Executive Summary Macroeconomic Backdrop Favors Defensive Consumer Staples Markets now expect five-to-six rate hikes in 2022 The rate of change in rates as opposed to their level has triggered the fast and furious…

Feature Chart 1Weak Economic Fundamentals Undermine Stock Performance Monetary policy easing has intensified in the past two months. The PBoC reduced one-year loan prime rate (LPR) by 10 bps and five-year by 5 bps following…

Dear Clients, This is the final publication for the year, in which we recap some of the key economic developments this month. Our publishing schedule will resume on January 6, 2022. The China Investment Strategy team wishes you a very…

Dear Clients, Next week, in addition to sending you the China Macro And Market Review, we will be presenting our 2022 outlook on China at our last webcasts of the year “China 2021 Key Views: A Challenging Balancing Act”.…

Highlights Financial markets in both mainstream EM and China are undergoing an adjustment that is not yet complete. EM equity and currency valuations are neutral. When valuations are neutral, the profit and liquidity cycles become the…

Dear Client, We will be working on our 2022 Outlook for China, which will be published on December 8. Next week we will be sending you BCA Research’s Annual Outlook, featuring long-time BCA client Mr. X, who visits towards the end…

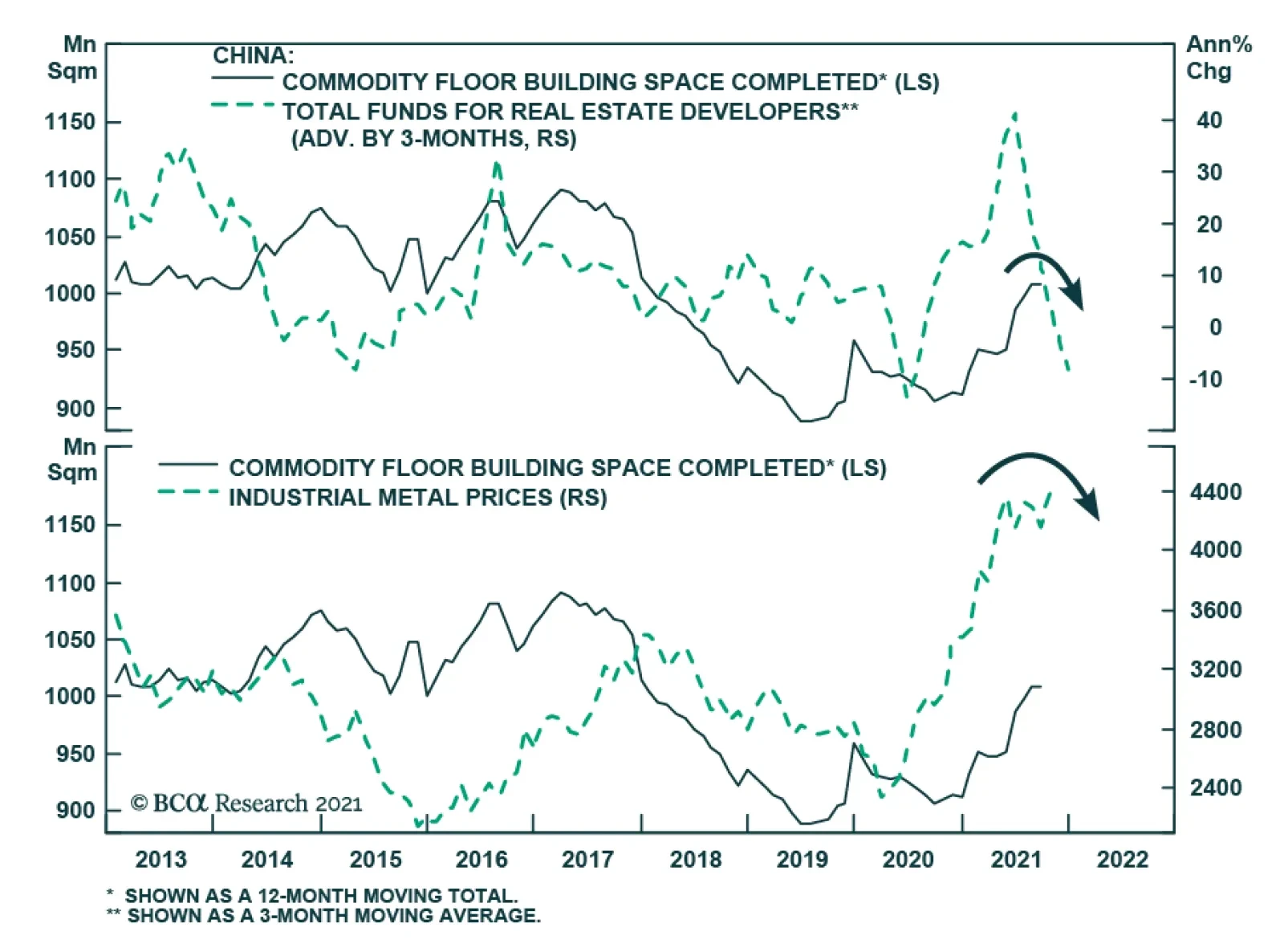

October new home prices fell for the second consecutive month in China (see The Numbers). Given how highly leveraged the Chinese property sector is, a continued decline in home prices would be an unwelcome development for Chinese…

Highlights Geopolitical conflicts point to energy price spikes and could add to inflation surprises in the near term. However, US fiscal drag and China’s economic slowdown are both disinflationary risks to be aware of. …