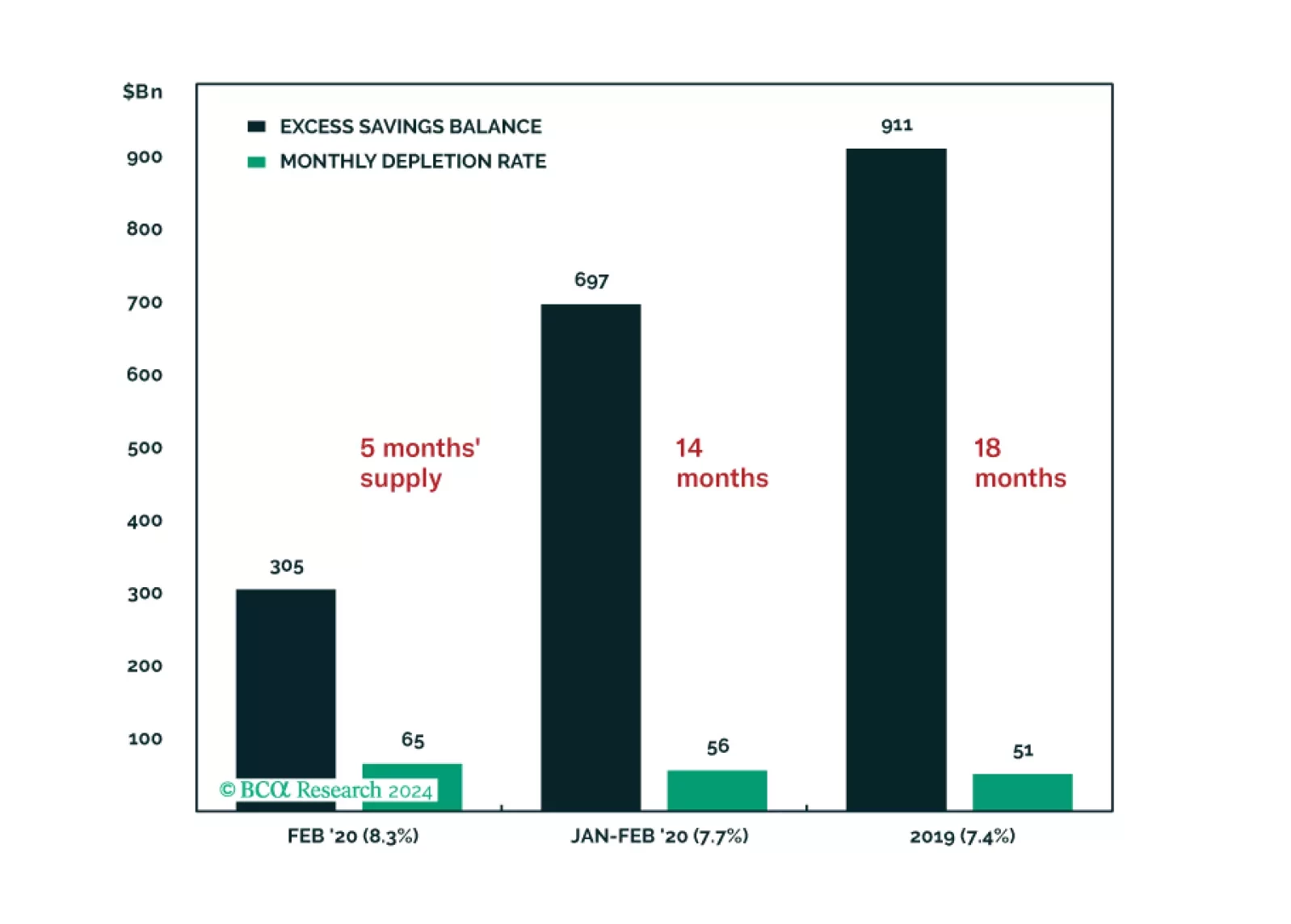

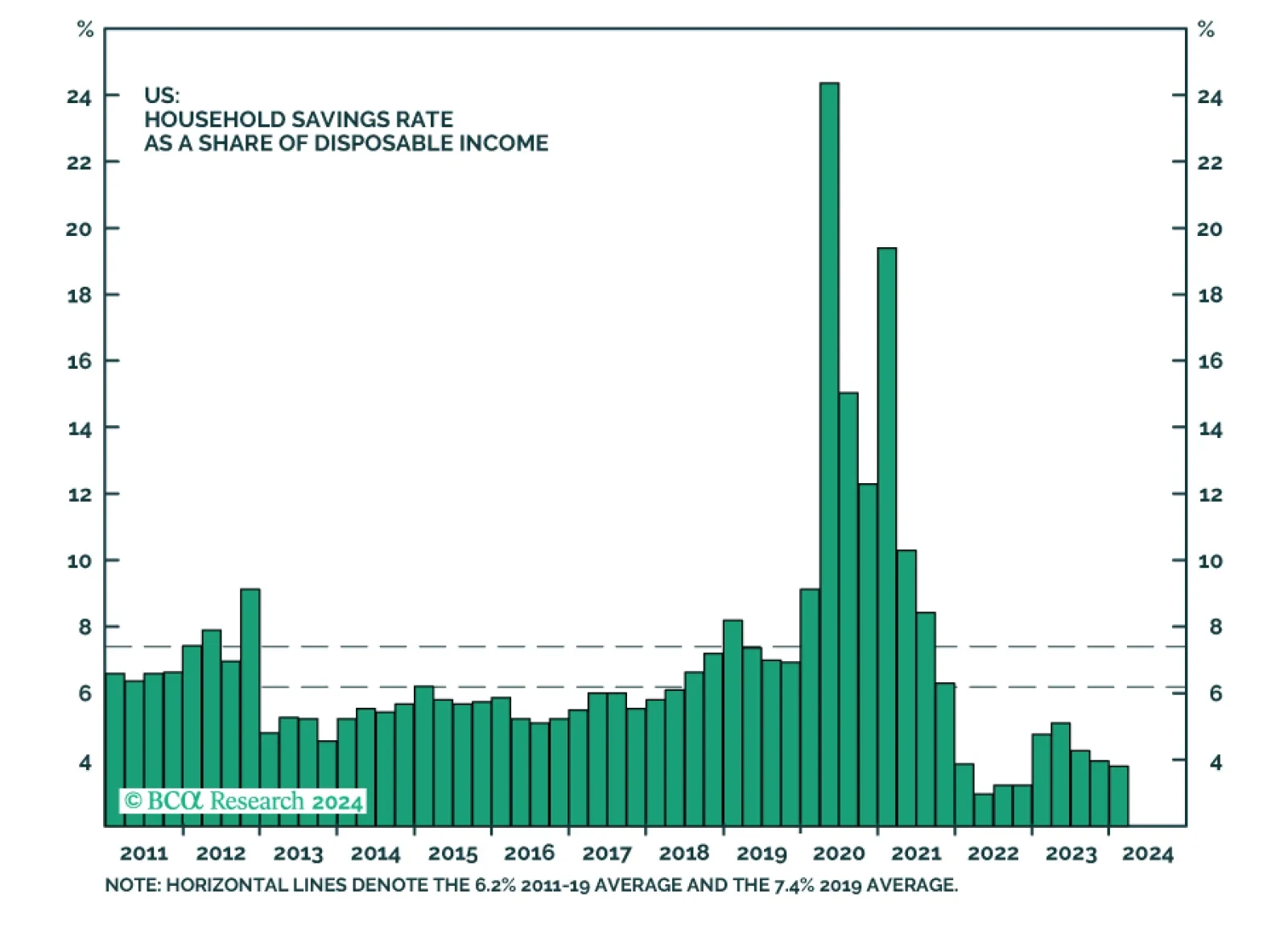

Our US Investment Strategy service examines the state of consumer finances in the context of their view that a recession will materialize this year with a double-digit peak-to-trough decline in S&P 500 earnings expectations…

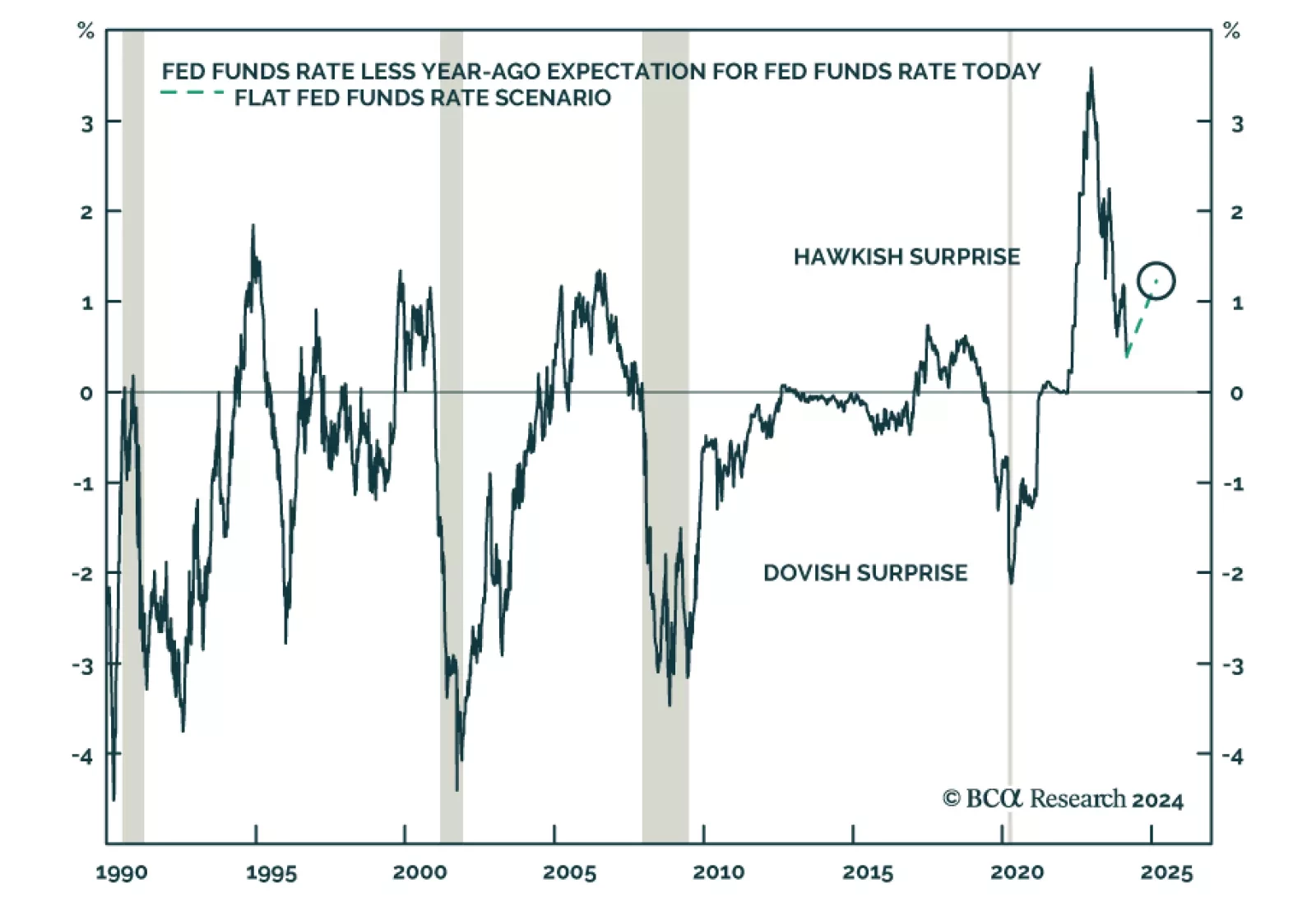

We noted in a previous Insight that recent comments from Raphael Bostic, President of the Federal Reserve Bank of Atlanta, may reflect a growing realization among policymakers that they have inadvertently caused a…

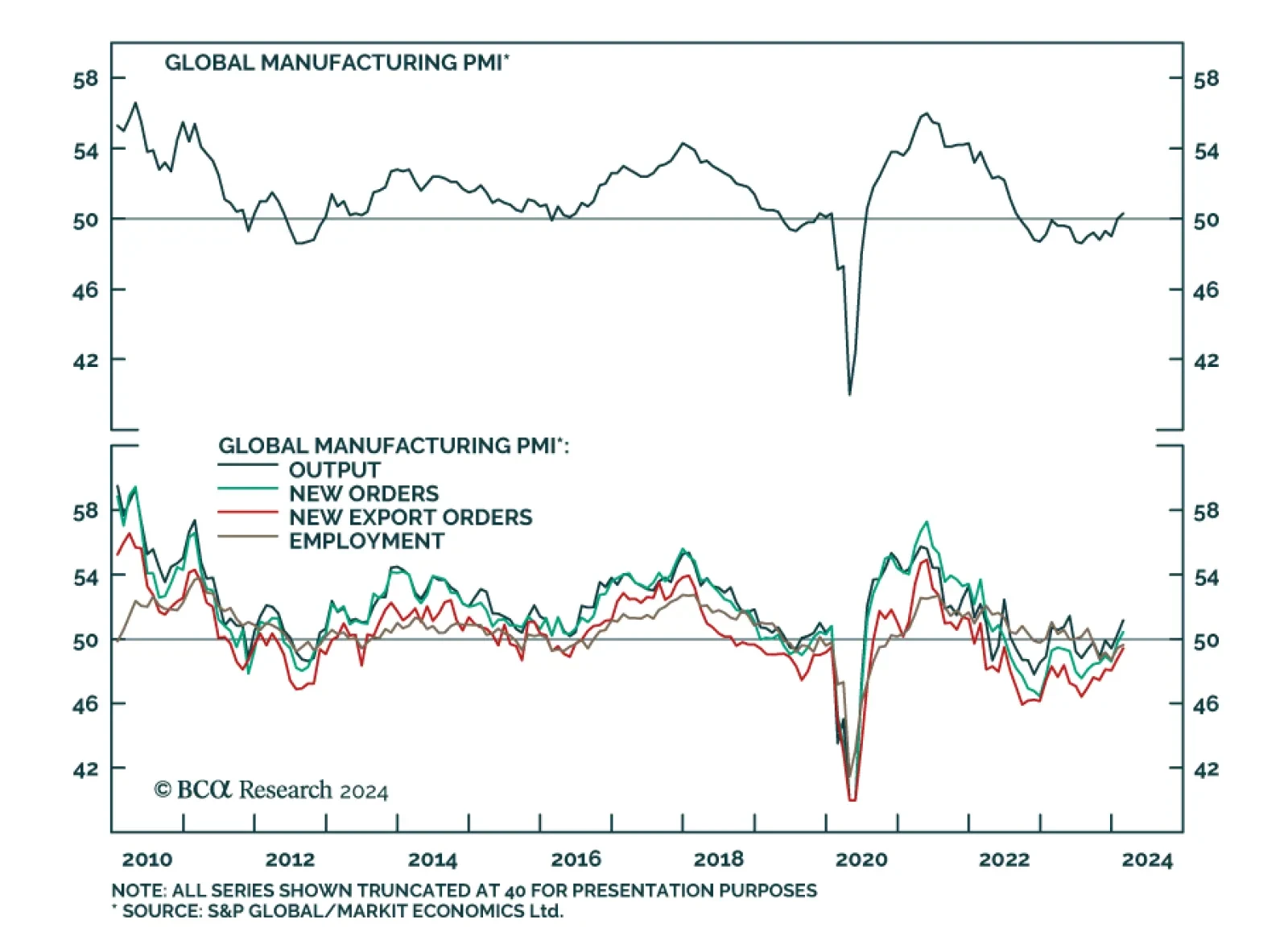

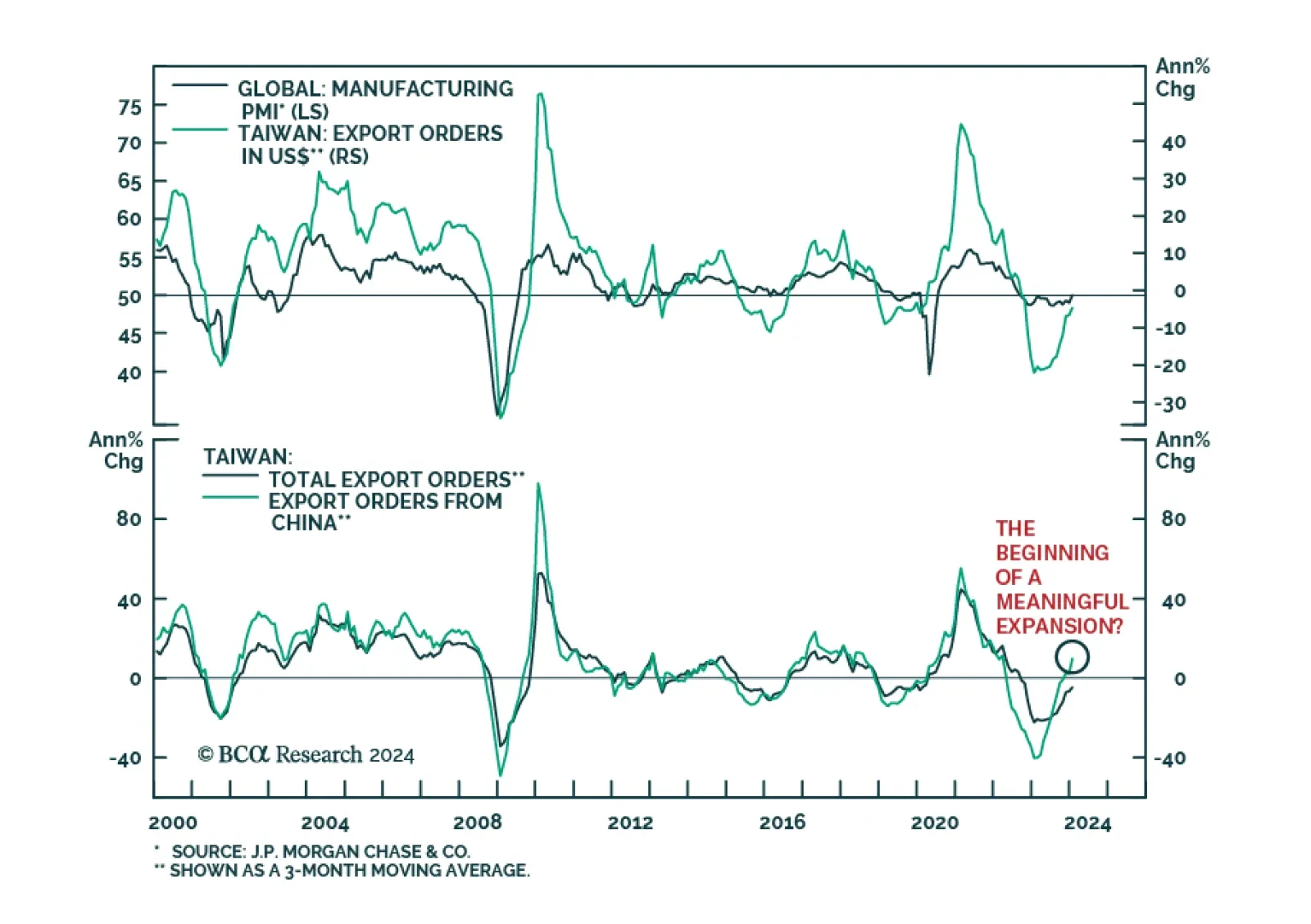

The JPM Global Manufacturing PMI improved from 50.0 to 50.3 in February, indicating that global manufacturing activity is growing again after having contracted for 18 months. Notably, new orders expanded from previously…

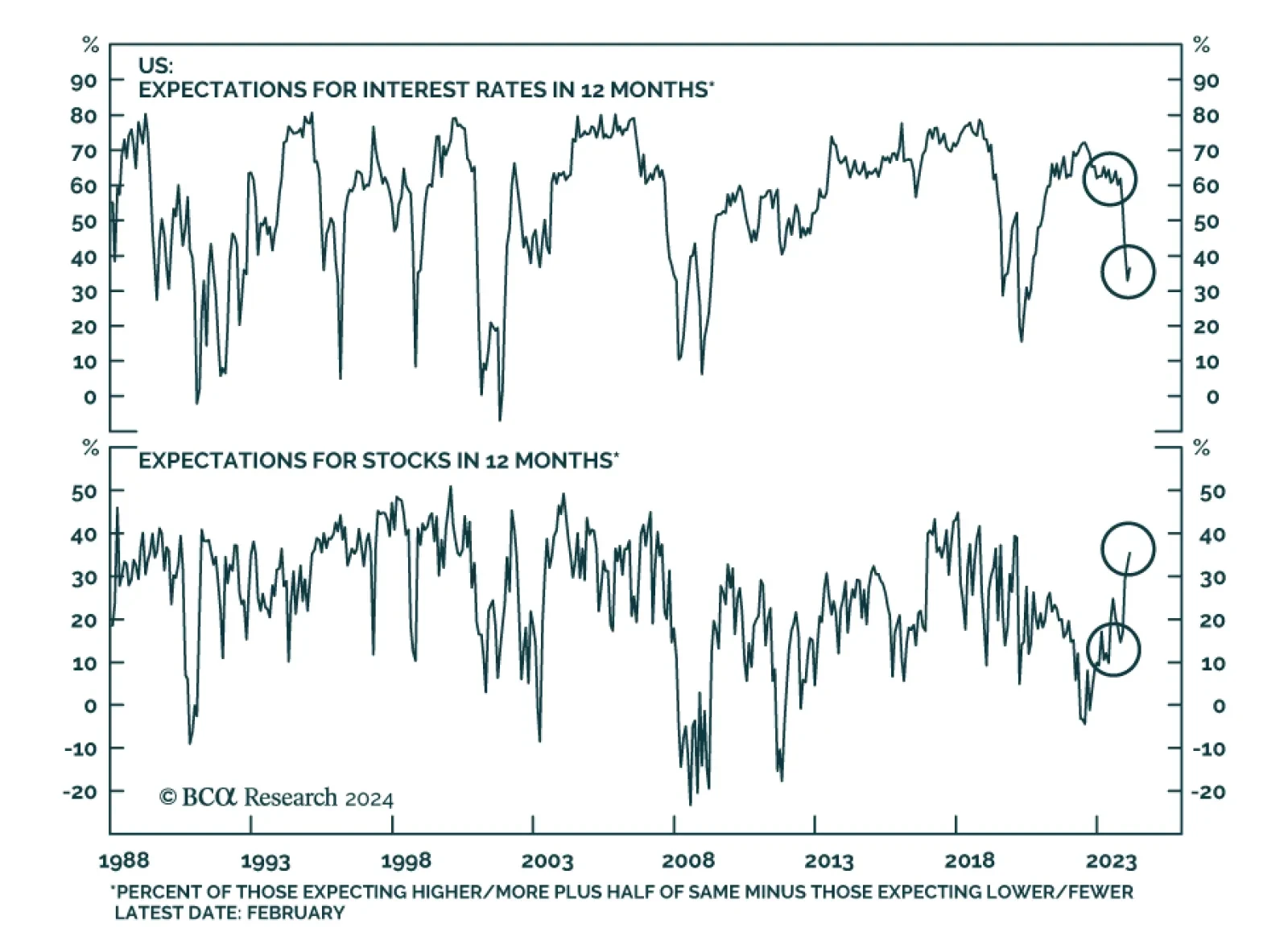

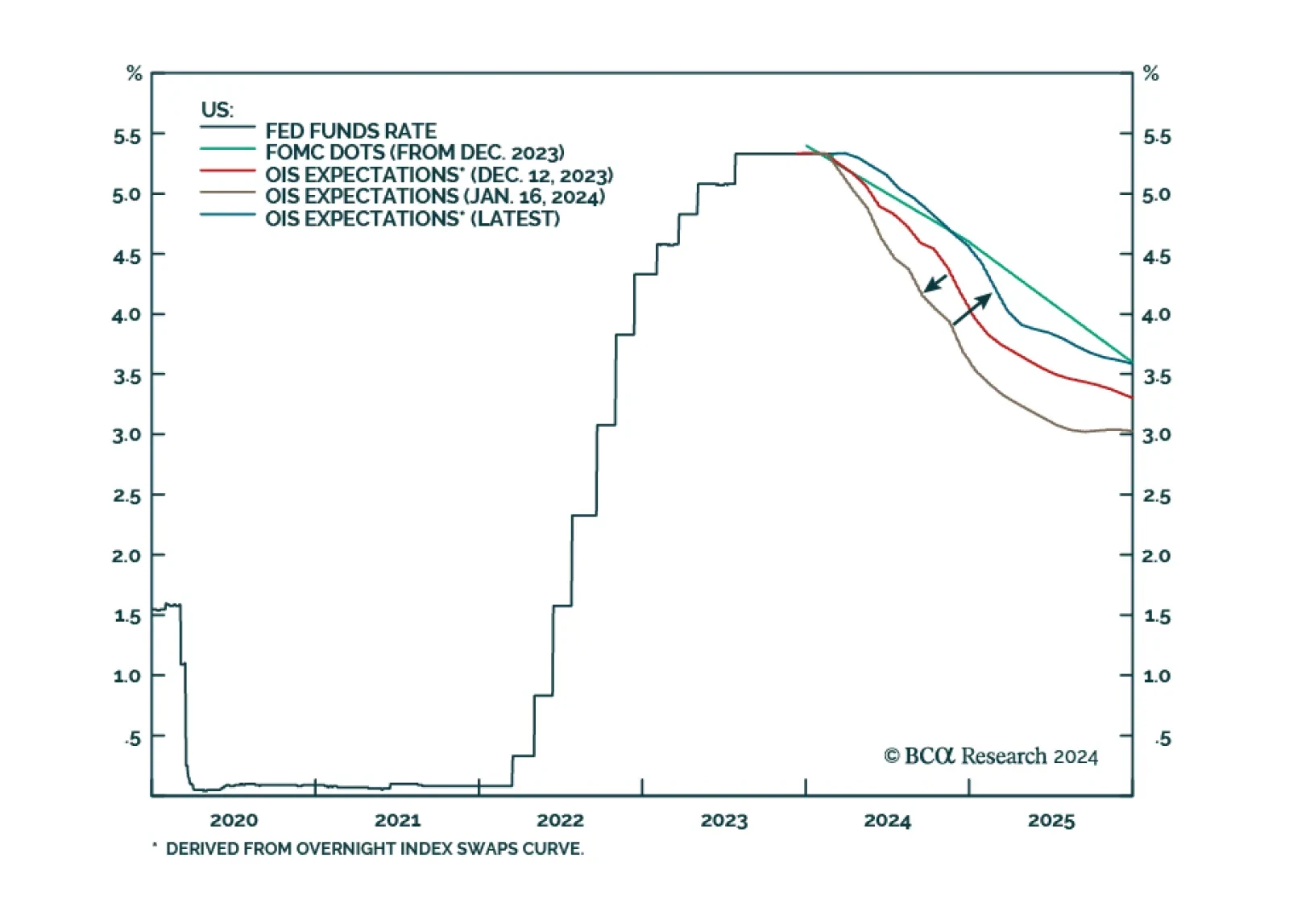

Economic sentiment has improved since the December FOMC meeting, with positive momentum extending into February. The chart above neatly summarizes the impact that the Fed’s projected easing has had on sentiment, both on…

We feel as good about spurning the soft-landing narrative today as we did about spurning the recession narrative a year ago, but we are not giving into complacency. This week’s report looks at two key ways that we may be getting it…

Despite the economy being on the verge of a recession, the South African Reserve Bank will not ease policy meaningfully. Doing so will accentuate the currency depreciation, which, in turn, will push up bond yields – an outcome the…

Earlier this year it looked like the spread between the rate of 10-year and 2-year Treasury notes was heading toward positive territory. Yet the 2s/10s spread peaked at -16 bps on January 16 and the inversion has been deepening…

On the surface, the latest Taiwanese export orders release delivered a positive signal on the global trade cycle. The 1.9% y/y expansion in January marks a significant improvement from the 16.0% contraction in December. Moreover…