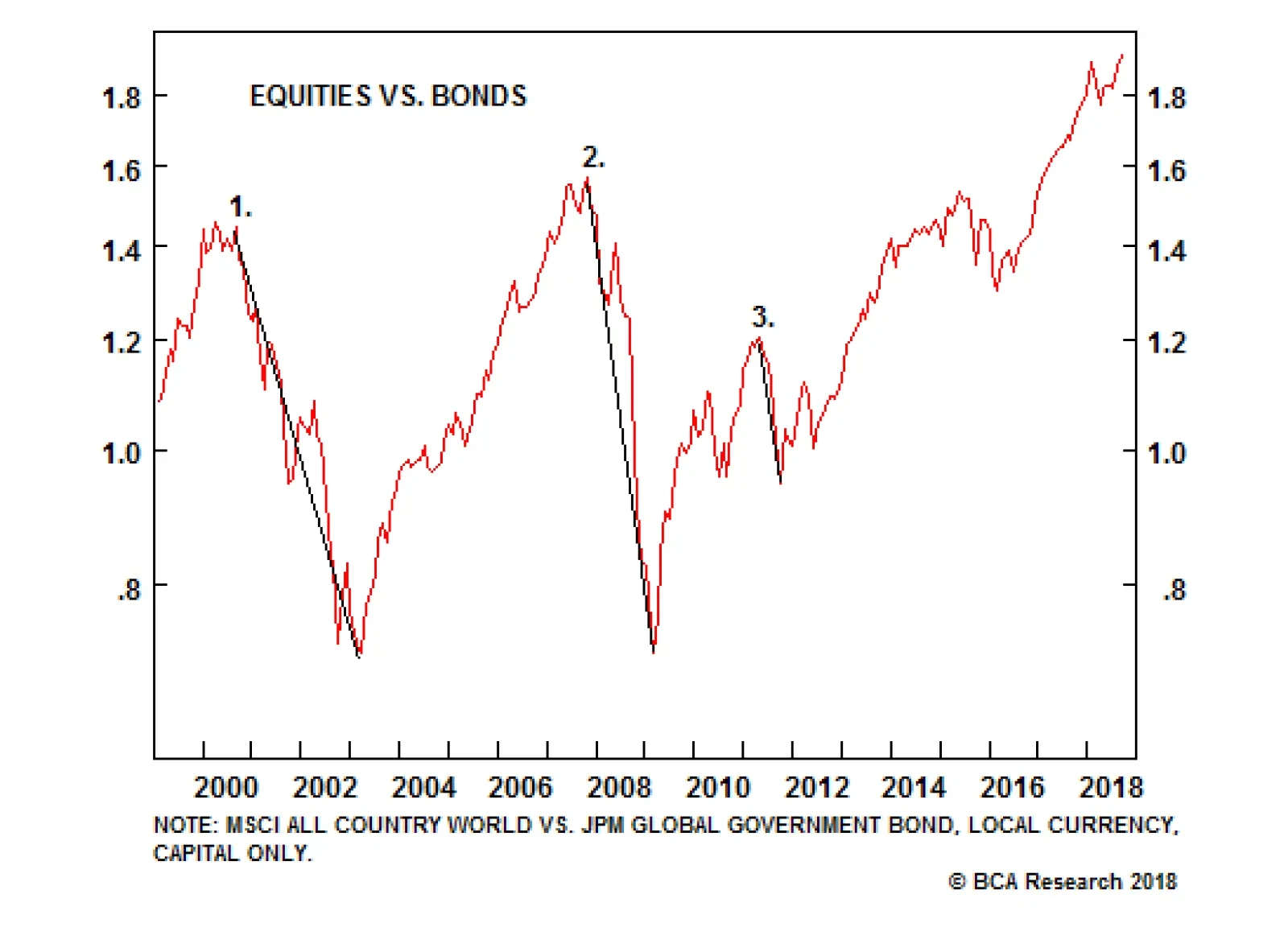

There have been three major financial market downturns, defined as a greater-than-six-month period when equities underperform bonds by more than 20 percent, in the 21th century (see chart). The twenty-first century’s…

Highlights Prediction 1: A major financial downturn will trigger the next major economic downturn, and not the other way round. Prediction 2: The straw that will break the back of a fragile financial system will be the global long…

Highlights We have downgraded our 12-month recommendation on global equities and credit from overweight to neutral. If macro developments evolve as expected, then we will shift to an outright bearish stance on risk assets later this…

Highlights The labor market continues to tighten and pressure the Fed. Tightening financial conditions suggest more muted returns for U.S. dollar assets and are associated with a peak in cyclical sectors. BCA's proprietary…

Looking Beyond The Next Few Months The next couple of months could remain tricky for equity markets. But, with economic growth set to remain above trend for another year or so and central banks cautious about the pace of monetary…

Highlights Apart from rising geopolitical tensions, our main macro themes remain a growth slowdown in China and a rise in U.S. core inflation. This combination bodes ill for EM financial markets. Continue underweighting EM stocks,…

Highlights The 2018 outlook for both economic growth and corporate profits remains constructive for risk assets, although evidence is gathering that global growth is peaking. Some measures of global activity related to capital…