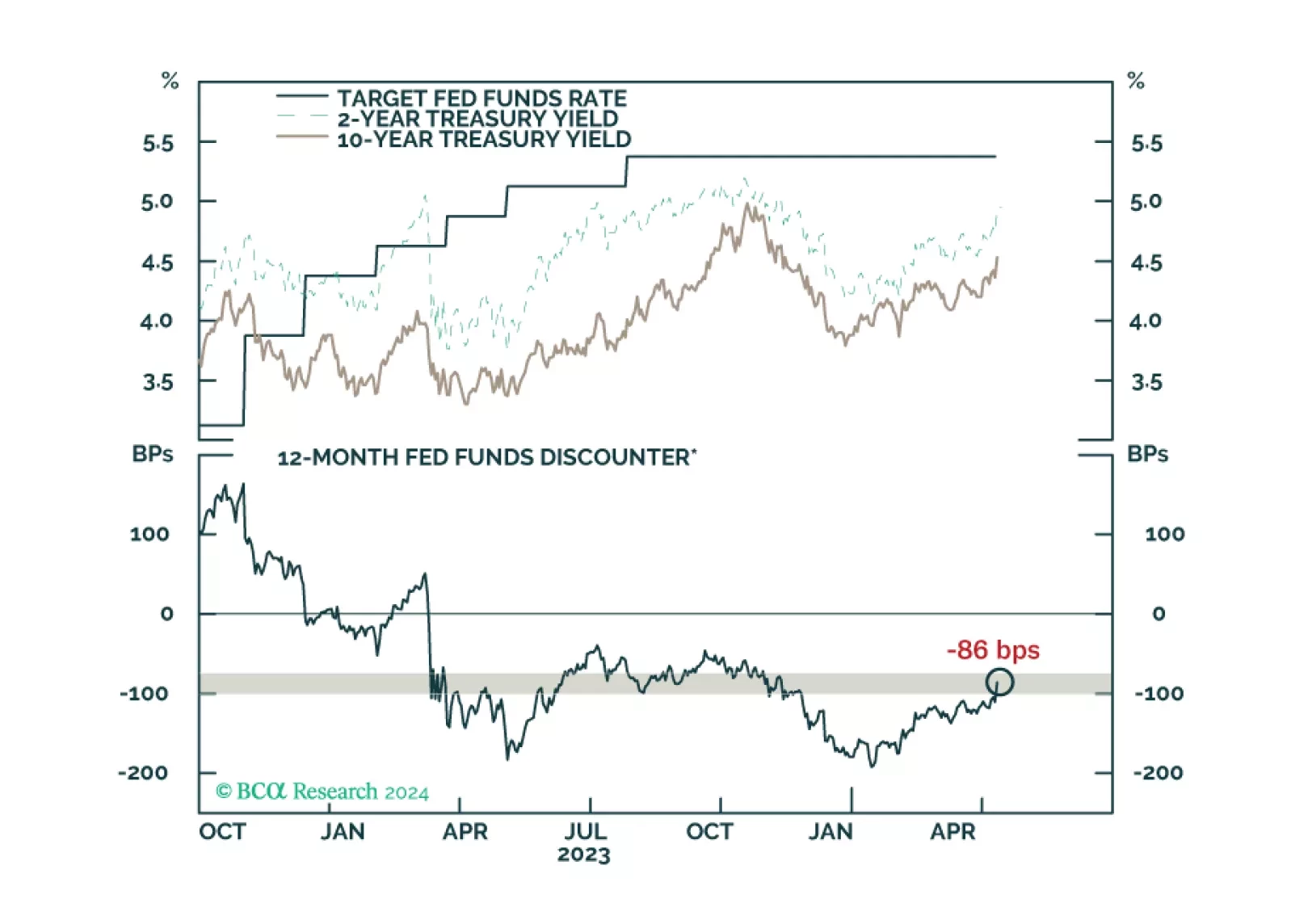

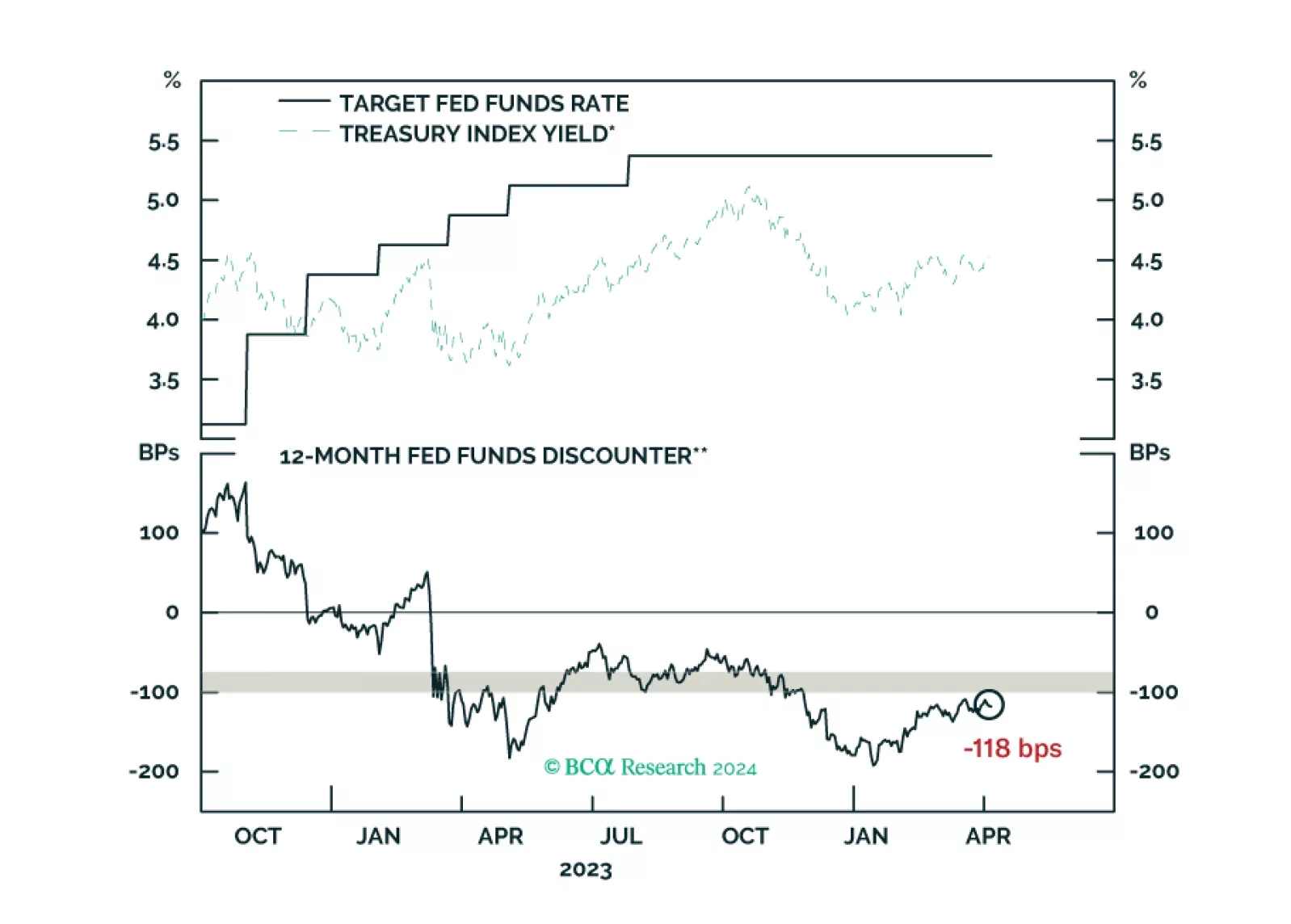

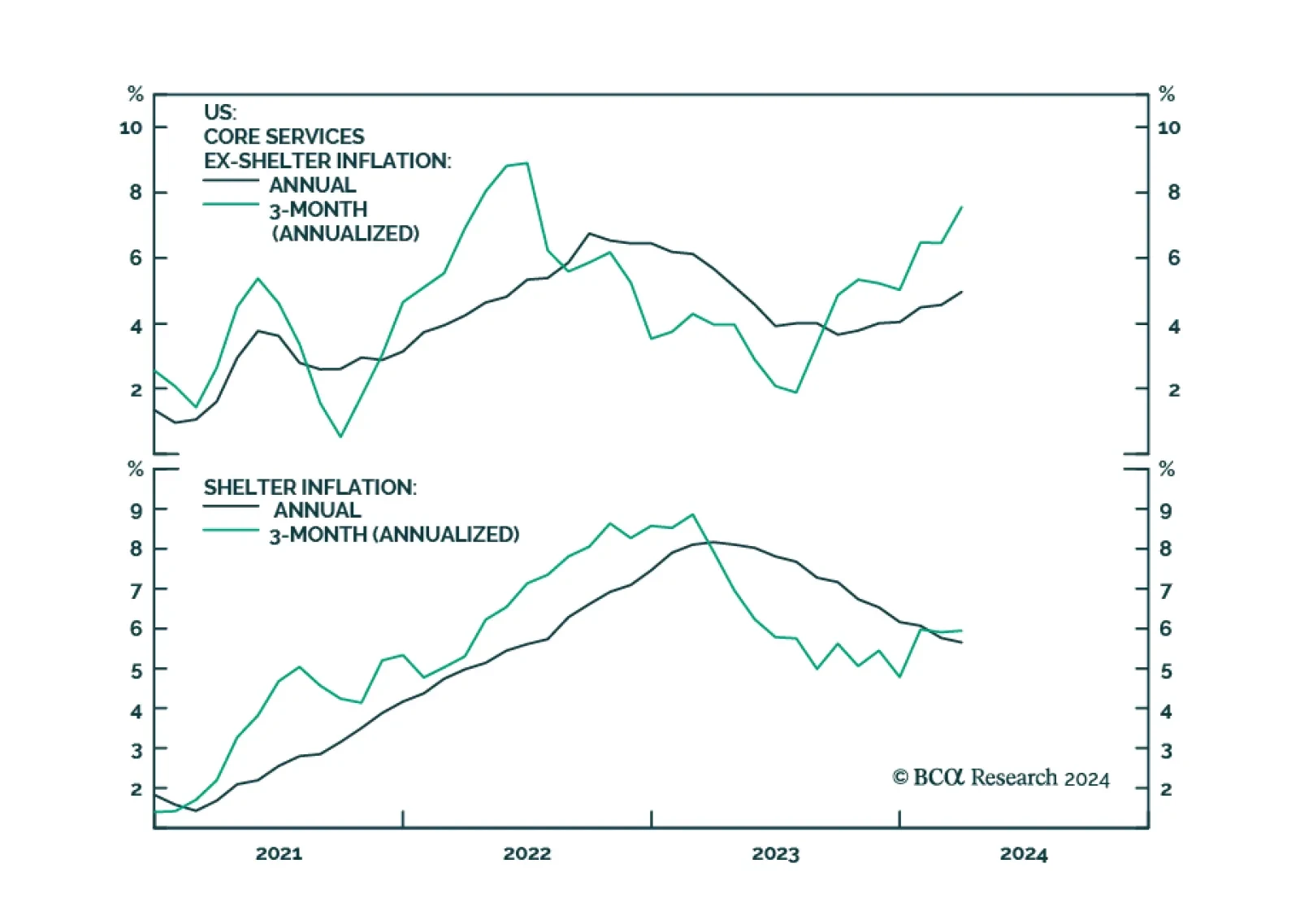

Headline inflation came in at 0.4% on a MoM basis and 3.5% on an annual basis, beating expectations of 0.3% and 3.4% respectively. Meanwhile core inflation came in at 0.4% on a MoM basis and 3.8% on an annual basis, beating…

Our reaction to this morning’s CPI report and bond market moves.

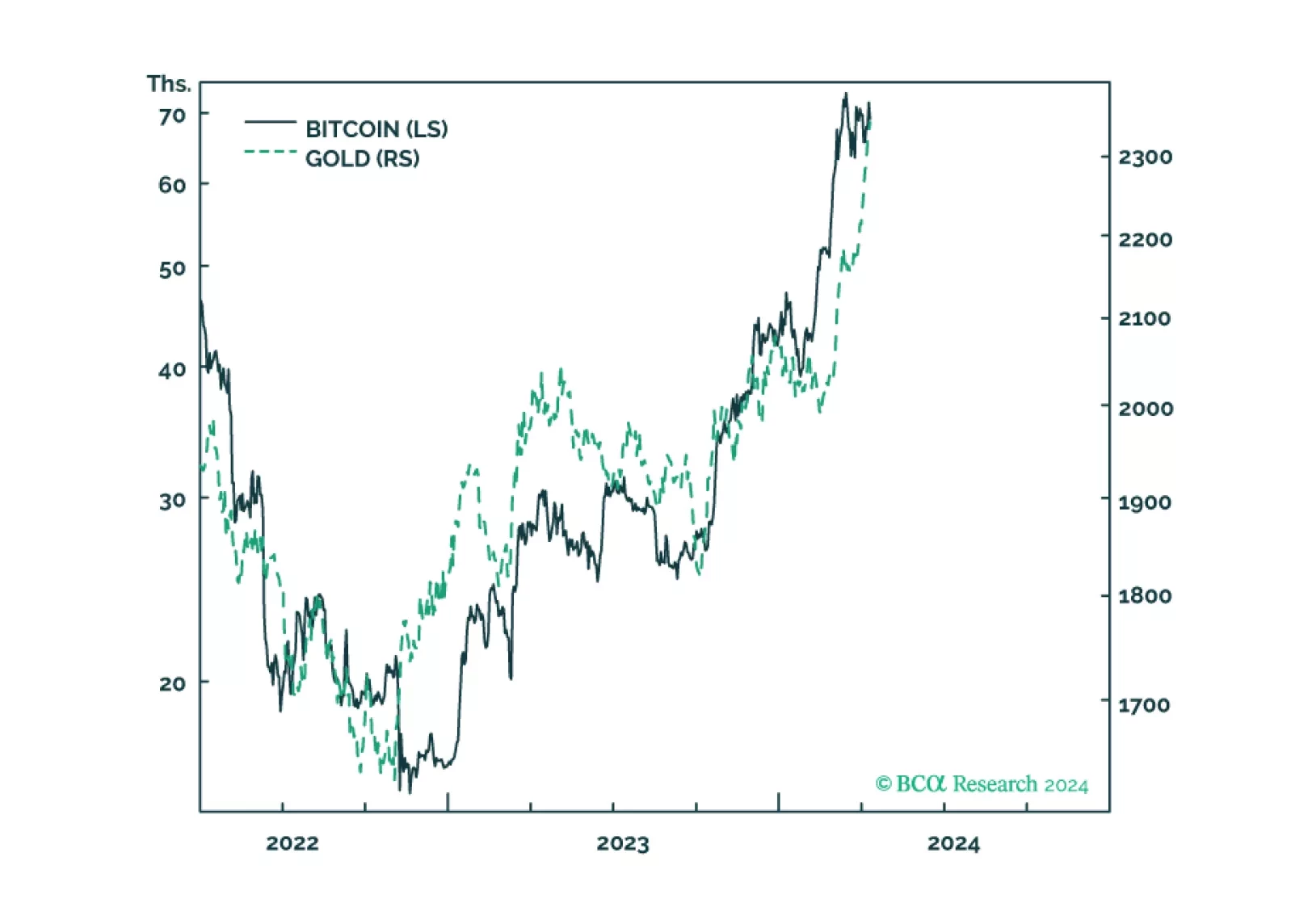

Gold and bitcoin are conceptually joined at the hip because the value of both comes from their ‘non-confiscatability’ by inflation, by bank failure, and in the case of bitcoin, by state expropriation. The sharp recent rallies in both…

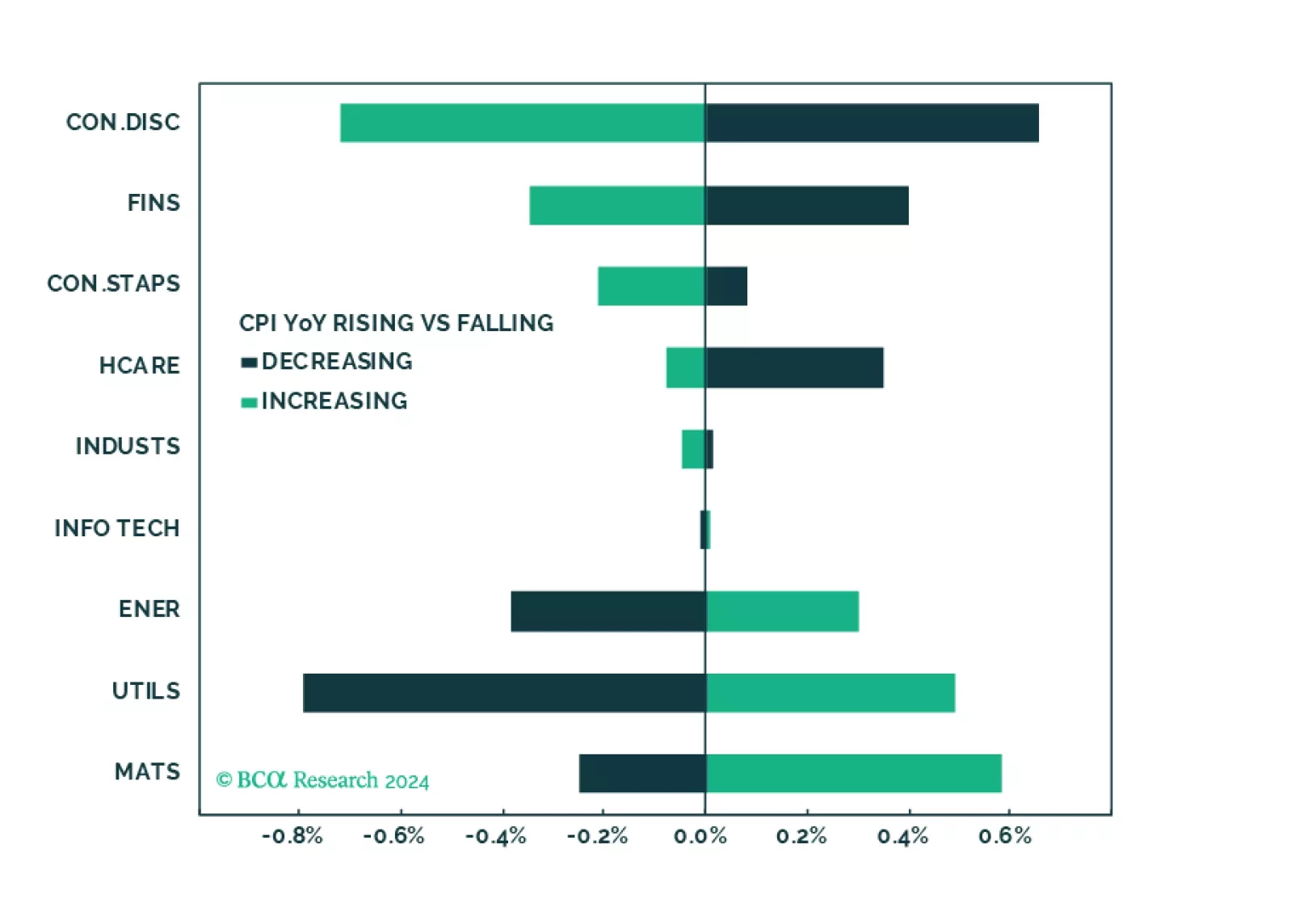

Fears of a hard landing are abating as growth has been surprising to the upside. New worries are emerging, such as the trajectory of disinflation, and the pace and timing of rate cuts. In this environment, it is important to build a…

Our reaction to this morning’s employment report and bond market moves.

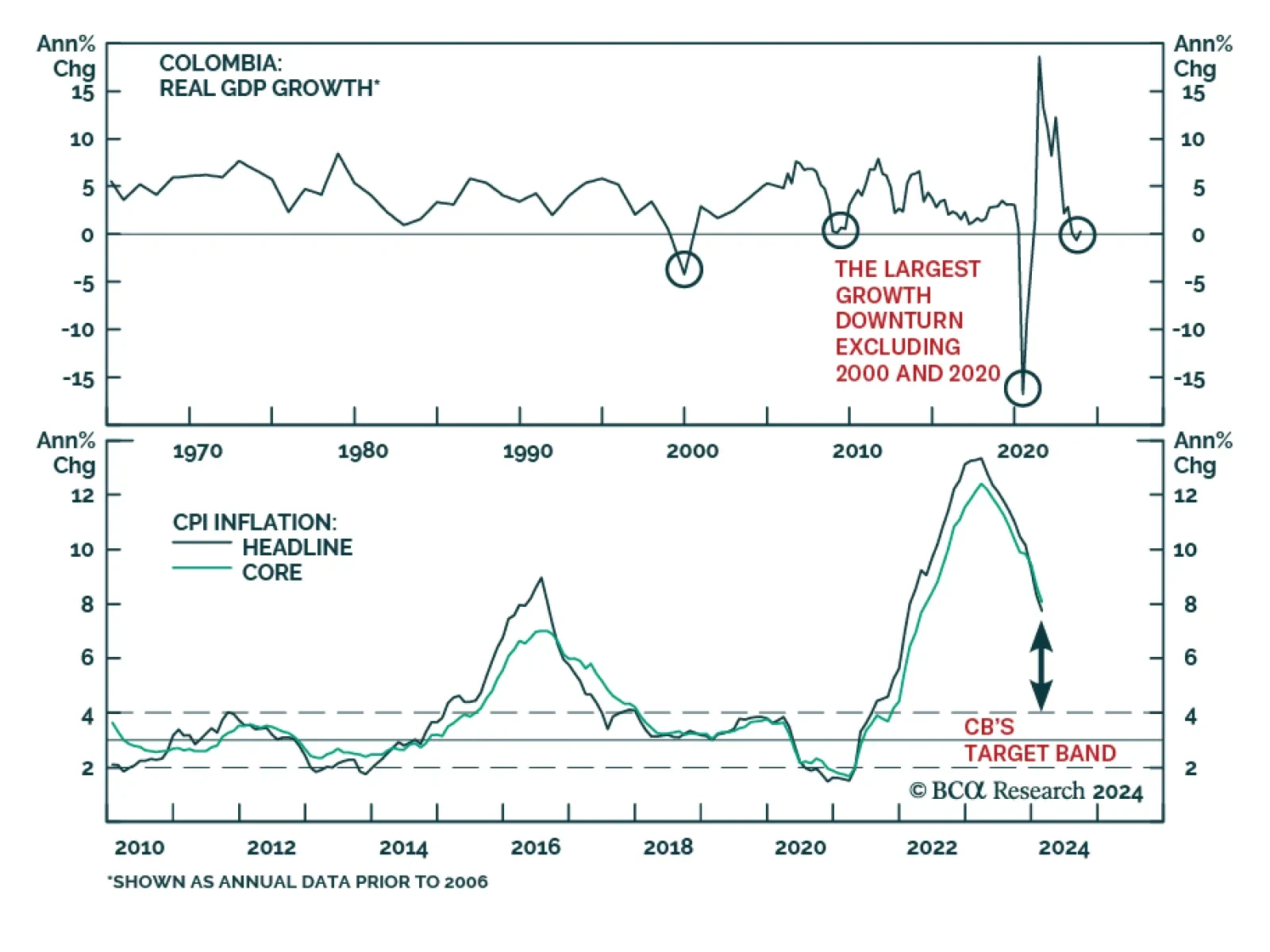

Colombia: Macroeconomic Fundamentals, Public Finances, And Political Uncertainty Warrant Underweight

BCA Research’s Emerging Markets Strategy service argues that Colombia has fallen from grace in terms of its healthy macroeconomic fundamentals, business-friendly government policies, and conservative fiscal stances.…

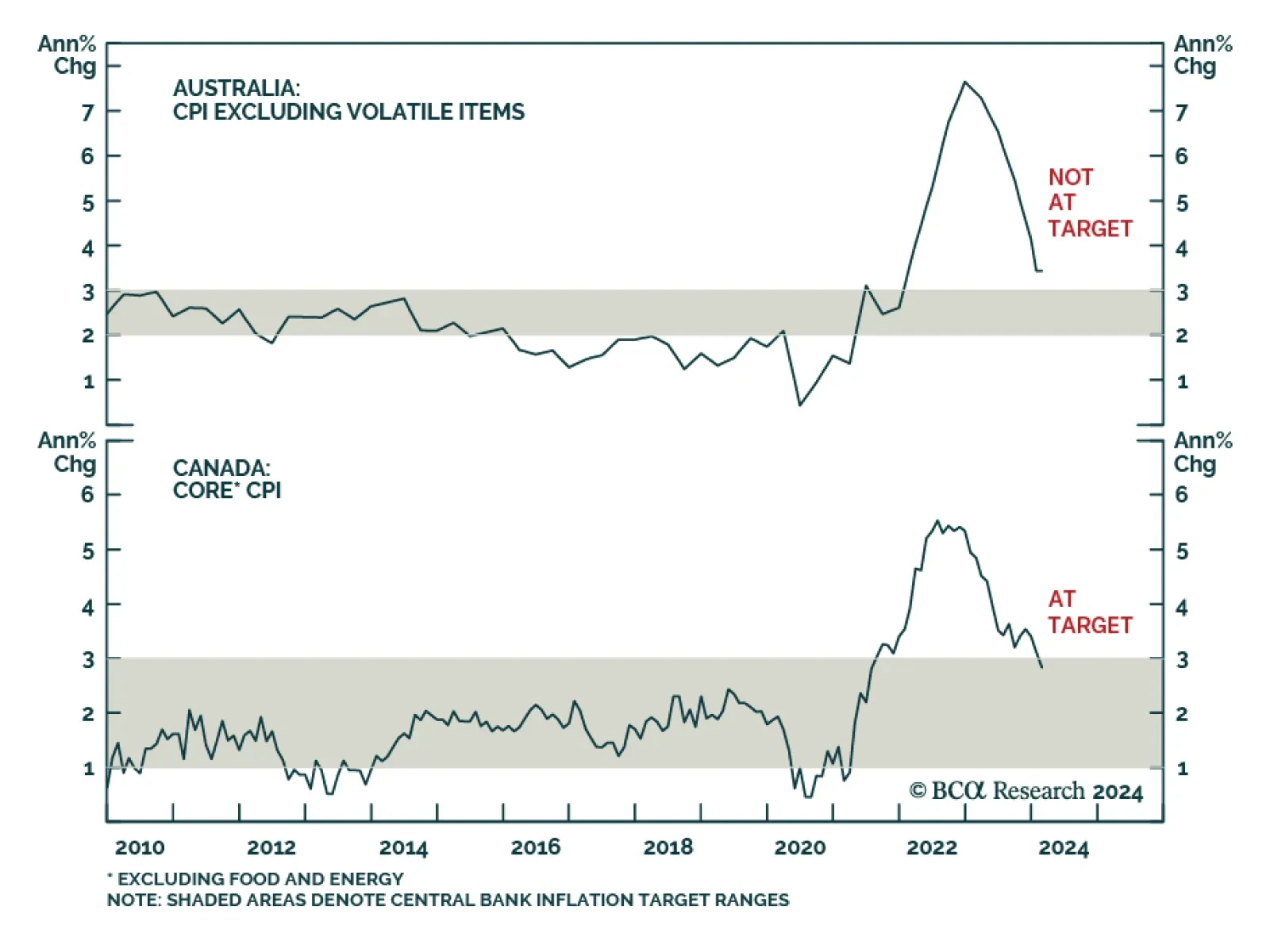

It is too early for the RBA to begin cutting rates. Inflation remains above target, with core CPI currently standing at 3.4%, one of the highest numbers amongst major economies. The labor market is also fundamentally strong.…

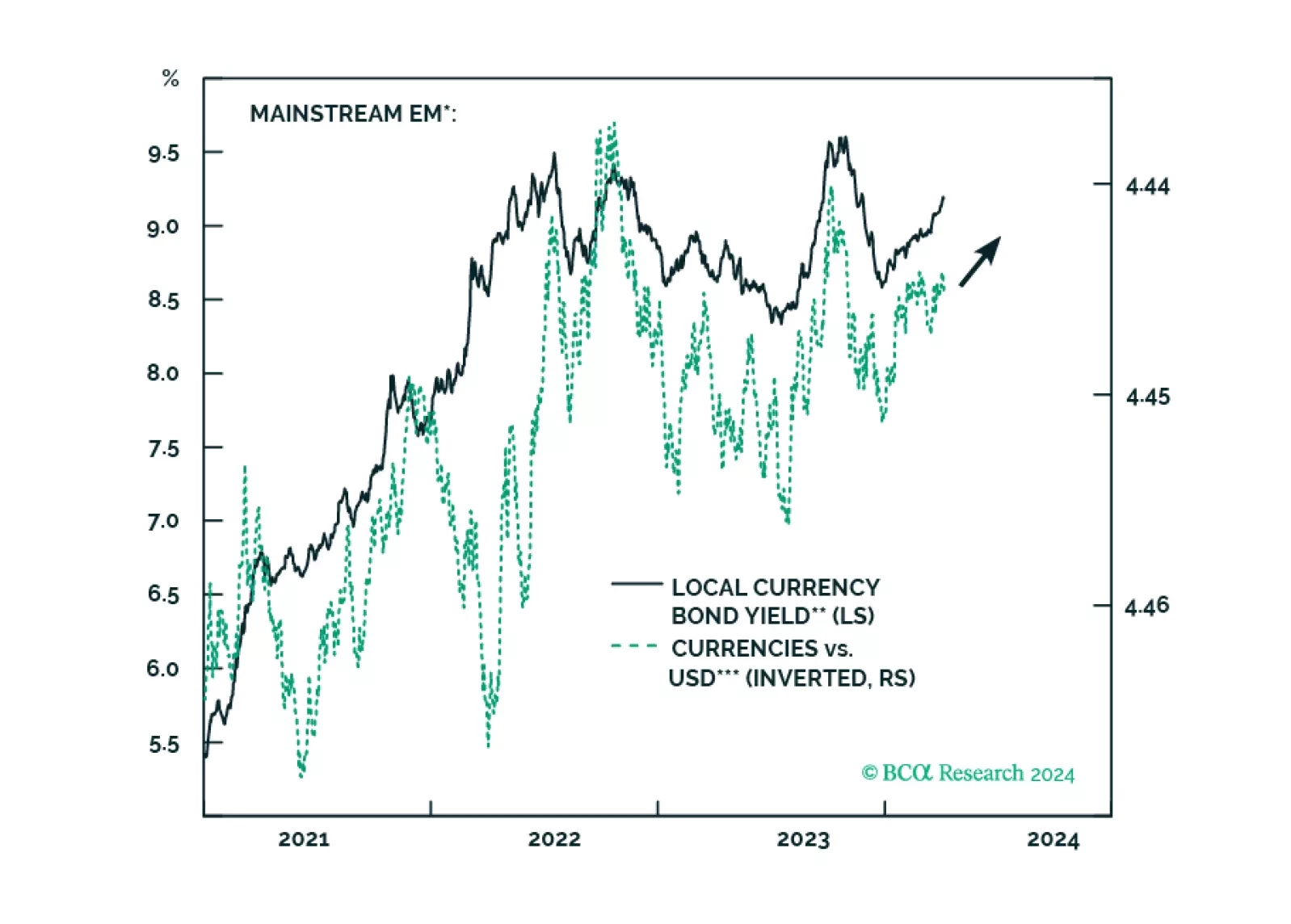

Climbing US bond yields, alongside higher oil prices, might spoil the party for global risk assets. There are budding cracks in EM domestic bonds, and even though we like this asset class in the long run, investors exposed to it…

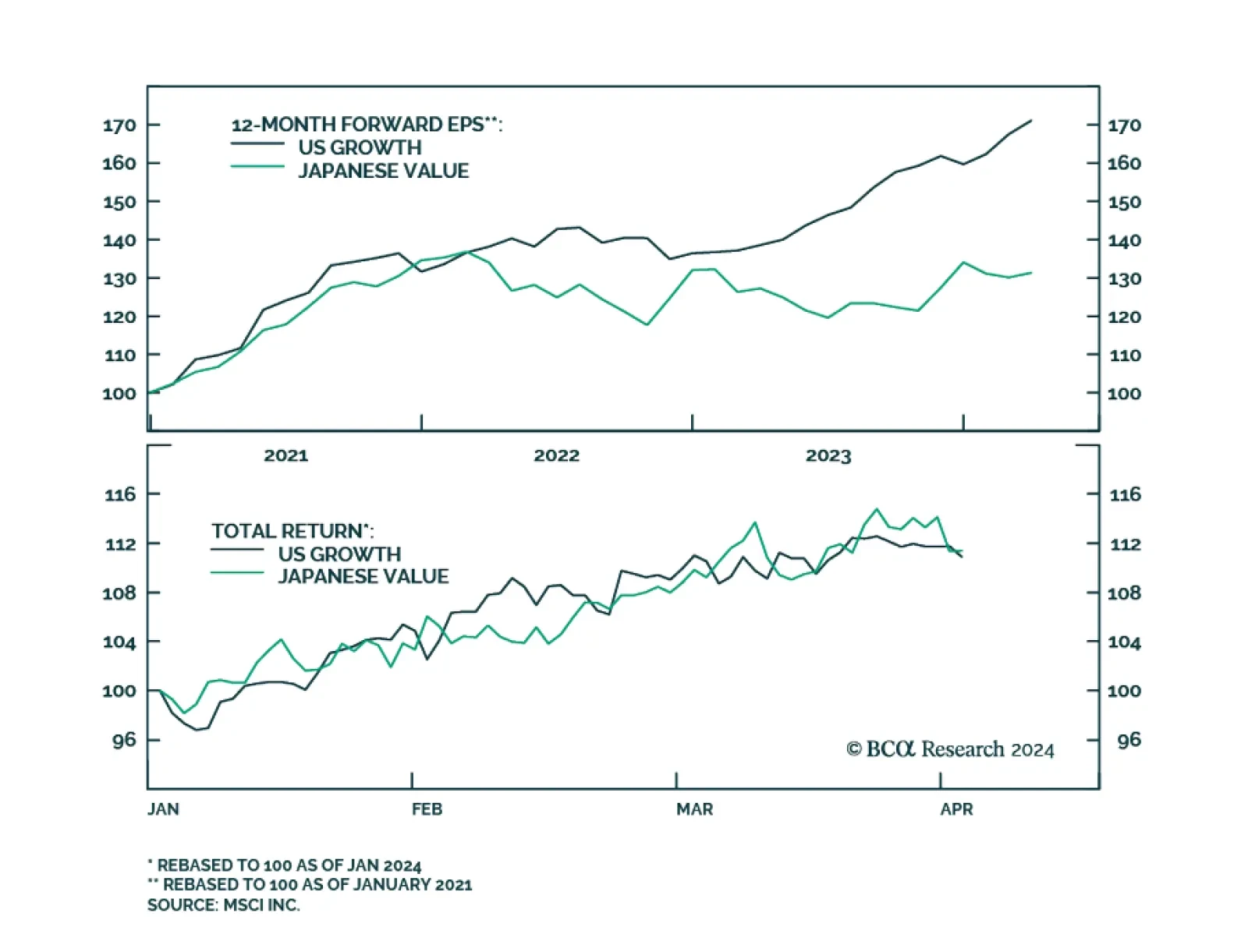

The extraordinary performance of AI companies has pushed US growth stocks to new highs. So far, the MSCI US Growth Index has returned almost 11% since the start of the year, outperforming global stocks by over 3%. No growth index…

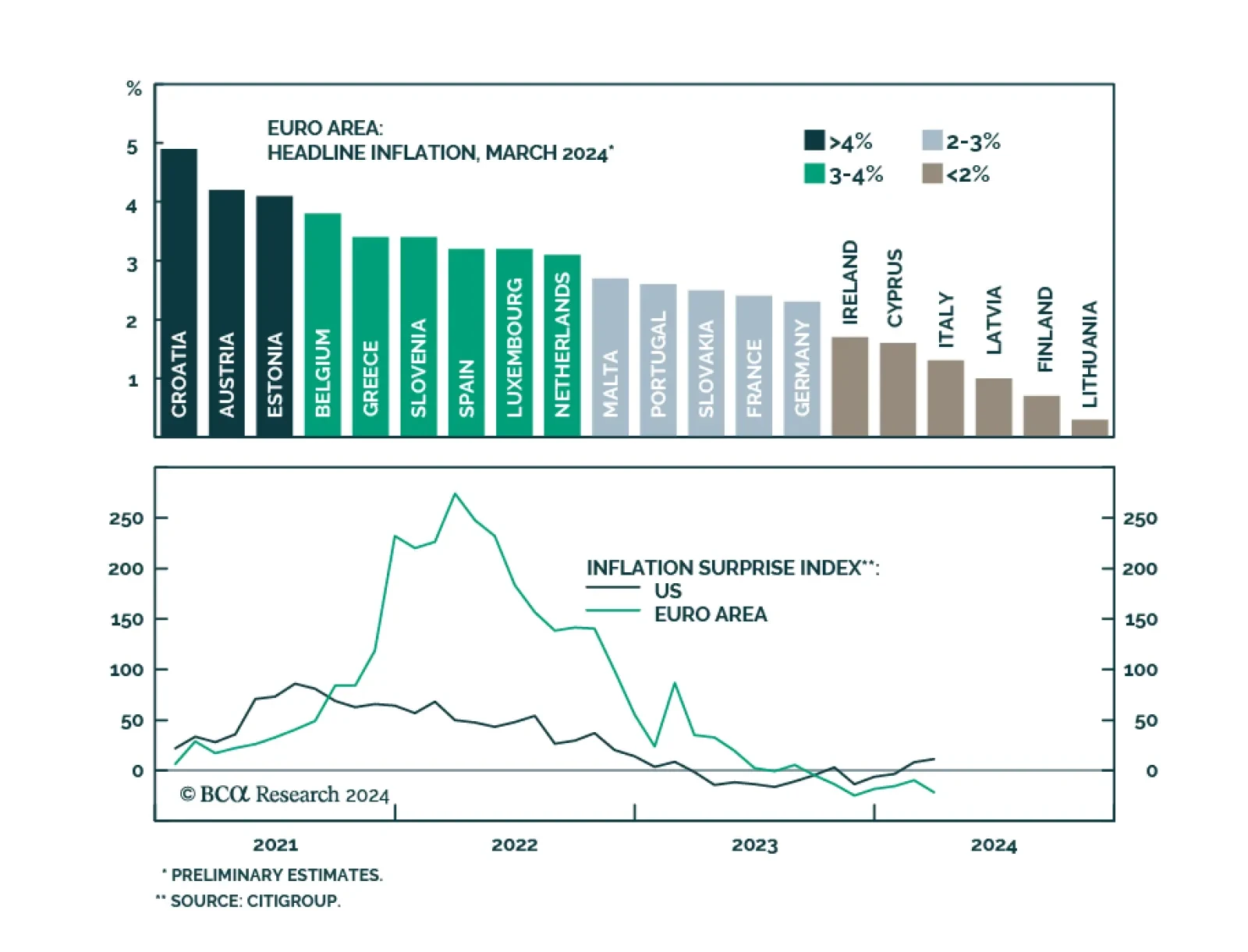

Flash estimates for Euro Area inflation in March surprised to the downside. Headline inflation slowed from 2.6% to 2.4% versus expectations of 2.5% and core inflation eased from 3.1% to 2.9% versus expectations of 3%. While the…