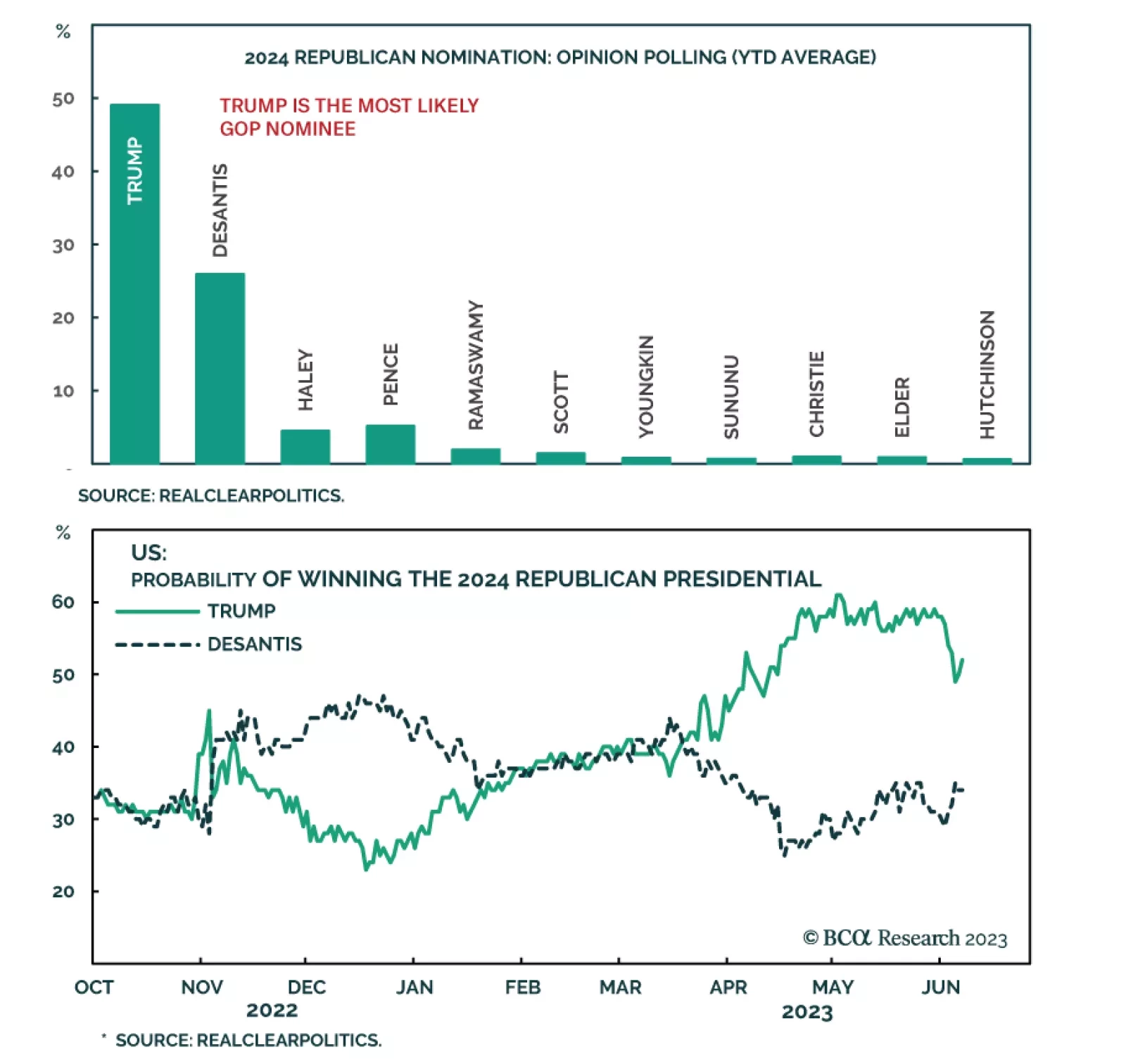

More equity volatility is coming in the short run. Trump’s nomination looks to be smooth, which marginally reduces the incumbent party advantage and increases policy uncertainty.

According to BCA Research’s US Political Strategy service, the odds of a US government shutdown are 50/50 and will go higher if Democrats harden their demands or if Republicans pick a populist speaker. The next deadline…

There is a connection between the bond market meltdown and Republican Party’s meltdown. Investors should expect more short-term financial market volatility as a result of the triple whammy of high bond yields, high oil prices, and a…

US fiscal, monetary, and foreign policies are unlikely to deliver any dovish surprises for investors in Q4, due to the impending government shutdown, persistent inflation, and instability among OPEC+ and China.

The geopolitical backdrop remains negative despite some marginally less negative news. China’s stimulus is not yet large or fast enough to prevent a market riot. Two of our preferred equity regions, ASEAN and Europe, are struggling…

Investors should prepare for an equity market pullback this fall, prefer Treasuries over stocks, and US defensives over cyclicals. A pullback could also morph into another bear market given that monetary policy is tight, policy…

According to BCA Research’s US Political Strategy service, if Trump is imprisoned, the odds of Republican policy enactment will rise, not fall, on the margin. If he is not imprisoned, then the opposite will occur. Prior…