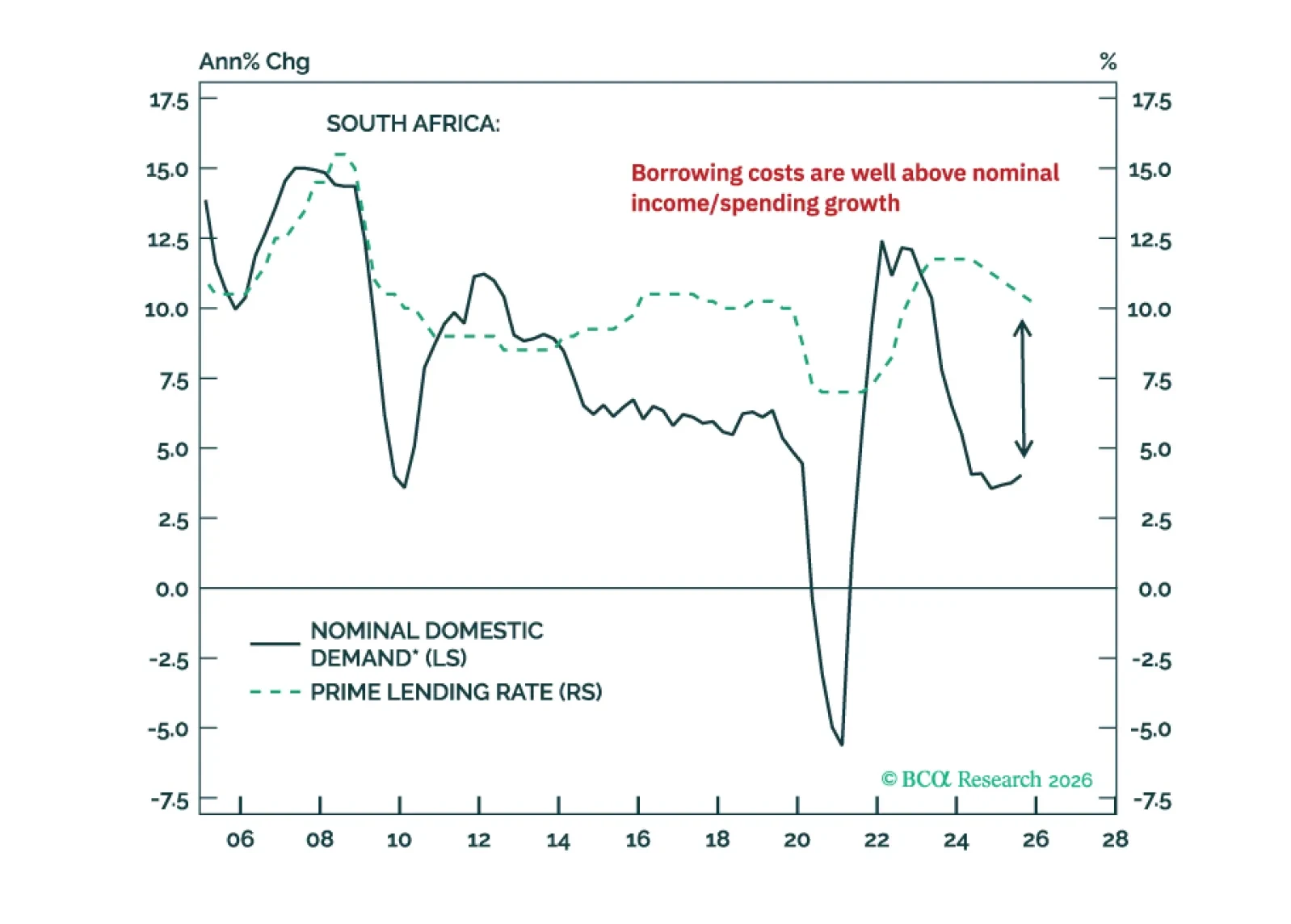

The precious metal bonanza has not resolved the South African economy’s plight. Nor did it improve its public debt sustainability issues. Investors should brace for a reversal in South African stocks, bonds, and the currency.

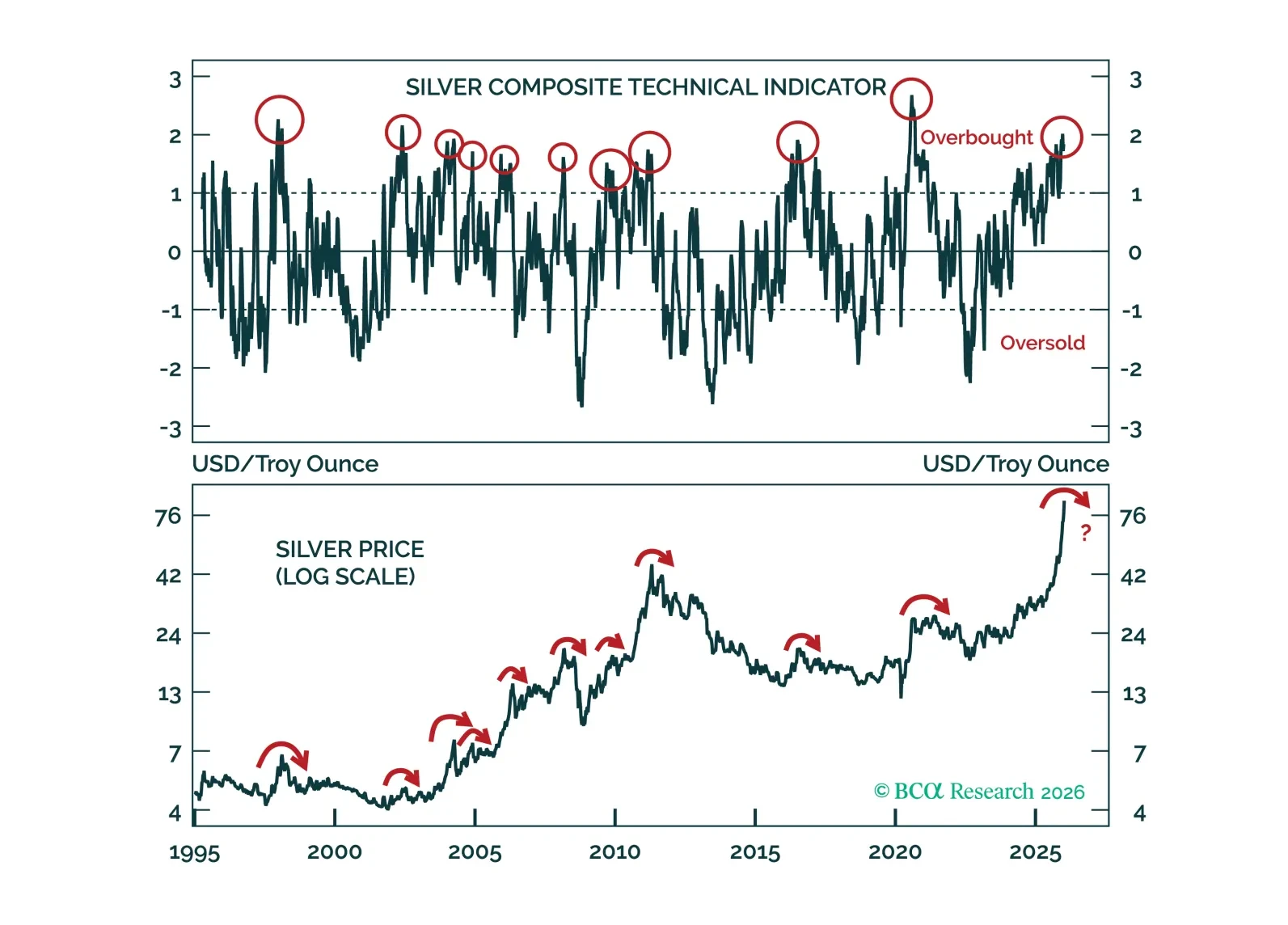

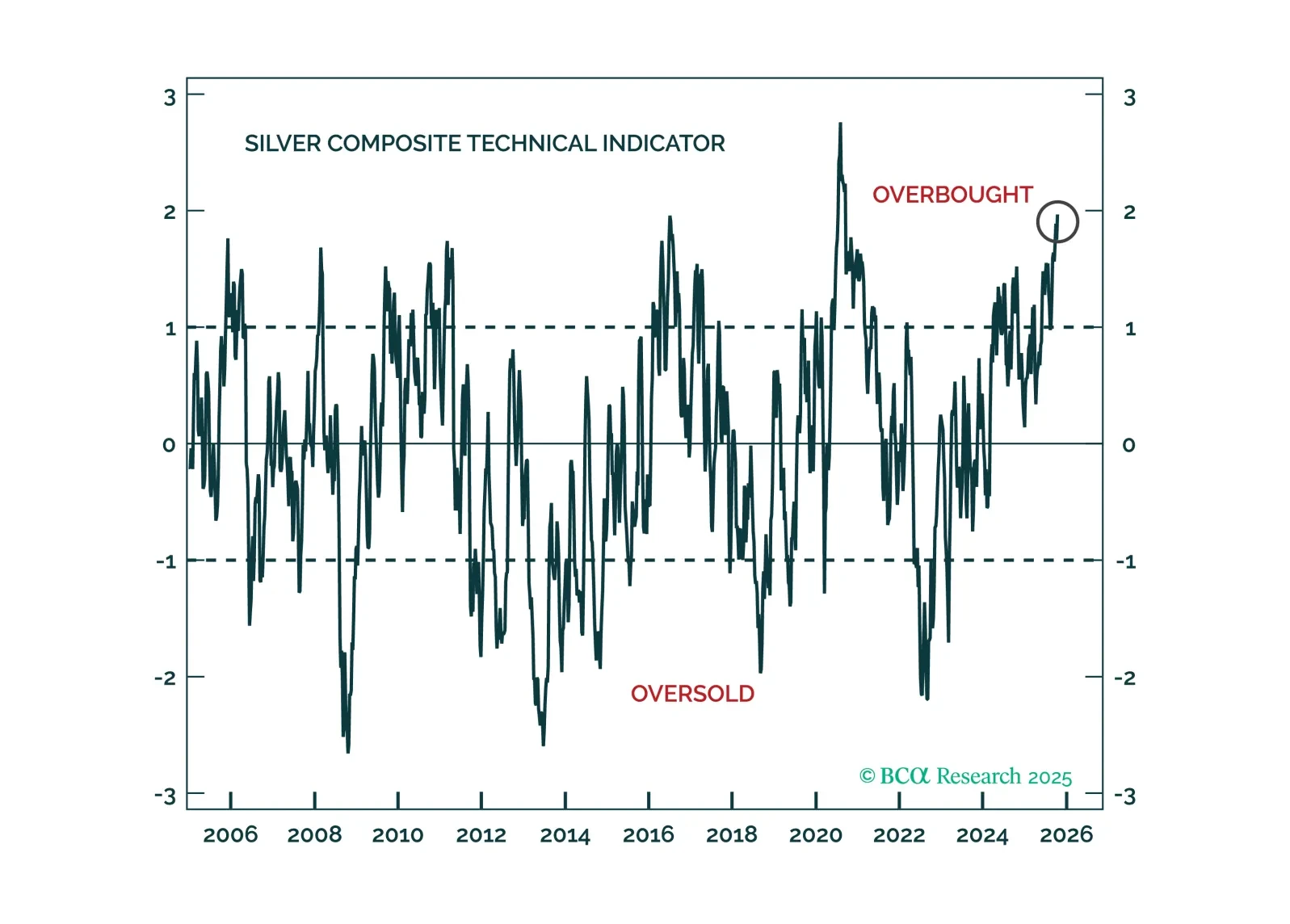

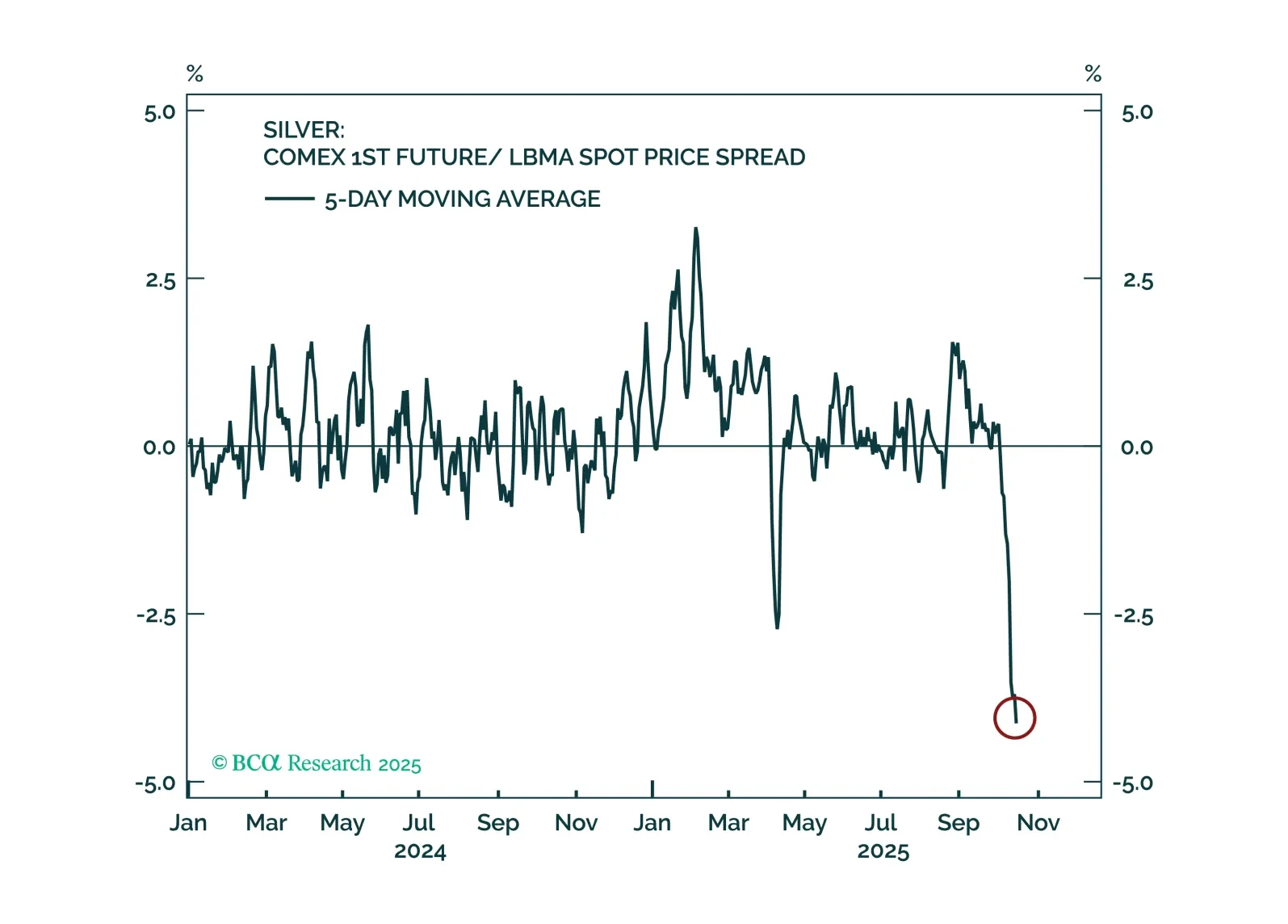

After silver's parabolic surge, we assess the rally's vulnerability by examining its weakest links. We conclude that silver is ripe for a pullback.

This year, we once again present our 2026 outlook as a retrospective from the future – a future in which the AI boom turned to bust.Next week, please join me for a Webcast on Wednesday, December 17 at 10:30 AM EST (3:30 PM GMT, 4:30…

Speculative froth has built up across all precious metals, yet gold’s structural tailwinds will allow it to weather corrections better than its peers.

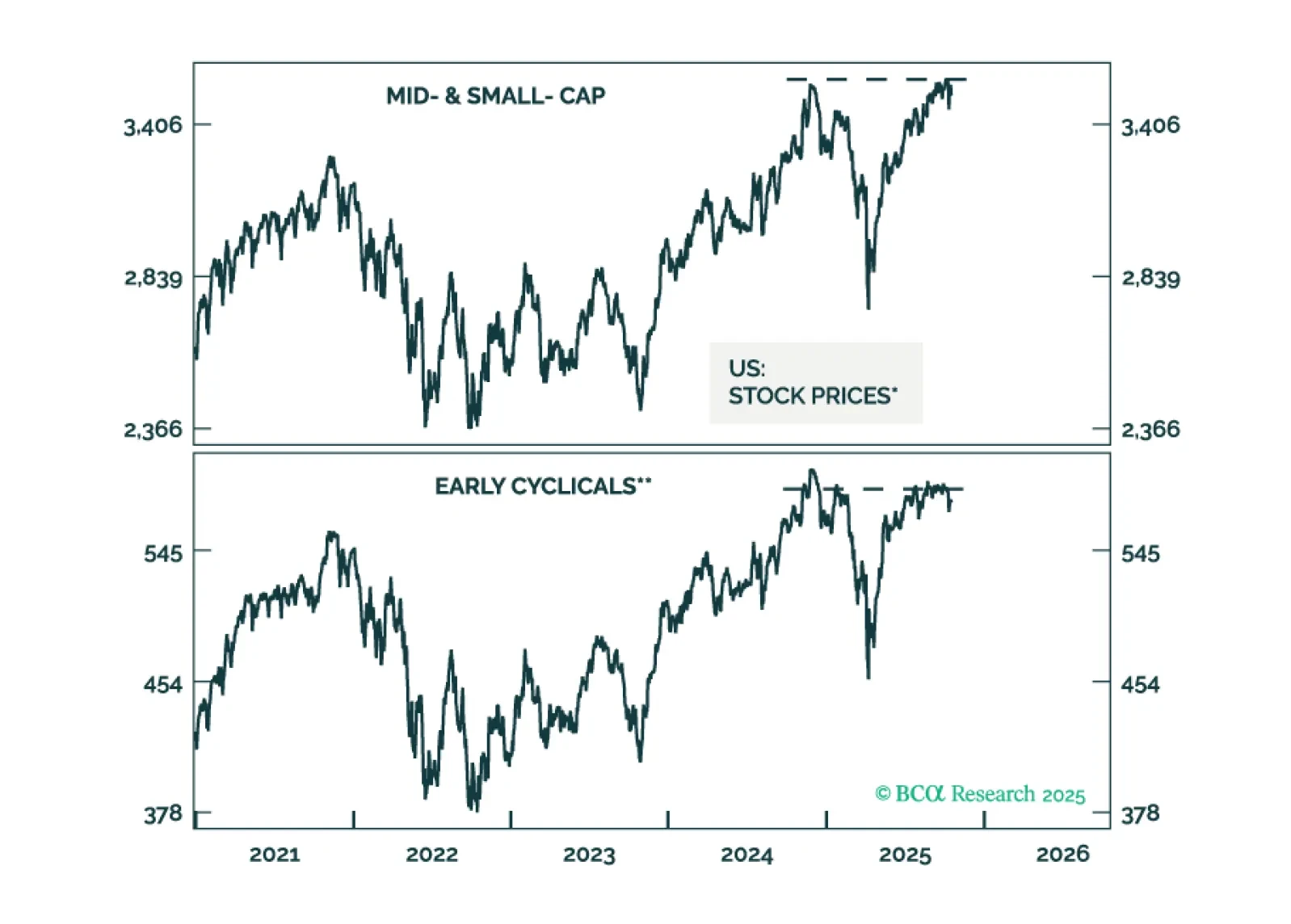

In global markets, speculative forces have intertwined with the sound fundamentals of specific equity segments, perplexing investors. This report aims to distinguish between excessive price run-ups and healthy fundamentals…

Silver’s short squeeze and stretched technicals warn of a potential tactical pullback.

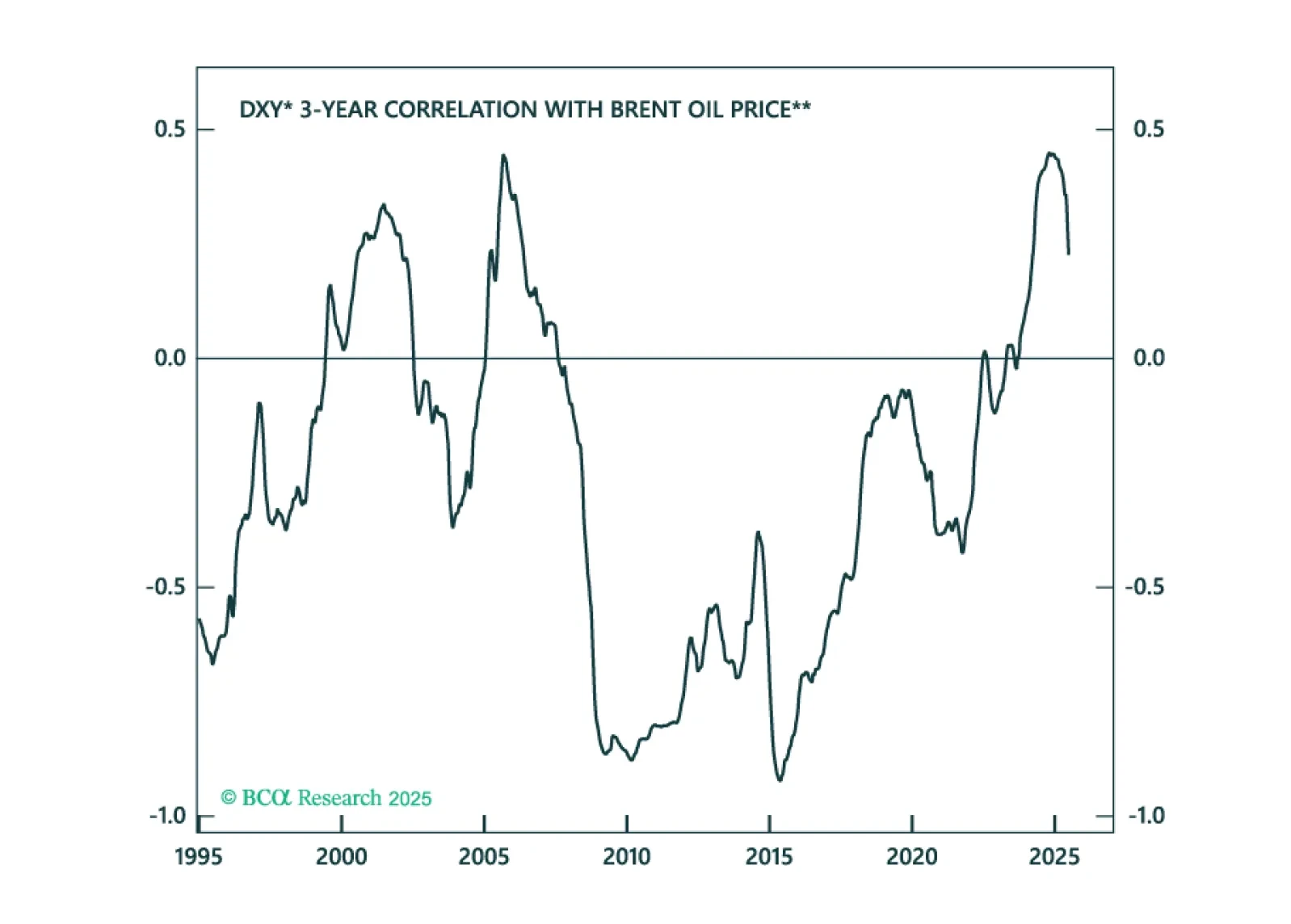

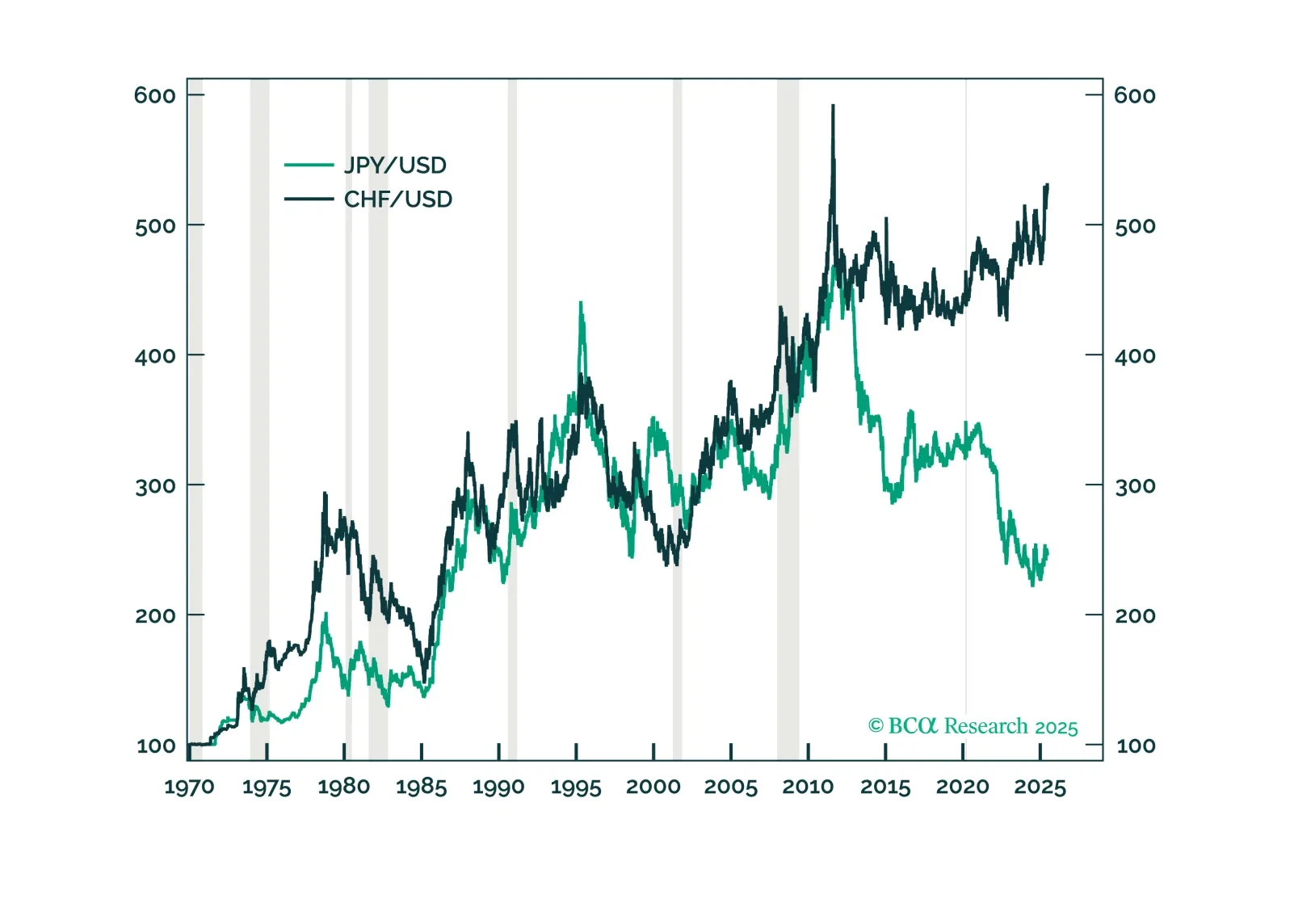

The dollar is breaking down, as capital leaves the US. The important question investors must answer is how much downside is left for the greenback, and whether depreciation will continue in a straight line over the coming months or pause (…

In this Insight, we highlight our strong conviction trades based on the central bank meetings held by the Bank of England, the Norges Bank, the Swiss National Bank and the Riksbank.

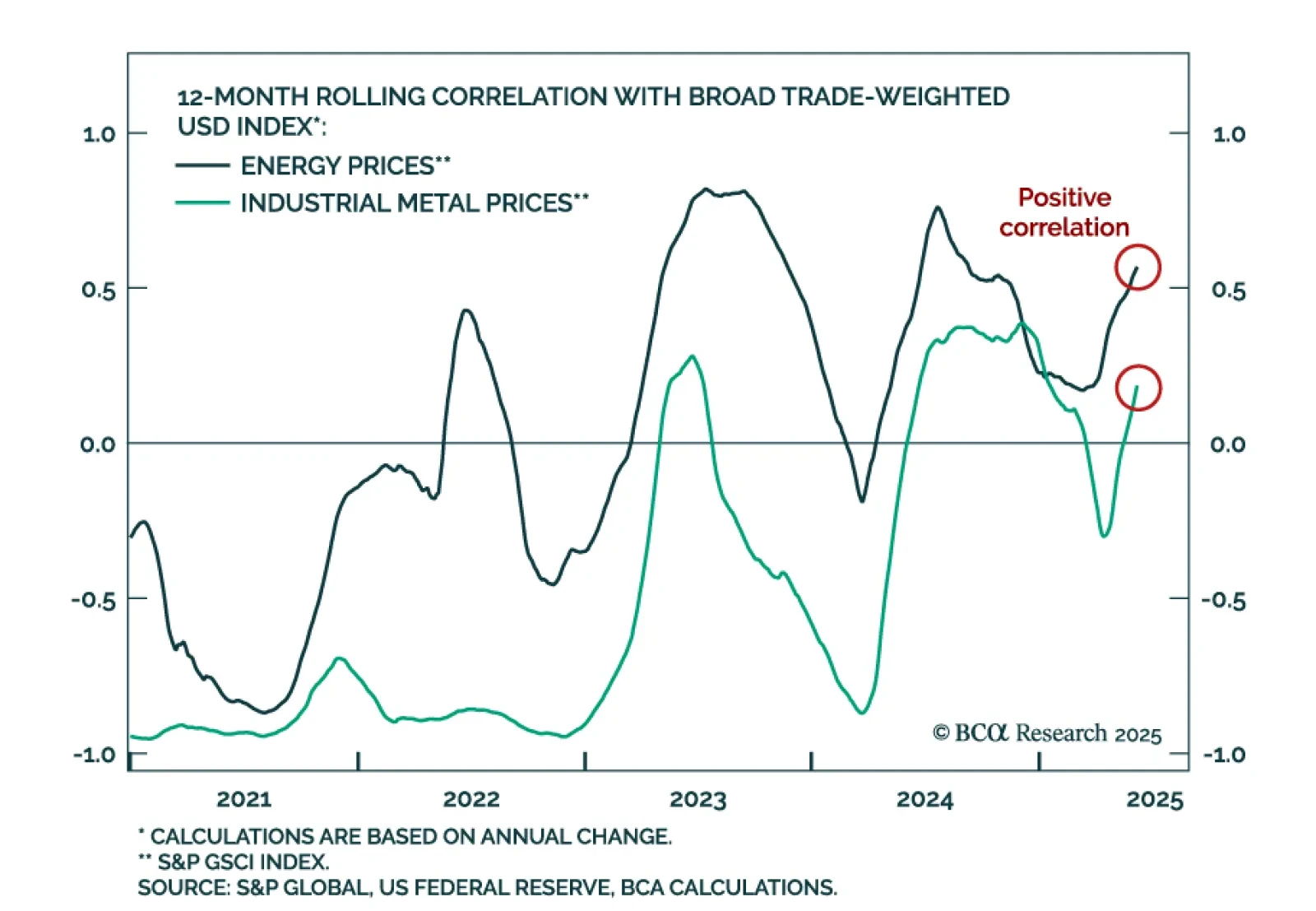

Our Commodity strategists see a breakdown of historical commodity correlations. The US dollar now shows a positive correlation with commodities, particularly energy, and a weaker dollar will no longer guarantee upside for commodity…

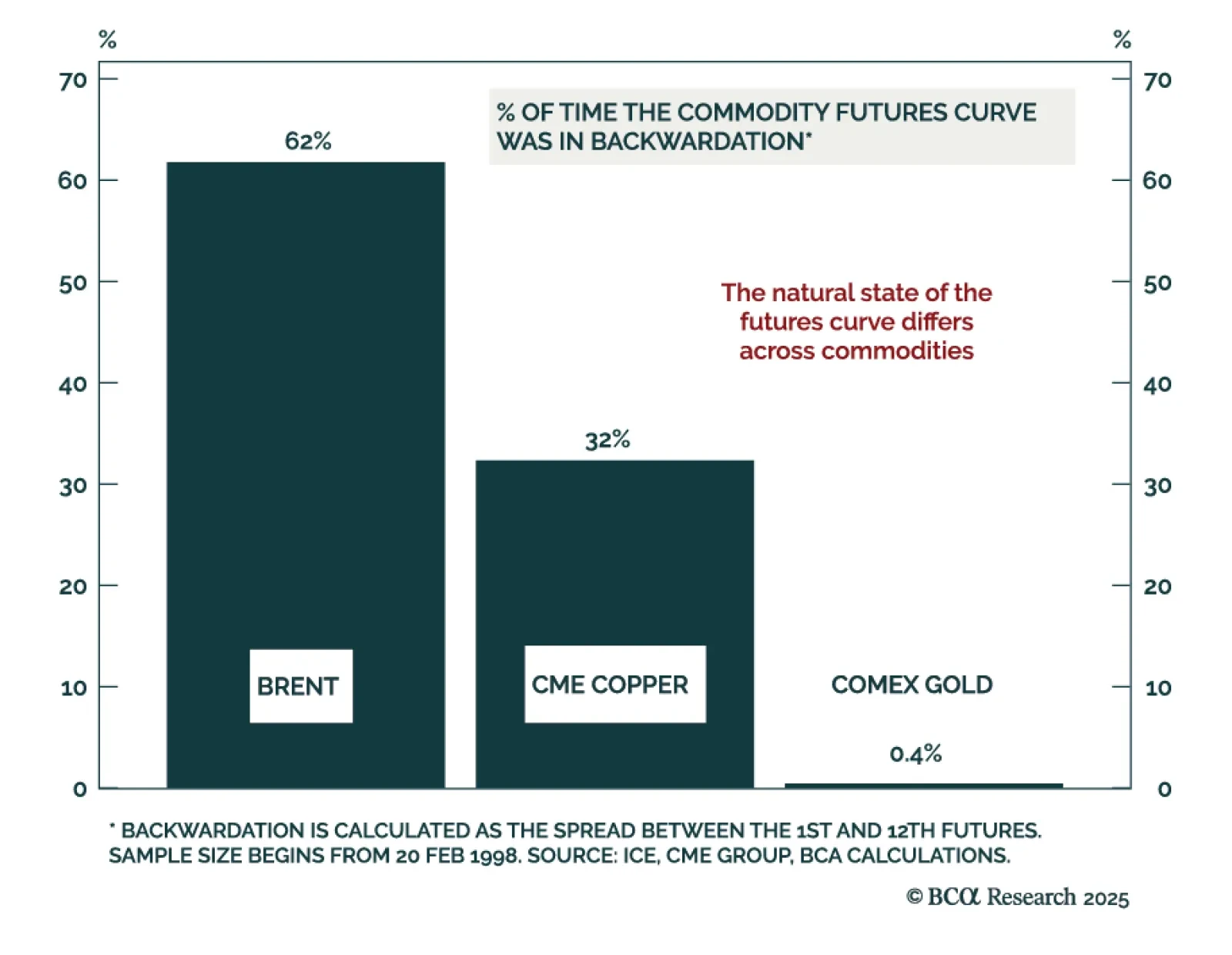

Oil, copper, and gold futures curves have experienced abnormal changes in the past few months, but a bearish global outlook will steepen contango structures across all three. Oil’s curve structure has flipped from backwardation…