Over the past month, market participants have shifted their expectations for the path of the Fed funds rate. At the start of May, expectations were for the Fed to cut rates below current levels to just above 4.5% by the end of…

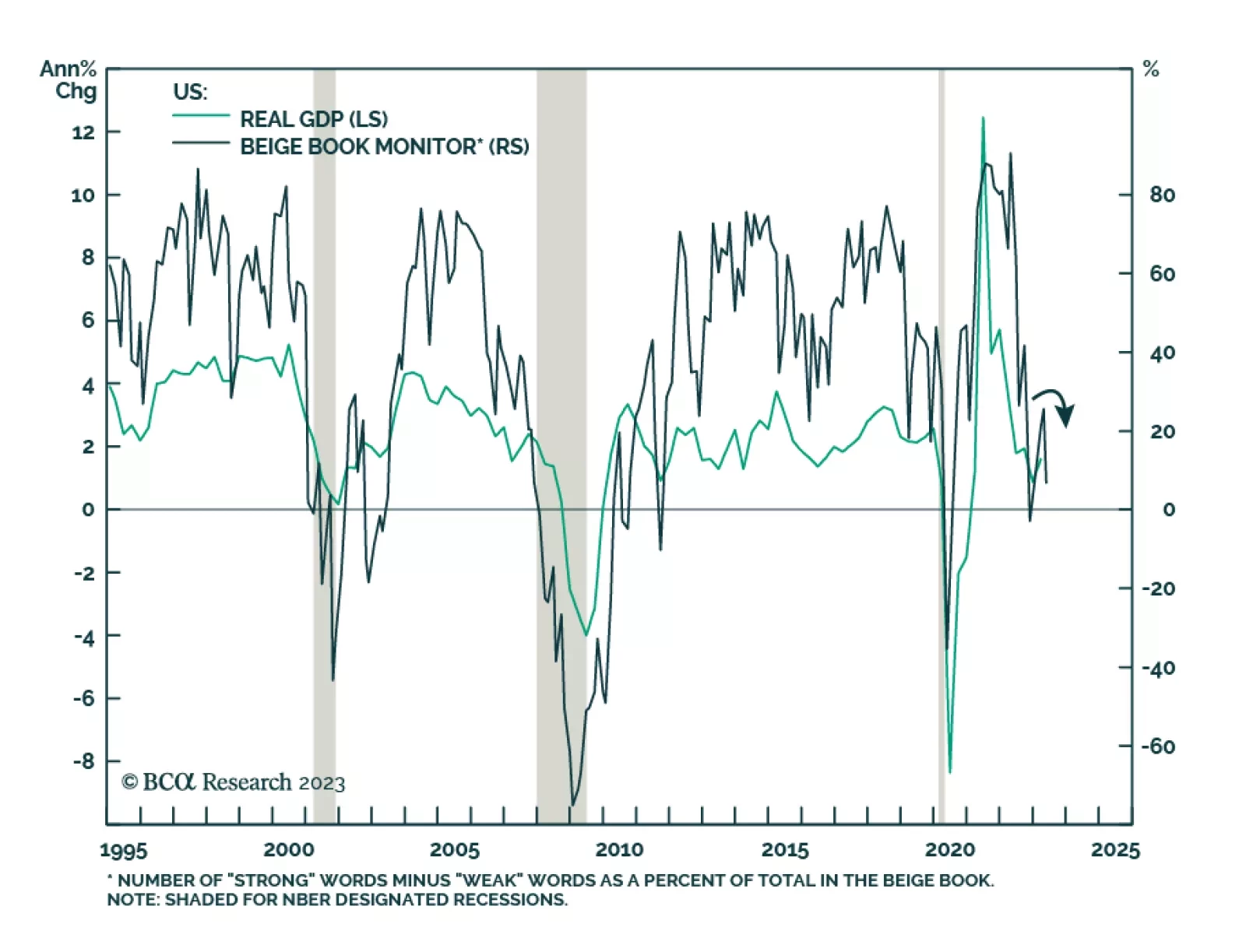

The Fed’s Beige Book is signaling that the US economy is losing steam following an improvement in momentum earlier this year. The release revealed that future growth expectations deteriorated. In particular, manufacturing…

Expectations for oil demand growth through 2023-24 are way too optimistic. Until these expectations fall to -0.5-1 percent, the oil price has further downside. Plus: collapsed complexity confirms that AI is in a mania, while basic…

Once the debt ceiling soap opera ends, investors will likely turn their attention to some of the tailwinds supporting stocks. These include stronger earnings growth, diminished bank stresses, better housing data, early signs of an…

In Section I, we review the three possible economic scenarios over the coming year, and underscore that the “soft landing” scenario remains improbable. A “no landing” scenario could occur, but it would ultimately lead back to the…

The debt ceiling game’s endpoint will avoid default only if it implies economic pain. For the Republicans, the best strategy is not to lift the debt ceiling unless the Democrats cut spending a lot, or unless the economy starts to…

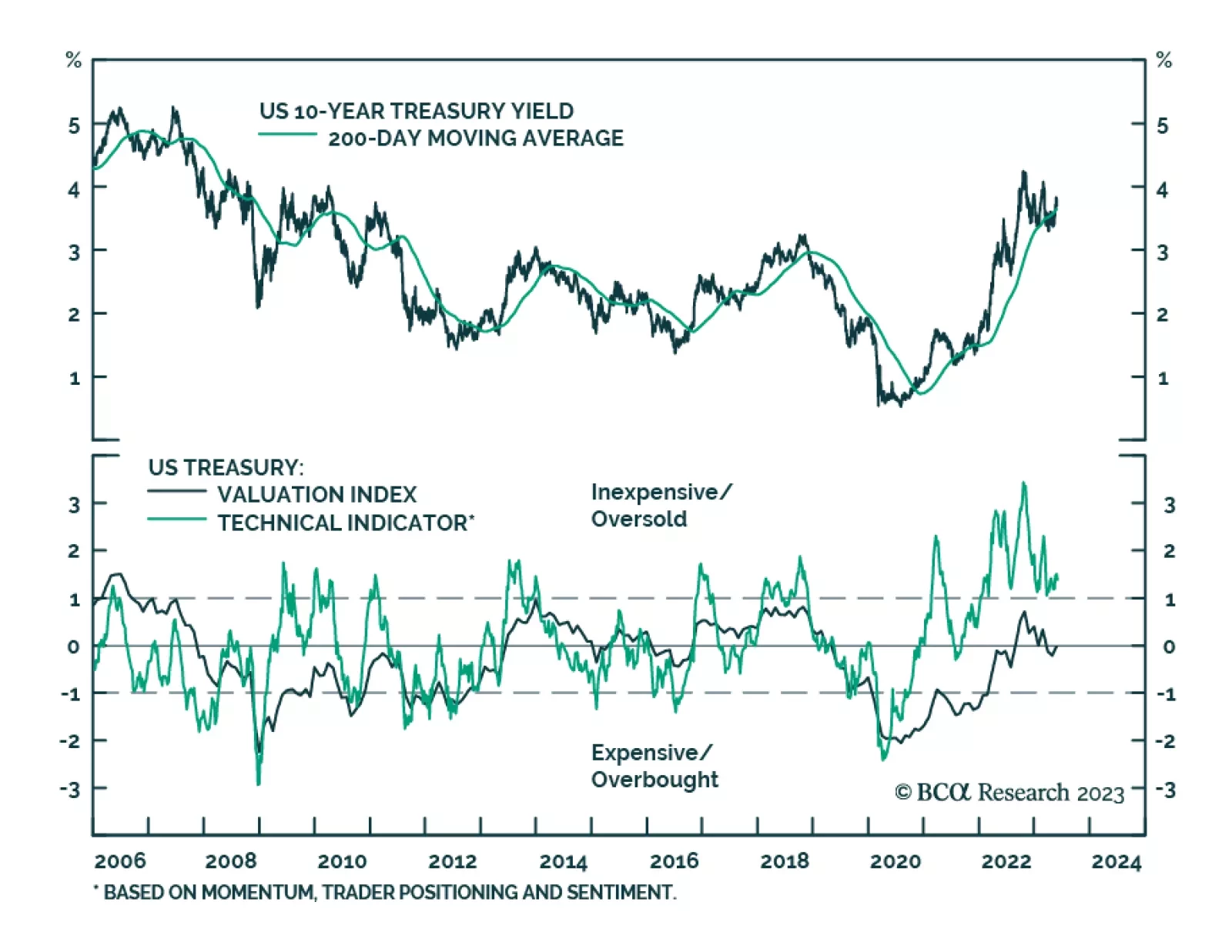

Investors should expect high volatility and a selloff in US stocks over the short run due to the higher-than-usual risk of technical default. Investors should seek shelter in defensive sectors and large cap stocks. Long-dated…

There is a 50:50 chance of experiencing a major deflationary shock in the next two years, and an even greater likelihood on a longer timeframe. The good news is that several assets provide a good insurance against this risk, and that…

If the recession begins this year, it is unlikely to be mild, because inflation will not have fallen by enough to allow the Fed to cut rates aggressively. In contrast, if the recession starts in 2024 or later, when inflation is…

As the Fed meets today, we explain what it did wrong in 1970, 1974, and 1980 that prevented inflation from being exorcised, and the lessons for 2023-24. Plus, we identify a currency cross that could rebound in the next year.