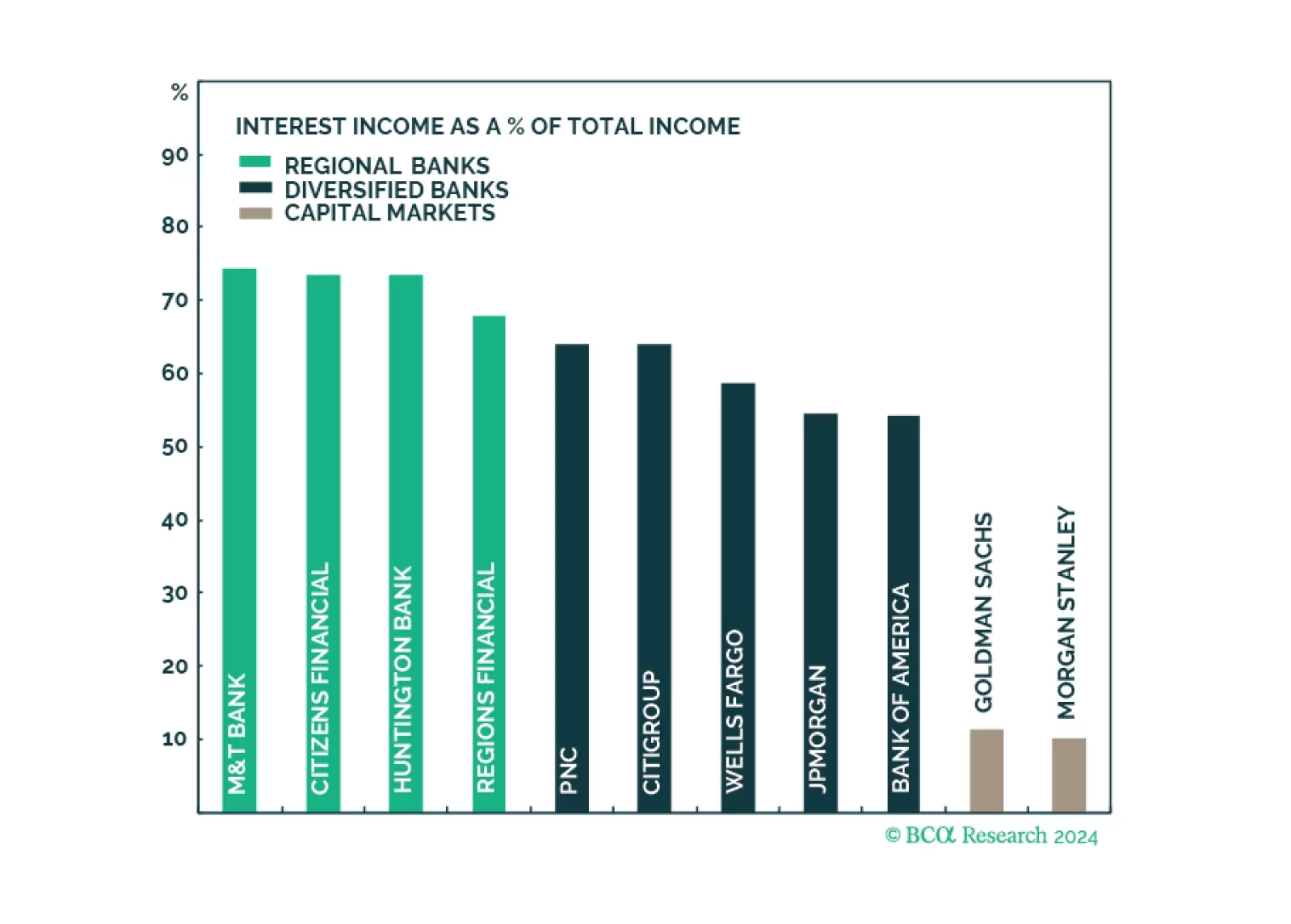

Q1 earnings results of the largest US banks have demonstrated that the engine of recent growth in profitability, NII, has faltered as funding costs are rising fast. However, the resurgence in non-NII thanks to a revival in corporate…

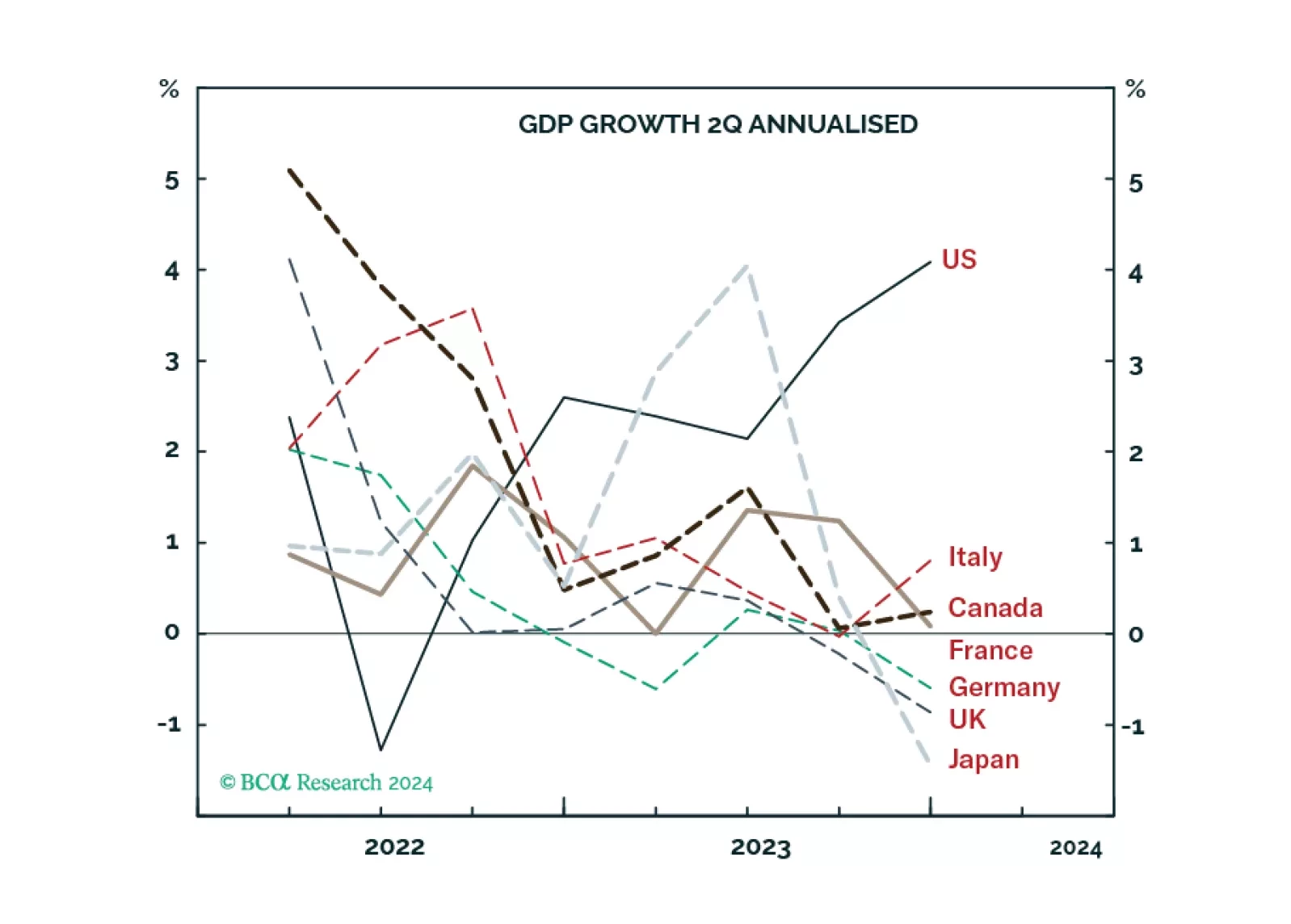

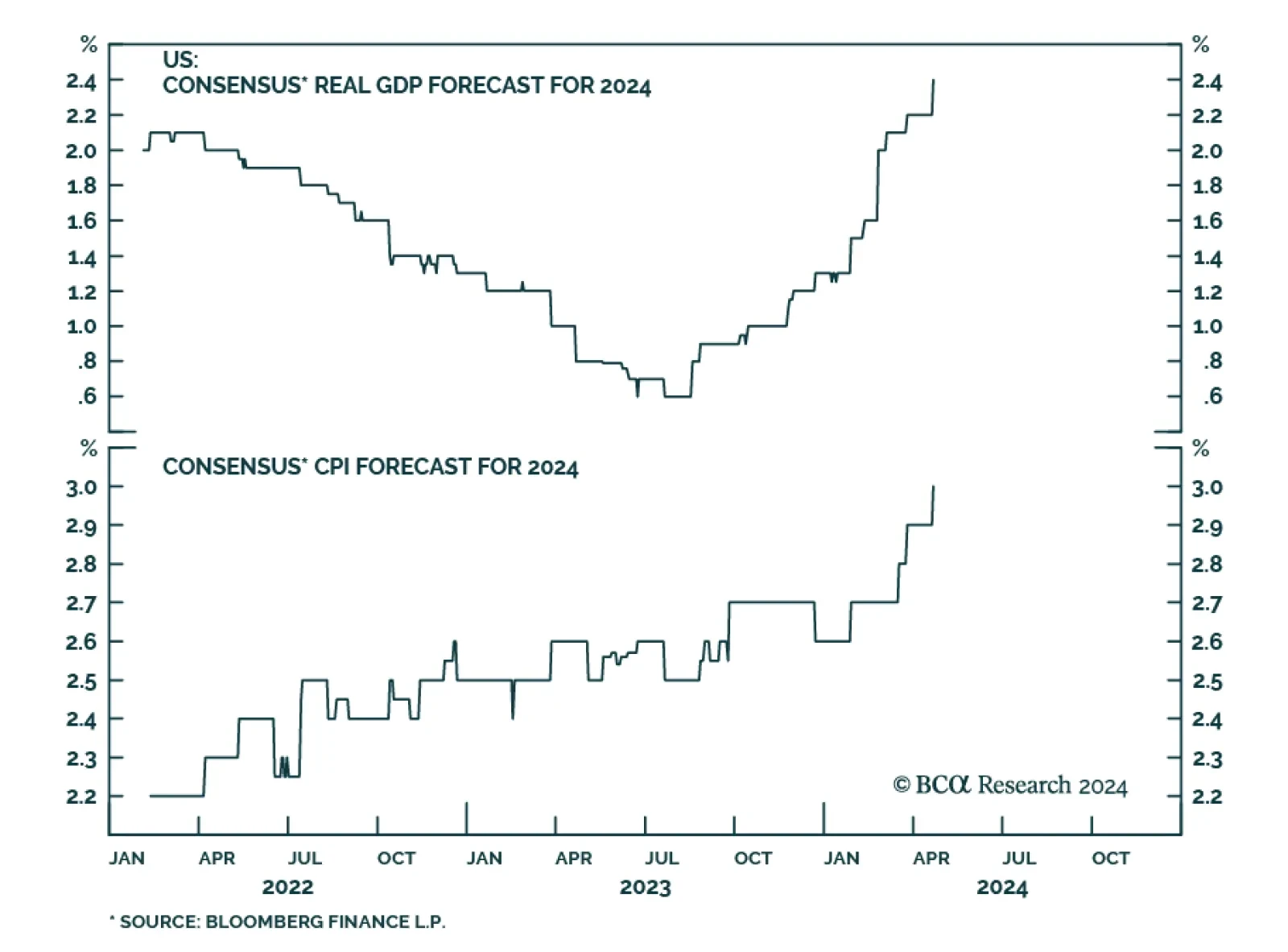

By the end of 2023, the “soft landing” scenario became the dominant narrative in financial markets. Following the regional banking scare in March of last year, market participants slowly came around to the view that…

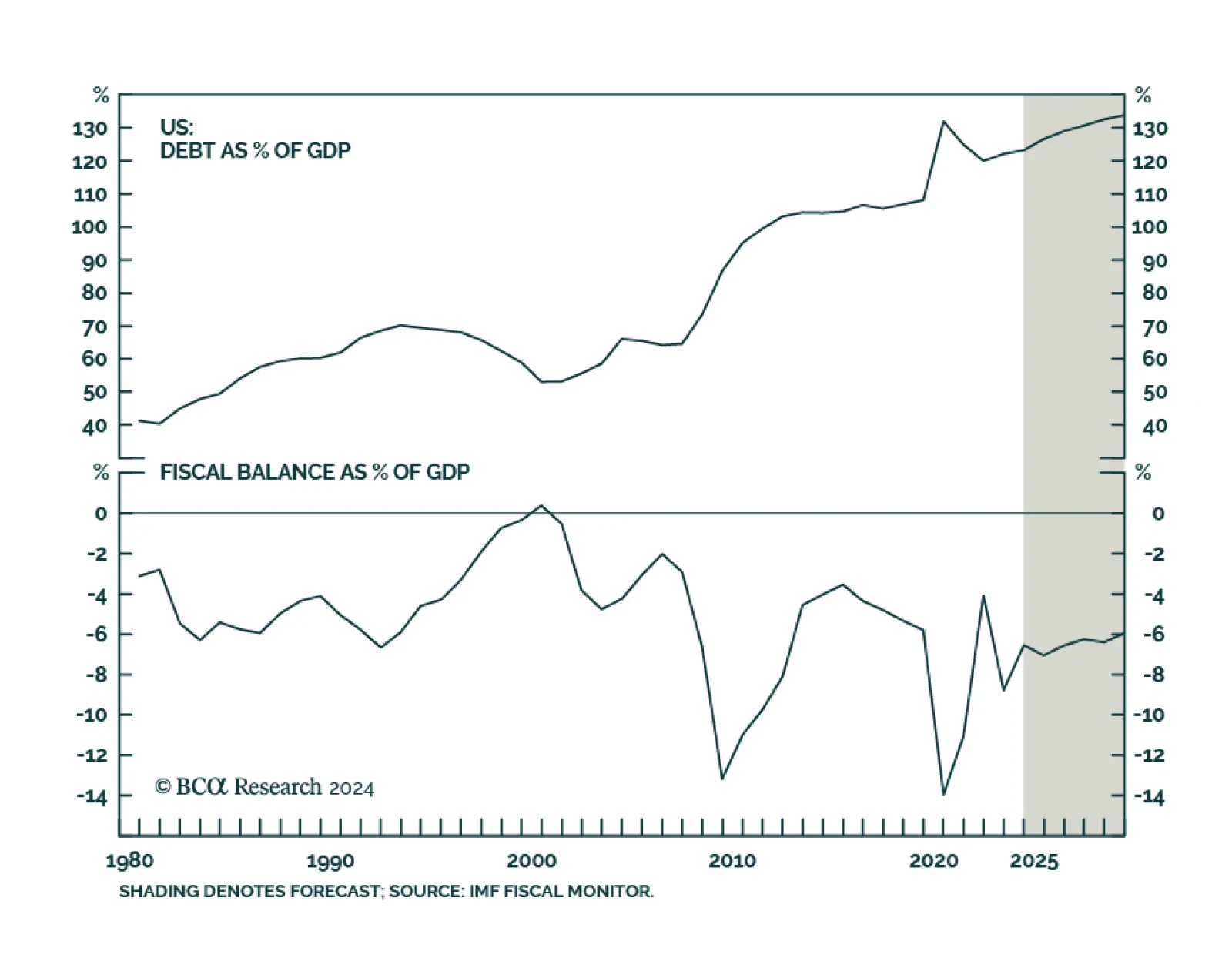

The IMF’s latest fiscal monitor report highlighted the dangers that rising sovereign debt alongside rising deficits pose to advanced economies. The United States, in particular, is at risk. The IMF projects that fiscal…

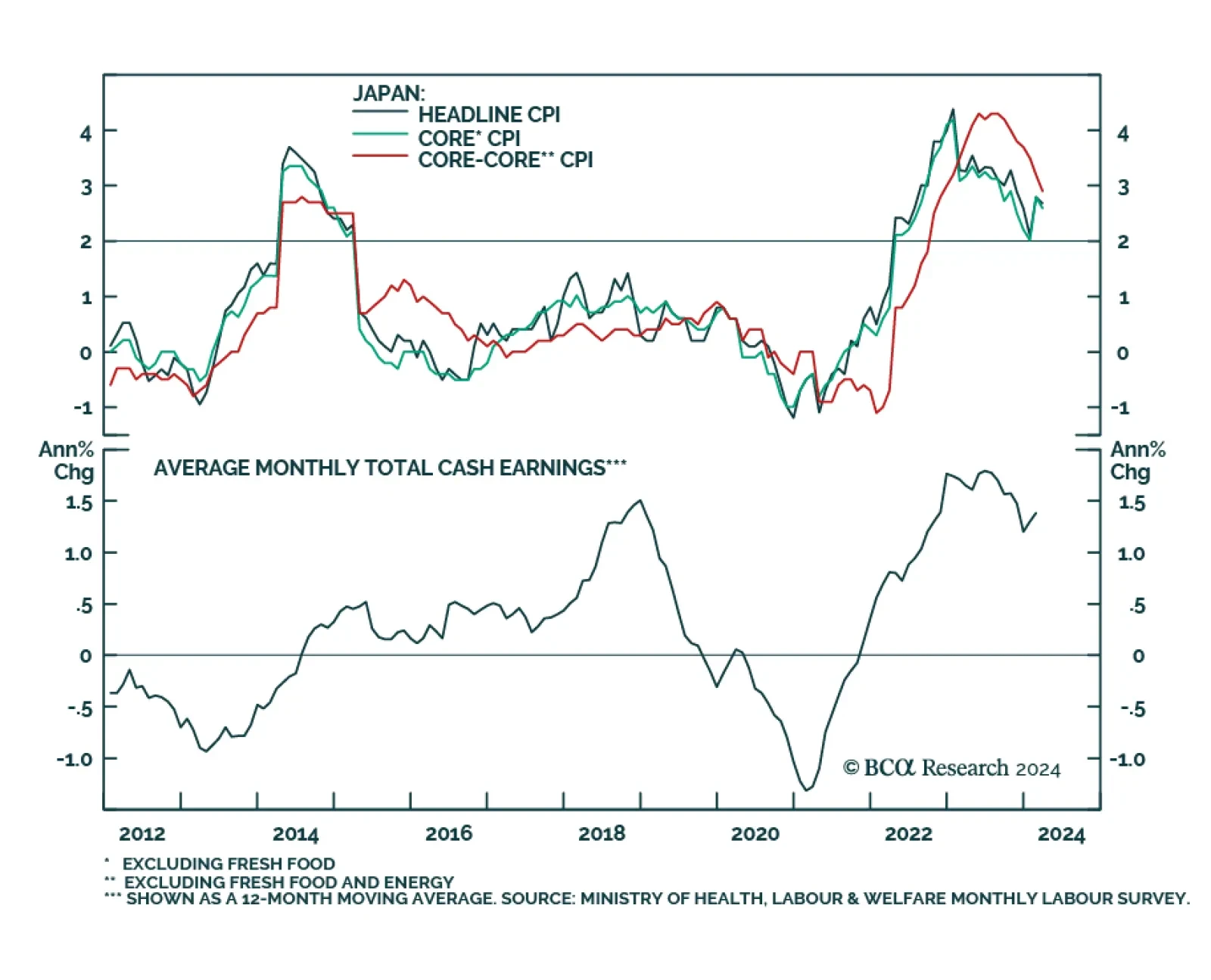

Japan’s national CPI inflation unexpectedly cooled in March, falling to 2.7% y/y versus consensus estimates it would remain at 2.8% y/y. Notably, measures of underlying inflation such as core CPI (ex-fresh food) and “…

Unlike most advanced economies that are flirting with recession due to weak demand, the ‘inverted’ US economy is motoring along due to strong supply, from a combination of surging labour participation and surging immigration. We go…

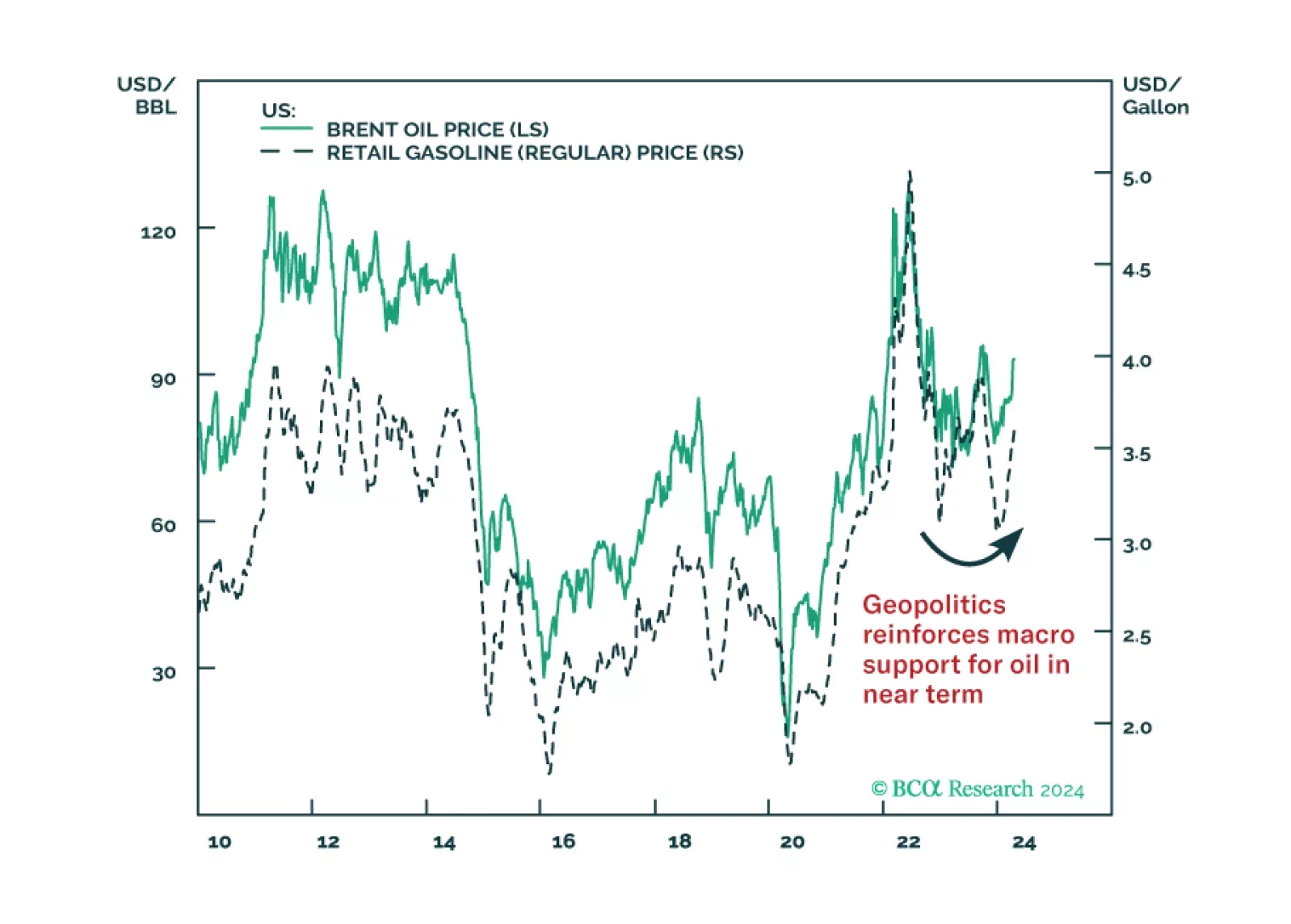

In the near term, favor oil and oil producers outside the Gulf Arab states. Over a 12-month horizon, favor US and North American equities, defensive sectors over cyclicals, and safe-assets. Within cyclicals, stick to energy and…

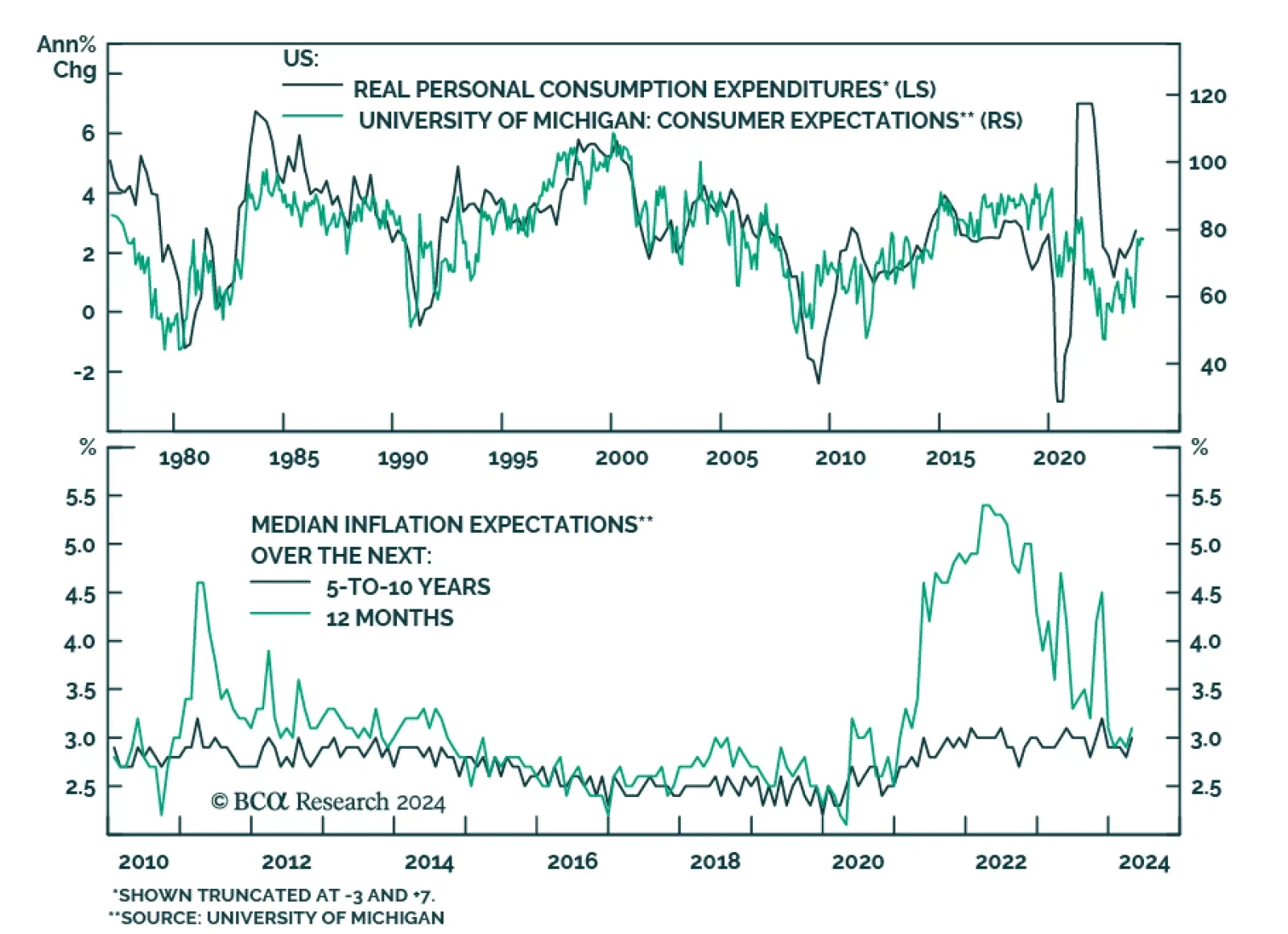

The preliminary reading of the University of Michigan gauge of consumer sentiment slid from 79.4 to 77.9 in April from 79.4, below expectations. Although both current conditions and expectations disappointed, the deterioration in…

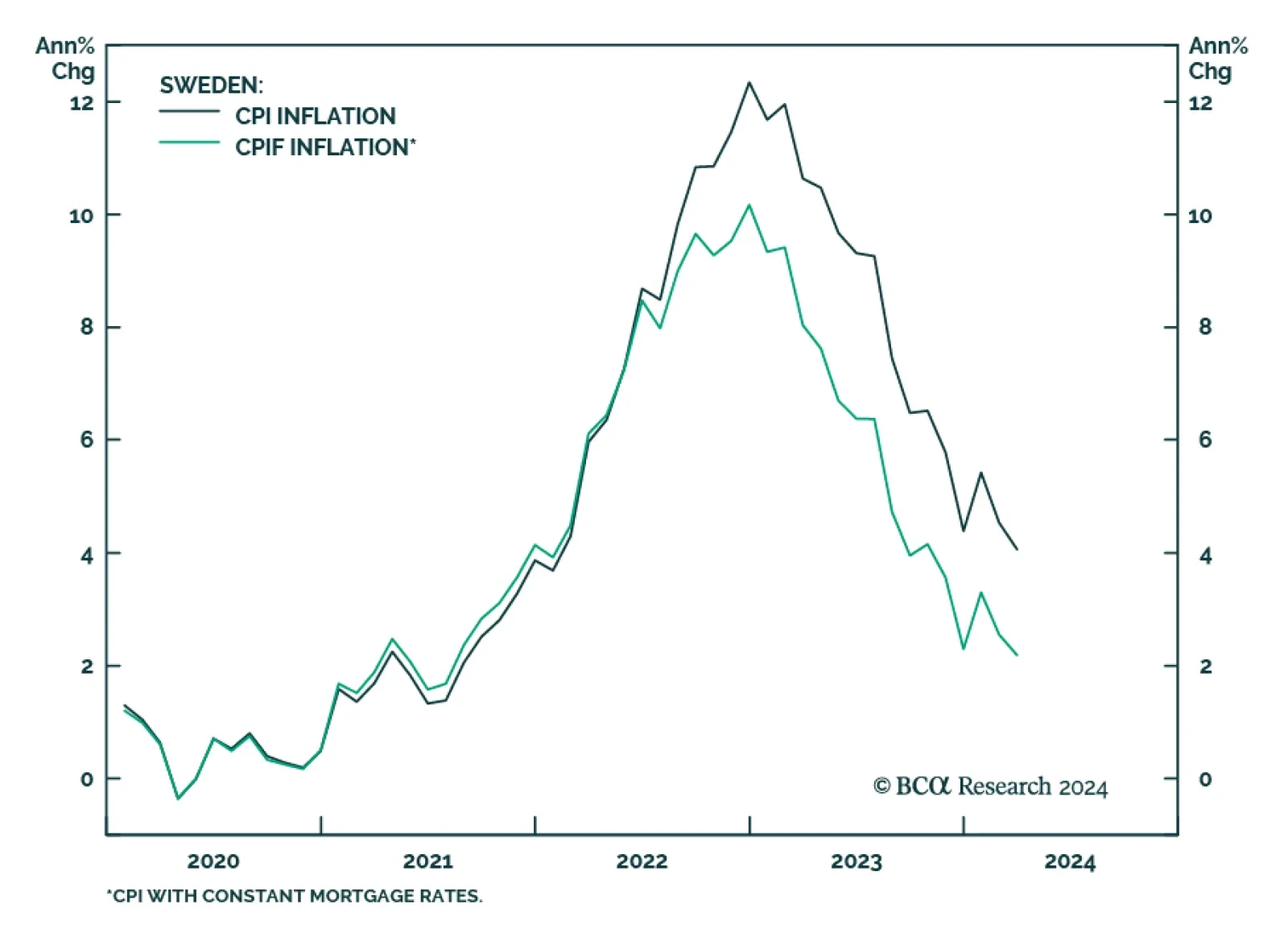

Headline inflation in Sweden came in at 4.1% in March. Lower food prices as well as lower inflation for recreation and culture were the main contributors to the drop. The biggest positive contributor was housing due to higher…

Stay overweight US equities versus world, long US energy sector versus Middle East stocks, and long Canada and Mexico versus global-ex-US stocks.