Central banks are in a dilemma whether to prioritize supporting growth or bringing inflation back to target. This is unlikely to end well. Investors should be defensively positioned.

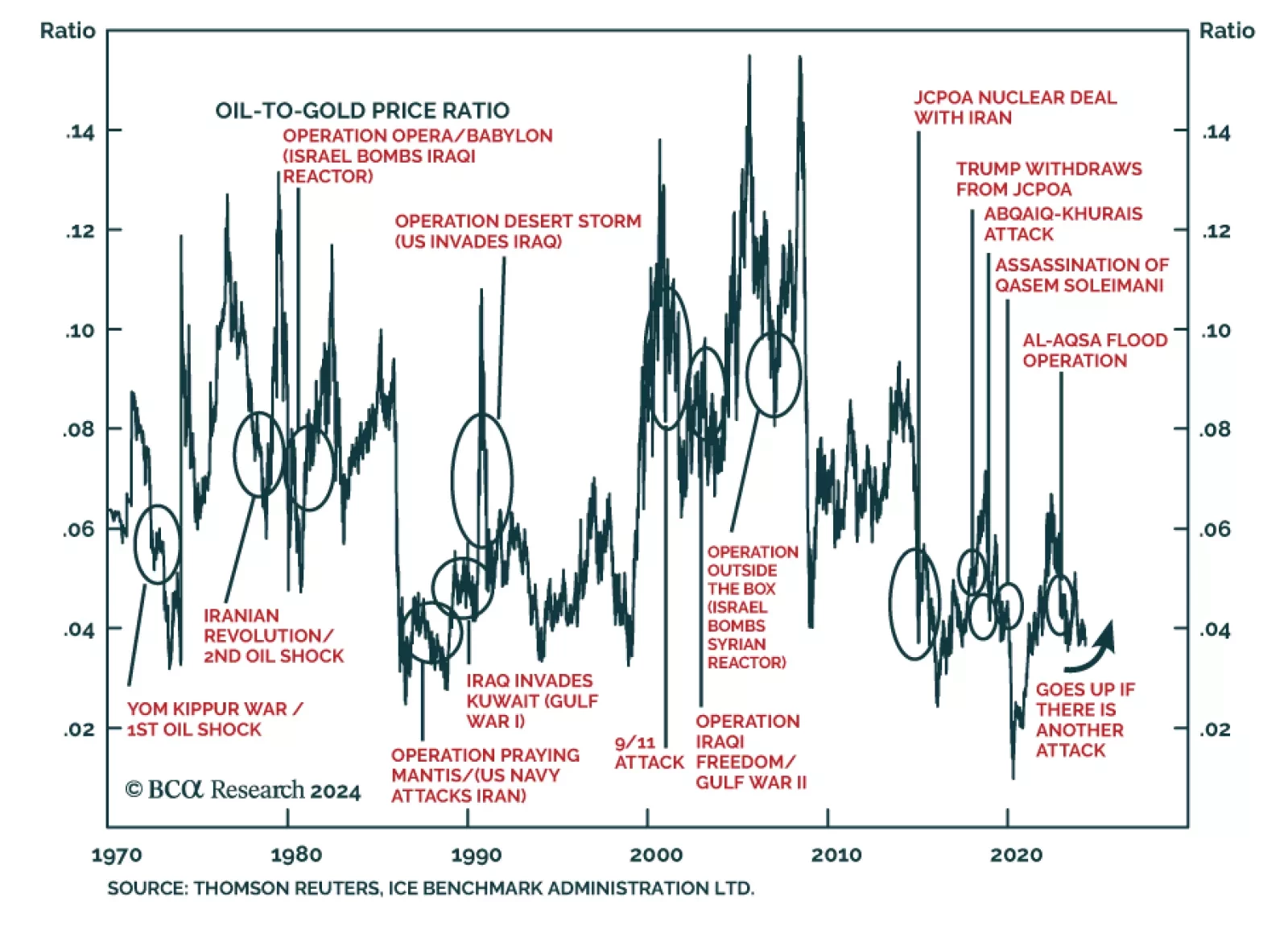

According to BCA Research’s Commodity & Energy Strategy and Geopolitical Strategy services, there are several avenues for tensions between Israel and Iran to escalate. Investors need to hedge against a 30% risk of a…

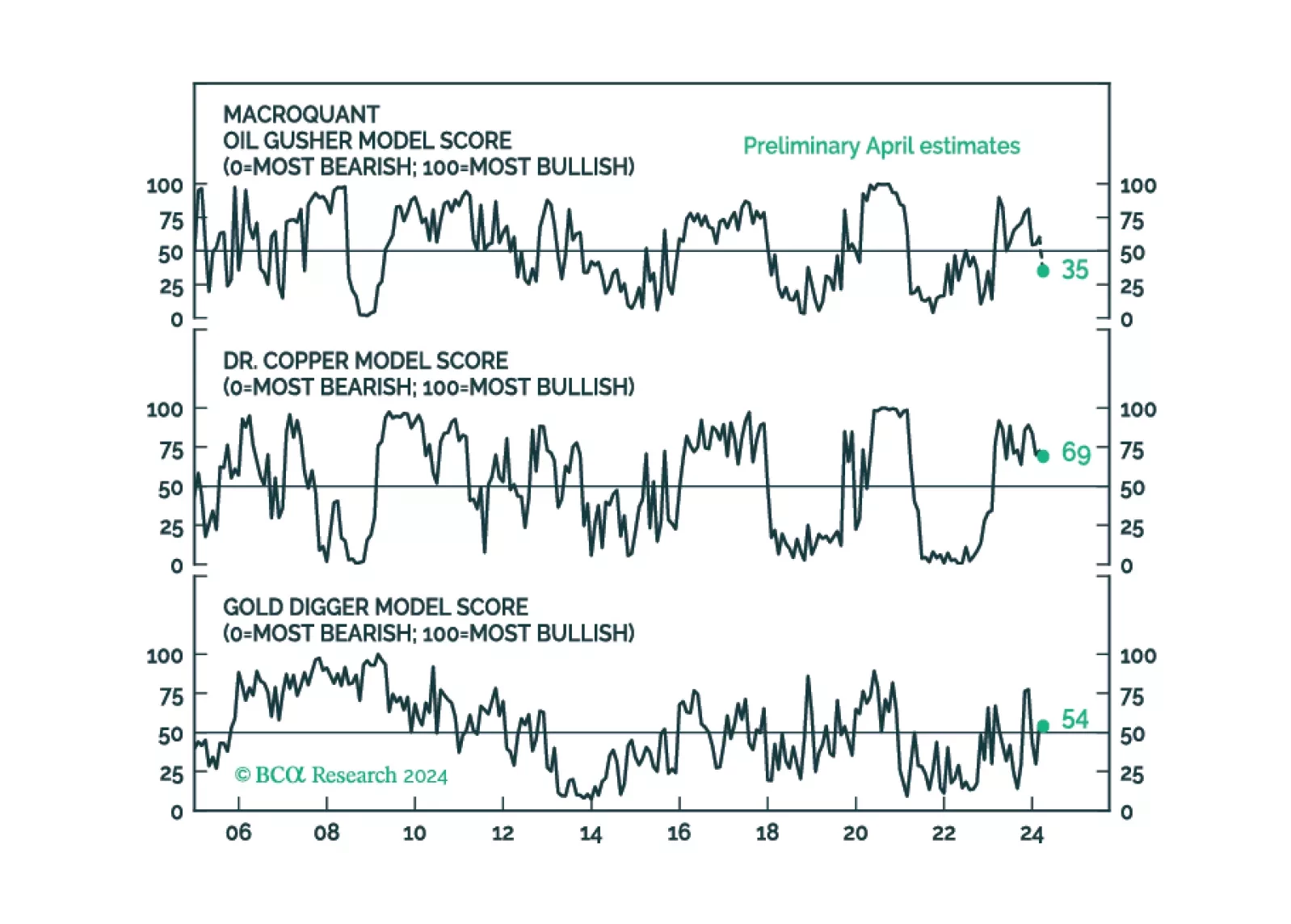

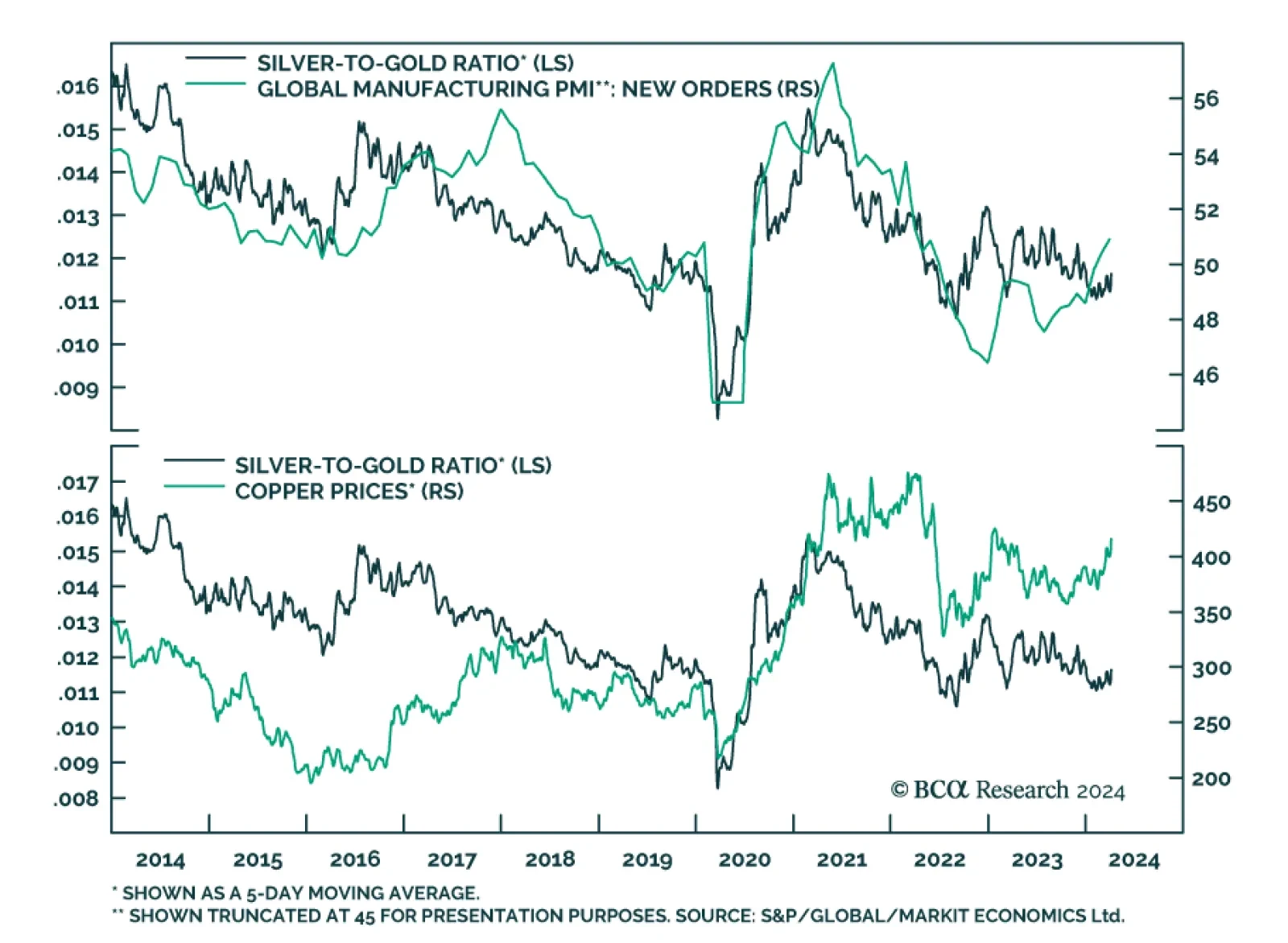

This year’s rise in commodity prices represents a blow-off rally rather than the start of a durable bull market. The global economy is heading for a recession. Stocks, commodities, and other risk assets are vulnerable.

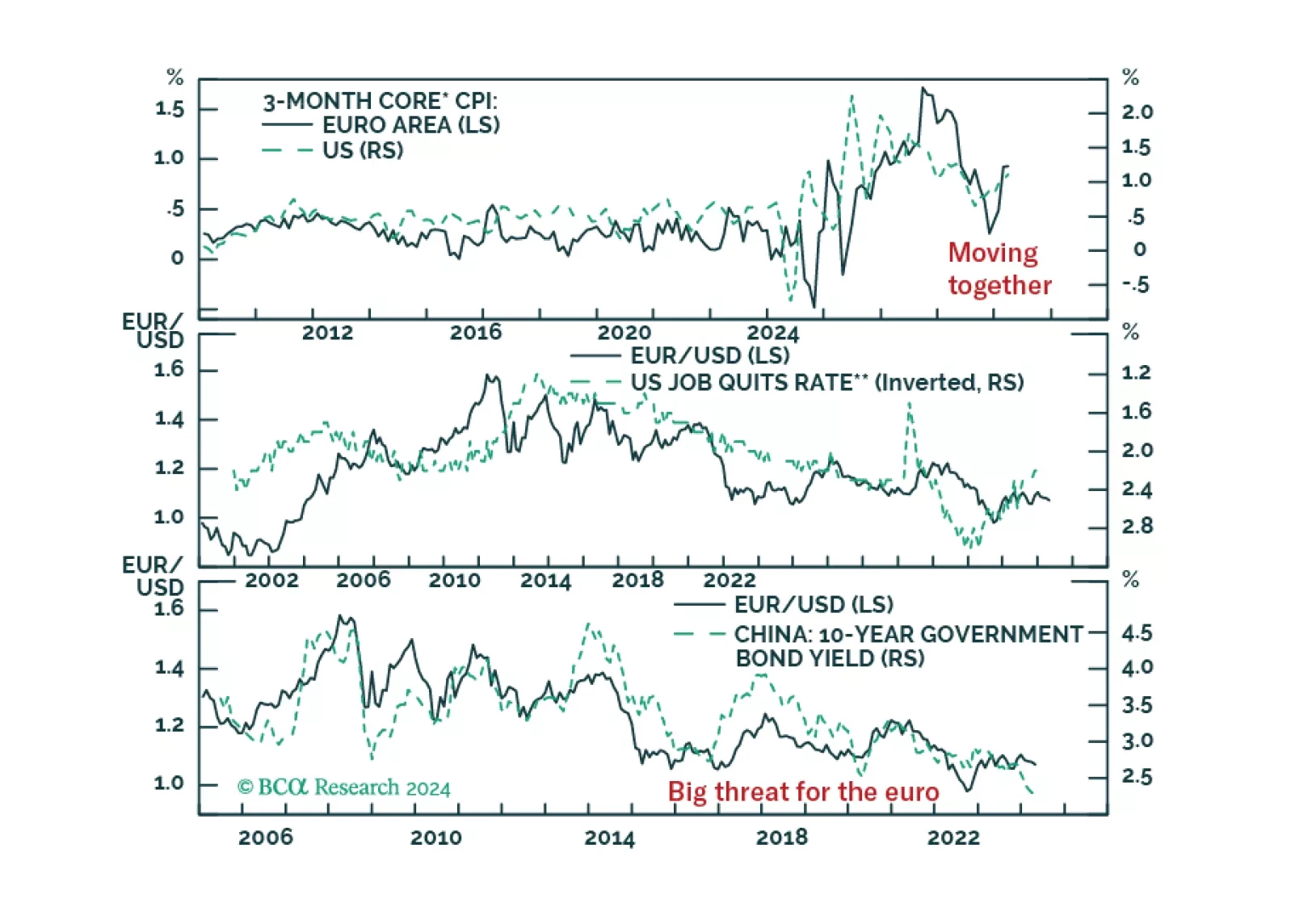

EUR/USD collapsed in the wake of last week’s hotter-than-expected US CPI report. Is this pessimism warranted and will the euro’s trading range that has prevailed since 2023 breakdown?

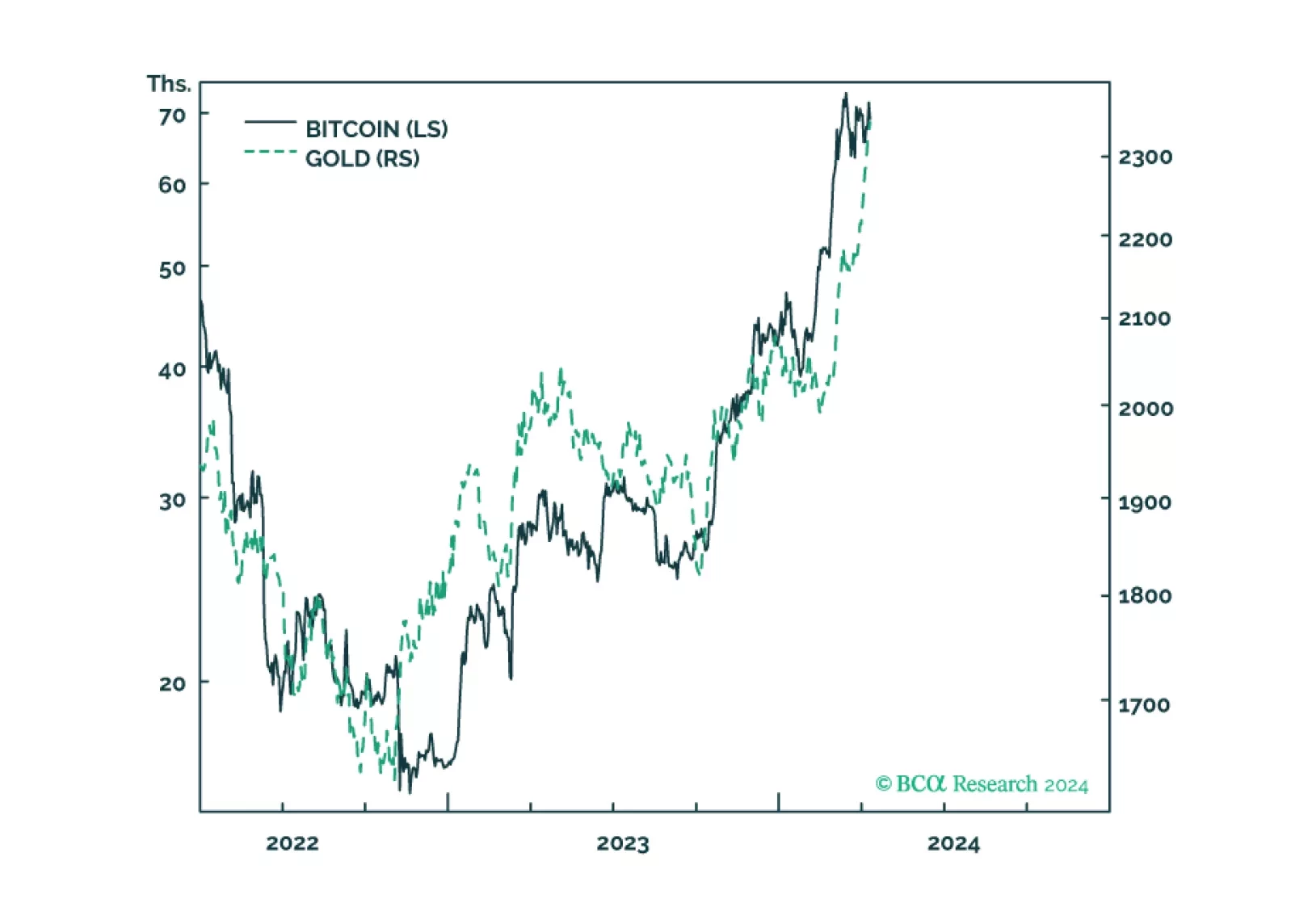

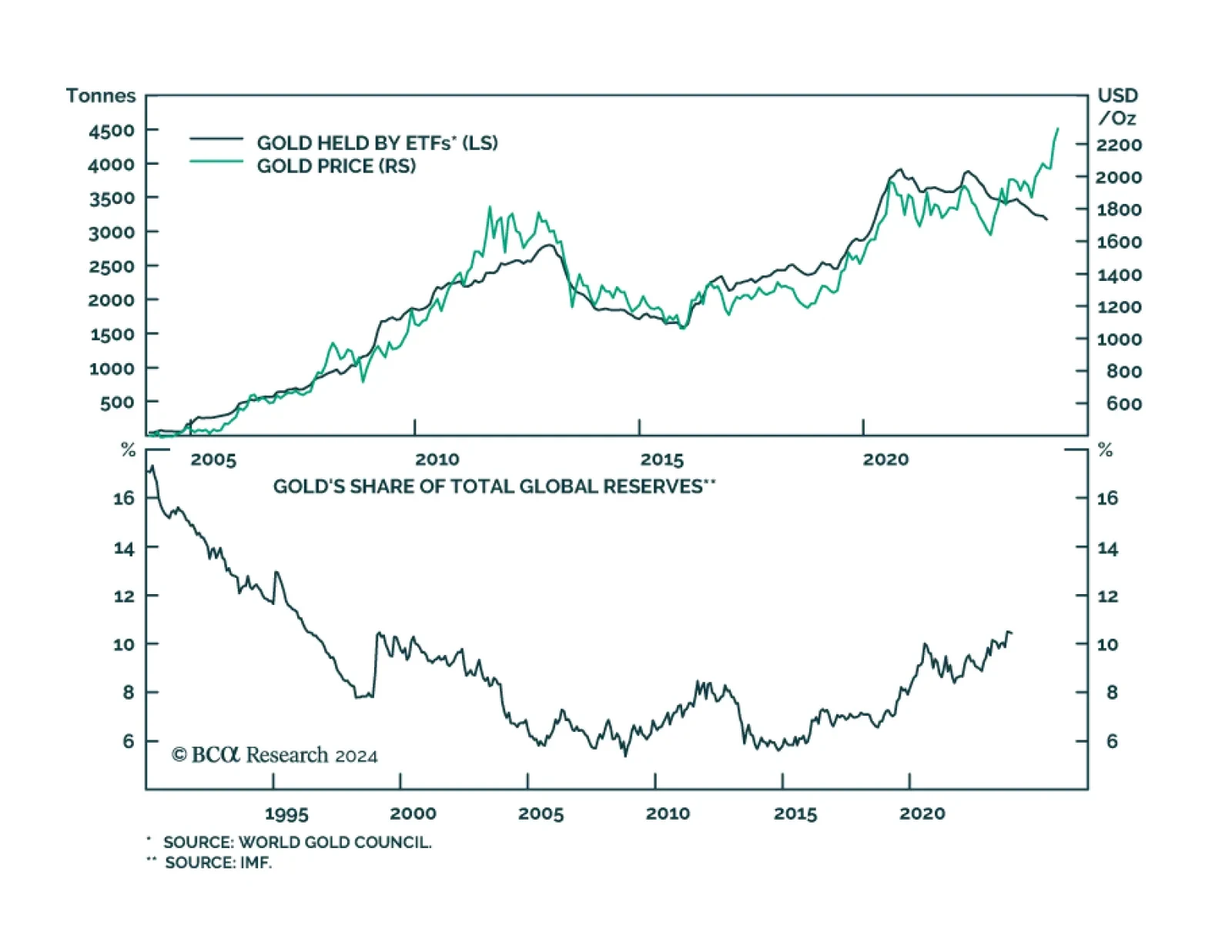

Gold and bitcoin are conceptually joined at the hip because the value of both comes from their ‘non-confiscatability’ by inflation, by bank failure, and in the case of bitcoin, by state expropriation. The sharp recent rallies in both…

Commodities are making headlines with the prices of crude oil, copper, and gold all making sizeable gains since mid-February. Multiple forces have been cited as drivers of the rally across these commodities. Increased…

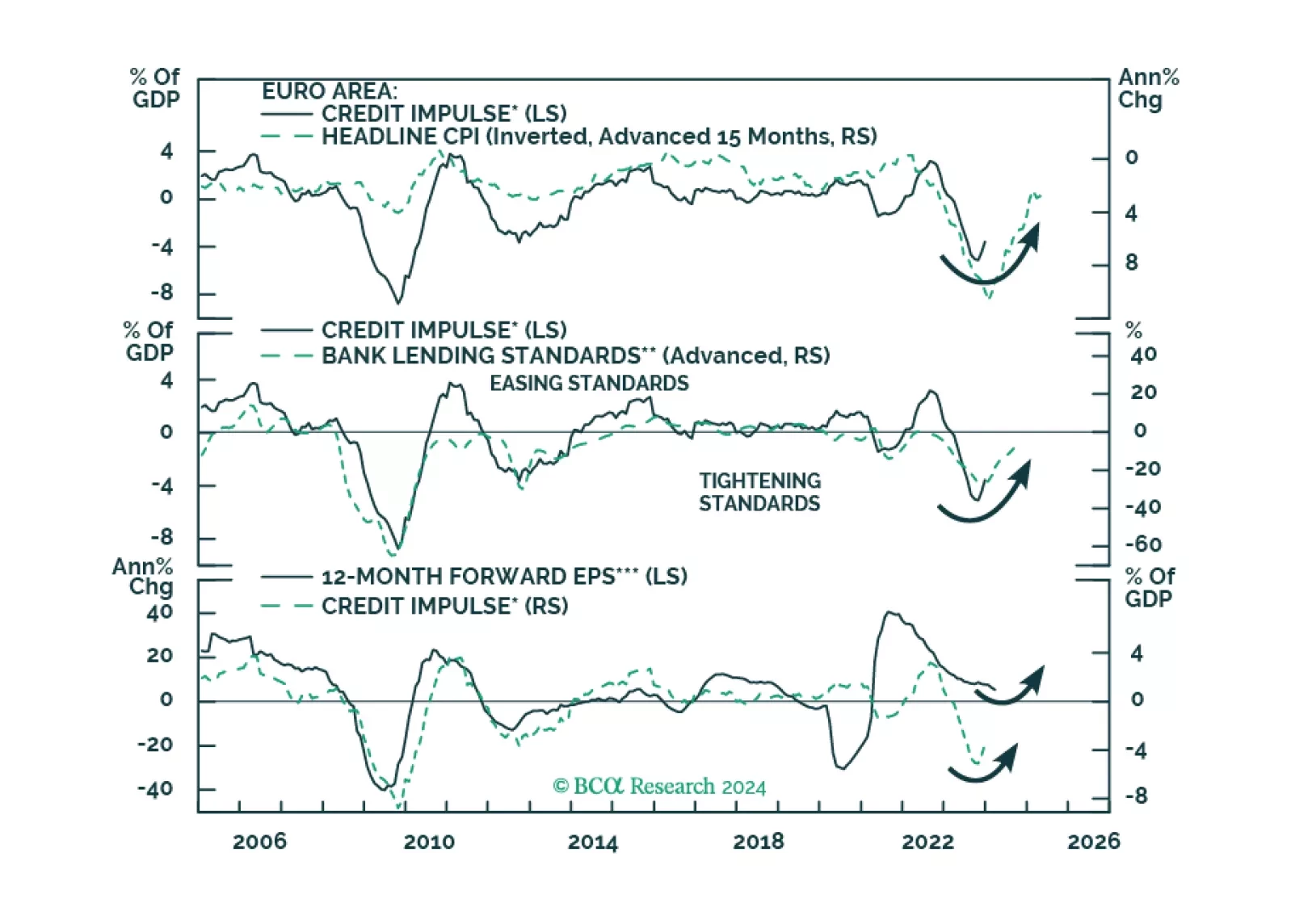

Europe credit flows are stabilizing, hence a major drag on the region’s growth will dissipate. What does this development imply for European equities?

Gold prices reached $2300 per ounce for the first time on Wednesday. They have now rallied by more than 12% so far this year. To a degree the furious rally in gold has been puzzling. Who has been buying? It certainly has not…

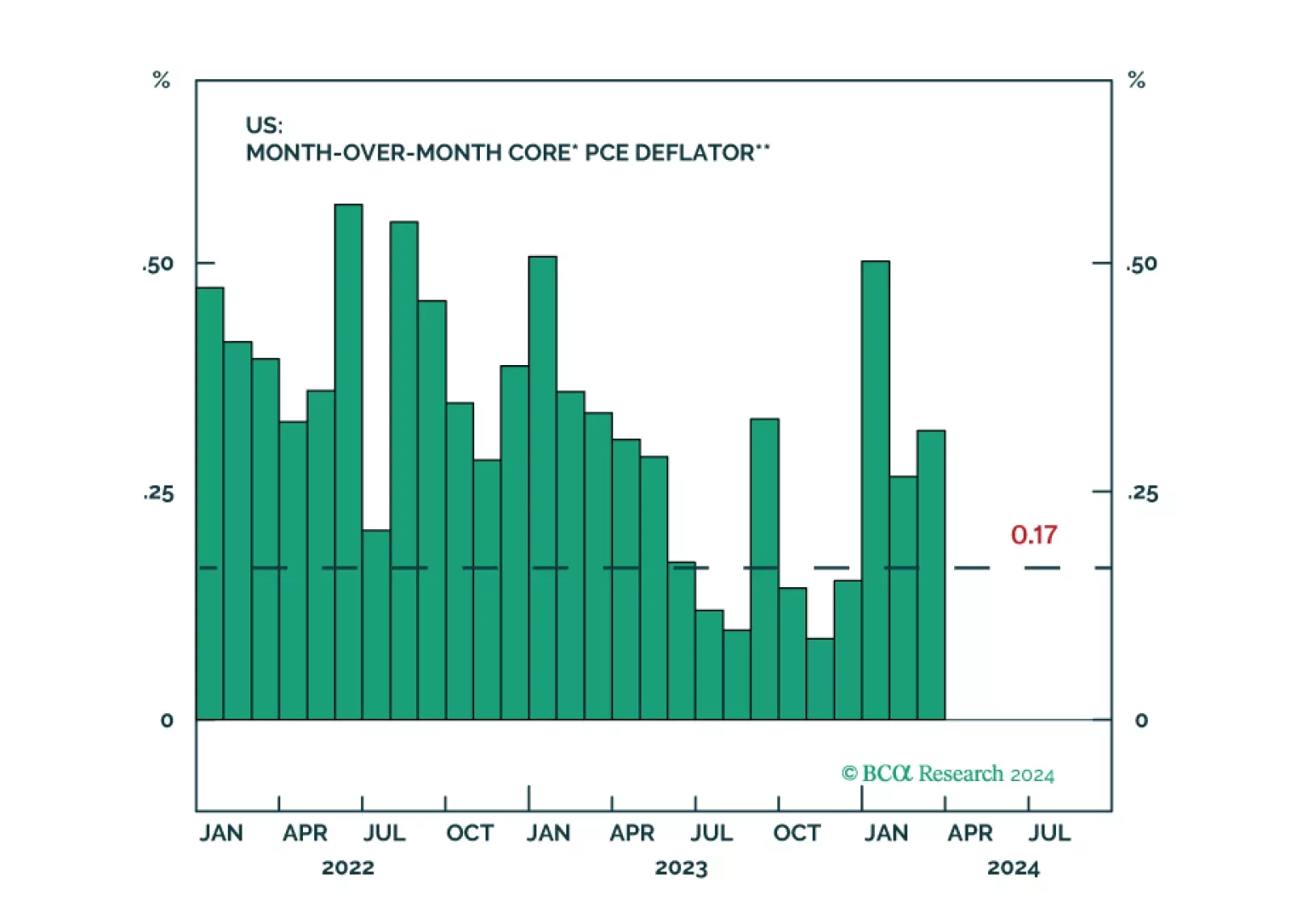

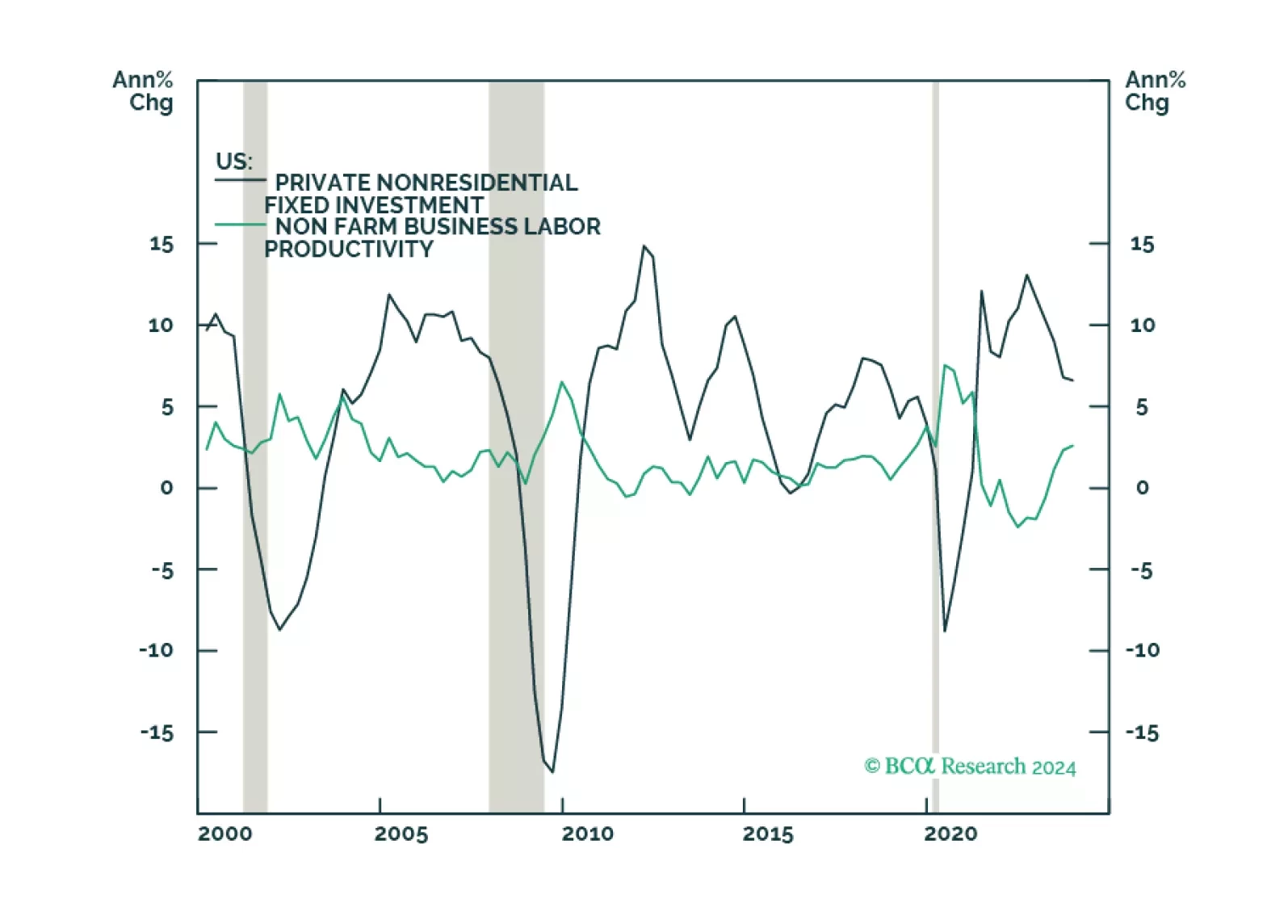

Inflationary pressures this year will remain subdued as labor-productivity growth – driven by strong capex and R+D spending – continues. This will make the Fed more confident in beginning its policy-rate-cutting cycle in June, and…

In this Strategy Outlook we examine why, contrary to popular perception, the odds of a global recession over the next 12 months are rising not falling.