Recession-Hard/Soft Landing

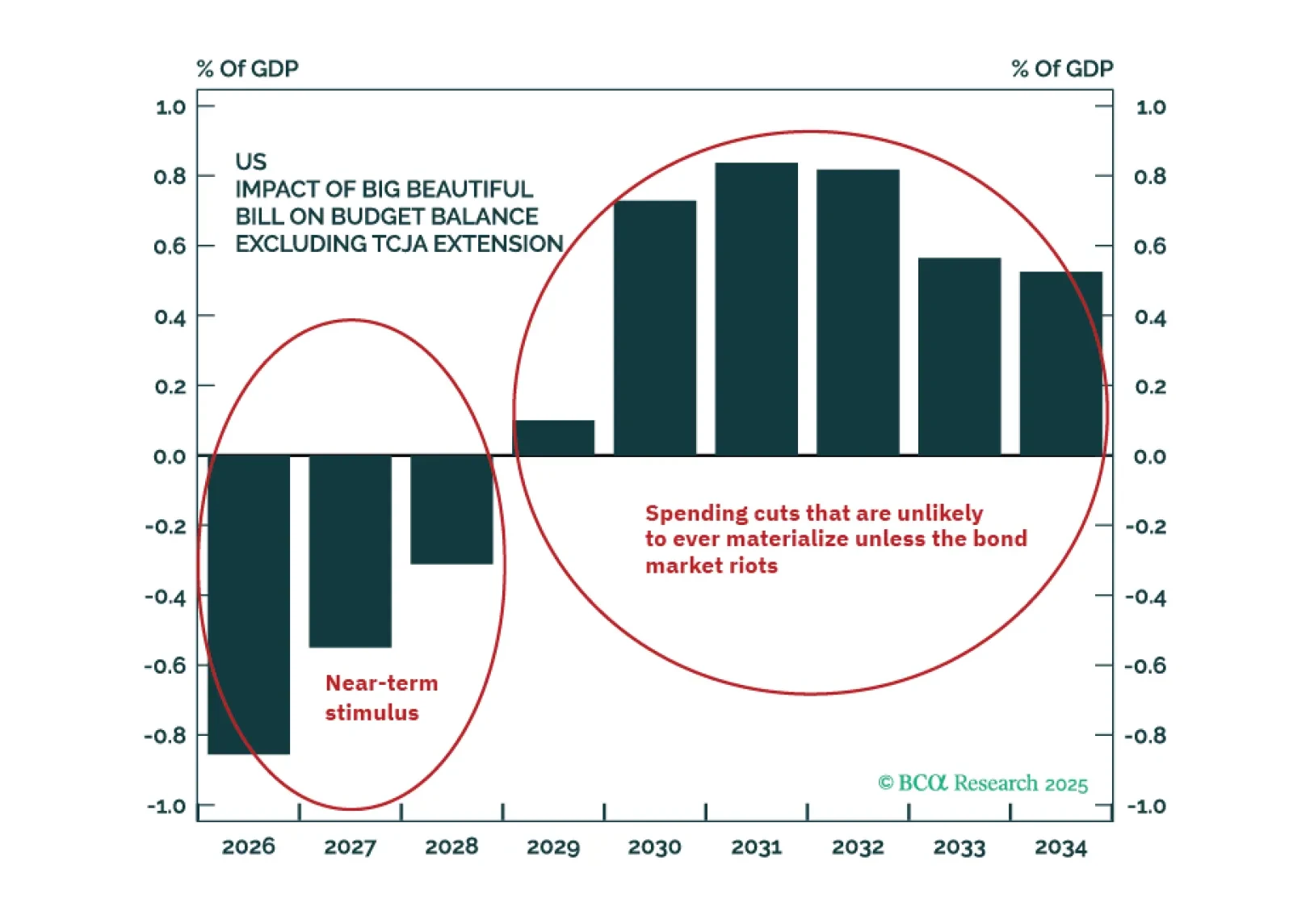

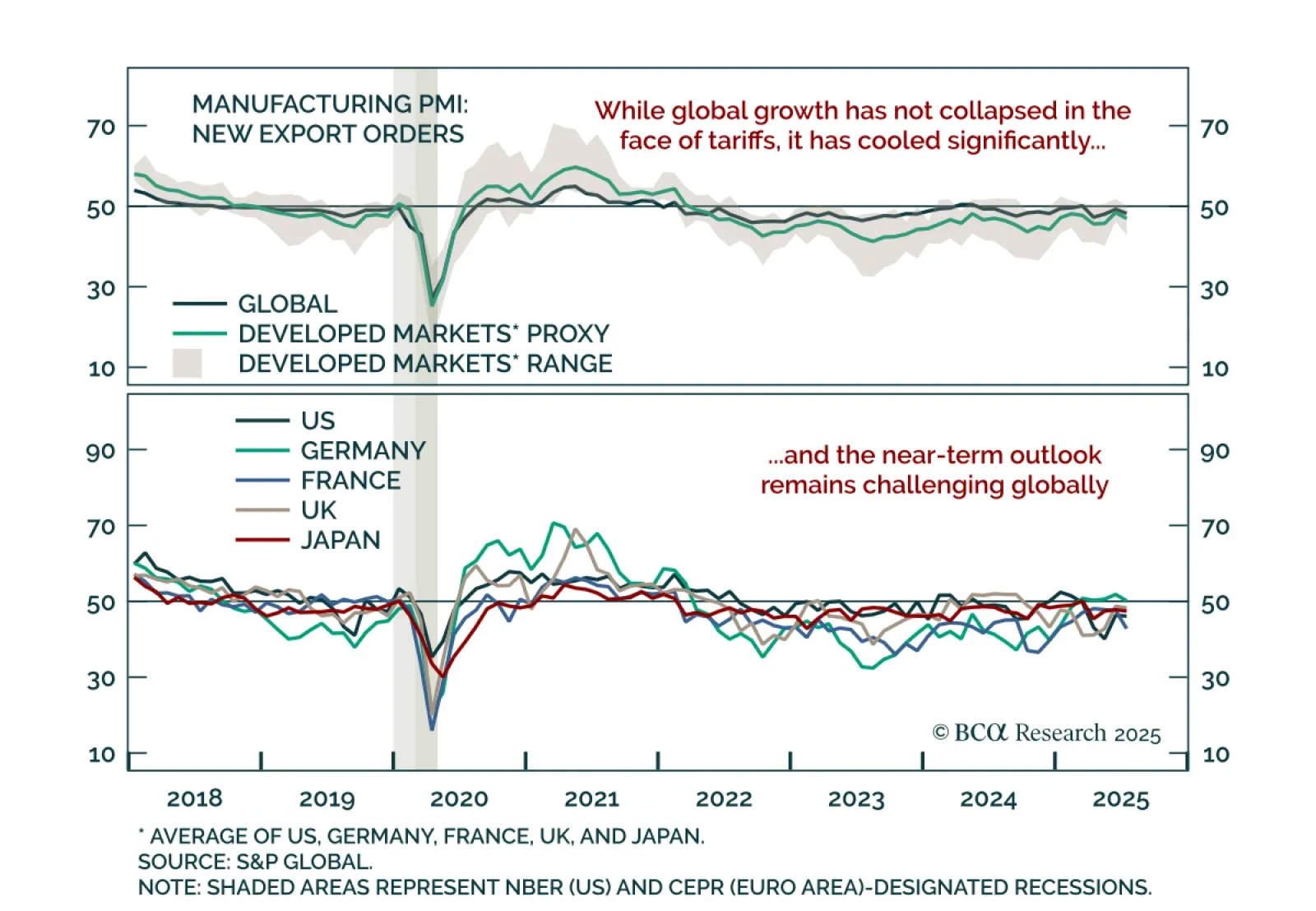

We maintain our 12-month US recession probability at 60%. However, until the “whites of the recession’s eyes” are more clearly visible, we would refrain from moving to a fully defensive stance.

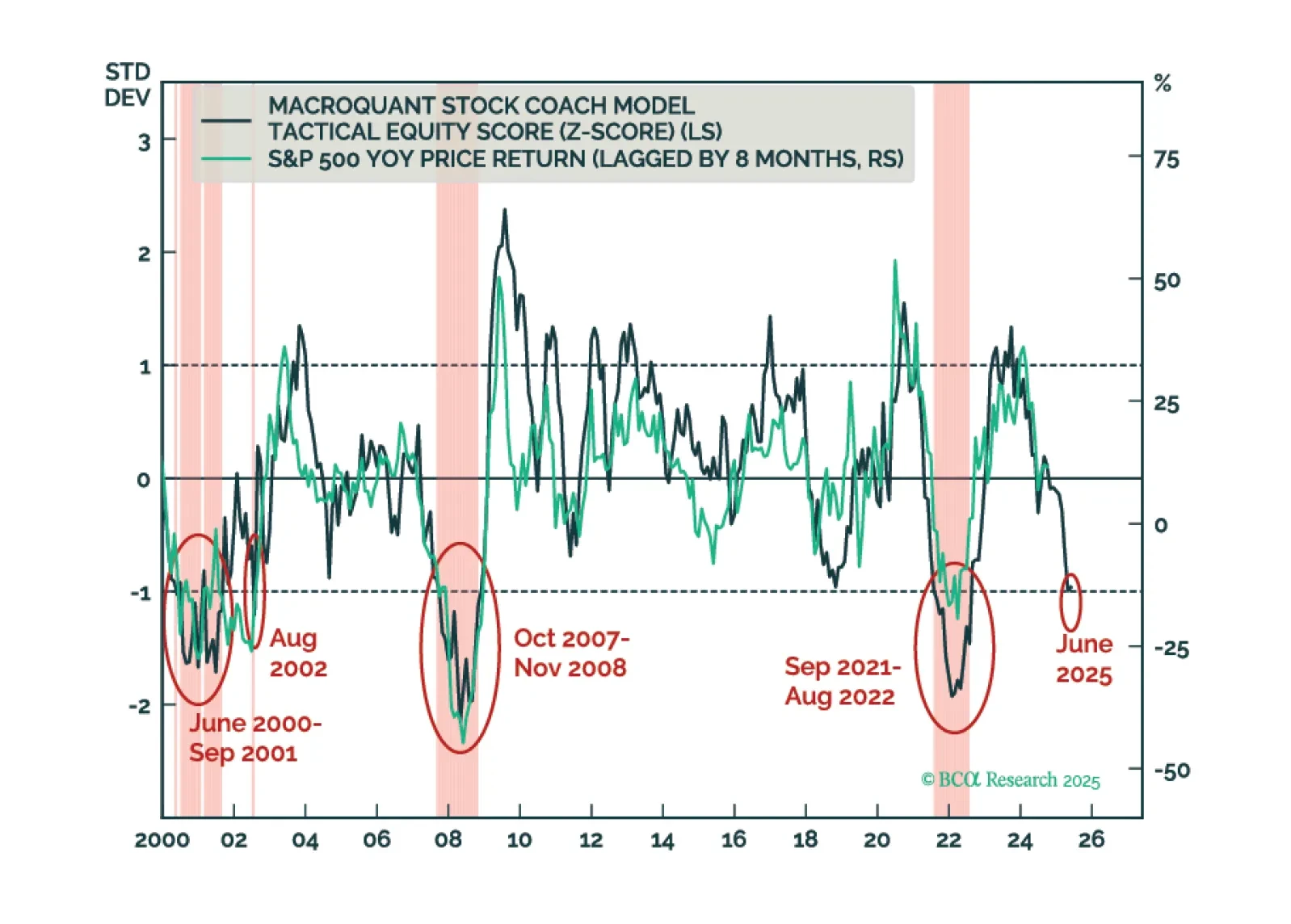

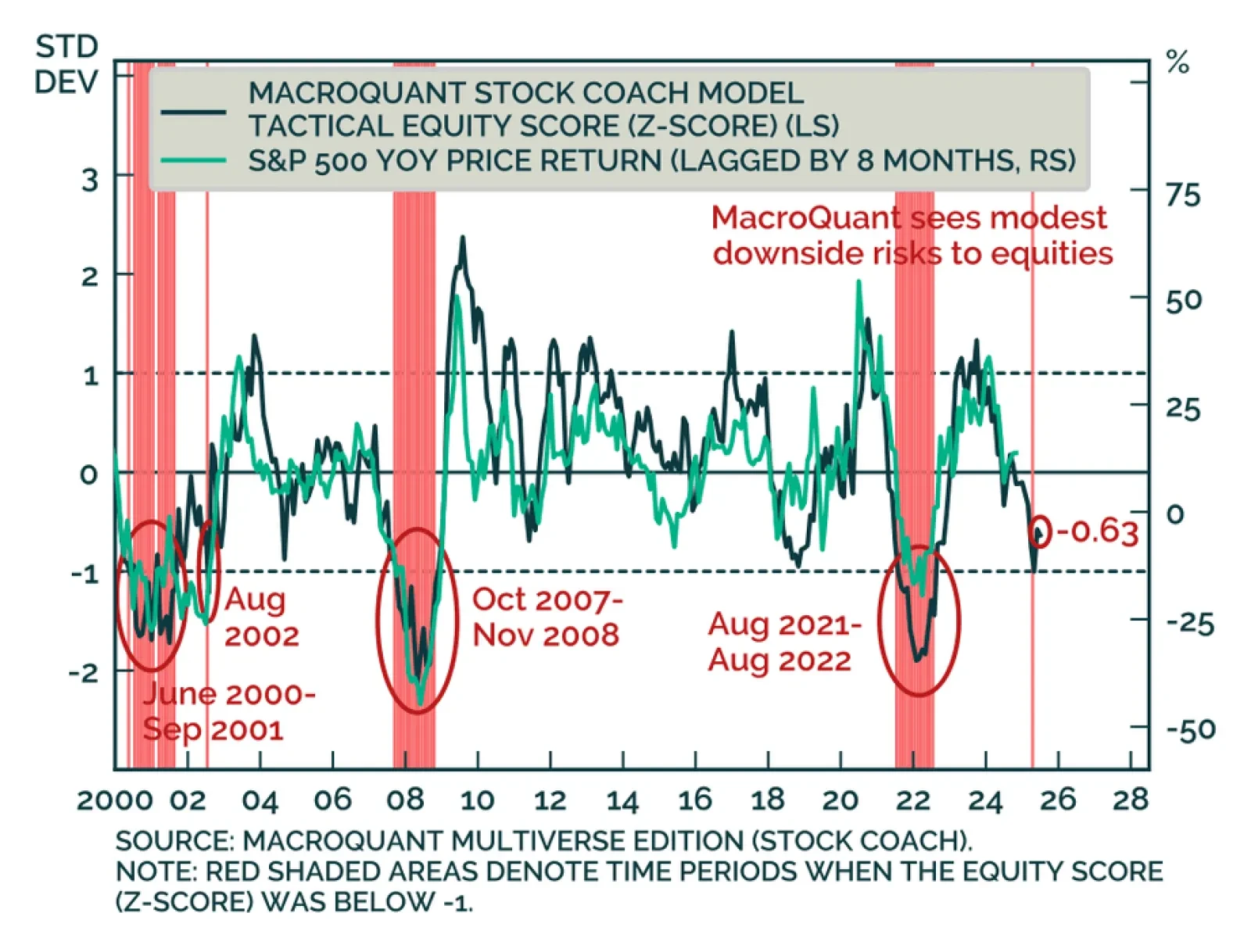

We will only move to a fully defensive stance if the “whites of the recession’s eyes” appear. So far, they have not. We will be increasingly looking to our MacroQuant model for guidance on when the next turning point in markets may come.

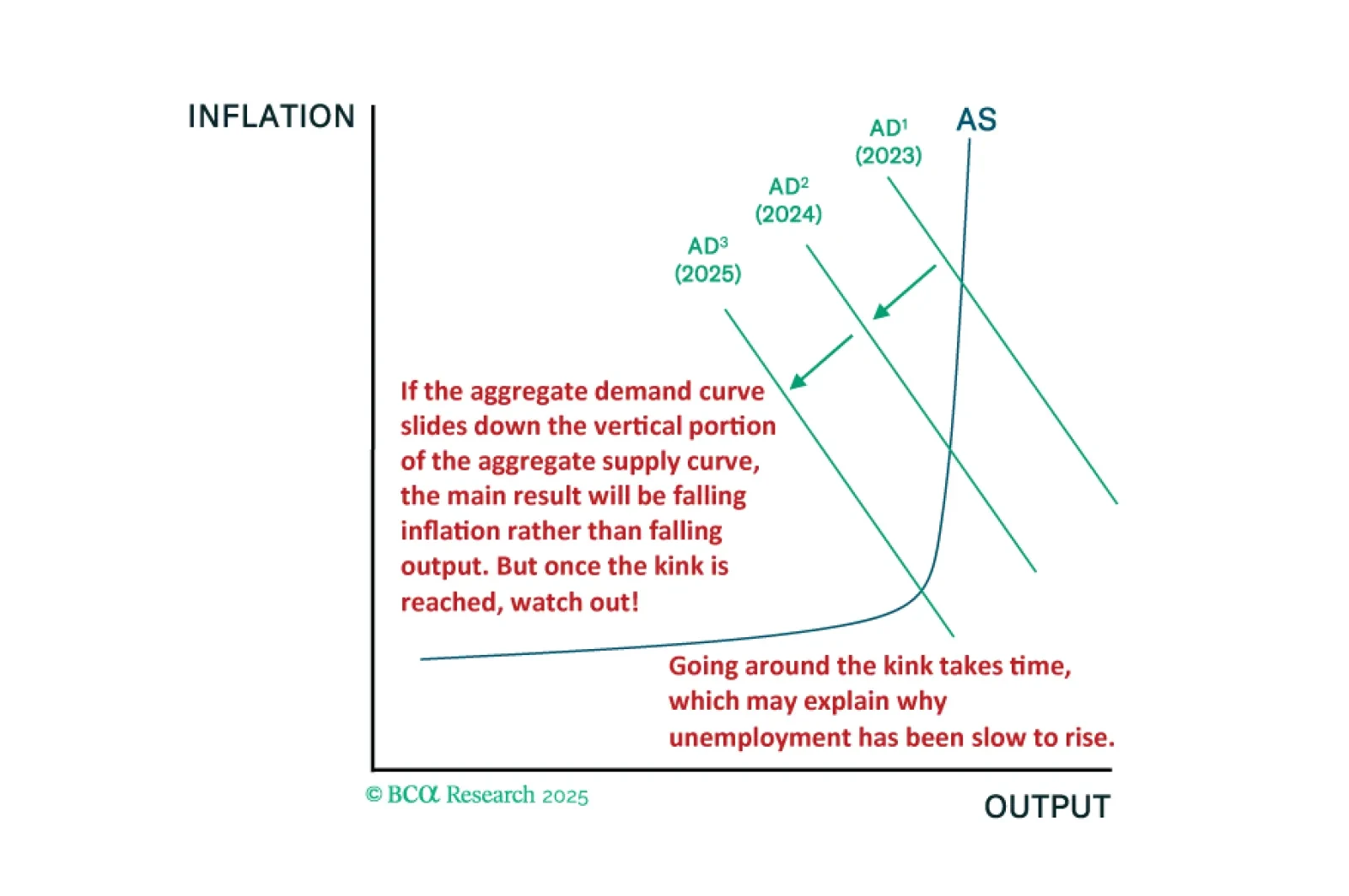

The fact that the US economy has been slower to deteriorate than in past cycles is entirely consistent with our kinked Phillips curve framework. We will be looking to our MacroQuant model for guidance on when to turn fully defensive.

We will abandon our recession call if US economic data show clear signs of stabilization over the summer months. For now, that has not happened. Maintain a modest underweight to stocks but look to get more defensive if MacroQuant’s equity z-score falls below -1.

Our Portfolio Allocation Summary for July 2025.

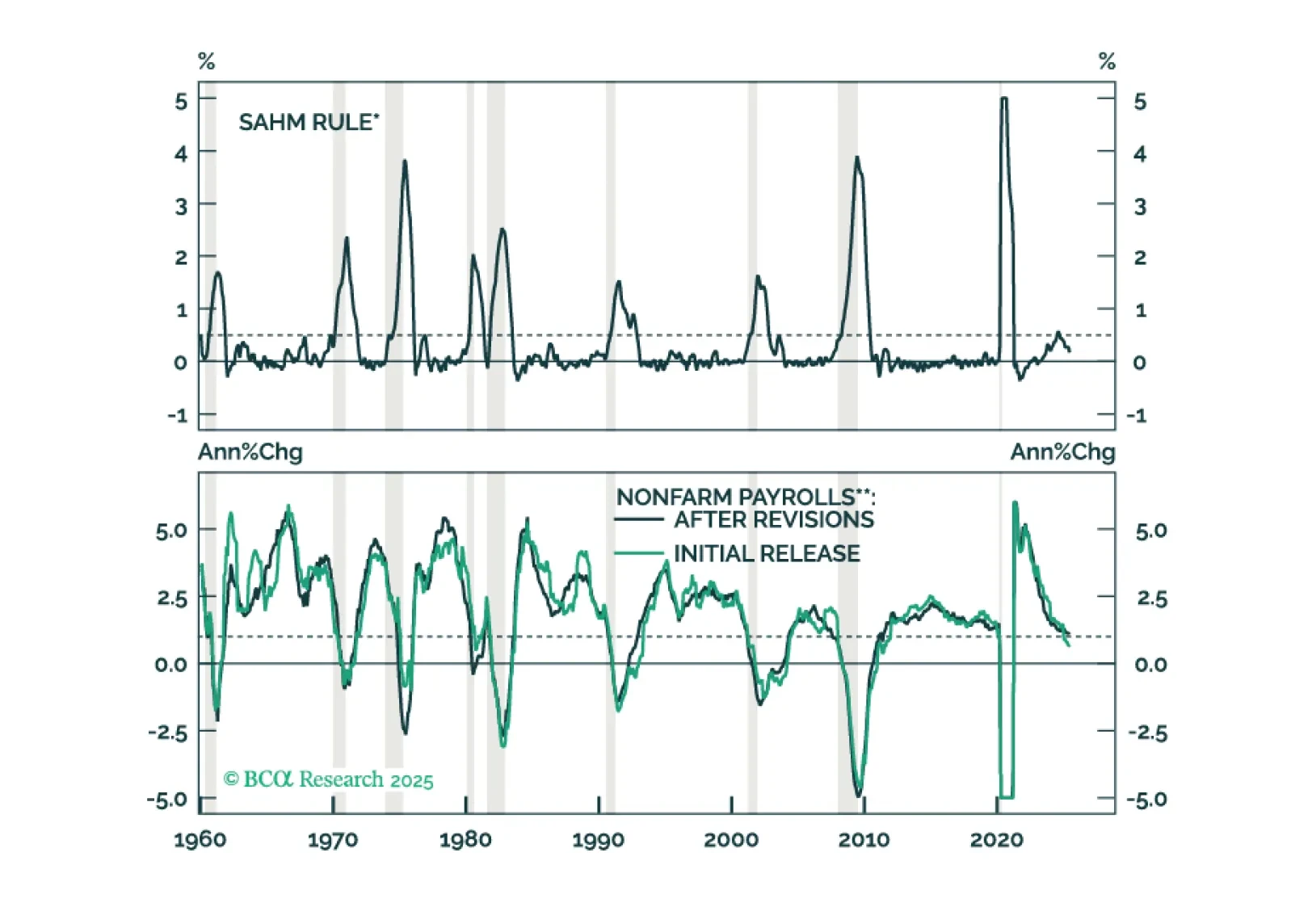

June’s employment report showed a tick down in the unemployment rate, an improvement that rules out a Fed rate cut later this month.

Investors should modestly underweight equities in their portfolios and look to turn more aggressively defensive once the whites of the recession’s eyes are visible. We think that will happen within the next few months.

The US economy has held up better so far this year than we had expected. For the time being, investors should remain modestly underweight equities. A more aggressive underweight would be justified only once the “whites of the recession’s eyes” are visible.