Markets are rallying on Fed rate cuts and China stimulus but there will also be October surprises ahead of the US election, which Trump could still win. Russia’s conflict with the West is escalating and the Middle East is…

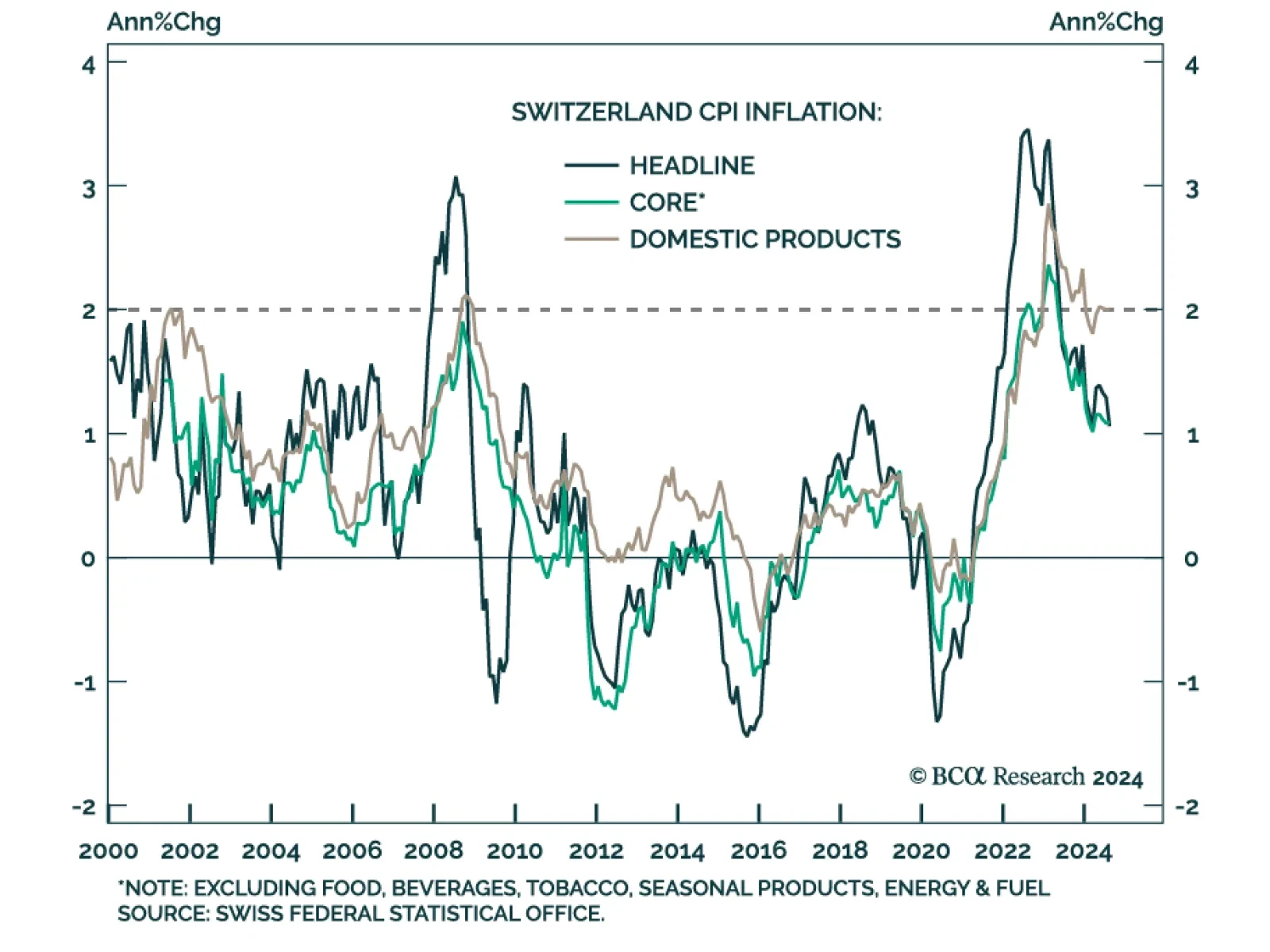

In a widely expected move, the Swiss National Bank (SNB) cut its policy rate for a third consecutive meeting on Thursday, from 1.25% to 1.00%. The move marked President Thomas Jordan’s final policy decision and his incoming…

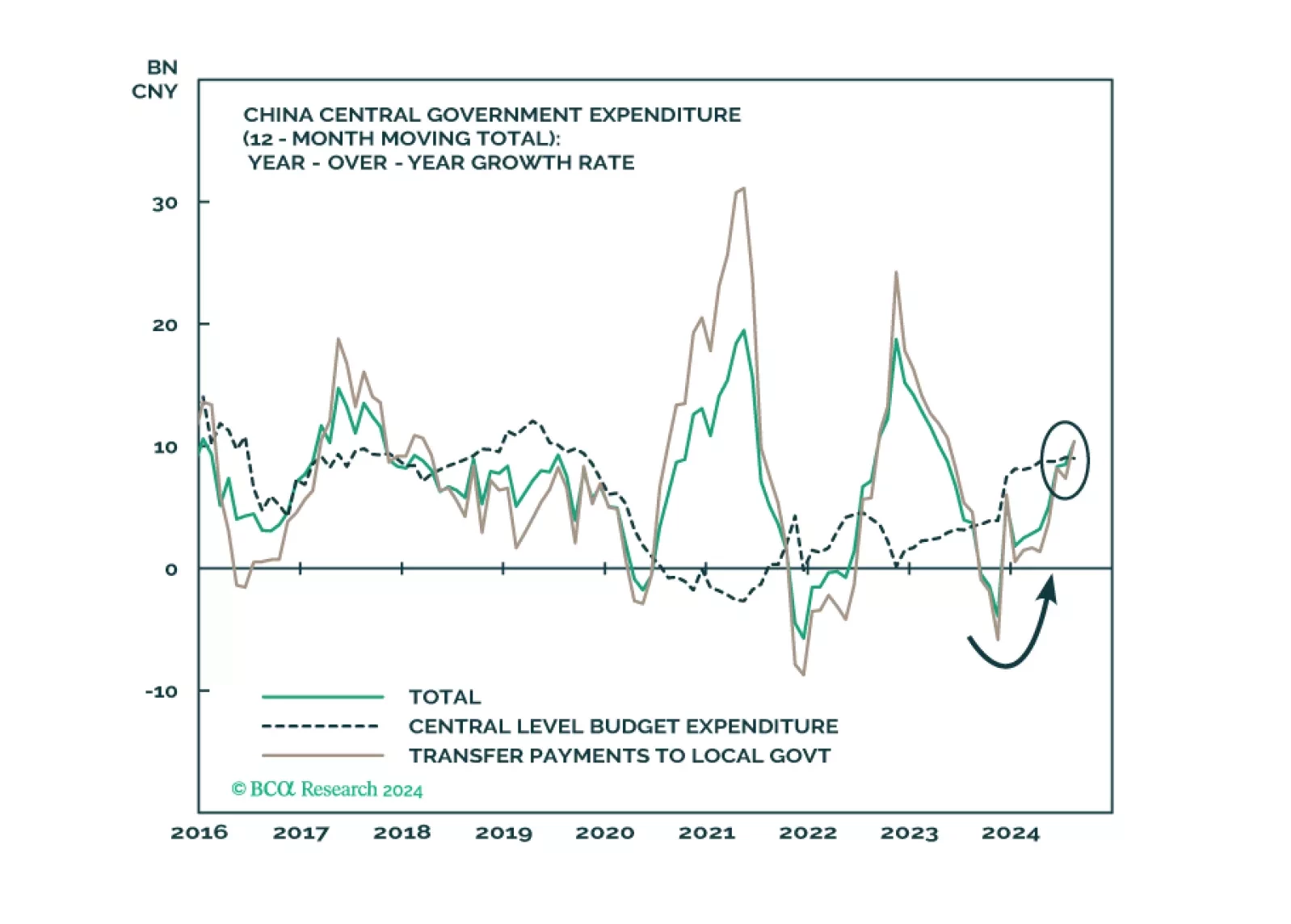

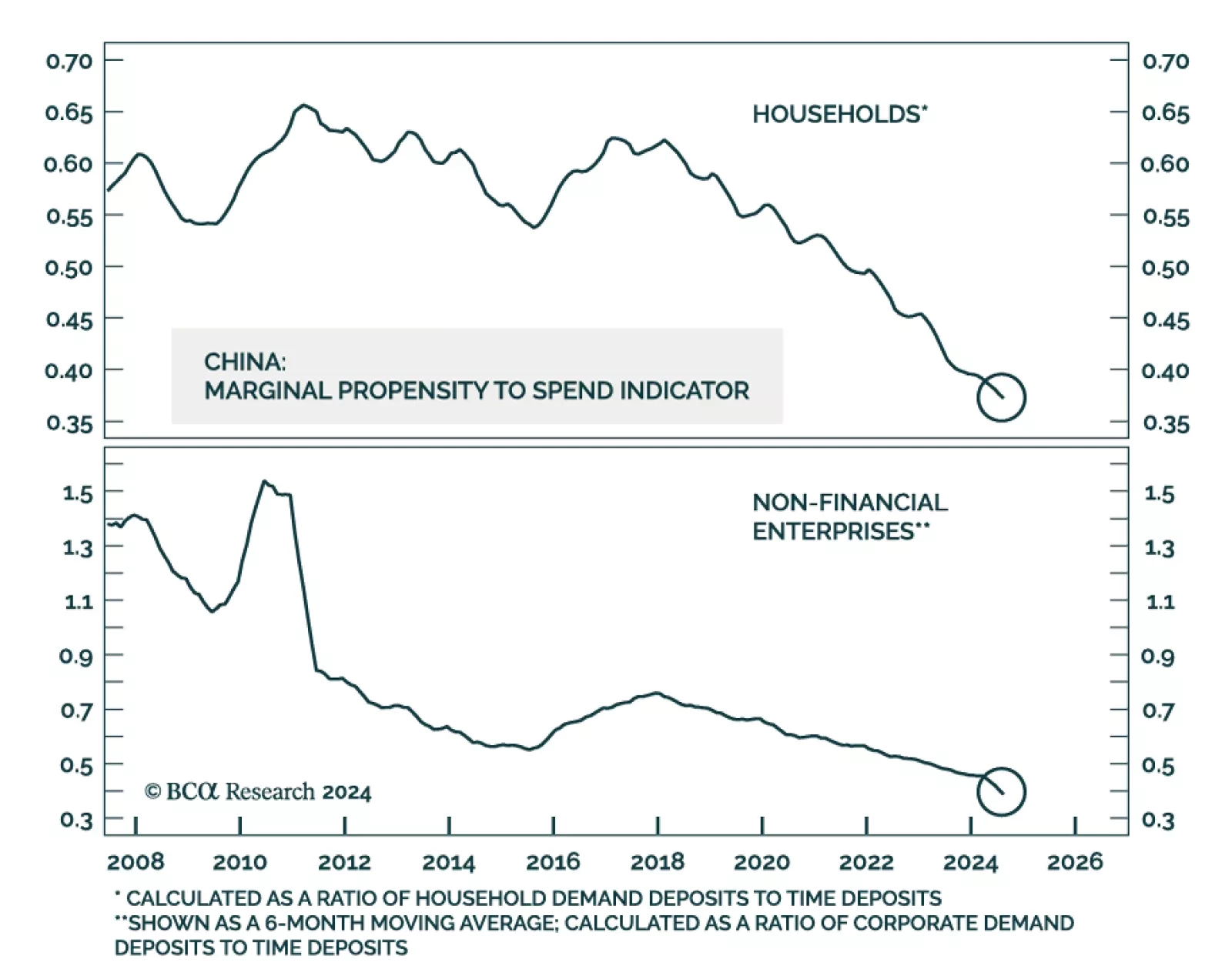

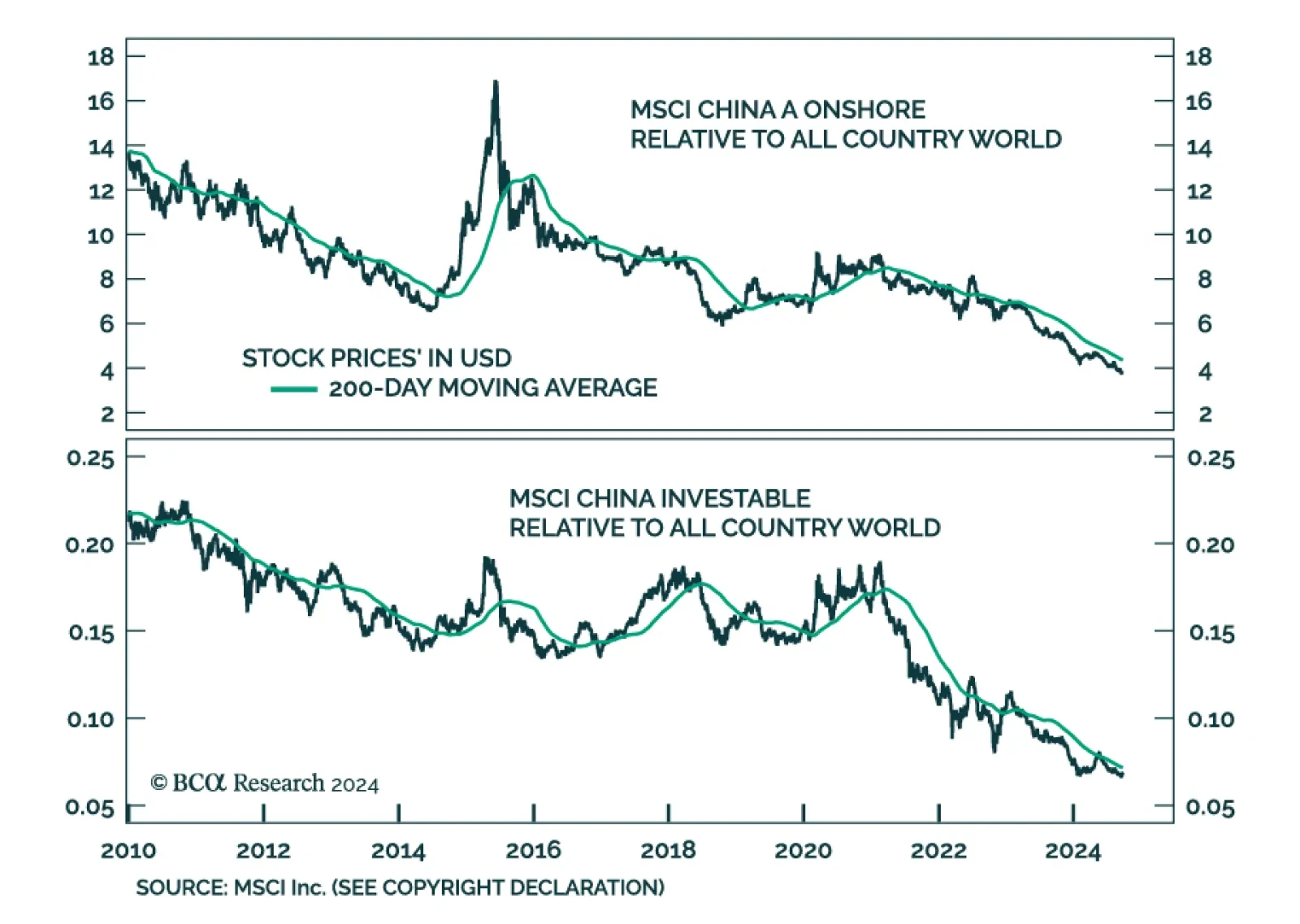

This week has not been short of developments on Chinese policy. After unleashing a monetary policy blitz, the authorities held an unscheduled Politburo meeting resulting in a pledge to take actions towards stabilizing the housing…

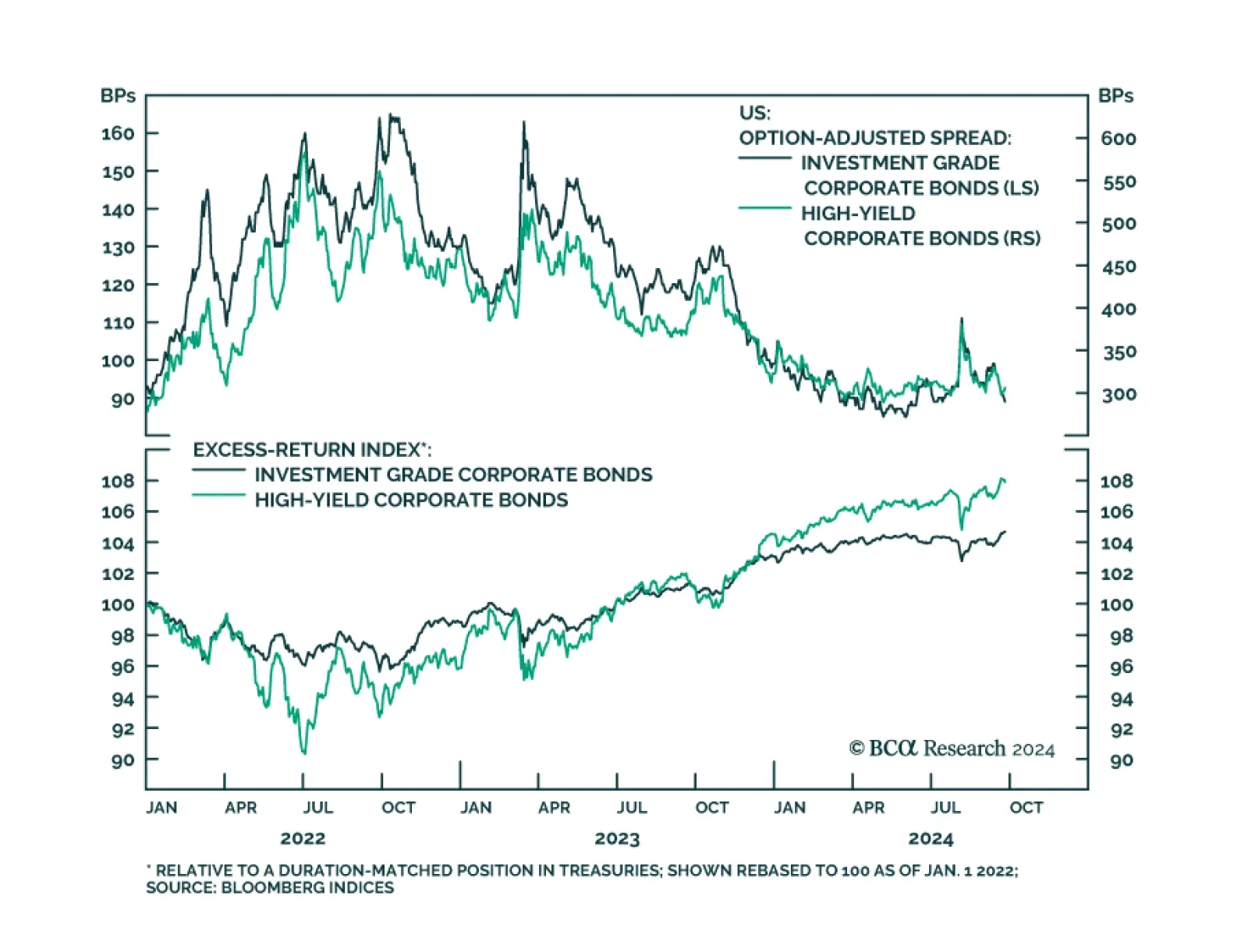

US investment grade and high yield spreads have tightened 22 and 75 bps since their August highs. Risk assets have cheered the outsized Fed rate cut as the narrative in markets aligns with the Fed’s conviction it can…

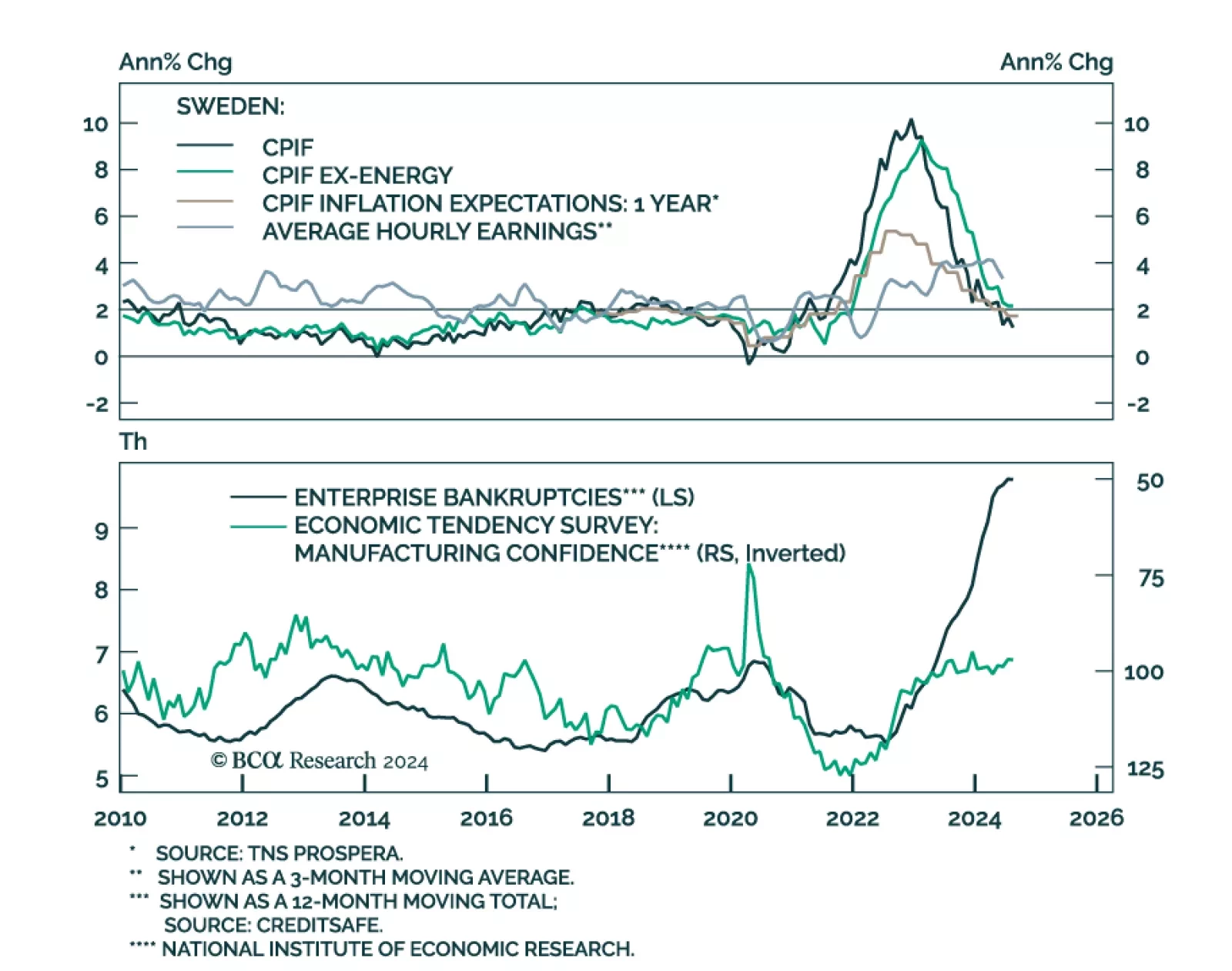

In a widely expected move, the Riksbank lowered its policy rate from 3.5% to 3.25% in September, marking its third cut this year. It embarked on its easing cycle in May, leading many other DM central banks, and has been…

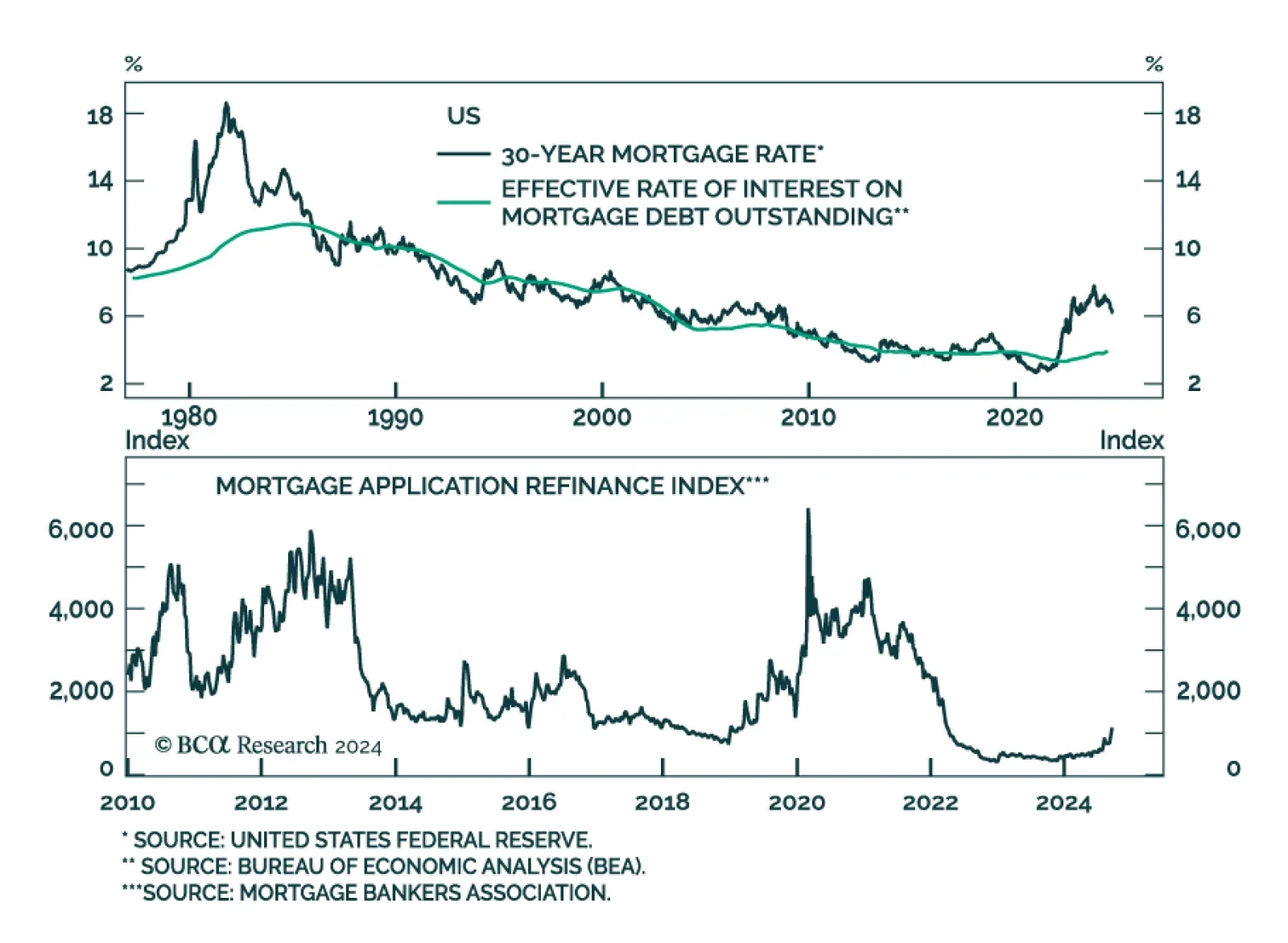

The conventional 30-year mortgage rate eased further to 6.2% from above 7% back in the spring, spurring a 20.3% surge in refinancing activity last week. Mortgage applications rose 11.0%, marking a fifth consecutive week of…

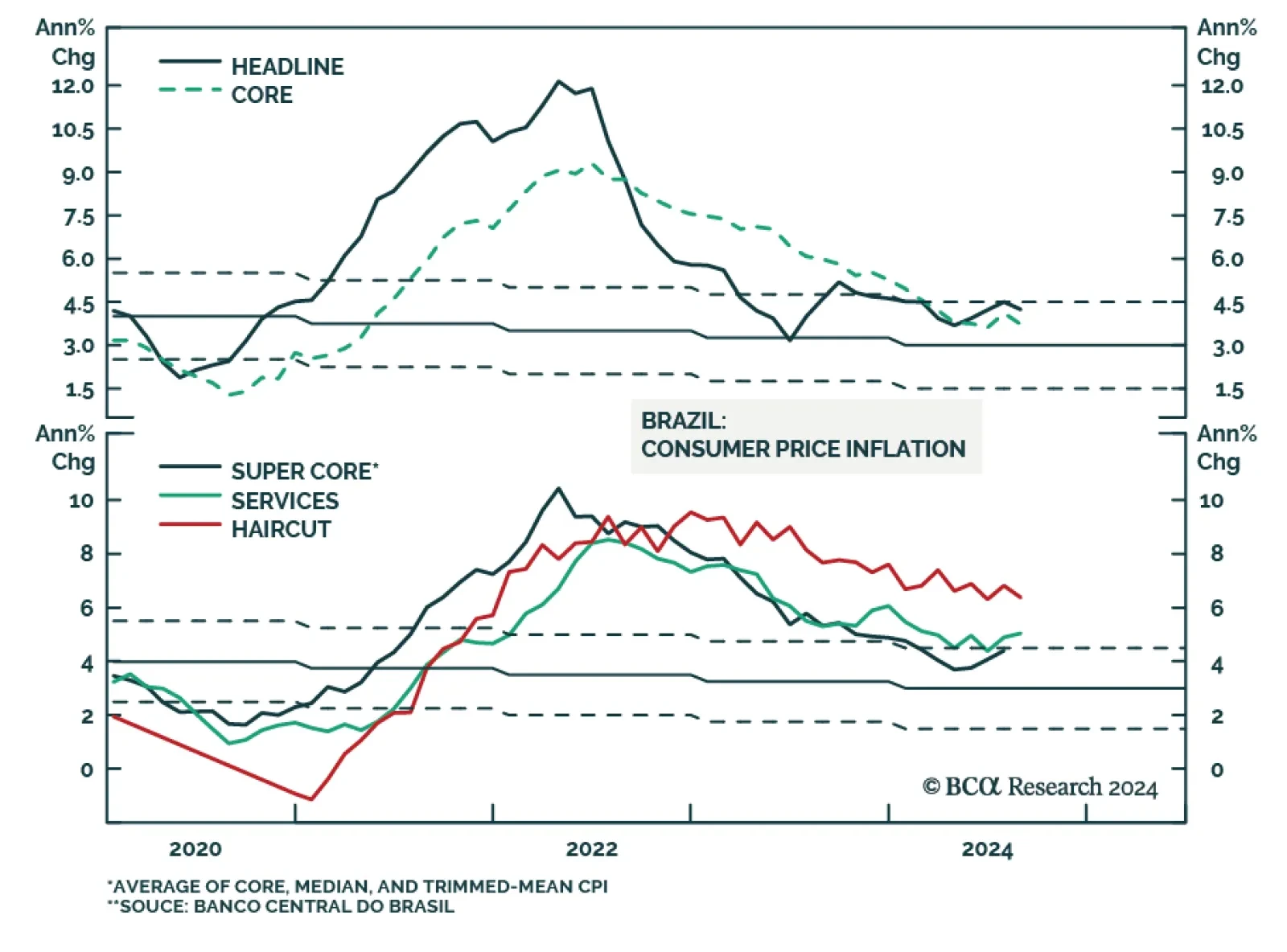

According to BCA Research’s Emerging Markets Strategy service, Brazil’s decision to raise interest rates is supported by recent economic data. Back in January of this year, they noted that Brazil would…

The PBoC announced further measures to stimulate the economy on Tuesday. It lowered the reserve requirement ratio from 10% to 9.5%, cut the 7-day reverse repo rate by 20 bps (following Monday’s 10 bps cut to the 14-day…

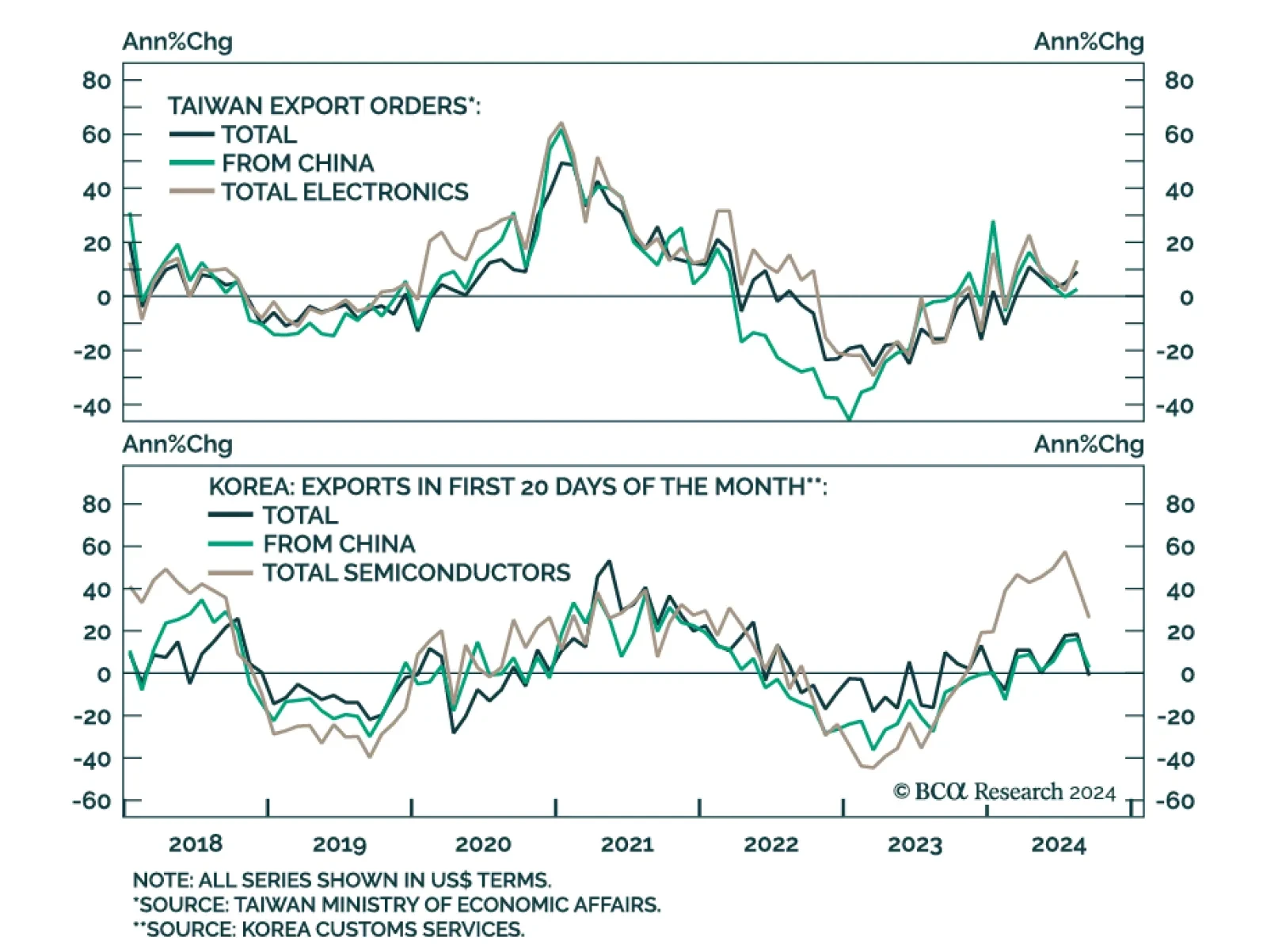

Export dynamics from small open economies are a good bellwether for global growth conditions. Taiwan export orders accelerated from 4.8% y/y to a faster-than-anticipated 9.1% in August. The faster pace of growth was also broad…

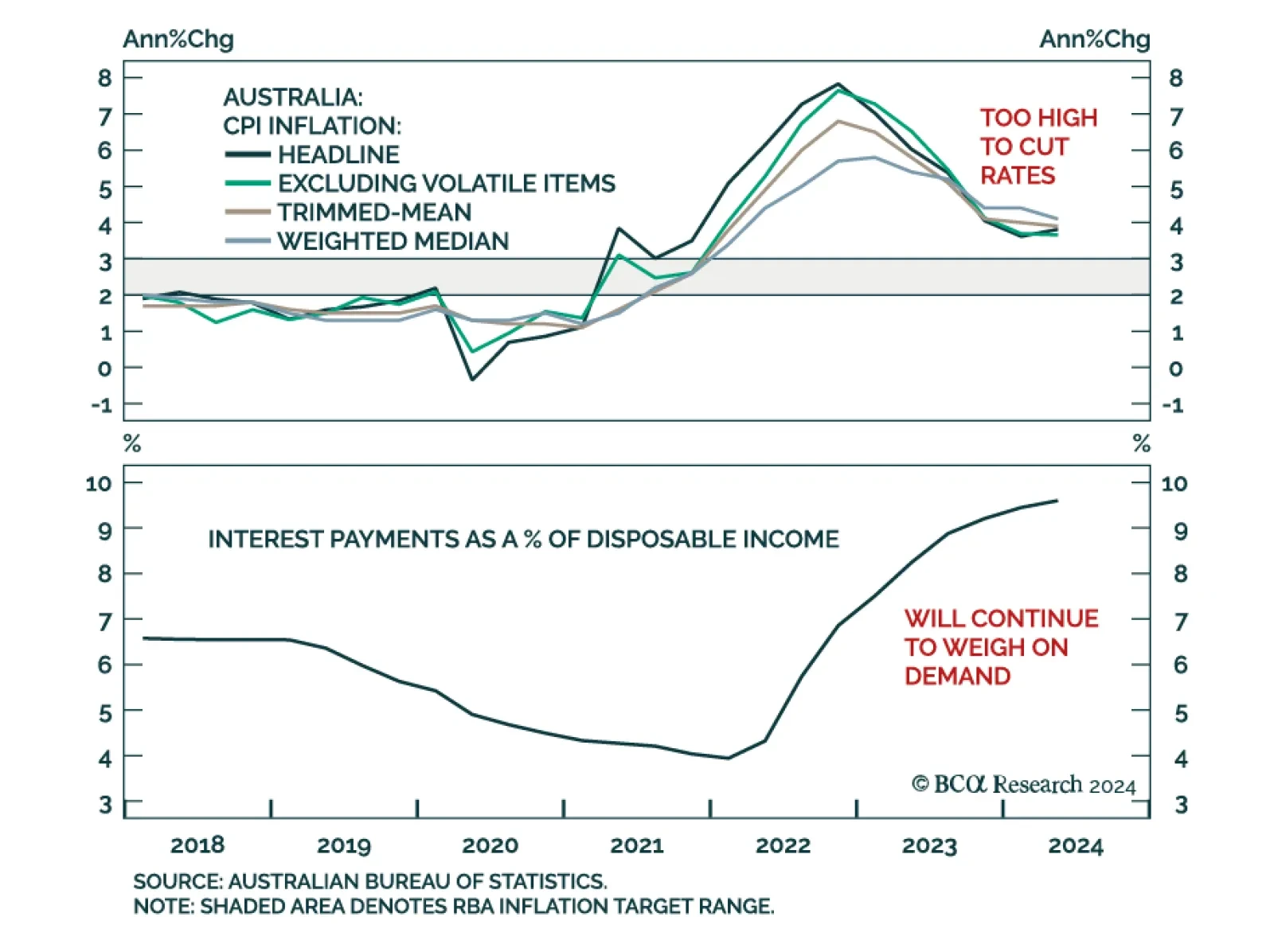

In a widely expected move, the Reserve Bank of Australia kept the cash rate unchanged at 4.35% in September. All measures of Australian CPI inflation remain well above the RBA target range. The Commonwealth Energy Bill Relief…