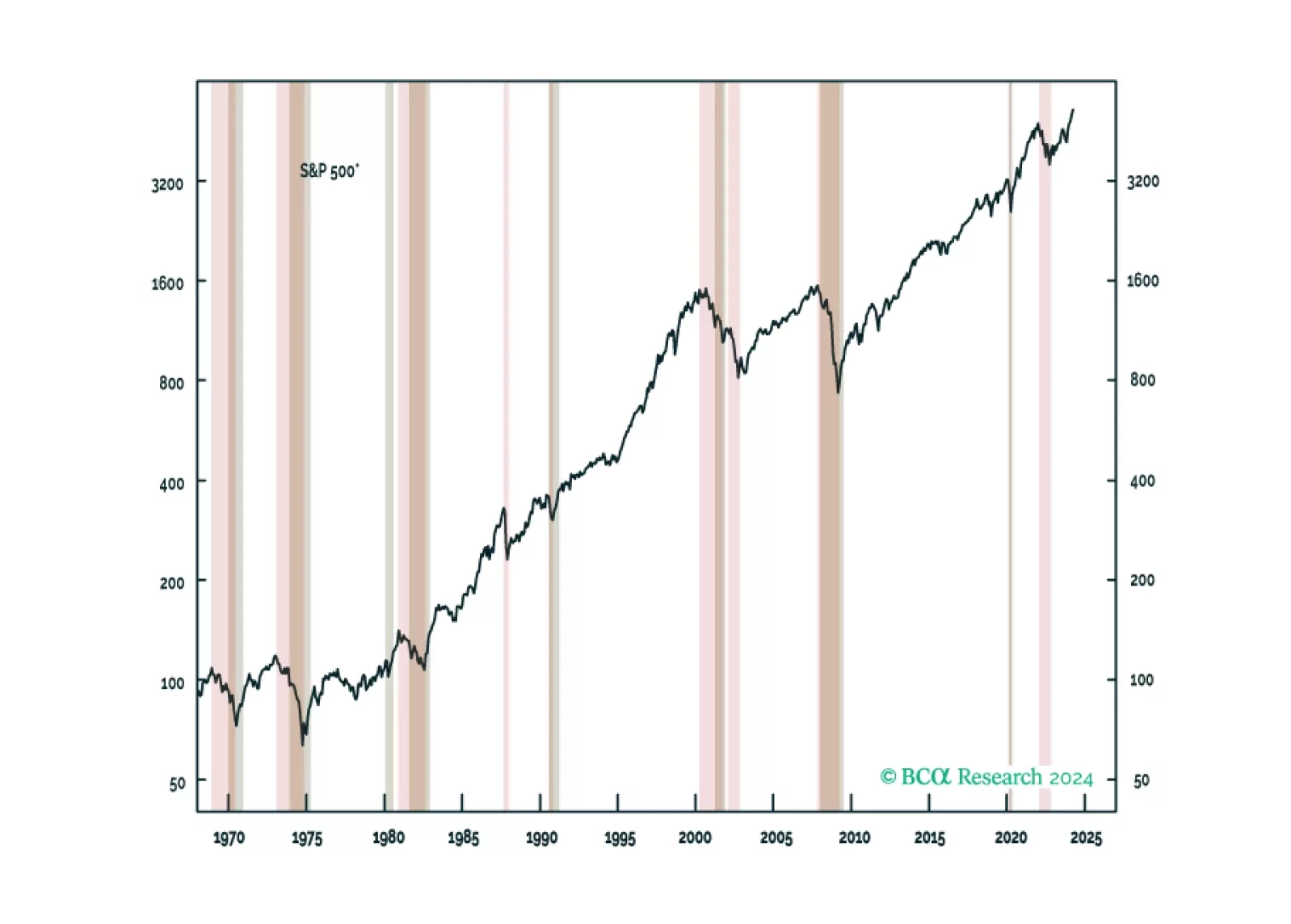

BCA Research’s US Investment Strategy service is watching households, the labor market and consumer credit for signs of a business cycle inflection and the all-clear signal to underweight equities. Equity bear markets…

The number of job openings in the US in February (8.76 million) was little changed from the downwardly revised 8.75 million in January, keeping the job openings rate stable at 5.3%. Similarly, the hiring rate was little changed…

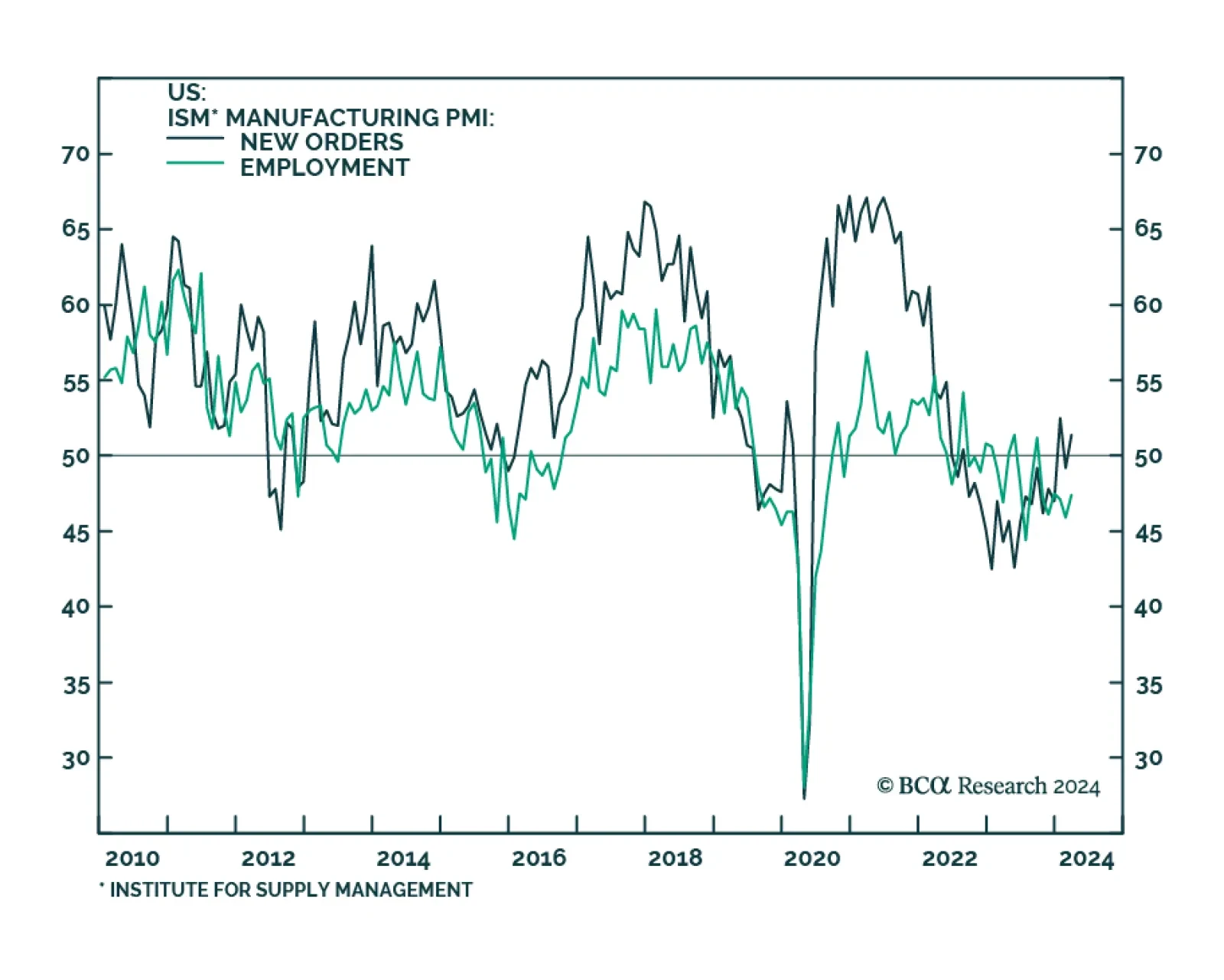

The ISM Manufacturing PMI came in at 50.3 in March, better than expectations of 48.4 and breaking above the 50 boom-bust line for the first time since September 2022. Notably the new orders component rebounded to 51.4, marking…

Our Portfolio Allocation Summary for April 2024.

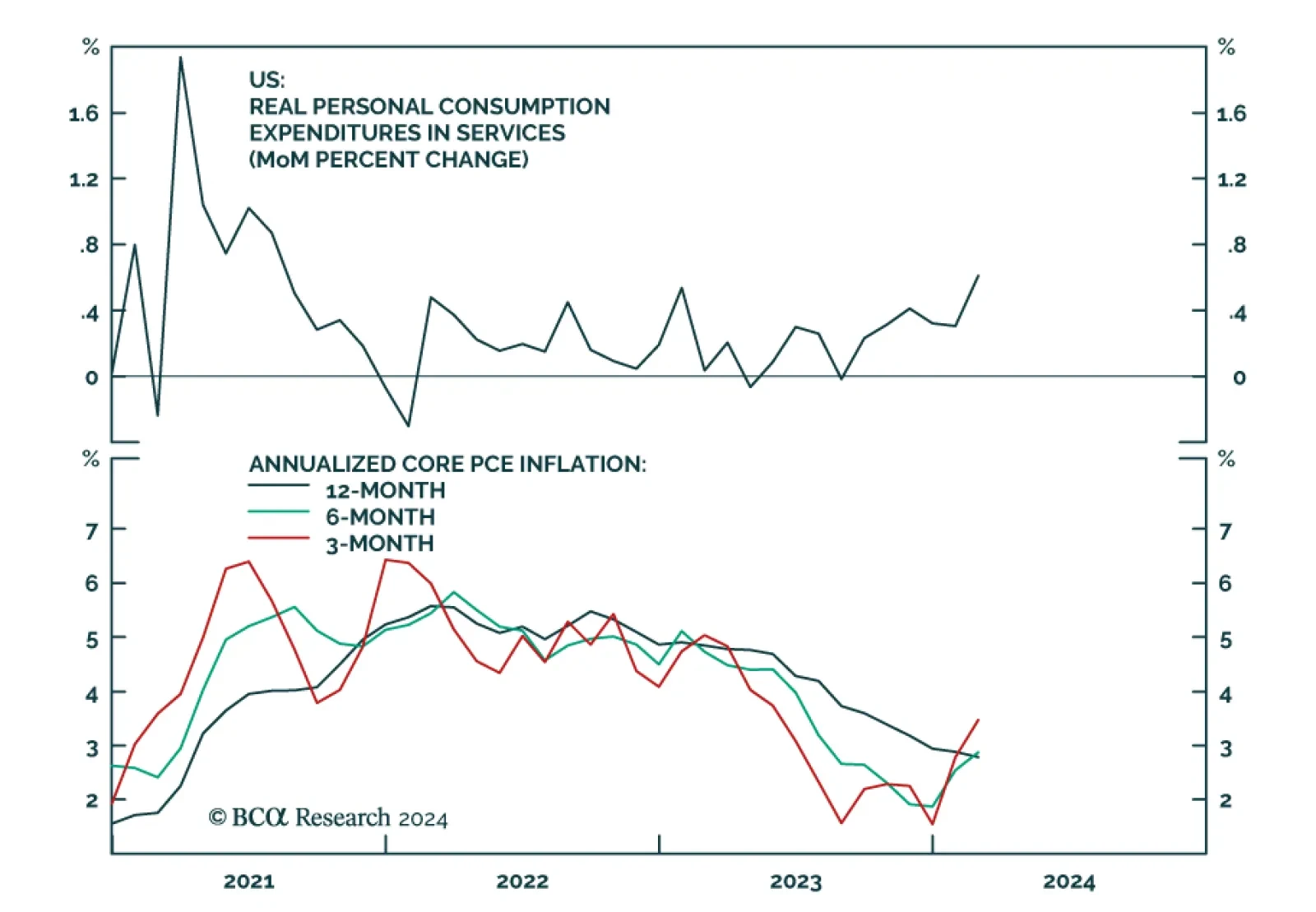

Friday’s PCE report showed a resilient US economy. Real personal consumption increased by 0.4% m/m in February, beating expectations of 0.1% m/m and remaining above its pre-pandemic trend. Both services and goods…

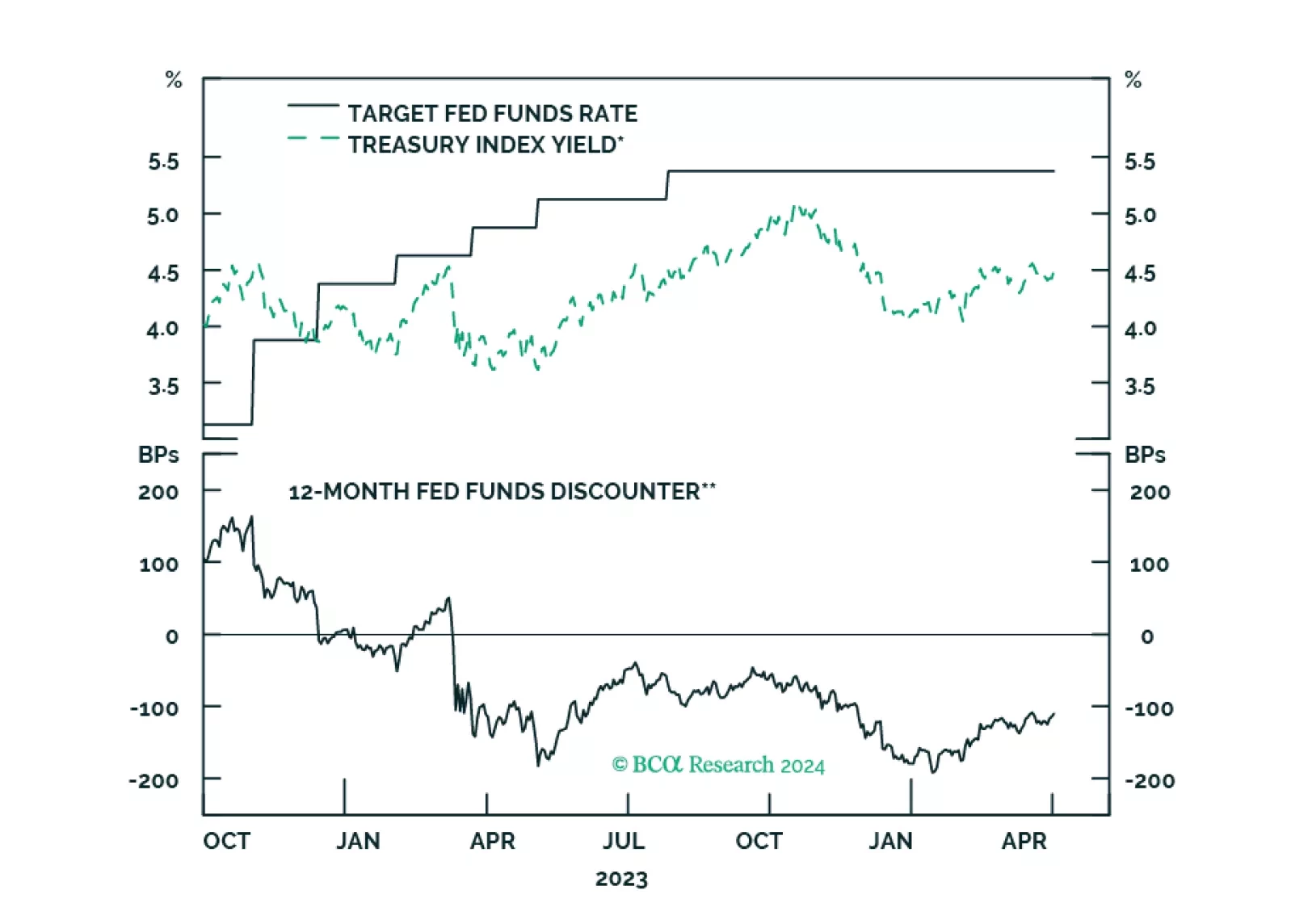

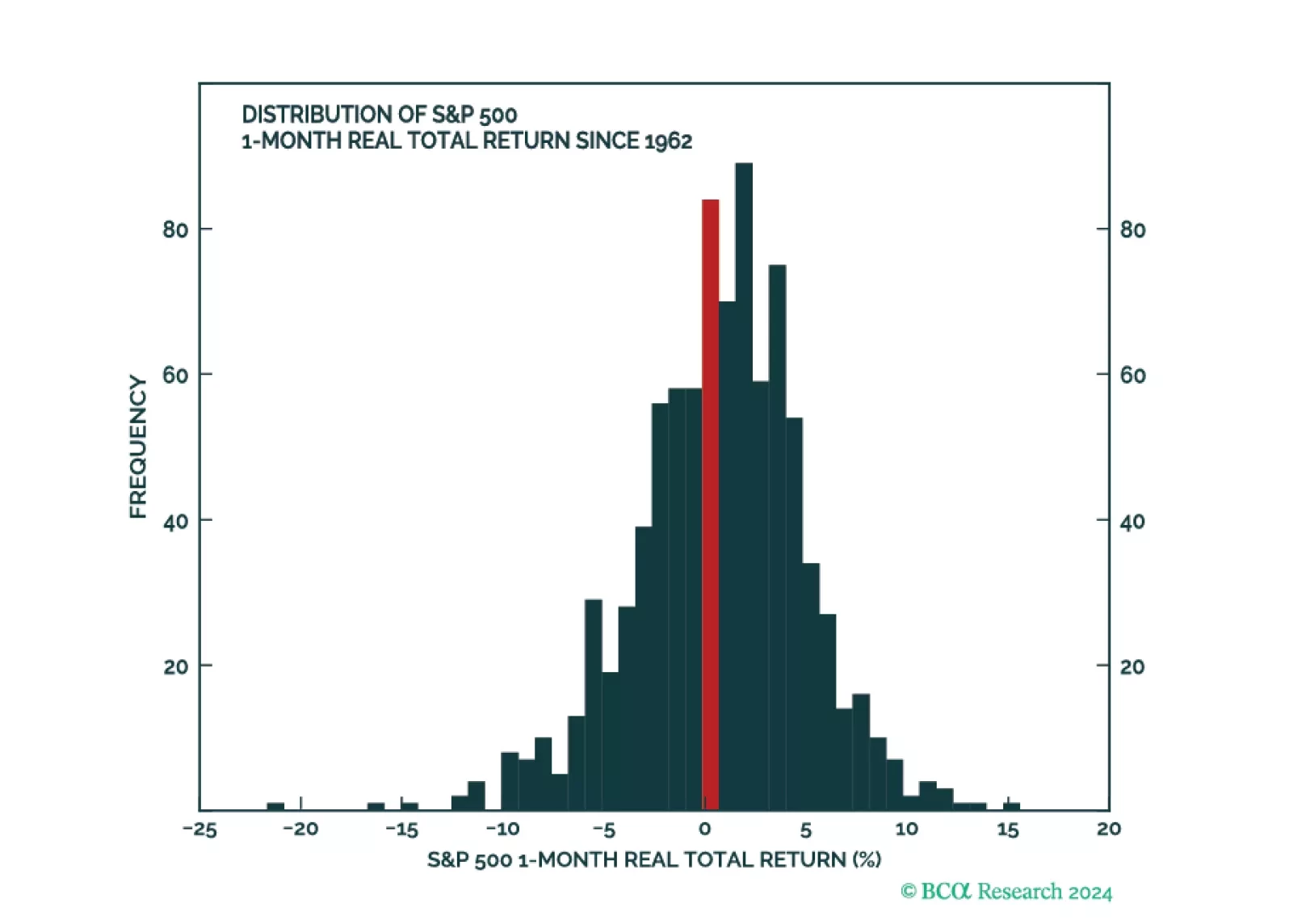

We are not yet ready to downgrade equities on a tactical basis but continue to expect we will eventually do so. We present a checklist of indicators that we are watching to determine when to de-risk.

MacroQuant downgraded equities from overweight to neutral on a 1-to-3 month horizon. The model maintains a negative view on stocks over a 12-month horizon.

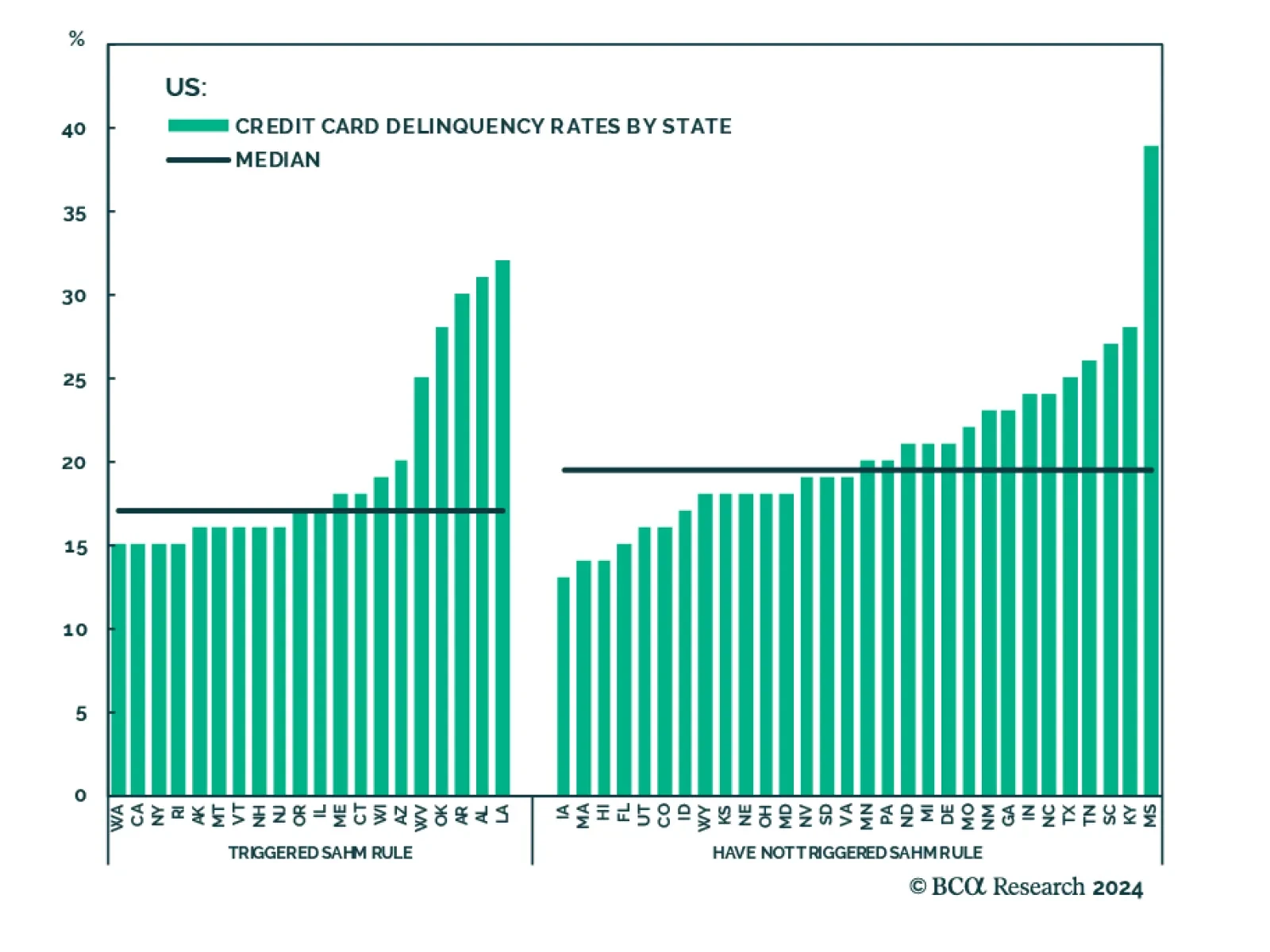

At 3.9% in February, the unemployment rate remains quite low in the US, corroborating the signal from GDP that current economic conditions are fine. Similarly, the Sahm Rule – which currently stands at 0.3 pp – has…

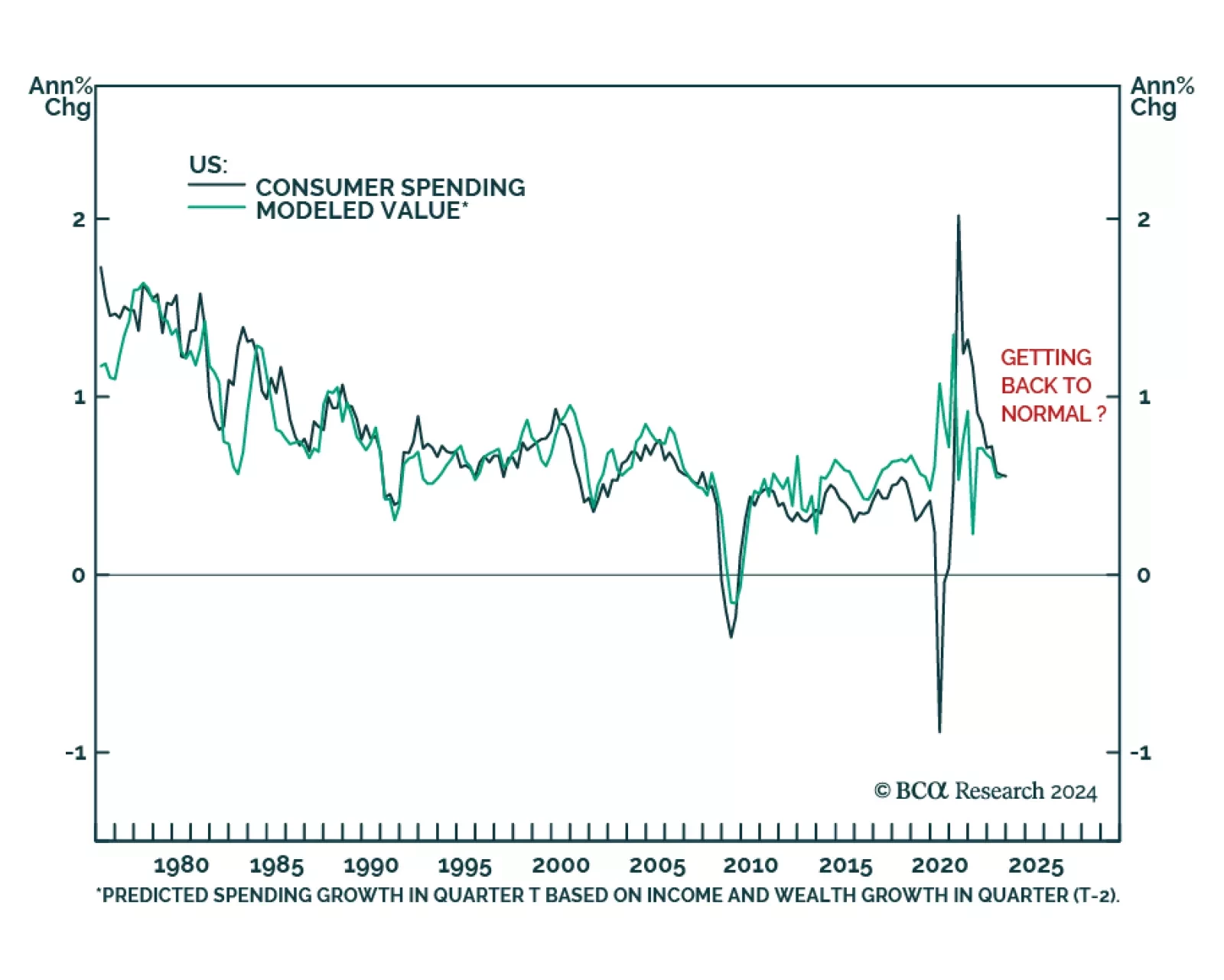

The US economy expanded at a faster pace than previously believed in 2023Q4. GDP grew at an annualized 3.4% q/q rate, thus annulling the second estimate’s downward revision. Notably, consumption growth was revised even…

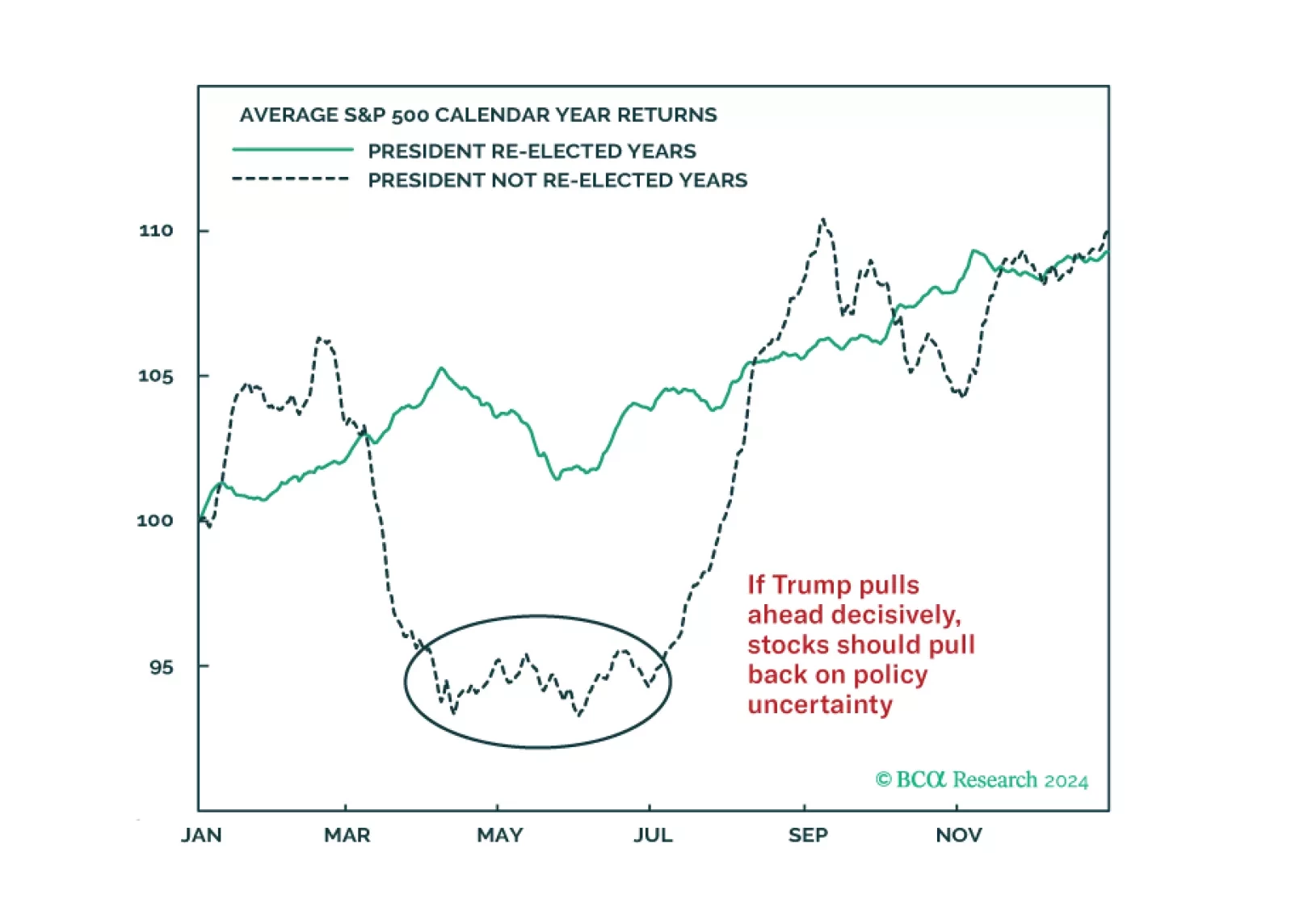

Investors around Europe and North America are concerned that the stock market is increasingly overbought and vulnerable to exogenous risks. We agree and have good reasons to fear that festering geopolitical risks and the US election…